- Q1 2024 revenues reached €463.2 million, +8% Year-on-Year

(YoY), and +11% at constant currency.

- By segment, the Zegna segment recorded positive performance,

driven by the ZEGNA brand.

- By distribution channel, Direct-to-Consumer (DTC) drove the

Group’s revenues.

- By geographical area, the Americas led revenues for the

quarter, continuing the Group’s strength there.

- In line with the outlook provided on April 5, 2024, revenues

on an organic growth basis3 declined by 5%, driven by Thom Browne

underperformance.

Ermenegildo Zegna N.V. (NYSE:ZGN) (the “Company” and, together

with its consolidated subsidiaries, the “Ermenegildo Zegna Group”

or the “Group”) today announced unaudited revenues of €463.2

million for the first quarter of 2024, +8.1% year-on-year (YoY)

from €428.3 million in the first quarter of 2023 (+10.7% at

constant currency and -5.3% on an organic growth basis4.)

Ermenegildo “Gildo” Zegna, Chairman and CEO of the Ermenegildo

Zegna Group, said: “Closing the first quarter of 2024 with

double-digit revenue growth on a constant currency basis is

reassuring given the challenges that the sector is facing. Our

growth in the Americas - also in double digits - and the ongoing

successful delivery on our ZEGNA One Brand strategy give me

additional assurance that we are moving in the right direction. I

am confident in the decisions we are making to accelerate our

direct control of the business, in particular at Thom Browne and

TOM FORD FASHION, and we have also reinforced our talent and

leadership across all levels, knowing how critical our people are

to delivering results. Finally, we are continuing our focus on

clienteling and customer experience, both of which will further

strengthen the long-term value of all our brands.

A highlight of our efforts to provide unforgettable experiences

was the launch in Milan of Oasi Zegna, an immersive exhibition that

we brought to life at the Group’s headquarters during Salone del

Mobile. Over 26,000 people visited the installation throughout the

week – an impressive indicator of the ZEGNA brand’s strength.

Looking at the rest of the year, we have a clear and defined

path in front of us. I am confident that we are taking the right

actions to make our brands even stronger and to deliver on our

medium-term ambitions.”

Revenues Analysis for the Three Months

Ended March 31, 2024

REVENUES BY SEGMENT (Unaudited)

For the three months ended

March 31,

Q1 2024 vs Q1 2023

(€ thousands, except percentages)

2024

2023

Revenues Growth

Organic Growth

Zegna

324,900

319,324

1.7%

4.3%

Thom Browne

79,066

113,251

(30.2%)

(35.0%)

Tom Ford Fashion

65,020

—

n.m.(*)

n.m.

Eliminations

(5,829)

(4,263)

n.m.

n.m.

Total revenues

463,157

428,312

8.1%

(5.3%)

(*) Throughout this section “n.m.” means

not meaningful.

Zegna segment

In Q1 2024, revenues for the Zegna segment amounted to €324.9

million, compared to €319.3 million in Q1 2023 (+1.7% YoY and +4.3%

on an organic growth basis). The ZEGNA brand revenues outpaced the

growth of the overall segment.

Thom Browne segment

In Q1 2024, revenues for the Thom Browne segment amounted to

€79.1 million, compared to €113.3 million in Q1 2023 (-30.2% YoY

and -35.0% on an organic growth basis). This was the result of

three main factors: i) different timing in deliveries across

quarters; ii) the decision to accelerate the streamlining of the

wholesale business and on doors selection, concentrating the

largest part of these initiatives in the first quarter of the year;

and iii) a lower-than-expected DTC trend in the Greater China

Region, where management has taken important actions intended to

improve performance.

Tom Ford Fashion segment

In Q1 2024, revenues for the Tom Ford Fashion segment amounted

to €65.0 million. 2024 is an important year for the TOM FORD

FASHION team, who is working to set up the foundations to support

the future development of the business. This includes a number of

important projects, such as new store openings in Rome and Beijing,

which are expected to occur in Q3 2024.

REVENUES BY BRAND AND PRODUCT LINE (Unaudited)

For the three months ended

March 31,

Q1 2024 vs Q1 2023

(€ thousands, except percentages)

2024

2023

Revenues Growth

Organic Growth

ZEGNA brand

282,870

271,889

4.0%

6.8%

Thom Browne

79,207

112,552

(29.6%)

(34.4%)

TOM FORD FASHION

65,020

—

n.m.

n.m.

Textile

33,243

33,818

(1.7%)

(0.8%)

Other (1)

2,817

10,053

(72.0%)

(43.6%)

Total revenues

463,157

428,312

8.1%

(5.3%)

________________________________________

(1) Other mainly includes revenues from

agreements with third party brands.

ZEGNA brand

In Q1 2024, revenues for the ZEGNA brand were €282.9 million

+4.0% YoY compared to €271.9 million in Q1 2023 (+6.8% on an

organic growth basis). This increase was driven by healthy growth

in key categories and, in particular, footwear and leisurewear.

Several key regions - mainly EMEA, the Americas and Japan - saw

solid double-digit growth. The Greater China Region recorded single

digit negative growth in the quarter.

Thom Browne

In Q1 2024, revenues for Thom Browne were €79.2 million, -29.6%

YoY compared to €112.6 million in Q1 2023 (-34.4% on an organic

growth basis). The brand recorded strong results in Japan while

EMEA and the Greater China Region underperformed. EMEA, in

particular, was impacted by the decision to reduce the wholesale

business to support the brand’s DTC development.

TOM FORD FASHION

In Q1 2024, revenues for the TOM FORD FASHION business were

€65.0 million, reflecting good performance, mainly in the United

States.

Textile

In Q1 2024, revenues for textile were €33.2 million, -1.7% YoY

compared to €33.8 million in Q1 2023 (-0.8% on an organic growth

basis), as a result of lower textile demand from the luxury goods

sector.

Other Revenues

In Q1 2024, other revenues, which mainly includes revenues for

third-party brands, were €2.8 million, -72.0% YoY compared to €10.1

million in Q1 2023 (-43.6% on an organic growth basis), reflecting

the end of the Tom Ford International distribution license for Tom

Ford Products5, following the acquisition of Tom Ford International

LLC on April 28, 2023.

REVENUES BY DISTRIBUTION CHANNEL (Unaudited)

For the three months ended

March 31,

Q1 2024 vs Q1 2023

(€ thousands, except percentages)

2024

2023

Revenues Growth

Organic Growth

Direct to

Consumer (DTC)

ZEGNA brand

239,615

229,596

4.4%

6.3%

Thom Browne

44,719

42,849

4.4%

(13.9%)

TOM FORD FASHION

43,701

—

n.m.

n.m.

Total Direct to Consumer (DTC)

328,035

272,445

20.4%

3.2%

As a percentage of branded products

(1)

77 %

71 %

Wholesale

branded

ZEGNA brand

43,255

42,293

2.3%

9.3%

Thom Browne

34,488

69,703

(50.5%)

(47.3%)

TOM FORD FASHION

21,319

—

n.m.

n.m.

Total Wholesale branded

99,062

111,996

(11.5%)

(25.9%)

As a percentage of branded products

23 %

29 %

Textile

33,243

33,818

(1.7%)

(0.8%)

Other (2)

2,817

10,053

(72.0%)

(43.6%)

Total revenues

463,157

428,312

8.1%

(5.3%)

________________________________________

(1) Branded products refer to the products

sold under the three brands that the Group operates, through the

DTC or wholesale branded distribution channels.

(2) Other mainly includes revenues from

agreements with third party brands.

DTC Revenues Analysis

In Q1 2024, DTC revenues were €328.0 million, + 20.4% YoY

compared to €272.4 million in Q1 2023 and +3.2% on an organic

growth basis. The integration of the TOM FORD FASHION business

contributed €43.7 million in DTC revenues for the quarter. ZEGNA

brand DTC revenues outperformed the Group’s average with +4.4% YoY

revenue growth and +6.3% on an organic growth basis, fueled by the

brand’s outstanding performance in the Americas and good results in

EMEA. At the end of March, ZEGNA counted 277 Directly Operated

Stores (DOS), including 16 stores in Korea and an additional 4 in

the United States converted to DOS. Thom Browne DTC revenues rose

by 4.4% YoY. Excluding the effect of the acquisition of the Thom

Browne business in Korea (previously accounted in the wholesale

channel), Thom Browne DTC revenues declined by 13.9% on an organic

growth basis. At the end of March 2024, Thom Browne counted 86 DOS,

the same number as the end of December 2023. At the end of March

2024, TOM FORD FASHION counted 54 DOS.

Wholesale Branded Revenues Analysis

In Q1 2024, wholesale branded revenues were €99.1 million,

-11.5% YoY compared to €112.0 million in Q1 2023 (-25.9% on an

organic growth basis). ZEGNA brand wholesale revenues were €43.3

million, +2.3% YoY (+9.3% on an organic growth basis). This

performance has been supported by the new drop collection strategy

with some deliveries postponed to Q1 2024 from Q4 2023 to allow key

wholesale customers to follow the new merchandising calendar, which

will influence FY 2024 deliveries across quarters and may result in

different timing from last year’s deliveries. Thom Browne wholesale

revenues declined to €34.5 million compared to €69.7 million in Q1

2023. Performance in Q1 2024 was negatively impacted by early

deliveries (which occurred in Q4 2023 instead of Q1 2024), a

demanding comparison base, and the decision to streamline the

brand’s wholesale business. TOM FORD FASHION wholesale revenues

were €21.3 million, representing 33% of total TOM FORD FASHION’s

revenues. Wholesale performance was negatively impacted by a shift

in certain deliveries.

REVENUES BY GEOGRAPHICAL AREA (Unaudited)

For the three months ended

March 31,

Q1 2024 vs Q1 2023

(€ thousands, except percentages)

2024

2023

Revenues Growth

Organic Growth

EMEA (1)

156,562

150,108

4.3%

(6.5%)

Americas (2)

114,177

72,407

57.7%

10.3%

Greater China Region

139,399

164,526

(15.3%)

(13.1%)

Rest of APAC (3)

52,434

40,727

28.7%

4.9%

Other (4)

585

544

7.5%

(12.7%)

Total revenues

463,157

428,312

8.1%

(5.3%)

________________________________________

(1) EMEA includes Europe, the Middle East

and Africa.

(2) Americas includes the United States of

America, Canada, Mexico, Brazil and other Central and South

American countries.

(3) Rest of APAC includes Japan, South

Korea, Singapore, Thailand, Malaysia, Vietnam, Indonesia,

Philippines, Australia, New Zealand, India and other Southeast

Asian countries.

(4) Other revenues mainly include

royalties.

In Q1 2024, the Group’s revenues were boosted by a strong

double-digit growth in the Americas, where revenues amounted to

€114.2 million (+57.7% YoY and +10.3% on an organic growth basis),

accounting for 25% of the Group’s revenues. EMEA recorded revenues

of €156.6 million, +4.3% YoY (-6.5% on an organic growth basis,

reflecting a negative performance for Thom Browne) and accounted

for 34% of the Group’s revenues. In Q1 2024, Italy represented

around 40% of revenues in EMEA and underperformed the results of

the region mainly due to Thom Browne. The Greater China Region

recorded revenues of €139.4 million (-15.3% YoY and -13.1% on an

organic growth basis), equal to 30% of the Group’s revenues, with

ZEGNA outperforming the region’s average. Revenues in the rest of

APAC rose by double-digits to €52.4 million (+28.7% YoY and +4.9%

on an organic growth basis), mainly driven by strong performance in

the Japanese market and the aforementioned conversion of the Thom

Browne and ZEGNA Korean monobrand stores from wholesale to

retail.

Group Monobrand(1) Store Network at March 31, 2024

At March 31, 2024

At December 31, 2023

At March 31, 2023

Stores

ZEGNA

Thom Browne

TOM FORD FASHION

Group

ZEGNA

Thom Browne

TOM FORD FASHION

Group

ZEGNA

Thom Browne

Group

EMEA (2)

73

9

5

87

71

9

4

84

67

10

77

Americas

63

7

12

82

59

7

12

78

54

7

61

Greater China Region

81

33

11

125

79

33

10

122

78

29

107

Rest of APAC

60

37

26

123

44

37

25

106

43

16

59

Total Direct to Consumer (DTC)

277

86

54

417

253

86

51

390

242

62

304

EMEA (2)

48

7

16

71

55

7

14

76

58

6

64

Americas

67

3

51

121

63

3

50

116

62

3

65

Greater China Region

13

10

—

23

13

10

—

23

12

10

22

Rest of APAC

4

4

6

14

20

5

6

31

23

22

45

Total Wholesale

132

24

73

229

151

25

70

246

155

41

196

Total

409

110

127

646

404

111

121

636

397

103

500

________________________________________

(1) Monobrand store count includes our

DOSs (which are divided into boutiques and outlets) and our

Wholesale monobrand stores (including also monobrand

franchisees).

(2) Does not include any stores in Russia

at March 31, 2024, December 31, 2023 or at March 31, 2023. Although

some stores may still be operating at March 31, 2024, they have not

been supplied by the Group since February 2022 and have therefore

been excluded from the Group’s store count.

UPCOMING EVENTS

Dividend and AGM

On April 5, 2024, the Group announced that it intends to make a

dividend distribution to the holders of ordinary shares of €0.12

per share, corresponding to a total dividend distribution to

shareholders of approximately €30 million6. This dividend

distribution is subject to the finalization and adoption of the

annual statutory accounts of the Company, provided that the

distribution is permitted under Dutch law and approved at the

Company’s 2024 Annual General Meeting of shareholders, expected to

be held on June 26, 2024.

SELECTED EVENTS FROM THE FIRST QUARTER 2024

Oasi Zegna Milan Take Over

On April 16, 2024, ZEGNA officially launched the BORN IN OASI

ZEGNA book: a timeless document, playbook, and visual tale that

acts as a vessel for the brand’s legacy. The project is much more

than a book. During the Salone del Mobile, the city of Milan’s

Design Week, ZEGNA carried out a number of projects and initiatives

throughout the city, including an immersive exhibition at the

Group’s headquarters, opened to the public, which over 26,000

people attended throughout the week. On April 19, 2024, the brand

also celebrated the official delivery of the new flowerbeds in

Piazza del Duomo, marking the beginning of a new global initiative

that will see the creation of other Oasi Zegna locations around the

world. The project embodies the ethos of ZEGNA, emphasizing the

importance of urban green spaces, biodiversity, and social

responsibility.

Thom Browne Partners with Frette

On April 16, 2024, also during the Salone del Mobile, Thom

Browne used a unique installation to announce the launch of Thom

Browne’s home furnishings collection through a collaboration with

Frette, the 160-year-old Italian label. Renowned for approaching

comfort with the finest fibers and studied details, with products

made by master craftspeople, Frette reflects Thom Browne’s

appreciation of heritage textiles and artisanal techniques. The

collection is available on thombrowne.com and at Thom Browne stores

around the world.

About Ermenegildo Zegna

Group

Founded in 1910 in Trivero, Italy, the Ermenegildo Zegna Group

(NYSE:ZGN) is a global luxury company with a leading position in

the high-end menswear business. Through its three complementary

brands, the Group reaches a wide range of communities and market

segments across the high-end fashion industry, from ZEGNA’s

timeless luxury to the modern tailoring of Thom Browne, to luxury

glamour with TOM FORD FASHION. The Ermenegildo Zegna Group is

internationally recognized for its unique Filiera, owned and

controlled by the Group, which is made up of the finest Italian

textile producers fully integrated with unique luxury manufacturing

capabilities, to ensure superior excellence, quality and innovation

capacity. The Ermenegildo Zegna Group has more than 7,000 employees

and recorded revenues of €1.9 billion in 2023.

Forward Looking

Statements

This communication contains forward-looking statements that are

based on beliefs and assumptions and on information currently

available to the Company. In particular, statements regarding

future financial performance and the Group’s expectations as to the

achievement of certain targeted metrics at any future date or for

any future period are forward-looking statements. In some cases,

you can identify forward-looking statements by the following words:

“may,” “will,” “could,” “would,” “should,” “expect,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “ongoing,” “target,” “seek”, “aspire,”

“goal,” “outlook,” “guidance,” “forecast,” “prospect” or the

negative or plural of these words, or other similar expressions

that are predictions or indicate future events or prospects,

although not all forward-looking statements contain these words.

Any statements that refer to expectations, projections or other

characterizations of future events or circumstances, including

strategies or plans, are also forward-looking statements. These

statements involve risks, uncertainties and other factors that may

cause actual results, levels of activity, performance or

achievements to be materially different from the information

expressed or implied by these forward-looking statements, and, as

such, undue reliance should not be placed on them. Actual results

may differ materially from those expressed in forward-looking

statements as a result of a variety of factors, including: the

recognition, integrity and reputation of our brands; our ability to

anticipate trends and to identify and respond to new and changing

consumer preference; the COVID-19 pandemic or similar public health

crises; international business, regulatory, social and political

risks; the conflict in Ukraine and sanctions imposed onto Russia;

the occurrence of acts of terrorism or similar events, conflicts,

civil unrest or situations of political instability; developments

in Greater China and other growth and emerging markets; our ability

to implement our strategy; recent and potential future

acquisitions; disruption to our manufacturing and logistics

facilities; risks related to the sale of our products through our

direct-to-consumer channel, as well as through points of sale

operated by third parties; our dependence on our local partners to

sell our products in certain markets; fluctuations in the price or

quality of, or disruptions in the availability of, raw materials;

our ability to negotiate, maintain or renew our license or

co-branding agreements with high end third party brands; tourist

traffic and demand; our dependence on certain key senior personnel

as well as skilled personnel; our ability to protect our

intellectual property rights; disruption in our information

technology, including as a result of cybercrime; the theft or

unauthorized use of personal information of our customers,

employees or other parties; fluctuations in currency exchange rates

or interest rates; the level of competition in the industry in

which we operate; global economic conditions and macro events,

including inflation; failures to comply with applicable laws and

regulations; climate change and other environmental impacts and our

ability to meet our customers’ and other stakeholders’ expectations

on environment, social and governance matters; the enactment of tax

reforms or other changes in tax laws and regulations; and other

risks and uncertainties, including those described in our filings

with the SEC.

Most of these factors are outside the Company’s control and are

difficult to predict. In light of the significant uncertainties in

these forward-looking statements, you should not regard these

statements as a representation or warranty by the Company and its

directors, officers or employees or any other person that the

Company will achieve its objectives and plans in any specified time

frame, or at all. The forward-looking statements in this

communication represent the views of the Company as of the date of

this communication. Subsequent events and developments may cause

that view to change. However, while the Company may elect to update

these forward-looking statements at some point in the future, the

Company disclaims any obligation to update or revise publicly

forward-looking statements. You should, therefore, not rely on

these forward-looking statements as representing the views of the

Company as of any date subsequent to the date of this

communication.

Non-IFRS Financial

Measures

The Group’s management monitors and evaluates operating and

financial performance using several non-IFRS financial measures

including: revenues on a constant currency basis (Constant

Currency) and revenues on an organic growth basis (Organic Growth).

The Group’s management believes that these non-IFRS financial

measures provide useful and relevant information regarding the

Group’s financial performance and financial condition, and improve

the ability of management and investors to assess and compare the

financial performance and financial position of the Group with

those of other companies. They also provide comparable measures

that facilitate management’s ability to identify operational

trends, as well as make decisions regarding future spending,

resource allocations and other strategic and operational decisions.

While similar measures are widely used in the industry in which the

Group operates, the financial measures that the Group uses may not

be comparable to other similarly named measures used by other

companies nor are they intended to be substitutes for measures of

financial performance or financial position as prepared in

accordance with IFRS.

Revenues on a constant currency basis (Constant

Currency)

In addition to presenting our revenues on a current currency

basis, we also present certain revenue information on a constant

currency basis (Constant Currency), which excludes the effects of

foreign currency translation from our subsidiaries with functional

currencies different from the Euro.

We calculate Constant Currency revenues by applying the current

period average foreign currency exchange rates to translate prior

period revenues of foreign subsidiaries expressed in local

functional currencies different than the Euro.

We use revenues on a Constant Currency basis to analyze how our

underlying revenues have changed between periods independent of the

effects of foreign currency translation.

Revenues on a Constant Currency basis are not a substitute for

revenues on a current currency basis or any IFRS-related measures,

however we believe that revenues excluding the impact of foreign

currency translation provide additional useful information to

management and to investors in analyzing and evaluating our

revenues and operating performance.

Revenues on an organic growth basis (Organic Growth)

In addition to presenting our revenues on a current currency

basis, we also present certain revenue information on an organic

growth basis (Organic Growth). Organic Growth is calculated as the

change in revenues from period to period, excluding the effects of

(a) foreign exchange, (b) acquisitions and disposals and (c)

changes in license agreements where the Group operates as a

licensee.

In calculating Organic Growth, the following adjustments are

made to revenues:

(a) Foreign exchange – Current period average foreign currency

exchange rates are used to translate prior period revenues of

foreign subsidiaries expressed in local functional currencies

different than the Euro.

(b) Acquisitions and disposals – Revenues generated by

businesses and operations acquired in the current year are

excluded. Revenues generated by businesses and operations acquired

in the prior year are excluded from the current year for the same

period that corresponds to the pre-acquisition period in the prior

year. Additionally, where a business or operation was a customer

prior to an acquisition, the related pre-acquisition revenues are

excluded from the current and prior periods. Revenues generated by

businesses and operations disposed of in the current year or prior

year are excluded from both periods as applicable.

(c) Changes in license agreements where the Group operates as a

licensee – Revenues generated from license agreements where the

Group operates as a licensee that are new or terminated in the

current year or prior year are excluded from both periods (except

if the effects are already included in acquisitions and disposals).

Additionally, revenues generated from license agreements where the

Group operates as a licensee that experienced a structural change

in the scope or perimeter in the current year or prior year are

excluded from both periods, including changes to product

categories, distribution channels or geographies of the underlying

license agreements.

We believe the presentation of Organic Growth is useful to

better understand and analyze the underlying change in the Group’s

revenues from period to period on a consistent perimeter and

constant currency basis.

Revenues on an Organic Growth basis are not a substitute for

revenues on a current currency basis or any IFRS-related measures,

however we believe that revenues excluding the effects of (a)

foreign exchange, (b) acquisitions and disposals and (c) changes in

license agreements where the Group operates as a licensee provide

additional useful information to management and to investors in

analyzing and evaluating our revenues and operating

performance.

The tables below show a reconciliation of reported revenue

growth to Constant Currency, excluding the effects of foreign

exchange, and to Organic Growth, which excludes also acquisitions

and disposals and changes in license agreements where the Group

operates as a licensee, by segment, by brand and product line, by

distribution channel and by geography for the three months ended

March 31, 2024 compared to the three months ended March 31, 2023

(Q1 2024 vs Q1 2023).

Segment

Q1 2024 vs Q1 2023

Revenues Growth

less

Foreign exchange

Constant

Currency

less

Acquisitions and disposals

less

Changes in license agreements

where the Group operates as a licensee

Organic Growth

Zegna

1.7%

(2.7%)

4.4%

0.3%

(0.2%)

4.3%

Thom Browne

(30.2%)

(1.4%)

(28.8%)

6.2%

—%

(35.0%)

Tom Ford Fashion(*)

n.m.

n.m.

n.m.

n.m.

n.m.

n.m.

Total

8.1%

(2.6%)

10.7%

17.1%

(1.1%)

(5.3%)

________________________________________

(*) Throughout this section considered not

meaningful (n.m.) as the Group began operating the Tom Ford Fashion

segment following the TFI Acquisition, which was completed on April

28, 2023, therefore there is no comparison figure for the

period.

Brand and product line

Q1 2024 vs Q1 2023

Revenues Growth

less

Foreign exchange

Constant

Currency

less

Acquisitions and disposals

less

Changes in license agreements

where the Group operates as a licensee

Organic Growth

ZEGNA brand

4.0%

(3.1%)

7.1%

0.3%

—%

6.8%

Thom Browne

(29.6%)

(1.4%)

(28.2%)

6.2%

—%

(34.4%)

TOM FORD FASHION

n.m

n.m

n.m

n.m

n.m

n.m

Textile

(1.7%)

(0.6%)

(1.1%)

(0.3%)

—%

(0.8%)

Other

(72.0%)

(0.3%)

(71.7%)

(0.4%)

(27.7%)

(43.6%)

Total

8.1%

(2.6%)

10.7%

17.1%

(1.1%)

(5.3%)

Distribution channel

Q1 2024 vs Q1 2023

Revenues Growth

less

Foreign exchange

Constant

Currency

less

Acquisitions and disposals

less

Changes in license agreements

where the Group operates as a licensee

Organic Growth

Direct to

Consumer (DTC)

ZEGNA brand

4.4%

(3.4%)

7.8%

1.5%

—%

6.3%

Thom Browne

4.4%

(5.6%)

10.0%

23.9%

—%

(13.9%)

TOM FORD FASHION

n.m.

n.m.

n.m.

n.m.

n.m.

n.m.

Total Direct to Consumer (DTC)

20.4%

(4.3%)

24.7%

21.5%

—%

3.2%

Wholesale

branded

ZEGNA brand

2.3%

(1.1%)

3.4%

(5.9%)

—%

9.3%

Thom Browne

(50.5%)

—%

(50.5%)

(3.2%)

—%

(47.3%)

TOM FORD FASHION

n.m.

n.m.

n.m.

n.m.

n.m.

n.m.

Total Wholesale branded

(11.5%)

(0.3%)

(11.2%)

14.7%

—%

(25.9%)

Textile

(1.7%)

(0.6%)

(1.1%)

(0.3%)

—%

(0.8%)

Other

(72.0%)

(0.3%)

(71.7%)

(0.4%)

(27.7%)

(43.6%)

Total

8.1%

(2.6%)

10.7%

17.1%

(1.1%)

(5.3%)

Geographical area

Q1 2024 vs Q1 2023

Revenues Growth

less

Foreign exchange

Constant

Currency

less

Acquisitions and disposals

less

Changes in license agreements

where the Group operates as a licensee

Organic Growth

EMEA (1)

4.3%

(0.4%)

4.7%

12.3%

(1.1%)

(6.5%)

Americas (2)

57.7%

0.8%

56.9%

50.3%

(3.7%)

10.3%

Greater China Region

(15.3%)

(4.1%)

(11.2%)

2.0%

(0.1%)

(13.1%)

Rest of APAC (3)

28.7%

(7.7%)

36.4%

33.1%

(1.6%)

4.9%

Other (4)

7.5%

0.1%

7.4%

20.1%

—%

(12.7%)

Total

8.1%

(2.6%)

10.7%

17.1%

(1.1%)

(5.3%)

________________________________________

(1) EMEA includes Europe, the Middle East

and Africa.

(2) North America includes the United

States of America, Canada, Mexico, Brazil and other Central and

South American countries.

(3) APAC includes Japan, South Korea,

Thailand, Malaysia, Vietnam, Indonesia, Philippines, Australia, New

Zealand, India and other Southeast Asian countries.

(4) Other revenues mainly include

royalties.

_______________________________

1 Throughout this press release, revenues

for the first quarter of 2024 are unaudited.

2 Growth rates refer to year-over-year

growth on a current currency basis, unless otherwise indicated.

3 Revenues on an organic growth basis

(Organic Growth) and revenues on a constant currency basis

(Constant Currency), are Non-IFRS Financial Measures. See the

Non-IFRS Financial Measures section starting on page 8 of this

press release for the definition and reconciliation of Non-IFRS

Financial Measures.

4 Organic Growth is calculated as the

change in revenues from period to period, excluding the TOM FORD

FASHION and the Thom Browne and ZEGNA Korean businesses, the

foreign exchange rates, and other minor effects. See the Non-IFRS

Financial Measures section starting on page 8 of this press release

for the definition and reconciliation of Non-IFRS Financial

Measures.

5 The licensing agreement for the

production and worldwide distribution of luxury men’s ready-to-wear

and made-to-measure clothing, footwear, and accessories under the

TOM FORD brand expired with the deliveries of the Fall/Winter 2022

collection, and a supply agreement to act as the exclusive supplier

for certain TOM FORD menswear products commenced starting with the

Spring/Summer 2023 collection and ended with the acquisition of

TFI.

6 Based on 250,310,263 Ordinary Shares

issued and outstanding at December 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423704891/en/

Paola Durante, Chief of External Relations Alice Poggioli,

Investor Relations Director Clementina Tito, Head of Corporate

Communication ir@zegna.com / corporatepress@zegna.com

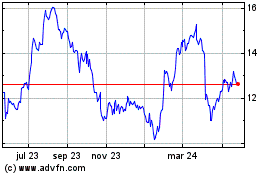

Ermenegildo Zegna NV (NYSE:ZGN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

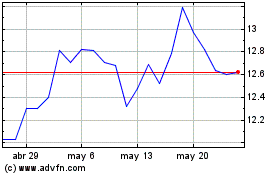

Ermenegildo Zegna NV (NYSE:ZGN)

Gráfica de Acción Histórica

De May 2023 a May 2024