Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Julio 2023 - 11:02AM

Edgar (US Regulatory)

Nuveen

California

Municipal

Value

Fund

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

LONG-TERM

INVESTMENTS

-

98.6% (100.0%

of

Total

Investments)

X

300,775,338

MUNICIPAL

BONDS

-

98.6% (100.0%

of

Total

Investments)

X

300,775,338

Consumer

Staples

-

0.6%

(0.6%

of

Total

Investments)

$

70

California

County

Tobacco

Securitization

Agency,

Tobacco

Settlement

Asset-Backed

Bonds,

Los

Angeles

County

Securitization

Corporation,

Series

2020A,

4.000%,

6/01/49

6/30

at

100.00

BBB+

$

64,266

4,895

Silicon

Valley

Tobacco

Securitization

Authority,

California,

Tobacco

Settlement

Asset-Backed

Bonds,

Santa

Clara

County

Tobacco

Securitization

Corporation,

Series

2007A,

0.000%,

6/01/41

7/23

at

36.67

N/R

1,740,123

Total

Consumer

Staples

1,804,389

Education

and

Civic

Organizations

-

2.6%

(2.6%

of

Total

Investments)

1,000

California

Municipal

Finance

Authority,

Revenue

Bonds,

Linxs

APM

Project,

Senior

Lien

Series

2018A,

5.000%,

12/31/43,

(AMT)

6/28

at

100.00

BBB-

1,013,810

220

California

School

Finance

Authority,

School

Facility

Revenue

Bonds,

Alliance

for

College-Ready

Public

Schools

Project,

Series

2016A,

5.000%,

7/01/46,

144A

7/25

at

100.00

BBB

220,704

1,425

California

School

Finance

Authority,

School

Facility

Revenue

Bonds,

Alliance

for

College-Ready

Public

Schools

Project,

Series

2016C,

5.250%,

7/01/52,

144A

7/25

at

101.00

BBB

1,437,568

3,780

University

of

California,

General

Revenue

Bonds,

Limited

Project

Series

2017M,

5.000%,

5/15/47

5/27

at

100.00

AA-

3,979,206

1,070

University

of

California,

General

Revenue

Bonds,

Series

2018AZ,

5.000%,

5/15/38

5/28

at

100.00

AA

1,160,137

Total

Education

and

Civic

Organizations

7,811,425

Health

Care

-

9.7%

(9.8%

of

Total

Investments)

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Refunding

Series

2016B:

4,105

5.000%,

11/15/46

11/26

at

100.00

A+

4,203,520

1,000

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Series

2018A,

5.000%,

11/15/36

11/27

at

100.00

A+

1,064,810

2,045

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

City

of

Hope

National

Medical

Center,

Series

2019,

4.000%,

11/15/45

11/29

at

100.00

A

1,893,649

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

CommonSpirit

Health,

Series

2020A:

1,815

4.000%,

4/01/44

4/30

at

100.00

A-

1,724,849

3,830

4.000%,

4/01/49

4/30

at

100.00

A-

3,544,742

625

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Lucile

Salter

Packard

Children's

Hospital,

Series

2014A,

5.000%,

8/15/43

8/24

at

100.00

AA-

634,950

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Refunding

Series

2014A:

240

5.000%,

10/01/38

10/24

at

100.00

A

243,410

840

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Series

2014B,

5.000%,

10/01/44

10/24

at

100.00

A

843,856

1,600

California

Municipal

Finance

Authority,

Revenue

Bonds,

Community

Health

System,

Series

2021A,

4.000%,

2/01/51

-

AGM

Insured

2/32

at

100.00

AA

1,483,056

California

Municipal

Finance

Authority,

Revenue

Bonds,

Eisenhower

Medical

Center,

Refunding

Series

2017A:

120

5.000%,

7/01/42

7/27

at

100.00

Baa2

122,122

2,000

4.000%,

7/01/47

7/27

at

100.00

Baa2

1,742,380

California

Municipal

Finance

Authority,

Revenue

Bonds,

NorthBay

Healthcare

Group,

Series

2017A:

100

5.250%,

11/01/41

11/26

at

100.00

BBB-

98,046

1,090

5.000%,

11/01/47

11/26

at

100.00

BBB-

1,008,468

400

5.250%,

11/01/47

11/26

at

100.00

BBB-

385,156

520

California

Municipal

Financing

Authority,

Certificates

of

Participation,

Palomar

Health,

Series

2022A,

5.250%,

11/01/52

-

AGM

Insured

11/32

at

100.00

AA

553,082

Nuveen

California

Municipal

Value

Fund

(continued)

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Health

Care

(continued)

$

1,000

California

Statewide

Communities

Development

Authority,

California,

Redlands

Community

Hospital,

Revenue

Bonds,

Series

2016,

5.000%,

10/01/46

10/26

at

100.00

A-

$

1,010,790

150

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2014A,

5.250%,

12/01/34

12/24

at

100.00

BB+

152,320

5,800

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2016A,

5.250%,

12/01/56,

144A

6/26

at

100.00

BB+

5,453,798

1,000

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2018A,

5.500%,

12/01/58,

144A

6/28

at

100.00

BB+

956,680

245

California

Statewide

Community

Development

Authority,

Health

Revenue

Bonds,

Enloe

Medical

Center,

Refunding

Series

2022A,

5.250%,

8/15/52

-

AGM

Insured

8/32

at

100.00

AA

259,916

2,000

University

of

California

Regents,

Medical

Center

Pooled

Revenue

Bonds,

Series

2022P,

5.000%,

5/15/47

5/32

at

100.00

AA-

2,180,900

Total

Health

Care

29,560,500

Housing/Multifamily

-

9.2%

(9.4%

of

Total

Investments)

2,175

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Creekwood,

Series

2021A,

4.000%,

2/01/56,

144A

8/31

at

100.00

N/R

1,509,472

2,190

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Glendale

Properties,

Junior

Series

2021A-2,

4.000%,

8/01/47,

144A

8/31

at

100.00

N/R

1,678,569

1,420

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Serenity

at

Larkspur

Apartments,

Series

2020A,

5.000%,

2/01/50,

144A

2/30

at

100.00

N/R

1,167,155

800

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Stoneridge

Apartments,

Series

2021A,

4.000%,

2/01/56,

144A

2/31

at

100.00

N/R

587,832

1,115

California

Community

Housing

Agency,

Workforce

Housing

Revenue

Bonds,

Annadel

Apartments,

Series

2019A,

5.000%,

4/01/49,

144A

4/29

at

100.00

N/R

921,347

2,193

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series

2019-2,

4.000%,

3/20/33

2033

2033

No

Opt.

Call

BBB+

2,118,301

1,849

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series

2021-1,

3.500%,

11/20/35

2021

2021

No

Opt.

Call

BBB+

1,717,951

325

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series2019-1,

4.250%,

1/15/35

No

Opt.

Call

BBB+

323,083

1,650

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Social

Certificates

Series

2023-1,

4.375%,

9/20/36

No

Opt.

Call

BBB

1,631,668

California

Municipal

Finance

Authority,

Mobile

Home

Park

Revenue

Bonds,

Caritas

Affordable

Housing

Inc

Projects,

Senior

Series

2014A:

80

5.250%,

8/15/39

8/24

at

100.00

A-

80,945

215

5.250%,

8/15/49

8/24

at

100.00

A-

217,128

2,320

CMFA

Special

Finance

Agency

I,

California,

Essential

Housing

Revenue

Bonds,

The

Mix

at

Center

City,

Series

2021A-2,

4.000%,

4/01/56,

144A

4/31

at

100.00

N/R

1,619,801

800

CMFA

Special

Finance

Agency,

California,

Essential

Housing

Revenue

Bonds,

Enclave

Apartments,

Senior

Series

2022A-1,

4.000%,

8/01/58,

144A

2/32

at

100.00

N/R

611,120

125

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

777

Place-Pomona,

Senior

Lien

Series

2021A-1,

3.600%,

5/01/47,

144A

5/32

at

100.00

N/R

97,802

1,130

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

777

Place-Pomona,

Senior

Lien

Series

2021A-2,

3.250%,

5/01/57,

144A

5/32

at

100.00

N/R

774,005

175

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Acacia

on

Santa

Rosa

Creek,

Mezzanine

Lien

Series

2021B,

4.000%,

10/01/46,

144A

10/31

at

100.00

N/R

132,239

1,465

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Acacia

on

Santa

Rosa

Creek,

Senior

Lien

Series

2021A,

4.000%,

10/01/56,

144A

10/31

at

100.00

N/R

1,201,857

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Housing/Multifamily

(continued)

$

2,005

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Altana

Glendale,

Series

2021A-2,

4.000%,

10/01/56,

144A

10/31

at

100.00

N/R

$

1,475,159

2,310

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Center

City

Anaheim,

Series

2020A,

5.000%,

1/01/54,

144A

1/31

at

100.00

N/R

1,834,302

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Millennium

South

Bay-

Hawthorne,

Series

2021A-1

and

A-2:

610

3.375%,

7/01/43,

144A

7/32

at

100.00

N/R

482,632

370

3.250%,

7/01/56,

144A

7/32

at

100.00

N/R

251,371

1,925

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Moda

at

Monrovia

Station,

Social

Series

2021A-2,

4.000%,

10/01/56,

144A

10/31

at

100.00

N/R

1,407,406

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Monterrey

Station

Apartments,

Senior

Lien

Series

2021A-1:

220

3.000%,

7/01/43,

144A

7/32

at

100.00

N/R

165,099

950

3.125%,

7/01/56,

144A

7/32

at

100.00

N/R

642,504

405

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Oceanaire-Long

Beach,

Social

Series

2021A-2,

4.000%,

9/01/56,

144A

9/31

at

100.00

N/R

302,823

880

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Parallel-Anaheim

Series

2021A,

4.000%,

8/01/56,

144A

8/31

at

100.00

N/R

646,818

750

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Pasadena

Portfolio

Social

Bond,

Mezzanine

Senior

Series

2021B,

4.000%,

12/01/56,

144A

12/31

at

100.00

N/R

532,845

555

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Pasadena

Portfolio

Social

Bond,

Series

2021A-2,

3.000%,

12/01/56

12/31

at

100.00

N/R

366,794

795

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Union

South

Bay,

Series

2021A-2,

4.000%,

7/01/56,

144A

7/31

at

100.00

N/R

588,236

560

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Westgate

Phase

1-Pasadena

Apartments,

Senior

Lien

Series

2021A-1,

3.000%,

6/01/47,

144A

6/31

at

100.00

N/R

406,364

2,035

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Westgate

Phase

1-Pasadena

Apartments,

Senior

Lien

Series

2021A-2,

3.125%,

6/01/57,

144A

6/31

at

100.00

N/R

1,324,642

2,080

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Wood

Creek

Apartments,

Senior

Lien

Series

2021A-1,

3.000%,

12/01/49

6/32

at

100.00

N/R

1,378,624

Total

Housing/Multifamily

28,195,894

Long-Term

Care

-

0.2%

(0.2%

of

Total

Investments)

545

California

Health

Facilities

Financing

Authority,

Insured

Revenue

Bonds,

Community

Program

for

Persons

with

Developmental

Disabilities,

Series

2011A,

6.250%,

2/01/26

7/23

at

100.00

AA

546,428

Total

Long-Term

Care

546,428

Tax

Obligation/General

-

21.7%

(22.0%

of

Total

Investments)

4,000

Anaheim

Union

High

School

District,

Orange

County,

California,

General

Obligation

Bonds,

2014

Election

Series

2019,

3.000%,

8/01/40

-

BAM

Insured

8/27

at

100.00

AA

3,395,520

375

Butte-Glenn

Community

College

District,

Butte

and

Glenn

Counties,

California,

General

Obligation

Bonds,

Election

2016

Series

2017A,

5.250%,

8/01/46

8/27

at

100.00

Aa2

398,790

5

California

State,

General

Obligation

Bonds,

Series

2013,

5.000%,

2/01/29

7/23

at

100.00

Aa2

5,010

3,000

California

State,

General

Obligation

Bonds,

Various

Purpose

Refunding

Series

2015,

5.000%,

8/01/34

8/25

at

100.00

Aa2

3,119,490

2,240

California

State,

General

Obligation

Bonds,

Various

Purpose

Series

2013,

5.000%,

11/01/43

11/23

at

100.00

Aa2

2,252,051

Nuveen

California

Municipal

Value

Fund

(continued)

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Tax

Obligation/General

(continued)

California

State,

General

Obligation

Bonds,

Various

Purpose

Series

2014:

$

5,000

5.000%,

5/01/32

5/24

at

100.00

Aa2

$

5,074,900

1,970

5.000%,

10/01/39

10/24

at

100.00

Aa2

2,007,548

2,000

California

State,

General

Obligation

Bonds,

Various

Purpose

Series

2018.

Bid

Group

A/B,

5.000%,

10/01/48

10/28

at

100.00

Aa2

2,143,540

2,100

Carlsbad

Unified

School

District,

San

Diego

County,

California,

General

Obligation

Bonds,

Series

2009B,

6.000%,

5/01/34

5/24

at

100.00

Aa1

2,149,245

3,000

Chaffey

Community

College

District,

San

Bernardino

County,

California,

General

Obligation

Bonds,

Taxable

Refunding

Series

2019,

4.000%,

6/01/43

6/28

at

100.00

AA

2,977,110

1,000

Chaffey

Joint

Union

High

School

District,

San

Bernardino

County,

California,

General

Obligation

Bonds,

Election

2012

Series

2017C,

5.250%,

8/01/47

2/27

at

100.00

Aa1

1,053,010

5,000

Chino

Valley

Unified

School

District,

San

Bernardino

County,

California,

General

Obligation

Bonds,

2016

Election

Series

2020B,

5.000%,

8/01/55

8/30

at

100.00

Aa2

5,347,400

690

Los

Angeles

Community

College

District,

California,

General

Obligation

Bonds,

2008

Election

Series

2017J,

4.000%,

8/01/41

8/27

at

100.00

Aaa

690,269

2,000

Marin

Healthcare

District,

Marin

County,

California,

General

Obligation

Bonds,

2013

Election,

Series

2015A,

4.000%,

8/01/40

8/25

at

100.00

Aa2

1,984,620

1,000

Oxnard

Union

High

School

District,

Ventura

County,

California,

General

Obligation

Bonds,

Election

2018

Series

2020B,

5.000%,

8/01/45

8/28

at

100.00

Aa2

1,066,920

2,000

Pittsburg

Unified

School

District

Financing

Authority,

Contra

Costa

County,

California, General

Obligation

Bonds,

Pittsburg

Unified

School

District

Bond

Program,

Series

2019,

5.000%,

9/01/47

-

AGM

Insured

9/28

at

100.00

AA

2,105,460

519

Puerto

Rico,

General

Obligation

Bonds,

Restructured

Series

2022A-1,

4.000%,

7/01/41

7/31

at

103.00

N/R

434,709

840

San

Benito

High

School

District,

San

Benito

and

Santa

Clara

Counties,

California,

General

Obligation

Bonds,

2016

Election

Series

2017,

5.250%,

8/01/46

8/27

at

100.00

Aa3

893,626

9,000

San

Marcos

Unified

School

District,

San

Diego

County,

California,

General

Obligation

Bonds,

2010

Election,

Series

2012B,

0.000%,

8/01/51

No

Opt.

Call

AA-

2,535,120

11,875

San

Mateo

Union

High

School

District,

San

Mateo

County,

California,

General

Obligation

Bonds,

Election

2010

Series

2011A,

0.000%,

9/01/41

(4)

9/36

at

100.00

Aaa

11,351,313

19,860

Yosemite

Community

College

District,

California,

General

Obligation

Bonds,

Capital

Appreciation,

Election

2004,

Series

2010D,

6.550%,

8/01/42

No

Opt.

Call

Aa2

15,245,529

Total

Tax

Obligation/General

66,231,180

Tax

Obligation/Limited

-

10.6%

(10.7%

of

Total

Investments)

Bell

Community

Redevelopment

Agency,

California,

Tax

Allocation

Bonds,

Bell

Project

Area,

Series

2003:

665

5.500%,

10/01/23

-

RAAI

Insured

7/23

at

100.00

AA

666,430

1,000

5.625%,

10/01/33

-

RAAI

Insured

7/23

at

100.00

AA

1,003,420

1,000

California

Infrastructure

and

Economic

Development

Bank,

Lease

Revenue

Bonds,

California

State

Teachers

Retirement

System

Headquarters

Expansion,

Green

Bond-Climate

Bond

Certified

Series

2019,

5.000%,

8/01/44

8/29

at

100.00

AA

1,073,000

1,500

California

State

Public

Works

Board,

Lease

Revenue

Bonds,

Department

of

Corrections

&

Rehabilitation,

Various

Correctional

Facilities

Series

2013F,

5.250%,

9/01/33

9/23

at

100.00

Aa3

1,505,850

1,250

California

State

Public

Works

Board,

Lease

Revenue

Bonds,

Department

of

Corrections

&

Rehabilitation,

Various

Correctional

Facilities

Series

2014A,

5.000%,

9/01/39

9/24

at

100.00

Aa3

1,266,800

55

Golden

State

Tobacco

Securitization

Corporation,

California,

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Series

2022A-1,

5.000%,

6/01/51

12/31

at

100.00

BBB+

57,317

4,000

Los

Angeles

County

Metropolitan

Transportation

Authority,

California,

Measure

R

Sales

Tax

Revenue

Bonds,

Senior

Series

2016A,

5.000%,

6/01/38

6/26

at

100.00

AAA

4,205,440

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Tax

Obligation/Limited

(continued)

$

2,300

Los

Angeles

County

Metropolitan

Transportation

Authority,

California,

Proposition

C

Sales

Tax

Revenue

Bonds,

Senior

Lien

Series

2017A,

5.000%,

7/01/42

7/27

at

100.00

AAA

$

2,443,589

1,000

Los

Angeles

County

Public

Works

Financing

Authority,

California,

Lease

Revenue

Bonds,

Series

2019E-1,

5.000%,

12/01/49

12/29

at

100.00

AA+

1,076,880

Patterson

Public

Finance

Authority,

California,

Revenue

Bonds,

Community

Facilities

District

2001-1,

Senior

Series

2013A:

1,140

5.250%,

9/01/30

9/23

at

100.00

N/R

1,144,184

1,040

5.750%,

9/01/39

9/23

at

100.00

N/R

1,043,661

165

Patterson

Public

Finance

Authority,

California,

Revenue

Bonds,

Community

Facilities

District

2001-1,

Subordinate

Lien

Series

2013B,

5.875%,

9/01/39

9/23

at

100.00

N/R

165,632

4,953

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1,

5.000%,

7/01/58

7/28

at

100.00

N/R

4,744,677

1,390

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2,

4.784%,

7/01/58

7/28

at

100.00

N/R

1,280,343

625

River

Islands

Public

Financing

Authority,

California,

Special

Tax

Bonds,

Community

Facilities

District

2003-1

Improvement

Area

1,

Refunding

Series

2022A-1,

5.250%,

9/01/52

-

AGM

Insured

9/29

at

103.00

AA

692,869

70

San

Clemente,

California,

Special

Tax

Revenue

Bonds,

Community

Facilities

District

2006-1

Marblehead

Coastal,

Series

2015,

5.000%,

9/01/40

9/25

at

100.00

N/R

70,729

150

San

Francisco

City

and

County

Redevelopment

Agency

Successor

Agency,

California,

Special

Tax

Bonds,

Community

Facilities

District

7,

Hunters

Point

Shipyard

Phase

One

Improvements,

Refunding

Series

2014,

5.000%,

8/01/39

8/24

at

100.00

N/R

151,108

5,000

San

Francisco

City

and

County

Redevelopment

Agency

Successor

Agency,

California,

Tax

Allocation

Bonds,

Mission

Bay

North

Redevelopment

Project,

Refunding

Series

2016A,

5.000%,

8/01/41

-

NPFG

Insured

8/26

at

100.00

A

5,177,200

110

Signal

Hill

Redevelopment

Agency,

California,

Project

1

Tax

Allocation

Bonds,

Series

2011,

7.000%,

10/01/26

7/23

at

100.00

N/R

110,288

Stockton

Public

Financing

Authority,

California,

Revenue

Bonds,

Arch

Road

East

Community

Facility

District

99-02,

Series

2018A:

1,000

5.000%,

9/01/33

9/25

at

103.00

N/R

1,052,090

765

5.000%,

9/01/43

9/25

at

103.00

N/R

779,772

195

Temecula

Public

Financing

Authority,

California,

Special

Tax

Bonds,

Community

Facilities

District

16-01,

Series

2017,

5.750%,

9/01/32,

144A

9/27

at

100.00

N/R

209,644

2,185

Transbay

Joint

Powers

Authority,

California,

Tax

Allocation

Bonds,

Senior

Green

Series

2020A,

5.000%,

10/01/45

4/30

at

100.00

A-

2,242,225

Total

Tax

Obligation/Limited

32,163,148

Transportation

-

18.5%

(18.8%

of

Total

Investments)

225

California

Municipal

Finance

Authority,

Special

Facility

Revenue

Bonds,

United

Airlines,

Inc.

Los

Angeles

International

Airport

Project,

Series

2019,

4.000%,

7/15/29,

(AMT)

No

Opt.

Call

BB-

219,283

Foothill/Eastern

Transportation

Corridor

Agency,

California,

Toll

Road

Revenue

Bonds,

Refunding

Series

2013A:

1,945

5.000%,

1/15/42

-

AGM

Insured

1/24

at

100.00

AA

1,955,989

2,580

Long

Beach,

California,

Harbor

Revenue

Bonds,

Series

2019A,

5.000%,

5/15/44

5/29

at

100.00

Aa2

2,774,067

10,415

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Subordinate

Lien

Series

2018C,

5.000%,

5/15/44,

(AMT)

11/27

at

100.00

AA-

10,700,892

2,670

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Subordinate

Lien

Series

2019D,

5.000%,

5/15/33,

(AMT)

11/28

at

100.00

AA-

2,843,416

1,480

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Subordinate

Lien

Series

2022A,

5.000%,

5/15/45,

(AMT)

5/32

at

100.00

AA-

1,557,582

3,000

Los

Angeles

Harbors

Department,

California,

Revenue

Bonds,

Series

2014C,

5.000%,

8/01/44

8/24

at

100.00

AA+

3,028,320

Nuveen

California

Municipal

Value

Fund

(continued)

Portfolio

of

Investments

May

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Transportation

(continued)

$

3,075

San

Diego

County

Regional

Airport

Authority,

California,

Airport

Revenue

Bonds,

Subordinate

Series

2021A,

4.000%,

7/01/51

7/31

at

100.00

A+

$

2,914,639

5,000

San

Diego

County

Regional

Airport

Authority,

California,

Airport

Revenue

Bonds,

Subordinate

Series

2021B,

4.000%,

7/01/51,

(AMT)

7/31

at

100.00

A+

4,601,800

13,570

San

Francisco

Airports

Commission,

California,

Revenue

Bonds,

San

Francisco

International

Airport,

Governmental

Purpose

Second

Series

2017B,

5.000%,

5/01/47

5/27

at

100.00

A+

14,112,257

6,465

San

Francisco

Airports

Commission,

California,

Revenue

Bonds,

San

Francisco

International

Airport,

Second

Governmental

Purpose

Series

2016C,

5.000%,

5/01/46

5/26

at

100.00

A+

6,656,235

4,160

San

Francisco

Airports

Commission,

California,

Revenue

Bonds,

San

Francisco

International

Airport,

Second

Series

2018D,

5.000%,

5/01/43,

(AMT)

5/28

at

100.00

A+

4,280,099

665

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Refunding

Senior

Lien

Toll

Road

Revenue

Bonds,

Series

2021A,

4.000%,

1/15/50

1/32

at

100.00

A

624,861

250

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Toll

Road

Revenue

Bonds,

Refunding

Junior

Lien

Series

2014B,

5.250%,

1/15/44

1/25

at

100.00

A-

254,662

Total

Transportation

56,524,102

U.S.

Guaranteed

-

6.1%

(6.2%

of

Total

Investments)

(5)

1,500

Bay

Area

Toll

Authority,

California,

Revenue

Bonds,

San

Francisco

Bay

Area

Toll

Bridge,

Subordinate

Series

2019S-H,

5.000%,

4/01/44,

(Pre-

refunded

4/01/29)

4/29

at

100.00

AA-

1,701,855

285

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Refunding

Series

2015A,

5.000%,

8/15/43,

(Pre-refunded

8/15/25)

8/25

at

100.00

A+

297,121

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Refunding

Series

2016B:

795

5.000%,

11/15/46,

(Pre-refunded

11/15/26)

11/26

at

100.00

N/R

847,661

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Refunding

Series

2014A:

185

5.000%,

10/01/38,

(Pre-refunded

10/01/24)

10/24

at

100.00

N/R

189,253

3,130

California

Infrastructure

and

Economic

Development

Bank,

Infrastructure

State

Revolving

Fund

Revenue

Bonds,

Series

2016A,

5.000%,

10/01/33,

(Pre-refunded

10/01/26)

10/26

at

100.00

AAA

3,339,585

2,215

Foothill/Eastern

Transportation

Corridor

Agency,

California,

Toll

Road

Revenue

Bonds,

Refunding

Junior

Lien

Series

2013C,

6.500%,

1/15/43,

(Pre-refunded

1/15/24)

1/24

at

100.00

A-

2,256,864

Foothill/Eastern

Transportation

Corridor

Agency,

California,

Toll

Road

Revenue

Bonds,

Refunding

Series

2013A:

4,875

5.750%,

1/15/46,

(Pre-refunded

1/15/24)

1/24

at

100.00

A

4,952,464

4,875

6.000%,

1/15/53,

(Pre-refunded

1/15/24)

1/24

at

100.00

A

4,958,996

Golden

State

Tobacco

Securitization

Corporation,

California,

Enhanced

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Refunding

Series

2015A:

80

5.000%,

6/01/40,

(Pre-refunded

6/01/25)

6/25

at

100.00

A+

83,295

100

5.000%,

6/01/40,

(Pre-refunded

6/01/25)

6/25

at

100.00

N/R

104,119

Total

U.S.

Guaranteed

18,731,213

Utilities

-

19.4%

(19.7%

of

Total

Investments)

1,000

California

Infrastructure

and

Economic

Development

Bank.

Clean

Water

State

Revolving

Fund

Revenue

Bonds,

Green

Series

2018,

5.000%,

10/01/43

4/28

at

100.00

AAA

1,071,120

California

Pollution

Control

Financing

Authority,

Water

Furnishing

Revenue

Bonds,

Poseidon

Resources

Channelside

LP

Desalination

Project,

Series

2012:

1,375

5.000%,

7/01/37,

(AMT),

144A

1/24

at

100.00

BBB

1,377,502

3,750

5.000%,

11/21/45,

(AMT),

144A

1/24

at

100.00

BBB

3,729,863

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Utilities

(continued)

$

1,500

California

Pollution

Control

Financing

Authority,

Water

Furnishing

Revenue

Bonds,

San

Diego

County

Water

Authoriity

Desalination

Project

Pipeline,

Refunding

Series

2019,

5.000%,

7/01/39,

144A

1/29

at

100.00

BBB

$

1,538,070

4,200

East

Bay

Municipal

Utility

District,

Alameda

and

Contra

Costa

Counties,

California,

Water

System

Revenue

Bonds,

Green

Series

2019A,

5.000%,

6/01/49

6/29

at

100.00

AAA

4,528,776

2,000

Irvine

Ranch

Water

District,

California,

Certificates

of

Participation,

Irvine

Ranch

Water

District

Series

2016,

5.000%,

3/01/41

9/26

at

100.00

AAA

2,103,240

1,800

Long

Beach

Bond

Finance

Authority,

California,

Natural

Gas

Purchase

Revenue

Bonds,

Series

2007A,

5.500%,

11/15/37

No

Opt.

Call

AA-

1,943,118

1,000

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Series

2016A,

5.000%,

7/01/40

1/26

at

100.00

Aa2

1,039,570

835

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Series

2016B,

5.000%,

7/01/37

1/26

at

100.00

Aa2

871,723

2,425

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Series

2019D,

5.000%,

7/01/49

7/29

at

100.00

Aa2

2,604,765

1,890

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Series

2020B,

5.000%,

7/01/40

7/30

at

100.00

Aa2

2,074,540

4,150

Los

Angeles

Department

of

Water

and

Power,

California,

Water

System

Revenue

Bonds,

Series

2022B,

5.000%,

7/01/47

1/32

at

100.00

Aa2

4,559,937

1,500

Los

Angeles

Department

of

Water

and

Power,

California,

Waterworks

Revenue

Bonds,

Series

2018B,

5.000%,

7/01/38

7/28

at

100.00

AA+

1,626,420

Los

Angeles

Department

of

Water

and

Power,

California,

Waterworks

Revenue

Bonds,

Series

2020C:

2,500

5.000%,

7/01/36

7/30

at

100.00

Aa2

2,833,400

6,000

5.000%,

7/01/38

7/30

at

100.00

Aa2

6,671,520

1,400

Los

Angeles,

California,

Wastewater

System

Revenue

Bonds,

Green

Subordinate

Series

2018A,

5.000%,

6/01/38

6/28

at

100.00

AA

1,511,538

1,000

M-S-R

Energy

Authority,

California,

Gas

Revenue

Bonds,

Citigroup

Prepay

Contracts,

Series

2009C,

6.500%,

11/01/39

No

Opt.

Call

A

1,162,130

2,000

Puerto

Rico

Aqueduct

and

Sewerage

Authority,

Revenue

Bonds,

Refunding

Senior

Lien

Series

2020A,

5.000%,

7/01/47,

144A

7/30

at

100.00

N/R

1,926,720

5,775

Riverside,

California,

Sewer

Revenue

Bonds,

Refunding

Series

2018A,

5.000%,

8/01/39

8/28

at

100.00

AA-

6,252,708

1,190

Sacramento,

California,

Wastewater

Revenue

Bonds,

Series

2019,

5.000%,

9/01/39

9/29

at

100.00

AA

1,302,169

San

Diego

Public

Facilities

Financing

Authority,

California,

Water

Utility

Revenue

Bonds,

Refunding

Subordinate

Lien

Series

2016B:

2,670

5.000%,

8/01/32

8/26

at

100.00

Aa3

2,862,908

3,000

5.000%,

8/01/37

8/26

at

100.00

Aa3

3,182,970

2,400

Southern

California

Public

Power

Authority,

Natural

Gas

Project

1

Revenue

Bonds,

Series

2007A,

5.250%,

11/01/24

No

Opt.

Call

A2

2,432,352

Total

Utilities

59,207,059

Total

Municipal

Bonds

(cost

$298,948,052)

300,775,338

Total

Long-Term

Investments

(cost

$298,948,052)

300,775,338

Other

Assets

&

Liabilities,

Net

-

1.4%

4,362,687

Net

Assets

Applicable

to

Common

Shares

-

100%

$

305,138,025

Nuveen

California

Municipal

Value

Fund

(continued)

Portfolio

of

Investments

May

31,

2023

(Unaudited)

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

300,775,338

$

–

$

300,775,338

Total

$

–

$

300,775,338

$

–

$

300,775,338

(1)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(2)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(3)

For

financial

reporting

purposes,

the

ratings

disclosed

are

the

highest

of

Standard

&

Poor’s

Group

(“Standard

&

Poor’s”),

Moody’s

Investors

Service,

Inc.

(“Moody’s”)

or

Fitch,

Inc.

(“Fitch”)

rating.

This

treatment

of

split-rated

securities

may

differ

from

that

used

for

other

purposes,

such

as

for

Fund

investment

policies.

Ratings

below

BBB

by

Standard

&

Poor’s,

Baa

by

Moody’s

or

BBB

by

Fitch

are

considered

to

be

below

investment

grade.

Holdings

designated

N/R

are

not

rated

by

any

of

these

national

rating

agencies.

(4)

Step-up

coupon

bond,

a

bond

with

a

coupon

that

increases

("steps

up"),

usually

at

regular

intervals,

while

the

bond

is

outstanding.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(5)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

AMT

Alternative

Minimum

Tax

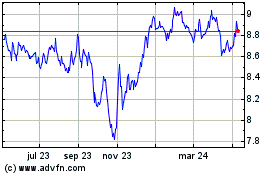

Nuveen California Munici... (NYSE:NCA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

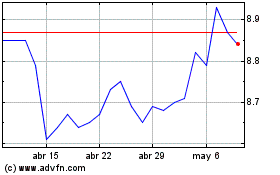

Nuveen California Munici... (NYSE:NCA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024