Additional Proxy Soliciting Materials (definitive) (defa14a)

30 Marzo 2021 - 3:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

|

|

|

|

|

|

|

|

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to

§240.14a-12

|

Nuveen Global High Income Fund (JGH)

(Exact Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

|

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

Nuveen Global High Income Fund Letter to Shareholders

Your Fund Has Consistently Delivered on Its Stated Investment Objective of Providing You High Current Income

Your Fund’s Current Board of Trustees Has a Proven Track Record of Enhancing Long-Term Shareholder Value

Leading Proxy Advisory Firms Institutional Shareholder Services (ISS) And Glass Lewis Recommend Shareholders

Vote on the Fund’s WHITE Proxy Card, Find Saba Failed to Demonstrate a Case for Change

Vote on the WHITE Proxy Card Today “FOR ALL” the Fund’s Highly Qualified Nominees

March 30, 2021

Dear Shareholder,

As our April 6th annual meeting approaches, we’d like to send one final reminder that your Fund’s experienced, entirely independent Board of Trustees

unanimously recommends that you:

|

|

•

|

|

Vote on the WHITE proxy card “FOR ALL” of your Board’s nominees—Jack B. Evans,

Albin F. Moschner and Matthew Thornton III— members of a team of highly qualified, experienced Trustees, bringing superior closed-end fund experience and a strong track record of responsible, independent

governance in the oversight of your Fund.

|

|

|

•

|

|

Do NOT support a proposal from Saba to pack the Board with its hand-picked nominees who lack any relevant closed-end fund experience and are beholden to Saba and its short-term interests.

|

We remain confident that

based on your Fund’s track record to date, and under the leadership of the current Trustees, the Fund is well-positioned to continue its pursuit of its investment objective of providing investors with high current income over the coming year.

We urge you to consider the following critical points:

YOUR FUND HAS

CONSISTENTLY DELIVERED ON ITS INVESTMENT OBJECTIVE FOR SHAREHOLDERS

|

|

•

|

|

Your Fund has paid meaningfully higher distributions as compared to the income return of its benchmark (the Bloomberg

Barclays Global High Yield Hedged Index), while also delivering attractive total returns.

|

|

|

•

|

|

The Fund’s Board has implemented a new level distribution policy1

and a resulting 32% increase in the Fund’s distribution rate, designed to help support secondary market trading.

|

BEST-IN-CLASS FUND GOVERNANCE

|

|

•

|

|

Your experienced Board has a track record of taking thoughtful actions designed to enhance shareholder value, including

share repurchases, dividend management programs and expense reductions through fund-level and complex-wide fee breakpoints.

|

|

|

•

|

|

Your Board consistently demonstrates their ability to live up to the Fund’s Governing Principles and the fiduciary

responsibility it owes to Fund shareholders, focused on creating sustainable value for all Fund shareholders over time.

|

1In any monthly period, in order to maintain its level distribution amount, the Fund may pay out more or less than its net investment income during the period. As a result, distribution sources may

include net investment income, realized gains and return of capital. If a Fund’s distribution includes anything other than net investment income, the Fund will provide a notice of its best estimate of the distribution sources at that time.

These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholders’ 1099-DIV forms delivered after the end of the calendar year.

TWO LEADING INDEPENDENT PROXY ADVISORY FIRMS, ISS AND GLASS LEWIS, HAVE BOTH RECOMMENDED THAT FUND SHAREHOLDERS VOTE

ON THE FUND’S WHITE PROXY CARD

|

|

•

|

|

Glass Lewis advised shareholders to vote for all the Fund’s highly qualified nominees and ISS recommended shareholders

vote for Matthew Thornton III.

|

|

|

•

|

|

ISS and Glass Lewis each found that Saba failed to demonstrate a case for change.

|

|

|

•

|

|

According to Glass Lewis, Saba’s claims regarding the Fund’s performance and fees are lacking:

|

|

|

○

|

On Performance: Saba’s “presentation is, at best, fractional – and likely a rather thin slice of

the quantitative review presumably undertaken by Saba when selecting possible close-end targets – it should be noted the Dissident’s commentary also seems to run afoul of comprehensively

countervailing data.”

|

|

|

○

|

On Fees: “As for Saba’s commentary around Nuveen purportedly ‘trapping’ investors in high-fee funds, we note the Fund’s total expense ratio of approximately 1.9% is actually below the asset class mean/median of 2.0%...and it is not particularly clear by what mechanism, fee-based or otherwise, JGH investors could reasonably be viewed as ‘trapped’ in our view.”

|

REJECT SABA’S PROPOSAL TODAY - A VOTE FOR SABA’s NOMINEES COULD HAVE NEGATIVE CONSEQUENCES FOR YOUR FUND

We urge you to reject Saba’s self-interested efforts to put your investment and opportunity for future returns at risk. If elected, Saba’s

inexperienced, hand-picked nominees may seek to take actions that would advance Saba’s near-term interests at the expense of long-term investors who rely on this Fund for consistent, high current income and competitive returns.

Saba’s actions could include the possible liquidation of your Fund, which would require you to seek an alternative investment to replace the monthly

distributions you receive from the Fund. A liquidation could also result in negative tax consequences for you.

Your Board’s qualifications and history

stand in direct contrast to Saba’s two nominees, whose only relevant closed-end fund experience relates to their activities in service of Saba’s interests.

We urge you to review our proxy materials, which outline why we believe your Board’s nominees deserve your vote. Voting takes just a few minutes and can be done

online, by phone or mail by following the instructions on the WHITE proxy card.

Saba may contact you by mail to solicit your vote. Please do not mail

in the gold proxy card sent to you by the Saba hedge fund or any proxy card other than the WHITE proxy card.

Thank you for your continued support.

Sincerely,

Terence J. Toth

Chair of the Board of Trustees

Nuveen Global

High Income Fund

If you have any questions, please call the Fund’s proxy solicitor, Georgeson LLC, toll-free at 866-431-2108.

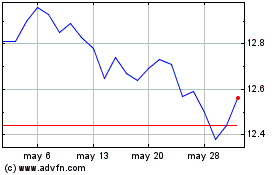

Nuveen Global High Income (NYSE:JGH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Nuveen Global High Income (NYSE:JGH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024