Kabanga Definitive Feasibility Study Nearing

Completion; Expected in September

Webcast Today at 10.30 AM ET

Lifezone Metals Limited’s (NYSE: LZM) Chief Executive

Officer, Chris Showalter, and Chief Financial Officer, Ingo

Hofmaier, are pleased to provide an update on recent activities at

Lifezone’s projects and its H1 2024 unaudited financial

results.

Lifezone continues to progress its Kabanga Nickel Project,

located in north-west Tanzania, through a strategic partnership

with the Government of Tanzania and BHP. Kabanga is believed to be

one of the world's largest and highest-grade undeveloped nickel

sulfide deposits. In addition, Lifezone continues to advance its

partnership with Glencore to recycle platinum, palladium and

rhodium in the United States.

Highlights:

- +2 million hours worked at the Kabanga Nickel Project without a

lost time injury.

- Design and engineering completed for the Kabanga Nickel Project

Definitive Feasibility Study, which remains on track for completion

by the end of September.

- The Project’s capital and operating expenditures estimates are

currently being finalized, based on an initial 1.7 million tonne

per year Phase 1, plus additional 1.7 million tonne per year Phase

2 expansion, for a combined 3.4 million tonne per year underground

mining operation, concentrator and Hydromet refinery.

- The Kabanga Nickel Project is expected to be a fully integrated

mine-to-metal operation that will enable a fully auditable supply

chain with production of refined, LME-grade nickel, copper and

cobalt metals in Tanzania.

- Production of first nickel, copper and cobalt metal cathode

samples from Kabanga source material via the semi-continuous

Hydromet pilot program at Lifezone’s Simulus Labs in Perth,

Australia.

- Infrastructure build-out in Tanzania continues with notable

recent developments, including:

- Inaugural Standard Gauge Railway service between the port city

of Dar es Salaam and the city of Morogoro began in June, and the

upgraded rail connecting Morogoro to Tanzania’s capital city of

Dodoma was completed in late-July. 1

- The Tanzania Electric Supply Company Limited (“TANESCO”) has

started generating surplus electricity at the Julius Nyerere Hydro

Power Project after switching on Turbine #7 at the facility,

located in eastern Tanzania. Once all nine turbines are

operational, it is expected to generate ~2.4 gigawatts of green

electricity into the national grid.2

- To date, Lifezone has achieved 95% completion of compensation

payments to those persons physically and economically displaced by

the Kabanga Nickel Project.

- Pilot work and Feasibility Study for the Phase 1 partnership

with Glencore to recycle platinum, palladium and rhodium from spent

automotive catalytic converters in the United States is progressing

well with planned completion in Q4 2024.

- Healthy cash position of $63.5 million as at June 30,

2024.

- Basic and diluted loss per share of $0.14 for H1 2024, compared

to basic and diluted loss per share of $0.18 in H1 2023.

Mr. Showalter stated: “Completing the design and engineering

phase of the Definitive Feasibility Study for the Kabanga Nickel

Project marks a pivotal milestone, bringing us another step closer

to our goal of establishing a fully integrated mine-to-metal

operation in Tanzania. We are dedicated to continuing our

collaboration with BHP and the Government of Tanzania to drive

sustainable development and prosperity.”

More than 2 million hours worked without lost time injury at

the Kabanga Nickel Project

Lifezone operates with safety as an ongoing, front-of-mind

initiative at every level. Achieving 2 million hours worked without

LTI reflects Lifezone’s commitment to create a safe working

culture, promoting and implementing comprehensive workplace health

and safety measures, which include rigorous monitoring and

reporting systems.

Kabanga’s Definitive Feasibility Study progresses towards

completion in September

In June, Lifezone completed the design and engineering phase of

the Definitive Feasibility Study for the Kabanga Nickel Project,

meaning that the Project’s flowsheet parameters and specifications

are now final for the Study and not open for additional revisions.

This includes the sizing of critical pieces of equipment, such as

underground mining fleet, crushers and mills, flotation tanks and

autoclaves. With these technical requirements locked in, Lifezone

is now focused on reviewing equipment and services suppliers,

finalizing the operating cost model and optimizing capital

expenditures.

The two-phased development plan for the Kabanga Nickel Project

was finalized in Q1 2024 and forms the basis of the mine plan and

ultimately the Definitive Feasibility Study. The plan calls for a

1.7 million tonne per year Phase 1 underground mining rate, with an

additional 1.7 million tonne per year Phase 2 expansion, for an

expected 3.4 million tonne per year operation in the aggregate.

Operating cash flows from Phase 1 operations are expected to help

cover the capital requirements for Phase 2.

Finished nickel, copper and cobalt metal cathode samples

produced at Lifezone’s laboratory

As announced in July, Lifezone has produced nickel, copper and

cobalt cathode samples via the semi-continuous pilot scale refinery

test work underway at the Company’s Simulus Laboratory in Perth,

Australia. The metals were produced from flotation concentrate

derived from borehole core samples at the Kabanga. This milestone

marks the first metal ever produced from Kabanga mineralization

since the deposit’s initial discovery in 1975 by the United Nations

Development Program.

Tanzanian infrastructure build-out – progress in rail

connectivity and clean hydropower generation

Kabanga stands to benefit from significant investments being

made into Tanzanian infrastructure. Recently, notable progress was

demonstrated in both rail and power.

Rail

Inaugural Standard Gauge Railway service began in June between

the port city of Dar es Salaam on the Indian Ocean and the city of

Morogoro, covering approximately 300 kilometers. This marked the

completion of Phase 1 of the Standard Gauge Rail construction

project. The Phase 2 project was completed in late-July, connecting

Morogoro to Makutupora, located just outside Tanzania’s capital

city of Dodoma, adding another approximately 420 kilometers. The

Standard Gauge Rail project is a nation-wide upgrade of the

existing metre gauge rail system connecting Dar es Salaam to the

city of Mwanza, located on the shore of Lake Victoria in northern

Tanzania.

Construction of Tanzania’s Standard Gauge Rail is comprised of

six total construction phases, with a scheduled end-date in 2026.

The Standard Gauge Railway system uses electric locomotives to move

trains carrying cargo and passengers that can travel at a speed of

160 kilometers per hour (~100 miles per hour). The Kabanga

Nickel Project stands to significantly benefit from this important

national project, which will connect the Hydromet refinery at

Kahama to the port of Dar es Salaam. The Definitive Feasibility

Study will contemplate truck transport of concentrate from the

Kabanga site to the Hydromet refinery in Kahama, a distance of

approximately 350 kilometers, with the produced refined nickel,

cobalt and copper being sent via rail to the port of Dar es

Salaam.

Future expansions of the Standard Gauge Rail system could

include a branch to the neighboring country of Burundi, which would

likely pass near to the Kabanga site and potentially eliminate the

need for road haulage between Kabanga and the Hydromet refinery at

Kahama.

Power

The Tanzania Electric Supply Company Limited (“TANESCO”) is now

generating surplus electricity at the Julius Nyerere Hydro Power

Project after switching on Turbine #7. Under construction since

2019, the Julius Nyerere Hydro Power Project began generating clean

hydroelectric power in Q1 2024. It is now nearing completion with a

total of nine turbines set to generate approximately 2.4 gigawatts

of green electricity into the national power grid.

Regular access to clean, green and reliable power is important

for the Kabanga Nickel Project, with the Julius Nyerere Hydro Power

Project being one of three hydroelectric plants that form part of

Tanzania’s Power System Master Plan. In addition, there is the

80-megawatt Rusumo Hydroelectric Power Station (commissioned in Q4

2023) and the 88-megawatt Kakono Hydroelectric Power Station

(scheduled for late-2028).

As announced in Q1 2024, TANESCO completed construction and

installation of a 33-kilovolt power line connecting the Kabanga

Nickel Project operations camp to the national power grid. With

reliable grid electricity, Kabanga has been able to end its

reliance on more emissions-intensive diesel generators.

Close collaboration with all Kabanga Nickel Project partners

and stakeholders continues

Key to moving the Kabanga Nickel Project forward is close

collaboration amongst all project partners and stakeholders. To

this end, regular meetings have been held between Lifezone, BHP and

the Government of Tanzania from May to finalize the Joint Financial

Model. This is based on the technical parameters determined through

the Definitive Feasibility Study, and forms the basis of the

sharing of the economic benefits between Lifezone and BHP, as the

funding shareholders, and the Government of Tanzania – as outlined

in the Framework Agreement signed in January 2021. It is also the

basis for the valuation of BHP’s potential T2 option earn-in post

Definitive Feasibility Study completion.

The Government of Tanzania has a 16% free-carried interest,

while BHP currently has a 14.3% indirect interest in the Kabanga

Nickel Project with an option to increase its indirect ownership to

51% following completion of the Definitive Feasibility Study and

the Joint Financial Model.

Compensation payments largely completed to those persons

affected by the Kabanga Nickel Project

With the future construction of the Kabanga Nickel Project,

within the Special Mining Licence 349 local households will be

physically impacted (i.e., houses and land title impacted) and 990

will likely be economically impacted (i.e., land title impacted).

In 2023, Lifezone worked proficiently to update and improve a

previous 2013 Relocation-Resettlement Action plan, and the Lifezone

Resettlement Action Plan was submitted to the Tanzanian Ministry of

Minerals in August 2023.

By the end of 2023, Lifezone achieved key resettlement

milestones, including obtaining the Tanzanian Chief Government

Valuer sign-off on the compensation schedule and valuation for land

acquisition and relocation.

The initiation of compensation payments to affected households

commenced on November 6th, 2023, and payments are 95% complete to

date, with the aim to complete the remaining affected households as

soon as possible. To date, a total of TZS 26.7 billion (US$10.5

million) was paid to 1,260 affected households. Our community team

is actively engaged in identifying and supporting community members

who have not received their payments, often related to missing

documentation. The completion of compensation payments will give

Lifezone legal surface title to the entire ~4,300 hectares of the

Kabanga Special Mining Licence area.

In June, the resettlement model houses showcase began, and five

model houses have been built following discussions with affected

persons. Households that will be physically displaced by the

Kabanga Nickel Project are entitled to select from one of two

different styles of replacement house. Those who will be affected

have participated in a process of balloting for preferred

resettlement sites, as well as selecting and influencing the

housing materials, structures and design. Feedback following the

initial showcase is being addressed ahead of final construction and

relocation. Lifezone will build approximately 410 new houses for

resettlement at land selected in cooperation with government and

local working groups.

Sustainability is a foundational consideration in all

decisions taken by Lifezone

Lifezone’s sustainability strategy encompasses all global

operations, including Tembo Nickel (Lifezone’s Tanzanian

subsidiary), Lifezone Asia-Pacific and its subsidiary operations

(in Perth, Australia), Lifezone Recycling (USA) and Lifezone’s

corporate office in London. The primary focus has been on the

environmental, social and development plans at the Kabanga Nickel

Project.

In Tanzania, our shared goal is for in-country beneficiation,

enabling Tanzania to achieve value creation and realize benefits

from the full supply chain: from mining through to finished metal.

With the application of Lifezone’s Hydromet Technology, the Kabanga

Nickel Project is expected to produce a greener, cleaner metal

product in Tanzania, by Tanzanians. Recent sustainability-related

highlights include:

- Early implementation of Sustainability Accounting Standards

Board reporting, focusing on data gathering for the most relevant

and material sustainability impacts.

- Continued monitoring of sustainability-linked risks and

identification of opportunities.

- Lifezone has engaged Minviro Ltd. – a leading Life Cycle

Assessment consulting firm, based in London, UK – to conduct a Life

Cycle Assessment of the Kabanga Nickel Project utilising the data

derived from the Feasibility Study. This will involve an analysis

of the various project impacts, from planned extraction through to

the production of finished metals. Additionally, Minviro will

conduct a second Life Cycle Assessment of our planned platinum,

palladium and rhodium recycling project in the US. The goal is to

complete both Life Cycle Assessments in early 2025.

- The 2024 Social Investment and Corporate Social Responsibility

plan for Kabanga was completed in Q2 2024 and has been submitted to

the District Council in July 2024, with the signing ceremony

planned for Q3 2024. This year’s Plan continues to specifically

focus on health and education in project affected communities.

- The Tanzanian National Environment Management Council visited

the Kabanga Nickel Project in June as part of their review of the

Environmental Impact Assessment for proposed developments within

the designated resettlement sites. Receipt of the approved

Environmental Impact Assessment for resettlement is expected in Q3

2024.

- Eight water boreholes were drilled and completed at the

resettlement sites, which have confirmed sufficient clean water is

available for community use. Initial testing has indicated high

water quality, and sampling and monitoring remains ongoing.

- The Local Skills and Supplier Mapping Roadshows completed in

2023 have provided Lifezone with a database of local skills and

service providers within neighboring communities. Through the

active use of this database, Lifezone has engaged and employed +420

local short-term workers in H1 2024. As a specific example,

Lifezone facilitated a contract between two local farming

cooperatives and the principal food vendor for the Kabanga

camp.

Healthy Financial Position

As of June 30, 2024, Lifezone Metals had unaudited interim

consolidated cash and cash equivalents of $63.5 million, a decrease

of $16.1 million from $79.6 million as of March 31, 2024. The

decrease reflects cash usage of $21.0 million, partially offset by

$4.9 million of proceeds from the 2024 convertible debenture

placement that were received in April.

As of June 30, 2024, a total of $10.4 million was spent on

compensation payments for those households that will be physically

or economically displaced by the Kabanga Nickel Project. This

activity started in November 2023, with $2.2 million spent to

December 31, 2023 and $8.2 million spent from January 1, 2024 to

June 30, 2024, resulting in 94% of the compensation payments

completed by the end of Q2 2024. Since H1, an additional

compensation payment has been made and as of August 19, 2024, total

compensation since initiation amounted to $10.5 million, taking

compensation payments to 95% complete.

TODAY: webcast with Lifezone’s senior management at 10.30 AM

ET

The Company invites shareholders, investors, and members of the

media to join the executive team for a virtual presentation and

discussion of Lifezone’s recent activities, H1 financial statements

and outlook. The presentation will be followed by a Q&A session

where participants can engage directly with senior management.

Event details:

- Date: Monday, August 19, 2024

- Time: 10:30 AM Eastern Time

- Location: Virtual (please click the webcast registration

link).

The presentation slides will be available on Lifezone’s website.

The webcast will be archived and accessible for replay for a

limited time after the event.

If you would like to sign up for Lifezone Metals news alerts,

please register here.

Social Media

LinkedIn | X | Instagram

About Lifezone Metals

At Lifezone Metals (NYSE: LZM), our mission is to provide

cleaner and more responsible metals production and recycling. Using

a scalable platform underpinned by our Hydromet Technology, we

offer the potential for lower energy, lower emission and lower cost

metals production compared to traditional smelting.

Our Kabanga Nickel Project in Tanzania is believed to be one of

the world's largest and highest-grade undeveloped nickel sulfide

deposits. By pairing with our Hydromet Technology, we are working

to unlock a new source of LME-grade nickel, copper and cobalt for

the global battery metals markets, to empower Tanzania to achieve

full in-country value creation and become the next premier source

of Class 1 nickel. A Definitive Feasibility Study for the project

is due for completion in Q3 2024.

Through our US-based, platinum, palladium and rhodium recycling

partnership, we are working to demonstrate that our Hydromet

Technology can process and recover platinum group metals from

responsibly sourced spent automotive catalytic converters in a

cleaner and more efficient way than conventional smelting and

refining methods.

www.lifezonemetals.com

Forward-Looking Statements

Certain statements made herein are not historical facts but may

be considered “forward-looking statements” within the meaning of

the Securities Act of 1933, as amended, the Securities Exchange Act

of 1934, as amended and the “safe harbor” provisions under the

Private Securities Litigation Reform Act of 1995 regarding, amongst

other things, the plans, strategies, intentions and prospects, both

business and financial, of Lifezone Metals Limited and its

subsidiaries.

Generally, statements that are not historical facts, including

statements concerning possible or assumed future actions, business

strategies, events or results of operations, and any statements

that refer to projections, forecasts or other characterizations of

future events or circumstances, including any underlying

assumptions, are forward-looking statements. Forward-looking

statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook” or the negatives of these terms

or variations of them or similar terminology or expressions that

predict or indicate future events or trends or that are not

statements of historical matters; provided that the absence of

these does not mean that a statement is not forward-looking. These

forward-looking statements include, but are not limited to,

statements regarding future events, the estimated or anticipated

future results of Lifezone Metals, future opportunities for

Lifezone Metals, including the efficacy of Lifezone Metals’

hydrometallurgical technology (Hydromet Technology) and the

development of, and processing of mineral resources at, the Kabanga

Project, and other statements that are not historical facts.

These statements are based on the current expectations of

Lifezone Metals’ management and are not predictions of actual

performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Lifezone Metals

and its subsidiaries. These statements are subject to a number of

risks and uncertainties regarding Lifezone Metals’ business, and

actual results may differ materially. These risks and uncertainties

include, but are not limited to: general economic, political and

business conditions, including but not limited to the economic and

operational disruptions; global inflation and cost increases for

materials and services; reliability of sampling; success of any

pilot work; capital and operating costs varying significantly from

estimates; delays in obtaining or failures to obtain required

governmental, environmental or other project approvals; changes in

government regulations, legislation and rates of taxation;

inflation; changes in exchange rates and the availability of

foreign exchange; fluctuations in commodity prices; delays in the

development of projects and other factors; the outcome of any legal

proceedings that may be instituted against the Lifezone Metals; our

ability to obtain additional capital, including use of the debt

market, future capital requirements and sources and uses of cash;

the risks related to the rollout of Lifezone Metals’ business, the

efficacy of the Hydromet Technology, and the timing of expected

business milestones; the acquisition of, maintenance of and

protection of intellectual property; Lifezone’s ability to achieve

projections and anticipate uncertainties (including economic or

geopolitical uncertainties) relating to our business, operations

and financial performance, including: expectations with respect to

financial and business performance, financial projections and

business metrics and any underlying assumptions; expectations

regarding product and technology development and pipeline and

market size; expectations regarding product and technology

development and pipeline; the effects of competition on Lifezone

Metals’ business; the ability of Lifezone Metals to execute its

growth strategy, manage growth profitably and retain its key

employees; the ability of Lifezone Metals to reach and maintain

profitability; enhancing future operating and financial results;

complying with laws and regulations applicable to Lifezone Metals’

business; Lifezone Metals’ ability to continue to comply with

applicable listing standards of the NYSE; the ability of Lifezone

Metals to maintain the listing of its securities on a U.S. national

securities exchange; our ability to comply with applicable laws and

regulations; stay abreast of accounting standards, or modified or

new laws and regulations applying to our business, including

privacy regulation; and other risks that will be detailed from time

to time in filings with the U.S. Securities and Exchange Commission

(SEC).

The foregoing list of risk factors is not exhaustive. There may

be additional risks that Lifezone Metals presently does not know or

that Lifezone Metals currently believes are immaterial that could

also cause actual results to differ from those contained in

forward-looking statements. In addition, forward-looking statements

provide Lifezone Metals’ expectations, plans or forecasts of future

events and views as of the date of this communication. Lifezone

Metals anticipates that subsequent events and developments will

cause Lifezone Metals’ assessments to change.

These forward-looking statements should not be relied upon as

representing Lifezone Metals’ assessments as of any date subsequent

to the date of this communication. Accordingly, undue reliance

should not be placed upon the forward-looking statements. Nothing

herein should be regarded as a representation by any person that

the forward-looking statements set forth herein will be achieved or

that any of the contemplated results in such forward-looking

statements will be achieved. You should not place undue reliance on

forward-looking statements in this communication, which are based

upon information available to us as of the date they are made and

are qualified in their entirety by reference to the cautionary

statements herein. In all cases where historical performance is

presented, please note that past performance is not a credible

indicator of future results.

Except as otherwise required by applicable law, we disclaim any

obligation to publicly update or revise any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data, or methods, future events, or other changes

after the date of this communication.

1

https://www.tanzaniainvest.com/transport/inaugural-sgr-train-service-dar-es-salaam-morogoro

2

https://www.ippmedia.com/the-guardian/news/local-news/read/tanesco-fields-700mw-surplus-as-jnhpp-switches-on-turbine-7-2024-06-22-040656

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819646238/en/

Investor Relations – North America Evan Young SVP:

Investor Relations & Capital Markets

evan.young@lifezonemetals.com Investor Relations – Europe

Ingo Hofmaier Chief Financial Officer

ingo.hofmaier@lifezonemetals.com Media Enquiries David

Petrie Manager: Corporate Communications

david.petrie@lifezonemetals.com

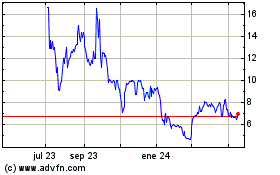

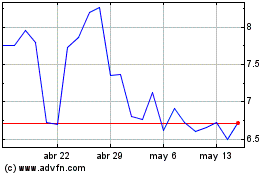

Lifezone Metals (NYSE:LZM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Lifezone Metals (NYSE:LZM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024