0001003078FALSE00010030782024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 6, 2024

___________________________________

MSC INDUSTRIAL DIRECT CO., INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

New York

| 1-14130

| 11-3289165 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

515 Broadhollow Road, Suite 1000, Melville , New York | 11747 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (516) 812-2000

Not Applicable

(Former name or former address, if changed since last report)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 per share | MSM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(b) and (e) On June 6, 2024, John Hill resigned as Senior Vice President & Chief Digital Information Officer of the Company effective June 12, 2024.

In connection with Mr. Hill’s resignation, the Company entered into a Separation Agreement (the “Separation Agreement”), dated June 12, 2024, with Mr. Hill. Under the terms of the Separation Agreement, in consideration for a general release and subject to compliance with confidentiality and cooperation provisions, Mr. Hill will receive (i) cash severance of $550,000, payable bi-weekly over the twelve months following the effective date of the Separation Agreement, (ii) acceleration of vesting of certain outstanding restricted stock unit awards, as set forth in the Separation Agreement and in accordance with the terms of the Company’s 2015 Omnibus Incentive Plan or the Company’s 2023 Omnibus Incentive Plan, (iii) a lump sum payment of $24,345.88, which equals the amount of fifty-two weeks of Company subsidy towards the cost of healthcare continuation coverage and is payable within thirty days following the effective date of the Separation Agreement and (iv) outplacement services.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

† | | Indicates a management contract or compensatory plan or arrangement. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | MSC INDUSTRIAL DIRECT CO., INC. |

| | | |

| Date: | June 12, 2024 | By: | /s/ KRISTEN ACTIS-GRANDE |

| | Name: | Kristen Actis-Grande |

| | Title: | Executive Vice President and Chief Financial Officer |

CONFIDENTIAL SEPARATION AND RELEASE AGREEMENT

This Confidential Separation and Release Agreement (“Agreement”) is made and entered into by and between Sid Tool Co., Inc. dba MSC Industrial Supply Co. (the “Company”) and John W. Hill (the “Executive”) (collectively, the “Parties”).

RECITALS

Executive was employed by the Company as Senior Vice President and Chief Digital Officer. Executive has resigned from the Company effective June 12, 2024, and the Company accepted Executive’s resignation.

The Company wishes to provide Executive with certain benefits in consideration of the promises and covenants of Executive, as contained herein, which include but are not limited to Executive’s agreement to release any and all claims Executive has against the Company.

Based on the foregoing facts and in consideration of and in exchange for the promises, covenants, and releases contained herein, the Parties mutually agree as follows:

1.Separation Date. Executive’s last day of active employment with the Company will be June 12, 2024 (the "Separation Date"). Executive understands that, except as provided in this Agreement or as required by applicable law, as of the Separation Date, all compensation and benefits Executive was receiving as an employee of the Company shall cease. Executive agrees that from and after the Separation Date, Executive shall no longer be, and shall not hold himself out as, an employee, or agent of the Company or any of its affiliates.

2.Separation Benefits. In consideration of Executive’s promises and releases set forth in this Agreement and Executive’s compliance with those promises and releases, including but not limited to the Release set forth in Paragraph 4, Executive is eligible to receive the following payments and benefits:

a.Separation Pay. The Company will pay Executive a special separation payment of $550,000, which is equivalent to twelve (12) months of Executive’s base salary as of the Separation Date (the “Separation Pay”). The Separation Pay, less all required and customary payroll taxes, deductions and other withholdings, is payable in equal pro rata bi-weekly installments in accordance with the Company’s normal payroll practices over the twelve months following the Effective Date of this Agreement (as defined in Paragraph 19 below) (such twelve month period the “Severance Period”), beginning on the first regular Company payroll date after the Effective Date and continuing on each regular payday thereafter until paid provided that Executive is in compliance with the terms of this Agreement and his contractual post-employment obligations to the Company. Because Executive has not asserted any sexual harassment claims, and Executive represents that Executive is currently unaware of any claims for sexual harassment that Executive may have, no part of the consideration in this Paragraph 2 has been specifically allocated for the release of claims for sexual harassment.

b.Additional Separation Benefit. If Executive is eligible for continuation coverage in the Company’s medical, dental and vision plan pursuant to the provisions of the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), and timely elects COBRA continuation coverage, the Company will pay Executive $24,345.88, which equals fifty-two (52) weeks of the subsidy provided by the Company toward the cost of Executive’s

healthcare coverage with the Company (the “Additional Separation Benefit”), less all applicable federal, state and local withholding taxes and deductions. The Additional Separation Benefit will be paid in a lump sum within thirty (30) days after the Effective Date of this Agreement.

c.Outplacement Assistance. The Company will provide Executive with outplacement services with a firm designated by the Company up to an amount determined in the Company’s discretion, provided that Executive commences such services no later than 90 (ninety) days following the Executive’s Separation Date.

d.Accelerated Vesting. With respect to certain awards previously granted to Executive under the MSC Industrial Direct, Co. Inc. 2015 Omnibus Incentive Plan or the MSC Industrial Direct, Co. Inc. 2023 Omnibus Incentive Plan (collectively, the “Omnibus Plans”) which, as of the Separation Date, are not fully vested, effective as of the Separation Date, such awards shall be deemed to be vested in the amount and pursuant to the terms as set forth on Exhibit A attached to this Agreement. Except as provided in this Paragraph 2.d. and Exhibit A, the terms of the Omnibus Plans and the applicable award agreements received by the Executive will continue to apply.

e.Forfeiture. Executive understands and agrees that to the fullest extent permitted by law Executive will forfeit any unpaid portion of the separation benefits set forth in this Paragraph 2 in the event of Executive’s breach of the provisions of this Agreement or any confidentiality, noncompete, nonsolicitation, non-disparagement or similar agreement with the Company and Executive will be required to repay to the Company any portion of the Separation Pay under subparagraph 2.a. of this Agreement already paid to Executive under this Agreement. Without limiting the foregoing, Executive agrees that the Company can withhold any separation benefits set forth above until after Executive complies with Executive’s obligations to return the Company’s property, without limiting any other right or remedy that the Company may have.

f.Valid Consideration. Executive agrees that the consideration described in this Agreement shall be a separation benefit only, and its existence does not entitle the Executive to any rights as an employee of the Company. Executive acknowledges that he would not otherwise be entitled to the separation benefits were it not for Executive’s covenants, promises, and releases set forth in this Agreement.

3.No Other Amounts Owed. Executive acknowledges that the Company has paid all regular wages earned by the Executive up through and including the Separation Date. Executive further acknowledges and agrees that no additional compensation or benefits are currently or will be due to Executive from the Company except as expressly set forth in this Agreement.

4.Release. In consideration of the special benefits described in Paragraph 2 of this Agreement, each of which alone provides good and sufficient consideration for Executive’s releases and promises in this Agreement, Executive, on Executive’s own behalf and on behalf of Executive’s agents, heirs, executors, administrators and assigns, voluntarily, knowingly and willingly releases and forever discharges the Company, its affiliates (as defined below), partnerships, divisions, and joint ventures, its employee benefit plans, and all of the foregoing's respective present or former officers, directors, partners, shareholders, employees, agents, trustees and administrators, predecessors, successors and assigns (each a “Releasee” and collectively, the "Releasees") from and covenants not to sue or pursue any claim against any Releasee regarding, any and all contractual obligations, rights, claims, causes of action, charges, demands, damages and liabilities of every kind whatsoever, known or unknown, suspected or unsuspected (collectively, "Claims"), which Executive ever had, now has or hereafter can, shall or may have by reason

of any matter, cause or thing whatsoever arising from the beginning of time to the time Executive signs this Agreement, to the fullest extent permitted by law (the "Release"). This Release is a full and final general release of all Claims, including, but not limited to: any claims under federal statutes, regulations or common law including without limitation under the Age Discrimination in Employment Act of 1967, as amended by the Older Workers Benefit Protection Act), Title VII of the 1964 Civil Rights Act, the Americans with Disabilities Act, the ADA Amendments Act, the Employee Retirement Income Security Act of 1974 (excluding claims for vested benefits), the National Labor Relations Act, the Family and Medical Leave Act, the Genetic Information Nondiscrimination Act, the Lily Ledbetter Fair Pay Act, the Worker Adjustment and Retraining Notification Act, the Rehabilitation Act, Executive Order 11246, VEVRA, the Immigration and Naturalization Act, and Sections 1981 through 1988 of Title 42 of the United States Code, all as amended; claims under the common law, statutes, regulations, and ordinances in any state or locality in which Executive worked and any other applicable state or locality; any claims for compensatory or punitive damages, liquidated damages, attorneys fees, and costs; claims for retaliation, wrongful discharge, constructive discharge, promissory estoppel, breach of contract, failure to give notice, oppression, invasion of privacy, violations of any state and/or municipality whistle-blowing statutes or laws or fair employment statutes or laws; and any claims for violations of any other law, rule, regulation, or ordinance pertaining to employment, wages, hours, stock ownership, or any other terms and conditions of employment and separation of employment, and any other claims, counterclaims and/or third party claims, which have been, or could have been, asserted by Executive in any court, arbitration, or other forum arising out of or in any way related to the employment relationship between Executive and the Company or between Executive and any other Releasees or the separation thereof, to the fullest extent permitted by law; provided, however, that nothing in this Release shall impair any vested retirement or 401(k) benefits Executive may have as of Executive’s Separation Date, any rights with respect to COBRA continuation coverage under any group health plan of the Company, any claims to require the Company to honor its commitments set forth in this Agreement, or any claims to interpret or to determine the scope, meaning or effect of this Agreement. Notwithstanding the foregoing, the definition of "Claims" hereunder does not include any claim that arises after the date that Executive signs this Agreement, any claim under unemployment or workers' compensation laws, and any claim that cannot, as a matter of law, be released by private agreement.

5.No Pending Claims. Executive hereby represents and warrants that Executive has not filed or caused to be filed any complaints, charges or lawsuits against the Company or any of the other Releasees, and that no such complaints, charges or lawsuits are pending.

6.Benefits. The Company will direct the trustee or administrator to distribute Executive’s vested accrued benefits, if any, in the Company’s pension and profit-sharing plans (if any) in accordance with the provisions of said plans. If Executive participated in the Company’s group health insurance plan, the following will apply. The Company will provide Executive the right to elect whatever group health plan continuation coverage to which Employee and Employee’s dependents are entitled pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1986, 26 U.S.C. § 4980B et seq., (“COBRA”), and to provide assistance with respect to exercising any conversion rights provided under the Company’s group health plan(s). Executive’s “qualifying event” for COBRA purposes shall be the Separation Date. Executive is hereby informed that in addition to COBRA continuation coverage, there may be other coverage options for Executive and Executive’s dependents through the Health Insurance Marketplace (also known as “Exchanges”) under the Patient Protection and Affordable Care Act (“PPACA”). Executive should review all available options carefully, as Executive’s election of COBRA could affect Executive’s eligibility to obtain coverage through the Exchanges. Executive will receive a Notice of COBRA Continuation Coverage Rights separately, but outside of providing this COBRA Notice, the Company specifically does not accept any responsibility for guiding Executive or advising

Executive about the timing constraints for such choices, or about Executive’s eligibility to obtain coverage through the Exchanges. The Company advises Executive to consult with Executive’s own counsel regarding options and choices for securing the health care coverage that Executive desires to put into effect following Executive’s termination.

7.Non-Disparagement. Executive agrees not to disparage or otherwise impugn the business or management of the Company or any of its affiliates, or any of their respective officers, directors, agents, representatives or employees. Executive further agrees not to make, or knowingly cause to be made, any statement or communication, written or oral, with the intention of damaging the business or reputation of the Company or any of its affiliates, or the personal or business reputations of any of their respective officers, directors, agents, representatives or employees, or of interfering with, impairing or disrupting the normal operations of the Company or any of its affiliates; provided, however, that nothing herein shall prevent Executive from providing truthful testimony if required by subpoena or order of a court or other governmental entity with jurisdiction over Executive or by law enforcement, as applicable.

8.Return of Company Property. All documents (electronic, paper or otherwise), data and records (electronic, paper or otherwise), materials, software, equipment, and other physical property, and all copies of the foregoing, whether or not otherwise containing confidential information, that have come into Executive’s possession or been created, produced, reproduced or utilized by the Company, or its parents, subsidiaries or affiliates or by Executive in connection with Executive’s employment ("Property"), have been and remain the sole property of the Company or its parents, subsidiaries or affiliates, as applicable. Executive agrees that Executive must and that Executive has returned all such Property to the Company on or before Executive’s Separation Date, including but not limited to Company-owned equipment (including without limitation computers, laptops, printers, tools, cell phones, smart phones, i-pads and blackberries) and passwords thereto, Company cars, office, desk and file cabinet keys, any Company corporate credit card, identification/pass cards, and other Company property including files, customer data, pricing and other financial information, formulas, papers, data, lists, charts, passwords, social media accounts, photographs, computer records or disks relating in any manner to the business activities of the Company and its affiliates, without retaining any copy or summary thereof. To the extent that Executive has any Property on any personal device or account, Executive agrees to delete Property from Executive’s device or account after first returning a copy of the property to the Company (in care of Beth Bledsoe, Chief People Officer). For purposes of this Agreement, the term "affiliate" includes without limitation (i) MSC Industrial Direct Co., Inc.; (ii) J&L America, Inc.; (iii) Engman-Taylor, an MSC Company, LLC; (iv) MSC Import Export LLC; (v) MSC Industrial Supply S.de.R.de C.V.; (vi) Wm. F. Hurst Co., LLC; (vii) MSC Industrial Supply ULC; (viii) American Specialty Grinding Co., Inc.; (ix) Tru-Edge Grinding LLC, an MSC Company; (x) Buckeye Industrial Supply Company LLC, an MSC Company; (xi) All Integrated Solutions, Inc.; (xii) Tower Fasteners, LLC.

9.Confidential, Trade Secret, Proprietary Information, and Restrictive Covenants. Executive shall not publish, disclose, or utilize any proprietary, trade secret, or other confidential information belonging to the Company or any third party doing business with the Company which Executive obtained in the course or scope of Executive’s employment by the Company. If applicable, Executive’s contractual and statutory obligation to refrain from using or disclosing Company’s confidential, trade secret, and proprietary information, and from soliciting and/or competing against the Company, including but not limited to the Associate Confidentiality, Non-Solicitation and Non-Competition Agreements (“Restrictive Covenant Agreements”) which Executive signed during Executive’s employment with the Company, survive(s) this Agreement and will operate concurrently herewith to the extent not inconsistent with this Agreement. Any breach of the Restrictive Covenant

Agreements by Executive shall entitle the Company to all of the relief set for therein and Executive will forfeit the consideration provided under this Agreement.

10.Disclaimer Regarding Government Agency Claims. Executive understands that nothing contained in this Agreement limits Executive’s ability to file a charge or complaint with the Equal Employment Opportunity Commission, the Occupational Safety and Health Administration, the Securities and Exchange Commission or any similar federal, state or local governmental agency or commission charged with enforcing a law on behalf of the government (“Government Agencies”). Executive further understands that this Agreement does not limit Executive’s ability to communicate with any Government Agencies or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information. However, by signing this Agreement, Executive hereby waives and releases the right to recover damages and any other form of personal relief in any proceeding Executive may bring before any of the Government Agencies, and Executive further represents that Executive will not seek or be entitled to any monetary recovery or other personal relief in any action or proceeding that may be commenced on Executive’s behalf arising out of the matters released in this Agreement. Notwithstanding the foregoing, this Agreement does not limit Executive’s right to receive an award for information provided to any Government Agency under an established whistleblower program of such Government Agency. Nothing in this Agreement, however, is intended to waive the Company’s attorney-client or work product privileges.

11.Cooperation. Executive agrees to cooperate with the Company to provide all information or testimony that the Company may hereafter reasonably request with respect to matters including but not limited to administrative, judicial, or other proceedings, inquiries or investigations, involving Executive’s present or former relationship with the Company, the work Executive has performed, or present or former associates or clients of the Company, so long as such requests do not unreasonably interfere with any other job in which the Executive is engaged. The Company agrees to reimburse Executive for all reasonable out-of-pocket costs Executive shall incur in connection with such cooperation.

12.Acknowledgement regarding Legal Compliance. Executive acknowledges that he is subject to certain Company policies and securities laws and regulations prohibiting insider trading. Executive confirms that he will not trade in shares of MSC Industrial Direct Co., Inc. until after the later of (i) July 8, 2024 or (ii) the date on which any information in his possession or knowledge ceases to be Material Nonpublic Information under applicable securities laws.

13.Entire Separation Agreement. The terms described in this Agreement set forth the entire agreement and understanding between Executive and the Company, and supersede all prior agreements, arrangements and understandings, written or oral, between Executive and the Company, pertaining to the subject matter of this Agreement. Notwithstanding the foregoing, this Agreement does not novate, and Executive agrees to continue to abide by and comply with the terms and conditions set forth in, any prior agreement by Executive not to use or disclose the Company's or any affiliate's confidential, trade secret or proprietary information or any material nonpublic information, to return the property of the Company or any affiliate, and to not disparage the Company or any affiliate, including without limitation the terms of the Associate Confidentiality, Non-Solicitation and Non-Competition Agreement(s) Executive previously executed with the Company and which shall survive execution of this Agreement to the extent not inconsistent with the terms of this Agreement.

14.Construction. This Agreement shall not be construed in favor of one Party or against the other.

15.No Waiver. The failure to insist upon compliance with any term, covenant, or condition contained in this Agreement shall not be deemed a waiver of that term, covenant, or condition, nor shall any waiver or relinquishment of any right or power contained in this Agreement at any one or more times be deemed a waiver or relinquishment of any right or power at any other time or times.

16.Governing Law, Consent to Jurisdiction, Waiver of Jury Trial. To the fullest extent permitted by law, Executive and the Company agree to waive any right to a trial by jury regarding any dispute, claim or cause of action arising out of, concerning, or related to, Executive’s employment, Executive’s termination of employment, or this Agreement. This Agreement shall be construed in accordance with the laws of the State of North Carolina without regard to any state’s conflict of law provisions. If at any time after the date of the execution of this Agreement, any provision of this Agreement shall be held in any court of competent jurisdiction to be illegal, void, or unenforceable, such provision shall be deemed to be restated to reflect, as nearly as possible, the original intentions of the parties in accordance with applicable law. The invalidity or unenforceability of any provision of this Agreement, however, shall not affect the validity or enforceability of any other provision of this Agreement, all of which shall remain in full force and effect.

17.Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original, all of which together shall constitute one and the same instrument.

18.Miscellaneous.

a.Executive acknowledges and agrees that Executive is not relying on any representations or promises by any representative of the Company concerning the meaning of any aspect of this Agreement.

b.This Agreement may not be altered or modified other than in a writing signed by Executive and an authorized representative of the Company.

c.The Company's offer to Executive of this Agreement is not intended to, and shall not be construed as, any admission of liability or of any improper conduct on the part of the Company or any of the Releasees.

d.The Company advises Executive to consult with an attorney of Executive’s choice prior to signing this Agreement. Executive understands and agrees that Executive has the right and has been given the opportunity to review this Agreement including specifically the Release in Paragraph 4, with an attorney of Executive’s choice should Executive so desire.

e.Executive also understands and agrees that the Company is under no obligation to offer Executive the payments set forth above, that Executive is under no obligation to consent to the Release set forth in Paragraph 4 and that Executive has entered into this Agreement freely and voluntarily.

19.Return of Agreement. Effective Date. Executive has twenty-one (21) days to consider the terms of this Agreement. Furthermore, once Executive has signed this Agreement, Executive

has seven (7) additional days from the date Executive signs it to revoke Executive’s consent to the Release by delivering (by hand or overnight courier) written notice of revocation, signed by Executive and delivered to the Company (c/o Beth Bledsoe, Chief People Officer, MSC Industrial Direct Co., Inc., 525 Harbour Place Dr., Davidson, North Carolina 28036 or Beth.Bledsoe@mscdirect.com) no later than 5:00 p.m. Eastern Time on the seventh (7th) day of the revocation period. The Agreement will not become effective until the eighth (8th) day after the date Executive has signed it and returned it to the Company, assuming that Executive has not revoked Executive’s consent during such time (the “Effective Date”). Executive acknowledges and agrees that, in the event Executive does not sign this Agreement within the twenty-one (21) day period or Executive revokes this Agreement during the revocation period, it shall have no force or effect, and Executive shall have no right to receive any of the payments or benefits provided for in Paragraph 2, other than base wages earned through Executive’s last day of employment.

20.Ownership of Claims. The Executive represents and warrants that Executive is the sole and lawful owner of all rights, title, and interest in and to all released matters, claims, and demands referred to herein. The Executive further represents and warrants that there has been no assignment or other transfer of any interest in such matter, claims, or demands which the Executive may have against the Company.

21.Binding Nature. This Agreement, and all the terms and provisions contained herein, shall bind the heirs, personal representatives, successors, and assigns of the Executive, and only inure to the benefit of the Company, its agents, directors, officers, Executives, servants, successors, and assigns.

22.Partial Invalidity. Should any portion, word, clause, phrase, sentence, or paragraph of this Agreement be declared void or unenforceable, such portion shall be considered independent and severable from the remainder, the validity of which shall remain unaffected.

23.Relief and Enforcement Costs. The Parties agree that in the event one Party breaches any provision of this Agreement, the other Party shall have the right to file a lawsuit against the breaching Party seeking temporary, preliminary, and permanent injunctive relief, and any other damages and relief available under the law. The prevailing Party shall recover all costs and reasonable attorney’s fees incurred in conjunction with enforcement of this Agreement to the extent permitted by law.

24.Section Headings. The section and paragraph headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

25.Code Section 409A. The parties hereto acknowledge and agree that, to the extent applicable, this Agreement shall be interpreted in accordance with, and incorporate the terms and conditions required by, Section 409A of the Code. Notwithstanding any provision of this agreement to the contrary, in the event the Company determines that any amounts payable hereunder will be immediately taxable to Executive under Section 409A of the Code, the Company and Executive shall cooperate in good faith to (x) adopt such amendments to this Agreement and appropriate policies and procedures, including amendments and policies with retroactive effect, that they mutually determine to be necessary or appropriate to preserve the intended tax treatment of the benefits provided by this Agreement, to preserve the economic benefits of this Agreement and to avoid less favorable accounting or tax consequences for the Company and/or (y) take such other actions as mutually determined to be necessary or appropriate to exempt the amounts payable hereunder from Section 409A of the Code or to

comply with the requirements of Section 409A of the Code and thereby avoid the application of penalty taxes thereunder.

26.Acknowledgment of Rights and Waiver of Claims Under the Age Discrimination in Employment Act. Executive acknowledges that Executive is knowingly and voluntarily waiving and releasing any rights Executive may have under the Age Discrimination in Employment Act of 1967 (“ADEA”). The Executive further acknowledges that Executive has been advised by this writing, as required by the Older Workers’ Benefit Protection Act, that: (a) Executive has at least twenty-one (21) days to consider this Agreement (although Executive may by Executive’s own choice execute this Agreement earlier); (b) Executive has seven (7) days following the execution of this Agreement by the Parties to revoke the Agreement; and (c) this Agreement shall not be effective until the date upon which the revocation period has expired, which is the Effective Date as set forth in Paragraph 19. The Executive may revoke this waiver only by giving the Company formal, written notice of Executive’s revocation of this waiver as set forth in Paragraph 19.

THIS AGREEMENT INCLUDES A RELEASE AND WAIVER OF ANY AND ALL CLAIMS THROUGH THE DATE EXECUTIVE SIGNS THIS AGREEMENT. ACCEPTANCE OF THE SEPARATION PAYMENT DESCRIBED IN PARAGRAPH 2 ABOVE SHALL ALSO CONSTITUTE A RELEASE AND WAIVER OF ANY AND ALL CLAIMS ARISING FROM AND AFTER THE NOTICE DATE THROUGH THE SEPARATION DATE.

Please sign below and return this Agreement no earlier than Executive’s Separation Date and no later than 11:59 PM on June 27, 2024. This Agreement may not be signed prior to Executive’s Separation Date. Please contact Beth Bledsoe at 704-763-3793 if Executive has any questions about this Agreement.

IN WITNESS WHEREOF, the Parties have executed this Agreement on the respective dates set forth below.

| | | | | |

Executive:

/s/ John W. Hill________________ John W. Hill

6/12/2024_____________________ Date | Sid Tool Co., Inc., dba MSC Industrial Supply Company:

By: /s/ Elizabeth Bledsoe_____________ Elizabeth Bledsoe

6/12/2024_________________________ Date |

Exhibit A

Associate Name: John W. Hill

Additional Vesting of Awards under the Omnibus Plans

Effective as of the Termination Date, Awards under the MSC Industrial Direct, Co. Inc. 2015 Omnibus Incentive Plan or the MSC Industrial Direct Co., Inc. 2023 Omnibus Incentive Plan (collectively, the “Omnibus Plans”) held by you on the Separation Date shall be deemed to be vested as follows:

| | | | | | | | | | | | | | |

| Date Award Granted | Type of Award | Next Vesting Date | Accelerated Vesting | Total Vesting |

| 4/18/22 | Restricted Stock Unit | 4/18/25 | 1,035 | 1,035 |

| 11/4/22 | Restricted Stock Unit | 11/4/24 | 832 | 832 |

| 11/3/23 | Restricted Stock Unit | 11/3/24 | 798 | 798 |

| GRAND TOTAL = | 2,665 |

The vesting provisions set forth above are determined in accordance with the following:

•For any unvested Options or Stock Appreciation Rights that have an exercise price that is not greater than the Fair Market Value of a Share of the underlying MSC stock on the Separation Date, each such Award will become vested and exercisable with respect to the number of Options or Stock Appreciation Rights that would have vested on the next scheduled vesting date for such Award in accordance with terms of the applicable Award Agreement and Omnibus Plan (the “Accelerated Vesting”).

•For any Restricted Stock Awards, Restricted Stock Unit Awards, Performance Share Award and other share-based Awards, any restrictions applicable to each such Award will lapse with respect to the number of Shares that would have vested on the next scheduled vesting date for such Award and any performance conditions imposed with respect to such Shares shall be deemed to be achieved at target performance levels or as otherwise provided in the applicable Award Agreement.

•For any unvested Options or Stock Appreciation Rights that have an exercise price that is greater than the Fair Market Value of the underlying MSC stock on your Separation Date (“underwater awards”), these underwater awards will not receive Accelerated Vesting.

For purposes of this Exhibit A, capitalized terms not otherwise defined in this Agreement shall have the meanings prescribed under the applicable Omnibus Plan. Except as provided in this Exhibit A, the terms of the Omnibus Plans and the applicable Award Agreements received by you will continue to apply. Please note that all vested Options and Stock Appreciation Rights must be exercised within 30 days of the Separation Date. All unexercised Options and Stock Appreciation Rights will expire 30 days after the Separation Date.

v3.24.1.1.u2

Cover

|

Jun. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 06, 2024

|

| Entity Registrant Name |

MSC INDUSTRIAL DIRECT CO., INC.

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity File Number |

1-14130

|

| Entity Address, Address Line One |

515 Broadhollow Road

|

| Entity Address, Address Line Two |

Suite 1000

|

| Entity Address, City or Town |

Melville

|

| Entity Address, State or Province |

NY

|

| City Area Code |

516

|

| Local Phone Number |

812-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.001 per share

|

| Trading Symbol |

MSM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001003078

|

| Amendment Flag |

false

|

| Entity Address, Postal Zip Code |

11747

|

| Entity Tax Identification Number |

11-3289165

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

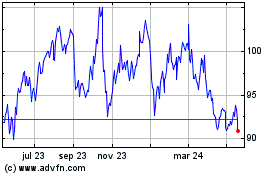

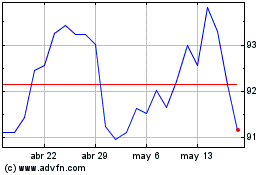

MSC Industrial Direct (NYSE:MSM)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

MSC Industrial Direct (NYSE:MSM)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024