Cameco (TSX: CCO; NYSE: CCJ) today announced that it has entered

into an agreement with a syndicate of underwriters led by CIBC

Capital Markets and Goldman Sachs & Co. LLC, pursuant to which

the underwriters have agreed to purchase, on a bought deal basis,

29,615,000 common shares of Cameco at a price of $21.95 per share

(the “Offering Price”), for gross proceeds to us of approximately

$650 million (the “Offering”). The common shares will be offered to

the public in Canada and the United States. The Offering is

expected to close on or about October 17, 2022, subject to

customary closing conditions, including receipt of all necessary

approvals of the Toronto Stock Exchange and the New York Stock

Exchange. Additionally, we have granted the underwriters an option

to purchase up to an additional 4,442,250 common shares at the

Offering Price, exercisable in whole or in part at any time up to

30 days following the closing of the Offering, for potential

additional gross proceeds to Cameco of approximately $97.5 million.

We intend to use the aggregate proceeds from the Offering, after

payment of fees and expenses, to partially fund our share of the

acquisition of Westinghouse Electric Company, one of the world’s

leading nuclear services businesses, through a strategic

partnership with Brookfield Renewable Partners (“Brookfield

Renewable”), together with Brookfield Renewable’s institutional

partners (the “Acquisition”).

CIBC Capital Markets and Goldman Sachs & Co. LLC are acting

as joint bookrunners for the Offering.

We intend to offer and sell the common shares in the U.S.

pursuant to our effective shelf registration statement on Form F-10

(File No. 333-267625) (the “U.S. Registration Statement”) filed

with the U.S. Securities and Exchange Commission (the “SEC”), and

in Canada pursuant to our short form base shelf prospectus (the

“Base Shelf Prospectus”), in each case, filed on September 26,

2022. A preliminary prospectus supplement relating to and

describing the terms of the Offering was filed with the SEC and

with the securities regulatory authorities in each of the provinces

and territories of Canada as part of the U.S. Registration

Statement and the Base Shelf Prospectus, respectively, and a final

prospectus supplement will be filed in connection with the

Offering. The documents filed or to be filed in connection with the

Offering contain important detailed information about the Company

and the Offering. Prospective investors should read these filings,

and the documents incorporated by reference therein, before making

an investment decision.

Copies of the Base Shelf Prospectus and the prospectus

supplements will be available free of charge on SEDAR at

www.sedar.com, and copies of the U.S. Registration Statement and

the prospectus supplements will be available free of charge on

EDGAR on the SEC website at www.sec.gov. Alternatively, copies may

be obtained from: CIBC Capital Markets, 161 Bay Street, 5th Floor,

Toronto, ON M5J 2S8 or by telephone at 1-416-956-6378 or by email

at mailbox.canadianprospectus@cibc.com; or from Goldman Sachs &

Co. LLC, Attention: Prospectus Department, 200 West Street, New

York, NY 10282, or by telephone: 1-866-471-2526, or by facsimile:

212-902-9316 or by emailing Prospectus-ny@ny.email.gs.com or

Goldman Sachs Canada Inc., TD North Tower, 77 King Street West

Suite 3400, Toronto, ON M5K 1B7.

No securities regulatory authority has either approved

or disapproved the contents of this press release. This press does

not constitute an offer to sell or the solicitation of an offer to

buy any securities of Cameco, nor shall there be any sale of the

securities in any province, territory, state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

the registration or qualification under the securities laws of any

such province, territory, state or jurisdiction.

Caution about forward-looking information

Certain information in this news release, including statements

regarding the Offering and the Acquisition, including the terms of

the Offering, the completion and the timing of completion of the

Offering and the anticipated use of the net proceeds of the

Offering, and the timing and completion of the Acquisition,

constitutes forward-looking information within the meaning of

applicable securities laws in Canada and the United States,

including the United States Private Securities Litigation Reform

Act of 1995. In some cases, but not necessarily in all cases,

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “targets”, “expects”

or “does not expect”, “is expected”, “should”, “an opportunity

exists”, “is positioned”, “estimates”, “intends”, “assumes”,

“anticipates” or “does not anticipate” or “believes”, or variations

of such words and phrases or state that certain actions, events or

results “may”, “could”, “would”, “might”, “will” or “will be

taken”, “occur” or “be achieved”. In addition, any statements that

refer to expectations, projections or other characterizations of

future events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts but instead represent management’s expectations,

estimates and projections regarding future events.

Forward-looking information is necessarily based on a number of

opinions, assumptions and estimates that, while considered

reasonable by the Company as of the date of this press release, are

subject to known and unknown risks, uncertainties, assumptions and

other factors that may cause the actual results, level of activity,

performance or achievements to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to the failure to satisfy the closing conditions to

the completion of the Offering or the Acquisition and the factors

described in greater detail in the “Risk Factors” section of the

Company’s current annual information form, prospectus supplement

dated October 11, 2022 and in the Company’s other materials filed

with the Canadian securities regulatory authorities and the SEC

from time to time, available at www.sedar.com and www.sec.gov,

respectively. These factors are not intended to represent a

complete list of the factors that could affect the Company;

however, these factors should be considered carefully. There can be

no assurance that such estimates and assumptions will prove to be

correct. The forward-looking statements contained in this press

release are made as of the date of this press release, and the

Company expressly disclaims any obligation to update or alter

statements containing any forward-looking information, or the

factors or assumptions underlying them, whether as a result of new

information, future events or otherwise, except as required by

law.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations. Utilities around the

world rely on our nuclear fuel products to generate safe, reliable,

carbon-free nuclear power. Our shares trade on the Toronto and New

York stock exchanges. Our head office is in Saskatoon,

Saskatchewan.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries unless

otherwise indicated.

Investor inquiries:

Rachelle Girard306-956-6403rachelle_girard@cameco.com

Media inquiries:

Veronica Baker306-385-5541veronica_baker@cameco.com

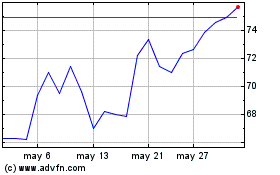

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024