Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas” or the

“

Company”) announced the closing of its previously

announced underwritten public offering (the

“

Offering”) of its common shares (the

“

Common Shares”). The Company issued 55,000,000

Common Shares, issued at a price of $5.00 per Common Share (the

“

Issue Price”), for aggregate gross proceeds to

the Company of $275,000,000.

The net proceeds from

the Offering are intended to be used to fund the advancement of

construction and development of the Company’s Thacker Pass lithium

project in Humboldt County, Nevada (“Thacker

Pass”).

Jonathan Evans,

President and Chief Executive Officer of Lithium Americas said, “We

are pleased to have completed this key financing milestone, which

together with the U.S. Department of Energy

(“DOE”) loan under the Advanced Technology

Vehicles Manufacturing Loan Program (the “Loan”),

satisfies the funding condition to closing the General Motors

Holdings LLC (“GM”) second tranche investment (the

“Tranche 2 Investment”). At the same time, the

Offering and GM funding will allow the Company to meet the

financing-related condition relating to closing the DOE Loan

conditional commitment (the “Conditional

Commitment”). These financings are expected to fully fund

Thacker Pass Phase 1 construction.”

Mr. Evans continued,

“With site preparation for major earthworks completed, our focus is

on de-risking construction execution by increasing detailed

engineering and progressing procurement packages. Once the

remaining closing conditions are met and the Tranche 2 Investment

and the DOE Loan close, which we anticipate to occur later this

year if conditions to finalization of the Loan are met, Thacker

Pass will advance to full notice to proceed and major construction

to support America's energy security and emissions reduction

aspirations. Our team continues to focus on our commitment to

sustainably develop Thacker Pass toward production."

For the DOE Loan, if

finalized, it is possible that the terms of the finalized Loan

agreement may change from the time of Conditional Commitment. While

the Conditional Commitment indicates DOE’s intent to finance

Thacker Pass, the Company must satisfy certain technical, legal,

environmental and financial conditions before the DOE enters into

definitive financing documents and funds the Loan.

ABOUT LITHIUM AMERICAS

The Company is a Canadian-based lithium resource

company that owns 100% of the Thacker Pass project located in

Humboldt County in northern Nevada, through its wholly-owned

subsidiary, Lithium Nevada Corp.

INVESTOR

CONTACT

Virginia Morgan, VP, IR and

ESG+1-778-726-4070ir@lithiumamericas.com

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation, and “forward-looking statements” within the meaning of

the United States Private Securities Litigation Reform Act of 1995

(collectively referred to as “forward-looking information”

(“FLI”)). All statements, other than statements of

historical fact, are FLI and can be identified by the use of

statements that include, but are not limited to, words, such as

“anticipate,” “plan,” “continues,” “estimate,” “expect,” “may,”

“will,” “projects,” “predict,” “proposes,” “potential,” “target,”

“implement,” “scheduled,” “forecast,” “intend,” “would,” “could,”

“might,” “should,” “believe” and similar terminology, or statements

that certain actions, events or results “may,” “could,” “would,”

“might” or “will” be taken, occur or be achieved. FLI in this news

release includes, but is not limited to, statements related to the

anticipated use of net proceeds of the Offering; the expected

operations, financial results and condition of the Company; the

Company’s future objectives and strategies to achieve those

objectives, including the future prospects of the Company; the

estimated cash flow, capitalization and adequacy thereof for the

Company; the estimated costs of the development of Thacker Pass,

including timing, progress, approach, continuity or change in

plans, construction, commissioning, milestones, anticipated

production and results thereof and expansion plans; expectations

regarding accessing funding from the Tranche 2 Investment and the

ATVM Loan Program; anticipated timing to resolve, and the expected

outcome of, any complaints or claims made or that could be made

concerning the permitting process in the United States for Thacker

Pass; capital expenditures and programs; estimates, and any change

in estimates, of the mineral resources and mineral reserves at

Thacker Pass; development of mineral resources and mineral

reserves; the expected benefits of the separation transaction

undertaken by the Company to acquire ownership of the North

American business assets of Lithium Americas Corp. (now named

Lithium Americas (Argentina) Corp.) (the

“Arrangement”) to, and resulting treatment of,

shareholders and the Company; the anticipated effects of the

Arrangement; information concerning the tax treatment of the

Arrangement; government regulation of mining operations and

treatment under governmental and taxation regimes; the future price

of commodities, including lithium; the creation of a battery supply

chain in the United States to support the electric vehicle market;

the realization of mineral resources and mineral reserves

estimates, including whether certain mineral resources will ever be

developed into mineral reserves, and information and underlying

assumptions related thereto; the timing and amount of future

production; currency exchange and interest rates; the Company’s

ability to raise capital; expected expenditures to be made by the

Company on Thacker Pass; ability to produce high purity battery

grade lithium products; settlement of agreements related to the

operation and sale of mineral production as well as contracts in

respect of operations and inputs required in the course of

production; the timing, cost, quantity, capacity and product

quality of production at Thacker Pass; successful development of

Thacker Pass, including successful results from the Company’s

testing facility and third-party tests related thereto; capital

costs, operating costs, sustaining capital requirements, after tax

net present value and internal rate of return, payback period,

sensitivity analyses, and net cash flows of Thacker Pass; the

expected capital expenditures for the construction of Thacker Pass;

anticipated job creation and workforce hub at Thacker Pass; the

expectation that the project labor agreement with North America’s

Building Trades Unions for construction of Thacker Pass will

minimize construction risk, ensure availability of skilled labor,

address the challenges associated with Thacker Pass’s remote

location and be effective in prioritizing employment of local and

regional skilled craft workers, including members of

underrepresented communities; the Company’s commitment to

sustainable development, minimizing the environmental impact at

Thacker Pass and plans for phased reclamation during the life of

mine; ability to achieve capital cost efficiencies; the Tranche 2

Investment and the potential for additional financing scenarios for

Thacker Pass; the expected timetable for completing the Tranche 2

Investment; the ability of the Company to complete the Tranche 2

Investment on the terms and timeline anticipated, or at all; the

receipt of required stock exchange and regulatory approvals and

authorizations, and the securing of sufficient available funding to

complete the development of Phase 1 of Thacker Pass as required for

the Tranche 2 Investment; the expected benefits of the Tranche 2

Investment; as well as other statements with respect to

management’s beliefs, plans, estimates and intentions, and similar

statements concerning anticipated future events, results,

circumstances, performance or expectations that are not historical

facts.

FLI involves known and unknown risks,

assumptions and other factors that may cause actual results or

performance to differ materially. FLI reflects the Company’s

current views about future events, and while considered reasonable

by the Company as of the date of this news release, are inherently

subject to significant uncertainties and contingencies.

Accordingly, there can be no certainty that they will accurately

reflect actual results. Assumptions upon which such FLI is based

include, without limitation, the ability to raise financing in a

timely manner and on acceptable terms; the potential benefits of

the Arrangement being realized; the risk of tax liabilities as a

result of the Arrangement, and general business and economic

uncertainties and adverse market conditions; the risk that the

Arrangement may not be tax-free for income tax purposes and

potential significant tax liabilities that the Company may be

exposed to if the tax-deferred spinoff rules are not met; the risk

of tax indemnity obligations owed by the Company to Lithium

Argentina following the Arrangement becoming payable, including as

a result of events outside of the Company’s control; uncertainties

inherent to feasibility studies and mineral resource and mineral

reserve estimates; the ability of the Company to secure sufficient

additional financing, advance and develop Thacker Pass, and to

produce battery grade lithium; the respective benefits and impacts

of Thacker Pass when production operations commence; settlement of

agreements related to the operation and sale of mineral production

as well as contracts in respect of operations and inputs required

in the course of production; the Company’s ability to operate in a

safe and effective manner, and without material adverse impact from

the effects of climate change or severe weather conditions;

uncertainties relating to receiving and maintaining mining,

exploration, environmental and other permits or approvals in

Nevada; demand for lithium, including that such demand is supported

by growth in the electric vehicle market; current technological

trends; the impact of increasing competition in the lithium

business, and the Company’s competitive position in the industry;

continuing support of local communities and the Fort McDermitt

Paiute Shoshone Tribe for Thacker Pass; continuing constructive

engagement with these and other stakeholders, and any expected

benefits of such engagement; the stable and supportive legislative,

regulatory and community environment in the jurisdictions where the

Company operates; impacts of inflation, currency exchanges rates,

interest rates and other general economic and stock market

conditions; the impact of unknown financial contingencies,

including litigation costs, environmental compliance costs and

costs associated with the impacts of climate change, on the

Company’s operations; increased attention to environmental, social,

governance and safety (“ESG-S”) and

sustainability-related matters, risks related to the Company’s

public statements with respect to such matters that may be subject

to heightened scrutiny from public and governmental authorities

related to the risk of potential “greenwashing” (i.e., misleading

information or false claims overstating potential

sustainability-related benefits); risks that the Company may face

regarding potentially conflicting anti-ESG-S initiatives from

certain U.S. state or other governments; estimates of and

unpredictable changes to the market prices for lithium products;

development and construction costs for Thacker Pass, and costs for

any additional exploration work at the project; estimates of

mineral resources and mineral reserves, including whether mineral

resources not included in mineral reserves will be further

developed into mineral reserves; reliability of technical data;

anticipated timing and results of exploration, development and

construction activities, including the impact of ongoing supply

chain disruptions and availability of equipment and supplies on

such timing; timely responses from governmental agencies

responsible for reviewing and considering the Company’s permitting

activities at Thacker Pass; availability of technology, including

low carbon energy sources and water rights, on acceptable terms to

advance Thacker Pass; the Company’s ability to obtain additional

financing on satisfactory terms or at all, including the outcome of

the ATVM Loan Program process; government regulation of mining

operations and mergers and acquisitions activity, and treatment

under governmental, regulatory and taxation regimes; ability to

realize expected benefits from investments in or partnerships with

third parties; accuracy of development budgets and construction

estimates; that the Company will meet its future objectives and

priorities; that the Company will have access to adequate capital

to fund its future projects and plans; that such future projects

and plans will proceed as anticipated; the ability of the Company

to satisfy all closing conditions for the Tranche 2 Investment and

complete the Tranche 2 Investment in a timely manner; the impact of

the Tranche 2 Investment on dilution of shareholders and on the

trading prices for, and market for trading in, the securities of

the Company; as well as assumptions concerning general economic and

industry growth rates, commodity prices, currency exchange and

interests rates and competitive conditions. Although the Company

believes that the assumptions and expectations reflected in such

FLI are reasonable, the Company can give no assurance that these

assumptions and expectations will prove to be correct.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. There can be no assurance that FLI

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information.

As such, readers are cautioned not to place undue reliance on this

information, and that this information may not be appropriate for

any other purpose, including investment purposes. The Company’s

actual results could differ materially from those anticipated in

any FLI as a result of the risk factors set out herein and in the

Company’s filings with securities regulators.

The FLI contained in this news release is

expressly qualified by these cautionary statements. All FLI in this

news release speaks as of the date of this news release. The

Company does not undertake any obligation to update or revise any

FLI, whether as a result of new information, future events or

otherwise, except as required by law. Additional information about

these assumptions and risks and uncertainties is contained in the

Company’s filings with securities regulators, including the

Company’s most recent Annual Report on Form 20-F and most recent

management’s discussion and analysis for our most recently

completed financial year and, if applicable, interim financial

period, which are available on SEDAR+ at www.sedarplus.ca and

on EDGAR at www.sec.gov. All FLI contained in this news release is

expressly qualified by the risk factors set out in the

aforementioned documents.

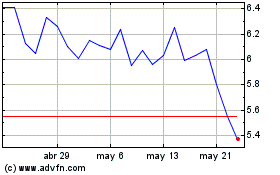

Lithium Americas (TSX:LAC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Lithium Americas (TSX:LAC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024