false

POS EX

0001400897

false

No

false

0001400897

2024-10-15

2024-10-15

0001400897

dei:BusinessContactMember

2024-10-15

2024-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As

filed with the Securities and Exchange Commission on October 15, 2024

Securities

Act File No. 333-273954

Investment

Company Act File No. 811-22072

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-2

| |

[X] Registration

Statement under the Securities Act of 1933 |

|

| |

[ ] Pre-Effective

Amendment No. |

|

| |

[X] Post-Effective

Amendment No. 1 |

|

| |

and/or |

|

| |

[X] Registration Statement under

the Investment Company Act of 1940 |

|

| |

[X] Amendment

No. 27 |

|

NXG

CUSHING MIDSTREAM ENERGY FUND

NXG

CUSHING® MIDSTREAM ENERGY FUND

(Registrant’s Exact Name as Specified in Charter)

600

N. Pearl St., Suite 1205

Dallas, Texas 75201

(Address

of Principal Executive Offices)

(214)

692-6334

(Registrant’s

Telephone Number, including Area Code)

John

Musgrave

Cushing® Asset Management, LP

600 N. Pearl St., Suite 1205

Dallas, Texas 75201

(Name

and Address of Agent for Service)

Copies

to:

Kevin

T. Hardy, Esq.

Skadden,

Arps, Slate, Meagher & Flom LLP

320

South Canal Street

Chicago,

Illinois 60606

Approximate

date of proposed public offering: From time to time after the effective date of this Registration Statement.

| [ ] | Check

box if the only securities being registered on this Form are being offered pursuant to

dividend or interest reinvestment plans. |

| [X] | Check

box if any securities being registered on this Form will be offered on a delayed or continuous

basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”),

other than securities offered in connection with a dividend reinvestment plan. |

| [X] | Check

box if this Form is a registration statement pursuant to General Instruction A.2 or a

post-effective amendment thereto. |

| [ ] | Check

box if this Form is a registration statement pursuant to General Instruction B or a post-effective

amendment thereto that will become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act. |

| [ ] | Check

box if this Form is a post-effective amendment to a registration statement filed pursuant

to General Instruction B to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act. |

It

is proposed that this filing will become effective (check appropriate box):

| [ ] | When

declared effective pursuant to Section 8(c) of the Securities Act. |

If

appropriate, check the following box:

| [ ] | This

[post-effective] amendment designates a new effective date for a previously filed [post-effective

amendment] [registration statement]. |

| [ ] | This

Form is filed to register additional securities for an offering pursuant to Rule 462(b)

under the Securities Act, and the Securities Act registration statement number of the

earlier effective registration statement for the same offering is ____________. |

| [ ] | This

Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities

Act, and the Securities Act registration statement number of the earlier effective registration

statement for the same offering is ___________. |

| [X] | This

Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities

Act, and the Securities Act registration statement number of the earlier effective registration

statement for the same offering is: 333-273954. |

Check

each box that appropriately characterizes the Registrant:

| [X] | Registered

Closed-End Fund (closed-end company that is registered under the Investment Company Act

of 1940 (“Investment Company Act”)). |

| [ ] | Business

Development Company (closed-end company that intends or has elected to be regulated as

a business development company under the Investment Company Act). |

| [ ] | Interval

Fund (Registered Closed-End Fund or a Business Development Company that makes periodic

repurchase offers under Rule 23c-3 under the Investment Company Act). |

| [X] | A.2

Qualified (qualified to register securities pursuant to General Instruction A.2 of this

Form). |

| [ ] | Well-Known

Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| [ ] | Emerging

Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange

Act”)). |

| [ ] | If

an Emerging Growth Company, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| [ ] | New

Registrant (registered or regulated under the Investment Company Act for less than 12

calendar months preceding this filing). |

EXPLANATORY

NOTE

This

Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 (File No. 333-273954) of NXG Cushing®

Midstream Energy Fund (the “Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act

of 1933, as amended (the “Securities Act”), solely for the purpose of filing Exhibit (n)(ii), “Consent of Independent

Registered Public Accounting Firm (N-CSR)” to the Registration Statement.

Accordingly,

this Post-Effective Amendment No. 1 consists only of a facing page, this explanatory note and Part C of the Registration Statement

on Form N-2 setting forth the exhibits to the Registration Statement. This Post-Effective Amendment No. 1 does not modify any

other part of the Registration Statement and therefore the remainder of the Registration Statement has been omitted.

PART

C

OTHER

INFORMATION

Item

25. Financial Statements And Exhibits

(1) Included

in Part A: Financial highlights

Incorporated

by reference into Part B:

The

Registrant’s audited financial statements, notes to such financial statements and the report of independent registered public

accounting firm thereon, by reference to the Registrant’s Annual Report for the period ended November 30, 2023, as contained

in the Registrant’s Form N-CSR filed with the Securities and Exchange Commission (the “Commission”) on February

8, 2024.

The

Registrant’s unaudited financial statements, and notes to such financial statements, by reference to the Registrant’s

Semi-Annual Report for the period ended May 31, 2024, as contained in the Registrant’s Form N-CSRS filed with the Commission

on August 9, 2024.

(2) Exhibits

| |

(d) |

Form of Subscription

Documents for Rights++ |

| |

(h) |

Form of Underwriting/Sales/Dealer

Manager Agreement++ |

| ++ |

To be filed by post-effective amendment. |

| (1) |

Incorporated by

reference to the Registrant’s Registration Statement on Form N-2 under the Securities Act of 1933, as amended, and the

Investment Company Act of 1940, as amended (Securities Act File No. 333- 143305 and Investment Company Act File No. 811-22072),

on Form N-2, filed on July 20, 2007. |

| (2) |

Incorporated by

reference to the Registrant’s Registration Statement on Form N-2 under the Securities Act of 1933, as amended, and the

Investment Company Act of 1940, as amended (Securities Act File No. 333- 143305 and Investment Company Act File No. 811-22072),

on Form N-2, filed on August 23, 2007. |

| (3) |

Incorporated by

reference to Exhibit 3.1 to the Registrant’s Form 8-K filed on May 16, 2011. |

| (4) |

Incorporated by

reference to the Registrant’s Registration Statement on Form N-2 under the Securities Act of 1933, as amended, and the

Investment Company Act of 1940, as amended (Securities Act File No. 333- 225523 and Investment Company Act File No. 811-22072),

on Form N-2, filed on June 8, 2018. |

| (5) |

Incorporated by

reference to the Registrant’s Registration Statement on Form N-2 under the Securities Act of 1933, as amended, and the

Investment Company Act of 1940, as amended (Securities Act File No. 333-273954 and Investment Company Act File No. 811-22072),

filed on August 11, 2023. |

| (6) |

Incorporated by

reference to Pre-Effective Amendment No. 2 to the Registrant’s Registration Statement on Form N-2 under the Securities

Act of 1933, as amended, and the Investment Company Act of 1940, as amended (Securities Act File No. 333-273954 and Investment

Company Act File No. 811-22072), filed on October 26, 2023. |

Item

26. Marketing Arrangements

The

information contained under the heading “Plan of Distribution” in this Registration Statement is incorporated herein

by reference and any information concerning any underwriters for a particular offering will be contained in the Prospectus Supplement

related to that offering.

Item

27. Other Expenses of Issuance and Distribution

The

following table sets forth the estimated expenses to be incurred in connection with the offering described in this Registration

Statement:

| SEC Fees | |

$ | 12,450 | |

| FINRA Fees | |

| 15,500 | |

| Printing and Mailing Expenses | |

| 50,000 | |

| Legal Fees | |

| 200,000 | |

| Exchange Listing Fees | |

| 40,000 | |

| Audit Fees | |

| 50,000 | |

| Miscellaneous Expenses | |

| 150,000 | |

| Total | |

| 517,950 | |

Item

28. Persons Controlled by or Under Common Control with Registrant

None

Item

29. Number of Holders of Securities

| Title Class |

Number

of

Record

Shareholders

as of

October 15, 2024 |

| Common shares of beneficial interest,

par value $0.001 per share |

6 |

Item

30. Indemnification

Article

IV of the Registrant’s Second Amended and Restated Agreement and Declaration of Trust provides as follows:

Section

2. Limitation of Liability. All persons contracting with or having any claim against the Trust or a particular Series shall

look only to the assets of the Trust or, as applicable, all Series or such particular Series for payment under such contract or

claim; and neither the Trustees nor, when acting in such capacity, any of the Trust’s officers, employees or agents, whether

past, present or future, shall be personally liable therefor. Every written instrument or obligation on behalf of the Trust or

any Series shall contain a statement to the foregoing effect, but the absence of such statement shall not operate to make any

Trustee or officer of the Trust liable thereunder. Provided they have exercised reasonable care and have acted under the reasonable

belief that their actions are in the best interest of the Trust, the Trustees and officers of the Trust shall not be responsible

or liable for any act or omission or for neglect or wrongdoing of them or any officer, agent, employee, investment adviser or

independent contractor of the Trust, but nothing contained in this Declaration or in the Delaware Act shall protect any Trustee

or officer of the Trust against liability to the Trust or to Shareholders to which he would otherwise be subject by reason of

willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office.

Section

3. Indemnification.

(a)

Subject to the exceptions and limitations contained in subsection (b) below:

(i) every

person who is, or has been, a Trustee or an officer, employee or agent of the Trust (including any individual who serves at its

request as director, officer, partner, employee, trustee, agent or the like of another organization in which it has any interest

as a shareholder, creditor or otherwise) (“Covered Person”) shall be indemnified by the Trust or the appropriate Series

to the fullest extent permitted by law against liability and against all expenses reasonably incurred or paid by him in connection

with any claim, action, suit or proceeding in which he becomes involved as a party or otherwise by virtue of his being or having

been a Covered Person and against amounts paid or incurred by him in the settlement thereof; and

(ii) as

used herein, the words “claim,” “action,” “suit,” or “proceeding” shall apply

to all claims, actions, suits or proceedings (civil, criminal, administrative, investigative, arbitration or other, including

appeals), actual or threatened, and the words “liability” and “expenses” shall include, without limitation,

attorneys’ fees, costs, judgments, amounts paid in settlement, fines, penalties and other liabilities.

(b)

No indemnification shall be provided hereunder to a Covered Person:

(i) who

shall have been adjudicated by a court or body before which the proceeding was brought (A) to be liable to the Trust or its Shareholders

by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his

office, or (B) not to have acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best

interests of the Trust; or

(ii) in

the event of a settlement, unless there has been a determination that such Covered Person did not engage in willful misfeasance,

bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office; (A) by the court or other

body approving the settlement; (B) by at least a majority of those Trustees who are neither Interested Persons of the Trust nor

are parties to the matter based upon a review of readily available facts (as opposed to a full trial-type inquiry); (C) by written

opinion of independent legal counsel based upon a review of readily available facts (as opposed to a full trial-type inquiry)

or (D) by a vote of a majority of the Outstanding Shares entitled to vote (excluding any Outstanding Shares owned of record or

beneficially by such individual).

(c)

The rights of indemnification herein provided may be insured against by policies maintained by the Trust, shall be severable,

shall not be exclusive of or affect any other rights to which any Covered Person may now or hereafter be entitled, and shall inure

to the benefit of the heirs, executors and administrators of a Covered Person.

(d) To

the maximum extent permitted by applicable law, expenses in connection with the preparation and presentation of a defense to any

claim, action, suit or proceeding of the character described in subsection (a) of this Section may be paid by the Trust or applicable

Series from time to time prior to final disposition thereof upon receipt of an undertaking by or on behalf of such Covered Person

that such amount will be paid over by him to the Trust or applicable Series if it is ultimately determined that he is not entitled

to indemnification under this Section; provided, however, that either (i) such Covered Person shall have provided appropriate

security for such undertaking, (ii) the Trust is insured against losses arising out of any such advance payments or (iii) either

a majority of a quorum of the Trustees who are neither Interested Persons of the Trust nor parties to the matter, or independent

legal counsel in a written opinion, shall have determined, based upon a review of readily available facts (as opposed to a full

trial-type inquiry) that there is reason to believe that such Covered Person will not be disqualified from indemnification under

this Section. Independent counsel retained for the purpose of rendering an opinion regarding advancement of expenses and/or a

majority of a quorum of the Trustees who are neither Interested Persons of the Trust nor parties to the matter, may proceed under

a rebuttable presumption that the Covered Person has not engaged in willful misfeasance, bad faith, gross negligence or reckless

disregard of the Covered Person’s duties to the Trust and were based on the Covered Person’s determination that those

actions were in the best interests of the Trust and its Shareholders; provided that the Covered Person is not an Interested Person

(or is an Interested Person solely by reason of being an officer of the Trust).

(e) Any

repeal or modification of this Article IV by the Shareholders, or adoption or modification of any other provision of the Declaration

or By-Laws inconsistent with this Article, shall be prospective only, to the extent that such repeal, or modification would, if

applied retrospectively, adversely affect any limitation on the liability of any Covered Person or indemnification available to

any Covered Person with respect to any act or omission which occurred prior to such repeal, modification or adoption. Any such

repeal or modification by the Shareholders shall require a vote of at least two-thirds of the Outstanding Shares entitled to vote

and present in person or by proxy at any meeting of the Shareholders.

Section

4. Indemnification of Shareholders.

(a) If

any Shareholder or former Shareholder of the Trust (as opposed to a Shareholder or former Shareholder of any Series) shall be

held personally liable solely by reason of his being or having been a Shareholder and not because of his acts or omissions or

for some other reason, the Shareholder or former Shareholder (or his heirs, executors, administrators or other legal representatives

or in the case of any entity, its general successor) shall be entitled out of the assets belonging to the Trust to be held harmless

from and indemnified against all loss and expense arising from such liability. The Trust shall, upon request by such Shareholder,

assume the defense of any claim made against such Shareholder for any act or obligation of the Trust and satisfy any judgment

thereon from the assets of the Series.

(b) If

any Shareholder or former Shareholder of any Series shall be held personally liable solely by reason of his being or having been

a Shareholder and not because of his acts or omissions or for some other reason, the Shareholder or former Shareholder (or his

heirs, executors, administrators or other legal representatives or in the case of any entity, its general successor) shall be

entitled out of the assets belonging to the applicable Series to be held harmless from and indemnified against all loss and expense

arising from such liability. The Trust, on behalf of the affected Series, shall, upon request by such Shareholder, assume the

defense of any claim made against such Shareholder for any act or obligation of the Series and satisfy any judgment thereon from

the assets of the Series.

Section

5. No Bond Required of Trustees. No Trustee shall be obligated to give any bond or other security for the performance of

any of his duties hereunder.

Section

6. No Duty of Investigation; Notice in Trust Instruments, Etc. No purchaser, lender, transfer agent or other Person dealing

with the Trustees or any officer, employee or agent of the Trust or a Series thereof shall be bound to make any inquiry concerning

the validity of any transaction purporting to be made by the Trustees or by said officer, employee or agent or be liable for the

application of money or property paid, loaned, or delivered to or on the order of the Trustees or of said officer, employee or

agent. Every obligation, contract, instrument, certificate, Share, other security of the Trust or a Series thereof or undertaking,

and every other act or thing whatsoever executed in connection with the Trust shall be conclusively presumed to have been executed

or done by the executors thereof only in their capacity as Trustees under this Declaration or in their capacity as officers, employees

or agents of the Trust or a Series thereof. Every written obligation, contract, instrument, certificate, Share, other security

of the Trust or a Series thereof or undertaking made or issued by the Trustees may recite that the same is executed or made by

them not individually, but as Trustees under the Declaration, and that the obligations of the Trust or a Series thereof under

any such instrument are not binding upon any of the Trustees or Shareholders individually, but bind only the Trust Property or

the Trust Property of the applicable Series, and may contain any further recital which they may deem appropriate, but the omission

of such recital shall not operate to bind the Trustees individually. The Trustees may maintain insurance for the protection of

the Trust Property or the Trust Property of the applicable Series, its Shareholders, Trustees, officers, employees and agents

in such amount as the Trustees shall deem adequate to cover possible tort liability, and such other insurance as the Trustees

in their sole judgment shall deem advisable.

Section

7. Reliance on Experts, Etc. Each Trustee, officer or employee of the Trust or a Series thereof shall, in the performance

of his duties, powers and discretions hereunder be fully and completely justified and protected with regard to any act or any

failure to act resulting from reliance in good faith upon the books of account or other records of the Trust or a Series thereof,

upon an opinion of counsel, or upon reports made to the Trust or a Series thereof by any of its officers or employees or by the

Investment Adviser, the Administrator, the Distributor, the Principal Underwriter, Transfer Agent, selected dealers, accountants,

appraisers or other experts or consultants selected with reasonable care by the Trustees, officers or employees of the Trust,

regardless of whether such counsel or expert may also be a Trustee.

Section

18 of the Investment Management Agreement between Registrant and Cushing® Asset Management, LP provides as follows:

18.

Limitation of Liability of the Fund and the Shareholders. None of the Trustees, officers, agents or shareholders of the

Fund will be personally liable under this Agreement. The name “The Cushing® MLP & Infrastructure Total Return Fund”

is the designation of the Fund for the time being under the Amended and Restated Agreement and Declaration of Trust and all persons

dealing with the Fund must look solely to the property of the Fund for the enforcement of any claims against the Fund, as none

of the Trustees, officers, agents or shareholders assume any personal liability for obligations entered into on behalf of the

Fund.

Insofar

as indemnification for liability arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion

of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant

of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and

will be governed by the final adjudication of such issue.

Item

31. Business and Other Connections of the Advisor

The

Investment Adviser is not engaged in any other business, profession, vocation or employment of a substantial nature. A description

of any other business, profession, vocation or employment of a substantial nature in which each limited partner or executive officer

of the Investment Adviser is or has been during the past two fiscal years engaged in for his or her own account or in his or her

capacity as trustee, officer, or portfolio manager of the Fund, is set forth in Part A and Part B of this Registration Statement

in the sections entitled “Management of the Fund” or in the Investment Adviser’s Form ADV, as filed with the

SEC (SEC File No. 801-63255), and which Form ADV is incorporated herein by reference.

Item

32. Location of Accounts and Records

The

accounts, books or other documents required to be maintained by Section 31(a) of the 1940 Act, and the rules promulgated under

the 1940 Act, are kept by the Registrant or its custodian, transfer agent, administrator and fund accountant. The Registrant is

located at the following address: NXG Cushing® Midstream Energy Fund, 600 N. Pearl Street, Suite 1205, Dallas,

Texas 75201. The Fund’s custodian is located at the following address: U.S. Bank National Association, 1555 N. RiverCenter

Drive, Suite 302, Milwaukee, Wisconsin 53212. The Fund’s transfer agent, registrar and administrator is located at the following

address: U.S. Bancorp Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Item

33. Management Services

Not

applicable.

Item

34. Undertakings

1. Not

applicable.

2. Not

applicable.

3. Registrant

undertakes:

| |

(a) |

to file, during any period in which offers or sales are being

made, a post-effective amendment to the registration statement: |

(1)

to include any prospectus required by Section 10(a)(3) of the Securities Act;

(2)

to reflect in the prospectus any facts or events after the effective date of the registration statement

(or the most recent post- effective amendment thereof) which, individually or in the aggregate, represent a fundamental change

in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume

of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation

from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

and

(3)

to include any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration statement.

Provided,

however, that paragraphs a(1), a(2), and a(3) of this section do not apply if the registration statement is filed pursuant to

General Instruction A.2 of this Form and the information required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of

the Exchange Act that are incorporated by reference into the registration statement, or is contained in a form of prospectus filed

pursuant to Rule 424(b) that is part of the registration statement.

| |

(b) |

that, for the purpose of determining

any liability under the Securities Act, each post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof; |

| |

(c) |

to remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering; |

| |

(d) |

that, for the purpose of determining

liability under the Securities Act to any purchaser: |

(1) if

the Registrant is relying on Rule 430B

(A) Each

prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance

on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information

required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of

the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of

securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

or

(2) If

the Registrant is subject to Rule 430C: Each prospectus filed pursuant to Rule 424(b) under the Securities Act as part of a registration

statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in

reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used

after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus

that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede

or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such date of first use.

| |

(e) |

that for the purpose of determining liability

of the Registrant under the Securities Act to any purchaser in the initial distribution of securities: |

The

undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or

sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser

and will be considered to offer or sell such securities to the purchaser:

(1)

any preliminary prospectus or prospectus of the undersigned Registrant relating to the

offering required to be filed pursuant to Rule 424 under the Securities Act;

(2)

free writing prospectus relating to the offering prepared by or on behalf of the undersigned

Registrant or used or referred to by the undersigned Registrants;

(3)

the portion of any other free writing prospectus or advertisement pursuant to Rule 482

under the Securities Act relating to the offering containing material information about the undersigned Registrant or its securities

provided by or on behalf of the undersigned Registrant; and

(4)

any other communication that is an offer in the offering made by the undersigned Registrant

to the purchaser.

| |

4. |

Registrant undertakes that, for the purpose

of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as

part of the Registration Statement in reliance upon Rule 430A and contained in the form of prospectus filed by the Registrant

pursuant to Rule 424(b)(1) will be deemed to be a part of the Registration Statement as of the time it was declared effective. |

Registrant

undertakes that, for the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment

that contains a form of prospectus will be deemed to be a new Registration Statement relating to the securities offered therein,

and the offering of such securities at that time will be deemed to be the initial bona fide offering thereof.

| |

5. |

Registrant undertakes that, for the purpose

of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant

to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference into the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

7. |

Registrant undertakes to send by first

class mail or other means designed to ensure equally prompt delivery, within two business days of receipt of a written or

oral request, any Statement of Additional Information constituting Part B of this Registration Statement. |

SIGNATURES

As

required by the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, this Registrant’s

Registration Statement has been signed on behalf of the Registrant, in the City of Dallas, State of Texas, on the 15th day of

October, 2024

| |

NXG CUSHING® MIDSTREAM ENERGY FUND |

|

| |

|

|

|

| |

By: |

/s/ John Musgrave |

|

| |

|

Name: |

John Musgrave |

|

| |

|

Title: |

Chief Executive Officer and President |

|

As

required by the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons

in the capacities set forth below on the 15th day of October, 2024.

Principal

Executive Officer

| /s/ John Musgrave |

|

| John Musgrave |

|

| Chief Executive Officer and President |

|

Principal

Financial Officer

| /s/ Blake

Nelson |

|

| Blake Nelson |

|

| Chief Financial Officer and Treasurer |

|

Trustees

| * |

|

| Andrea N. Mullins |

|

| Trustee |

|

| * |

|

| Ronald P. Trout |

|

| Trustee |

|

| * |

Signed by Blake Nelson, an attorney-in-fact,

pursuant to a power of attorney filed herewith. |

| By: |

/s/

Blake Nelson |

|

| |

Blake Nelson |

|

| |

Attorney-In-Fact |

|

| |

October 15, 2024 |

|

EXHIBIT

INDEX

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference of our

report dated January 29, 2024, with respect to the financial statements and financial highlights of NXG Cushing Midstream Energy Fund

included in the Annual Report to Shareholders (Form N-CSR) for the year ended November 30, 2023, into this Registration Statement (Form

N-2, File No. 333-273954), filed with the Securities and Exchange Commission.

Dallas, Texas

October 15, 2024

v3.24.3

N-2

|

Oct. 15, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001400897

|

| Amendment Flag |

false

|

| Document Type |

POS EX

|

| Entity Registrant Name |

NXG

CUSHING MIDSTREAM ENERGY FUND

|

| Entity Address, Address Line One |

600

N. Pearl St.

|

| Entity Address, Address Line Two |

Suite 1205

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

(214)

|

| Local Phone Number |

692-6334

|

| No Substantive Changes, 462(c) |

false

|

| Exhibits Only, 462(d) |

true

|

| Entity Well-known Seasoned Issuer |

No

|

| Entity Emerging Growth Company |

false

|

| Business Contact [Member] |

|

| Cover [Abstract] |

|

| Entity Address, Address Line One |

600 N. Pearl St.

|

| Entity Address, Address Line Two |

Suite 1205

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| Contact Personnel Name |

John

Musgrave

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 462

-Subsection d

| Name: |

dei_ExhibitsOnly462d |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 462

-Subsection c

| Name: |

dei_NoSubstantiveChanges462c |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

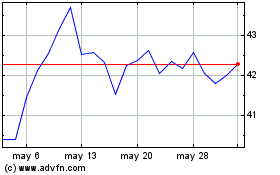

NXG Cushing Midstream En... (NYSE:SRV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

NXG Cushing Midstream En... (NYSE:SRV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024