Park Hotels & Resorts Inc. (“Park” or the “Company”) (NYSE: PK)

today announced results for the first quarter ended March 31,

2024 and provided an operational update.

Selected Statistical and Financial

Information

(unaudited, amounts in millions, except RevPAR,

ADR, Total RevPAR and per share data)

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Change(1) |

|

Comparable RevPAR |

$ |

175.65 |

|

|

$ |

162.91 |

|

|

7.8 |

% |

|

Comparable Occupancy |

|

70.9 |

% |

|

|

67.4 |

% |

|

3.5 |

% pts |

|

Comparable ADR |

$ |

247.91 |

|

|

$ |

241.96 |

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

|

Comparable Total RevPAR |

$ |

289.68 |

|

|

$ |

271.73 |

|

|

6.6 |

% |

|

|

|

|

|

|

|

|

|

Net income(2) |

$ |

29 |

|

|

$ |

33 |

|

|

(12.1 |

)% |

|

Net income attributable to stockholders(2) |

$ |

28 |

|

|

$ |

33 |

|

|

(15.2 |

)% |

|

|

|

|

|

|

|

|

|

Operating income |

$ |

92 |

|

|

$ |

80 |

|

|

15.1 |

% |

|

Operating income margin |

|

14.5 |

% |

|

|

12.4 |

% |

|

210 |

bps |

|

|

|

|

|

|

|

|

|

Comparable Hotel Adjusted EBITDA(2) |

$ |

168 |

|

|

$ |

145 |

|

|

16.0 |

% |

|

Comparable Hotel Adjusted EBITDA margin(2) |

|

27.3 |

% |

|

|

25.4 |

% |

|

190 |

bps |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(2) |

$ |

162 |

|

|

$ |

146 |

|

|

11.0 |

% |

|

Adjusted FFO attributable to stockholders |

$ |

111 |

|

|

$ |

92 |

|

|

20.7 |

% |

|

|

|

|

|

|

|

|

|

Earnings per share - Diluted(1) |

$ |

0.13 |

|

|

$ |

0.15 |

|

|

(13.3 |

)% |

|

Adjusted FFO per share – Diluted(1) |

$ |

0.52 |

|

|

$ |

0.42 |

|

|

23.8 |

% |

|

Weighted average shares outstanding – Diluted |

|

211 |

|

|

|

221 |

|

|

(10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

____________________________

|

(1) |

Amounts are calculated based on unrounded numbers. |

|

(2) |

In Q1 2024, Park recognized a $5 million benefit resulting from

grant money received from the Massachusetts Growth Capital

Corporation's Hotel & Motel Relief Grant Program, and Park's

Hawaii hotels benefited from a state unemployment tax refund of

approximately $4 million. Excluding these items, Comparable Hotel

Adjusted EBITDA would have increased 40 bps compared to the prior

year. |

|

|

|

Thomas J. Baltimore, Jr., Chairman and Chief

Executive Officer, stated, "I am incredibly pleased with our first

quarter results as demand trends accelerated across all segments,

fueled by the strategic investments we have made in Hawaii, Key

West and Orlando that we believe will continue to drive performance

in 2024 and beyond. Sector-leading Comparable RevPAR increased

nearly 8% compared to the first quarter of 2023, exceeding overall

upper upscale hotel performance by nearly 500 basis points as

reported by Smith Travel Research. This is exceptionally strong

performance given a tough year-over-year comparison, with

Comparable RevPAR for the first quarter of 2023 increasing 28% over

the first quarter of 2022. Performance at our resort and urban

hotels continues to accelerate, each with Comparable RevPAR growth

of 8% compared to the first quarter of 2023. Combined RevPAR at our

Hawaii hotels increased nearly 7% compared to the first quarter of

2023 due to an increase in both group and transient demand,

primarily at the Hilton Hawaiian Village resort where RevPAR

increased nearly 8%. Following transformative renovation projects

in 2023, the Casa Marina resort in Key West experienced RevPAR

gains in excess of 34% driven by a 24% increase in rate compared to

the first quarter of 2023, while RevPAR at the Bonnet Creek Orlando

complex increased nearly 9%, led by an increase in RevPAR at the

Signia Bonnet Creek hotel of over 16%. Group demand continues to

improve with 2024 Comparable Group Revenue Pace up nearly 11%

compared to the same time last year, driven by accelerated business

demand, an increase in citywide events and strong convention

calendars at our New York, New Orleans and Chicago hotels.

With current liquidity of over $1.3 billion, we

remain laser-focused on executing on our strategic objectives in

2024 to create long-term shareholder value, including reshaping our

portfolio through investing in value-enhancing ROI projects,

disposing of non-core assets and strengthening our balance sheet by

extending maturities.”

Additional Highlights

- In March 2024, Park received the 2024 ENERGY STAR Partner of

the Year Award for Energy Management for the second consecutive

year, the only hotel company to once again earn this recognition

for its energy management program;

- In April 2024, Park paid its first quarter 2024 cash dividend

of $0.25 per share to stockholders of record as of March 29, 2024,

an increase of 67% to Park's 2023 recurring quarterly dividend of

$0.15 per share; and

- In April 2024, Park declared its second quarter 2024 cash

dividend of $0.25 per share to stockholders of record as of June

28, 2024, to be paid on July 15, 2024.

Operational Update

Changes in Park's 2024 Comparable ADR, Occupancy

and RevPAR compared to the same period in 2023, and 2024 Comparable

Occupancy were as follows:

|

|

Comparable ADR |

|

Comparable Occupancy |

|

Comparable RevPAR |

|

|

Comparable Occupancy |

|

|

2024 vs 2023 |

|

2024 vs 2023 |

|

2024 vs 2023 |

|

|

2024 |

|

Jan 2024 |

4.1 |

% |

|

5.3 |

% pts |

|

13.4 |

% |

|

|

65.0 |

% |

|

Feb 2024 |

3.4 |

|

|

3.5 |

|

|

8.7 |

|

|

|

70.8 |

|

|

Mar 2024 |

0.7 |

|

|

1.8 |

|

|

3.1 |

|

|

|

76.7 |

|

|

Q1 2024 |

2.5 |

|

|

3.5 |

|

|

7.8 |

|

|

|

70.9 |

|

|

|

|

|

|

|

|

|

|

|

|

Preliminary Apr 2024 |

0.5 |

|

|

(1.1 |

) |

|

(1.0 |

) |

|

|

74.8 |

|

|

|

|

|

|

|

|

|

|

|

|

Preliminary YTD Apr 2024 |

1.9 |

|

|

2.4 |

|

|

5.4 |

|

|

|

71.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in Park's 2024 Comparable ADR, Occupancy

and RevPAR for the three months ended March 31, 2024 compared

to the same period in 2023, and 2024 Comparable Occupancy for the

three months ended March 31, 2024 by hotel type were as

follows:

|

|

Three Months Ended March 31, |

|

|

Comparable ADR |

|

Comparable Occupancy |

|

Comparable RevPAR |

|

|

Comparable Occupancy |

|

|

2024 vs 2023 |

|

2024 vs 2023 |

|

2024 vs 2023 |

|

|

2024 |

|

Resort |

5.1 |

% |

|

2.2 |

% pts |

|

8.0 |

% |

|

|

82.4 |

% |

|

Urban |

0.1 |

|

|

4.7 |

|

|

8.1 |

|

|

|

63.0 |

|

|

Airport |

0.9 |

|

|

3.1 |

|

|

5.5 |

|

|

|

70.7 |

|

|

Suburban |

1.1 |

|

|

4.4 |

|

|

9.2 |

|

|

|

59.6 |

|

|

All Types |

2.5 |

|

|

3.5 |

|

|

7.8 |

|

|

|

70.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

The Comparable Rooms Revenue mix for the three

months ended March 31, 2024 and 2023 were as follows:

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Change |

|

Group |

32.9 |

% |

|

31.1 |

% |

|

1.8 |

% |

|

Transient |

59.5 |

|

|

62.2 |

|

|

(2.7 |

) |

|

Contract |

5.5 |

|

|

4.5 |

|

|

1.0 |

|

|

Other |

2.1 |

|

|

2.2 |

|

|

(0.1 |

) |

|

|

|

|

|

|

|

|

|

|

Park continued to see improvements in demand as

business travel accelerated and group demand continued to witness

ongoing strength at both its urban and resort hotels, increasing

Comparable group revenues for the first quarter of 2024 by over 15%

year-over-year. Comparable RevPAR growth for the first quarter was

driven by increases in Comparable RevPAR at both its resort and

urban hotels of 8% year-over-year. The growth in Comparable RevPAR

at Park's urban portfolio resulted from the continued acceleration

of group business in New York, New Orleans and Chicago where RevPAR

at the New York Hilton Midtown and the Hilton New Orleans Riverside

increased over 11% and 13%, respectively, while combined RevPAR at

its Chicago hotels increased nearly 11% led by an increase in

RevPAR at the Hilton Chicago of nearly 18%. At Park's resort

hotels, group demand at its Hawaii hotels continued to improve,

increasing combined RevPAR by nearly 7% versus prior year, which

was primarily driven by the Hilton Hawaiian Village resort where

group rooms revenue increased nearly 41% versus prior year, while

the Bonnet Creek Orlando complex saw the highest combined group

rooms revenue quarter in the property's history, increasing nearly

38% versus prior year.

During the first quarter of 2024, projected

Comparable group revenues for 2024 increased by nearly $56 million

or approximately 240,000 Comparable group room nights. At the end

of March 2024, Comparable Group Revenue Pace and room night

bookings for 2024 increased approximately 11% and 6% as compared to

what 2023 group bookings were at the end of March 2023,

respectively, with 2024 average Comparable group rates projected to

exceed 2023 average group rates by 4% for the same time period.

Results for Park's Comparable hotels in each of

the Company’s key markets are as follows:

|

(unaudited) |

|

|

|

|

Comparable ADR |

|

Comparable Occupancy |

|

Comparable RevPAR |

|

|

Hotels |

|

Rooms |

|

1Q24 |

|

1Q23 |

|

Change(1) |

|

1Q24 |

|

1Q23 |

|

Change |

|

1Q24 |

|

1Q23 |

|

Change(1) |

|

Hawaii |

2 |

|

3,507 |

|

$ |

311.13 |

|

$ |

298.27 |

|

4.3 |

% |

|

90.2 |

% |

|

88.1 |

% |

|

2.1 |

% pts |

|

$ |

280.53 |

|

$ |

262.80 |

|

6.7 |

% |

|

Orlando |

3 |

|

2,325 |

|

|

283.63 |

|

|

274.48 |

|

3.3 |

|

|

74.2 |

|

|

72.3 |

|

|

1.9 |

|

|

|

210.46 |

|

|

198.43 |

|

6.1 |

|

|

New York |

1 |

|

1,878 |

|

|

254.83 |

|

|

247.85 |

|

2.8 |

|

|

74.7 |

|

|

69.0 |

|

|

5.7 |

|

|

|

190.37 |

|

|

170.94 |

|

11.4 |

|

|

New Orleans |

1 |

|

1,622 |

|

|

227.65 |

|

|

229.38 |

|

(0.8 |

) |

|

75.0 |

|

|

65.6 |

|

|

9.4 |

|

|

|

170.75 |

|

|

150.51 |

|

13.4 |

|

|

Boston |

3 |

|

1,536 |

|

|

191.00 |

|

|

186.11 |

|

2.6 |

|

|

74.3 |

|

|

70.5 |

|

|

3.8 |

|

|

|

141.85 |

|

|

131.17 |

|

8.1 |

|

|

Southern California |

5 |

|

1,773 |

|

|

199.19 |

|

|

208.91 |

|

(4.7 |

) |

|

74.6 |

|

|

73.3 |

|

|

1.3 |

|

|

|

148.65 |

|

|

153.13 |

|

(2.9 |

) |

|

Key West |

2 |

|

461 |

|

|

671.01 |

|

|

575.05 |

|

16.7 |

|

|

84.1 |

|

|

79.1 |

|

|

5.0 |

|

|

|

564.62 |

|

|

454.92 |

|

24.1 |

|

|

Chicago |

3 |

|

2,467 |

|

|

166.20 |

|

|

161.20 |

|

3.1 |

|

|

41.8 |

|

|

38.9 |

|

|

2.9 |

|

|

|

69.45 |

|

|

62.66 |

|

10.8 |

|

|

Puerto Rico |

1 |

|

652 |

|

|

347.89 |

|

|

310.15 |

|

12.2 |

|

|

83.7 |

|

|

85.6 |

|

|

(1.9 |

) |

|

|

291.32 |

|

|

265.53 |

|

9.7 |

|

|

Washington, D.C. |

2 |

|

1,085 |

|

|

181.36 |

|

|

168.96 |

|

7.3 |

|

|

66.9 |

|

|

64.5 |

|

|

2.4 |

|

|

|

121.32 |

|

|

109.01 |

|

11.3 |

|

|

Denver |

1 |

|

613 |

|

|

170.58 |

|

|

167.16 |

|

2.0 |

|

|

63.5 |

|

|

60.5 |

|

|

3.0 |

|

|

|

108.28 |

|

|

101.06 |

|

7.1 |

|

|

Miami |

1 |

|

393 |

|

|

350.53 |

|

|

336.76 |

|

4.1 |

|

|

86.5 |

|

|

87.8 |

|

|

(1.3 |

) |

|

|

303.19 |

|

|

295.51 |

|

2.6 |

|

|

Seattle |

2 |

|

1,246 |

|

|

134.63 |

|

|

146.22 |

|

(7.9 |

) |

|

67.7 |

|

|

58.2 |

|

|

9.5 |

|

|

|

91.14 |

|

|

85.03 |

|

7.2 |

|

|

San Francisco |

2 |

|

660 |

|

|

313.07 |

|

|

324.80 |

|

(3.6 |

) |

|

65.1 |

|

|

61.5 |

|

|

3.6 |

|

|

|

203.85 |

|

|

199.72 |

|

2.1 |

|

|

Other |

10 |

|

3,210 |

|

|

175.28 |

|

|

176.68 |

|

(0.8 |

) |

|

60.3 |

|

|

57.1 |

|

|

3.2 |

|

|

|

105.69 |

|

|

100.90 |

|

4.8 |

|

|

All Markets |

39 |

|

23,428 |

|

$ |

247.91 |

|

$ |

241.96 |

|

2.5 |

% |

|

70.9 |

% |

|

67.4 |

% |

|

3.5 |

% pts |

|

$ |

175.65 |

|

$ |

162.91 |

|

7.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________________

|

(1) |

Calculated based on unrounded numbers. |

|

|

|

Balance Sheet and Liquidity

Park's current liquidity is over $1.3 billion,

including approximately $950 million of available capacity under

the Company's revolving credit facility ("Revolver"). As of

March 31, 2024, Park's Comparable Net Debt was approximately

$3.5 billion, which excludes the $725 million non-recourse CMBS

Loan ("SF Mortgage Loan") secured by 1,921-room Hilton San

Francisco Union Square and 1,024-room Parc 55 San Francisco – a

Hilton Hotel (collectively, the "Hilton San Francisco Hotels").

As of March 31, 2024, the weighted average

maturity of Park's consolidated debt, excluding the SF Mortgage

Loan, is 3.2 years.

Park had the following debt outstanding as of

March 31, 2024:

|

(unaudited, dollars in millions) |

|

|

|

|

|

Debt |

|

Collateral |

|

Interest Rate |

|

Maturity Date |

|

As of March 31, 2024 |

|

Fixed Rate Debt |

|

|

|

|

|

|

|

|

|

Mortgage loan |

|

Hilton Denver City Center |

|

4.90% |

|

September 2024(1) |

|

$ |

54 |

|

|

Mortgage loan |

|

Hyatt Regency Boston |

|

4.25% |

|

July 2026 |

|

|

128 |

|

|

Mortgage loan |

|

DoubleTree Hotel Spokane City Center |

|

3.62% |

|

July 2026 |

|

|

14 |

|

|

Mortgage loan |

|

Hilton Hawaiian Village Beach Resort |

|

4.20% |

|

November 2026 |

|

|

1,275 |

|

|

Mortgage loan |

|

Hilton Santa Barbara Beachfront Resort |

|

4.17% |

|

December 2026 |

|

|

158 |

|

|

Mortgage loan |

|

DoubleTree Hotel Ontario Airport |

|

5.37% |

|

May 2027 |

|

|

30 |

|

|

2025 Senior Notes |

|

|

|

7.50% |

|

June 2025 |

|

|

650 |

|

|

2028 Senior Notes |

|

|

|

5.88% |

|

October 2028 |

|

|

725 |

|

|

2029 Senior Notes |

|

|

|

4.88% |

|

May 2029 |

|

|

750 |

|

|

Finance lease obligations |

|

|

|

7.66% |

|

2024 to 2028 |

|

|

1 |

|

|

Fixed Rate Debt |

|

|

|

5.24%(2) |

|

|

|

|

3,785 |

|

|

|

|

|

|

|

|

|

|

|

|

Variable Rate Debt |

|

|

|

|

|

|

|

|

|

Revolver(3) |

|

Unsecured |

|

SOFR + 2.00%(4) |

|

December 2026 |

|

|

— |

|

|

Total Variable Rate Debt |

|

|

|

7.43% |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

Add: unamortized premium |

|

|

|

|

|

|

|

|

1 |

|

|

Less: unamortized deferred financing costs and discount |

|

|

|

|

|

|

(22 |

) |

|

Total Debt(5)(6) |

|

|

|

5.24%(2) |

|

|

|

$ |

3,764 |

|

| |

|

|

|

|

|

|

|

|

|

|

____________________________

|

(1) |

The loan matures in August 2042 but became callable by the lender

in August 2022 with six months of notice. As of March 31,

2024, Park had not received notice from the lender. |

|

(2) |

Calculated on a weighted average basis. |

|

(3) |

Park has approximately $950 million of available capacity under the

Revolver. |

|

(4) |

SOFR includes a credit spread adjustment of 0.1%. |

|

(5) |

Excludes $164 million of Park’s share of debt of its unconsolidated

joint ventures. |

|

(6) |

Excludes the SF Mortgage Loan, which is included in debt associated

with hotels in receivership in Park's consolidated balance sheets.

In June 2023, Park ceased making debt service payments toward the

non-recourse SF Mortgage Loan, and Park received a notice of

default. The stated rate on the loan is 4.11%, however, beginning

June 1, 2023, the default interest rate on the loan is 7.11%.

Additionally, beginning June 1, 2023, the loan accrues a monthly

late payment administrative fee of 3% of the monthly amount due. In

October 2023, the Hilton San Francisco Hotels were placed into

court-ordered receivership, and thus, Park has no further economic

interest in the operations of the hotels. |

|

|

|

Capital Investments

Park expects to incur approximately $260 million

to $280 million in capital improvement costs during 2024, of which

$70 million was spent during the first quarter of 2024. Key

upcoming renovations and return on investment projects include:

|

(dollars in millions) |

|

|

|

|

|

|

|

Projects & Scope of Work |

|

Estimated Start Date |

|

Estimated Completion Date |

|

Budget |

|

Hilton Hawaiian Village Waikiki Beach Resort |

|

|

|

|

|

|

|

|

Phase 1: Renovation of 392 guestrooms and the addition of 12

guestrooms through the conversion of suites to increase room count

at the Rainbow Tower to 808 |

|

Q3 2024 |

|

Q1 2025 |

|

$ |

44 |

|

|

Phase 2: Renovation of 404 guestrooms and the addition of 14

guestrooms through the conversion of suites to increase room count

at the Rainbow Tower to 822 |

|

Q3 2025 |

|

Q1 2026 |

|

$ |

45 |

|

Hilton Waikoloa Village |

|

|

|

|

|

|

|

|

Phase 1: Renovation of 197 guestrooms and the addition of 6

guestrooms through the conversion of suites to increase room count

at the Palace Tower to 406 |

|

Q3 2024 |

|

Q4 2024 |

|

$ |

32 |

|

|

Phase 2: Renovation of 203 guestrooms and the addition of 5

guestrooms through the conversion of suites to increase room count

at the Palace Tower to 411 |

|

Q3 2025 |

|

Q4 2025 |

|

$ |

32 |

|

|

Lobby renovation: Renovation of the Palace Tower lobby |

|

Q3 2025 |

|

Q4 2025 |

|

$ |

3 |

|

Hilton New Orleans Riverside |

|

|

|

|

|

|

|

|

Guestroom renovation: Renovation of 250 guestrooms at the

1,167-room Main Tower |

|

Q3 2024 |

|

Q4 2024 |

|

$ |

16 |

| |

|

|

|

|

|

|

|

|

Dividends

Park declared a first quarter 2024 cash dividend

of $0.25 per share to stockholders of record as of March 29, 2024.

The first quarter 2024 cash dividend was paid on April 15,

2024.

On April 19, 2024, Park declared a second quarter

2024 cash dividend of $0.25 per share to be paid on July 15, 2024

to stockholders of record as of June 28, 2024. The declared

dividends translate to an annualized yield of 6% based on recent

trading levels. Park is currently targeting a pay-out ratio in the

range of 65% to 70% of Adjusted FFO per share for the full year,

which based on Park's current guidance, translates into an

incremental top-off dividend to be declared during the fourth

quarter of 2024.

Full-Year 2024 Outlook

Park expects full-year 2024 operating results to

be as follows:

| (unaudited,

dollars in millions, except per share amounts and RevPAR) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Full-Year 2024

Outlookas of

April 30, 2024 |

|

Full-Year 2024

Outlookas of

February 27, 2024 |

|

|

| Metric |

Low |

|

High |

|

Low |

|

High |

|

Change at Midpoint |

| |

|

|

|

|

|

|

|

|

|

|

Comparable RevPAR |

$ |

186 |

|

|

$ |

188 |

|

|

$ |

185 |

|

|

$ |

188 |

|

|

$ |

1 |

|

| Comparable RevPAR change vs.

2023 |

|

4.0 |

% |

|

|

5.5 |

% |

|

|

3.5 |

% |

|

|

5.5 |

% |

|

|

25 |

bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

151 |

|

|

$ |

191 |

|

|

$ |

146 |

|

|

$ |

186 |

|

|

$ |

5 |

|

| Net income attributable to

stockholders |

$ |

140 |

|

|

$ |

180 |

|

|

$ |

134 |

|

|

$ |

174 |

|

|

$ |

6 |

|

| Earnings per share –

Diluted(1) |

$ |

0.66 |

|

|

$ |

0.85 |

|

|

$ |

0.64 |

|

|

$ |

0.83 |

|

|

$ |

0.02 |

|

| Operating income |

$ |

407 |

|

|

$ |

446 |

|

|

$ |

397 |

|

|

$ |

436 |

|

|

$ |

10 |

|

| Operating income margin |

|

15.4 |

% |

|

|

16.6 |

% |

|

|

15.1 |

% |

|

|

16.3 |

% |

|

|

30 |

bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

655 |

|

|

$ |

695 |

|

|

$ |

645 |

|

|

$ |

685 |

|

|

$ |

10 |

|

| Comparable Hotel Adjusted

EBITDA margin(1) |

|

27.1 |

% |

|

|

28.1 |

% |

|

|

26.8 |

% |

|

|

27.8 |

% |

|

|

30 |

bps |

| Comparable Hotel Adjusted

EBITDA margin change vs. 2023(1) |

|

(70 |

) bps |

|

|

30 |

bps |

|

|

(100 |

) bps |

|

|

— |

bps |

|

|

30 |

bps |

| Adjusted FFO per share –

Diluted(1) |

$ |

2.07 |

|

|

$ |

2.27 |

|

|

$ |

2.02 |

|

|

$ |

2.22 |

|

|

$ |

0.05 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________________

|

(1) |

Amounts are calculated based on unrounded numbers. |

|

|

|

Park's outlook is based in part on the following

assumptions:

- Comparable RevPAR for the second quarter of 2024 is expected to

be between $197 and $201, representing year-over-year growth of 3%

to 5%;

- The mortgage loan secured by the Hilton Denver City Center is

not called by the lender during 2024;

- Includes 50 bps of RevPAR and $9 million of Hotel Adjusted

EBITDA disruption from renovations at certain of Park's hotels, of

which $8 million is associated with renovations at Park's Hawaii

hotels;

- Adjusted FFO excludes $55 million of default interest and late

payment administrative fees associated with default of the SF

Mortgage Loan for full-year 2024, which began in June 2023 and is

required to be recognized in interest expense until legal title to

the Hilton San Francisco Hotels are transferred;

- Fully diluted weighted average shares for the full-year 2024 of

211 million; and

- Park's Comparable portfolio as of April 30, 2024 and does

not take into account potential future acquisitions, dispositions

or any financing transactions, which could result in a material

change to Park’s outlook.

Park's full-year 2024 outlook is based on a number

of factors, many of which are outside the Company's control,

including uncertainty surrounding macro-economic factors, such as

inflation, changes in interest rates, supply chain disruptions and

the possibility of an economic recession or slowdown, as well as

the assumptions set forth above, all of which are subject to

change.

Supplemental Disclosures

In conjunction with this release, Park has

furnished a financial supplement with additional disclosures on its

website. Visit www.pkhotelsandresorts.com for more information.

Park has no obligation to update any of the information provided to

conform to actual results or changes in Park’s portfolio, capital

structure or future expectations.

Conference Call

Park will host a conference call for investors and

other interested parties to discuss first quarter 2024 results on

May 1, 2024 beginning at 11 a.m. Eastern Time. Participants

may listen to the live webcast by logging onto the Investors

section of the website at www.pkhotelsandresorts.com.

Alternatively, participants may listen to the live call by dialing

(877) 451-6152 in the United States or (201) 389-0879

internationally and requesting Park Hotels & Resorts’ First

Quarter 2024 Earnings Conference Call. Participants are encouraged

to dial into the call or link to the webcast at least ten minutes

prior to the scheduled start time.

A replay of the webcast will be available within

24 hours after the live event on the Investors section of Park’s

website.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements include, but are

not limited to, statements related to the effects of Park's

decision to cease payments on its $725 million SF Mortgage Loan

secured by the Hilton San Francisco Hotels and the lender's

exercise of its remedies, including placing such hotels into

receivership, as well as Park’s current expectations regarding the

performance of its business, financial results, liquidity and

capital resources, including anticipated repayment of certain of

Park's indebtedness, the completion of capital allocation

priorities, the expected repurchase of Park's stock, the impact

from macroeconomic factors (including inflation, elevated interest

rates, potential economic slowdown or a recession and geopolitical

conflicts), the effects of competition and the effects of future

legislation or regulations, the expected completion of anticipated

dispositions, the declaration, payment and any change in amounts of

future dividends and other non-historical statements.

Forward-looking statements include all statements that are not

historical facts, and in some cases, can be identified by the use

of forward-looking terminology such as the words “outlook,”

“believes,” “expects,” “potential,” “continues,” “may,” “will,”

“should,” “could,” “seeks,” “projects,” “predicts,” “intends,”

“plans,” “estimates,” “anticipates,” “hopes” or the negative

version of these words or other comparable words. You should not

rely on forward-looking statements since they involve known and

unknown risks, uncertainties and other factors which are, in some

cases, beyond Park’s control and which could materially affect its

results of operations, financial condition, cash flows, performance

or future achievements or events.

All such forward-looking statements are based on

current expectations of management and therefore involve estimates

and assumptions that are subject to risks, uncertainties and other

factors that could cause actual results to differ materially from

the results expressed in these forward-looking statements. You

should not put undue reliance on any forward-looking statements and

Park urges investors to carefully review the disclosures Park makes

concerning risk and uncertainties in Item 1A: “Risk Factors” in

Park’s Annual Report on Form 10-K for the year ended December 31,

2023, as such factors may be updated from time to time in Park’s

filings with the SEC, which are accessible on the SEC’s website at

www.sec.gov. Except as required by law, Park undertakes no

obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Non-GAAP Financial Measures

Park presents certain non-GAAP financial measures

in this press release, including Nareit FFO attributable to

stockholders, Adjusted FFO attributable to stockholders, FFO per

share, Adjusted FFO per share, EBITDA, Adjusted EBITDA, Hotel

Adjusted EBITDA, Hotel Adjusted EBITDA margin and Net Debt. These

non-GAAP financial measures should be considered along with, but

not as alternatives to, net income (loss) as a measure of its

operating performance. Please see the schedules included in this

press release including the “Definitions” section for additional

information and reconciliations of such non-GAAP financial

measures.

About Park

Park is one of the largest publicly-traded lodging

real estate investment trusts ("REIT") with a diverse portfolio of

iconic and market-leading hotels and resorts with significant

underlying real estate value. Park's portfolio currently consists

of 43 premium-branded hotels and resorts with over 26,000 rooms

primarily located in prime city center and resort locations. Visit

www.pkhotelsandresorts.com for more information.

|

|

|

PARK HOTELS & RESORTS INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (unaudited, in

millions, except share and per share data) |

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

|

(unaudited) |

|

|

|

ASSETS |

|

|

|

|

Property and equipment, net |

$ |

7,441 |

|

|

$ |

7,459 |

|

|

Contract asset |

|

774 |

|

|

|

760 |

|

|

Intangibles, net |

|

42 |

|

|

|

42 |

|

|

Cash and cash equivalents |

|

378 |

|

|

|

717 |

|

|

Restricted cash |

|

32 |

|

|

|

33 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $3

and $3 |

|

125 |

|

|

|

112 |

|

|

Prepaid expenses |

|

62 |

|

|

|

59 |

|

|

Other assets |

|

40 |

|

|

|

40 |

|

|

Operating lease right-of-use assets |

|

191 |

|

|

|

197 |

|

|

TOTAL ASSETS (variable interest entities –

$231 and

$236) |

$ |

9,085 |

|

|

$ |

9,419 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

Liabilities |

|

|

|

|

Debt |

$ |

3,764 |

|

|

$ |

3,765 |

|

|

Debt associated with hotels in receivership |

|

725 |

|

|

|

725 |

|

|

Accrued interest associated with hotels in receivership |

|

49 |

|

|

|

35 |

|

|

Accounts payable and accrued expenses |

|

223 |

|

|

|

210 |

|

|

Dividends payable |

|

57 |

|

|

|

362 |

|

|

Due to hotel managers |

|

101 |

|

|

|

131 |

|

|

Other liabilities |

|

206 |

|

|

|

200 |

|

|

Operating lease liabilities |

|

218 |

|

|

|

223 |

|

|

Total liabilities (variable interest entities – $217 and $218) |

|

5,343 |

|

|

|

5,651 |

|

|

Stockholders' Equity |

|

|

|

|

Common stock, par value $0.01 per share, 6,000,000,000 shares

authorized, 211,377,190 shares issued and 210,525,968 shares

outstanding as of March 31, 2024 and 210,676,264 shares issued

and 209,987,581 shares outstanding as of December 31, 2023 |

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

4,154 |

|

|

|

4,156 |

|

|

Accumulated deficit |

|

(367 |

) |

|

|

(344 |

) |

|

Total stockholders' equity |

|

3,789 |

|

|

|

3,814 |

|

|

Noncontrolling interests |

|

(47 |

) |

|

|

(46 |

) |

|

Total equity |

|

3,742 |

|

|

|

3,768 |

|

|

TOTAL LIABILITIES AND EQUITY |

$ |

9,085 |

|

|

$ |

9,419 |

|

| |

|

|

|

|

|

|

|

|

PARK HOTELS & RESORTS INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited,

in millions, except per share data) |

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Revenues |

|

|

|

|

Rooms |

$ |

374 |

|

|

$ |

382 |

|

|

Food and beverage |

|

182 |

|

|

|

181 |

|

|

Ancillary hotel |

|

62 |

|

|

|

65 |

|

|

Other |

|

21 |

|

|

|

20 |

|

|

Total revenues |

|

639 |

|

|

|

648 |

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

Rooms |

|

102 |

|

|

|

107 |

|

|

Food and beverage |

|

123 |

|

|

|

127 |

|

|

Other departmental and support |

|

145 |

|

|

|

158 |

|

|

Other property |

|

52 |

|

|

|

60 |

|

|

Management fees |

|

30 |

|

|

|

30 |

|

|

Impairment and casualty loss |

|

6 |

|

|

|

1 |

|

|

Depreciation and amortization |

|

65 |

|

|

|

64 |

|

|

Corporate general and administrative |

|

17 |

|

|

|

16 |

|

|

Other |

|

21 |

|

|

|

20 |

|

|

Total expenses |

|

561 |

|

|

|

583 |

|

|

|

|

|

|

|

Gain on sale of assets, net |

|

— |

|

|

|

15 |

|

|

Gain on derecognition of assets |

|

14 |

|

|

|

— |

|

|

|

|

|

|

|

Operating income |

|

92 |

|

|

|

80 |

|

|

|

|

|

|

|

Interest income |

|

5 |

|

|

|

10 |

|

|

Interest expense |

|

(53 |

) |

|

|

(52 |

) |

|

Interest expense associated with hotels in receivership |

|

(14 |

) |

|

|

(8 |

) |

|

Equity in earnings from investments in affiliates |

|

— |

|

|

|

4 |

|

|

Other gain, net |

|

— |

|

|

|

1 |

|

|

|

|

|

|

|

Income before income taxes |

|

30 |

|

|

|

35 |

|

|

Income tax expense |

|

(1 |

) |

|

|

(2 |

) |

|

Net income |

|

29 |

|

|

|

33 |

|

|

Net income attributable to noncontrolling interests |

|

(1 |

) |

|

|

— |

|

|

Net income attributable to stockholders |

$ |

28 |

|

|

$ |

33 |

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

Earnings per share - Basic |

$ |

0.13 |

|

|

$ |

0.15 |

|

|

Earnings per share - Diluted |

$ |

0.13 |

|

|

$ |

0.15 |

|

|

|

|

|

|

|

Weighted average shares outstanding – Basic |

|

209 |

|

|

|

220 |

|

|

Weighted average shares outstanding – Diluted |

|

211 |

|

|

|

221 |

|

| |

|

|

|

|

|

|

|

|

PARK HOTELS & RESORTS INC. NON-GAAP

FINANCIAL MEASURES RECONCILIATIONS EBITDA AND

ADJUSTED EBITDA |

|

|

|

(unaudited, in millions) |

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Net income |

$ |

29 |

|

|

$ |

33 |

|

|

Depreciation and amortization expense |

|

65 |

|

|

|

64 |

|

|

Interest income |

|

(5 |

) |

|

|

(10 |

) |

|

Interest expense |

|

53 |

|

|

|

52 |

|

|

Interest expense associated with hotels in receivership(1) |

|

14 |

|

|

|

8 |

|

|

Income tax expense |

|

1 |

|

|

|

2 |

|

|

Interest expense, income tax and depreciation and amortization

included in equity in earnings from investments in affiliates |

|

3 |

|

|

|

3 |

|

|

EBITDA |

|

160 |

|

|

|

152 |

|

|

Gain on sales of assets, net |

|

— |

|

|

|

(15 |

) |

|

Gain on derecognition of assets(1) |

|

(14 |

) |

|

|

— |

|

|

Share-based compensation expense |

|

4 |

|

|

|

4 |

|

|

Impairment and casualty loss |

|

6 |

|

|

|

1 |

|

|

Other items |

|

6 |

|

|

|

4 |

|

|

Adjusted EBITDA |

$ |

162 |

|

|

$ |

146 |

|

| |

|

|

|

|

|

|

|

____________________________

|

(1) |

For the three months ended March 31, 2024, represents accrued

interest expense associated with the default of the SF Mortgage

Loan, which was offset by a gain on derecognition for the

corresponding increase of the contract asset on the condensed

consolidated balance sheets, as Park expects to be released from

this obligation upon final resolution with the lender. |

|

|

|

|

PARK HOTELS & RESORTS INC. NON-GAAP

FINANCIAL MEASURES RECONCILIATIONS COMPARABLE

HOTEL ADJUSTED EBITDA AND COMPARABLE HOTEL

ADJUSTED EBITDA MARGIN |

|

|

|

(unaudited, dollars in millions) |

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Adjusted EBITDA |

$ |

162 |

|

|

$ |

146 |

|

|

Less: Adjusted EBITDA from investments in affiliates |

|

(8 |

) |

|

|

(7 |

) |

|

Add: All other(1) |

|

15 |

|

|

|

13 |

|

|

Hotel Adjusted EBITDA |

|

169 |

|

|

|

152 |

|

|

Less: Adjusted EBITDA from hotels disposed of |

|

(1 |

) |

|

|

(2 |

) |

|

Less: Adjusted EBITDA from the Hilton San Francisco Hotels |

|

— |

|

|

|

(5 |

) |

|

Comparable Hotel Adjusted EBITDA |

$ |

168 |

|

|

$ |

145 |

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Total Revenues |

$ |

639 |

|

|

$ |

648 |

|

|

Less: Other revenue |

|

(21 |

) |

|

|

(20 |

) |

|

Less: Revenues from hotels disposed of |

|

— |

|

|

|

(7 |

) |

|

Less: Revenues from the Hilton San Francisco Hotels |

|

— |

|

|

|

(48 |

) |

|

Comparable Hotel Revenues |

$ |

618 |

|

|

$ |

573 |

|

| |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Change(2) |

|

Total Revenues |

$ |

639 |

|

|

$ |

648 |

|

|

(1.3 |

)% |

|

Operating income |

$ |

92 |

|

|

$ |

80 |

|

|

15.1 |

% |

|

Operating income margin(2) |

|

14.5 |

% |

|

|

12.4 |

% |

|

210 |

bps |

|

|

|

|

|

|

|

|

|

Comparable Hotel Revenues |

$ |

618 |

|

|

$ |

573 |

|

|

7.8 |

% |

|

Comparable Hotel Adjusted EBITDA |

$ |

168 |

|

|

$ |

145 |

|

|

16.0 |

% |

|

Comparable Hotel Adjusted EBITDA margin(2) |

|

27.3 |

% |

|

|

25.4 |

% |

|

190 |

bps |

|

|

|

|

|

|

|

|

|

|

|

____________________________

|

(1) |

Includes other revenues and other expenses, non-income taxes on TRS

leases included in other property expenses and corporate general

and administrative expenses in the condensed consolidated

statements of operations. |

|

(2) |

Percentages are calculated based on unrounded numbers. |

|

|

|

|

PARK HOTELS & RESORTS INC. NON-GAAP

FINANCIAL MEASURES RECONCILIATIONS NAREIT FFO AND

ADJUSTED FFO |

|

(unaudited, in millions, except per share data) |

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Net income attributable to stockholders |

$ |

28 |

|

|

$ |

33 |

|

|

Depreciation and amortization expense |

|

65 |

|

|

|

64 |

|

|

Depreciation and amortization expense attributable to

noncontrolling interests |

|

(1 |

) |

|

|

(1 |

) |

|

Gain on sales of assets, net |

|

— |

|

|

|

(15 |

) |

|

Gain on derecognition of assets(1) |

|

(14 |

) |

|

|

— |

|

|

Impairment loss |

|

5 |

|

|

|

— |

|

|

Equity investment adjustments: |

|

|

|

|

Equity in earnings from investments in affiliates |

|

— |

|

|

|

(4 |

) |

|

Pro rata FFO of investments in affiliates |

|

1 |

|

|

|

5 |

|

|

Nareit FFO attributable to stockholders |

|

84 |

|

|

|

82 |

|

|

Casualty loss |

|

1 |

|

|

|

1 |

|

|

Share-based compensation expense |

|

4 |

|

|

|

4 |

|

|

Interest expense associated with hotels in receivership(1) |

|

14 |

|

|

|

— |

|

|

Other items |

|

8 |

|

|

|

5 |

|

|

Adjusted FFO attributable to stockholders |

$ |

111 |

|

|

$ |

92 |

|

|

Nareit FFO per share –

Diluted(2) |

$ |

0.40 |

|

|

$ |

0.37 |

|

|

Adjusted FFO per share –

Diluted(2) |

$ |

0.52 |

|

|

$ |

0.42 |

|

|

Weighted average shares outstanding – Diluted |

|

211 |

|

|

|

221 |

|

|

|

|

|

|

|

|

|

|

____________________________

|

(1) |

For the three months ended March 31, 2024, represents accrued

interest expense associated with the default of the SF Mortgage

Loan, which was offset by a gain on derecognition for the

corresponding increase of the contract asset on the condensed

consolidated balance sheets, as Park expects to be released from

this obligation upon final resolution with the lender. |

|

(2) |

Per share amounts are calculated based on unrounded numbers. |

|

|

|

|

PARK HOTELS & RESORTS INC. NON-GAAP

FINANCIAL MEASURES RECONCILIATIONS NET

DEBT |

|

|

|

(unaudited, in millions) |

|

|

|

March 31, 2024 |

|

Debt |

$ |

3,764 |

|

|

Add: unamortized deferred financing costs and discount |

|

22 |

|

|

Less: unamortized premium |

|

(1 |

) |

|

Debt, excluding unamortized deferred financing cost, premiums and

discounts |

|

3,785 |

|

|

Add: Park's share of unconsolidated affiliates debt, excluding

unamortized deferred financing costs |

|

164 |

|

|

Less: cash and cash equivalents |

|

(378 |

) |

|

Less: restricted cash |

|

(32 |

) |

|

Net Debt |

$ |

3,539 |

|

| |

|

|

|

|

PARK HOTELS & RESORTS INC. NON-GAAP

FINANCIAL MEASURES RECONCILIATIONS OUTLOOK –

EBITDA, ADJUSTED EBITDA, COMPARABLE HOTEL ADJUSTED EBITDA

AND COMPARABLE HOTEL ADJUSTED EBITDA MARGIN |

|

|

|

(unaudited, in millions) |

Year Ending |

|

|

December 31, 2024 |

|

|

Low Case |

|

High Case |

|

Net income |

$ |

151 |

|

|

$ |

191 |

|

|

Depreciation and amortization expense |

|

258 |

|

|

|

258 |

|

|

Interest income |

|

(17 |

) |

|

|

(17 |

) |

|

Interest expense |

|

209 |

|

|

|

209 |

|

|

Interest expense associated with hotels in receivership |

|

55 |

|

|

|

55 |

|

|

Income tax expense |

|

4 |

|

|

|

4 |

|

|

Interest expense, income tax and depreciation and amortization

included in equity in earnings from investments in affiliates |

|

9 |

|

|

|

9 |

|

|

EBITDA |

|

669 |

|

|

|

709 |

|

|

Gain on derecognition of assets |

|

(55 |

) |

|

|

(55 |

) |

|

Share-based compensation expense |

|

18 |

|

|

|

18 |

|

|

Impairment and casualty loss |

|

6 |

|

|

|

6 |

|

|

Other items |

|

17 |

|

|

|

17 |

|

|

Adjusted EBITDA |

|

655 |

|

|

|

695 |

|

|

Less: Adjusted EBITDA from investments in affiliates |

|

(21 |

) |

|

|

(22 |

) |

|

Add: All other |

|

58 |

|

|

|

58 |

|

|

Comparable Hotel Adjusted EBITDA |

$ |

692 |

|

|

$ |

731 |

|

|

|

|

|

|

|

|

Year Ending |

|

|

December 31, 2024 |

|

|

Low Case |

|

High Case |

|

Total Revenues |

$ |

2,640 |

|

|

$ |

2,689 |

|

|

Less: Other revenue |

|

(92 |

) |

|

|

(92 |

) |

|

Comparable Hotel Revenues |

$ |

2,548 |

|

|

$ |

2,597 |

|

|

|

|

|

|

|

|

Year Ending |

|

|

December 31, 2024 |

|

|

Low Case |

|

High Case |

|

Total Revenues |

$ |

2,640 |

|

|

$ |

2,689 |

|

|

Operating income |

$ |

407 |

|

|

$ |

446 |

|

|

Operating income margin(1) |

|

15.4 |

% |

|

|

16.6 |

% |

|

|

|

|

|

|

Comparable Hotel Revenues |

$ |

2,548 |

|

|

$ |

2,597 |

|

|

Comparable Hotel Adjusted EBITDA |

$ |

692 |

|

|

$ |

731 |

|

|

Comparable Hotel Adjusted EBITDA margin(1) |

|

27.1 |

% |

|

|

28.1 |

% |

|

|

|

|

|

|

|

|

|

____________________________

|

(1) |

Percentages are calculated based on unrounded numbers. |

|

|

|

| PARK HOTELS

& RESORTS INC. NON-GAAP FINANCIAL MEASURES

RECONCILIATIONS OUTLOOK – NAREIT FFO ATTRIBUTABLE

TO STOCKHOLDERS AND ADJUSTED FFO ATTRIBUTABLE TO

STOCKHOLDERS |

| |

| (unaudited,

in millions except per share data) |

Year

Ending |

| |

December 31, 2024 |

| |

Low Case |

|

High Case |

|

Net income attributable to stockholders |

$ |

140 |

|

|

$ |

180 |

|

|

Depreciation and amortization expense |

|

258 |

|

|

|

258 |

|

|

Depreciation and amortization expense attributable to

noncontrolling interests |

|

(5 |

) |

|

|

(5 |

) |

|

Gain on derecognition of assets |

|

(55 |

) |

|

|

(55 |

) |

|

Impairment loss |

|

5 |

|

|

|

5 |

|

|

Equity investment adjustments: |

|

|

|

|

Equity in earnings from investments in affiliates |

|

(3 |

) |

|

|

(3 |

) |

|

Pro rata FFO of equity investments |

|

10 |

|

|

|

10 |

|

|

Nareit FFO attributable to stockholders |

|

350 |

|

|

|

390 |

|

|

Casualty loss |

|

1 |

|

|

|

1 |

|

|

Share-based compensation expense |

|

18 |

|

|

|

18 |

|

|

Interest expense associated with hotels in receivership |

|

55 |

|

|

|

55 |

|

|

Other items |

|

14 |

|

|

|

16 |

|

|

Adjusted FFO attributable to stockholders |

$ |

438 |

|

|

$ |

480 |

|

|

Adjusted FFO per share –

Diluted(1) |

$ |

2.07 |

|

|

$ |

2.27 |

|

|

Weighted average diluted shares outstanding |

|

211 |

|

|

|

211 |

|

| |

|

|

|

|

|

|

|

____________________________

|

(1) |

Per share amounts are calculated based on unrounded numbers. |

|

|

|

|

PARK HOTELS & RESORTS INC.

DEFINITIONS |

|

|

|

|

| Comparable |

| |

The Company presents

certain data for its consolidated hotels on a Comparable basis as

supplemental information for investors: Comparable Hotel Revenues,

Comparable RevPAR, Comparable Occupancy, Comparable ADR, Comparable

Hotel Adjusted EBITDA and Comparable Hotel Adjusted EBITDA Margin.

The Company presents Comparable hotel results to help the Company

and its investors evaluate the ongoing operating performance of its

hotels. The Company’s Comparable metrics include results from

hotels that were active and operating in Park's portfolio since

January 1st of the previous year and property acquisitions as

though such acquisitions occurred on the earliest period presented.

Additionally, Comparable metrics exclude results from property

dispositions that have occurred through April 30, 2024 and the

Hilton San Francisco Hotels, which were placed into receivership at

the end of October 2023. |

| |

|

|

| EBITDA, Adjusted

EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin |

| |

Earnings before interest expense, taxes and depreciation and

amortization (“EBITDA”), presented herein, reflects net income

(loss) excluding depreciation and amortization, interest income,

interest expense, income taxes and interest expense, income tax and

depreciation and amortization included in equity in earnings from

investments in affiliates.Adjusted EBITDA, presented herein, is

calculated as EBITDA, as previously defined, further adjusted to

exclude the following items that are not reflective of Park's

ongoing operating performance or incurred in the normal course of

business, and thus, excluded from management's analysis in making

day-to-day operating decisions and evaluations of Park's operating

performance against other companies within its industry: |

| |

|

- Gains or losses on sales of assets for both consolidated and

unconsolidated investments;

- Costs associated with hotel acquisitions or dispositions

expensed during the period;

- Severance expense;

- Share-based compensation expense;

- Impairment losses and casualty gains or losses; and

- Other items that management believes are not representative of

the Company’s current or future operating performance.

|

| |

Hotel Adjusted EBITDA measures hotel-level results before debt

service, depreciation and corporate expenses of the Company’s

consolidated hotels, which excludes hotels owned by unconsolidated

affiliates, and is a key measure of the Company’s profitability.

The Company presents Hotel Adjusted EBITDA to help the Company and

its investors evaluate the ongoing operating performance of the

Company’s consolidated hotels.Hotel Adjusted EBITDA margin is

calculated as Hotel Adjusted EBITDA divided by total hotel

revenue.EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel

Adjusted EBITDA margin are not recognized terms under United States

(“U.S.”) GAAP and should not be considered as alternatives to net

income (loss) or other measures of financial performance or

liquidity derived in accordance with U.S. GAAP. In addition, the

Company’s definitions of EBITDA, Adjusted EBITDA, Hotel Adjusted

EBITDA and Hotel Adjusted EBITDA margin may not be comparable to

similarly titled measures of other companies.The Company believes

that EBITDA, Adjusted EBITDA, Hotel Adjusted EBITDA and Hotel

Adjusted EBITDA margin provide useful information to investors

about the Company and its financial condition and results of

operations for the following reasons: (i) EBITDA, Adjusted EBITDA,

Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin are among

the measures used by the Company’s management team to make

day-to-day operating decisions and evaluate its operating

performance between periods and between REITs by removing the

effect of its capital structure (primarily interest expense) and

asset base (primarily depreciation and amortization) from its

operating results; and (ii) EBITDA, Adjusted EBITDA, Hotel Adjusted

EBITDA and Hotel Adjusted EBITDA margin are frequently used by

securities analysts, investors and other interested parties as a

common performance measure to compare results or estimate

valuations across companies in the industry.EBITDA, Adjusted

EBITDA, Hotel Adjusted EBITDA and Hotel Adjusted EBITDA margin have

limitations as analytical tools and should not be considered either

in isolation or as a substitute for net income (loss) or other

methods of analyzing the Company’s operating performance and

results as reported under U.S. GAAP. Because of these limitations,

EBITDA, Adjusted EBITDA and Hotel Adjusted EBITDA should not be

considered as discretionary cash available to the Company to

reinvest in the growth of its business or as measures of cash that

will be available to the Company to meet its obligations. Further,

the Company does not use or present EBITDA, Adjusted EBITDA, Hotel

Adjusted EBITDA and Hotel Adjusted EBITDA margin as measures of

liquidity or cash flows. |

| |

|

|

| Nareit FFO

attributable to stockholders, Adjusted FFO attributable to

stockholders, Nareit FFO per share – diluted and Adjusted FFO per

share – diluted |

| |

Nareit FFO attributable to stockholders and Nareit FFO per diluted

share (defined as set forth below) are presented herein as non-GAAP

measures of the Company’s performance. The Company calculates funds

from (used in) operations (“FFO”) attributable to stockholders for

a given operating period in accordance with standards established

by the National Association of Real Estate Investment Trusts

(“Nareit”), as net income (loss) attributable to stockholders

(calculated in accordance with U.S. GAAP), excluding depreciation

and amortization, gains or losses on sales of assets, impairment,

and the cumulative effect of changes in accounting principles, plus

adjustments for unconsolidated joint ventures. Adjustments for

unconsolidated joint ventures are calculated to reflect the

Company’s pro rata share of the FFO of those entities on the same

basis. As noted by Nareit in its December 2018 “Nareit Funds from

Operations White Paper – 2018 Restatement,” since real estate

values historically have risen or fallen with market conditions,

many industry investors have considered presentation of operating

results for real estate companies that use historical cost

accounting to be insufficient by themselves. For these reasons,

Nareit adopted the FFO metric in order to promote an industry-wide

measure of REIT operating performance. The Company believes Nareit

FFO provides useful information to investors regarding its

operating performance and can facilitate comparisons of operating

performance between periods and between REITs. The Company’s

presentation may not be comparable to FFO reported by other REITs

that do not define the terms in accordance with the current Nareit

definition, or that interpret the current Nareit definition

differently. The Company calculates Nareit FFO per diluted share as

Nareit FFO divided by the number of fully diluted shares

outstanding during a given operating period.The Company also

presents Adjusted FFO attributable to stockholders and Adjusted FFO

per diluted share when evaluating its performance because

management believes that the exclusion of certain additional items

described below provides useful supplemental information to

investors regarding the Company’s ongoing operating performance.

Management historically has made the adjustments detailed below in

evaluating its performance and in its annual budget process.

Management believes that the presentation of Adjusted FFO provides

useful supplemental information that is beneficial to an investor’s

complete understanding of operating performance. The Company

adjusts Nareit FFO attributable to stockholders for the following

items, which may occur in any period, and refers to this measure as

Adjusted FFO attributable to stockholders: |

| |

|

- Costs associated with hotel acquisitions or dispositions

expensed during the period;

- Severance expense;

- Share-based compensation expense;

- Casualty gains or losses; and

- Other items that management believes are not representative of

the Company’s current or future operating performance.

|

| |

|

|

| Net Debt |

| |

Net Debt, presented herein, is a non-GAAP financial measure that

the Company uses to evaluate its financial leverage. Net Debt is

calculated as (i) debt excluding unamortized deferred financing

costs; and (ii) the Company’s share of investments in affiliate

debt, excluding unamortized deferred financing costs; reduced by

(a) cash and cash equivalents; and (b) restricted cash and cash

equivalents. Net Debt also excludes Debt associated with hotels in

receivership.The Company believes Net Debt provides useful

information about its indebtedness to investors as it is frequently

used by securities analysts, investors and other interested parties

to compare the indebtedness of companies. Net Debt should not be

considered as a substitute to debt presented in accordance with

U.S. GAAP. Net Debt may not be comparable to a similarly titled

measure of other companies. |

| |

|

|

| Occupancy |

| |

Occupancy represents

the total number of room nights sold divided by the total number of

room nights available at a hotel or group of hotels. Occupancy

measures the utilization of the Company’s hotels’ available

capacity. Management uses Occupancy to gauge demand at a specific

hotel or group of hotels in a given period. Occupancy levels also

help management determine achievable Average Daily Rate (“ADR”)

levels as demand for rooms increases or decreases. |

| |

|

|

| Average Daily

Rate |

| |

ADR (or rate)

represents rooms revenue divided by total number of room nights

sold in a given period. ADR measures average room price attained by

a hotel and ADR trends provide useful information concerning the

pricing environment and the nature of the customer base of a hotel

or group of hotels. ADR is a commonly used performance measure in

the hotel industry, and management uses ADR to assess pricing

levels that the Company is able to generate by type of customer, as

changes in rates have a more pronounced effect on overall revenues

and incremental profitability than changes in Occupancy, as

described above. |

| |

|

|

| Revenue per Available

Room |

| |

Revenue per Available

Room (“RevPAR”) represents rooms revenue divided by the total

number of room nights available to guests for a given period.

Management considers RevPAR to be a meaningful indicator of the

Company’s performance as it provides a metric correlated to two

primary and key factors of operations at a hotel or group of

hotels: Occupancy and ADR. RevPAR is also a useful indicator in

measuring performance over comparable periods. |

| |

|

|

| Total RevPAR |

| |

Total RevPAR

represents rooms, food and beverage and other hotel revenues

divided by the total number of room nights available to guests for

a given period. Management considers Total RevPAR to be a

meaningful indicator of the Company’s performance as approximately

one-third of revenues are earned from food and beverage and other

hotel revenues. Total RevPAR is also a useful indicator in

measuring performance over comparable periods. |

| |

|

|

| Group Revenue

Pace |

| |

Group Revenue Pace

represents bookings for future business and is calculated as group

room nights multiplied by the contracted room rate expressed as a

percentage of a prior period relative to a prior point in

time. |

| |

|

|

Investor ContactIan Weissman+ 1

571 302 5591

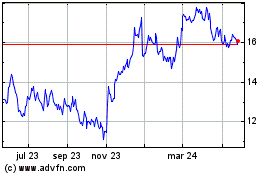

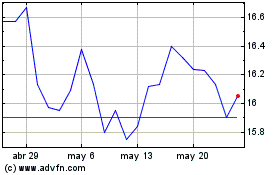

Park Hotels and Resorts (NYSE:PK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Park Hotels and Resorts (NYSE:PK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024