Ceapro Reports Third Quarter 2013 Financial Results

13 Noviembre 2013 - 7:00AM

Marketwired Canada

November 13, 2013 - Ceapro Inc. (TSX VENTURE:CZO) ("Ceapro" or the Company")

today released its financial results for the three-month and nine-month periods

ended September 30, 2013.

-- Highest third quarter revenue in Ceapro's history: revenues increased by

56% or $714,000 over third quarter of 2012.

-- Income from operations of $198,000 compared to a loss of $114,000 in the

third quarter of 2012.

-- Net profit of $123,000 compared to a net loss of $137,000 in 2012.

-- Highest nine months revenues in Ceapro's history: revenues increased by

27% or $1,059,000 over the same period in 2012.

-- Income from operations of $446,000 compared to a loss of $265,000 for

the same period in 2012.

-- Net profit of $280,000 compared to a net loss of $301,000 in 2012

FINANCIAL RESULTS FOR THE THIRD QUARTER AND THE FIRST NINE MONTHS ENDED

SEPTEMBER 30, 2013

-- Revenues were $1,997,000 for the three-month period ended September 30,

2013, as compared to $1,283,000 for the same period in 2012. For the

first nine months, revenues were $5,022,000 in 2013 compared to

$3,963,000 for the same period in 2012.These respective increase of 56%

and 27% reflect higher sales volumes of Avenanthramides and oat oil.

-- Research and development Investments were $203,000 and $568,000 for the

three-month period and nine-month period ended September 30, 2013 as

compared to $298,000 and $726,000 for the same periods in 2012. The

decreased investment in 2013 compared to 2012 is due to grant

recognition of discounted CAAP funding and grant contributions from

Alberta Innovates Technology Future and a federal government program

offset by significant increased expenses for regulatory and patents of

$150,000 incurred during the first nine months of 2013 for the issuance

of several key patents.

-- General and Administration expenses were $393,000 and $1,266,000 for the

three-month period and nine-month period ended September 30, 2013

compared to $431,000 and $1,313,000 for the same periods in 2012. These

respective decreases of $38,000 and $47,000 in 2013 as compared to 2012

are the result of decreased consulting engineer fees related to

feasibility studies conducted in 2012 but not in 2013 and to lower legal

expenses

-- Sales and Marketing expenses were $5,000 and $74,000 for the three-month

and nine-month period ended September 30, 2013 compared to $33,000 and

$159,000 for the same periods in 2012. These decreases reflect lower

travel costs for attendance at conferences and lower consulting costs

for marketing studies

-- Income from Operations was $198,000 in the third quarter of 2013 in

comparison with a loss of $114,000 for the same period of 2012. For the

first nine months of 2013, income from operations was $446,000 compared

to a loss of $265,000 for the same period in 2012.

-- Net income/loss. For the three-month period ended September 30, 2013,

net income was $123,000 versus a net loss of $137,000 for the same

period in 2012. For the first nine-months of 2013, Net income amounted

to $280,000 compared to a net loss of $301,000 for the same period in

2012. The Company commenced in April 2013 paying rent on its new

manufacturing facility which rent has been classified as "other

operating loss" as the facility is not yet operational.

"We are very pleased with our 2013 year to date results showing an increase of

revenues of $1,059,000 or 26.7% compared to the first nine months of 2012 and

showing a net profit of $280,000 compared to a net loss of $301,000 for the same

period in 2012" said Gilles Gagnon, President and CEO. " This result, which

includes the two highest quarterly revenues in Ceapro's history, is even more

impressive considering they were achieved during a year where we are building a

new facility which requires significant investment and resources" he added.

The complete financial statements are available for review on SEDAR at

http://sedar.com/Ceapro and on the Company's website at www.ceapro.com .

About Ceapro Inc.

Ceapro Inc. is a Canadian growth-stage biotechnology company. Primary business

activities relate to the development and commercialization of active ingredients

for personal care and cosmetic industries using proprietary technology and

natural, renewable resources. To learn more about Ceapro, visit www.ceapro.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

CEAPRO INC.

Consolidated Statements of Net Income (Loss) and Comprehensive Income (Loss)

Unaudited

Quarters Ended Nine Months Ended

September 30, September 30,

2013 2012 2013 2012

$ $ $ $

----------------------------------------------------------------------------

Revenue 1,997,398 1,283,167 5,021,999 3,962,811

Cost of goods sold 1,155,535 609,261 2,551,124 1,947,172

----------------------------------------------------------------------------

Gross margin 841,863 673,906 2,470,875 2,015,639

Research and product

development 203,191 297,087 567,640 726,701

General and

administration 393,163 431,064 1,266,149 1,312,557

Sales and marketing 4,850 32,649 73,773 159,083

Finance costs (note 12) 42,361 27,172 117,004 81,834

----------------------------------------------------------------------------

Income (loss) from

operations 198,298 (114,066) 446,309 (264,536)

Other operating loss

(note 11) (75,115) (22,494) (166,670) (36,086)

----------------------------------------------------------------------------

Net income (loss) for

the period 123,183 (136,560) 279,639 (300,622)

Other comprehensive loss

Actuarial loss on

employee future benefit

obligation (note 7) - - (16,916) -

----------------------------------------------------------------------------

Total comprehensive

income (loss) for the

period 123,183 (136,560) 262,723 (300,622)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) per

common share (note 18):

----------------------------------------------------------------------------

Basic 0.002 (0.00) 0.005 (0.00)

----------------------------------------------------------------------------

Diluted 0.00 (0.00) 0.00 (0.00)

----------------------------------------------------------------------------

Weighted average number

of common shares

outstanding 60,278,948 60,278,948 60,278,948 60,278,948

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Branko Jankovic

Vice President and CFO

Ceapro Inc.

T (Edmonton): 780.917.8376

E: bjankovic@ceapro.com

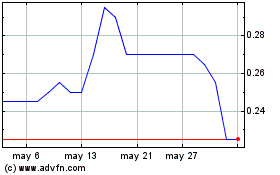

Ceapro (TSXV:CZO)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Ceapro (TSXV:CZO)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024