The Board of Directors of Source Capital, Inc. (NYSE: SOR) (the

“Fund”), today announced that for the Fund’s Discount Management

Program (the “Program”) measurement period from January 1, 2022

through December 31, 2022, the Fund traded at an average discount

to net asset value (NAV) of less than 10%, including that the Fund

traded at a discount to NAV of 4.0% at the end of 2022, one of its

lowest discounts in the past 10 years. As a result, the tender

offer for calendar year 2022 under the Fund’s Program will not

occur.

In addition to the contingent tender offer in place for calendar

year 2023 (as described in the January 4, 2022 press release), the

Board approved a contingent tender offer for calendar year 2024.

Under the terms of the updated Program, the Board approved

extending the Program through the year ending December 31, 2024.

Under the Program’s extension, the Fund will conduct a tender offer

for 10% of the Fund’s outstanding shares of common stock at a price

equal to 98% of NAV per share if its shares trade at an average

discount to NAV of more than 10% during the measurement period from

January 1, 2024 through December 31, 2024. Should a tender offer be

required it shall close no later than June 30, 2025. In the future,

the Board may determine to extend the Program beyond 2024.

The Fund’s portfolio managers, officers and Board of Directors

do not intend to tender their shares if a tender is required under

the Program for 2023 or 2024.

In addition to the Program, the Fund will continue to implement

its Stock Repurchase Program to repurchase stock at prices that are

accretive to shareholders.

The portfolio managers also announced that as of November 30,

2022, approximately 29% of the Fund is invested in, or committed

to, the private-credit/loan asset class. This is up from

approximately 25% as of December 31, 2021.

Finally, the Fund will host an investor call on February 8,

2023, at 1pm PST. Details of the call and how to submit questions

will be posted at

https://fpa.com/funds/overview/source-capital.

About Source Capital, Inc.

Source Capital, Inc. is a closed-end investment company managed

by First Pacific Advisors, LP. Its shares are listed on the New

York Stock Exchange under the symbol “SOR.” The investment

objective of the Fund is to seek maximum total return for

shareholders from both capital appreciation and investment income

to the extent consistent with protection of invested capital. The

Fund may invest in longer duration assets like dividend paying

equities and illiquid assets like private loans in pursuit of its

investment objective and is thus intended only for those investors

with a long-term investment horizon (greater than or equal to ~5

years).

You can obtain additional information by visiting the website

at www.fpa.com, by email at crm@fpa.com, toll free by calling

1-800-982-4372, or by contacting the Fund in writing.

Important Disclosures

You should consider the Fund’s investment objectives, risks,

and charges and expenses carefully before you invest.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities nor shall there be

any sale of the securities in any state in which such offer,

solicitation or sale would be unlawful under the securities laws of

any such state. In the event of a tender offer, there may be tax

consequences for a stockholder. For example, a stockholder may owe

capital gains taxes on any increase in the value of the shares over

your original cost.

As with any stock, the price of the Fund’s common shares will

fluctuate with market conditions and other factors. Shares of

closed-end management investment companies frequently trade at a

price that is less than (a “discount”) or more than (a “premium”)

their net asset value. If the Fund’s shares trade at a premium to

net asset value, there is no assurance that any such premium will

be sustained for any period of time and will not decrease, or that

the shares will not trade at a discount to net asset value

thereafter. The Fund’s daily New York Stock Exchange closing market

prices, net asset values per share, as well as other information,

including updated portfolio statistics and performance are

available by visiting the website at

https://fpa.com/funds/overview/source-capital, by email at

crm@fpa.com, toll free by calling 1-800-279-1241 (option 1), or by

contacting the Fund in writing.

Investments, including investments in closed-end funds, carry

risks and investors may lose principal value. Capital markets are

volatile and can decline significantly in response to adverse

issuer, political, regulatory, market, or economic developments. It

is important to remember that there are risks inherent in any

investment and there is no assurance that any investment or asset

class will provide positive performance over time. Value style

investing presents the risk that the holdings or securities may

never reach our estimate of intrinsic value because the market

fails to recognize what the portfolio management team considers the

true business value or because the portfolio management team has

misjudged those values. In addition, value style investing may fall

out of favor and underperform growth or other style investing

during given periods. Non-U.S. investing presents additional risks,

such as the potential for adverse political, currency, economic,

social or regulatory developments in a country, including lack of

liquidity, excessive taxation, and differing legal and accounting

standards. Non-U.S. securities, including American Depository

Receipts (ADRs) and other depository receipts, are also subject to

interest rate and currency exchange rate risks.

Fixed income instruments are subject to interest rate, inflation

and credit risks. Such investments may be secured, partially

secured or unsecured and may be unrated, and whether or not rated,

may have speculative characteristics. The market price of the

Fund’s fixed income investments will change in response to changes

in interest rates and other factors. Generally, when interest rates

rise, the values of fixed income instruments fall, and vice versa.

Certain fixed income instruments are subject to prepayment risk

and/or default risk.

Private placements, including private credit and loans, are

instruments that are not registered under the federal securities

laws, and are generally eligible for sale only to certain eligible

investors. Private placements may be illiquid, and thus more

difficult to sell, because there may be relatively few potential

purchasers for such investments, and in certain cases, the sale of

such investments may also be restricted under securities laws.

The Fund may use leverage. While the use of leverage may help

increase the distribution and return potential of the Fund, it also

increases the volatility of the Fund’s net asset value (NAV), and

potentially increases volatility of its distributions and market

price. There are costs associated with the use of leverage,

including ongoing dividend and/or interest expenses. There also may

be expenses for issuing or administering leverage. Leverage changes

the Fund’s capital structure through the issuance of preferred

shares and/or debt, both of which are senior to the common shares

in priority of claims. If short-term interest rates rise, the cost

of leverage will increase and likely will reduce returns earned by

the Fund’s common stockholders.

The Fund invests in Special Purpose Acquisition Companies

(“SPACS”). SPACS involve risks, including but not limited to: (i)

having no operating history or ongoing business other than seeking

acquisitions; (ii) not being required to undergo the rigorous due

diligence of a traditional initial public offering (“IPO”); (iii)

investors may become exposed to speculative investments; (iv)

providing sponsors certain incentives not found in traditional IPOs

which may cause potential conflicts of interest in the structure of

the SPAC; (v) inability to identify an acquisition target or obtain

approval for a target by shareholders; and/or (vi) shareholders may

not have sufficient voting power to disapprove a SPAC transaction.

As with any investment, an investment in a SPAC may lose value.

SPACS may be considered illiquid, may be subject to restrictions on

resale, or may be diluted by additional offerings.

This material has been distributed for informational purposes

only and should not be considered as investment advice or a

recommendation of any particular security, strategy or investment

product. No part of this material may be reproduced in any form, or

referred to in any other publication, without express written

permission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230103005071/en/

For investor questions: Ryan Leggio, Partner rleggio@fpa.com

310-996-5484 or Media: Tucker Hewes, Hewes Communications, Inc.

Tel: 212-207-9451

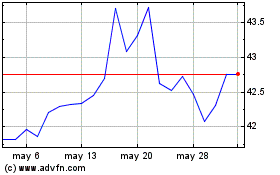

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024