Coca-Cola Gets Lift From Diet Sodas, Price Increases -- Update

30 Octubre 2018 - 8:30AM

Noticias Dow Jones

By Jennifer Maloney and Aisha Al-Muslim

A rebound in demand for diet cola lifted Coca-Cola Co.'s core

soda business in the latest quarter, as consumers turned back to

the zero-calorie drinks they once spurned.

The company's global soda volume grew 2% from the same quarter a

year ago, led by rising demand for Diet Coke and Coke Zero Sugar, a

reformulation of Coke Zero that tastes and looks more like original

Coke, with a red circle on the cans.

"Coke Zero Sugar is on a roll," with sales growth world-wide in

the high-teen percentage points, Chief Executive James Quincey said

in an interview Tuesday.

Diet Coke even eked out gains in the U.S., where its sales

volume had been sliding for more than a decade as consumers turned

to bottled water and flavored seltzer. Low- and no-calorie Sprite

and Fanta also helped boost sales, except in a couple of Central

American countries where the company changed the recipes too

sharply and consumers were unhappy, Mr. Quincey said.

"We've course-corrected" in those markets, he said. "Where we've

gone down in stages in the sugar reduction, we've seen good

consumer acceptance."

The soda giant in January launched four new flavors of Diet

Coke, including Ginger Lime and Zesty Blood Orange, packaged in new

slim cans.

Low single-digit percentage price increases on Coke products in

North America, implemented after the U.S. placed tariffs on Chinese

imports, didn't seem to dampen demand. Organic revenue, which

excludes currency swings, acquisitions and divestitures, increased

6% from a year ago. Sales volume grew 2% from a year earlier.

Coca-Cola replaced Coke Zero with Coke Zero Sugar in the U.S.

last year. The company has been aiming to cut sugar from its

products and diversify beyond soda as more countries implement

taxes on high-calorie beverages to combat rising rates of obesity

and diabetes, and as consumers switch to healthier beverages.

Overall, net revenue for the beverage company dropped 9% to

$8.25 billion, as a result of the refranchising of company-owned

bottling operations. Analysts polled by Refinitiv had expected

revenue of $8.17 billion.

The Atlanta-based company posted a profit for the third quarter

of $1.88 billion, or 44 cents a share, up from $1.45 billion, or 33

cents a share, a year earlier. On an adjusted basis, it earned 58

cents a share, beating the 55 cents a share analysts expected.

For 2018, the company maintained its guidance of at least 4%

growth in organic revenue and comparable adjusted earnings per

share from continuing operations of a 8% to 10% growth versus $1.91

in 2017.

The stock was up 0.6% in morning trading Tuesday. Shares are up

1.9% in the past 12 months.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and Aisha

Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

October 30, 2018 10:15 ET (14:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

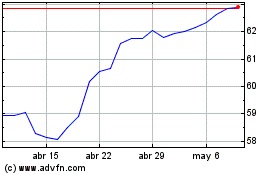

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

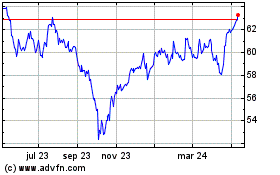

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024