GAAP Revenue Increases 6%; Underlying

Revenue Rises 6%

Growth in GAAP Operating Income of 13% and

Adjusted Operating Income of 11%

Second Quarter GAAP EPS Rises 10% to $2.27

and Adjusted EPS Increases 10% to $2.41

Six Months GAAP EPS Rises 12% to $5.08 and

Adjusted EPS Increases 12% to $5.30

Marsh McLennan (NYSE: MMC), the world’s leading professional

services firm in the areas of risk, strategy and people, today

reported financial results for the second quarter ended June 30,

2024.

John Doyle, President and CEO, said: "We generated strong

results in the second quarter with 6% underlying revenue growth,

10% adjusted EPS growth, and 130 basis points of margin

expansion."

"We continued to invest in our talent and capabilities to

deliver for clients. We also deployed capital into high quality

acquisitions and recently announced a 15% increase in our dividend.

Our first half results leave us well positioned for another great

year in 2024."

Consolidated Results

Consolidated revenue in the second quarter of 2024 was $6.2

billion, an increase of 6% compared with the second quarter of

2023. On an underlying basis, revenue increased 6%. Operating

income rose 13% to $1.6 billion. Adjusted operating income, which

excludes noteworthy items as presented in the attached supplemental

schedules, rose 11% to $1.7 billion. Net income attributable to the

Company was $1.1 billion. Earnings per share increased 10% to

$2.27. Adjusted earnings per share increased 10% to $2.41.

For the six months ended June 30, 2024, consolidated revenue was

$12.7 billion, an increase of 8% on both a GAAP and underlying

basis compared to the prior period. Operating income was $3.6

billion, an increase of 12% from the prior year period. Adjusted

operating income rose 11% to $3.7 billion. Net income attributable

to the Company was $2.5 billion, or $5.08 per diluted share,

compared with $4.55 in the first six months of 2023. Adjusted

earnings per share increased 12% to $5.30.

Risk & Insurance Services

Risk & Insurance Services revenue was $4.0 billion in the

second quarter of 2024, an increase of 8%, or 7% on an underlying

basis. Operating income increased 12% to $1.3 billion, while

adjusted operating income increased 12% to $1.3 billion. For the

six months ended June 30, 2024, revenue was $8.3 billion, an

increase of 9%, or 8% on an underlying basis. Operating income rose

12% to $2.9 billion, and adjusted operating income increased 12% to

$2.9 billion.

Marsh's revenue in the second quarter of 2024 was $3.3 billion,

an increase of 8%, or 7% on an underlying basis. In U.S./Canada,

underlying revenue rose 6%. International operations produced

underlying revenue growth of 7%, reflecting 8% growth in Latin

America, 7% growth in EMEA, and 7% growth in Asia Pacific. For the

six months ended June 30, 2024, Marsh’s underlying revenue growth

was 7%.

Guy Carpenter's revenue in the second quarter was $632 million,

an increase of 10%, or 11% on an underlying basis. For the six

months ended June 30, 2024, Guy Carpenter’s underlying revenue

growth was 9%.

Consulting

Consulting revenue was $2.2 billion in the second quarter of

2024, an increase of 2%, or 4% on an underlying basis. Operating

income increased 5% to $410 million, while adjusted operating

income increased 6% to $426 million. For the first six months ended

June 30, 2024, revenue was $4.4 billion, an increase of 5%, or 6%

on an underlying basis. Operating income rose 5% to $842 million,

and adjusted operating income increased 7% to $870 million.

Mercer's revenue in the second quarter was $1.4 billion, flat on

a GAAP basis, or an increase of 5% on an underlying basis. Health

revenue of $547 million increased 9% on an underlying basis. Wealth

revenue of $612 million increased 3% on an underlying basis. Career

revenue of $220 million increased 2% on an underlying basis. For

the six months ended June 30, 2024, Mercer’s revenue was $2.8

billion, an increase of 6% on an underlying basis.

Oliver Wyman’s revenue in the second quarter of 2024 was $837

million, an increase of 3% on an underlying basis. For the six

months ended June 30, 2024, Oliver Wyman’s revenue was $1.6

billion, an increase of 8% on an underlying basis.

Other Items

The Company repurchased 1.5 million shares of stock for $300

million in the second quarter of 2024. Through six months ended

June 30, 2024, the Company has repurchased 3.0 million shares of

stock for $600 million.

In the second quarter of 2024, the Company repaid $600 million

of senior notes that matured.

Last week, the Board of Directors increased the quarterly

dividend 15% to $0.815 per share, with the third quarter dividend

payable on August 15, 2024.

In June, Marsh McLennan Agency (MMA) completed the acquisition

of Fisher Brown Bottrell Insurance, Inc., one of the largest

bank-affiliated insurance agencies in the U.S.

Conference Call

A conference call to discuss second quarter 2024 results will be

held today at 8:30 a.m. Eastern time. The live audio webcast may be

accessed at marshmclennan.com. A replay of the webcast will be

available approximately two hours after the event. The webcast is

listen-only. Those interested in participating in the

question-and-answer session may register here to receive the

dial-in numbers and unique PIN to access the call.

About Marsh McLennan

Marsh McLennan (NYSE: MMC) is a global leader in risk, strategy

and people, advising clients in 130 countries across four

businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With

annual revenue of $23 billion and more than 85,000 colleagues,

Marsh McLennan helps build the confidence to thrive through the

power of perspective. For more information, visit

marshmclennan.com, or follow us on LinkedIn and X.

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements," as

defined in the Private Securities Litigation Reform Act of 1995.

These statements, which express management's current views

concerning future events or results, use words like "anticipate,"

"assume," "believe," "continue," "estimate," "expect," "intend,"

"plan," "project" and similar terms, and future or conditional

tense verbs like "could," "may," "might," "should," "will" and

"would".

Forward-looking statements are subject to inherent risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in our forward-looking statements.

Factors that could materially affect our future results include,

among other things:

- the impact of geopolitical or macroeconomic conditions on us,

our clients and the countries and industries in which we operate,

including from multiple major wars, escalating conflict throughout

the Middle East and rising tension in the South China Sea, slower

GDP growth or recession, lower interest rates, capital markets

volatility, inflation and changes in insurance premium rates;

- the impact from lawsuits or investigations arising from errors

and omissions, breaches of fiduciary duty or other claims against

us in our capacity as a broker or investment advisor, including

claims related to our investment business’ ability to execute

timely trades;

- the increasing prevalence of ransomware, supply chain and other

forms of cyber attacks, and their potential to disrupt our

operations, or the operations of our third party vendors, and

result in the disclosure of confidential client or company

information;

- the financial and operational impact of complying with laws and

regulations, including domestic and international sanctions

regimes, anti-corruption laws such as the U.S. Foreign Corrupt

Practices Act, U.K. Anti Bribery Act and cybersecurity, data

privacy and artificial intelligence regulations;

- our ability to attract, retain and develop industry leading

talent;

- our ability to compete effectively and adapt to competitive

pressures in each of our businesses, including from

disintermediation as well as technological change, digital

disruption and other types of innovation such as artificial

intelligence;

- our ability to manage potential conflicts of interest,

including where our services to a client conflict, or are perceived

to conflict, with the interests of another client or our own

interests;

- the impact of changes in tax laws, guidance and

interpretations, such as the implementation of the Organization for

Economic Cooperation and Development international tax framework,

or the increasing number of challenges from tax authorities in the

current global tax environment; and

- the regulatory, contractual and reputational risks that arise

based on insurance placement activities and insurer revenue

streams.

The factors identified above are not exhaustive. Marsh McLennan

and its subsidiaries (collectively, the "Company") operate in a

dynamic business environment in which new risks emerge frequently.

Accordingly, we caution readers not to place undue reliance on any

forward-looking statements, which are based only on information

currently available to us and speak only as of the dates on which

they are made. The Company undertakes no obligation to update or

revise any forward-looking statement to reflect events or

circumstances arising after the date on which it is made.

Further information concerning the Company, including

information about factors that could materially affect our results

of operations and financial condition, is contained in the

Company's filings with the Securities and Exchange Commission,

including the "Risk Factors" section and the "Management’s

Discussion and Analysis of Financial Condition and Results of

Operations" section of our most recently filed Annual Report on

Form 10-K.

Marsh & McLennan

Companies, Inc.

Consolidated Statements of

Income

(In millions, except per share

data)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Revenue

$

6,221

$

5,876

$

12,694

$

11,800

Expense:

Compensation and benefits

3,454

3,337

6,924

6,544

Other operating expenses

1,125

1,082

2,203

2,073

Operating expenses

4,579

4,419

9,127

8,617

Operating income

1,642

1,457

3,567

3,183

Other net benefit credits

66

60

133

118

Interest income

12

10

49

24

Interest expense

(156

)

(146

)

(315

)

(282

)

Investment income

1

3

2

5

Income before income taxes

1,565

1,384

3,436

3,048

Income tax expense

425

337

872

749

Net income before non-controlling

interests

1,140

1,047

2,564

2,299

Less: Net income attributable to

non-controlling interests

15

12

39

29

Net income attributable to the

Company

$

1,125

$

1,035

$

2,525

$

2,270

Net income per share attributable to

the Company:

- Basic

$

2.28

$

2.09

$

5.13

$

4.59

- Diluted

$

2.27

$

2.07

$

5.08

$

4.55

Average number of shares

outstanding:

- Basic

492

495

492

495

- Diluted

496

499

497

499

Shares outstanding at June 30

492

494

492

494

Marsh & McLennan Companies, Inc.

Supplemental Information - Revenue Analysis Three Months

Ended June 30 (Millions) (Unaudited)

The Company advises clients in 130 countries. As a result,

foreign exchange rate movements may impact period over period

comparisons of revenue. Similarly, certain other items such as

acquisitions and dispositions, including transfers among

businesses, may impact period over period comparisons of revenue.

Non-GAAP underlying revenue measures the change in revenue from one

period to the next by isolating these impacts.

Components of Revenue

Change*

Three Months Ended

June 30,

% Change

GAAP Revenue*

Currency Impact

Acquisitions/

Dispositions/ Other

Impact**

Non-GAAP

Underlying Revenue

2024

2023

Risk and Insurance Services

Marsh

$

3,265

$

3,038

8

%

(1

)%

2

%

7

%

Guy Carpenter

632

576

10

%

(1

)%

—

11

%

Subtotal

3,897

3,614

8

%

(1

)%

2

%

7

%

Fiduciary interest income

125

108

Total Risk and Insurance Services

4,022

3,722

8

%

(1

)%

2

%

7

%

Consulting

Mercer

1,379

1,374

—

(1

)%

(3

)%

5

%

Oliver Wyman Group

837

798

5

%

—

2

%

3

%

Total Consulting

2,216

2,172

2

%

(1

)%

(1

)%

4

%

Corporate Eliminations

(17

)

(18

)

Total Revenue

$

6,221

$

5,876

6

%

(1

)%

1

%

6

%

Revenue Details

The following table provides more detailed revenue information

for certain of the components presented above:

Components of Revenue

Change*

Three Months Ended

June 30,

% Change

GAAP Revenue*

Currency Impact

Acquisitions/

Dispositions/ Other

Impact**

Non-GAAP

Underlying Revenue

2024

2023

Marsh:

EMEA

$

912

$

858

6

%

—

—

7

%

Asia Pacific

391

357

9

%

(4

)%

6

%

7

%

Latin America

137

137

1

%

(10

)%

3

%

8

%

Total International

1,440

1,352

7

%

(2

)%

2

%

7

%

U.S./Canada

1,825

1,686

8

%

—

2

%

6

%

Total Marsh

$

3,265

$

3,038

8

%

(1

)%

2

%

7

%

Mercer:

Wealth

$

612

$

637

(4

)%

(1

)%

(6

)%

3

%

Health

547

518

6

%

(1

)%

(2

)%

9

%

Career

220

219

1

%

(3

)%

1

%

2

%

Total Mercer

$

1,379

$

1,374

—

(1

)%

(3

)%

5

%

*

Rounded to whole percentages. Components

of revenue may not add due to rounding.

**

Acquisitions, dispositions, and other

includes the impact of current and prior year items excluded from

the calculation of non-GAAP underlying revenue for comparability

purposes. Details on these items are provided in the reconciliation

of non-GAAP revenue to GAAP revenue tables included in this

release.

Marsh & McLennan Companies, Inc.

Supplemental Information - Revenue Analysis Six Months

Ended June 30 (Millions) (Unaudited)

The Company advises clients in 130 countries. As a result,

foreign exchange rate movements may impact period over period

comparisons of revenue. Similarly, certain other items such as

acquisitions and dispositions, including transfers among

businesses, may impact period over period comparisons of revenue.

Non-GAAP underlying revenue measures the change in revenue from one

period to the next by isolating these impacts.

Components of Revenue

Change*

Six Months Ended

June 30,

% Change

GAAP Revenue*

Currency Impact

Acquisitions/

Dispositions/ Other

Impact**

Non-GAAP

Underlying Revenue

2024

2023

Risk and Insurance Services

Marsh

$

6,268

$

5,782

8

%

(1

)%

2

%

7

%

Guy Carpenter

1,780

1,647

8

%

—

(1

)%

9

%

Subtotal

8,048

7,429

8

%

(1

)%

1

%

8

%

Fiduciary interest income

247

199

Total Risk and Insurance Services

8,295

7,628

9

%

(1

)%

1

%

8

%

Consulting

Mercer (a)

2,804

2,718

3

%

(1

)%

(1

)%

6

%

Oliver Wyman Group

1,626

1,485

9

%

—

2

%

8

%

Total Consulting

4,430

4,203

5

%

(1

)%

—

6

%

Corporate Eliminations

(31

)

(31

)

Total Revenue

$

12,694

$

11,800

8

%

(1

)%

1

%

8

%

Revenue Details

The following table provides more detailed revenue information

for certain of the components presented above:

Components of Revenue

Change*

Six Months Ended

June 30,

% Change

GAAP Revenue*

Currency Impact

Acquisitions/

Dispositions/ Other

Impact**

Non-GAAP

Underlying Revenue

2024

2023

Marsh:

EMEA

$

1,937

$

1,790

8

%

—

—

8

%

Asia Pacific

727

669

9

%

(4

)%

6

%

7

%

Latin America

262

252

4

%

(7

)%

3

%

8

%

Total International

2,926

2,711

8

%

(1

)%

2

%

8

%

U.S./Canada

3,342

3,071

9

%

—

2

%

7

%

Total Marsh

$

6,268

$

5,782

8

%

(1

)%

2

%

7

%

Mercer:

Wealth (a)

$

1,284

$

1,218

5

%

—

2

%

4

%

Health (a)

1,085

1,063

2

%

(1

)%

(6

)%

10

%

Career

435

437

—

(2

)%

—

2

%

Total Mercer

$

2,804

$

2,718

3

%

(1

)%

(1

)%

6

%

(a)

Acquisitions, dispositions and other in 2024 includes a net gain

of $21 million from the sale of the U.K. pension administration and

U.S. health and benefits administration businesses, that comprised

of a $66 million gain in Wealth, offset by a $45 million loss in

Health.

*

Rounded to whole percentages. Components

of revenue may not add due to rounding.

**

Acquisitions, dispositions, and other

includes the impact of current and prior year items excluded from

the calculation of non-GAAP underlying revenue for comparability

purposes. Details on these items are provided in the reconciliation

of non-GAAP revenue to GAAP revenue tables included in this

release.

Marsh & McLennan Companies, Inc.

Reconciliation of Non-GAAP Measures Three Months Ended

June 30 (Millions) (Unaudited)

Overview

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States

(referred to in this release as in accordance with "GAAP" or

"reported" results). The Company also refers to and presents

certain additional non-GAAP financial measures, within the meaning

of Regulation G and item 10(e) Regulation S-K in accordance with

the Securities Exchange Act of 1934. These measures are: non-GAAP

revenue, adjusted operating income (loss), adjusted operating

margin, adjusted income, net of tax and adjusted earnings per share

(EPS). The Company has included reconciliations of these non-GAAP

financial measures to the most directly comparable financial

measure calculated in accordance with GAAP in the following

tables.

The Company believes these non-GAAP financial measures provide

useful supplemental information that enables investors to better

compare the Company’s performance across periods. Management also

uses these measures internally to assess the operating performance

of its businesses and to decide how to allocate resources. However,

investors should not consider these non-GAAP measures in isolation

from, or as a substitute for, the financial information that the

Company reports in accordance with GAAP. The Company's non-GAAP

measures include adjustments that reflect how management views its

businesses, and may differ from similarly titled non-GAAP measures

presented by other companies.

Adjusted Operating Income (Loss) and Adjusted Operating

Margin

Adjusted operating income (loss) is calculated by excluding the

impact of certain noteworthy items from the Company's GAAP

operating income (loss). The following tables identify these

noteworthy items and reconcile adjusted operating income (loss) to

GAAP operating income (loss), on a consolidated and reportable

segment basis, for the three and six months ended June 30, 2024 and

2023. The following tables also present adjusted operating margin.

For the three and six months ended June 30, 2024 and 2023, adjusted

operating margin is calculated by dividing the sum of adjusted

operating income and identified intangible asset amortization by

consolidated or segment adjusted revenue. The Company's adjusted

revenue used in the determination of adjusted operating margin is

calculated by excluding the impact of certain noteworthy items from

the Company's GAAP revenue.

Risk & Insurance

Services

Consulting

Corporate/

Eliminations

Total

Three Months Ended June 30,

2024

Operating income (loss)

$

1,297

$

410

$

(65

)

$

1,642

Operating margin

32.2

%

18.5

%

N/A

26.4

%

Add (deduct) impact of noteworthy

items:

Restructuring (a)

29

5

10

44

Changes in fair value of contingent

consideration

7

2

—

9

Acquisition related costs (b)

11

9

—

20

Operating income adjustments

47

16

10

73

Adjusted operating income (loss)

$

1,344

$

426

$

(55

)

$

1,715

Total identified intangible amortization

expense

$

77

$

12

$

—

$

89

Adjusted operating margin

35.3

%

19.8

%

N/A

29.0

%

Three Months Ended June 30,

2023

Operating income (loss)

$

1,157

$

388

$

(88

)

$

1,457

Operating margin

31.1

%

17.9

%

N/A

24.8

%

Add (deduct) impact of noteworthy

items:

Restructuring (a)

31

7

27

65

Changes in fair value of contingent

consideration

10

—

—

10

Acquisition related costs (b)

—

10

—

10

Disposal of businesses

—

(2

)

—

(2

)

Operating income adjustments

41

15

27

83

Adjusted operating income (loss)

$

1,198

$

403

$

(61

)

$

1,540

Total identified intangible amortization

expense

$

73

$

14

$

—

$

87

Adjusted operating margin

34.2

%

19.2

%

N/A

27.7

%

(a)

Costs primarily include severance and lease exit charges for

activities focused on workforce actions, rationalization of

technology and functional resources, and reductions in real

estate.

(b)

Primarily reflects one-time acquisition related costs.

Marsh & McLennan Companies, Inc.

Reconciliation of Non-GAAP

Measures

Six Months Ended June

30

(Millions) (Unaudited)

Risk & Insurance

Services

Consulting

Corporate/

Eliminations

Total

Six Months Ended June 30, 2024

Operating income (loss)

$

2,862

$

842

$

(137

)

$

3,567

Operating margin

34.5

%

19.0

%

N/A

28.1

%

Add (deduct) impact of noteworthy

items:

Restructuring (a)

51

16

19

86

Changes in contingent consideration

12

3

—

15

Acquisition and disposition related costs

(b)

12

30

—

42

Disposal of businesses (c)

—

(21

)

—

(21

)

Operating income adjustments

75

28

19

122

Adjusted operating income (loss)

$

2,937

$

870

$

(118

)

$

3,689

Total identified intangible amortization

expense

$

156

$

23

$

—

$

179

Adjusted operating margin

37.3

%

20.3

%

N/A

30.5

%

Six Months Ended June 30, 2023

Operating income (loss)

$

2,552

$

799

$

(168

)

$

3,183

Operating margin

33.5

%

19.0

%

N/A

27.0

%

Add (deduct) impact of noteworthy

items:

Restructuring (a)

63

16

39

118

Changes in contingent consideration

16

1

—

17

Acquisition related costs (b)

—

27

—

27

Disposal of businesses (c)

—

17

—

17

JLT legacy legal charges (d)

—

(51

)

—

(51

)

Operating income adjustments

79

10

39

128

Adjusted operating income (loss)

$

2,631

$

809

$

(129

)

$

3,311

Total identified intangible amortization

expense

$

147

$

25

$

—

$

172

Adjusted operating margin

36.4

%

19.8

%

N/A

29.5

%

(a)

Costs primarily include severance and

lease exit charges for activities focused on workforce actions,

rationalization of technology and functional resources, and

reductions in real estate.

(b)

Primarily reflects exit costs for the

disposition of the Mercer U.K. pension administration and U.S.

health and benefits administration businesses and one-time

acquisition related costs. 2023 includes integration costs related

to the Westpac superannuation fund transaction.

(c)

Net gain on sale of the Mercer U.K.

pension administration and U.S. health and benefits administration

businesses. In 2023, the amount reflects a loss on sale of a small

individual financial advisory business in Canada. These amounts are

included in revenue in the consolidated statements of income and

excluded from non-GAAP revenue and adjusted revenue used in the

calculation of adjusted operating margin.

(d)

Insurance and indemnity recoveries for a

legacy JLT E&O matter relating to suitability of advice

provided to individuals for defined benefit pension transfers in

the U.K.

Marsh & McLennan Companies, Inc.

Reconciliation of Non-GAAP Measures Three and Six Months

Ended June 30 (In millions, except per share data)

(Unaudited)

Adjusted income, net of tax is calculated as the Company's GAAP

income from continuing operations, adjusted to reflect the after

tax impact of the operating income adjustments in the preceding

tables and the additional items listed below. Adjusted EPS is

calculated by dividing the Company’s adjusted income, net of tax,

by the average number of shares outstanding-diluted for the

relevant period. The following tables reconcile adjusted income,

net of tax to GAAP income from continuing operations and adjusted

EPS to GAAP EPS for the three and six months ended June 30, 2024

and 2023.

Three Months Ended

June 30, 2024

Three Months Ended

June 30, 2023

Amount

Adjusted EPS

Amount

Adjusted EPS

Net income before non-controlling

interests, as reported

$

1,140

$

1,047

Less: Non-controlling interest, net of

tax

15

12

Subtotal

$

1,125

$

2.27

$

1,035

$

2.07

Operating income adjustments

$

73

$

83

Investments adjustment

(1

)

(1

)

Pension settlement

1

—

Income tax effect of adjustments (a)

(4

)

(17

)

69

0.14

65

0.13

Adjusted income, net of tax

$

1,194

$

2.41

$

1,100

$

2.20

Six Months Ended

June 30, 2024

Six Months Ended

June 30, 2023

Amount

Adjusted EPS

Amount

Adjusted EPS

Net income before non-controlling

interests, as reported

$

2,564

$

2,299

Less: Non-controlling interest, net of

tax

39

29

Subtotal

$

2,525

$

5.08

$

2,270

$

4.55

Operating income adjustments

$

122

$

128

Investments adjustment

(2

)

1

Pension settlement adjustment

2

—

Income tax effect of adjustments (a)

(15

)

(33

)

107

0.22

96

0.19

Adjusted income, net of tax

$

2,632

$

5.30

$

2,366

$

4.74

(a)

For items with an income tax impact, the tax effect was

calculated using an effective tax rate based on the tax

jurisdiction for each item.

Marsh & McLennan Companies, Inc.

Supplemental

Information

Three and Six Months Ended

June 30

(Millions) (Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Consolidated

Compensation and benefits

$

3,454

$

3,337

$

6,924

$

6,544

Other operating expenses

1,125

1,082

2,203

2,073

Total expenses

$

4,579

$

4,419

$

9,127

$

8,617

Depreciation and amortization expense

$

87

$

91

$

186

$

175

Identified intangible amortization

expense

89

87

179

172

Total

$

176

$

178

$

365

$

347

Risk and Insurance Services

Compensation and benefits (a)

$

2,108

$

1,965

$

4,226

$

3,896

Other operating expenses (a)

617

600

1,207

1,180

Total expenses

$

2,725

$

2,565

$

5,433

$

5,076

Depreciation and amortization expense

$

46

$

49

$

92

$

86

Identified intangible amortization

expense

77

73

156

147

Total

$

123

$

122

$

248

$

233

Consulting

Compensation and benefits (a)

$

1,314

$

1,336

$

2,628

$

2,571

Other operating expenses (a)

492

448

960

833

Total expenses

$

1,806

$

1,784

$

3,588

$

3,404

Depreciation and amortization expense

$

26

$

27

$

63

$

48

Identified intangible amortization

expense

12

14

23

25

Total

$

38

$

41

$

86

$

73

(a)

The Company reclassified certain prior period amounts between

Compensation and benefits and Other operating expenses for each

reporting segment for comparability purposes. The reclassification

had no impact on consolidated or reporting segment total

expenses.

Marsh & McLennan

Companies, Inc.

Consolidated Balance

Sheets

(Millions)

(Unaudited)

June 30,

2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,653

$

3,358

Cash and cash equivalents held in a

fiduciary capacity

11,497

10,794

Net receivables

7,739

6,418

Other current assets

1,133

1,178

Total current assets

22,022

21,748

Goodwill and intangible assets

20,154

19,861

Fixed assets, net

879

882

Pension related assets

2,187

2,051

Right of use assets

1,468

1,541

Deferred tax assets

285

357

Other assets

1,596

1,590

TOTAL ASSETS

$

48,591

$

48,030

LIABILITIES AND EQUITY

Current liabilities:

Short-term debt

$

1,267

$

1,619

Accounts payable and accrued

liabilities

3,205

3,403

Accrued compensation and employee

benefits

2,086

3,346

Current lease liabilities

304

312

Accrued income taxes

505

321

Fiduciary liabilities

11,497

10,794

Total current liabilities

18,864

19,795

Long-term debt

12,278

11,844

Pension, post-retirement and

post-employment benefits

715

779

Long-term lease liabilities

1,586

1,661

Liabilities for errors and omissions

322

314

Other liabilities

1,261

1,267

Total equity

13,565

12,370

TOTAL LIABILITIES AND EQUITY

$

48,591

$

48,030

Marsh & McLennan

Companies, Inc.

Consolidated Statements of

Cash Flows

(Millions) (Unaudited)

Six Months Ended

June 30,

2024

2023

Operating cash flows:

Net income before non-controlling

interests

$

2,564

$

2,299

Adjustments to reconcile net income to

cash provided by operations:

Depreciation and amortization

365

347

Non-cash lease expense

132

143

Share-based compensation expense

193

191

Net gain on investments, disposition of

assets and other

(97

)

(9

)

Changes in assets and liabilities:

Accrued compensation and employee

benefits

(1,226

)

(1,101

)

Provision for taxes, net of payments and

refunds

214

245

Net receivables

(1,287

)

(1,029

)

Other changes to assets and

liabilities

(92

)

(98

)

Contributions to pension and other benefit

plans in excess of current year credit

(182

)

(164

)

Operating lease liabilities

(150

)

(159

)

Net cash provided by operations

434

665

Financing cash flows:

Purchase of treasury shares

(600

)

(600

)

Borrowings from term-loan and credit

facilities

—

200

Net proceeds from issuance of commercial

paper

749

308

Proceeds from issuance of debt

988

589

Repayments of debt

(1,609

)

(8

)

Net issuance of common stock from treasury

shares

(6

)

(21

)

Net distributions of non-controlling

interests and deferred/contingent consideration

(101

)

(332

)

Dividends paid

(706

)

(591

)

Change in fiduciary liabilities

901

682

Net cash (used for) provided by

financing activities

(384

)

227

Investing cash flows:

Capital expenditures

(167

)

(185

)

Purchases of long term investments and

other

(13

)

(23

)

Sales of long term investments

14

16

Dispositions

27

(17

)

Acquisitions, net of cash and cash held in

a fiduciary capacity acquired

(644

)

(292

)

Net cash used for investing

activities

(783

)

(501

)

Effect of exchange rate changes on

cash, cash equivalents, and cash and cash equivalents held in a

fiduciary capacity

(269

)

242

(Decrease)/increase in cash, cash

equivalents, and cash and cash equivalents held in a fiduciary

capacity

(1,002

)

633

Cash, cash equivalents, and cash and

cash equivalents held in a fiduciary capacity at beginning of

period

14,152

12,102

Cash, cash equivalents, and cash and

cash equivalents held in a fiduciary capacity at end of

period

$

13,150

$

12,735

Reconciliation of cash, cash

equivalents, and cash and cash equivalents held in a fiduciary

capacity to the Consolidated Balance Sheets

Balance at June 30,

2024

2023

(In millions)

Cash and cash equivalents

$

1,653

$

1,171

Cash and cash equivalents held in a

fiduciary capacity

11,497

11,564

Total cash, cash equivalents, and cash and

cash equivalents held in a fiduciary capacity

$

13,150

$

12,735

Marsh & McLennan Companies, Inc.

Reconciliation of Non-GAAP Measures Three Months Ended

June 30 (Millions) (Unaudited)

Non-GAAP revenue isolates the impact of foreign exchange rate

movements and certain transaction-related items from the current

period GAAP revenue. The non-GAAP revenue measure is presented on a

constant currency basis, excluding the impact of foreign currency

fluctuations. The Company isolates the impact of foreign exchange

rate movements period over period, by translating the current

period foreign currency GAAP revenue into U.S. Dollars based on the

difference in the current and corresponding prior period exchange

rates. Similarly, certain other items such as acquisitions and

dispositions, including transfers among businesses, may impact

period over period comparisons of revenue and are consistently

excluded from current and prior period GAAP revenues for

comparability purposes. Percentage changes, referred to as non-GAAP

underlying revenue, are calculated by dividing the period over

period change in non-GAAP revenue by the prior period non-GAAP

revenue.

The following table provides the reconciliation of GAAP revenue

to non-GAAP revenue:

2024

2023

Three Months Ended June 30,

GAAP Revenue

Currency Impact

Acquisitions/

Dispositions/ Other Impact

Non-GAAP Revenue

GAAP Revenue

Acquisitions/ Dispositions/ Other

Impact

Non-GAAP Revenue

Risk and Insurance Services

Marsh

$

3,265

$

33

$

(64

)

$

3,234

$

3,038

$

(1

)

$

3,037

Guy Carpenter

632

6

—

638

576

—

576

Subtotal

3,897

39

(64

)

3,872

3,614

(1

)

3,613

Fiduciary interest income

125

1

—

126

108

—

108

Total Risk and Insurance Services

4,022

40

(64

)

3,998

3,722

(1

)

3,721

Consulting

Mercer

1,379

17

(26

)

1,370

1,374

(68

)

1,306

Oliver Wyman Group

837

3

(19

)

821

798

—

798

Total Consulting

2,216

20

(45

)

2,191

2,172

(68

)

2,104

Corporate Eliminations

(17

)

—

—

(17

)

(18

)

—

(18

)

Total Revenue

$

6,221

$

60

$

(109

)

$

6,172

$

5,876

$

(69

)

$

5,807

Revenue Details

The following table provides more detailed revenue information

for certain of the components presented above:

2024

2023

Three Months Ended June 30,

GAAP Revenue

Currency Impact

Acquisitions/

Dispositions/ Other Impact

Non-GAAP Revenue

GAAP Revenue

Acquisitions/

Dispositions/

Other Impact

Non-GAAP Revenue

Marsh:

EMEA

$

912

$

5

$

(1

)

$

916

$

858

$

(1

)

$

857

Asia Pacific

391

12

(20

)

383

357

—

357

Latin America

137

14

(4

)

147

137

—

137

Total International

1,440

31

(25

)

1,446

1,352

(1

)

1,351

U.S./Canada

1,825

2

(39

)

1,788

1,686

—

1,686

Total Marsh

$

3,265

$

33

$

(64

)

$

3,234

$

3,038

$

(1

)

$

3,037

Mercer:

Wealth

$

612

$

4

$

(12

)

$

604

$

637

$

(49

)

$

588

Health

547

7

(10

)

544

518

(19

)

499

Career

220

6

(4

)

222

219

—

219

Total Mercer

$

1,379

$

17

$

(26

)

$

1,370

$

1,374

$

(68

)

$

1,306

Note: Amounts in the tables above are

rounded to whole numbers.

Marsh & McLennan Companies, Inc.

Reconciliation of Non-GAAP Measures Six Months Ended June

30 (Millions) (Unaudited)

The following table provides the reconciliation of GAAP revenue

to non-GAAP revenue:

2024

2023

Six Months Ended June 30,

GAAP Revenue

Currency Impact

Acquisitions/

Dispositions/ Other Impact

Non-GAAP Revenue

GAAP Revenue

Acquisitions/ Dispositions/ Other

Impact

Non-GAAP Revenue

Risk and Insurance Services

Marsh

$

6,268

$

39

$

(103

)

$

6,204

$

5,782

$

(1

)

$

5,781

Guy Carpenter

1,780

4

(3

)

1,781

1,647

(12

)

1,635

Subtotal

8,048

43

(106

)

7,985

7,429

(13

)

7,416

Fiduciary interest income

247

1

(1

)

247

199

—

199

Total Risk and Insurance Services

8,295

44

(107

)

8,232

7,628

(13

)

7,615

Consulting

Mercer (a)

2,804

25

(54

)

2,775

2,718

(92

)

2,626

Oliver Wyman Group

1,626

(1

)

(29

)

1,596

1,485

(1

)

1,484

Total Consulting

4,430

24

(83

)

4,371

4,203

(93

)

4,110

Corporate Eliminations

(31

)

—

—

(31

)

(31

)

—

(31

)

Total Revenue

$

12,694

$

68

$

(190

)

$

12,572

$

11,800

$

(106

)

$

11,694

Revenue Details

The following table provides more detailed revenue information

for certain of the components presented above:

2024

2023

Six Months Ended June 30,

GAAP Revenue

Currency Impact

Acquisitions/

Dispositions/ Other Impact

Non-GAAP Revenue

GAAP Revenue

Acquisitions/ Dispositions/ Other

Impact

Non-GAAP Revenue

Marsh:

EMEA

$

1,937

$

(5

)

$

(2

)

$

1,930

$

1,790

$

(1

)

$

1,789

Asia Pacific

727

25

(39

)

713

669

—

669

Latin America

262

17

(8

)

271

252

—

252

Total International

2,926

37

(49

)

2,914

2,711

(1

)

2,710

U.S./Canada

3,342

2

(54

)

3,290

3,071

—

3,071

Total Marsh

$

6,268

$

39

$

(103

)

$

6,204

$

5,782

$

(1

)

$

5,781

Mercer:

Wealth (a)

$

1,284

$

6

$

(74

)

$

1,216

$

1,218

$

(48

)

$

1,170

Health (a)

1,085

9

22

1,116

1,063

(44

)

1,019

Career

435

10

(2

)

443

437

—

437

Total Mercer

$

2,804

$

25

$

(54

)

$

2,775

$

2,718

$

(92

)

$

2,626

(a)

Acquisitions, dispositions and other in 2024 includes a net gain

of $21 million from the sale of the U.K. pension administration and

U.S. health and benefits administration businesses, that comprised

of a $66 million gain in Wealth, offset by a $45 million loss in

Health.

Note: Amounts in the tables above are

rounded to whole numbers.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717145202/en/

Media: Erick R. Gustafson Marsh McLennan +1 202 263 7788

erick.gustafson@mmc.com

Investor: Sarah DeWitt Marsh McLennan +1 212 345 6750

sarah.dewitt@mmc.com

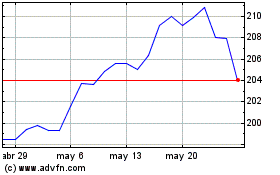

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024