Contract Value $4.9 billion, +7.4% YoY FX

Neutral

SECOND QUARTER 2024 HIGHLIGHTS

- Revenues: $1.6 billion, +6.1% as reported; +6.9% FX

neutral.

- Net income: $230 million, +15.9% as reported; adjusted EBITDA:

$416 million, +8.2% as reported, +9.8% FX neutral.

- Diluted EPS: $2.93, +18.1%; adjusted EPS: $3.22, +13.0%.

- Operating cash flow: $370 million, -15.1%; free cash flow: $341

million, -17.0%.

- Repurchased 0.8 million common shares for $340 million.

- Board of Directors increased the share repurchase authorization

by $600.0 million in July 2024.

Gartner, Inc. (NYSE: IT) today reported results for the second

quarter of 2024 and updated its financial outlook for the full year

2024. Additional information regarding the Company’s results as

well as the updated 2024 financial outlook is provided in an

earnings supplement available on the Company’s Investor Relations

website at https://investor.gartner.com.

Gene Hall, Gartner’s Chief Executive Officer, commented,

“Contract value in the second quarter grew high single digits,

accelerating from Q1. Revenue, Adjusted EBITDA, and Adjusted EPS

were ahead of expectations. We remain well-positioned to drive

long-term, sustained, double-digit growth built on delivering

actionable, objective insight to help our clients address their

mission-critical priorities.”

CONFERENCE CALL INFORMATION

The Company will host a webcast call at 8:00 a.m. Eastern time

on Tuesday, July 30, 2024 to discuss the Company’s financial

results. Listeners can access the webcast live at

https://edge.media-server.com/mmc/p/7xniippv. To participate

actively in the live call via dial-in, please register at

https://register.vevent.com/register/BI446d1e541106469781d3392325f5091b.

Once registered, participants will receive a dial-in number and a

unique PIN to access the call. A replay of the webcast will be

available on the Company’s website for approximately 30 days

following the call.

CONSOLIDATED RESULTS HIGHLIGHTS

(Unaudited; $ in millions, except per

share amounts)

Three Months Ended

June 30,

Inc/(Dec)

2024

2023

Inc/(Dec)

FX Neutral

GAAP Metrics:

Revenues

$

1,595

$

1,503

6.1%

6.9%

Net income

230

198

15.9%

na

Diluted EPS

2.93

2.48

18.1%

na

Operating cash flow

370

436

(15.1)%

na

Non-GAAP Metrics:

Adjusted EBITDA

$

416

$

384

8.2%

9.8%

Adjusted EPS

3.22

2.85

13.0%

na

Free cash flow

341

410

(17.0)%

na

na=not available.

CONTRACT VALUE HIGHLIGHTS

- Global Technology Sales Contract Value (GTS CV): $3.8 billion,

+6.1% YoY FX Neutral

- Global Business Sales Contract Value (GBS CV): $1.1 billion,

+12.0% YoY FX Neutral

SEGMENT RESULTS HIGHLIGHTS

Our segment results for the three months ended June 30, 2024

were as follows:

(Unaudited; $ in millions)

Research

Conferences

Consulting

Revenues

$

1,266

$

186

$

143

Inc/(Dec)

4.8

%

10.2

%

13.1

%

Inc/(Dec) - FX neutral

5.5

%

10.8

%

14.9

%

Gross contribution

$

933

$

108

$

54

Inc/(Dec)

5.4

%

9.8

%

13.5

%

Contribution margin

73.7

%

58.1

%

37.6

%

nm=not meaningful.

Additional details regarding our segment results can be obtained

from the earnings supplement, our quarterly report on Form 10–Q

filed with the SEC on July 30, 2024 and our webcast.

Certain financial metrics contained in this Press Release are

considered non-GAAP financial measures. Definitions of these

non-GAAP financial measures are included in this Press Release

under “Non-GAAP Financial Measures” and the related reconciliations

are under “Supplemental Information — Non-GAAP Reconciliations.” In

this Press Release, some totals may not add due to rounding. The

percentage changes are based on the unrounded whole number and

recalculation based on millions may yield a different result.

ABOUT GARTNER

Gartner, Inc. (NYSE: IT) delivers actionable, objective insight

that drives smarter decisions and stronger performance on an

organization’s mission-critical priorities.

FORWARD-LOOKING STATEMENTS

Statements contained in this press release regarding the

Company’s growth and prospects, projected financial results,

long-term objectives, and all other statements in this release

other than recitation of historical facts are forward-looking

statements within the meaning of Section 27A of the Securities

Exchange Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Such forward-looking statements

involve known and unknown risks, estimates, uncertainties and other

factors that may cause actual results to be materially different.

Such factors include, but are not limited to, the following: the

impact of general economic conditions, including inflation (and

related monetary policy by governments in response to inflation),

recession, and national elections in a number of large countries on

economic activity and our operations; changes in macroeconomic and

market conditions and market volatility, including interest rates

and the effect on the credit markets and access to capital; our

ability to carry out our strategic initiatives and manage

associated costs; our ability to recover potential claims under our

event cancellation insurance; the timing of conferences and

meetings, in particular our Gartner Symposium/Xpo series that

normally occurs during the fourth quarter; our ability to achieve

and effectively manage growth, including our ability to integrate

our acquisitions and consummate and integrate future acquisitions;

our ability to pay our debt obligations; our ability to maintain

and expand our products and services; our ability to expand or

retain our customer base; our ability to grow or sustain revenue

from individual customers; our ability to attract and retain a

professional staff of research analysts and consultants as well as

experienced sales personnel upon whom we are dependent, especially

in light of labor competition; our ability to achieve continued

customer renewals and achieve new contract value, backlog and

deferred revenue growth in light of competitive pressures; our

ability to successfully compete with existing competitors and

potential new competitors; our ability to enforce and protect our

intellectual property rights; our ability to keep pace with

technological developments in artificial intelligence; additional

risks associated with international operations, including foreign

currency fluctuations; the impact on our business resulting from

changes in global geopolitical conditions, including those

resulting from the conflict in the Middle East, the war in Ukraine

and current and future sanctions imposed by governments or other

authorities; the impact of restructuring and other charges on our

businesses and operations; cybersecurity incidents; risks

associated with the creditworthiness, budget cuts, and shutdown of

governments and agencies; our ability to meet ESG commitments; the

impact of changes in tax policy (including global minimum tax

legislation) and heightened scrutiny from various taxing

authorities globally; changes to laws and regulations; and other

risks and uncertainties described under “Risk Factors” in our most

recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K, which can be found on Gartner’s

website at https://investor.gartner.com and the SEC’s website at

www.sec.gov. Forward-looking statements included herein speak only

as of the date hereof and Gartner disclaims any obligation to

revise or update such statements to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events or circumstances, except as required by applicable law.

NON-GAAP FINANCIAL MEASURES

Certain financial measures used in this Press Release are not

defined by U.S. generally accepted accounting principles (“GAAP”)

and as such are considered non-GAAP financial measures. We provide

these measures to enhance the user’s overall understanding of the

Company’s current financial performance and the Company’s prospects

for the future. Investors are cautioned that these non-GAAP

financial measures may not be defined in the same manner by other

companies and, as a result, may not be comparable to other

similarly titled measures used by other companies. Also, these

non-GAAP financial measures should not be construed as

alternatives, or superior, to other measures determined in

accordance with GAAP. The non-GAAP financial measures used in this

Press Release are defined below.

Adjusted EBITDA and Adjusted EBITDA Margin: Represents

GAAP net income (loss) adjusted for: (i) interest expense, net;

(ii) tax provision (benefit); (iii) gain on event cancellation

insurance claims, as applicable; (iv) gain/loss on divestitures, as

applicable; (v) other (income) expense, net; (vi) stock-based

compensation expense; (vii) depreciation, amortization, and

accretion; (viii) loss on impairment of lease related assets, as

applicable; and (ix) acquisition and integration charges and

certain other non-recurring items. Adjusted EBITDA Margin

represents Adjusted EBITDA divided by GAAP Revenue. We believe

Adjusted EBITDA and Adjusted EBITDA Margin are important measures

of our recurring operations as they exclude items not

representative of our core operating results.

Adjusted Net Income: Represents GAAP net income (loss)

adjusted for the impact of certain items directly related to

acquisitions and other non-recurring items. These adjustments

include: (i) the amortization of acquired intangibles; (ii)

acquisition and integration charges and other non-recurring items;

(iii) gain on event cancellation insurance claims, as applicable;

(iv) gain/loss on divestitures, as applicable; (v) loss on

impairment of lease related assets, as applicable; (vi) the

non-cash (gain) loss on de-designated interest rate swaps, as

applicable; and (vii) the related tax effect. We believe Adjusted

Net Income is an important measure of our recurring operations as

it excludes items that may not be indicative of our core operating

results.

Adjusted EPS: Represents GAAP diluted EPS adjusted for

the impact of certain items directly related to acquisitions and

other non-recurring items. These adjustments include on a per share

basis: (i) the amortization of acquired intangibles; (ii)

acquisition and integration charges and other non-recurring items;

(iii) gain on event cancellation insurance claims, as applicable;

(iv) gain/loss on divestitures, as applicable; (v) loss on

impairment of lease related assets, as applicable; (vi) the

non-cash (gain) loss on de-designated interest rate swaps, as

applicable; and (vii) the related tax effect. We believe Adjusted

EPS is an important measure of our recurring operations as it

excludes items that may not be indicative of our core operating

results.

Free Cash Flow: Represents cash provided by operating

activities determined in accordance with GAAP less payments for

capital expenditures. We believe Free Cash Flow is an important

measure of the recurring cash generated by the Company’s core

operations that may be available to be used to repay debt

obligations, repurchase our stock, invest in future growth through

new business development activities, or make acquisitions.

Foreign Currency Neutral (FX Neutral): We provide foreign

currency neutral dollar amounts and percentages for our contract

values, revenues, certain expenses, and other metrics. These

foreign currency neutral dollar amounts and percentages eliminate

the effects of exchange rate fluctuations and thus provide a more

accurate and meaningful trend in the underlying data being

measured. We calculate foreign currency neutral dollar amounts by

converting the underlying amounts in local currency for different

periods into U.S. dollars by applying the same foreign exchange

rates to all periods presented.

SUPPLEMENTAL INFORMATION - NON-GAAP RECONCILIATIONS

The tables below provide reconciliations of certain Non-GAAP

financial measures used in this Press Release with the most

directly comparable GAAP measure. See “Non-GAAP Financial Measures”

above for definitions of these measures.

Reconciliation - GAAP Net Income to Adjusted EBITDA

(Unaudited; $ in millions)

Three Months Ended June 30,

2024

2023

GAAP net income

$

230

$

198

Interest expense, net

20

25

Other (income) expense, net

(1

)

(6

)

Tax provision

70

66

Operating income

319

283

Adjustments:

Stock-based compensation expense (a)

40

32

Depreciation, amortization and accretion

(b)

51

47

Loss on impairment of lease related assets

(c)

—

10

Acquisition and integration charges and

other non-recurring items (d)

7

8

Gain from sale of divested operation

(e)

—

4

Adjusted EBITDA

$

416

$

384

(a)

Consists of costs for stock-based

compensation awards.

(b)

Includes depreciation expense,

amortization of intangibles and accretion on asset retirement

obligations.

(c)

Includes impairment loss for lease related

assets.

(d)

Consists of direct and incremental

expenses related to acquisitions and divestitures, facility-related

exit costs and other non-recurring items.

(e)

Consists of the gain on our February 2023

divestiture.

Reconciliation - GAAP Net Income and GAAP Net Income per

Diluted Share to Adjusted Net Income and Adjusted EPS

(Unaudited; $ in millions, except per

share amounts)

Three Months Ended June 30,

2024

2023

Amount

Per Share

Amount

Per Share

GAAP net income and GAAP net income per

diluted share

$

230

$

2.93

$

198

$

2.48

Acquisition and other adjustments:

Amortization of acquired intangibles

(a)

23

0.29

23

0.29

Acquisition and integration charges and

other non-recurring items (b), (c)

8

0.10

9

0.12

Gain from sale of divested operation

(d)

—

—

4

0.05

Loss on impairment of lease related assets

(e)

—

—

10

0.13

Gain on de-designated interest rate swaps

(f)

(1

)

(0.01

)

(6

)

(0.08

)

Tax impact of adjustments (g)

(8

)

(0.10

)

(11

)

(0.13

)

Adjusted net income and Adjusted EPS

(h)

$

252

$

3.22

$

227

$

2.85

(a)

Consists of non-cash amortization from

acquired intangibles.

(b)

Consists of direct and incremental

expenses related to acquisitions and divestitures, facility-related

exit costs and other non-recurring items.

(c)

Includes the amortization and write-off of

deferred financing fees, which are recorded in Interest expense,

net in the Company’s accompanying Condensed Consolidated Statements

of Operations.

(d)

Consists of the gain on our February 2023

divestiture.

(e)

Includes impairment loss for lease related

assets.

(f)

Represents the fair value adjustment for

interest rate swaps after de-designation.

(g)

The blended effective tax rates on the

adjustments were approximately 25.1% and 26.6% for the three months

ended June 30, 2024 and 2023, respectively.

(h)

Adjusted EPS was calculated based on 78.3

million and 79.8 million diluted shares for the three months ended

June 30, 2024 and 2023, respectively.

Reconciliation - GAAP Cash Provided by Operating Activities

to Free Cash Flow

(Unaudited; $ in millions)

Three Months Ended June 30,

2024

2023

GAAP cash provided by operating

activities

$

370

$

436

Cash paid for capital expenditures

(29

)

(26

)

Free Cash Flow

$

341

$

410

GARTNER, INC. Condensed

Consolidated Statements of Operations (Unaudited; in millions,

except per share data)

Three Months Ended

June 30,

2024

2023

Revenues:

Research

$

1,266.0

$

1,208.0

Conferences

186.1

168.9

Consulting

143.0

126.4

Total revenues

1,595.1

1,503.3

Costs and expenses:

Cost of services and product

development

513.3

487.4

Selling, general and administrative

712.1

680.3

Depreciation

27.6

23.7

Amortization of intangibles

22.9

22.9

Acquisition and integration charges

0.4

2.0

Gain from sale of divested operation

—

3.9

Total costs and expenses

1,276.3

1,220.2

Operating income

318.8

283.1

Interest expense, net

(20.0

)

(24.6

)

Other income, net

0.5

5.6

Income before income taxes

299.3

264.1

Provision for income taxes

69.8

66.1

Net income

$

229.5

$

198.0

Net income per share:

Basic

$

2.95

$

2.50

Diluted

$

2.93

$

2.48

Weighted average shares outstanding:

Basic

77.8

79.3

Diluted

78.3

79.8

Source: Gartner, Inc.

Gartner-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730460453/en/

David Cohen SVP, Investor Relations, Gartner +1 203.316.6631

investor.relations@gartner.com

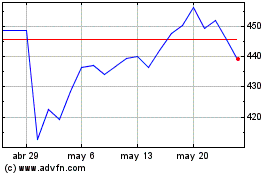

Gartner (NYSE:IT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Gartner (NYSE:IT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025