Madison Pacific Properties Inc. announces the results for the six months ended February 28, 2021, declares special dividend a...

13 Abril 2021 - 6:00PM

Madison Pacific Properties Inc. (the Company) (TSX: MPC and MPC.C),

a Vancouver-based real estate company announces the results of

operations for the six months ended February 28, 2021.

The results reported are pursuant to

International Financial Reporting Standards (IFRS) for public

companies.

For the six months ended February 28, 2021, the

Company is reporting net income of $22.3 million (2020: $14.7

million); cash flows from operating activities before changes in

non-cash operating balances of $4.9 million (2020: $7.0 million);

and income per share of $0.34 (2020: $0.25). Included in net income

is an after-tax net gain from the fair value adjustment on

investment properties of $14.9 million (2020: $9.9 million).

The Company currently owns approximately $628

million in investment and development properties, including the

Company’s proportionate share of properties held through

jointly-controlled partnerships. The Company’s investment portfolio

comprises 52 properties with approximately 1.83 million rentable

sq. ft. of industrial and commercial space and a 50% interest in a

54 unit multi-family rental property. Approximately 98.9% of

available space within the industrial and commercial investment

properties is currently leased. The Company’s development

properties include a 50% interest in the Silverdale Hills Limited

Partnership which owns approximately 1,389 acres of undeveloped

residential designated lands in Mission, British Columbia.

Approximately 38 acres of these residential lands in Mission are

currently under development as townhomes and single family lots for

sale. Construction of the first phase of the development of 34

townhomes commenced in late 2020. Sales for the townhomes and

single family lots are expected to commence in the third quarter of

fiscal 2021.

The COVID-19 pandemic has continued to cause

economic disruption and it is difficult to predict the duration and

extent of the pandemic and whether it will have any long-term

impact on the Company’s business. The Company is currently well

positioned, with a diversified income portfolio of industrial,

office, retail and multi-family rental assets. Approximately 82% of

the Company’s commercial investment properties are located in

British Columbia where the provincial government has various social

gathering and business restrictions in place. The Company has

provided some short-term rent deferrals and rent relief, including

rent relief through government assistance programs, for certain

tenants that have been significantly affected by the COVID-19

pandemic. As at February 28, 2021, outstanding repayable rent

deferrals amounted to $324 thousand and rent relief for the six

months ended February 28, 2021, amounted to $105 thousand. These

are uncertain and challenging times and management will be

continuing to monitor business developments and market conditions

and any effect they may have on the business.

For a review of the risks and uncertainties to

which the Company is subject see its most recently filed annual and

interim MD&A.

The Company announced today that it has declared

the payment of a special cash dividend of $0.34 per Class B voting

common share and Class C non-voting share payable on May 4, 2021 to

shareholders of record on April 23, 2021.

The amount of the special one-time dividend

allows the Company to continue to pursue real estate opportunities

while returning some capital to shareholders. The special dividend

is in addition to any dividends that may be declared pursuant to

the regular dividend policy of the Company.

The dividend is an eligible dividend for

Canadian tax purposes.

The Board of Directors is also pleased to

announce that Mr. John DeLucchi has been appointed to the Board of

Directors of the Company. Mr. DeLucchi was recently appointed

President and Chief Executive Officer of Madison Venture Corp.

Before joining Madison Venture Corp., Mr. DeLucchi was a partner at

PricewaterhouseCoopers LLP and was in the role of British Columbia

Managing Partner from 2009 to 2017.

The Board of Directors are pleased to have Mr.

DeLucchi join them and look forward to working with him.

| Contact: |

Mr. Marvin

Haasen |

Ms. Bernice Yip |

| |

President & CEO |

Investor Information |

| Telephone: |

(604) 732-6540 |

(604) 732-6540 |

| Fax: |

(604) 732-6550 |

|

| |

|

|

| Address: |

389 West 6th Avenue |

|

| |

Vancouver, B.C. |

|

| |

V5Y 1L1 |

|

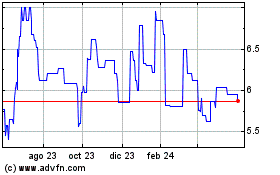

Madison Pacific Properties (TSX:MPC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

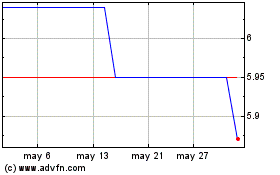

Madison Pacific Properties (TSX:MPC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025