Reunion Offers Warrant Holders Incentive to Exercise

15 Noviembre 2021 - 7:00AM

Reunion Gold Corporation (“

Reunion” or the

“

Company”) (TSX-V: RGD) is pleased to announce

that it will offer holders of 57,394,345 common share purchase

warrants issued on May 18, 2021 (the “

May 18

Warrants”), 23,075,000 common share purchase warrants

issued on May 21, 2021 (the “

May 21 Warrants” and

together with the May 18 Warrants, the “

May

Warrants”), and 37,499,999 common share purchase warrants

issued on August 6, 2020 (the “

August Warrants”

and together with the May Warrants, the “

Outstanding

Warrants”) an incentive program for the early exercise of

the Outstanding Warrants (the “

Program”).

Pursuant to the Program, the Company will issue

for each Outstanding Warrant that is exercised between November 16,

2021 and the close of business Eastern Time (E.T.) on December 15,

2021, (i) one common share in the capital of the Company (the

“Share”) to which they are otherwise entitled

under the terms of the Outstanding Warrants and (ii) one-half of

one common share purchase warrant (the “Incentive

Warrant”). Each whole Incentive Warrant will allow the

holder to acquire one Share at an exercise price of $0.20 for a

period of two years following the date of the issuance of the

Incentive Warrant.

Each August Warrant is currently exercisable to

purchase one Share at $0.12 until August 6, 2022, each May 18

Warrant is exercisable until May 18, 2023 to acquire one Share at a

price of $0.12, and each May 21 Warrant is exercisable until May

21, 2023 to acquire one Share at a price of $0.12. If a holder does

not exercise its Outstanding Warrants before 5:00 p.m. E.T. on

December 15, 2021 (or only partially exercises them), these

warrants (or the portion of them that are not exercised) will

remain outstanding and continue to be exercisable on their existing

terms.

Holders of Outstanding Warrants who elect to participate in the

Program will be required to deliver the following to the Company on

or prior to 5:00 p.m. E.T. on December 15, 2021:

- a duly completed and executed exercise

Form, in the form which accompanies the certificate representing

the Outstanding Warrants;

- the original

certificate representing the Outstanding Warrants being exercised;

and

- the applicable aggregate exercise price ($0.12 per Outstanding

Warrant) payable to the Company by way of certified cheque, money

order, bank draft, or wire transfer in lawful money of Canada.

The proceeds from the early exercise of the

Outstanding Warrants will be used for exploration on the Company’s

mineral projects, with a focus on the Oko West project in Guyana,

and for general working capital.

The Incentive Warrants and any Shares issued

upon the exercise of the Incentive Warrants will be subject to a

hold period expiring four months after the date of distribution of

the Incentive Warrants.

Insiders of the Company hold 12,977,836 August

Warrants and 13,961,652 May Warrants, including 3,602,836 August

Warrants and 6,269,345 May Warrants held by directors and officers

of the Company. The participation by such insiders in the Program

constitutes a “related party transaction” as defined under

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”).

Such participation is exempt from the formal valuation and minority

shareholder approval requirements of MI 61-101 based on the fact

that neither the fair market value of the Shares subscribed for by

the insiders, nor the consideration for the Shares paid by such

insiders, would exceed 25% of the Company’s market

capitalization.

Cautionary Statement

The securities being offered have not been, nor

will they be registered under the United States Securities Act of

1933, as amended, or state securities laws and may not be offered

or sold within the United States or to, or for the account or

benefit of, U.S. persons absent U.S. federal and state registration

or an applicable exemption from the U.S. registration requirements.

This release does not constitute an offer for sale of securities in

the United States.

This press release contains 'forward-looking

information' within the meaning of applicable Canadian securities

legislation. Forward looking information in this news release

includes information with respect to the intended use of proceeds.

Forward-looking information is based on reasonable assumptions that

have been made by Reunion Gold Corporation as at the date of the

information and is subject to known and unknown risks,

uncertainties, and other factors that may cause actual results or

events to differ materially from those anticipated in the

forward-looking information.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

About Reunion Gold

Reunion Gold Corporation is a leading gold

explorer with a portfolio of projects in the Guiana Shield, South

America. The Company’s Shares are listed on the TSX Venture

Exchange under the symbol ‘RGD’. Additional information about the

Company is available on SEDAR (www.sedar.com) and on the Company’s

website (www.reuniongold.com).

For further information please contact:

REUNION GOLD CORPORATION Paul

Fowler, Manager, Corporate DevelopmentTel: +1 450.677.2585Email:

info@reuniongold.com

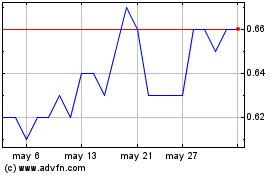

Reunion Gold (TSXV:RGD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Reunion Gold (TSXV:RGD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025