UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

11-K

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the Plan Year Ended June 30, 2009

or

|

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

file number: 1-16153

Coach,

Inc. Savings and Profit Sharing Plan

(Full

title of the Plan)

COACH,

INC.

(Name of

issuer of the securities held pursuant to the Plan)

516

West 34

th

Street,

New York, NY 10001

(Address

of principal executive offices); (Zip Code)

COACH,

INC. SAVINGS AND PROFIT SHARING PLAN

TABLE

OF CONTENTS

|

|

Page Number

|

|

|

|

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

3

|

|

|

|

|

FINANCIAL

STATEMENTS

|

|

|

|

|

|

Statements

of Net Assets Available for Benefits as of June 30, 2009 and

2008

|

4

|

|

|

|

|

Statement

of Changes in Net Assets Available for Benefits

|

|

|

For

the Year Ended June 30, 2009

|

5

|

|

|

|

|

Notes

to Financial Statements

|

6

|

|

|

|

|

SUPPLEMENTAL

SCHEDULE

|

|

|

|

|

|

Form

5500, Schedule H, Part IV, Line 4i – Schedule of Assets

(Held

|

|

|

at

End of Year) as of June 30, 2009

|

15

|

Note: All

other schedules required by Section 2520.103-10 of the Department of Labor’s

Rules and Regulations for Reporting and Disclosure under the Employee Retirement

Income Security Act of 1974 have been omitted because they are not

applicable.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Participants of the Coach, Inc. Savings and Profit Sharing Plan and the Human

Resources Committee of Coach, Inc.:

We have

audited the accompanying statements of net assets available for benefits of the

Coach, Inc. Savings and Profit Sharing Plan (the “Plan”) as of June 30, 2009 and

2008, and the related statement of changes in net assets available for benefits

for the year ended June 30, 2009. These financial statements are the

responsibility of the Plan's management. Our responsibility is to

express an opinion on these financial statements based on our

audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require

that we plan and perform the audit to obtain reasonable assurance about whether

the financial statements are free of material misstatement. The Plan

is not required to have, nor were we engaged to perform, an audit of its

internal control over financial reporting. Our audits included

consideration of internal control over financial reporting as a basis for

designing audit procedures that are appropriate in the circumstances, but not

for the purpose of expressing an opinion on the effectiveness of the Plan's

internal control over financial reporting. Accordingly, we express no

such opinion. An audit also includes examining, on a test basis,

evidence supporting the amounts and disclosures in the financial statements,

assessing the accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis

for our opinion.

In our

opinion, such financial statements present fairly, in all material respects, the

net assets available for benefits of the Plan as of June 30, 2009 and 2008, and

the changes in net assets available for benefits for the year ended June 30,

2009, in conformity with accounting principles generally accepted in the United

States of America.

Our

audits were conducted for the purpose of forming an opinion on the basic

financial statements taken as a whole. The supplemental schedule of

assets (held at end of year) as of June 30, 2009, is presented for the purpose

of additional analysis and is not a required part of the basic financial

statements, but is supplementary information required by the Department of

Labor's Rules and Regulations for Reporting and Disclosure under the Employee

Retirement Income Security Act of 1974. This schedule is the

responsibility of the Plan's management. Such schedule has been

subjected to the auditing procedures applied in our audit of the basic 2009

financial statements and, in our opinion, is fairly stated in all material

respects when considered in relation to the basic financial statements taken as

a whole.

/s/

Deloitte & Touche LLP

New York,

New York

December

17, 2009

Coach,

Inc. Savings and Profit Sharing Plan

Statements

of Net Assets Available for Benefits

|

|

|

June 30, 2009

|

|

|

June 30, 2008

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

Investments,

at fair value:

|

|

|

|

|

|

|

|

Fidelity

Management Trust Company:

|

|

|

|

|

|

|

|

Common

collective trust fund

|

|

$

|

14,654,760

|

|

|

$

|

11,974,293

|

|

|

Mutual

funds

|

|

|

68,110,000

|

|

|

|

82,171,714

|

|

|

Coach,

Inc. common stock

|

|

|

21,134,591

|

|

|

|

22,832,304

|

|

|

Participant

loans receivable

|

|

|

2,408,885

|

|

|

|

2,145,840

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

investments, at fair value

|

|

|

106,308,236

|

|

|

|

119,124,151

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivable:

|

|

|

|

|

|

|

|

|

|

Employer

contributions

|

|

|

6,919,174

|

|

|

|

4,037,899

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

assets available for benefits, at fair value

|

|

|

113,227,410

|

|

|

|

123,162,050

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment

from fair value to contract value for fully benefit-responsive investment

contracts

|

|

|

592,467

|

|

|

|

484,769

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

assets available for benefits

|

|

$

|

113,819,877

|

|

|

$

|

123,646,819

|

|

See

accompanying Notes to Financial Statements.

Coach,

Inc. Savings and Profit Sharing Plan

Statement

of Changes in Net Assets Available for Benefits

|

|

|

Year

Ended

|

|

|

|

|

June 30, 2009

|

|

|

Additions:

|

|

|

|

|

|

|

|

|

|

Interest

and dividends

|

|

$

|

2,517,667

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

Participants

|

|

|

10,410,466

|

|

|

Employer

|

|

|

11,190,235

|

|

|

Participant

rollovers

|

|

|

832,509

|

|

|

|

|

|

|

|

|

|

|

|

22,433,210

|

|

|

|

|

|

|

|

|

Total

additions

|

|

|

24,950,877

|

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

|

|

|

|

|

|

Net

depreciation in fair value of investments

|

|

|

24,617,969

|

|

|

Participant

withdrawals and benefit payments

|

|

|

9,950,986

|

|

|

Administrative

expenses

|

|

|

183,216

|

|

|

Deemed

distributions

|

|

|

25,648

|

|

|

|

|

|

|

|

|

Total

deductions

|

|

|

34,777,819

|

|

|

|

|

|

|

|

|

Net

decrease in net assets available for benefits

|

|

|

(9,826,942

|

)

|

|

|

|

|

|

|

|

Net

assets available for benefits:

|

|

|

|

|

|

|

|

|

|

|

|

Beginning

of year

|

|

|

123,646,819

|

|

|

|

|

|

|

|

|

End

of year

|

|

$

|

113,819,877

|

|

See

accompanying Notes to Financial Statements.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

The

following description of the Coach, Inc. Savings and Profit Sharing Plan (the

"Plan") provides only general information. Participants should refer to the Plan

document for a more complete description of the Plan’s provisions.

General:

The Plan,

as amended, was adopted by Coach, Inc. (the “Company”) effective July 1, 2001

and is a defined contribution plan. All U.S. employees of the Company who meet

certain eligibility requirements and are not part of a collective bargaining

agreement may participate in the Plan.

The Plan

is administered by the Human Resources Committee (“Plan Committee”) appointed by

the Board of Directors of the Company. The assets of the Plan are maintained and

transactions therein are executed by Fidelity Management Trust Company, the

trustee of the Plan ("Trustee"). The Plan is subject to the reporting and

disclosure requirements, participation and vesting standards, and fiduciary

responsibility provisions of the Employee Retirement Income Security Act of 1974

("ERISA"), as amended.

Eligibility:

Employees

become eligible to participate in the Plan one year following their initial date

of employment or attainment of age 21, whichever is later. Once an employee is

eligible, in order to receive a profit sharing contribution for any Plan year,

the employee must be employed by Coach on the last day of the Plan year. In

addition, a part time employee is required to work a minimum of 750 hours and an

intern, temporary or seasonal employee is required to work 1,000 hours during

the Plan year to be eligible for a profit sharing contribution.

Contributions:

The

401(k) feature of the Plan is funded by both employee contributions and employer

matching contributions. Participants may contribute between 1% and 50% of their

pre-tax annual compensation, not to exceed the amount permitted pursuant to the

Internal Revenue Code (the “IRC”). Employer matching contributions to the

accounts of Non-Highly Compensated Employees, as defined by the Internal Revenue

Service (the “IRS”), are equal to 100% of the first 3% of each participant’s

eligible compensation contributed to the Plan and 50% of the next 2% of eligible

compensation contributed to the Plan. Employer matching contributions to the

accounts of Highly Compensated Employees, as defined by the IRS, are equal to

50% of up to 6% of each participant’s eligible compensation contributed to the

Plan. Employer matching contributions are made to the account of each eligible

employee each pay period.

The

profit sharing feature of the Plan is non-contributory on the part of employees

and is funded by Company contributions from its current or accumulated earnings

and profit amounts. The discretionary annual contribution is authorized by the

Company’s Board of Directors in accordance with, and subject to, the terms and

limitations of the Plan. Profit sharing contributions for the Plan year ended

June 30, 2009 were 3% of participant’s eligible compensation for all eligible

participants. Eligible employees who had attained the ages of 35-39 and were

credited with 10 or more years of vested service as of July 1, 2001 receive two

times the above profit sharing contribution. Eligible employees who had attained

the age of 40 or more and were credited with 10 or more years of vested service

as of July 1, 2001 receive three times the above profit sharing

contribution.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

All

contributions are allocated among the various investment options according to

the participant’s selected investment direction.

Participant

Accounts:

Each

participant's account is credited with the participant's contributions and

employer’s matching and profit sharing contributions, as well as an allocation

of each selected investment's earnings or losses. Allocations are based on

participant account balances as defined in the Plan document.

Vesting

and Forfeitures:

As of

June 30, 2009, percentage vesting for each category of contributions is as

follows:

|

|

|

|

|

|

|

Employer Matching Contributions

|

|

|

|

|

|

Years of

Service for

Vesting

|

|

|

Employee

Contributions

|

|

|

Non-Highly

Compensated

Employees

|

|

|

Highly

Compensated

Employees

|

|

|

Employer

Profit Sharing

Contributions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Immediate

|

|

|

|

100%

|

|

|

|

100%

|

|

|

|

-

|

|

|

|

-

|

|

|

1

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

20%

|

|

|

|

-

|

|

|

2

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

40%

|

|

|

|

-

|

|

|

3

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

60%

|

|

|

|

100%

|

|

|

4

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

80%

|

|

|

|

-

|

|

|

5

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

100%

|

|

|

|

-

|

|

A

participant also becomes 100% vested in his or her matching and profit sharing

contribution accounts upon termination of employment by reason of death,

retirement or disability. For purposes of the Plan, retirement is defined as

termination of employment after age 65 or age 55 if the participant has at least

ten years of service with the Company.

Effective

as of July 1, 2007, in accordance with the Pension Protection Act of 2006, all

active participant account balances derived from employer profit sharing

contributions that were previously made to a participant account and any future

employer profit sharing contributions will be 100% vested after three complete

years of service.

In the

event a participant leaves the Company prior to becoming fully vested, the

participant’s unvested employer matching and profit sharing contribution

accounts may forfeit. If the participant’s account balance is 100% unvested,

forfeiture will occur in the Plan year in which the participant leaves the

Company. If a participant is partially vested and takes a distribution of

his/her account balance from the Plan, forfeiture of the unvested account

balance will occur in the Plan year in which the distribution is taken. If a

participant does not take a distribution, forfeiture of the unvested account

balance will occur after five years.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

In the

event the participant rejoins the Company within five years, he/she may continue

to vest in the unvested portion of his/her account balance. If the participant

rejoins the Company within one year, the unvested balance continues to vest as

if the participant never left the Company. If the participant rejoins the

Company between one and five years, the unvested balance continues to vest from

point of rehire.

If a

participant who was terminated as of July 1, 2007 is rehired, any unvested

contributions previously made to his/her profit sharing contribution account

will continue to vest 100% after five complete years of service and any future

employer profit sharing contributions will be vested after three complete years

of service.

If the

participant does take a distribution and rejoins the Company within five years,

the unvested amount that was forfeited will be restored only if the participant

repays to the Plan the full amount of the vested distribution before the earlier

of (1) the end of five consecutive breaks in service years beginning after the

distribution or (2) within five years after reemployment with the Company.

Vesting of the unvested participant balance cannot be restored by a repayment of

a previous distribution after five consecutive one-year breaks in

service.

Forfeited

accounts will be used first to pay Plan administrative expenses. Any remaining

amounts will be used to reduce future employer contributions payable under the

Plan. As of June 30, 2009 and 2008, forfeited unvested amounts totaled $80,579

and $109,824, respectively. During the Plan year ended June 30, 2009, $140,490

of forfeitures were used to pay Plan administrative expenses and $134,730 were

used to reduce employer contributions.

Administrative

Expenses:

Unless

elected to be paid by the Company, administrative expenses incurred in

connection with the Plan shall be paid from forfeitures, if any, or from the

Trust.

Participant

Loans:

Active

participants may borrow from their fund accounts a minimum of $1,000, up to a

maximum of the lesser of 50% of their vested account balance or $50,000, reduced

by the highest outstanding loan balance in the participant’s account during the

prior twelve month period. The loans are secured by the balance in the

participant’s account and bear interest at rates commensurate with prevailing

market rates, as determined by the Plan Committee. During the 2009 Plan year,

interest rates on outstanding loans ranged from 3.25% to 8.25%. Principal

repayments and interest payments are made ratably through payroll deductions and

must be repaid within five years unless used by the participant to purchase a

primary residence, in which case the term is ten years. A participant may only

have one loan outstanding at a time.

If a

participant’s loan is in default, the participant shall be treated as having

received a taxable deemed distribution for the amount in default. Participant

payments on a loan after the date it was deemed distributed shall be treated as

employee contributions to the Plan for purposes of increasing the tax basis in

the participant’s account. These payments shall not be treated as employee

contributions for any other purpose under the Plan. In the 2009 Plan year,

deemed distributions were $25,648.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

Payment

of Benefits:

Upon

termination of employment, participants are entitled to receive the full vested

balance of their Plan account in a lump sum cash distribution or in part in the

form of installments. In the event of a participant’s death, the distribution of

the participant’s account balance will be made to the participant's designated

beneficiary or the participant's estate, if no beneficiary has been so

designated.

Any

participant may apply to withdraw all or part of his/her vested account balance

subject to specific hardship and in-service withdrawal provisions of the Plan.

Hardship withdrawals must be approved by the Plan Administrator, who is

appointed by the Plan Committee, and are limited to amounts of participants’

deferral contributions. Hardship withdrawals require a six-month suspension from

contributing to the Plan from the date of the hardship withdrawal. In-service

withdrawals are available to participants upon the attainment of age 59 ½ and

are limited to a participant’s vested account balance. Hardship and in-service

withdrawals will be subject to income taxes. A hardship withdrawal may also be

subject to an additional tax based on early withdrawal.

Investment

Options:

Participants

may direct employee deferrals as well as employer matching and profit sharing

contributions into any of 23 different investment options, including a common

collective trust fund, several mutual funds and Company stock, in no less than

1% increments.

|

2.

|

Summary

of Significant Accounting Policies

|

Basis

of Accounting:

The

Plan's financial statements have been prepared in conformity with accounting

principles generally accepted in the United States of America.

Payment

of Benefits:

Benefit

payments to participants are recorded when paid.

Investment

Valuation and Income Recognition:

The

Plan’s investments are stated at fair value. Fair value of a financial

instrument is the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at

the measurement date. Shares of the trust and mutual funds are valued at the net

asset value of shares held by the Plan at year-end. Shares of Coach, Inc. common

stock are stated at fair value as determined by quoted market prices at

year-end. The common collective trust fund is stated at fair value as determined

by the issuer of the common collective trust fund based on the fair value of the

underlying investments. The common collective trust fund’s underlying

investments in investment contracts are valued at fair value of the underlying

investments and then adjusted by the issuer to contract value, which is invested

principal plus accrued interest. Certain events, such as a change in law,

regulation, or administrative ruling or employer-initiated termination of the

Plan, may limit the ability of the Plan to transact the common collective trust

fund at contract value with the issuer. The Plan presents, in the Statement of

Changes in Net Assets Available for Benefits, the net depreciation in the fair

value of its investments, which consists of the realized gains or losses and the

unrealized gains or losses on those investments based on the value of the assets

at the beginning of the Plan year or at the time of purchase during the year.

Participant loans are valued at the outstanding loan balances, which

approximates fair value.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

In

accordance with Financial Accounting Standards Board (“FASB”) Staff Position

(“FSP”), AAG INV-1 and SOP 94-4-1, “

Reporting of Fully

Benefit-Responsive Contracts Held by Certain Investment Companies Subject to the

AICPA Investment Company Guide and Defined-Contribution Health and Welfare and

Pension Plans

”, the statements of net assets available for benefits

present an investment contract at fair value, as well as an additional line item

showing an adjustment of the fully benefit-responsive contract from fair value

to contract value. The statement of changes in net assets available for

benefits is presented on a contract value basis and is not affected by FSP AAG

INV-1 and SOP 94-4-1.

Purchases

and sales of investments are recorded on a trade date basis. Dividend income is

recorded on the ex-dividend date. Interest income is recorded when earned. Cost

of securities sold is determined by the specific identification

method.

Use

of Estimates:

The

preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of net assets

available for benefits and changes therein. Actual results could differ from

estimates in amounts that may be material to the financial

statements.

Risk

and Uncertainties:

Investment

securities, in general, are exposed to various risks, such as interest rate,

credit and overall market volatility. Due to the level of risk associated

with certain investment securities, it is reasonably possible that changes in

such risk factors could materially affect participant account balances and the

amount reported on the statement of net assets available for benefits and

changes therein.

Recent

Accounting Pronouncements:

In

September 2006, the FASB issued Statement of Financial Accounting Standard

(“SFAS”) 157, “

Fair Value

Measurements.

” SFAS 157 defines fair value, establishes a framework for

measuring fair value in generally accepted accounting principles and expands

disclosures about fair value measurements. This standard was effective for

the Plan’s fiscal year that began on July 1, 2008. The adoption did not

have a material impact on the Plan’s financial statements. For further

information about the fair value measurements of the Plan’s financial assets see

Note 7.

In

October 2008, the FASB issued FSP No. SFAS 157-3, “

Determining the Fair Value of a

Financial Asset When the Market for That Asset Is Not Active

” which

amends SFAS 157 by incorporating an example to illustrate key considerations in

determining the fair value of a financial asset in an inactive market. FSP

157-3 was effective on October 10, 2008. The Plan has adopted the

provisions of SFAS 157 and incorporated the considerations of this FSP in

determining the fair value of its financial assets. FSP 157-3 did not have

a material impact on the Plan’s financial statements.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

In April

2009, the FASB issued FSP No. SFAS 157-4, “

Determining Fair Value When the

Volume and Level of Activity for the Asset or Liability Have Significantly

Decreased and Identifying Transactions That Are Not Orderly

” which amends

SFAS 157 by incorporating a two-step process to determine whether a market is

not active and a transaction is not distressed. The Plan adopted FSP 157-4

for the Plan year ended June 30, 2009. FSP 157-4 did not have a material

impact on the Plan’s consolidated financial statements.

In June

2009, the FASB issued SFAS 168, “

The FASB Accounting Standards

Codification and the Hierarchy of Generally Accepted Accounting Principles-a

replacement of FASB Statement No. 162

.” SFAS 168 states that the FASB

Accounting Standards Codification will become the source of authoritative U.S.

GAAP recognized by the FASB. Once effective, the Codification’s content

will carry the same level of authority, effectively superseding Statement

162. The GAAP hierarchy will be modified to include only two levels of

GAAP: authoritative and nonauthoritative. This statement will be effective

for the Plan’s financial statements beginning with the Plan year ending June 30,

2010. The Plan’s management does not expect the application of SFAS 168 to

have a material impact on the Plan’s financial statements.

The fair

value of the following individual investments represents 5% or more of the

Plan's total net assets available for benefits at June 30, 2009 and

2008:

|

|

|

Shares

|

|

|

Fair Value

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

June 30,

|

|

|

June 30,

|

|

|

Fund

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coach,

Inc. Common Stock

|

|

|

786,219

|

|

|

|

790,524

|

|

|

$

|

21,134,591

|

|

|

$

|

22,832,304

|

|

|

Fidelity

Balanced Fund

|

|

|

583,740

|

|

|

|

614,261

|

|

|

|

8,265,760

|

|

|

|

11,204,125

|

|

|

Fidelity

Diversified International Fund

|

|

|

323,195

|

|

|

|

330,931

|

|

|

|

7,530,438

|

|

|

|

11,926,743

|

|

|

Fidelity

Managed Income Portfolio*

|

|

|

15,247,227

|

|

|

|

12,459,062

|

|

|

|

14,654,760

|

|

|

|

11,974,293

|

|

|

Neuberger

Berman Genesis Trust

|

|

|

327,863

|

|

|

|

310,774

|

|

|

|

10,645,724

|

|

|

|

15,908,540

|

|

|

Spartan

U.S. Equity Index Fund

|

|

|

239,923

|

|

|

|

251,486

|

|

|

|

7,845,472

|

|

|

|

11,435,067

|

|

*Amounts

shown at fair value. Contract value at June 30, 2009 and 2008 was

$15,247,227 and $12,459,062, respectively.

During

the Plan year ended June 30, 2009, the Plan investments (including gains and

losses on investments bought and sold, as well as held during the year)

depreciated in value by $24,617,969 as follows:

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

Net

depreciation in fair value:

|

Fund Types

|

|

|

|

|

|

|

|

|

|

Mutual

funds

|

|

$

|

(23,289,036

|

)

|

|

Coach,

Inc. Common Stock

|

|

|

(1,328,933

|

)

|

|

Net

depreciation in fair value of investments

|

|

$

|

(24,617,969

|

)

|

|

4.

|

Exempt

Party-In-Interest Transactions

|

Certain

Plan investments are shares of mutual funds managed by Fidelity Investments,

Inc. The Trustee is an affiliate of Fidelity Investments, Inc. and

therefore, these transactions qualify as party-in-interest transactions.

Fees charged to the Plan by the Plan Trustee for administrative expenses

amounted to $183,216 for the year ended June 30, 2009.

The

Company is also a party-in-interest to the Plan under the definition provided in

Section 3(14) of ERISA. Therefore, Coach, Inc.’s common stock transactions

qualify as party-in-interest transactions. At June 30, 2009 and 2008, the Plan

held 786,219 and 790,524 shares, respectively, of common stock of the Company,

the sponsoring employer, with a cost basis of $14,288,518 and $14,046,756,

respectively.

|

5.

|

Federal

Income Tax Status

|

The IRS

has determined and informed the Company by letter dated June 23, 2003 that the

Plan and related trust are designed in accordance with applicable sections of

the IRC. The Plan Administrator and the Plan’s tax counsel believe that

the Plan is designed and is currently being operated in compliance with the

applicable requirements of the IRC and the Plan and related trust continue to be

tax-exempt. Therefore, no provision for income taxes has been included in

the Plan’s financial statements.

Although

it has not expressed any intent to do so, the Board of Directors of the Company

reserves the right to change, amend or terminate the Plan at any time at its

discretion, subject to the provisions of ERISA. In the event the Plan is

terminated, participants would become 100% vested in their employer matching and

profit sharing contributions.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

|

7.

|

Fair

Value Measurements

|

In

accordance with SFAS 157, the Plan classifies its investments into Level 1,

which refers to securities valued using quoted prices from active markets for

identical assets; Level 2, which refers to securities not traded on an active

market but for which observable market inputs are readily available; and Level

3, which refers to securities valued based on significant unobservable

inputs. Assets and liabilities are classified in their entirety based on

the lowest level of input that is significant to the fair value

measurement. The following table sets forth by level within the fair value

hierarchy a summary of the Plan’s investments measured at fair value on a

recurring basis at June 30, 2009.

|

|

|

Fair Value Measurements at June 30, 2009

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock

|

|

$

|

21,134,591

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Mutual

funds

|

|

|

68,110,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Common

collective trust fund

|

|

|

-

|

|

|

|

14,654,760

|

|

|

|

-

|

|

|

Participant

loans

|

|

|

-

|

|

|

|

-

|

|

|

|

2,408,885

|

|

|

Total

|

|

$

|

89,244,591

|

|

|

$

|

14,654,760

|

|

|

$

|

2,408,885

|

|

The

following table presents a reconciliation of the beginning and ending balances

of the fair value measurements using significant unobservable inputs (Level

3):

|

|

|

Participant Loans

|

|

|

Balance

at June 30, 2008

|

|

$

|

2,145,840

|

|

|

Purchases,

issuances and settlements

|

|

|

263,045

|

|

|

Balance

at June 30, 2009

|

|

$

|

2,408,885

|

|

|

8.

|

Subsequent

Event Evaluation

|

The

Company adopted SFAS 165, “

Subsequent Events

,” for the

Plan year ended on June 30, 2009. SFAS 165 formalizes the recognition and

nonrecognition of subsequent events and the disclosure requirements not

addressed in other applicable generally accepted accounting guidance. The

Company evaluated subsequent events through December 17, 2009, the date these

financial statements were issued, for both conditions existing and not existing

as of December 17, 2009 and concluded there were no subsequent events to

recognize or disclose.

Coach,

Inc. Savings and Profit Sharing Plan

Notes

to Financial Statements

|

9.

|

Reconciliation

to Form 5500

|

The

following is a reconciliation of the Plan’s net assets at contract value per the

financial statements to the Plan’s net assets at fair value, per Form

5500:

|

|

|

June 30, 2009

|

|

|

June 30, 2008

|

|

|

Net

assets available for benefits per financial statements

|

|

$

|

113,819,877

|

|

|

$

|

123,646,819

|

|

|

Less:

Adjustment from contract value to fair value for fully

|

|

|

|

|

|

|

|

|

|

benefit-responsive

investment contracts

|

|

|

592,467

|

|

|

|

484,769

|

|

|

Net

assets available for benefits per Form 5500

|

|

$

|

113,227,410

|

|

|

$

|

123,162,050

|

|

The

following is a reconciliation of the decrease in net assets per the financial

statements for the year ended June 30, 2009, to Form 5500:

|

|

|

June 30, 2009

|

|

|

Decrease

in net assets, per financial statements

|

|

$

|

(9,826,942

|

)

|

|

Less:

Change in the adjustment from contract value to

|

|

|

|

|

|

fair

value for fully benefit-responsive investment contracts

|

|

|

107,698

|

|

|

Decrease

in net assets, per Form 5500

|

|

$

|

(9,934,640

|

)

|

Plan

No.: 001

EIN:

52-2242751

Supplemental

Schedule

Coach,

Inc.

Savings

and Profit Sharing Plan

Form

5500, Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of

Year)

June

30, 2009

|

Identity of Issuer, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity

Date, Rate of Interest, Par or Maturity Value

|

|

Number

of

Shares

|

|

|

Cost

|

|

|

Current

Value

|

|

|

American

Funds Growth Fund

|

|

Mutual

fund

|

|

|

207,934

|

|

|

|

**

|

|

|

$

|

4,738,827

|

|

|

Fidelity

Balanced Fund*

|

|

Mutual

fund

|

|

|

583,740

|

|

|

|

**

|

|

|

|

8,265,760

|

|

|

Fidelity

Diversified International Fund*

|

|

Mutual

fund

|

|

|

323,195

|

|

|

|

**

|

|

|

|

7,530,438

|

|

|

Fidelity

Equity-Income Fund*

|

|

Mutual

fund

|

|

|

119,701

|

|

|

|

**

|

|

|

|

3,826,849

|

|

|

Fidelity

Freedom 2000 Fund*

|

|

Mutual

fund

|

|

|

21,090

|

|

|

|

**

|

|

|

|

222,710

|

|

|

Fidelity

Freedom 2005 Fund*

|

|

Mutual

fund

|

|

|

7,443

|

|

|

|

**

|

|

|

|

66,689

|

|

|

Fidelity

Freedom 2010 Fund*

|

|

Mutual

fund

|

|

|

53,602

|

|

|

|

**

|

|

|

|

594,984

|

|

|

Fidelity

Freedom 2015 Fund*

|

|

Mutual

fund

|

|

|

122,379

|

|

|

|

**

|

|

|

|

1,125,889

|

|

|

Fidelity

Freedom 2020 Fund*

|

|

Mutual

fund

|

|

|

149,243

|

|

|

|

**

|

|

|

|

1,617,792

|

|

|

Fidelity

Freedom 2025 Fund*

|

|

Mutual

fund

|

|

|

158,113

|

|

|

|

**

|

|

|

|

1,407,209

|

|

|

Fidelity

Freedom 2030 Fund*

|

|

Mutual

fund

|

|

|

224,962

|

|

|

|

**

|

|

|

|

2,359,852

|

|

|

Fidelity

Freedom 2035 Fund*

|

|

Mutual

fund

|

|

|

317,788

|

|

|

|

**

|

|

|

|

2,745,684

|

|

|

Fidelity

Freedom 2040 Fund*

|

|

Mutual

fund

|

|

|

621,108

|

|

|

|

**

|

|

|

|

3,732,856

|

|

|

Fidelity

Freedom 2045 Fund*

|

|

Mutual

fund

|

|

|

247,207

|

|

|

|

**

|

|

|

|

1,750,224

|

|

|

Fidelity

Freedom 2050 Fund*

|

|

Mutual

fund

|

|

|

122,182

|

|

|

|

**

|

|

|

|

847,940

|

|

|

Fidelity

Freedom Income Fund*

|

|

Mutual

fund

|

|

|

50,517

|

|

|

|

**

|

|

|

|

505,671

|

|

|

Fidelity

Managed Income Portfolio*

|

|

Common

collective trust fund

|

|

|

15,247,227

|

|

|

|

**

|

|

|

|

14,654,760

|

|

|

Fidelity

U.S. Bond Index Fund*

|

|

Mutual

fund

|

|

|

509,122

|

|

|

|

**

|

|

|

|

5,518,886

|

|

|

Munder

Mid-Cap Core Growth Class Y

|

|

Mutual

fund

|

|

|

145,360

|

|

|

|

**

|

|

|

|

2,690,620

|

|

|

Neuberger

Berman Genesis Trust

|

|

Mutual

fund

|

|

|

327,863

|

|

|

|

**

|

|

|

|

10,645,724

|

|

|

Spartan

U.S. Equity Index Fund

|

|

Mutual

fund

|

|

|

239,923

|

|

|

|

**

|

|

|

|

7,845,472

|

|

|

Victory

SPL Value I

|

|

Mutual

fund

|

|

|

2,481

|

|

|

|

**

|

|

|

|

27,023

|

|

|

Coach,

Inc. Common Stock*

|

|

Common

stock

|

|

|

786,219

|

|

|

|

**

|

|

|

|

21,134,591

|

|

|

Participant

loans*

|

|

Loans

to participants with interest rates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ranging

from 3.25% to 8.25% and with

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

maturity

dates to August 28, 2018.

|

|

|

-

|

|

|

|

|

|

|

|

2,408,885

|

|

|

Other

in-transit investment

|

|

|

|

|

|

|

|

|

|

|

|

|

42,901

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

$

|

106,308,236

|

|

*

Represents a party-in-interest to the Plan

** Not

required as the investment is Participant-directed

COACH,

INC. SAVINGS AND PROFIT SHARING PLAN

EXHIBITS

TO FORM 11-K

For the

Plan Year Ended June 30, 2009

Commission

File No. 1-16153

Exhibits

(numbered in accordance with Item 601 of Regulation S-K)

|

Exhibit

Number

|

Description

|

|

|

|

|

23.1

|

Consent

of Independent Registered Public Accounting

Firm

|

COACH,

INC. SAVINGS AND PROFIT SHARING PLAN

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Plan Committee

has duly caused this annual report to be signed on its behalf by the undersigned

hereunto duly authorized.

Coach,

Inc. Savings and Profit Sharing Plan

(Name of

Plan)

|

|

/s/ Sarah

Dunn

|

|

|

Sarah

Dunn

|

|

|

Plan

Administrator

|

|

|

|

|

|

December

17, 2009

|

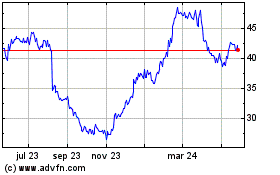

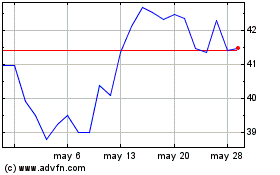

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024