Moog Inc. (NYSE: MOG.A and MOG.B), a worldwide designer,

manufacturer and systems integrator of high-performance precision

motion and fluid controls and control systems, today reported

fiscal first quarter 2025 diluted earnings per share of $1.64 and

adjusted diluted earnings per share of $1.78, which includes an

out-of-period warranty expense.

(in millions, except per share

results)

Three Months Ended

Q1 2025

Q1 2024

Deltas

Net sales

$

910

$

857

6

%

Operating margin(1)

11.1

%

11.0

%

10 bps

Adjusted operating margin(1)

11.8

%

11.3

%

50 bps

Diluted net earnings per share(2)

$

1.64

$

1.48

11

%

Adjusted diluted net earnings per

share(2)

$

1.78

$

1.53

16

%

Net cash provided (used) by operating

activities

$

(132

)

$

60

$

(193

)

Free cash flow

$

(165

)

$

(2

)

$

(163

)

See the reconciliations of adjusted

financial results and free cash flow to reported results included

in the financial statements herein for the periods ended December

28, 2024 and December 30, 2023.

(1) Q1 2025 includes 80 basis points for

an out-of-period warranty expense.

(2) Q1 2025 includes $0.18 for an out-of-period warranty expense.

Quarter Highlights

- Net sales increased due to growth in aerospace and defense

businesses, while sales declined in the Industrial segment, in part

due to divestitures.

- Operating margin increased due to benefits of simplification

initiatives and improved operations, mostly offset by higher

restructuring and other charges. Adjusted operating margin,

excluding these charges, expanded across all of our segments.

- Commercial Aircraft operating profit includes an $8 million

out-of-period warranty expense.

- Diluted earnings per share increased due to the incremental

operating profit from higher sales.

- Adjusted diluted earnings per share increased due to the

incremental operating profit from both higher sales and margin

enhancement across all of our segments.

- Free cash flow use was driven by working capital

requirements.

- Bookings of $1.3 billion were driven by record orders in Space

and Defense and strong orders in Commercial Aircraft.

- Twelve-month backlog remained steady at $2.5 billion, as growth

in Space and Defense was offset by declines in Industrial due to

the impact of the divestitures and weaker foreign currencies.

"We have delivered a great quarter with strong sales growth,

impressive bookings and solid margin enhancement," said Pat Roche,

CEO. "We are delivering value for our customers and are being

rewarded with significant program wins. Our operational initiatives

will deliver continued margin enhancement and strong free cash flow

in the second half of 2025."

Segment Results

Sales in the first quarter of 2025 increased compared to the

first quarter of 2024, driven by defense growth in Space and

Defense and in Military Aircraft, and by aftermarket demand in

Commercial Aircraft. These increases were partially offset by a

sales decline in Industrial. Space and Defense sales increased 8%

to $248 million, supported by broad-based demand. Military Aircraft

sales increased 15% to $213 million, driven by the ramp-up of

activity on the FLRAA program and new production programs.

Commercial Aircraft sales increased 14% to $221 million, reflecting

strong repair activity and initial provisioning of spares.

Industrial sales decreased 7% to $228 million, half due to the lost

sales associated with our portfolio shaping activities.

Operating margin increased 10 basis points to 11.1% in the first

quarter of 2025 compared to the first quarter of 2024. Space and

Defense operating margin increased 50 basis points to 11.5% due to

sales growth, partially offset by investments to prepare for

upcoming major programs. Military Aircraft operating margin

increased 20 basis points to 10.7%, driven by increased activity on

the FLRAA program and lower research and development expenses,

partially offset by an unfavorable sales mix. Commercial Aircraft

operating margin increased 40 basis points to 11.0%, driven by

higher levels of aftermarket sales, offset by a 340 basis-point

out-of-period warranty expense. Excluding this warranty expense,

Commercial Aircraft operating margin would have been 14.4% in the

first quarter of 2025. Industrial operating margin decreased 60

basis points to 11.2%, due to restructuring and other charges.

Adjusted operating margin excludes $6 million and $2 million in

restructuring and other charges in the first quarter of 2025 and

2024, respectively. Industrial adjusted operating margin increased

60 basis points to 13.2% in the first quarter of 2025 compared to

the first quarter of 2024, driven by simplification

initiatives.

Free Cash Flow Results

Free cash flow in the first quarter was a use of cash of $165

million driven by working capital requirements. Physical

inventories grew to support future sales growth. In addition, free

cash flow was negatively impacted by the timing of collections and

compensation payments.

2025 Financial Guidance

"Fiscal year 2025 is shaping up to be another strong year, with

growth in sales, continued operating margin expansion and enhanced

free cash flow generation," said Jennifer Walter, CFO. "Both

pricing and simplification will drive our operating margin

expansion this year, while our focus on optimizing our planning and

sourcing activities will contribute to our significant cash

generation in the back half of the year."

(in millions, except per share

results)

FY 2025 Guidance

Current

Previous

Net sales

$

3,700

$

3,700

Operating margin

12.9

%

13.0

%

Adjusted operating margin

13.0

%

13.0

%

Diluted net earnings per share(1)

$

8.06

$

8.20

Adjusted diluted net earnings per

share

$

8.20

$

8.20

Free cash flow conversion

50 - 75

%

50 - 75

%

(1) Diluted net earnings per share figures

are forecasted to be within range of +/- $0.20.

Diluted net earnings per share for the second quarter of 2025 is

forecasted to be $1.75, plus or minus $0.10.

Conference call information

In conjunction with today’s release, Pat Roche, CEO, and

Jennifer Walter, CFO, will host a conference call today beginning

at 10:00 a.m. ET, which will be simultaneously broadcast live

online. Listeners can access the call and supplemental financial

materials at www.moog.com/investors/communications.

Cautionary Statement

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which can be identified by words such as: “may,” “will,”

“should,” “believes,” “expects,” “expected,” “intends,” “plans,”

“projects,” “approximate,” “estimates,” “predicts,” “potential,”

“outlook,” “forecast,” “anticipates,” “presume,” “assume” and other

words and terms of similar meaning (including their negative

counterparts or other various or comparable terminology). These

forward-looking statements are made pursuant to the Private

Securities Litigation Reform Act of 1995, are neither historical

facts nor guarantees of future performance and are subject to

several factors, risks and uncertainties, the impact or occurrence

of which could cause actual results to differ materially from the

expected results described in the forward-looking statements.

Although it is not possible to create a comprehensive list of

all factors that may cause our actual results to differ from the

results expressed or implied by our forward-looking statements or

that may affect our future results, some of these factors and other

risks and uncertainties are described in Item 1A “Risk Factors” of

our Annual Report on Form 10-K and in our other periodic filings

with the Securities and Exchange Commission (“SEC”) and include,

but are not limited to, risks relating to: (i) our operation in

highly competitive markets with competitors who may have greater

resources than we possess; (ii) our operation in cyclical markets

that are sensitive to domestic and foreign economic conditions and

events; (iii) our heavy dependence on government contracts that may

not be fully funded or may be terminated; (iv) supply chain

constraints and inflationary impacts on prices for raw materials

and components used in our products; (v) failure of our

subcontractors or suppliers to perform their contractual

obligations; and (vi) our accounting estimations for over-time

contracts and any changes we need to make thereto. You should

evaluate all forward-looking statements made in this press release

in the context of these risks and uncertainties.

While we believe we have identified and discussed in our SEC

filings the material risks affecting our business, there may be

additional factors, risks and uncertainties not currently known to

us or that we currently consider immaterial that may affect the

forward-looking statements we make herein. Given these factors,

risks and uncertainties, investors should not place undue reliance

on forward-looking statements as predictive of future results. Any

forward-looking statement speaks only as of the date on which it is

made, and we disclaim any obligation to update any forward-looking

statement made in this press release, except as required by

applicable law.

Moog Inc.

CONSOLIDATED STATEMENTS OF

EARNINGS (UNAUDITED)

(dollars in thousands, except

per share data)

Three Months Ended

December 28,

2024

December 30, 2023

Net sales

$

910,315

$

856,850

Cost of sales

668,040

623,651

Gross profit

242,275

233,199

Research and development

23,605

30,579

Selling, general and administrative

127,781

118,725

Interest

17,002

16,694

Restructuring

3,784

1,889

Other

1,524

2,701

Earnings before income taxes

68,579

62,611

Income taxes

15,466

14,799

Net earnings

$

53,113

$

47,812

Net earnings per share

Basic

$

1.66

$

1.50

Diluted

$

1.64

$

1.48

Weighted average common shares

outstanding

Basic

31,971,462

31,902,101

Diluted

32,407,293

32,249,313

Moog Inc.

RECONCILIATION TO ADJUSTED NET

EARNINGS BEFORE TAXES, INCOMES TAXES, NET EARNINGS AND DILUTED NET

EARNINGS PER SHARE (UNAUDITED)

(dollars in thousands)

Three Months Ended

December 28,

2024

December 30, 2023

As Reported:

Earnings before income taxes

$

68,579

$

62,611

Income taxes

15,466

14,799

Effective income tax rate

22.6

%

23.6

%

Net earnings

53,113

47,812

Diluted net earnings per share

$

1.64

$

1.48

Restructuring and Other

Charges:

Earnings before income taxes

$

6,056

$

1,889

Income taxes

1,512

498

Net earnings

4,544

1,391

Diluted net earnings per share

$

0.14

$

0.04

As Adjusted:

Earnings before income taxes

$

74,635

$

64,500

Income taxes

16,978

15,297

Effective income tax rate

22.7

%

23.7

%

Net earnings

57,657

49,203

Diluted net earnings per share

$

1.78

$

1.53

The diluted net earnings per share

associated with the adjustments in the table above may not

reconcile when totaled due to rounding.

Results shown above have been adjusted to exclude impacts

associated with restructuring and other charges related to

continued portfolio shaping and footprint rationalization

activities. While management believes that these adjusted financial

measures may be useful in evaluating the financial condition and

results of operations of the Company, this information should be

considered supplemental and is not a substitute for financial

information prepared in accordance with GAAP.

Moog Inc.

CONSOLIDATED SALES AND

OPERATING PROFIT (UNAUDITED)

(dollars in thousands)

Three Months Ended

December 28,

2024

December 30, 2023

Net sales:

Space and Defense

$

247,784

$

230,128

Military Aircraft

213,420

186,244

Commercial Aircraft

220,923

194,222

Industrial

228,188

246,256

Net sales

$

910,315

$

856,850

Operating profit:

Space and Defense

$

28,539

$

25,297

11.5

%

11.0

%

Military Aircraft

22,916

19,589

10.7

%

10.5

%

Commercial Aircraft

24,204

20,626

11.0

%

10.6

%

Industrial

25,498

29,024

11.2

%

11.8

%

Total operating profit

101,157

94,536

11.1

%

11.0

%

Deductions from operating profit:

Interest expense

17,002

16,694

Equity-based compensation expense

4,325

4,165

Non-service pension expense

1,946

3,187

Corporate and other expenses, net

9,305

7,879

Earnings before income taxes

$

68,579

$

62,611

Moog Inc.

RECONCILIATION TO ADJUSTED

OPERATING PROFIT AND MARGINS (UNAUDITED)

(dollars in thousands)

Three Months Ended

December 28,

2024

December 30, 2023

Space and Defense operating profit - as

reported

$

28,539

$

25,297

Restructuring and other

930

—

Space and Defense operating profit - as

adjusted

$

29,469

$

25,297

11.9

%

11.0

%

Military Aircraft operating profit - as

reported

$

22,916

$

19,589

Restructuring and other

591

—

Military Aircraft operating profit - as

adjusted

$

23,507

$

19,589

11.0

%

10.5

%

Commercial Aircraft operating profit - as

reported and adjusted

$

24,204

$

20,626

11.0

%

10.6

%

Industrial operating profit - as

reported

$

25,498

$

29,024

Restructuring and other

4,535

1,889

Industrial operating profit - as

adjusted

$

30,033

$

30,913

13.2

%

12.6

%

Total operating profit - as adjusted

$

107,213

$

96,425

11.8

%

11.3

%

While management believes that these adjusted financial measures

may be useful in evaluating the financial condition and results of

operations of the Company, this information should be considered

supplemental and is not a substitute for financial information

prepared in accordance with GAAP.

Moog Inc.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(dollars in thousands)

December 28,

2024

September 28, 2024

ASSETS

Current assets

Cash and cash equivalents

$

73,448

$

61,694

Restricted cash

360

123

Receivables, net

472,310

419,971

Unbilled receivables

735,759

709,014

Inventories, net

886,088

863,702

Prepaid expenses and other current

assets

77,783

86,245

Total current assets

2,245,748

2,140,749

Property, plant and equipment, net

934,087

929,357

Operating lease right-of-use assets

56,744

52,591

Goodwill

818,503

833,764

Intangible assets, net

59,469

63,479

Deferred income taxes

24,219

20,991

Other assets

54,242

52,695

Total assets

$

4,193,012

$

4,093,626

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities

Accounts payable

$

267,054

$

292,988

Accrued compensation

68,366

101,127

Contract advances and progress

billings

293,550

299,732

Accrued liabilities and other

284,849

305,180

Total current liabilities

913,819

999,027

Long-term debt, excluding current

installments

1,104,151

874,139

Long-term pension and retirement

obligations

162,222

167,161

Deferred income taxes

26,080

27,738

Other long-term liabilities

171,962

164,928

Total liabilities

2,378,234

2,232,993

Shareholders’ equity

Common stock - Class A

43,844

43,835

Common stock - Class B

7,436

7,445

Additional paid-in capital

777,060

784,509

Retained earnings

2,712,875

2,668,723

Treasury shares

(1,141,242

)

(1,082,240

)

Stock Employee Compensation Trust

(186,219

)

(194,049

)

Supplemental Retirement Plan Trust

(156,865

)

(163,821

)

Accumulated other comprehensive loss

(242,111

)

(203,769

)

Total shareholders’ equity

1,814,778

1,860,633

Total liabilities and shareholders’

equity

$

4,193,012

$

4,093,626

Moog Inc.

CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED)

(dollars in thousands)

Three Months Ended

December 28,

2024

December 30, 2023

CASH FLOWS FROM OPERATING ACTIVITIES

Net earnings

$

53,113

$

47,812

Adjustments to reconcile net earnings to

net cash provided (used) by operating activities:

Depreciation

23,478

20,927

Amortization

2,323

2,720

Deferred income taxes

(3,577

)

(4,547

)

Equity-based compensation expense

4,325

4,165

Other

2,708

(2,478

)

Changes in assets and liabilities

providing (using) cash:

Receivables

(63,037

)

58,887

Unbilled receivables

(31,073

)

(51,015

)

Inventories

(48,711

)

(46,852

)

Accounts payable

(22,973

)

(5,752

)

Contract advances and progress

billings

(1,314

)

64,171

Accrued expenses

(29,372

)

(31,814

)

Accrued income taxes

(9,698

)

12,324

Net pension and post retirement

liabilities

1,555

2,957

Other assets and liabilities

(10,031

)

(11,114

)

Net cash provided (used) by operating

activities

(132,284

)

60,391

CASH FLOWS FROM INVESTING ACTIVITIES

Acquisitions of businesses, net of cash

acquired

—

(5,212

)

Purchase of property, plant and

equipment

(32,778

)

(37,416

)

Net proceeds from businesses sold

13,487

—

Other investing transactions

169

(479

)

Net cash provided (used) by investing

activities

(19,122

)

(43,107

)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from revolving lines of

credit

426,500

279,500

Payments on revolving lines of credit

(197,000

)

(223,000

)

Payments on finance lease obligations

(2,745

)

(1,286

)

Payment of dividends

(8,961

)

(8,619

)

Proceeds from sale of treasury stock

—

581

Purchase of outstanding shares for

treasury

(55,692

)

(8,711

)

Proceeds from sale of stock held by

SECT

9,665

5,001

Purchase of stock held by SECT

(8,087

)

(4,561

)

Other financing transactions

(439

)

—

Net cash provided (used) by financing

activities

163,241

38,905

Effect of exchange rate changes on

cash

(2,564

)

1,495

Increase (decrease) in cash, cash

equivalents and restricted cash

9,271

57,684

Cash, cash equivalents and restricted cash

at beginning of year (1)

64,537

69,144

Cash, cash equivalents and restricted cash

at end of period

$

73,808

$

126,828

(1) Beginning of year cash balance at

September 29, 2024 includes cash related to assets held for sale of

$2,720.

Moog Inc.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(UNAUDITED)

(dollars in thousands)

Three Months Ended

December 28,

2024

December 30, 2023

Net cash provided (used) by operating

activities

$

(132,284

)

$

60,391

Purchase of property, plant and

equipment

(32,778

)

(37,416

)

Receivables Purchase Agreement

—

(25,000

)

Free cash flow

$

(165,062

)

$

(2,025

)

Adjusted net earnings

$

57,657

$

49,203

Free cash flow conversion

(286

)%

(4

)%

Free cash flow is defined as net cash provided (used) by

operating activities, less purchase of property, plant and

equipment, less the benefit from the Receivables Purchase

Agreement. Free cash flow conversion is defined as free cash flow

divided by adjusted net earnings. Free cash flow and free cash flow

conversion are not measures determined in accordance with GAAP and

may not be comparable with the measures as used by other companies.

However, management believes these adjusted financial measures may

be useful in evaluating the liquidity, financial condition and

results of operations of the Company. This information should be

considered supplemental and is not a substitute for financial

information prepared in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124319201/en/

Aaron Astrachan 716.687.4225

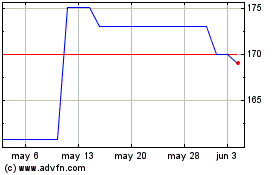

Moog (NYSE:MOG.B)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Moog (NYSE:MOG.B)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025