Ceapro Reports First Quarter 2012 Financial Results and Provides a Corporate Update

28 Mayo 2012 - 3:30PM

Marketwired Canada

Ceapro Inc. (TSX VENTURE:CZO) ("Ceapro" or "the Company") today released

financial results for the quarter ended March 31, 2012 and provided a corporate

update.

FINANCIAL RESULTS FOR THE QUARTER ENDED MARCH 31, 2012

-- Total sales of $1,190,000 compared to $1,534,000 in 2011.

-- Income from operations of $17,000 compared to $353,000 in 2011

-- Net loss of $4,000 compared to a net income of $330,000 for 2011.

"Our sales revenue and profits were lower in the first quarter versus last year

and were the result of normal quarterly fluctuations", said Gilles Gagnon,

Acting CEO of Ceapro. "Our results are best measured over the course of the

entire year due to timing of orders and because different product mixes with

different gross margins can have a big influence on quarterly results. Our

operations in the quarter demonstrated solid operational performance while extra

expenditures were required for launching a marketing study and to conduct a

feasibility study related to manufacturing activities. We have continued to

invest in our Company, our solid R&D program, and new technology to ensure

Ceapro remains well noticed on the world innovation stage", added Mr. Gagnon.

CORPORATE UPDATE

Marketing and Sales:

New business:

-- First sales orders received from new customers serviced by Ross Organics

in the US Southwest

-- New distribution partners in Europe get strong interest in Ceapro

products. During the first quarter several new companies have begun

formulating with Ceapro products and placing small initial orders. We

are very pleased with their rapid acceptance and positive reception as

our experience has shown that the sales cycle will often run two years

or even longer for new customers.

Marketing strategy:

During the first quarter we launched a strategic marketing review to help

determine the best way to increase the distribution and sales of Ceapro products

across the globe. A US based company with exposure to the personal care industry

was engaged to do a comprehensive review of our company and products, assess the

markets, and determine the best strategy to grow. While we have successfully

focused most of our limited resources on developing good products and processes

as a sound foundation for success, it is now time to invest significantly in

building out our marketing and sales network with the appropriate expertise to

assist us in that regard. We will also take the opportunity to assess the

branding of Ceapro.

Business Development:

-- Completion of a major world-wide avenanthramide technology licensing

agreement with Agriculture and Agri-Food Canada to allow product

expansion to several indications in cosmetics and potential access to

new food and nutraceutical markets

-- Ongoing discussions with potential distributors in European and Asia

Pacific markets .

Research and Development:

Our research and collaboration efforts have continued to generate positive news

which we expect will translate into large gains in the future for Ceapro.

Avenanthramides:

-- The recent licensing of key avenanthramide process technology from

Agriculture and Agri-Foods Canada is a very important milestone. This

technology should support the growth of our flagship avenanthramide

products by allowing for greater increases in output capacity and then

enabling to pursue new markets like functional foods which were not

previously possible due to the limited commercial supply. We believe

that this market offers a great potential for our avenanthramides.

Research data from other parties also suggest that consumption of

avenanthramides have the ability to provide significant therapeutic

benefits for conditions such as inflammatory bowel syndrome, colon

cancer, and exercise induced inflammation. Given the expected

availability of higher quantities and concentrations of avenanthramides,

we look forward to the development of formulations suitable for the

functional food, nutraceutical and pharmaceutical areas

Beta Glucan

-- Beta glucan is another oat product with high potential. Ceapro customers

currently utilize this ingredient for skin moisturization, anti-aging,

wound and skin repair formulations. In order to further support new

claims, we recently completed a study demonstrating superior and longer

lasting skin moisturization of Ceapro Oat Beta Glucan versus Hyaluronic

acid, a similar molecular weight product also used for this indication.,

-- Beta glucan is also the ingredient in oats that is well known to

significantly reduce cholesterol levels ("the bad one"). In light of

this opportunity, Ceapro has successfully created a high purity powder

form of beta glucan from its liquid product at pilot scale using a novel

supercritical fluid drying process. This may allow for new formulations

to be launched into new markets like functional foods and drinks and

pharmaceuticals. The technology has attracted the interest of third

parties and may provide Ceapro an opportunity to generate additional

value through out-licensing.

Spearmint:

-- Yield

Our spearmint program is beginning its third growing season and we have

developed prototype extracts for analysis at our in-vitro lab in

Charlottetown. While we are relatively early in our studies, we are very

pleased with the results to date. We have previously obtained

concentrations of rosmarinic acid as high as 13.5% in our plants with

the super spearmint variety licensed from University of Guelph which is

up to 27 times higher than the usual concentration of 0.5% found in

regular spearmint varieties. This type of yield will provide a strong

competitive advantage for Ceapro.

-- Clinical trial

There is currently a very interesting clinical trial being conducted by

researchers at University of Guelph. Given rosmarinic acid has

recognized anti-inflammatory properties, the goal of this study is to

confirm expected beneficial effects of drinking a spearmint tea for the

improvement of conditions like osteoarthritis and cartilage degradation

of the knee, a patholology that affects more than 10% of the Canadian

population. This two arms controlled trial which has been set for 50

participants had already enrolled 40 participants. They will randomly

consume two cups of spearmint tea each day for four months- either a

regular spearmint tea or a super spearmint tea with high concentration

of rosmarinic acid. Expected results will be to confirm efficacy, if any

and to compare any dose response relationship of different

concentrations of rosmarinic acid.

-- Equine and Companion Animal Market

Before initiating the human clinical trial with the spearmint tea,

University of Guelph researchers conducted a study with horses where

they indeed demonstrated the positive effects on inflammation when

horses consumed the spearmint. Potential markets for equine and senior

companion animals where inflammation is a major issue are definitely

significant markets to consider in the future.

We have high expectations for this spearmint product for which we have obtained

the rights for all indications from the University of Guelph. This is a great

example of one plant that can produce several therapeutic products for several

large markets that need solutions and represents a good example of how Ceapro

may transition into the functional food or nutraceutical markets. It is also a

great example of Canadian collaboration on the world stage and we expect this

will be very beneficial for all the participants, and Canadian agriculture

producers who may have opportunities to grow large volumes of a novel crop.

"As you can see, at Ceapro, we have a lot of exciting things to look forward in

2012 and beyond. The Ceapro team has worked very hard to develop these

attractive growth opportunities and we anticipate this will result in increases

in shareholder value", commented Mr. Gagnon.

The complete audited annual report and financial statements are available for

review on SEDAR at http://sedar.com/Ceapro and on the Company's website at

www.ceapro.com.

About Ceapro Inc.

Ceapro Inc. is a Canadian growth-stage biotechnology company. Primary business

activities relate to the development and commercialization of active ingredients

for personal care and cosmetic industries using proprietary technology and

natural, renewable resources. To learn more about Ceapro, visit www.ceapro.com.

CEAPRO INC.

Consolidated Statements of Net Income (loss) and Comprehensive Income (loss)

Unaudited

Three Months Ended March 31,

2012 2011

$ $

(restated, note 18)

----------------------------------------------------------------------------

Revenue 1,189,513 1,533,594

Cost of goods sold 520,694 612,248

----------------------------------------------------------------------------

Gross margin 668,819 921,346

Research and product development 162,472 187,275

General and administration 391,888 304,511

Sales and marketing 71,426 30,028

Finance costs (note 12) 25,997 46,506

----------------------------------------------------------------------------

Income from operations 17,036 353,026

Other operating loss (note 11) 20,552 23,063

----------------------------------------------------------------------------

Net income (loss) and

comprehensive income (loss) for

the period (3,516) 329,963

----------------------------------------------------------------------------

Net income (loss) per common

share:

----------------------------------------------------------------------------

Basic (0.00) 0.01

----------------------------------------------------------------------------

Diluted (0.00) 0.01

----------------------------------------------------------------------------

Weighted average number of

common shares outstanding 60,278,948 56,508,241

----------------------------------------------------------------------------

----------------------------------------------------------------------------

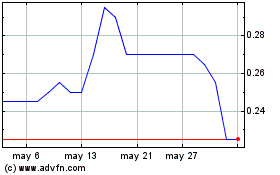

Ceapro (TSXV:CZO)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Ceapro (TSXV:CZO)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024