Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

18 Abril 2023 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2023

Commission File Number: 001-40486

ATRenew Inc.

(Registrant’s Name)

12th Floor, No. 6 Building

433 Songhu Road, Shanghai

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Supplemental Submission Pursuant to Item 16I(a) of Form 20-F

ATRenew Inc. (the “Company”) is submitting via EDGAR the following information as required under Item 16I(a) of Form 20-F in relation to the Holding Foreign Companies Accountable Act (“HFCAA”).

On May 4, 2022, the Company was conclusively identified by the U.S. Securities and Exchange Commission (the “SEC”) as a Commission-Identified Issuer pursuant to the HFCAA because it filed an annual report on Form 20-F for the year ended December 31, 2021 with the SEC on April 27, 2022 with an audit report issued by Deloitte Touche Tohmatsu Certified Public Accountants LLP, a registered public accounting firm retained by the Company, for the preparation of the audit report on the Company’s financial statements included therein. Deloitte Touche Tohmatsu Certified Public Accountants LLP is a registered public accounting firm headquartered in mainland China, a jurisdiction where the Public Company Accounting Oversight Board (the “PCAOB”) determined that it had been unable to inspect or investigate completely registered public accounting firms headquartered there until December 2022 when the PCAOB vacated its previous determination.

In response to Item 16I(a) of Form 20-F, based on the following information, the Company believes it is not owned or controlled by a governmental entity in mainland China.

Based on an examination of the Company’s register of members and public filings made by its shareholders, including the the Schedule 13G amendment filed by Tiger Global Private Investment Partners X, L.P., Tiger Global PIP Performance X, L.P., Tiger Global PIP Management X, Ltd., Tiger Global Management, LLC, Charles P. Coleman III and Scott Shleifer on December 2, 2022, to the Company’s knowledge, other than C&XF Group Limited, JD entities, 5Y Capital entities and Tiger entities, no shareholder owns more than 5% of the Company’s outstanding shares as of February 28, 2023.

•C&XF Group Limited held 7.6% of the total issued and outstanding shares and 42.2% of the aggregate voting power of the Company as of February 28, 2023. C&XF Group Limited is a limited liability company incorporated under the laws of the British Virgin Islands. Mr. Kerry Xuefeng Chen is the sole shareholder and the sole director of C&XF Group Limited.

•JD.com Development Limited, Tianjin Huihe Haihe Intelligent Logistics Industry Fund Partnership (Limited Partnership) and Windcreek Limited collectively held 33.5% of the total issued and outstanding shares and 36.0% of the aggregate voting power of the Company as of February 28, 2023. JD.com Development Limited, a limited liability company incorporated under the laws of the British Virgin Islands, is wholly-owned by JD.com Investment Limited, which in turn is wholly-owned by JD.com, Inc. (Nasdaq: JD, HKSE: 9618). Tianjin Huihe Haihe Intelligent Logistics Industry Fund Partnership (Limited Partnership) is a limited partnership incorporated under the laws of the PRC. The general partner of Tianjin Huihe Haihe Intelligent Logistics Industry Fund Partnership (Limited Partnership) is Tianjin Huihe Haihe Investment Management Partnership (Limited Partnership). The general partner of Tianjin Huihe Haihe Investment Management Partnership (Limited Partnership) is Tianjin Huihe Capital Management Co., Ltd. Tianjin Huihe Capital Management Co., Ltd. is a wholly-owned subsidiary of Xi’an Jingdong Xincheng Information Technology Co., Ltd., which is a consolidated variable interest entity of JD.com, Inc. Windcreek Limited, a limited liability company incorporate under the laws of the British Virgin Islands, is a wholly-owned subsidiary of JD.com Investment Limited, which in turn is wholly-owned by JD.com, Inc.

•Morningside China TMT Fund II, L.P., Morningside China TMT Top Up Fund, L.P. and Shanghai Chenxi Venture Capital Center (Limited Partnership) collectively held 12.8% of the total issued and outstanding shares and 4.7% of the aggregate voting power of the Company as of February 28, 2023. Both Morningside China TMT Fund II, L.P. and Morningside China TMT Top Up Fund, L.P. are controlled by their general partner, Morningside China TMT GP II, L.P., which, in turn, is controlled by its general partner, TMT General Partner Ltd. TMT General Partner Ltd. is controlled by its board of directors which consists of five individuals, namely Jianming Shi, Qin Liu, Gerald Lokchung Chan, Maria K. Lam and Makim Wai On Andrew Ma. These directors have the voting and dispositive powers over the shares held by Morningside China TMT Fund II, L.P. and Morningside China TMT Top Up Fund, L.P. Shanghai Chenxi Venture Capital Center (Limited Partnership) is controlled by Shanghai Xingpan Investment Management Consulting Co., Ltd., its fund manager. Shanghai Xingpan Investment Management Consulting Co., Ltd. is controlled by an investment committee consisting of three individuals, i.e. Qin Liu, Jianming Shi and Ye Yuan, who have the voting and dispositive powers over the shares held by Shanghai Chenxi Venture Capital Center (Limited Partnership).

•Based on the information contained in the Schedule 13G amendment filed by Tiger Global Private Investment Partners X, L.P., Tiger Global PIP Performance X, L.P., Tiger Global PIP Management X, Ltd., Tiger Global Management, LLC, Charles P. Coleman III and Scott Shleifer on December 2, 2022, Tiger entities beneficially owned 7,654,145 shares of the Company as of November 30, 2022. Based on the total issued and outstanding shares of the Company as of February 28, 2023 and assuming Tiger entities’ shareholding does not change since November 30, 2022, Tiger entities held 5.1% of the total issued and outstanding shares and 1.9% of the aggregate voting power of the Company as of February 28, 2023.

Please refer to “Item 6.E. Directors, Senior Management and Employees—Share Ownership” of the Company’s annual report on Form 20-F for the year ended December 31, 2022 filed with the SEC on April 18, 2023 for more details.

In addition, the Company is not aware of any governmental entity in mainland China that is in possession of the power, direct or indirect, to direct or cause the direction of the management and policies of the Company, whether through the ownership of voting securities, by contract, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ATRenew Inc.

|

|

|

By |

: |

/s/ Chen Chen |

Name |

: |

Chen Chen |

Title |

: |

Chief Financial Officer |

Date: April 18, 2023

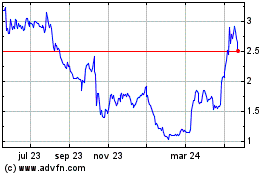

ATRenew (NYSE:RERE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

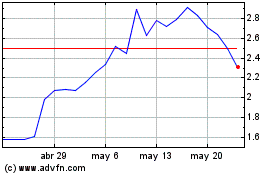

ATRenew (NYSE:RERE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024