Sirios files on SEDAR the Mineral Resource Estimate for Cheechoo detailing Indicated Resources of 1.4 Moz at 0.94 g/t Au and Inferred Resources of 0.5 Moz at 0.73 g/t Au

16 Enero 2023 - 8:00AM

Management of

SIRIOS RESOURCES INC. (TSX-V: SOI)

is pleased to announce the filing on SEDAR of the technical report

“Mineral Resource Estimate Update for the Cheechoo Project, Eeyou

Istchee James Bay, Quebec”, with an effective date of July 20,

2022. The report, compliant to NI 43-101 standards and completed

for Sirios by BBA, includes an updated mineral resource estimate of

the Cheechoo Gold Project, located in Eeyou Istchee James Bay,

Quebec.

The updated mineral resource estimate (Table 1),

based on an open pit constrained model, includes an

indicated resource of 1.4 million ounces of gold contained

in 46.3 million tonnes at an average grade of 0.94 g/t Au, and an

inferred resource of 0.5 million ounces of gold contained in 21.1

million tonnes at an average grade of 0.73 g/t Au.

Table 1: Conceptual pit constrained

Indicated and Inferred Resource Estimate for the Cheechoo

Project

Table 1 is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/a3c704b5-b795-4a5b-b0be-6b843c777a5d

Dominique Doucet, President and CEO of Sirios,

stated, "Once again, I wish to congratulate our technical team for

this achievement which led us to an updated resources estimation,

which now includes more than 74% of the gold ounces classified as

indicated resources in addition to a significant increase of the

gold grade of the Cheechoo deposit. We have again demonstrated that

the Cheechoo project improves significantly with each new

exploration campaign undertaken on the property. Moreover,

exploration work continues in the area of the conceptual pit, with

the goal of increasing the mineral resources. As demonstrated by

recent trenching results in the metasediments to the east of the

deposit, the discovery potential across the property remains

excellent."

The mineral resource estimate has been prepared

by consulting firm BBA in accordance with the Definition Standards

of the Canadian Institute of Mining, Metallurgy and Petroleum

(“CIM”) as defined in the National Instrument 43-101 (“NI 43-101”).

The estimate is based on data from 329 diamond drill holes totaling

76,713 metres and 386 channels totalling 3,217 metres which

were completed by Sirios between 2012 and 2022. The full technical

report is now available on SEDAR (www.sedar.com) under the

Corporation’s profile as well as on Sirios’ web site.

Sirios' press release issued on December 6, 2022

(entitled "Sirios Announces Indicated Resource of 1.4 M oz at 0.94

g/t and Inferred Resource of 0.5 M oz at 0.73 g/t Gold at

Cheechoo") summarized the key results contained in the 2022

Cheechoo mineral resource estimate update.

Notes to the MRE Table:

- The independent qualified person for the 2022 MRE, as defined

by NI 43-101 guidelines, is Pierre-Luc Richard, P. Geo., of

PLR Resources Inc. The effective date of the estimate is July 20,

2022.

- These mineral resources are not mineral reserves as they do not

have demonstrated economic viability. The quantity and grade of

reported Inferred resources in this MRE are uncertain in nature and

there has been insufficient exploration to define these resources

as Indicated or Measured; however, it is reasonably expected that

the majority of Inferred Mineral Resources could be upgraded to

Indicated Mineral Resources with continued exploration.

- Resources are presented as undiluted and pit

constrained, and are considered to have reasonable prospects

for economic extraction. A cut-off grade of 0.35 g/t Au was

used for the MRE. The pit optimization was done using Deswik mining

software. The constraining pit shell was developed using pit slopes

of 45 to 50 degrees in hard rock and 26 degrees in overburden. The

cut-off grade and pit optimization were calculated using the

following parameters (amongst others): Gold price = USD1,650;

CAD:USD exchange rate = 1.29; Hard Rock Mining cost = $2.90/t mined

with incremental bench costs of $0.05 per 10 m bench;

Overburden Mining Cost = $5.00/t mined; Mining Recovery = 95%;

Mining dilution = 5% at 0 g/t Au; Metallurgical Recovery

varying from 84% to 92%; Processing cost = $14.57/t processed;

G&A = $5.42/t processed; and Refining and Transportation

cost = $5.00/oz. The conceptual pit-constrained resource has a

2.3:1 stripping ratio at the 0.35g/t Au cut-off grade. The mineral

resource cut-off grade was calculated at 0.32 g/t Au, however a

more conservative cut-off grade of 0.35 g/t Au was used for the

mineral resource estimate. The cut-off grade will be re-evaluated

in light of future prevailing market conditions and costs.

- The MRE was prepared using Surpac 2022 Refresh 1 and is based

on 329 surface drillholes (76,713m) and 386 surface channel samples

(3,217m), with a total of 55,566 assays. The resource database was

validated before proceeding to the resource estimation. Grade model

resource estimation was interpolated from drillhole and channel

data using an OK interpolation method within blocks measuring 10 m

x 10 m x 10 m in size. The cut-off date for drillhole database was

July 20, 2022.

- The model comprises 20 mineralized zones (which have a minimum

thickness of 3 m, with rare exceptions mostly between 2 and 3 m),

and two low-grade mineralized bodies mostly included in the

tonalite intrusive unit, each defined by drillhole intercepts. The

block model was reblocked to 10 m x 10 m x 10 m using the weighted

average grade and tonnage from high-grade and low-grade zones.

- High-grade capping was done on the composited assay data and

established on a per zone basis. Capping grades vary from

3 g/t Au to 55 g/t Au. A value of zero grade was applied

in cases where the core was not assayed.

- Fixed density values were established on a per unit basis,

corresponding to the median of the SG data of each unit ranging

from 2.65 t/m3 to 2.76 t/m3. A fixed density of 2.00 t/m3 was

assigned to the overburden.

- The MRE presented herein is categorized as Indicated and

Inferred Resources. The Indicated Mineral Resource category is

defined for blocks that are informed by a minimum of two drillholes

where drill spacing is less than 50 m for the intrusive-related

mineralization applied to 10x10x10m reblocks. The Inferred Mineral

Resource category is defined for blocks that are informed by a

minimum of two drillholes where drill spacing is less than 100 m

for the intrusive-related mineralization applied to 10x10x10m

reblocks. Where needed, some materials have been either upgraded or

downgraded to avoid isolated blocks.

- The number of tonnes (metric) and ounces were rounded to the

nearest hundred thousand.

- CIM definitions and guidelines for mineral resource estimates

have been followed.

The scientific and technical content of this

press release has been reviewed and approved by Mr. Dominique

Doucet, P.Eng. President and CEO of Sirios Resources Inc. and Mr.

Jordi Turcotte, P. Geo. Senior Geologist who are both “Qualified

Persons” as defined by National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”).

About Cheechoo PropertySirios’

100% owned Cheechoo property is located in the Eeyou Istchee James

Bay region of Quebec, approximately 200 km east of Wemindji and

less than 10 km from Newmont’s Eleonore gold mine.

About SiriosSirios Resources

Inc. is a Canadian-based mining exploration

company focused on developing its portfolio of

high-potential gold properties in the Eeyou Istchee

James Bay region of Quebec.

Cautionary note regarding

forward-looking informationThis news release contains

“forward-looking information” within the meaning of applicable

Canadian securities legislation based on expectations, estimates

and projections as at the date of this news release.

Forward-looking information involves risks, uncertainties and other

factors that could cause actual events, results, performance,

prospects and opportunities to differ materially from those

expressed or implied by such forward-looking information. Factors

that could cause actual results to differ materially from such

forward-looking information include, but are not limited to,

capital and operating costs varying significantly from estimates;

the preliminary nature of metallurgical test results; delays in

obtaining or failures to obtain required governmental,

environmental or other project approvals; uncertainties relating to

the availability and costs of financing needed in the future;

changes in equity markets; inflation; fluctuations in commodity

prices; delays in the development of projects; the other risks

involved in the mineral exploration and development industry; and

those risks set out in the Company’s public documents filed on

SEDAR at www.sedar.com. Although the Company believes that the

assumptions and factors used in preparing the forward looking

information in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all. The

Company disclaims any intention or obligation to update or revise

any forward- looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

The estimate of Inferred Mineral Resources

mentioned in this press release conform to National Instrument

43-101 standards and was prepared by Pierre-Luc Richard, P. Geo.,

independent qualified person, as defined by NI 43-101 guidelines.

The effective date of the estimate is July 20, 2022. The

above-mentioned mineral resources are not mineral reserves as they

do not have demonstrated economic viability. The quantity and grade

of the reported Inferred Mineral Resources are conceptual in nature

and are estimated based on limited geological evidence and

sampling. Geological evidence is sufficient to imply but not verify

geological and grade or quality continuity.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact:Dominique Doucet,

President, Eng. Tel: (514)

918-2867ddoucet@sirios.com

website: www.sirios.com

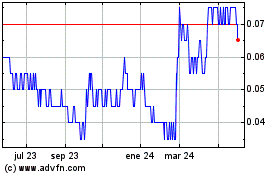

Sirios Resources (TSXV:SOI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

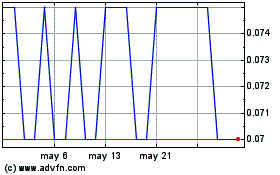

Sirios Resources (TSXV:SOI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024