Abasca Resources Inc. (“

Abasca” or the

“

Company”) (TSX-V: ABA) (formerly AMV Capital

Corporation (“

AMV”)) is pleased to announce the

closing yesterday of the previously-announced asset purchase

transaction with 101159623 Saskatchewan Ltd.

(“

SaskCo”) resulting in the reverse takeover of

AMV (the “

Transaction”), along with a concurrent

financing and name change.

The Transaction

Pursuant to the terms of the Transaction, the

Company acquired a 100% right, title and interest in and to the

mineral claims (the “Claims”) that comprise the

Key Lake South Uranium Project located in the southeastern

Athabasca Basin Region in Saskatchewan (the “KLS

Project”) for and in consideration of 25,639,288 common

shares of the Company (the “Consideration Shares”

and each common share of the Company, a “Common

Share”). The Transaction constituted a “reverse takeover”

pursuant to the policies of the TSX Venture Exchange (the

“Exchange”). Please refer to the Company’s filing

statement (the “Filing Statement”) dated December

21, 2022, filed under the Company’s profile on SEDAR at

www.sedar.com, for further details of the Transaction.

In connection with closing of the Transaction,

AMV changed its name to “Abasca Resources Inc.” effective

yesterday.

The Company is to make its final submissions to

the Exchange shortly, with a view to enabling the Company’s common

shares to resume trading on the Exchange under its new ticker

symbol “ABA” in early January 2023.

Flow-Through Private Placement and

Subscription Receipt Offering

In connection with the Transaction, the Company

completed a $2,898,900 non-brokered flow-through private placement

(the “Flow-Through Private Placement”) of

5,797,800 units of the Company (the “FT Units”) at

a price of $0.50 per FT Unit, with each FT Unit consisting of one

Common Share issued on a flow-through basis (a “FT

Share”) and one-half of one share purchase warrant of the

Company (each whole warrant, a “NFT Warrant”).

Each NFT Warrant entitles the holder to acquire one Common Share (a

“NFT Warrant Share”) at a price of $0.60 per share

for a period of two years.

During 2023, the Company will incur an amount

equal to the gross proceeds from the issuance of the FT Shares on

“Canadian exploration expenses” (as this term is defined in the

Income Tax Act (Canada) (the “Tax Act”)) on the

KLS Project that the Company has renounced pursuant to the Tax Act

with an effective date not later than December 31, 2022, and that

qualify either as “flow-through mining expenditures” (as this term

is defined in the Tax Act) or, if the Company in its sole

discretion so determines, as “flow-through critical mineral mining

expenditures” (as this term is defined in the Tax Act). Such

expenditures will include a winter drilling exploration program on

the KLS Project.

Also in connection with the Transaction, 1379294

B.C. Ltd., a British Columbia company affiliated with SaskCo

(“FinCo”), completed a non-brokered financing (the

“Offering“, and collectively with the Flow-Through

Private Placement, the “Financings”) consisting of

the sale of 1,880,138 subscription receipts (“Subscription

Receipts”) at and for a price of $0.45 per Subscription

Receipt to raise $846,062.10. Immediately prior to the completion

of the Transaction, the Subscription Receipts converted into units

of FinCo, and FinCo then amalgamated with a wholly-owned subsidiary

of AMV (the “Amalgamation”). Pursuant to the

Amalgamation, each unit of FinCo was automatically exchanged, for

no additional consideration and without any further action, into

one unit of the Company (a “NFT Unit”), with each

NFT Unit comprised of one Common Share and one-half of one NFT

Warrant.

Finders’ fees in cash totaling $112,312 were

paid to finders, such amount being equal to 8% of the proceeds

raised from subscribers that the finders introduced to the Company.

The Company also issued to the finders 230,135 share purchase

warrants having the same terms as the NFT Warrants (such amount

being equal to 8% of the total number of FT Units or NFT Units

purchased by subscribers that the finders introduced to the

Company).

Qiang Sean Wang, who remains a director and

officer of the Company, acquired 100,000 FT Units under the

Flow-Through Private Placement. Mr. Wang is a “related party”

within the meaning of Multilateral Instrument 61-101 - Protection

of Minority Security Holders in Special Transactions of the

Canadian Securities Administrators (“MI 61-101”)

and the Flow-Through Private Placement thereby constituted a

“related party transaction” under MI 61-101. The Company is exempt

from the formal valuation requirement pursuant to subsection 5.5(b)

of MI 61- 101 on the basis that the securities of the Company are

listed or quoted on the Exchange. The Company is also exempt from

the minority approval requirement pursuant to subsection 5.7(1)(b)

of MI 61-101 on the basis that: (i) the securities of the Company

are listed on the Exchange; (ii) at the time the transaction is

agreed to, neither the fair market value of the securities to be

distributed in the transaction nor the consideration to be received

for those securities, insofar as the transaction involves

interested parties, exceeds $2,500,000; (iii) the Company has more

than one independent director, and (iv) the directors of the

Company unanimously approved the Flow-Through Private

Placement.

Resale Restrictions and

Escrow

The Consideration Shares, the securities issued

in connection with the Flow-Through Private Placement, and certain

of the securities issued in connection with the Offering, are

subject to resale restrictions under applicable securities laws or

the Exchange Hold Period under the policies of the Exchange, which

will expire on April 30, 2023.

On completion of the Transaction, the principals

of Abasca have entered into a Tier 2 Value Escrow Agreement (the

“Escrow Agreement”) with Abasca and Odyssey Trust

Company, as escrow agent, in respect of 33,440,288 Common Shares,

2,020,000 NFT Warrants and 1,790,000 stock options. Under the terms

of the Escrow Agreement, 10% of such escrowed securities are to be

released upon the Exchange’s issuance of its final bulletin in

respect of the Transaction, with subsequent 15% releases occurring

6, 12, 18, 24, 30 and 36 months from closing.

Board of Directors and Executive

Management

Concurrently with the completion of the

Transaction, the following individuals were appointed as directors

or officers of Abasca:

|

Dawn Zhou - |

President,

Chief Executive Officer and Director |

|

Dave Billard - |

Director |

|

Denis Arsenault - |

Director |

|

Erik Martin - |

Chief Financial Officer |

|

Brian McEwan - |

Vice President, Exploration |

Also concurrently with the completion of the

Transaction, Jerry Minni resigned as CFO, Corporate Secretary and a

director of the Company and Michael Dake resigned as a director of

the Company. Qiang Sean Wang resigned as President and CEO of the

Company but will continue as a director and act as Executive

Director. Brett Kagetsu will continue serving as a director.

Additional Information

The CUSIP / ISIN number for the Common

Shares is 00258D100 / CA00258D1006.

For further information, please refer to the

Filing Statement posted to Abasca’s issuer profile on SEDAR at

www.sedar.com, as well as AMV’s news releases dated September 14

and October 25, 2022.

About Abasca

Abasca is a mineral exploration company that is

primarily engaged in the acquisition and evaluation of mineral

exploration properties. The Company owns the KLS Project, a

23,977-hectare uranium exploration project located in the Athabasca

Basin Region in northern Saskatchewan and the Sage Property, an

early-stage mineral exploration property near Kamloops, British

Columbia. Abasca’s common shares trade under the symbol “ABA” on

the Exchange.

On behalf of Abasca Resources

Inc.

Dawn Zhou, M.Sc, CPA, CGAPresident, CEO and

director

For more information

contact:

dawnzhou.csit@sasktel.net Tel: +1 (306) 933

4261

Neither the TSX Venture Exchange Inc. nor its

Regulation Service Provider (as that term is defined in the

policies of the TSX Venture Exchange Inc.) accepts responsibility

for the adequacy or accuracy of this press release.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities in

any jurisdiction. Any securities referred to herein have not been,

nor will they be, registered under the United States Securities Act

of 1933, as amended, and may not be offered or sold in the United

States or to a U.S. Person absent registration or an applicable

exemption from the registration requirements of the United States

Securities Act of 1933, as amended, and applicable state securities

laws.

Forward-Looking Statements

This press release may contain certain

forward-looking information and statements

(“forward-looking information”) within the meaning

of applicable Canadian securities legislation, that are not based

on historical fact, including without limitation statements

containing the words "believes", "anticipates", "plans", "intends",

"will", "should", "expects", "continue", "estimate", "forecasts"

and other similar expressions. Readers are cautioned to not place

undue reliance on forward-looking information. Actual results and

developments may differ materially from those contemplated by these

statements. Abasca undertakes no obligation to comment on analyses,

expectations or statements made by third-parties in respect of

Abasca, its securities, or financial or operating results (as

applicable). Although Abasca believes that the expectations

reflected in forward-looking information in this press release are

reasonable, such forward-looking information has been based on

expectations, factors and assumptions concerning future events

which may prove to be inaccurate and are subject to numerous risks

and uncertainties, certain of which are beyond Abasca’s control,

including the risk factors discussed in the Filing Statement which

are incorporated herein by reference and are available through

SEDAR at www.sedar.com. The forward-looking information contained

in this press release are expressly qualified by this cautionary

statement and are made as of the date hereof. Abasca disclaims any

intention and has no obligation or responsibility, except as

required by law, to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise.

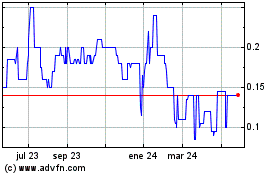

Abasca Resources (TSXV:ABA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

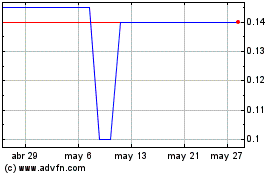

Abasca Resources (TSXV:ABA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025