U.S. Bank Hires El-Yafi to Lead New Global Transaction Services Group

28 Enero 2025 - 9:30AM

Business Wire

Accomplished global financial services

executive will drive efforts to create an interconnected, focused

approach to serving clients’ international banking and payment

needs

U.S. Bank has named international banking leader Tarek El-Yafi

as head of U.S. Bank Global Transaction Services, a new group

created to help meet the growing international banking and payment

needs of clients.

El-Yafi joins U.S. Bank after more than 25 years at Standard

Chartered Bank and Citi. El-Yafi has deep experience in the U.S.,

UK and Asia, Africa and the Middle East with transaction banking,

payments, foreign exchange (FX), treasury management and trade

services.

“We’ve built strong global banking and payment solutions that

many firms utilize to operate more efficiently across the world.

Global Transaction Services will interconnect our expertise from

across the bank to meet the growing international financial

services needs of U.S. businesses,” said U.S. Bancorp President

Gunjan Kedia. “Tarek is an accomplished leader with a strong track

record of delivering innovative global money movement

solutions.”

The Global Transaction Services team will work in close

partnership with bankers covering all segments, as well as existing

businesses across U.S. Bank – including Global Treasury Management,

Working Capital Finance, Foreign Exchange, Elavon and others – in

commercializing their international capabilities. A key area of

focus will be U.S.-based clients’ efforts to control cross-border

payment costs via more efficient conversion to more than 60

currencies reaching more than 100 countries. Global Transaction

Services will also help optimize clients’ use of cross-border trade

working capital solutions, foreign deposit accounts, interest rate

risk management products and payment acceptance solutions.

With the launch of Global Transaction Services, U.S. Bank is

building on its growing global banking and payments presence. In

addition to facilitating cross-border payments for a wide-range of

clients, U.S. Bank in recent years has doubled the size of its FX

hedging business. The bank has a growing fund administration

service in Europe and is also one of the leading European trustee

and agency providers, helping financial institutions and

corporations manage overseas trust assets and navigate European

debt and loan markets. The bank’s payment acceptance and processing

subsidiary, Elavon, serves businesses in more than 36 countries and

100 currencies.

“U.S. Bank has very deep relationships with the nation’s leading

companies. With Global Transaction Services, we’ll work together to

help them operate more efficiently around the globe by optimizing

areas like cross-border payments, foreign deposit accounts and

broader working capital solutions,” said El-Yafi.

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $678 billion

in assets as of December 31, 2024, is the parent company of U.S.

Bank National Association. Headquartered in Minneapolis, the

company serves millions of customers locally, nationally and

globally through a diversified mix of businesses including consumer

banking, business banking, commercial banking, institutional

banking, payments and wealth management. U.S. Bancorp has been

recognized for its approach to digital innovation, community

partnerships and customer service, including being named one of the

2024 World’s Most Ethical Companies and Fortune’s most admired

superregional bank. Learn more at usbank.com/about.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128673579/en/

Todd Deutsch, U.S. Bank Public Affairs and Communications

todd.deutsch@usbank.com

US Bancorp (NYSE:USB)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

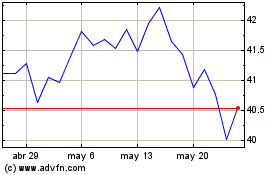

US Bancorp (NYSE:USB)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025