Cameco (TSX: CCO; NYSE: CCJ) announced today that

it is extending the temporary production suspension at the Cigar

Lake uranium mine in northern Saskatchewan as the effects of the

global COVID-19 pandemic persist.

Cameco announced on March 23 that the Cigar Lake operation was

being placed in safe care and maintenance mode for four weeks,

during which we would assess the status of the situation and

determine whether to restart the mine or extend the production

suspension.

With the impact of COVID-19 continuing to escalate, we have

determined that the Cigar Lake workforce will need to remain at its

current reduced level for a longer duration. The precautions and

restrictions put in place by the federal and provincial

governments, the increasing significant concern among leaders in

the remote isolated communities of northern Saskatchewan, and the

challenges of maintaining the recommended physical distancing at

fly-in/fly-out sites with a full workforce were critical factors

Cameco considered in reaching this decision.

Cameco will therefore keep the facility in safe care and

maintenance for an indeterminate period. We will monitor the

situation on a continual basis to determine when a safe,

sustainable restart is possible.

Cigar Lake ore is processed at Orano Canada Inc.’s McClean Lake

mill, which is also presently in care and maintenance. Orano has

also decided to extend the temporary production suspension at its

McClean Lake mill.

“The global challenges posed by this pandemic are not abating –

in fact, they are deepening,” Cameco’s president and CEO Tim Gitzel

said. “We therefore need to stay vigilant and do everything we can

to keep people and families safe. We are especially sensitive to

the situation in the remote, isolated communities of northern

Saskatchewan that are home to a sizeable portion of the workforce

at Cigar Lake.”

The care and maintenance crews remaining at all four of Cameco’s

mining and milling operations in northern Saskatchewan are in a

safe working environment. Guidance and direction from public health

authorities are being followed closely, and the smaller workforces

that remain have proven to be much more conducive to achieving the

recommended physical distancing and enhanced safety

precautions.

The proactive decisions we have made to protect our employees

and to help slow down the spread of the COVID-19 virus are

necessary decisions and they are consistent with our values.

Given the rapidly developing COVID-19 pandemic and the number of

moving pieces it creates, we are withdrawing our outlook for 2020.

Although we will provide a further update on our business when we

report our first quarter results before markets open on May 1,

2020, we do not expect to resume providing outlook information

until we have a sufficient basis to assess the future implication

for us.

“Despite the current uncertainties as a result of the COVID-19

pandemic, we expect our business to be resilient,” Gitzel said.

“With many governments and communities declaring states of

emergency in their jurisdictions, our utility customers’ nuclear

power plants are part of the critical infrastructure needed to

guarantee the availability of 24-hour electricity to run hospitals,

care facilities and essential services. So our customers are going

to need uranium. As a reliable, independent, commercial supplier,

we will continue to work with them to help meet their delivery

needs.

“However, the COVID-19 pandemic has disrupted global uranium

production, adding to the supply curtailments that have occurred in

the industry for many years. As such, we believe the risk to

uranium supply is greater than the risk to uranium demand, creating

a renewed focus on ensuring availability of long-term supply. Over

time, we expect this renewed focus on security of supply will

provide the market signals producers need, and will help offset any

near-term costs we may incur as a result of the current disruptions

to our business.”

Our balance sheet remains strong, and we believe we are well

positioned to self-manage risk. Thanks to the disciplined execution

of our strategy on all three fronts – operational, marketing and

financial – we expect to have the financial capacity to manage the

disruptions to our operations caused by the COVID-19 pandemic. At

December 31, 2019 we had $1.2 billion in cash and $1 billion in

long-term debt with maturities in 2022, 2024 and 2042. In addition,

we have a $1 billion undrawn credit facility. We expect our cash

balances and operating cash flows to meet our capital requirements

during 2020, and therefore, we do not anticipate drawing on our

credit facility.

The Cigar Lake operation is owned by Cameco (50.025%), Orano

Canada Inc. (37.1%), Idemitsu Canada Resources Ltd. (7.875%) and

TEPCO Resources Inc. (5.0%) and is operated by Cameco.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations. Utilities around the

world rely on our nuclear fuel products to generate power in safe,

reliable, carbon-free nuclear reactors. Our shares trade on the

Toronto and New York stock exchanges. Our head office is in

Saskatoon, Saskatchewan.

Caution Regarding Forward-Looking Information and

Statements

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect.

Examples of forward-looking information in this news release

include the extension of the production suspension at the Cigar

Lake mine for an indeterminate period; our statement that we will

monitor the situation on a continual basis to determine when a

safe, sustainable restart is possible; our expectations regarding

the safety of our working environment at our Saskatchewan

operations; our expectation that our business will be resilient

despite the current uncertainties as a result of the COVID-19

pandemic; our expectation that nuclear plants will be part of the

critical infrastructure needed to guarantee the availability of

power, that our customers will continue to need uranium, and our

intention to work with our customers to help meet their delivery

needs; our views regarding uranium supply and demand, and our

expectation that a renewed focus on security of supply will provide

the market signals producers need and will help us offset any

near-term costs we incur as a result of the current disruptions to

our business; our intention to provide a further update on our

business when we report our first quarter 2020 results, and our

expectation to resume providing outlook information when we have a

sufficient basis to do so; and our expectations regarding our

ability to self-manage risk, including our financial capacity to

manage the disruptions to our operations caused by COVID-19 without

drawing on our credit facility.

Material risks that could lead to different results include: the

risk that suspension at the Cigar Lake mine may continue for an

extended period due to a number of factors, including the length of

the period during which a safe, sustainable restart of the mine is

not possible; the risk that we may face significant delays in

restarting the mine once we determine to do so, or that there may

be significant delays in restarting processing at the McClean Lake

mill; risks of safety incidents and risks to the health of our care

and maintenance crews at our Saskatchewan operations; the risk that

our business may not be as resilient in recovering from the

disruptions caused by the COVID-19 pandemic as we expect; the risk

that demand for nuclear power and uranium will decrease; the risk

that we will incur costs as a result of the current disruptions to

our business that we are unable to offset in the future; the risk

that we may be unable to provide a meaningful further update on our

business when we report our first quarter 2020 results, or that we

will be unable to resume providing outlook information for an

extended period; the risk that we may be required to draw on our

credit facility to manage disruptions to our business caused by

COVID-19; and the risk that we may be unable to successfully manage

the current uncertain environment resulting from COVID-19 and its

related operational, marketing or financial risks successfully,

including the risk of significant disruption to our workforce,

required supplies or services, ability to transport uranium, or our

delivery schedule.

In presenting this forward-looking information, we have made

assumptions which may prove incorrect, including assumptions

regarding the period of the suspension at the Cigar Lake mine and

our ability to determine when a safe, sustainable restart is

possible; assumptions regarding our ability to resume production at

Cigar Lake and Orano’s ability to resume processing at their

McClean Lake mill after the period of suspension; assumptions

regarding the safety of our working environment at our Saskatchewan

operations, the sufficiency of compliance with guidance and

direction from public health authorities, and our ability to do so;

the ability of our business to recover from the disruptions caused

by COVID-19; assumptions regarding uranium supply and demand and

the demand for nuclear power; assumptions regarding our ability to

offset the costs of the current disruptions to our business in the

future; our ability to provide a meaningful further update on our

business when we report our first quarter 2020 results, and to

resume providing outlook information in the future; our ability to

manage disruptions to our business caused by COVID-19 without

drawing on our credit facility; and our ability to successfully

manage the current uncertain environment resulting from COVID-19

and its related operational, marketing or financial risks

successfully.

Forward-looking information is designed to help you understand

management’s current views of our near-term and longer-term

prospects, and it may not be appropriate for other purposes. We

will not necessarily update this information unless we are required

to by securities laws.

Qualified Person

The above scientific and technical information relating to the

Cigar Lake uranium mining operation was approved by Lloyd Rowson,

general manager, Cigar Lake, Cameco.

Investor inquiries:

Rachelle Girard

306-956-6403

Media

inquiries:

Jeff

Hryhoriw

306-385-5221

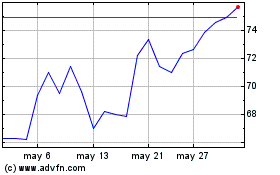

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024