0000089439FALSE00000894392021-04-202021-04-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported): | July 23, 2024 |

MUELLER INDUSTRIES INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-6770 | 25-0790410 |

| (State or other jurisdiction | (Commission File | (IRS Employer |

| of incorporation) | Number) | Identification No.) |

| | | | | | | | |

| 150 Schilling Boulevard | Suite 100 | |

| Collierville | Tennessee | 38017 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | | | | |

| Registrant’s telephone number, including area code: | (901) | 753-3200 |

| | | | | |

| Registrant’s Former Name or Address, if changed since last report: | N/A |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock | MLI | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new of revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On July 23, 2024, the Registrant issued a press release announcing earnings for the quarter ended June 29, 2024. A copy of the press release announcing the second quarter 2024 earnings is attached as Exhibit 99.1.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| | 99.1 | Press release, dated July 23, 2024 reporting second quarter 2024 earnings. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | MUELLER INDUSTRIES, INC. |

| | |

| | By: | /s/ ANTHONY J. STEINRIEDE | |

| | Name: | Anthony J. Steinriede |

| | Title: | Vice President - Corporate Controller |

| | | |

| July 23, 2024 | | |

Exhibit Index

| | | | | |

| Exhibit No. | Description |

| | |

| 99.1 | |

Mueller Industries, Inc. Reports Second Quarter 2024 Earnings

COLLIERVILLE, Tenn., July 23, 2024 -- Mueller Industries, Inc. (NYSE: MLI) announces results for the second quarter of 2024. Comparisons are to the second quarter of 2023.

•Net Sales of $997.7 million versus $897.0 million

•Operating Income of $210.0 million versus $210.7 million

•Earnings Before Taxes of $222.9 million versus $241.0 million

•Net Income of $160.2 million versus $177.7 million

•Diluted EPS of $1.41 versus $1.561

Second Quarter Financial and Operating Highlights:

•COMEX copper averaged $4.55 per pound during the quarter, 18.4% higher than in the second quarter of 2023.

•The increase in net sales was attributable to higher unit shipments in most of our businesses, price increases tied to higher copper prices, and the inclusion of one month of reported sales for our recently acquired Nehring business.

•In 2023, we reported an insurance settlement gain of $19.5 million related to the August 2022 fire at our Westermeyer facility. Adjusting for this gain, our quarterly operating income performance improved by 9.8% over the prior year period.

•Net cash generated from operations was $100.8 million, and our cash balance was $825.7 million at quarter end. Cash deployed during the quarter included $566.6 million for acquisitions and $15.1 million in stock repurchases.

•Our current ratio remains solid at 4.7 to 1.

Regarding the quarter performance and outlook, Greg Christopher, Mueller’s CEO said, “Our businesses continue to perform well despite persistent heightened inflation and restrained construction activity. We maintain a positive long-term outlook for our business. Our internal investments are paying off, and we expect they will yield even greater benefits as market conditions improve. Moreover, our acquisition of Nehring Electrical Works, which we completed during the quarter, provides a substantial platform for expansion in the energy infrastructure space.”

1 Diluted EPS for the second quarter of 2023 has been adjusted retroactively to reflect the two-for-one stock split that took effect on October 20, 2023.

Mueller Industries, Inc. (NYSE: MLI) is an industrial corporation whose holdings manufacture vital goods for important markets such as air, water, oil and gas distribution; climate comfort; food preservation; energy transmission; medical; aerospace; and automotive. It includes a network of companies and brands throughout North America, Europe, Asia, and the Middle East.

Statements in this release that are not strictly historical may be “forward-looking” statements, which involve risks and uncertainties. These include economic and currency conditions, continued availability of raw materials and energy, market demand, pricing, competitive and technological factors, and the availability of financing, among others, as set forth in the Company’s SEC filings. The words “outlook,” “estimate,” “project,” “intend,” “expect,” “believe,” “target,” “encourage,” “anticipate,” “appear,” and similar expressions are intended to identify forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date of this report. The Company has no obligation to publicly update or revise any forward-looking statements to reflect events after the date of this report.

CONTACT

Jeffrey A. Martin

(901) 753-3226

MUELLER INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Quarter Ended | | For the Six Months Ended |

| (In thousands, except per share data) | | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| | | | | | | | |

| Net sales | | $ | 997,745 | | | $ | 896,984 | | | $ | 1,847,399 | | | $ | 1,868,176 | |

| | | | | | | | |

| Cost of goods sold | | 724,990 | | 639,272 | | 1,333,693 | | 1,318,070 |

| Depreciation and amortization | | 10,018 | | 10,416 | | 19,187 | | 21,073 |

| Selling, general, and administrative expense | | 52,731 | | 56,062 | | 101,088 | | 108,693 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Gain on insurance settlement | | — | | | (19,466) | | | — | | | (19,466) | |

| | | | | | | | |

| Operating income | | 210,006 | | 210,700 | | 393,431 | | 439,806 |

| | | | | | | | |

| Interest expense | | (107) | | | (135) | | | (222) | | | (278) | |

| Interest income | | 14,383 | | | 7,732 | | | 31,628 | | | 13,967 | |

| Realized and unrealized gains on short-term investments | | — | | | 20,820 | | | 365 | | | 22,730 | |

| Other (expense) income, net | | (1,356) | | | 1,841 | | | (726) | | | 2,167 | |

| | | | | | | | |

| Income before income taxes | | 222,926 | | 240,958 | | | 424,476 | | 478,392 | |

| | | | | | | | |

| Income tax expense | | (58,384) | | | (62,122) | | | (110,218) | | | (123,479) | |

| (Loss) income from unconsolidated affiliates, net of foreign tax | | (1,095) | | | 715 | | | (9,102) | | | (269) | |

| | | | | | | | |

| Consolidated net income | | 163,447 | | | 179,551 | | | 305,156 | | | 354,644 | |

| | | | | | | | |

| Net income attributable to noncontrolling interests | | (3,282) | | | (1,840) | | | (6,628) | | | (3,694) | |

| | | | | | | | |

| Net income attributable to Mueller Industries, Inc. | | $ | 160,165 | | | $ | 177,711 | | | $ | 298,528 | | | $ | 350,950 | |

| | | | | | | | |

Weighted average shares for basic earnings per share (1) | | 111,216 | | 111,320 | | 111,316 | | 111,354 |

Effect of dilutive stock-based awards (1) | | 2,763 | | 2,680 | | 2,746 | | 2,046 |

| | | | | | | | |

Adjusted weighted average shares for diluted earnings per share (1) | | 113,979 | | 114,000 | | 114,062 | | 113,400 |

| | | | | | | | |

Basic earnings per share (1) | | $ | 1.44 | | | $ | 1.60 | | | $ | 2.68 | | | $ | 3.15 | |

| | | | | | | | |

Diluted earnings per share (1) | | $ | 1.41 | | | $ | 1.56 | | | $ | 2.62 | | | $ | 3.09 | |

| | | | | | | | |

Dividends per share (1) | | $ | 0.20 | | | $ | 0.15 | | | $ | 0.40 | | | $ | 0.30 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) Adjusted retroactively to reflect the two-for-one stock split that occurred on October 20, 2023. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| MUELLER INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME, CONTINUED |

| (Unaudited) |

| | | | | | | | |

| | For the Quarter Ended | | For the Six Months Ended |

| (In thousands) | | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| | | | | | | | |

| Summary Segment Data: | | | | | | | | |

| | | | | | | | |

| Net sales: | | | | | | | | |

| Piping Systems Segment | | $ | 688,469 | | | $ | 638,005 | | | $ | 1,278,637 | | | $ | 1,300,484 | |

| Industrial Metals Segment | | 195,341 | | 146,266 | | 351,408 | | 311,500 |

| Climate Segment | | 130,532 | | 123,954 | | 247,342 | | 276,908 |

| Elimination of intersegment sales | | (16,597) | | | (11,241) | | | (29,988) | | | (20,716) | |

| | | | | | | | |

Net sales | | $ | 997,745 | | | $ | 896,984 | | | $ | 1,847,399 | | | $ | 1,868,176 | |

| | | | | | | | |

| Operating income: | | | | | | | | |

| Piping Systems Segment | | $ | 162,258 | | | $ | 151,142 | | | $ | 304,938 | | | $ | 314,996 | |

| Industrial Metals Segment | | 29,693 | | 17,971 | | 53,964 | | 45,186 |

| Climate Segment | | 38,993 | | 57,067 | | 71,568 | | 111,055 |

| Unallocated income (expenses) | | (20,938) | | | (15,480) | | | (37,039) | | | (31,431) | |

| | | | | | | | |

| Operating income | | $ | 210,006 | | | $ | 210,700 | | | $ | 393,431 | | | $ | 439,806 | |

MUELLER INDUSTRIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | |

| | (Unaudited) | | |

(In thousands) | | June 29,

2024 | | December 30, 2023 |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 825,655 | | | $ | 1,170,893 | |

| Short-term investments | | — | | 98,146 |

Accounts receivable, net | | 522,572 | | 351,561 |

| Inventories | | 406,217 | | 380,248 |

Other current assets | | 50,347 | | 39,173 |

| | | | |

| Total current assets | | 1,804,791 | | 2,040,021 |

| | | | |

| Property, plant, and equipment, net | | 471,443 | | 385,165 |

Operating lease right-of-use assets | | 34,534 | | 35,170 | |

Other assets | | 755,417 | | 298,945 |

| | | | |

| Total assets | | $ | 3,066,185 | | | $ | 2,759,301 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current portion of debt | | $ | 785 | | | $ | 796 | |

| Accounts payable | | 198,537 | | 120,485 |

Current portion of operating lease liabilities | | 8,000 | | | 7,893 | |

Other current liabilities | | 179,906 | | 187,964 |

| | | | |

| Total current liabilities | | 387,228 | | 317,138 |

| | | | |

| Long-term debt | | 74 | | 185 |

| Pension and postretirement liabilities | | 11,696 | | 12,062 |

| Environmental reserves | | 14,808 | | 15,030 |

| Deferred income taxes | | 20,023 | | 19,134 |

| Noncurrent operating lease liabilities | | 26,330 | | 26,683 | |

Other noncurrent liabilities | | 33,168 | | 10,353 |

| | | | |

Total liabilities | | 493,327 | | 400,585 |

| | | | |

| Total Mueller Industries, Inc. stockholders’ equity | | 2,546,103 | | | 2,337,445 |

Noncontrolling interests | | 26,755 | | | 21,271 |

| | | | |

Total equity | | 2,572,858 | | | 2,358,716 |

| | | | |

| Total liabilities and equity | | $ | 3,066,185 | | | $ | 2,759,301 | |

MUELLER INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | For the Six Months Ended |

(In thousands) | | June 29, 2024 | | July 1, 2023 |

| | | | |

| Cash flows from operating activities | | | | |

| Consolidated net income | | $ | 305,156 | | | $ | 354,644 | |

| Reconciliation of consolidated net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 19,349 | | | 21,252 | |

| Stock-based compensation expense | | 13,476 | | | 12,459 | |

| Provision for doubtful accounts receivable | | (67) | | | (80) | |

| Loss from unconsolidated affiliates | | 9,102 | | | 269 | |

| Dividends from unconsolidated affiliates | | 3,541 | | | — | |

| Insurance proceeds - noncapital related | | 15,000 | | | 9,854 | |

| | | | |

| Gain on disposals of properties | | (1,286) | | | (141) | |

| | | | |

| Unrealized gain on short-term investments | | — | | | (20,820) | |

| Gain on sales of securities | | (365) | | | — | |

| | | | |

| Gain on insurance settlement | | — | | | (19,466) | |

| | | | |

| Deferred income tax (benefit) expense | | (1,509) | | | 2,406 | |

| Changes in assets and liabilities, net of effects of businesses acquired: | | | | |

| Receivables | | (132,012) | | | (77,701) | |

| Inventories | | 6,706 | | | (12,149) | |

| Other assets | | 8,511 | | | (5,571) | |

| Current liabilities | | 30,276 | | | (14,460) | |

| Other liabilities | | (2,375) | | | (976) | |

| Other, net | | 872 | | | 1,310 | |

| | | | |

| Net cash provided by operating activities | | $ | 274,375 | | | $ | 250,830 | |

| | | | |

| Cash flows from investing activities | | | | |

| Capital expenditures | | $ | (25,603) | | | $ | (29,221) | |

| Acquisition of businesses, net of cash acquired | | (566,577) | | | — | |

| | | | |

| Investments in unconsolidated affiliates | | (8,700) | | | — | |

| Insurance proceeds - capital related | | — | | | 24,646 | |

| Purchase of short-term investments | | — | | | (106,231) | |

| Purchase of long-term investments | | (7,976) | | | — | |

| Proceeds from the maturity of short-term investments | | — | | | 217,863 | |

| Proceeds from the sale of securities | | 96,465 | | | — | |

| Issuance of notes receivable | | (3,800) | | | — | |

| Proceeds from sales of properties | | 3,976 | | | 142 | |

| Dividends from unconsolidated affiliates | | — | | | 797 | |

| | | | |

| Net cash (used in) provided by investing activities | | $ | (512,215) | | | $ | 107,996 | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| MUELLER INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited) |

| | | | |

| | For the Six Months Ended |

| (In thousands) | | June 29, 2024 | | July 1, 2023 |

| | | | |

| Cash flows from financing activities | | | | |

| Dividends paid to stockholders of Mueller Industries, Inc. | | $ | (44,488) | | | $ | (33,402) | |

| Repurchase of common stock | | (42,994) | | | (19,303) | |

| | | | |

| | | | |

| Repayments of debt | | (111) | | | (130) | |

| Issuance (repayment) of debt by consolidated joint ventures, net | | 11 | | | (143) | |

| Net cash used to settle stock-based awards | | (2,002) | | | (2,588) | |

| | | | |

| | | | |

| | | | |

| Net cash used in financing activities | | $ | (89,584) | | | $ | (55,566) | |

| | | | |

| Effect of exchange rate changes on cash | | (4,784) | | | 4,825 | |

| | | | |

| (Decrease) increase in cash, cash equivalents, and restricted cash | | (332,208) | | | 308,085 | |

| Cash, cash equivalents, and restricted cash at the beginning of the period | | 1,174,223 | | | 465,296 | |

| | | | |

| Cash, cash equivalents, and restricted cash at the end of the period | | $ | 842,015 | | | $ | 773,381 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

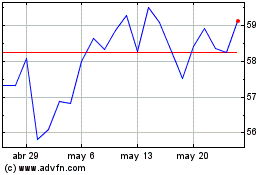

Mueller Industries (NYSE:MLI)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Mueller Industries (NYSE:MLI)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024