As filed with the Securities and Exchange Commission, November 20, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

FORM S-8

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

____________

W. P. CAREY INC.

(Exact name of registrant as specified in its charter)

____________

| | | | | |

| Maryland | 45-4549771 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| |

| One Manhattan West, 395 9th Avenue, 58th Floor | |

| New York, New York | 10001 |

| (Address of Principal Executive Offices) | (Zip code) |

____________

W. P. Carey Inc. Non-Employee Director Stock Election Plan

(Full title of the plan)

____________

Jason E. Fox

Chief Executive Officer

W. P. Carey Inc.

One Manhattan West, 395 9th Avenue, 58th Floor

New York, New York 10001

Telephone: (212) 492-1100

(Name, address and telephone number, including area code, of agent for service)

____________

Copies of communications to:

Jeffrey G. Aromatorio, Esq.

Reed Smith LLP

Reed Smith Centre

225 Fifth Avenue

Pittsburgh, Pennsylvania 15222-2716

Telephone: (412) 288-3364

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o

Smaller reporting company o Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in Part I are not required to be filed with the Securities and Exchange Commission (the “Commission”) as part of this Form S-8 Registration Statement in accordance with Rule 428 of the Securities Act of 1933, as amended (the “1933 Act”). The documents containing information specified in the instructions to Part I of Form S-8 will be sent or given to individuals participating in the W. P. Carey Inc. Non-Employee Director Stock Election Plan as specified by Rule 428(b)(1) of the 1933 Act. Those documents and the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the 1933 Act.

PART II

INFORMATION REQUIRED IN THE

REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents filed by the registrant (the “Company”) with the Commission are incorporated by reference in this Registration Statement:

(a) The Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Commission on February 10, 2023;

(b) The Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the Commission on April 28, 2023, the Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the Commission on July 28, 2023 and the Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the Commission on November 3, 2023;

(c) The Company’s Current Reports on Form 8-K and Form 8-K/A filed on April 24, 2023, June 20, 2023, September 21, 2023 (except Item 7.01), November 2, 2023 (except Item 7.01), November 3, 2023 (except Item 7.01) and November 7, 2023; and

(d) The description of our Securities set forth in Exhibit 4.22 of our Annual Report on Form 10-K filed with the SEC on February 21, 2020, and any amendments thereto or reports that we may file in the future for the purpose of updating such description.

All documents subsequently filed by the registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (other than portions of those documents furnished or otherwise not deemed to be filed), prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in this Registration Statement or in any other contemporaneously or subsequently filed document which also is or is deemed to be incorporated by reference in this Registration Statement modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Maryland law permits a Maryland corporation to include in its charter a provision limiting the liability of its directors and officers to the corporation and its stockholders for money damages, except for liability resulting from:

| | | | | | | | | | | |

| • | | actual receipt of an improper benefit in money, property or services; or |

| • | | active and deliberate dishonesty established by a final judgment and which is material to the cause of action. |

The Company’s charter contains such a provision that eliminates directors’ and officers’ liability for money damages to the maximum extent permitted by Maryland law. These limitations of liability do not apply to liabilities arising under the federal securities laws and do not generally affect the availability of equitable remedies such as injunctive relief or rescission. The Company’s charter and bylaws also provide that the Company must indemnify (to the maximum extent permitted by Maryland law), and pay or reimburse reasonable expenses in advance of final disposition of a proceeding to, any individual who is a present or former director or officer of the Company or a predecessor of the Company from and against any claim or liability to which such person may become subject or which such person may incur by reason of his or her service in such capacity as a director or officer. Additionally, the Company’s charter provides that the Company may, with the approval of the board of directors, indemnify, if and to the extent determined to be authorized and appropriate in accordance with applicable law, any person permitted, but not required, to be indemnified under Maryland law by the Company or a predecessor of the Company.

Maryland law requires a corporation (unless its charter provides otherwise, which the Company’s charter does not) to indemnify a director or officer who has been successful in the defense of any proceeding to which he or she was made, or was threatened to be made, a party by reason of his or her service in that capacity. Maryland law permits a corporation to indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made, or threatened to be made, a party by reason of their service in those or other capacities unless it is established that:

| | | | | | | | | | | |

| • | | the act or omission of the director or officer was material to the matter giving rise to the proceeding and (a) was committed in bad faith or (b) was the result of active and deliberate dishonesty; |

| • | | the director or officer actually received an improper personal benefit in money, property or services; or |

| • | | in the case of any criminal proceeding, the director or officer had reasonable cause to believe that the act or omission was unlawful. |

However, under Maryland law, a Maryland corporation may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis of that personal benefit was improperly received, unless in either case a court orders indemnification and then

only for expenses. In addition, Maryland law permits a corporation to advance reasonable expenses to a director or officer upon the corporation’s receipt of:

| | | | | | | | | | | |

| • | | a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation; and |

| • | | a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the corporation if it is ultimately determined that the standard of conduct was not met. |

The Company has adopted an Indemnification Policy applicable to its officers and Directors. The Indemnification Policy requires, among other things, that the Company indemnify its (or any predecessor company’s) officers and Directors, to the fullest extent permitted by Maryland law, against all reasonable costs, charges, and expenses (including attorney’s fees), judgments, penalties, fines, and settlements (if such settlement is approved in advance by the Company) actually and reasonably incurred in connection with the defense and/or settlement of any threatened, pending, or completed suit, action, or proceeding, and to advance to such officers and Directors all related reasonable costs, charges and expenses (including attorney’s fees) incurred by them in connection therewith, subject to reimbursement if it is subsequently determined that indemnification is not permitted. The Company must also advance all reasonable costs, charges and expenses incurred by officers and Directors seeking to enforce their rights to advancement under the Indemnification Policy and may cover officers and Directors under the Company’s Directors and officers liability insurance. Although the Indemnification Policy offers substantially the same scope of coverage afforded by provisions in the Company’s charter and bylaws, it provides greater assurance to officers and Directors that indemnification will be available, because it cannot be modified unilaterally in the future by the Board of Directors or by the stockholders to eliminate the rights that it provides with respect to existing facts.

Insofar as the foregoing provisions permit indemnification of directors, executive officers or persons controlling us for liability arising under the 1933 Act, the Company has been informed that, in the opinion of the Commission, this indemnification is against public policy as expressed in the 1933 Act and is therefore unenforceable.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. Exhibits.

The following exhibits are filed herewith or incorporated by reference as part of the registration Statement:

| | | | | |

| Exhibit Number | Description |

| 4.1 | Articles of Amendment and Restatement of W. P. Carey Inc., incorporated by reference to Exhibit 3.1 to Registrant’s Current Report on Form 8-K filed with the SEC on June 16, 2017 (File No. 001-13779). |

| |

| 4.2 | Fifth Amended and Restated Bylaws of W. P. Carey Inc., incorporated by reference to Exhibit 3.2 to Registrant’s Current Report on Form 8-K filed with the SEC on June 16, 2017 (File No. 001-13779). |

| |

| 4.3 | Form of Common Stock Certificate, incorporated by reference to Exhibit 4.1 to Registrant’s Annual Report on Form 10-K for the year ended December 31, 2012 filed February 26, 2013 (File No. 001-13779). |

| |

| 4.4 | W. P. Carey Inc. Non-Employee Director Stock Election Plan.* |

| |

| 5.1 | Opinion of Reed Smith LLP.* |

| |

| 23.1 | Consent of Reed Smith LLP (included in the opinion filed as Exhibit 5.1 to this registration statement).* |

| |

| 23.2 | Consent of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm.* |

| |

| 24.1 | Power of Attorney (included on signature page hereto).* |

| |

| 107 | Filing Fee Table.* |

| |

| _________________ |

| |

| * | Filed herewith. |

Item 9. Undertakings.

(a) Rule 415 offering.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post‑effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the 1933 Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post‑effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post‑effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the 1934 Act that are incorporated by reference in the registration statement;

(2) That, for the purpose of determining any liability under the 1933 Act, each such post‑effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(3) To remove from registration by means of a post‑effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) Filings incorporating subsequent 1934 Act Documents by Reference.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the 1933 Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the 1934 Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the 1934 Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Filing of Registration Statement on Form S-8.

Insofar as indemnification for liabilities arising under the 1933 Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the 1933 Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the 1933 Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York on November 20, 2023.

| | | | | | | | | | | |

| | W. P. CAREY INC. |

| | | |

| | By: | /s/ Jason E. Fox |

| | | Jason E. Fox |

| | | Chief Executive Officer |

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Jason E. Fox, ToniAnn Sanzone and Susan C. Hyde, his or her true and lawful attorneys-in-fact and agents, each acting alone, with full powers of substitution and resubstitution, for him or her or in his or her name, place and stead, in any and all capacities to sign any and all amendments or post-effective amendments to this registration statement and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, each acting alone, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, each acting alone, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated, as of November 20, 2023.

| | | | | |

| Signature | Title |

| |

| /s/ Jason E. Fox | Chief Executive Officer and Director |

| Jason E. Fox | (Principal Executive Officer) |

| |

| |

| /s/ ToniAnn Sanzone | Chief Financial Officer |

| ToniAnn Sanzone | (Principal Financial Officer) |

| |

| |

| /s/ Brian Zander | Chief Accounting Officer |

| Brian Zander | (Principal Accounting Officer) |

| |

| | | | | |

| |

| /s/ Christopher J. Niehaus | Chair of the Board and Director |

| Christopher J. Niehaus | |

| |

| |

| /s/ Mark A. Alexander | Director |

| Mark A. Alexander | |

| |

| |

| /s/ Constantine H. Beier | Director |

| Constantine H. Beier | |

| |

| |

| /s/ Tonit M. Callaway | Director |

| Tonit M. Callaway | |

| |

| |

| /s/ Peter J. Farrell | Director |

| Peter J. Farrell | |

| |

| |

| /s/ Robert J. Flanagan | Director |

| Robert J. Flanagan | |

| |

| |

| /s/ Margaret G. Lewis | Director |

| Margaret G. Lewis | |

| |

| |

| /s/ Elisabeth Stheeman | Director |

| Elisabeth Stheeman | |

| |

| |

| /s/ Nick J.M. van Ommen | Director |

| Nick J.M. van Ommen | |

Exhibit Index

(Pursuant to Item 601 of Regulation S-K)

| | | | | |

Exhibit

No. | Description |

| 4.1 | |

| |

| 4.2 | |

| |

| 4.3 | |

| |

| 4.4 | |

| |

| 5.1 | |

| |

| 23.1 | |

| |

| 23.2 | |

| |

| 24.1 | Power of Attorney (included on signature page hereto).* |

| |

| 107 | |

______________

* Filed herewith.

W. P. Carey Inc.

Non-Employee Director Stock Election Plan

Article I – General Provisions

Section 1.1 – Establishment and Purpose

W. P. Carey Inc. (the “Company”) established and maintains the W. P. Carey Inc. Non-Employee Director Stock Election Plan (the “Plan”) pursuant to which each member of the Board (as hereinafter defined) who is not an employee of the Company or any of its subsidiaries (a “Non-Employee Director”) shall be eligible: (a) to elect to receive shares of the Company’s common stock, par value $.001 per share (the “Common Stock”), in lieu of cash compensation; and (b) through an election to defer receipt of compensation to be earned by such Non-Employee Director, to have Restricted Stock Units (as hereinafter defined) credited to an account established for such Non-Employee Director by the Company in compliance with Section 409A (as hereinafter defined). The purpose of the Plan is to assist the Company in attracting, retaining and motivating highly qualified Non-Employee Directors and to promote identification of, and align Non-Employee Directors’ interests more closely with, the interests of the shareholders of the Company.

Section 1.2 – Definitions

In addition to the terms previously or hereinafter defined, the following terms when used herein shall have the meaning set forth below:

1.“Board” shall mean the Board of Directors of the Company.

2.“Code” shall mean the Internal Revenue Code of 1986, as amended, or any successor statute thereto.

3.“Committee” shall mean the committee of the Board appointed by the Board to administer the Plan. Unless otherwise determined by the Board, the Committee shall be the Compensation Committee of the Board.

4.“Compensation” shall mean all cash fees to be paid to a Non-Employee Director for service rendered to the Company as a director (including services on any Committee of the Board for which committee fees are specifically authorized).

5.“Fair Market Value” shall mean, as of any date, the closing price for the Common Stock as reported in the New York Stock Exchange—Composite Transactions reporting system for the date in question or, if no sales were effected on such date, on the next preceding date on which sales were effected.

6.“Plan Year” shall mean the twelve-month period beginning January 1 and ending December 31 in any particular year.

7.“Restricted Stock Unit” shall mean a unit that is equivalent to one share of Common Stock.

8.“Section 409A” shall mean Section 409A of the Code, the regulations and other binding guidance promulgated thereunder.

9.“Separation from Service” shall mean the Non-Employee Director’s death, retirement or other termination of service with the Company and all of its controlled group members within the meaning of Section 409A. For purposes hereof, the determination of controlled group members shall be made pursuant to the provisions of Section 414(b) and 414(c) of the Code; provided that the language “at least 50 percent” shall be used instead of “at least 80 percent” in each place it appears in Section 1563(a)(1), (2) and (3) of the Code and Treas. Reg. § 1.414(c)-2. Whether the Non-Employee Director has a Separation from Service will be determined based on all of the facts and circumstances and in accordance with the guidance issued under Section 409A.

Section 1.3 – Administration

The Plan shall be administered by the Committee. The Committee shall serve at the pleasure of the Board. A majority of the Committee shall constitute a quorum, and the acts of a majority of the members of the Committee present at any meeting at which a quorum is present, or acts approved in writing by a majority of the members of the Committee, shall be deemed the acts of the Committee. The Committee is authorized and has sole authority and discretion to interpret and construe the Plan, to make all determinations and take all other actions necessary or advisable for the administration of the Plan, and to delegate to employees of the Company or any subsidiary the authority to perform administrative functions under the Plan; provided, however, that the Committee shall have no authority to determine the persons entitled to receive Common Stock or Restricted Stock Units under the Plan nor the timing, amount or price of Common Stock or Restricted Stock Units issued under the Plan.

Section 1.4 – Eligibility

An individual who is a Non-Employee Director shall be eligible to participate in the Plan.

Section 1.5 – Common Stock Subject to the Plan

The maximum number of shares of Common Stock that may be issued pursuant to the Plan is 200,000. Common Stock to be issued under the Plan may be either authorized and unissued shares of Common Stock or shares reacquired by the Company.

Article II – Elections and Distributions

Section 2.1 – Elections to Receive Common Stock from Compensation

Any Non-Employee Director may elect in writing, on a form prescribed by the Committee, to receive Common Stock under this Plan in lieu of all or a portion of the Compensation otherwise payable to such Non-Employee Director in any Plan Year (a “Stock Acquisition Election”). If a Non-Employee Director makes a Stock Acquisition Election, the Non-Employee Director shall receive, as of the date that the Compensation otherwise would have been paid, the number of shares of Common Stock (including through the issuance of fully vested restricted stock or units) that could have been purchased on that date based on the amount of Compensation subject to the Stock Acquisition Election and the Fair Market Value of the Common Stock on that date, rounded down to the nearest whole share. In the absence of a Stock Acquisition Election or a Stock Unit Election (as hereinafter defined), all Compensation shall be paid to the Non-Employee Director in cash in accordance with the Company’s policies and procedures.

Section 2.2 – Elections to Receive Restricted Stock Units

Any Non-Employee Director may elect in writing, on a form prescribed by the Committee, to receive Restricted Stock Units under this Plan in any Plan Year with respect to all of the Compensation otherwise payable to the Non-Employee Director in that Plan Year (a “Stock Unit Election”). If a Non-Employee Director makes a Stock Unit Election, an account established for the Non-Employee Director and maintained by the Company shall be credited with that number of Restricted Stock Units equal to the number of shares of Common Stock (rounded down to the nearest whole share) that could have been purchased with the amount of Compensation subject to a Stock Unit Election based on the Fair Market Value of the Common Stock on the day that the Compensation would have been paid to the Non-Employee Director. The Committee may establish one or more accounts for a Non-Employee Director as deemed necessary or appropriate for the proper administration of the Plan.

Section 2.3 – Terms and Conditions of Elections

A Stock Acquisition Election or Stock Unit Election (an “Election”) shall be subject to the following terms and conditions, as applicable:

a.An Election for a Plan Year shall be in writing and shall be irrevocable for the applicable Plan Year; and

b.An Election shall be effective for any Plan Year only if made on or prior to December 31st of the calendar year immediately preceding the beginning of the Plan Year to which the Election relates (or such other date as permitted by the Committee to the extent consistent with Section 409A). A Non-Employee Director who first becomes eligible to participate in the Plan may file an Election (“Initial Election”) at any time prior to

the 30-day period following the date on which the Non-Employee Director initially becomes eligible to participate in the Plan, and a Non-Employee Director may file an Initial Election within 30-days prior to the effective date of the Plan, subject to applicable rules of the Committee. With respect to a Stock Unit Election, any such Initial Election shall only apply to Compensation earned and payable for services rendered after the date on which the Stock Unit Election is delivered to the Company; and

c.Except as otherwise specifically provided in an Election form, an Election shall remain in effect for the initial Plan Year to which it applies and for future Plan Years until and unless such Election is superseded.

Section 2.4 – Adjustment of Restricted Stock Unit Accounts

a.Dividends and Distributions — Any dividend or distribution equivalents payable with respect to deferred Restricted Stock Units shall be deferred, and the Non-Employee Director’s Stock Unit account shall be credited with additional Restricted Stock Units equal to the number of shares of Common Stock (rounded down to the nearest whole share) that could have been purchased on that date with the cash dividends paid on the number of shares of Common Stock equal to the number of Restricted Stock Units in such Non-Employee Director’s account based on the Fair Market Value of the Common Stock or, in the case of stock dividends, which would have been distributable on the Common Stock represented by Restricted Stock Units if such shares of Common Stock had been outstanding on the date fixed for determining the shareholders entitled to receive such stock dividend.

b.Adjustments — In the event that the outstanding shares of Common Stock of the Company shall be changed into or exchanged for a different number or kind of shares of stock or other securities of the Company or of another corporation, whether through reorganization, recapitalization, stock split-up, combination of shares, merger or consolidation, then there shall be substituted, for the shares of Common Stock represented by Restricted Stock Units, the number and kind of shares of stock or other securities which would have been substituted therefor if such shares of Common Stock had been outstanding on the date fixed for determining the shareholders entitled to receive such changed or substituted stock or other securities. In the event there shall be any change, other than specified in this Section 2.4, in the number or kind of outstanding shares of Common Stock of the Company or of any stock or other securities into which such Common Stock shall be changed or for which it shall have been exchanged, then, if the Board shall determine, in its discretion, that such change equitably requires an adjustment in the number of Restricted Stock Units or the Common Stock represented by such Restricted Stock Units, such adjustment shall be made by the Board and shall be effective and binding for all purposes of the Plan and on each outstanding account.

Section 2.5 – Change in Control

In the event of any threatened or actual change in control of the Company (as set forth in the W. P. Carey Inc. 2017 Share Incentive Plan or any successor plan), issued and outstanding shares of Common Stock equal to the aggregate number of Restricted Stock Units in each Non-Employee Director’s Stock Unit account shall be contributed to a “rabbi trust” (within the meaning of Rev. Proc. 92 64) established by the Company. Any such trust shall be established as a grantor trust, of which the Company is the grantor, within the meaning of subpart E, part I, subchapter J, chapter 1, subtitle A of the Internal Revenue Code of 1986. Notwithstanding the foregoing provisions of this Section 2.5 or any provision of the Plan to the contrary: (i) no assets shall be set aside in the deferred compensation trust or any other trust if the provisions of such trust restrict the assets of the trust in a manner that would result in a transfer of property as provided under Section 409A(b)(2) of the Code (relating to the employer’s financial health) or Section 409A(b)(3) of the Code (relating to the funding status of the employer’s defined benefit plans); and (ii) no contribution to any such trust may be made during any “restricted period” within the meaning of Section 409A(b)(3) of the Code.

Section 2.6 – Distribution of Restricted Stock Units

The distribution of Restricted Stock Unit accounts shall be subject to the following terms and conditions:

Unless a Non-Employee Director has selected a different payment option as may be permitted and as set forth in a deferral election form, within 30 days following the date of such Non-Employee Director’s Separation from Service, the Company shall issue to such Non-Employee Director that number of shares of Common Stock equal to the whole number of Restricted Stock Units in such Non-Employee Director’s Stock Unit account and cash equal to any fractional Restricted Stock Units in such account multiplied by the Fair Market Value of the Common Stock as of the date immediately preceding the date of payment; provided that if such 30 day period spans two calendar years then payment will be made in the second taxable year.

Article III – Miscellaneous Provisions

Section 3.1 – Amendment and Discontinuance

The Board may alter, amend, suspend or discontinue the Plan, provided that no such action shall deprive any person without such person’s consent of any rights theretofore granted pursuant hereto. Notwithstanding the foregoing or any provision of this Plan to the contrary, the Board may, in its sole discretion and without the Non-Employee Director’s consent, modify or amend the terms of the Plan or an Election, or take any other action it deems necessary or advisable, to cause the Plan to comply with Section 409A (or an exception thereto). The Board shall submit proposed amendments to the Plan to the shareholders of the Company for approval if such approval is required in order for the Plan to comply with Rule 16b-3 of the Securities Exchange Act of 1934 (the “Exchange Act”) (or any successor rule).

Section 3.2 – Compliance with Governmental Regulations

Notwithstanding any provision of the Plan or the terms of any agreement entered into pursuant to the Plan, the Company shall not be required to issue any shares hereunder prior to registration of the shares subject to the Plan under the Securities Act of 1933 or the Exchange Act, if such registration shall be necessary or before compliance by the Company or any participant with any other provisions of either of those acts or of regulations or rulings of the Securities and Exchange Commission thereunder, or before compliance with other federal and state laws and regulations and rulings thereunder, including the rules of the New York Stock Exchange, Inc. The Company shall use its best efforts to effect such registrations and to comply with such laws, regulations and rulings forthwith upon advice by its counsel that any such registration or compliance is necessary.

Section 3.3 – Compliance with Section 16

With respect to persons subject to Section 16 of the Exchange Act, transactions under this Plan are intended to comply with all applicable conditions of Rule 16b-3 (or its successor rule). To the extent that any provision of the Plan or any action by the Board or the Committee fails to so comply, it shall be deemed amended to the extent permitted by law and to the extent deemed advisable by the Committee.

Section 3.4 – Non-Alienation of Benefits

No right or interest of a Non-Employee Director in a Restricted Stock Unit account under the Plan may be sold, assigned, transferred, pledged, encumbered or otherwise disposed of except as expressly provided in the Plan; and no interest or benefit of any Non-Employee Director under the Plan shall be subject to the claims of creditors of the Non-Employee Director.

Section 3.5 – Withholding Taxes

To the extent required by applicable law or regulation, each Non-Employee Director must arrange with the Company for the payment of any federal, state or local income or other tax applicable to the receipt of Common Stock or Restricted Stock Units under the Plan before the Company shall be required to deliver to the Non-Employee Director a certificate for Common Stock free and clear of all restrictions under the Plan.

Section 3.6 – Funding

No obligation of the Company under the Plan shall be secured by any specific assets of the Company, nor shall any assets of the Company be designated as attributable or allocated to the satisfaction of any such obligation. To the extent that any person acquires a right to receive payments from the Company under the Plan, such right shall be no greater than the right of any unsecured creditor of the Company. Notwithstanding any provision of this Plan to the contrary, if the Company maintains a separate trust fund or otherwise set asides assets to assure its ability to pay any benefits due under this Plan, neither the Non-Employee Director nor the Non-Employee Director’s beneficiary shall have any legal or equitable ownership interest in, or lien on, such trust fund, investment or any other asset of the Company.

Section 3.7 – Section 409A

a.The provisions of this Plan and all elections made hereunder shall be administered, interpreted and construed in a manner necessary in order to comply with Section 409A or an exception thereto (or disregarded to the extent such provision cannot be so administered, interpreted or construed). It is intended that distribution events authorized under this Plan qualify as a permissible distribution events for purposes of Section 409A, and the Plan shall be interpreted and construed accordingly in order to comply with Section 409A. The Company reserves the right to accelerate, delay or modify distributions to the extent permitted under Section 409A.

b.For purposes of Section 409A and the Plan: (i) the right to installment payments shall be treated as the right to a single payment for purposes of distribution and/or deferral elections; and (ii) a payment shall be treated as made on the scheduled payment date if such payment is made at such date or a later date in the same calendar year or, if later, by the 15th day of the third calendar month following the scheduled payment date. Except as specified in Section 2.6, a Non-Employee Director shall have no right to designate the date of any payment under the Plan. Notwithstanding any provision herein to the contrary, if a Non-Employee Director is a “specified employee” for purposes of Section 409A (as determined in accordance with the procedures established by the Company), any payment to the Non-Employee Director due upon Separation from Service will be delayed for a period of six months after the date of the Non-Employee Director’s Separation from Service (or, if earlier, the death of the Non-Employee Director). Any payment that would otherwise have been due or owing during such six month period will be paid on the first business day of the seventh month following the date of Separation from Service.

Section 3.8 – Governing Law

The Plan shall be governed by and construed and interpreted in accordance with the internal laws of the State of New York, without regard to its conflict of law provisions.

Section 3.9 – Effective Date of Plan

The Plan shall be adopted as of September 14, 2023, with elections effective for the Plan Year beginning January 1, 2024.

Exhibit 5.1 and 23.1

November 20, 2023

W. P. Carey Inc.

One Manhattan West, 395 9th Avenue

58th Floor

New York, New York 10001

Re: Registration Statement on Form S‑8 for W. P. Carey Inc.

W. P. Carey Inc. Non-Employee Director Stock Election Plan

Ladies and Gentlemen:

We have acted as counsel to W. P. Carey Inc., a Maryland corporation (the “Company”), in connection with the registration under the Securities Act of 1933 (the “Act”) on Form S-8 (the “Registration Statement”) of the issuance by the Company from time to time of up to 100,000 shares of its Common Stock, par value $0.001 per share (the “Shares”) under the Company’s Non-Employee Director Stock Election Plan (the “Plan”).

We have examined such corporate records, certificates and other documents, and such questions of law as we have considered necessary or appropriate for the purposes of this opinion, including, without limitation, (a) the Articles of Incorporation of the Company, as presently in effect, (b) the Bylaws of the Company, as presently in effect, (c) the Registration Statement, and (d) the Plan. In making the foregoing examinations, we have assumed the genuineness of all signatures and the authenticity of all documents submitted to us as originals, the conformity to the original documents of all documents submitted to us as copies, and the authority and legal competence of persons who executed such documents. As to the various questions of fact material to this opinion, we have relied, to the extent deemed reasonably appropriate, upon representations of officers or directors of the Company and upon documents, records, and instruments furnished to us by the Company, without independently checking or verifying the accuracy of such documents, records, and instruments. Upon the basis of such examination, we advise you that, in our opinion, the Shares have been duly authorized, and when the Registration Statement has become effective under the Act and when the Shares have been duly issued in accordance with the Plan, the Shares will be validly issued, fully paid and nonassessable.

The foregoing opinion is limited to the Federal laws of the United States and the laws of the State of Maryland, and we are expressing no opinion as to the effect of the laws of any other jurisdiction.

This opinion is rendered solely in connection with the transactions covered hereby, is limited to the matters stated herein, and no opinions may be implied or inferred beyond the matters expressly stated herein.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

| | |

| Yours truly, |

|

| /s/ Reed Smith LLP |

|

| REED SMITH LLP |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of W. P. Carey Inc. of our report dated February 10, 2023 relating to the financial statements, financial statement schedules and the effectiveness of internal control over financial reporting, which appears in W. P. Carey Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022.

/s/ PricewaterhouseCoopers LLP

New York, New York

November 20, 2023

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

W. P. Carey Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity | | Security Class Title | | Fee Calculation Rule | | Amount Registered (1) | | Proposed Maximum Offering Price Per Share | | Maximum Aggregate Offering Price | | Fee Rate | | Amount of Registration Fee |

| Equity | | Common Stock, $0.001 par value per share | | Rule 457(c) and Rule 457(h) | | 100,000 | | $55.23 (2) | | $5,523,000 | | $0.0001476 | | $815.19 |

| Total Offering Amounts | | | | | | $5,523,000 | | | | $815.19 |

| Total Fee Offsets | | | | | | | | | | — |

| Net Fee Due | | | | | | | | | | $815.19 |

__________

(1)Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an indeterminate amount of any additional shares of the Common Stock W. P. Carey Inc. (the “Registrant”) that may be offered or issued under the W. P. Carey Inc. Non-Employee Director Stock Election Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction.

(2)Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) of the Securities Act. The proposed maximum offering price per share and the proposed maximum aggregate offering price are calculated based on the average of the high and low prices of the Registrant’s Common Stock as reported on the New York Stock Exchange on November 14, 2023.

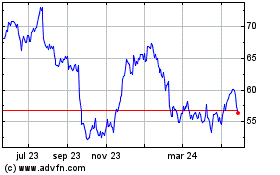

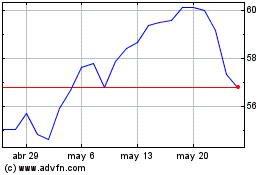

WP Carey (NYSE:WPC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

WP Carey (NYSE:WPC)

Gráfica de Acción Histórica

De May 2023 a May 2024