Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Noviembre 2024 - 10:11AM

Edgar (US Regulatory)

Portfolio

of

Investments

September

30,

2024

JGH

(Unaudited)

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

LONG-TERM

INVESTMENTS

-

135.2%

(98.0%

of

Total

Investments)

X

241,050,171

CORPORATE

BONDS

-

74

.6

%

(

54

.0

%

of

Total

Investments)

X

241,050,171

AUTOMOBILES

&

COMPONENTS

-

1.0%

$

600,000

(a)

Ford

Otomotiv

Sanayi

AS

7

.125

%

04/25/29

$

620,304

1,000,000

(a)

IHO

Verwaltungs

GmbH,

(cash

6.375%,

PIK

7.125%)

6

.375

05/15/29

978,911

476,000

(a)

Nemak

SAB

de

CV

3

.625

06/28/31

386,493

1,360,000

(a)

Phinia

Inc

6

.625

10/15/32

1,371,228

TOTAL

AUTOMOBILES

&

COMPONENTS

3,356,936

BANKS

-

0.8%

875,000

(a)

Access

Bank

PLC

6

.125

09/21/26

831,664

1,050,000

(a)

Grupo

Aval

Ltd

4

.375

02/04/30

935,006

750,000

(a)

Turkiye

Vakiflar

Bankasi

TAO

8

.994

10/05/34

783,450

TOTAL

BANKS

2,550,120

CAPITAL

GOODS

-

2.6%

5,470,000

(a)

Albion

Financing

2

Sarl

8

.750

04/15/27

5,613,144

1,500,000

(a)

Alta

Equipment

Group

Inc

9

.000

06/01/29

1,343,202

500,000

(a)

IHS

Holding

Ltd

6

.250

11/29/28

467,965

925,000

(a)

Sisecam

UK

PLC

8

.625

05/02/32

951,067

TOTAL

CAPITAL

GOODS

8,375,378

COMMERCIAL

&

PROFESSIONAL

SERVICES

-

2.3%

1,075,000

(a)

Ambipar

Lux

Sarl

9

.875

02/06/31

1,115,362

2,040,000

(a)

Garda

World

Security

Corp

8

.250

08/01/32

2,087,942

1,625,000

(a)

RR

Donnelley

&

Sons

Co

9

.500

08/01/29

1,638,829

2,000,000

(a)

RR

Donnelley

&

Sons

Co

10

.875

08/01/29

1,938,242

600,000

(a)

VT

Topco

Inc

8

.500

08/15/30

640,177

TOTAL

COMMERCIAL

&

PROFESSIONAL

SERVICES

7,420,552

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

3.4%

2,120,000

(a)

Carvana

Co,

(cash

12.000%,

PIK

12.000%)

12

.000

12/01/28

2,226,430

2,275,000

Kohl's

Corp

4

.625

05/01/31

1,915,892

750,000

(a)

Michaels

Cos

Inc/The

5

.250

05/01/28

553,582

4,900,000

(a)

Michaels

Cos

Inc/The

7

.875

05/01/29

2,850,644

1,000,000

(a)

Staples

Inc

10

.750

09/01/29

970,300

878,636

(a)

Staples

Inc

12

.750

01/15/30

721,717

786,000

(a)

Velocity

Vehicle

Group

LLC

8

.000

06/01/29

818,388

1,000,000

(a),(b)

Wayfair

LLC

7

.250

10/31/29

1,024,460

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

11,081,413

CONSUMER

DURABLES

&

APPAREL

-

1.4%

2,000,000

(a),(b)

CD&R

Smokey

Buyer

Inc

9

.500

10/15/29

2,001,900

2,400,000

(a),(b)

S&S

Holdings

LLC

8

.375

10/01/31

2,416,465

TOTAL

CONSUMER

DURABLES

&

APPAREL

4,418,365

CONSUMER

SERVICES

-

2.1%

1,900,000

(a)

Fertitta

Entertainment

LLC

/

Fertitta

Entertainment

Finance

Co

Inc

6

.750

07/15/30

1,770,150

2,000,000

(a)

Merlin

Entertainments

Group

US

Holdings

Inc

7

.375

02/15/31

2,007,790

2,000,000

(a)

Motion

Bondco

DAC

6

.625

11/15/27

1,902,084

1,000,000

(a)

Wynn

Macau

Ltd

5

.500

10/01/27

977,732

TOTAL

CONSUMER

SERVICES

6,657,756

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

0.2%

735,000

Walgreens

Boots

Alliance

Inc

8

.125

08/15/29

733,590

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

733,590

ENERGY

-

9.7%

1,000,000

(a)

Coronado

Finance

Pty

Ltd

9

.250

10/01/29

1,027,565

1,000,000

Ecopetrol

SA

5

.875

11/02/51

726,916

1,500,000

Ecopetrol

SA

8

.875

01/13/33

1,608,532

625,000

Ecopetrol

SA

6

.875

04/29/30

624,177

80,000

Ecopetrol

SA

8

.375

01/19/36

81,800

2,351,000

(a)

Energean

Israel

Finance

Ltd,

Reg

S

5

.875

03/30/31

2,006,696

485,000

(a)

Energian

Israel

Finance

Ltd,

Reg

S

8

.000

09/02/53

458,408

745,000

Genesis

Energy

LP

/

Genesis

Energy

Finance

Corp

7

.875

05/15/32

758,519

985,000

Genesis

Energy

LP

/

Genesis

Energy

Finance

Corp

8

.250

01/15/29

1,019,928

550,000

(a)

Gran

Tierra

Energy

Inc

9

.500

10/15/29

522,097

Portfolio

of

Investments

September

30,

2024

(continued)

JGH

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

ENERGY

(continued)

$

2,000,000

(a)

Hilcorp

Energy

I

LP

/

Hilcorp

Finance

Co

8

.375

%

11/01/33

$

2,156,198

1,500,000

(a)

Indika

Energy

Tbk

PT

8

.750

05/07/29

1,534,023

725,000

(a)

Kosmos

Energy

Ltd

8

.750

10/01/31

714,472

1,500,000

(a)

Leviathan

Bond

Ltd,

Reg

S

6

.500

06/30/27

1,419,870

500,000

(a)

Medco

Laurel

Tree

Pte

Ltd

6

.950

11/12/28

500,048

1,500,000

(a)

Medco

Maple

Tree

Pte

Ltd

8

.960

04/27/29

1,582,494

391,000

(a)

Medco

Oak

Tree

Pte

Ltd

7

.375

05/14/26

396,623

1,870,000

(a)

Nabors

Industries

Inc

8

.875

08/15/31

1,778,884

980,000

Petrobras

Global

Finance

BV

6

.900

03/19/49

985,206

200,000

Petroleos

Mexicanos

6

.500

01/23/29

188,992

6,171,000

Petroleos

Mexicanos

6

.700

02/16/32

5,532,555

750,000

Petroleos

Mexicanos

10

.000

02/07/33

794,675

290,000

(a)

Shelf

Drilling

Holdings

Ltd

9

.625

04/15/29

267,476

1,000,000

(a)

SierraCol

Energy

Andina

LLC

6

.000

06/15/28

919,166

800,000

(a)

Talos

Production

Inc

9

.000

02/01/29

823,729

378,250

(a)

Transocean

Inc

8

.750

02/15/30

394,376

1,033,000

(a)

Tullow

Oil

PLC

10

.250

05/15/26

937,607

1,500,000

(a)

Venture

Global

LNG

Inc

9

.875

02/01/32

1,666,788

TOTAL

ENERGY

31,427,820

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

1.8%

750,000

(a)

Uniti

Group

LP

/

Uniti

Group

Finance

Inc

/

CSL

Capital

LLC

10

.500

02/15/28

800,555

2,000,000

(a)

Uniti

Group

LP

/

Uniti

Group

Finance

Inc

/

CSL

Capital

LLC

6

.500

02/15/29

1,736,704

2,970,000

(a)

Uniti

Group

LP

/

Uniti

Group

Finance

Inc

/

CSL

Capital

LLC

10

.500

02/15/28

3,170,196

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

5,707,455

FINANCIAL

SERVICES

-

4.9%

1,500,000

(c)

Credit

Suisse

Group

AG

7

.500

01/17/72

176,250

4,500,000

(a)

Encore

Capital

Group

Inc

8

.500

05/15/30

4,742,671

3,500,000

(a)

Icahn

Enterprises

LP

/

Icahn

Enterprises

Finance

Corp

9

.000

06/15/30

3,528,928

570,500

(a)

Mexico

Remittances

Funding

Fiduciary

Estate

Management

Sarl

4

.875

01/15/28

517,578

1,000,000

(a)

NCR

Corp

ATM

9

.500

04/01/29

1,100,869

4,000,000

OneMain

Finance

Corp

7

.125

11/15/31

4,048,056

2,000,000

(a)

VistaJet

Malta

Finance

PLC

/

Vista

Management

Holding

Inc

6

.375

02/01/30

1,718,270

TOTAL

FINANCIAL

SERVICES

15,832,622

FOOD,

BEVERAGE

&

TOBACCO

-

1.0%

1,600,000

(a)

Fiesta

Purchaser

Inc

9

.625

09/15/32

1,656,220

500,000

(a)

Minerva

Luxembourg

SA

8

.875

09/13/33

545,182

900,000

(a)

Ulker

Biskuvi

Sanayi

AS

7

.875

07/08/31

934,550

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

3,135,952

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

4.5%

1,750,000

(a)

CHS/Community

Health

Systems

Inc

4

.750

02/15/31

1,538,332

2,405,000

(a)

CHS/Community

Health

Systems

Inc

10

.875

01/15/32

2,650,274

242,000

(a)

CHS/Community

Health

Systems

Inc

6

.125

04/01/30

206,916

2,020,202

(a)

Global

Medical

Response

Inc

10

.000

10/31/28

2,025,253

1,295,000

(a)

LifePoint

Health

Inc

11

.000

10/15/30

1,461,260

2,500,000

(a)

LifePoint

Health

Inc

10

.000

06/01/32

2,748,417

3,770,000

(a)

Prime

Healthcare

Services

Inc

9

.375

09/01/29

3,888,692

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

14,519,144

INSURANCE

-

2.2%

1,000,000

(a)

Acrisure

LLC

/

Acrisure

Finance

Inc

8

.500

06/15/29

1,044,162

1,265,000

(a)

Acrisure

LLC

/

Acrisure

Finance

Inc

8

.250

02/01/29

1,305,284

1,620,000

(a)

Alliant

Holdings

Intermediate

LLC

/

Alliant

Holdings

Co-Issuer

7

.375

10/01/32

1,642,441

1,045,000

(a)

Ardonagh

Finco

Ltd

7

.750

02/15/31

1,080,240

830,000

(a)

Ardonagh

Group

Finance

Ltd

8

.875

02/15/32

857,813

1,000,000

(a)

Fidelis

Insurance

Holdings

Ltd

6

.625

04/01/41

990,000

TOTAL

INSURANCE

6,919,940

MATERIALS

-

4.7%

750,000

AngloGold

Ashanti

Holdings

PLC

6

.500

04/15/40

787,226

1,325,000

(a),(d)

Cemex

SAB

de

CV

9

.125

N/A

1,445,304

300,000

(a)

First

Quantum

Minerals

Ltd

8

.625

06/01/31

300,601

300,000

(a),(b)

LD

Celulose

International

GmbH

7

.950

01/26/32

307,875

1,000,000

(a)

Limak

Cimento

Sanayi

ve

Ticaret

AS

9

.750

07/25/29

979,652

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

MATERIALS

(continued)

$

1,580,000

(a)

Mineral

Resources

Ltd

8

.000

%

11/01/27

$

1,622,910

2,070,000

(a)

Mineral

Resources

Ltd

8

.500

05/01/30

2,156,596

750,000

(a)

NOVA

Chemicals

Corp

9

.000

02/15/30

812,340

600,000

(a)

OCP

SA

5

.125

06/23/51

487,500

1,160,000

(a)

Olympus

Water

US

Holding

Corp

6

.250

10/01/29

1,122,433

585,000

(a)

Owens-Brockway

Glass

Container

Inc

7

.250

05/15/31

600,989

500,000

(a)

Sasol

Financing

USA

LLC

8

.750

05/03/29

528,800

1,500,000

Sasol

Financing

USA

LLC

5

.500

03/18/31

1,338,283

1,170,000

(a)

SunCoke

Energy

Inc

4

.875

06/30/29

1,060,834

1,850,000

(a)

Tronox

Inc

4

.625

03/15/29

1,728,134

TOTAL

MATERIALS

15,279,477

MEDIA

&

ENTERTAINMENT

-

7.5%

1,700,000

(a)

CSC

Holdings

LLC

11

.250

05/15/28

1,641,039

2,905,000

(a)

CSC

Holdings

LLC

11

.750

01/31/29

2,807,947

2,285,000

(a)

Directv

Financing

LLC

/

Directv

Financing

Co-Obligor

Inc

5

.875

08/15/27

2,243,487

4,750,000

(a)

DISH

Network

Corp

11

.750

11/15/27

4,985,269

1,000,000

(a)

Getty

Images

Inc

9

.750

03/01/27

999,601

1,545,000

(a)

Gray

Escrow

Inc

5

.375

11/15/31

966,276

1,325,000

(a)

Gray

Television

Inc

4

.750

10/15/30

842,953

715,000

(a)

Gray

Television

Inc

10

.500

07/15/29

746,791

1,275,000

(a)

LCPR

Senior

Secured

Financing

DAC

5

.125

07/15/29

1,033,167

1,500,000

(a)

McGraw-Hill

Education

Inc

7

.375

09/01/31

1,556,360

2,000,000

(a)

McGraw-Hill

Education

Inc

8

.000

08/01/29

2,007,174

3,530,000

(a)

Univision

Communications

Inc

7

.375

06/30/30

3,416,329

925,000

(a)

Virgin

Media

Secured

Finance

PLC

5

.500

05/15/29

887,166

TOTAL

MEDIA

&

ENTERTAINMENT

24,133,559

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

2.4%

2,740,000

(a)

Bausch

Health

Cos

Inc

4

.875

06/01/28

2,144,050

4,000,000

(a)

Grifols

SA

4

.750

10/15/28

3,746,678

1,760,000

(a)

Organon

&

Co

/

Organon

Foreign

Debt

Co-Issuer

BV

7

.875

05/15/34

1,864,632

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

7,755,360

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

1.5%

3,258,400

(a)

Anywhere

Real

Estate

Group

LLC

/

Anywhere

Co-Issuer

Corp

7

.000

04/15/30

3,026,899

2,175,000

Kennedy-Wilson

Inc

5

.000

03/01/31

1,952,578

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

4,979,477

SOFTWARE

&

SERVICES

-

4.3%

5,200,000

(a)

Ahead

DB

Holdings

LLC

6

.625

05/01/28

5,031,671

5,000,000

(a)

Condor

Merger

Sub

Inc

7

.375

02/15/30

4,876,789

1,022,875

(a)

Rackspace

Finance

LLC

3

.500

05/15/28

511,872

3,400,000

(a)

Rocket

Software

Inc

9

.000

11/28/28

3,548,189

TOTAL

SOFTWARE

&

SERVICES

13,968,521

TELECOMMUNICATION

SERVICES

-

8.3%

355,000

(a)

Altice

France

SA

8

.125

02/01/27

290,295

1,550,000

(a)

C&W

Senior

Finance

Ltd

6

.875

09/15/27

1,544,612

725,000

(a)

CT

Trust

5

.125

02/03/32

664,717

1,500,000

(a)

Frontier

Communications

Holdings

LLC

8

.625

03/15/31

1,617,135

2,295,000

(a)

Iliad

Holding

SASU

8

.500

04/15/31

2,468,516

3,000,000

(a)

Level

3

Financing

Inc

10

.500

05/15/30

3,228,750

3,585,000

(a)

Level

3

Financing

Inc

10

.500

04/15/29

3,907,825

1,750,000

(a)

Liberty

Costa

Rica

Senior

Secured

Finance

10

.875

01/15/31

1,916,775

900,000

(a)

Millicom

International

Cellular

SA2028

2028

5

.125

01/15/28

874,461

525,000

(a)

Millicom

International

Cellular

SA

7

.375

04/02/32

539,440

200,000

(a),(b)

Sable

International

Finance

Ltd

7

.125

10/15/32

200,750

1,000,000

(a)

Vmed

O2

UK

Financing

I

PLC

7

.750

04/15/32

1,026,480

1,650,000

(a)

Windstream

Escrow

LLC

/

Windstream

Escrow

Finance

Corp

7

.750

08/15/28

1,651,551

300,000

(a),(b)

Windstream

Escrow

LLC

/

Windstream

Escrow

Finance

Corp

8

.250

10/01/31

304,990

1,646,000

(a)

Zayo

Group

Holdings

Inc

4

.000

03/01/27

1,472,253

1,500,000

(a)

Zayo

Group

Holdings

Inc

6

.125

03/01/28

1,245,000

3,690,000

(a)

Zegona

Finance

PLC

8

.625

07/15/29

3,939,075

TOTAL

TELECOMMUNICATION

SERVICES

26,892,625

Portfolio

of

Investments

September

30,

2024

(continued)

JGH

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

TRANSPORTATION

-

5.0%

$

1,000,000

(a)

American

Airlines

Inc

8

.500

%

05/15/29

$

1,061,014

8,000,000

(a)

Brightline

East

LLC

11

.000

01/31/30

6,800,375

3,580,000

(a)

GN

Bondco

LLC

9

.500

10/15/31

3,768,276

750,000

(a)

Grupo

Aeromexico

SAB

de

CV

8

.500

03/17/27

757,885

1,750,000

(a)

Transnet

SOC

Ltd

8

.250

02/06/28

1,814,015

2,000,000

(a)

VistaJet

Malta

Finance

PLC

/

Vista

Management

Holding

Inc

9

.500

06/01/28

1,954,775

TOTAL

TRANSPORTATION

16,156,340

UTILITIES

-

3.0%

750,000

(a)

AES

Espana

BV

5

.700

05/04/28

712,613

500,000

(a)

Continuum

Green

Energy

India

Pvt

/

Co-Issuers

7

.500

06/26/33

525,000

625,000

(a)

Electricidad

Firme

de

Mexico

Holdings

SA

de

CV

4

.900

11/20/26

605,794

1,000,000

(a)

Empresa

de

Transmision

Electrica

SA

5

.125

05/02/49

785,428

600,000

(a)

EnfraGen

Energia

Sur

SA

/

EnfraGen

Spain

SA

/

Prime

Energia

SpA

5

.375

12/30/30

516,911

500,000

(a)

Eskom

Holdings

SOC

Ltd

8

.450

08/10/28

529,445

1,400,000

(a)

Eskom

Holdings

SOC

Ltd

6

.350

08/10/28

1,423,943

4,425,000

(a)

Ferrellgas

LP

/

Ferrellgas

Finance

Corp

5

.875

04/01/29

4,140,870

586,004

(a)

UEP

Penonome

II

SA2020

1

6

.500

10/01/38

507,765

TOTAL

UTILITIES

9,747,769

TOTAL

CORPORATE

BONDS

(Cost

$244,032,222)

241,050,171

PRINCIPAL

DESCRIPTION

RATE

(e)

MATURITY

(f)

VALUE

X

56,208,673

VARIABLE

RATE

SENIOR

LOAN

INTERESTS

-

17

.4

%

(

12

.6

%

of

Total

Investments)

(e)

X

56,208,673

CAPITAL

GOODS

-

1.3%

$

250,000

(b)

Foundation

Building

Materials

Holding

Company

LLC,

Term

Loan

B2,

(TBD)

TBD

TBD

$

243,991

895,506

TransDigm,

Inc.,

Term

Loan

J,

(TSFR3M

+

2.500%)

7

.104

02/28/31

893,025

3,002,350

Windsor

Holdings

III,

LLC,

Term

Loan

B,

(TSFR1M

+

4.000%)

8

.461

08/01/30

3,020,320

TOTAL

CAPITAL

GOODS

4,157,336

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

1.1%

1,900,000

Johnstone

Supply

LLC,

Term

Loan,

(TSFR1M

+

3.000%)

8

.174

05/16/31

1,897,625

1,461,234

PetSmart,

Inc.,

Term

Loan

B,

(TSFR1M

+

3.750%)

8

.695

02/14/28

1,450,925

345,000

(b)

Wand

NewCo

3,

Inc.,

Term

Loan

B,

(TBD)

TBD

TBD

345,000

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

3,693,550

CONSUMER

DURABLES

&

APPAREL

-

0.7%

2,385,000

Varsity

Brands

LLC

,Term

Loan,

(TSFR3M

+

3.750%)

8

.821

07/28/31

2,371,835

TOTAL

CONSUMER

DURABLES

&

APPAREL

2,371,835

CONSUMER

SERVICES

-

0.7%

694,643

Carnival

Corporation,

Term

Loan

B2,

(TSFR1M

+

2.750%)

7

.595

08/09/27

697,463

1,200,000

GBT

US

III

LLC,

Term

loan

B,

(TSFR3M

+

3.000%)

8

.279

07/28/31

1,198,998

346,496

GVC

Holdings

(Gibraltar)

Limited,

Term

Loan

B,

(TSFR6M

+

2.750%)

8

.014

10/31/29

347,000

TOTAL

CONSUMER

SERVICES

2,243,461

FINANCIAL

SERVICES

-

0.6%

500,000

AAL

Delaware

Holdco,

Inc.,

Term

loan

B,

(TSFR1M

+

3.500%)

8

.345

07/30/31

502,892

1,365,000

Boost

Newco

Borrower,

LLC,

Term

loan

B,

(TSFR3M

+

2.500%)

7

.104

01/31/31

1,367,273

TOTAL

FINANCIAL

SERVICES

1,870,165

FOOD,

BEVERAGE

&

TOBACCO

-

1.6%

861,918

Pegasus

BidCo

BV,

Term

Loan,

(TSFR3M

+

3.750%)

8

.868

07/12/29

864,345

4,428,564

Triton

Water

Holdings,

Inc,

Term

Loan,

(TSFR3M

+

3.250%)

7

.918

03/31/28

4,425,907

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

5,290,252

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

3.8%

165,963

ICON

Luxembourg

S.A.R.L.,

Term

Loan

B,

(TSFR3M

+

2.000%)

6

.604

07/03/28

167,029

4,365,000

Insulet

Corporation,

Term

loan

B,

(TSFR1M

+

2.500%)

7

.345

07/31/31

4,390,252

2,691,515

Medline

Borrower,

LP,

Term

Loan

B,

(TSFR1M

+

2.750%)

7

.595

10/23/28

2,695,647

2,781,563

Onex

TSG

Intermediate

Corp.,

Term

Loan

B,

(TSFR3M

+

4.750%)

9

.710

02/28/28

2,782,425

1,907,989

Parexel

International

Corporation,

Term

loan

B,

(TSFR1M

+

3.000%)

7

.845

11/15/28

1,910,517

PRINCIPAL

DESCRIPTION

RATE(e)

MATURITY(f)

VALUE

HEALTH

CARE

EQUIPMENT

&

SERVICES

(continued)

$

207,508

Select

Medical

Corporation,

Term

Loan

B1,

(TSFR1M

+

3.000%)

7

.845

%

03/05/27

$

208,588

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

12,154,458

HOUSEHOLD

&

PERSONAL

PRODUCTS

-

0.9%

1,989,770

Illuminate

Merger

Sub

Corp.,

Term

Loan,

(TSFR3M

+

3.000%)

8

.365

05/16/28

1,987,651

774,000

Journey

Personal

Care

Corp.,

Term

Loan

B,

(TSFR1M

+

4.250%)

9

.210

03/01/28

774,000

TOTAL

HOUSEHOLD

&

PERSONAL

PRODUCTS

2,761,651

INSURANCE

-

0.2%

618,766

USI,

Inc.,

Term

Loan,

(TSFR3M

+

2.750%)

7

.354

09/27/30

617,605

TOTAL

INSURANCE

617,605

MATERIALS

-

1.0%

952,612

Berlin

Packaging

LLC,

Term

Loan

B,

(TSFR1M

+

3.750%)

8

.961

05/12/31

952,998

2,113,690

Nouryon

Finance

B.V.,

Term

Loan

B,

(TSFR3M

+

3.500%)

8

.628

04/03/28

2,119,640

277,163

W.R.

Grace

&

Co.-Conn.,

Term

Loan

B,

(TSFR3M

+

3.250%)

7

.854

09/22/28

278,202

TOTAL

MATERIALS

3,350,840

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

2.6%

41,672

ICON

Luxembourg

S.A.R.L.,

Term

Loan,

(TSFR3M

+

2.250%)

6

.604

07/03/28

41,940

1,971,695

Jazz

Financing

Lux

S.a.r.l.,

Term

Loan

B,

(TSFR1M

+

2.250%)

7

.095

05/05/28

1,971,872

6,294,028

(b),(g)

Organon

&

Co,

Term

Loan

B,

(TBD)

TBD

TBD

6,294,028

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

8,307,840

SOFTWARE

&

SERVICES

-

2.3%

3,335,000

(b)

Amazon

Holdco

Inc

,Term

Loan,

(TBD)

TBD

TBD

3,328,747

2,500,000

Fortress

Intermediate

3,

Inc,

Term

Loan

B,

(TSFR1M

+

3.750%)

8

.595

05/08/31

2,498,437

740,506

Open

Text

Corporation,

Term

Loan

B,

(TSFR1M

+

2.250%)

7

.095

01/31/30

744,083

221,107

Rackspace

Technology

Global,

Inc.,

Term

Loan,

First

Lien,

(TSFR1M

+

6.250%)

11

.483

05/15/28

224,953

798,000

Ultimate

Software

Group

Inc

(The),

Term

Loan

B,

(TSFR3M

+

3.500%)

8

.555

02/10/31

798,998

TOTAL

SOFTWARE

&

SERVICES

7,595,218

TRANSPORTATION

-

0.4%

562,500

AAdvantage

Loyalty

IP

Ltd.,

Term

Loan,

(TSFR3M

+

4.750%)

10

.294

04/20/28

579,139

591,019

Brown

Group

Holding,

LLC,

Term

Loan

B2,

(TSFR3M

+

2.750%)

8

.322

07/01/31

590,442

4,933

SkyMiles

IP

Ltd.,

Term

Loan

B,

(TSFR3M

+

3.750%)

9

.032

10/20/27

5,030

TOTAL

TRANSPORTATION

1,174,611

UTILITIES

-

0.2%

617,187

Talen

Energy

Supply,

LLC,

Term

Loan

B,

(TSFR3M

+

3.500%)

8

.596

05/17/30

619,851

TOTAL

UTILITIES

619,851

TOTAL

VARIABLE

RATE

SENIOR

LOAN

INTERESTS

(Cost

$55,818,014)

56,208,673

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

X

55,396,789

SOVEREIGN

DEBT

-

17

.1

%

(

12

.4

%

of

Total

Investments)

X

55,396,789

ANGOLA

-

1.0%

$

900,000

(a)

Angolan

Government

International

Bond

8

.000

11/26/29

$

817,443

1,050,000

(a)

Angolan

Government

International

Bond

8

.750

04/14/32

941,543

1,500,000

(a)

Angolan

Government

International

Bond

8

.250

05/09/28

1,423,734

TOTAL

ANGOLA

3,182,720

ARGENTINA

-

0.8%

2,100,000

Argentine

Republic

Government

International

Bond

5

.000

01/09/38

1,094,979

3,025,000

Argentine

Republic

Government

International

Bond

4

.125

07/09/35

1,452,000

TOTAL

ARGENTINA

2,546,979

BENIN

-

0.3%

1,025,000

(a)

Benin

Government

International

Bond

7

.960

02/13/38

1,016,031

TOTAL

BENIN

1,016,031

BRAZIL

-

0.3%

1,000,000

Brazilian

Government

International

Bond

7

.125

05/13/54

1,034,617

TOTAL

BRAZIL

1,034,617

Portfolio

of

Investments

September

30,

2024

(continued)

JGH

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

COLOMBIA

-

1.0%

$

1,400,000

Colombia

Government

International

Bond

5

.625

%

02/26/44

$

1,126,573

1,320,000

Colombia

Government

International

Bond

7

.500

02/02/34

1,368,885

700,000

Colombia

Government

International

Bond

8

.750

11/14/53

766,823

TOTAL

COLOMBIA

3,262,281

COTE

D'IVOIRE

-

1.2%

1,318,057

(a)

Ivory

Coast

Government

International

Bond

5

.750

12/31/32

1,259,146

1,700,000

(a)

Ivory

Coast

Government

International

Bond

8

.250

01/30/37

1,748,804

750,000

(a)

Ivory

Coast

Government

International

Bond

6

.125

06/15/33

705,933

TOTAL

COTE

D'IVOIRE

3,713,883

DOMINICAN

REPUBLIC

-

0.3%

1,175,000

(a)

Dominican

Republic

International

Bond

5

.300

01/21/41

1,079,496

TOTAL

DOMINICAN

REPUBLIC

1,079,496

ECUADOR

-

0.5%

1,767,500

(a)

Ecuador

Government

International

Bond

5

.000

07/31/30

1,283,395

371,475

(a)

Ecuador

Government

International

Bond

1

.000

07/31/35

210,593

88,000

(a)

Ecuador

Government

International

Bond

5

.000

07/31/40

45,260

TOTAL

ECUADOR

1,539,248

EGYPT

-

1.3%

2,300,000

(a)

Egypt

Government

International

Bond

7

.053

01/15/32

1,990,682

1,700,000

(a)

Egypt

Government

International

Bond

7

.600

03/01/29

1,638,401

975,000

(a)

Egypt

Government

International

Bond

8

.500

01/31/47

785,947

TOTAL

EGYPT

4,415,030

EL

SALVADOR

-

0.8%

925,000

(a)

El

Salvador

Government

International

Bond

8

.625

02/28/29

908,775

1,575,000

(a)

El

Salvador

Government

International

Bond

9

.250

04/17/30

1,563,601

1,000,000

(a)

El

Salvador

Government

International

Bond

0

.250

04/17/30

19,966

TOTAL

EL

SALVADOR

2,492,342

HONDURAS

-

0.6%

1,250,000

(a)

Honduras

Government

International

Bond

6

.250

01/19/27

1,207,350

750,000

(a)

Honduras

Government

International

Bond

5

.625

06/24/30

663,375

TOTAL

HONDURAS

1,870,725

IRAQ

-

0.4%

1,356,250

(a)

Iraq

International

Bond

5

.800

01/15/28

1,314,263

TOTAL

IRAQ

1,314,263

JORDAN

-

0.2%

825,000

(a)

Jordan

Government

International

Bond

5

.850

07/07/30

777,566

TOTAL

JORDAN

777,566

KENYA

-

1.0%

2,000,000

(a)

Republic

of

Kenya

Government

International

Bond

7

.000

05/22/27

1,962,844

825,000

(a)

Republic

of

Kenya

Government

International

Bond

6

.300

01/23/34

674,713

750,000

(a)

Republic

of

Kenya

Government

International

Bond

9

.750

02/16/31

758,025

TOTAL

KENYA

3,395,582

MONGOLIA

-

0.4%

675,000

(a)

Mongolia

Government

International

Bond

4

.450

07/07/31

598,392

500,000

(a)

Mongolia

Government

International

Bond

8

.650

01/19/28

534,000

TOTAL

MONGOLIA

1,132,392

NIGERIA

-

0.7%

1,200,000

(a)

Nigeria

Government

International

Bond

6

.125

09/28/28

1,088,921

1,425,000

(a)

Nigeria

Government

International

Bond

7

.875

02/16/32

1,282,141

TOTAL

NIGERIA

2,371,062

PANAMA

-

0.4%

1,000,000

Panama

Government

International

Bond

8

.000

03/01/38

1,129,298

TOTAL

PANAMA

1,129,298

RWANDA

-

0.6%

2,450,000

(a)

Rwanda

International

Government

Bond

5

.500

08/09/31

2,025,832

TOTAL

RWANDA

2,025,832

SENEGAL

-

0.6%

2,100,000

(a)

Senegal

Government

International

Bond

6

.250

05/23/33

1,808,363

TOTAL

SENEGAL

1,808,363

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SOUTH

AFRICA

-

0.8%

$

1,400,000

Republic

of

South

Africa

Government

International

Bond

5

.000

%

10/12/46

$

1,081,962

1,475,000

Republic

of

South

Africa

Government

International

Bond

7

.300

04/20/52

1,466,121

TOTAL

SOUTH

AFRICA

2,548,083

TURKEY

-

2.5%

1,050,000

(b)

Turkiye

Government

International

Bond

6

.500

01/03/35

1,029,525

1,375,000

Turkiye

Government

International

Bond

4

.875

04/16/43

1,036,509

1,225,000

Turkiye

Government

International

Bond

6

.000

01/14/41

1,078,000

1,250,000

Turkiye

Government

International

Bond

5

.875

06/26/31

1,213,070

1,500,000

Turkiye

Government

International

Bond

6

.500

09/20/33

1,483,500

2,225,000

Turkiye

Government

International

Bond

7

.625

05/15/34

2,361,310

TOTAL

TURKEY

8,201,914

UKRAINE

-

0.1%

335,400

(a)

Ukraine

Government

International

Bond

1

.750

02/01/35

144,557

269,339

(a)

Ukraine

Government

International

Bond

1

.750

02/01/36

114,792

64,899

(a)

Ukraine

Government

International

Bond

1

.750

02/01/29

38,024

242,291

(a)

Ukraine

Government

International

Bond

1

.750

02/01/34

107,335

49,812

(a)

Ukraine

Government

International

Bond

0

.000

02/01/30

21,668

186,147

(a)

Ukraine

Government

International

Bond

0

.000

02/01/34

63,011

157,307

(a)

Ukraine

Government

International

Bond

0

.000

02/01/35

68,507

131,089

(a)

Ukraine

Government

International

Bond

0

.000

02/01/36

56,467

TOTAL

UKRAINE

614,361

UZBEKISTAN

-

0.9%

745,000

(a)

Republic

of

Uzbekistan

International

Bond

7

.850

10/12/28

787,372

950,000

(a)

Republic

of

Uzbekistan

International

Bond

3

.900

10/19/31

811,387

1,075,000

(a)

Republic

of

Uzbekistan

International

Bond

5

.375

02/20/29

1,040,062

TOTAL

UZBEKISTAN

2,638,821

ZAMBIA

-

0.4%

1,459,178

(a)

Zambia

Government

International

Bond

5

.750

06/30/33

1,285,900

TOTAL

ZAMBIA

1,285,900

TOTAL

SOVEREIGN

DEBT

(Cost

$55,616,723)

55,396,789

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

X

51,053,415

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

15

.8

%

(

11

.5

%

of

Total

Investments)

X

51,053,415

BANKS

-

2.9%

$

1,000,000

(a),(d)

Banco

del

Estado

de

Chile

7

.950

N/A

$

1,074,019

1,000,000

(a)

Banco

Nacional

de

Comercio

Exterior

SNC/Cayman

Islands

2

.720

08/11/31

912,367

800,000

Bancolombia

SA

8

.625

12/24/34

858,840

2,000,000

(d),(h)

Fifth

Third

Bancorp

(TSFR3M

+

3.295%)

7

.898

N/A

1,988,980

1,500,000

(d),(h)

First

Citizens

BancShares

Inc/NC

(TSFR3M

+

4.234%)

9

.180

N/A

1,532,864

1,000,000

(a),(d)

NBK

Tier

1

Ltd

3

.625

N/A

954,610

475,000

(a)

Turkiye

Garanti

Bankasi

AS

7

.177

05/24/27

480,939

385,000

(a)

Turkiye

Garanti

Bankasi

AS

8

.375

02/28/34

395,027

1,000,000

(a)

Yapi

ve

Kredi

Bankasi

AS

9

.250

01/17/34

1,065,379

TOTAL

BANKS

9,263,025

CAPITAL

GOODS

-

0.3%

1,000,000

(a)

AerCap

Global

Aviation

Trust

6

.500

06/15/45

998,440

TOTAL

CAPITAL

GOODS

998,440

ENERGY

-

4.9%

2,000,000

Enbridge

Inc

8

.500

01/15/84

2,236,996

1,000,000

(d)

Energy

Transfer

LP

7

.125

N/A

1,021,525

1,900,000

(d)

Energy

Transfer

LP

6

.500

N/A

1,895,455

3,000,000

(d),(h)

Plains

All

American

Pipeline

LP

(TSFR3M

+

4.372%)

9

.490

N/A

2,987,075

1,105,000

(a)

South

Bow

Canadian

Infrastructure

Holdings

Ltd

7

.625

03/01/55

1,145,168

575,000

(a)

South

Bow

Canadian

Infrastructure

Holdings

Ltd

7

.500

03/01/55

604,104

6,000,000

(a),(d)

Venture

Global

LNG

Inc

9

.000

N/A

6,081,773

TOTAL

ENERGY

15,972,096

Portfolio

of

Investments

September

30,

2024

(continued)

JGH

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

FINANCIAL

SERVICES

-

0.8%

$

1,500,000

(d)

Ally

Financial

Inc

4

.700

%

N/A

$

1,307,160

1,500,000

(d)

Ally

Financial

Inc

4

.700

N/A

1,225,420

TOTAL

FINANCIAL

SERVICES

2,532,580

FOOD,

BEVERAGE

&

TOBACCO

-

0.7%

1,000,000

(a),(d)

Land

O'

Lakes

Inc

7

.000

N/A

820,000

1,500,000

(a),(d)

Land

O'

Lakes

Inc

8

.000

N/A

1,384,786

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

2,204,786

INSURANCE

-

0.8%

1,765,000

Enstar

Finance

LLC

5

.750

09/01/40

1,744,147

1,000,000

(a),(d)

SBL

Holdings

Inc

6

.500

N/A

860,261

TOTAL

INSURANCE

2,604,408

MEDIA

&

ENTERTAINMENT

-

0.5%

1,750,000

Paramount

Global

6

.375

03/30/62

1,618,726

TOTAL

MEDIA

&

ENTERTAINMENT

1,618,726

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

0.8%

2,500,000

(a)

EUSHI

Finance

Inc

7

.625

12/15/54

2,637,812

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

2,637,812

UTILITIES

-

4.1%

600,000

(a)

AES

Andes

SA

8

.150

06/10/55

619,376

2,047,000

(a)

AltaGas

Ltd

7

.200

10/15/54

2,090,772

1,000,000

Emera

Inc

6

.750

06/15/76

1,005,770

1,500,000

(a),(d)

NRG

Energy

Inc

10

.250

N/A

1,691,946

3,360,000

PG&E

Corp

7

.375

03/15/55

3,524,214

4,000,000

(a),(d)

Vistra

Vision

LLC

8

.875

N/A

4,289,464

TOTAL

UTILITIES

13,221,542

TOTAL

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

(Cost

$50,232,650)

51,053,415

PRINCIPAL

DESCRIPTION

(i)

RATE

MATURITY

VALUE

X

30,276,942

CONTINGENT

CAPITAL

SECURITIES

-

9

.4

%

(

6

.8

%

of

Total

Investments)

X

30,276,942

BANKS

-

7.8%

$

1,800,000

(d)

Banco

Bilbao

Vizcaya

Argentaria

SA

9

.375

N/A

$

1,987,274

400,000

(a),(d)

Banco

de

Credito

e

Inversiones

SA

8

.750

N/A

430,703

1,975,000

(a),(d)

Banco

Mercantil

del

Norte

SA/Grand

Cayman

8

.375

N/A

2,065,371

2,100,000

(d)

Banco

Santander

SA

4

.750

N/A

1,999,155

2,200,000

(d)

Banco

Santander

SA

9

.625

N/A

2,586,416

1,000,000

Bancolombia

SA

4

.625

12/18/29

989,818

1,475,000

(d)

Barclays

PLC

8

.000

N/A

1,553,309

1,000,000

(a)

BBVA

Bancomer

SA/Texas

8

.450

06/29/38

1,090,497

2,000,000

(a),(d)

BNP

Paribas

SA

7

.000

N/A

2,043,066

1,500,000

(a),(d)

BNP

Paribas

SA

8

.000

N/A

1,600,602

2,000,000

(d)

ING

Groep

NV

6

.500

N/A

2,001,674

2,000,000

(a),(d)

Intesa

Sanpaolo

SpA

7

.700

N/A

1,997,561

2,000,000

(d)

Lloyds

Banking

Group

PLC

8

.000

N/A

2,142,734

1,400,000

(d)

NatWest

Group

PLC

8

.125

N/A

1,527,305

1,000,000

(a),(d)

Societe

Generale

SA

10

.000

N/A

1,074,836

TOTAL

BANKS

25,090,321

FINANCIAL

SERVICES

-

1.6%

1,650,000

(d)

Deutsche

Bank

AG

6

.000

N/A

1,613,239

3,030,000

(a),(d)

UBS

Group

AG

9

.250

N/A

3,573,382

TOTAL

FINANCIAL

SERVICES

5,186,621

TOTAL

CONTINGENT

CAPITAL

SECURITIES

(Cost

$28,491,882)

30,276,942

SHARES

DESCRIPTION

RATE

VALUE

X

1,370,009

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

0

.4

%

(

0

.3

%

of

Total

Investments)

X

1,370,009

BANKS

-

0.1%

25,200

Western

Alliance

Bancorp

4

.250

$

508,536

TOTAL

BANKS

508,536

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

SHARES

DESCRIPTION

RATE

VALUE

FINANCIAL

SERVICES

-

0.3%

33,625

Synchrony

Financial

8

.250

%

$

861,473

TOTAL

FINANCIAL

SERVICES

861,473

TOTAL

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

(Cost

$1,470,625)

1,370,009

SHARES

DESCRIPTION

VALUE

X

937,435

COMMON

STOCKS

-

0

.3

%

(

0

.2

%

of

Total

Investments)

X

937,435

TRANSPORTATION

-

0.3%

47,127

(j)

Grupo

Aeromexico

SAB

de

CV

$

937,435

TOTAL

TRANSPORTATION

937,435

TOTAL

COMMON

STOCKS

(Cost

$885,858)

937,435

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

–

ASSET-BACKED

SECURITIES

-

0.2%

(0.2%

of

Total

Investments)

–

$

127

CWABS

Asset-Backed

Certificates

Trust

2007-4,

2007

4

4

.483

04/25/47

0

750,000

(a),(c)

Industrial

DPR

Funding

Ltd,

2022

1A

5

.380

04/15/34

665,790

TOTAL

ASSET-BACKED

SECURITIES

(Cost

$750,000)

665,790

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$437,297,974)

436,959,224

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

2.8% (2.0%

of

Total

Investments)

X

9,093,571

REPURCHASE

AGREEMENTS

-

2

.8

%

(

2

.0

%

of

Total

Investments)

X

9,093,571

$

9,093,571

(k)

Fixed

Income

Clearing

Corporation

1

.520

10/01/24

$

9,093,571

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$9,093,571)

9,093,571

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$9,093,571)

9,093,571

TOTAL

INVESTMENTS

-

138

.0

%

(Cost

$

446,391,545

)

446,052,795

BORROWINGS

-

(36.8)%

(l),(m)

(

119,000,000

)

OTHER

ASSETS

&

LIABILITIES,

NET

- (1.2)%

(

3,824,695

)

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

323,228,100

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(n)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

Capital

Services

LLC

$

87,400,000

Receive

1-Month

LIBOR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

1,546,252

$

1,546,252

Portfolio

of

Investments

September

30,

2024

(continued)

JGH

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

The

following

is

a

reconciliation

of

the

Fund’s

Level

3

investments

held

at

the

beginning

and

end

of

the

measurement

period:

The

table

below

presents

the

transfers

in

and

out

of

the

three

valuation

levels

for

the

Fund

as

of

the

end

of

the

reporting

period

when

compared

to

the

valuation

levels

at

the

end

of

the

previous

fiscal

year.

Changes

in

valuation

inputs

or

methodologies

may

result

in

transfers

into

or

out

of

an

assigned

level

within

the

fair

value

hierarchy.

Transfers

in

or

out

of

levels

are

generally

due

to

the

availability

of

publicly

available

information

and

to

the

significance

or

extent

the

Adviser

determines

that

the

valuation

inputs

or

methodologies

may

impact

the

valuation

of

those

securities.

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Corporate

Bonds

$

–

$

240,873,921

$

176,250

$

241,050,171

Variable

Rate

Senior

Loan

Interests

–

56,208,673

–

56,208,673

Sovereign

Debt

–

55,396,789

–

55,396,789

$1,000

Par

(or

similar)

Institutional

Preferred

–

51,053,415

–

51,053,415

Contingent

Capital

Securities

–

30,276,942

–

30,276,942

$25

Par

(or

similar)

Retail

Preferred

1,370,009

–

–

1,370,009

Common

Stocks

937,435

–

–

937,435

Asset-Backed

Securities

–

–

665,790

665,790

Short-Term

Investments:

Repurchase

Agreements

–

9,093,571

–

9,093,571

Investments

in

Derivatives:

Interest

Rate

Swaps*

–

1,546,252

–

1,546,252

Variable

Rate

Senior

Loan

Interests*

–

–

–

–

Total

$

2,307,444

$

444,449,563

$

842,040

$

447,599,047

*

Represents

net

unrealized

appreciation

(depreciation).

Level

3

Corporate

Bonds

Asset

Backed

Securities

Balance

at

the

beginning

of

period

$-

$648,570

Gains

(losses):

Net

realized

gains

(losses)

-

-

Change

in

net

unrealized

appreciation

(depreciation)

-

17,220

Purchases

at

cost

-

-

Sales

at

proceeds

-

-

Net

discounts

(premiums)

-

-

Transfers

into

176,250

-

Transfers

(out

of)

-

-

Balance

at

the

end

of

period

$176,250

$665,790

Change

in

net

unrealized

appreciation

(depreciation)

during

the

period

of

Level

3

securities

held

as

of

period

end

$3,750

$17,220

Level

1

Level

2

Level

3

Transfers

In

(Transfers

Out)

Transfers

In

(Transfers

Out)

Transfers

In

(Transfers

Out)

JGH

Corporate

Bonds

$-

$-

$-

$(176,250)

$176,250

$-

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$297,098,664

or

66.6%

of

Total

Investments.

(b)

When-issued

or

delayed

delivery

security.

(c)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(d)

Perpetual

security.

Maturity

date

is

not

applicable.

(e)

Senior

loans

generally

pay

interest

at

rates

which

are

periodically

adjusted

by

reference

to

a

base

short-term,

floating

lending

rate

(Reference

Rate)

plus

an

assigned

fixed

rate

(Spread).

These

floating

lending

rates

are

generally

(i)

the

lending

rate

referenced

by

the

Secured

Overnight

Financing

Rate

(“SOFR”),

or

(ii)

the

prime

rate

offered

by

one

or

more

major

United

States

banks.

Senior

loans

may

be

considered

restricted

in

that

the

Fund

ordinarily

is

contractually

obligated

to

receive

approval

from

the

agent

bank

and/or

borrower

prior

to

the

disposition

of

a

senior

loan.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(f)

Senior

loans

generally

are

subject

to

mandatory

and/or

optional

prepayment.

Because

of

these

mandatory

prepayment

conditions

and

because

there

may

be

significant

economic

incentives

for

a

borrower

to

prepay,

prepayments

of

senior

loans

may

occur.

As

a

result,

the

actual

remaining

maturity

of

senior

loans

held

may

be

substantially

less

than

the

stated

maturities

shown.

(g)

Portion

of

investment

purchased

on

a

delayed

delivery

basis.

(h)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(i)

Contingent

Capital

Securities

(“CoCos”)

are

hybrid

securities

with

loss

absorption

characteristics

built

into

the

terms

of

the

security

for

the

benefit

of

the

issuer.

For

example,

the

terms

may

specify

an

automatic

write-down

of

principal

or

a

mandatory

conversion

into

the

issuer’s

common

stock

under

certain

adverse

circumstances,

such

as

the

issuer’s

capital

ratio

falling

below

a

specified

level.

(j)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(k)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.520%

dated

9/30/24

to

be

repurchased

at

$9,093,955

on

10/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.500%

and

maturity

date

9/30/26,

valued

at

$9,275,519.

(l)

Borrowings

as

a

percentage

of

Total

Investments

is

26.7%.

(m)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investment

(excluding

any

investments

pledged

as

collateral

to

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

(n)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

PIK

Payment-in-kind

(“PIK”)

security. Depending

on

the

terms

of

the

security,

income

may

be

received

in

the

form

of

cash,

securities,

or

a

combination

of

both. The

PIK

rate

shown,

where

applicable,

represents

the

annualized

rate

of

the

last

PIK

payment

made

by

the

issuer

as

of

the

end

of

the

reporting

period.

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

TSFR

1M

CME

Term

SOFR

1

Month

TSFR

3M

CME

Term

SOFR

3

Month

TSFR

6M

CME

Term

SOFR

6

Month

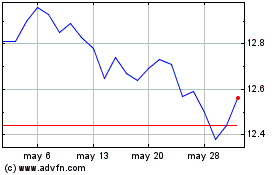

Nuveen Global High Income (NYSE:JGH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Nuveen Global High Income (NYSE:JGH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024