false

0001279620

0001279620

2024-08-13

2024-08-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 13, 2024

| Zoned Properties, Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 000-51640 |

|

46-5198242 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

8360 E. Raintree Drive, #230

Scottsdale, AZ |

|

85260 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(Registrant’s telephone number, including

area code): (877) 360-8839

N/A

(Former name, former address and former fiscal

year, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2.)

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Regulation

FD Disclosure.

On August 13, 2024, Zoned

Properties, Inc. (the “Company”) issued a press release announcing its financial results for the three and six months ended

June 30, 2024. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information contained

in the website is not a part of this current report on Form 8-K.

Item 7.01. Regulation

FD Disclosure.

Beginning August 13,

2024, the Company’s management will deliver the investor presentation attached hereto as Exhibit 99.2 and incorporated herein by

reference.

The information included

in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ZONED PROPERTIES, INC. |

| |

|

| Dated: August 13, 2024 |

/s/ Bryan McLaren |

| |

Bryan McLaren |

| |

Chief Executive Officer & Chief Financial Officer |

2

Exhibit 99.1

Zoned

Properties Reports Strong Q2 2024 Financial Results with Continued

Momentum in Shift to Direct-to-Consumer Real Estate Focus

●

Operating Cash Flow for the Six Months Ended June 30, 2024 Increased 71%;

●

Operating Expenses for the Three Months Ended June 30, 2024 Decreased 17%;

●

Announced Listing of Non-Core Asset in Chino Valley for $16 Million;

●

Announced Share Repurchase Program for up to $1 Million

SCOTTSDALE,

Ariz., August 13, 2024 /AccessWire/ -- Zoned Properties®, Inc. (“Zoned Properties” or the “Company”) (OTCQB:

ZDPY), a technology-driven property investment company for emerging and highly regulated industries, including legalized cannabis, today

announced its financial results for the second quarter ended June 30, 2024, as well as recent highlights related to the Company’s

ongoing progress.

Recent

Highlights:

| ● | The

Company continues to make material progress in expanding its portfolio, enhancing cash flow,

and reducing expenses. |

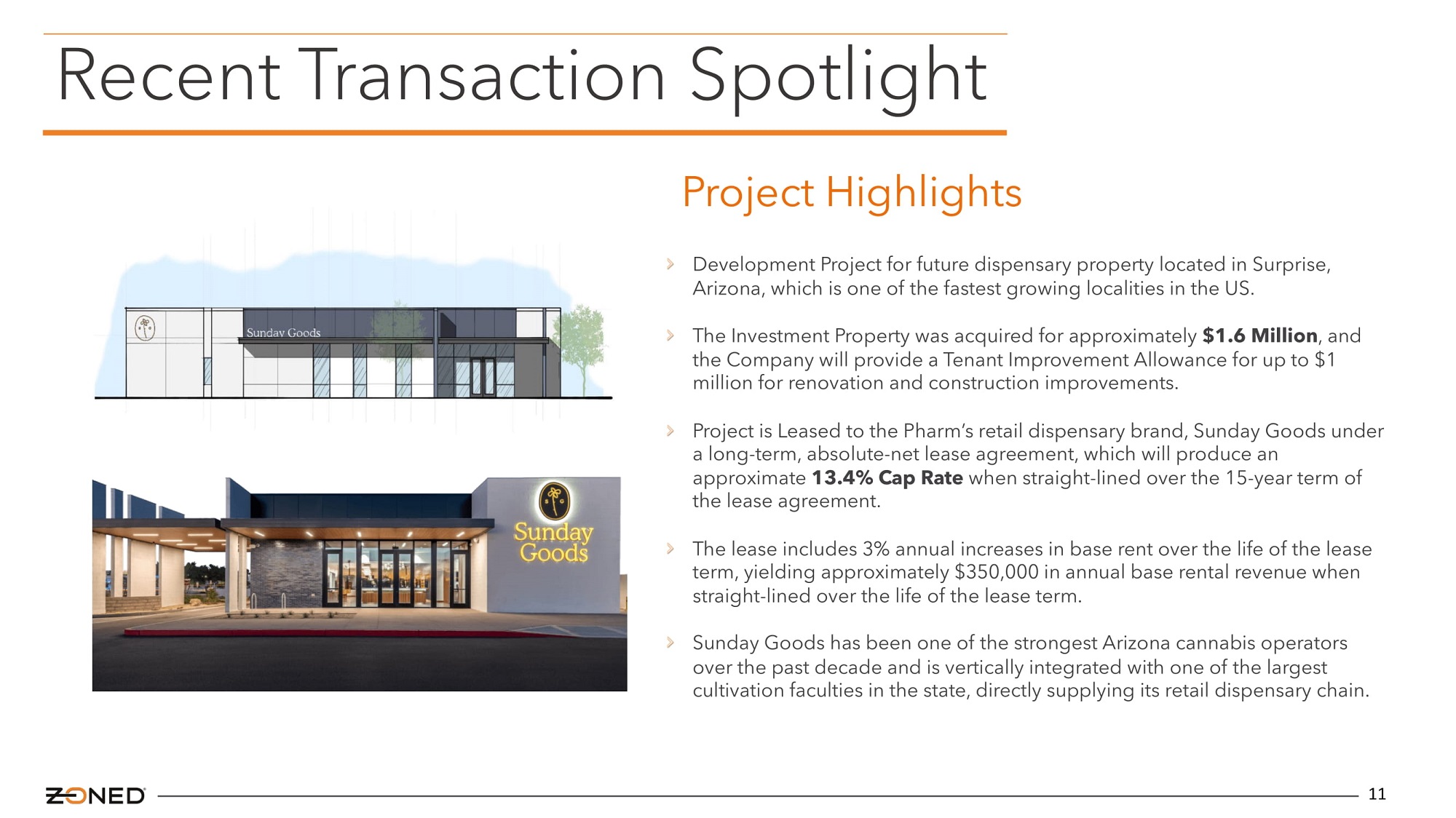

| ● | Subsequent

to quarter end, the Company successfully acquired its next investment property in Surprise,

AZ, leased to Sunday Goods which produces a 13.4% effective cap rate when straight lined

over the life of the lease term. The strategic acquisition with a best-in-class operator

in a prime retail location strengthens the Company’s portfolio and brings the Company

above $3 million in annualized rental revenue. Arizona's cannabis market is one of the strongest

in the nation surpassing $1.4 Billion in total sales in 2023, with many projecting sales

to reach over $1.5 Billion in 2024. The Company’s retail dispensary real estate footprint

now includes Arizona, Michigan, and Illinois; with prospective real estate acquisitions anticipated

in Ohio. |

| ● | Subsequent

to quarter end, the Company secured five new retail dispensary locations in Ohio, working

with tier-one dispensary operators as applicants through the state's lottery system. Several

of the properties are in major metropolitan areas and are expected to be leased to the tier-one

cannabis operators, further solidifying the Company’s presence in key markets with

best-in-class operating tenants, and driving future growth. |

| ● | Recently

announced strategic geographic expansion with the acquisition of a prime dispensary location

in Chicago, Illinois leased to Justice Cannabis Co.'s BLOC, marking an entry into one of

the largest urban markets for legalized cannabis, with a 16.5% effective cap rate when straight

lined over the life of the lease term. |

| ● | The

Company announced the approval a stock repurchase program, pursuant to which the Company

is authorized to purchase up to $1 million of its common stock over an unlimited period of

time. The Company anticipates it will begin repurchases of its common stock in the coming

months. |

| ● | The

Company recently listed one of its legacy cultivation property assets in Chino Valley, Arizona

for sale at a purchase price of $16 million. This potential transaction marks a significant

development in the Company's strategic real estate portfolio optimization. The Chino Valley

property has been a valuable non-core asset within the Company's portfolio and this potential

sale is part of a strategic shift to streamline the Company's portfolio and concentrate efforts

on a direct-to-consumer real estate strategy. |

Financial

Highlights for the Three and Six Months Ended June 30, 2024:

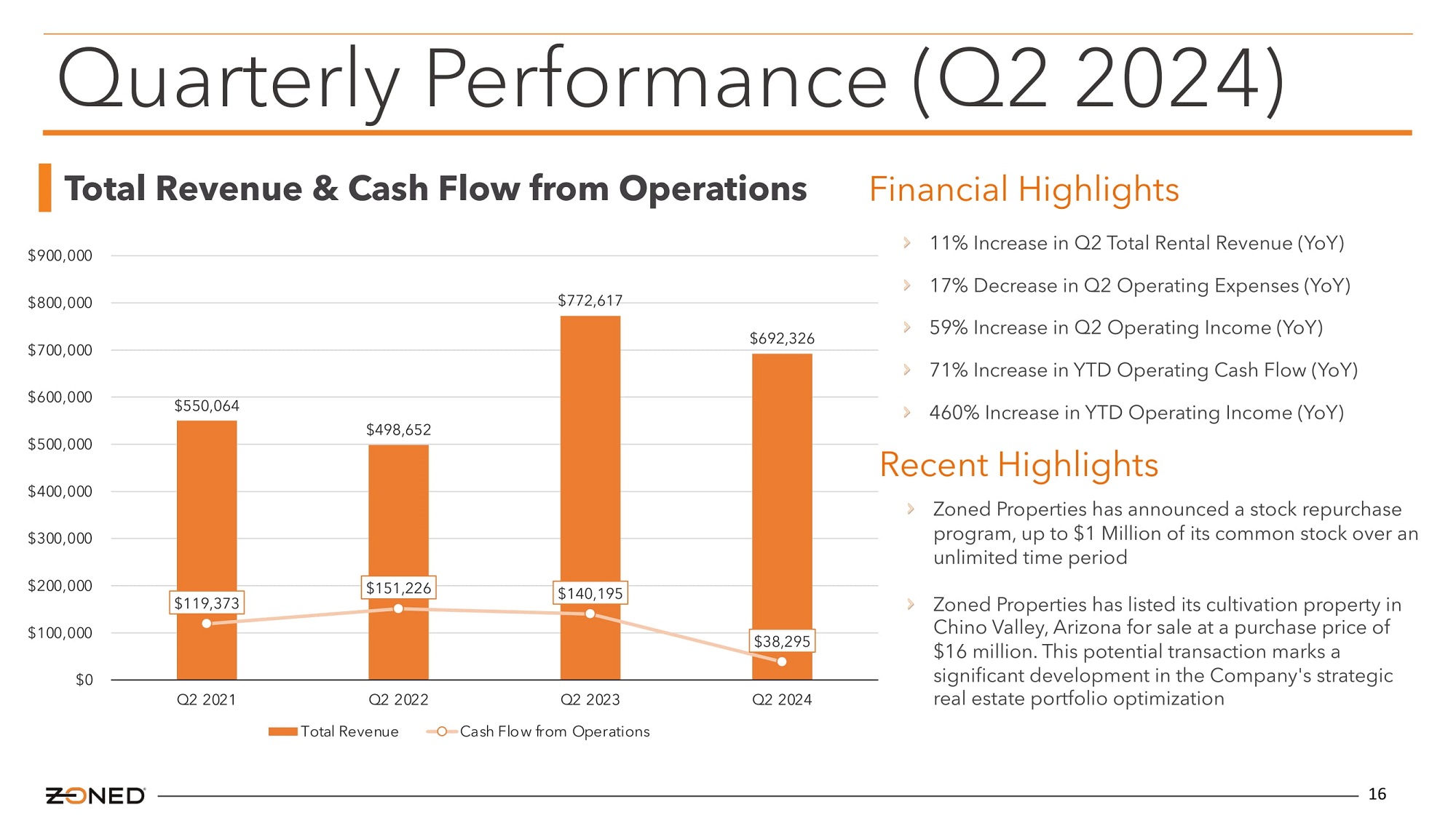

| ● | Property

Investment Portfolio Revenues were $679,326 for the quarter ended June 30, 2024, compared

to revenues of $609,591 for the quarter ended June 30, 2023, an increase of 11%. |

| ● | Revenues

were $692,326 for the quarter ended June 30, 2024, compared to revenues of $772, 617 for

the quarter ended June 30, 2023, a decrease of 10%. |

| ● | Income

from operations was $103,138 for the quarter ended June 30, 2024, compared to $64,805 for

the quarter ended June 30, 2023, an increase of 59%. |

| ● | Income

from Operations was $232,047 for the six months ended June 30, 2024, compared to $41,419

for the six months ended June 30, 2023, an increase of 460%. |

| ● | The

Company reported a net loss of $(32,283), or ($0.00) per fully diluted share, for the quarter

ended June 30, 2024, as compared to a net profit of $42,159, or $0.01 per fully diluted share,

for the quarter ended June 30, 2023. |

| ● | Cash

provided by operating activities was $245,513 for the six months ended June 30, 2024, compared

to $143,784 for the six months ended June 30, 2023, an increase of 71%. |

| ● | Operating

expenses were $589,188 for the quarter ended June 30, 2024, compared to $707,812 for the

quarter ended June 30, 2023, a decrease of 17%. |

| ● | The

Company had cash on hand of $1.53 million as of June 30, 2024, compared to cash on hand of

$3.1 million as of December 31, 2023. The decrease in cash position primarily reflects the

Company's acquisition of the Chicago, Illinois dispensary property. |

Management

Commentary:

“Our

team continues to execute on the Zoned Properties’ mission, and we are thrilled with the strides made in growing our rental revenue

base, operating cash flow and the significant reduction we have seen in operating expenses for the second quarter of 2024. The recent

acquisition of the Surprise, Arizona property leased to Sunday Goods and the securing of five strategic property locations in the Ohio

cannabis lottery process is pivotal to our portfolio expansion of direct-to-consumer real estate assets with best-in-class operating

tenants. These developments are significant in diversifying our tenant roster as we focus on geographic expansion in some of the strongest

cannabis state markets in the US.”

“Moreover,

we continue to formulate ways to enhance our balance sheet to support our exciting growth path, including the decision to list our Chino

Valley cultivation property for sale, a potential pathway to produce non-dilutive funding. Additionally, as part of our flexible capital

allocation strategy we plan to utilize our positive cash flow opportunistically towards our share repurchase program in the second half

of the year, given the continued disconnect between our share price and tangible book value,” said Bryan McLaren, Chief Executive

Officer of Zoned Properties.

About

Zoned Properties, Inc. (OTCQB: ZDPY):

Zoned

Properties Inc. (“Zoned Properties” or the “Company”) (OTCQB: ZDPY) is a technology-driven property investment

company focused on acquiring value-add real estate within the regulated cannabis industry in the United States. The Company aspires to

innovate within the real estate development sector, focusing on direct-to-consumer real estate that is leased to the best-in-class cannabis

retailers.

Headquartered

in Scottsdale, Arizona, Zoned Properties is redefining the approach to commercial real estate investment through its standardized investment

process backed by its proprietary property technology. Zoned Properties has developed a national ecosystem of real estate services to

support its real estate development model, including a commercial real estate brokerage and a real estate advisory practice. With a decade

of national experience and a team of experts devoted to the emerging cannabis industry, Zoned Properties is addressing the specific needs

of a modern market in highly regulated industries. The Company targets commercial properties that face unique zoning or development challenges,

identifies solutions that can potentially have a major impact on their commercial value, and then works to acquire the properties while

securing long-term, absolute-net leases.

Zoned

Properties targets commercial properties that can be acquired and rezoned for specific purposes, including the regulated and legalized

cannabis industry. It does not grow, harvest, sell or distribute cannabis or any substances regulated under United States law such as

the Controlled Substance Act of 1970, as amended (the “CSA”). Zoned Properties corporate headquarters are located at 8360

E. Raintree Dr., Suite 230, Scottsdale, Arizona. For more information, call 877-360-8839 or visit www.ZonedProperties.com.

Twitter:

@ZonedProperties

LinkedIn:

@ZonedProperties

Safe

Harbor Statement

This

press release contains forward-looking statements. All statements other than statements of historical facts included in this press release

are forward-looking statements. In some cases, forward-looking statements can be identified by words such as "believe," "expect,"

"anticipate," "plan," "potential," "continue" or similar expressions. Such forward-looking statements

include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed

or implied by such forward-looking statements. These factors, risks and uncertainties are discussed in the Company's filings with the

Securities and Exchange Commission. Investors should not place any undue reliance on forward-looking statements since they involve known

and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially

affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company's current

views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results

of operations, growth strategy and liquidity. The Company assumes no obligation to publicly update or revise these forward-looking statements

for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements,

even if new information becomes available in the future.

Investor

Relations

Zoned

Properties, Inc.

Bryan

McLaren

Tel

(877) 360-8839

Investors@zonedproperties.com

www.zonedproperties.com

3

Exhibit

99.2

August 2024 Corporate Presentation OTCQB: ZDPY www. ZonedProperties .com The Cannabis Friendly Landlord

2 Safe Harbor Statement This presentation contains forward - looking statements . All statements other than statements of historical facts included in this press release are forward - looking statements . In some cases, forward - looking statements can be identified by words such as "believe," "expect," "anticipate," "plan," "potential," "continue" or similar expressions . Such forward - looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward - looking statements . These factors, risks and uncertainties are discussed in the Company's filings with the Securities and Exchange Commission . Investors should not place any undue reliance on forward - looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially affect actual results, levels of activity, performance or achievements . Any forward - looking statement reflects the Company's current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity . The Company assumes no obligation to publicly update or revise these forward - looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward - looking statements, even if new information becomes available in the future . Forward - Looking Statements

Table of Contents I. Company Overview II. Market Landscape III. Financial Performance IV. Executive Management V. Capital Structure VI. Investment Thesis 3

Company Overview

Our MISSION To acquire value - add Retail Dispensary Properties leased to best - in - class Cannabis Operators . Our VISION Our VALUES To Own a Portfolio of Premier Dispensary Properties approved and operating in every Local Community. Sophistication , Safety , Sustainability , Stewardship Our Motto The Cannabis Friendly Landlord Company Philosophy 5

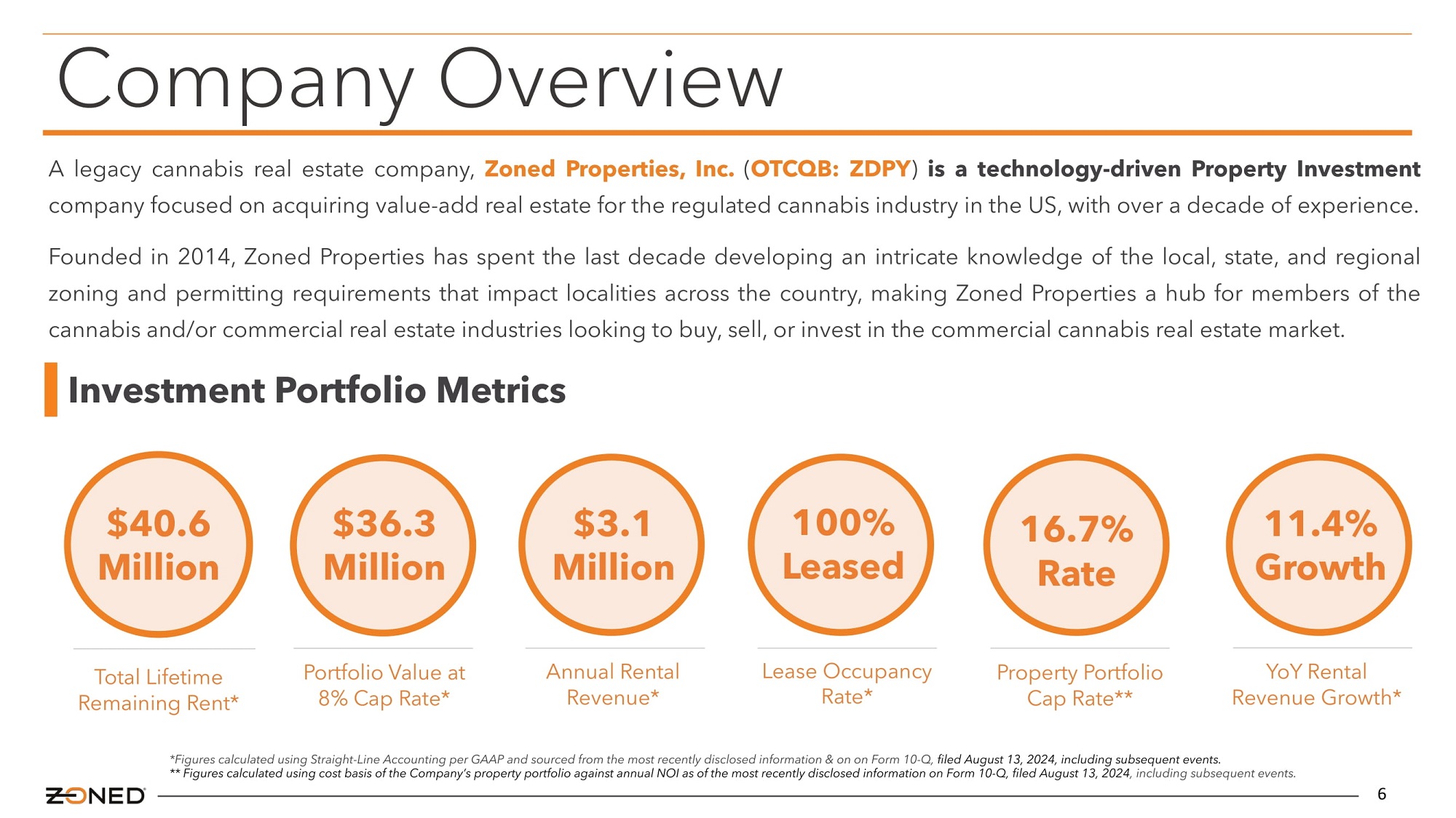

6 A legacy cannabis real estate company, Zoned Properties, Inc . ( OTCQB : ZDPY ) is a technology - driven Property Investment company focused on acquiring value - add real estate for the regulated cannabis industry in the US, with over a decade of experience . Founded in 2014 , Zoned Properties has spent the last decade developing an intricate knowledge of the local, state, and regional zoning and permitting requirements that impact localities across the country, making Zoned Properties a hub for members of the cannabis and/or commercial real estate industries looking to buy, sell, or invest in the commercial cannabis real estate market . Company Overview Lease Occupancy Rate* 100% Leased Property Portfolio Cap Rate** 16.7% Rate Portfolio Value at 8% Cap Rate* Annual Rental Revenue* $3.1 Million YoY Rental Revenue Growth* 11.4% Growth $36.3 Million Total Lifetime Remaining Rent* $40.6 Million Investment Portfolio Metrics *Figures calculated using Straight - Line Accounting per GAAP and sourced from the most recently disclosed information & on on Form 10 - Q, filed August 13, 2024, including subsequent events. ** Figures calculated using cost basis of the Company’s property portfolio against annual NOI as of the most recently disclos ed information on Form 10 - Q, filed August 13, 2024 , including subsequent events.

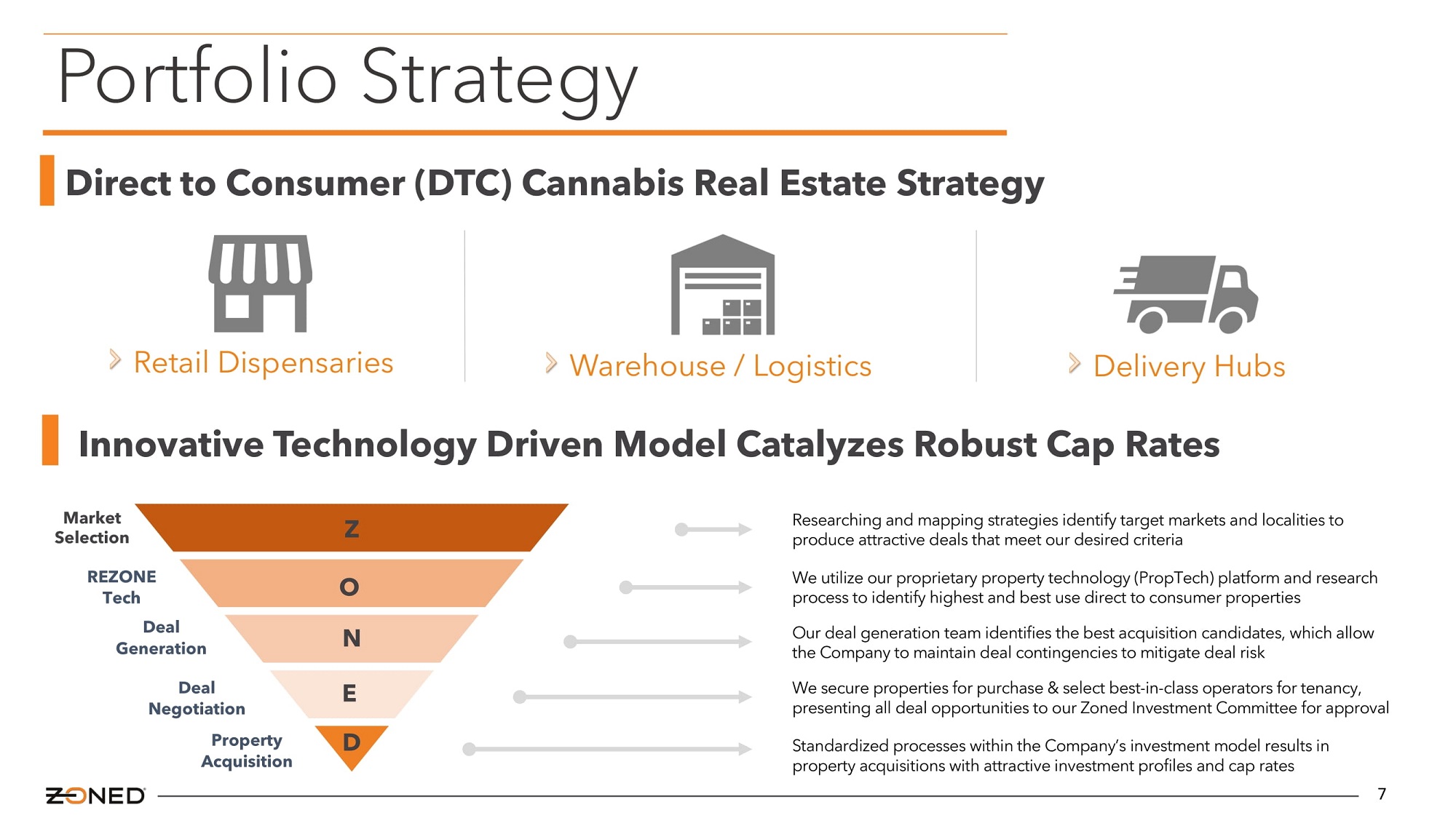

7 Direct to Consumer (DTC) Cannabis Real Estate Strategy Warehouse / Logistics Delivery Hubs Retail Dispensaries Portfolio Strategy Z O N E D Market Selection Deal Generation REZONE Tech Deal Negotiation Property Acquisition Our deal generation team identifies the best acquisition candidates, which allow the Company to maintain deal contingencies to mitigate deal risk Researching and mapping strategies identify target markets and localities to produce attractive deals that meet our desired criteria We secure properties for purchase & select best - in - class operators for tenancy, presenting all deal opportunities to our Zoned Investment Committee for approval We utilize our proprietary property technology (PropTech) platform and research process to identify highest and best use direct to consumer properties Standardized processes within the Company’s investment model results in property acquisitions with attractive investment profiles and cap rates Innovative Technology Driven Model Catalyzes Robust Cap Rates

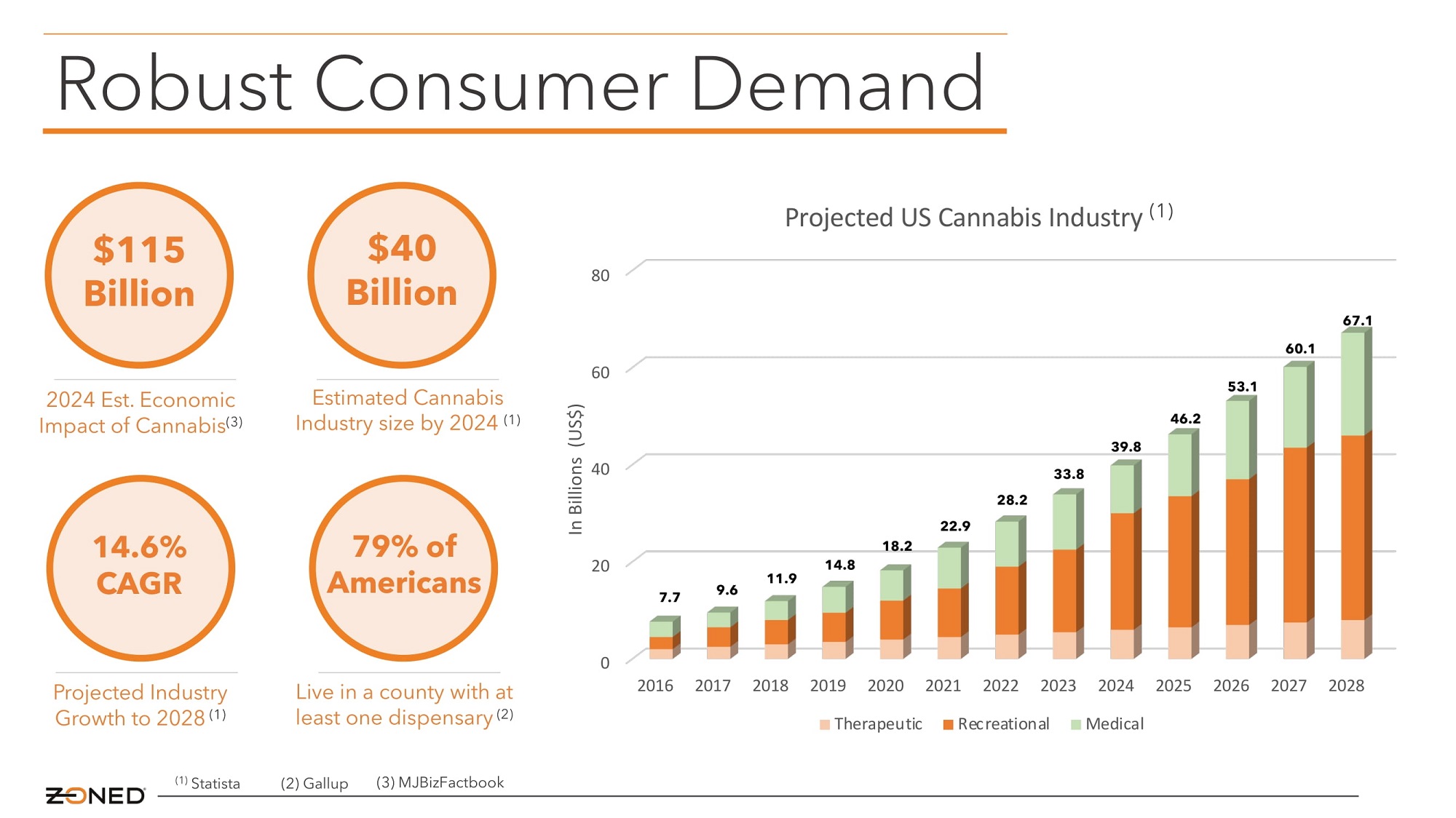

(1) Statista Robust Consumer Demand 0 20 40 60 80 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 In Billions (US$) Projected US Cannabis Industry (1) Therapeutic Recreational Medical 7.7 9.6 11.9 14.8 18.2 22.9 28.2 33.8 39.8 46.2 53.1 60.1 67.1 2024 Est. Economic Impact of Cannabis (3) $115 Billion Estimated Cannabis Industry size by 2024 (1) $40 Billion Projected Industry Growth to 2028 (1) 14.6% CAGR 79% of Americans (2) Gallup Live in a county with at least one dispensary (2) (3) MJBizFactbook

Marketplace Relationships

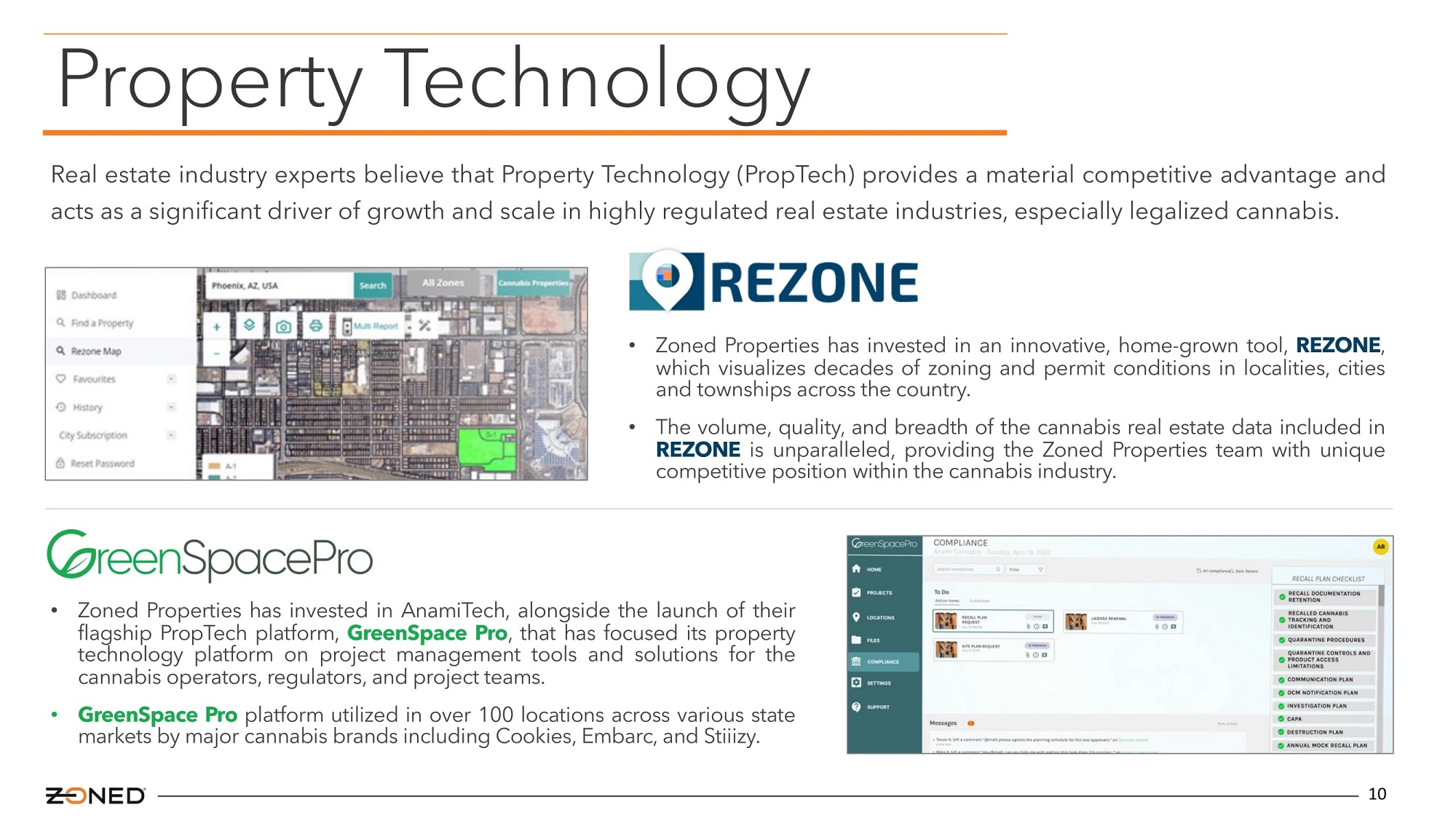

10 Property Technology • Zoned Properties has invested in an innovative, home - grown tool, REZONE , which visualizes decades of zoning and permit conditions in localities, cities and townships across the country . • The volume, quality, and breadth of the cannabis real estate data included in REZONE is unparalleled, providing the Zoned Properties team with unique competitive position within the cannabis industry . • Zoned Properties has invested in AnamiTech, alongside the launch of their flagship PropTech platform, GreenSpace Pro , that has focused its property technology platform on project management tools and solutions for the cannabis operators, regulators, and project teams . • GreenSpace Pro platform utilized in over 100 locations across various state markets by major cannabis brands including Cookies, Embarc, and Stiiizy . Real estate industry experts believe that Property Technology (PropTech) provides a material competitive advantage and acts as a significant driver of growth and scale in highly regulated real estate industries, especially legalized cannabis .

11 Development Project for future dispensary property located in Surprise, Arizona, which is one of the fastest growing localities in the US. The Investment Property was acquired for approximately $1.6 Million , and the Company will provide a Tenant Improvement Allowance for up to $1 million for renovation and construction improvements. Project is Leased to the Pharm’s retail dispensary brand, Sunday Goods under a long - term, absolute - net lease agreement, which will produce an approximate 13.4% Cap Rate when straight - lined over the 15 - year term of the lease agreement. The lease includes 3% annual increases in base rent over the life of the lease term, yielding approximately $350,000 in annual base rental revenue when straight - lined over the life of the lease term. Sunday Goods has been one of the strongest Arizona cannabis operators over the past decade and is vertically integrated with one of the largest cultivation faculties in the state, directly supplying its retail dispensary chain. Project Highlights Recent Transaction Spotlight

Market Landscape

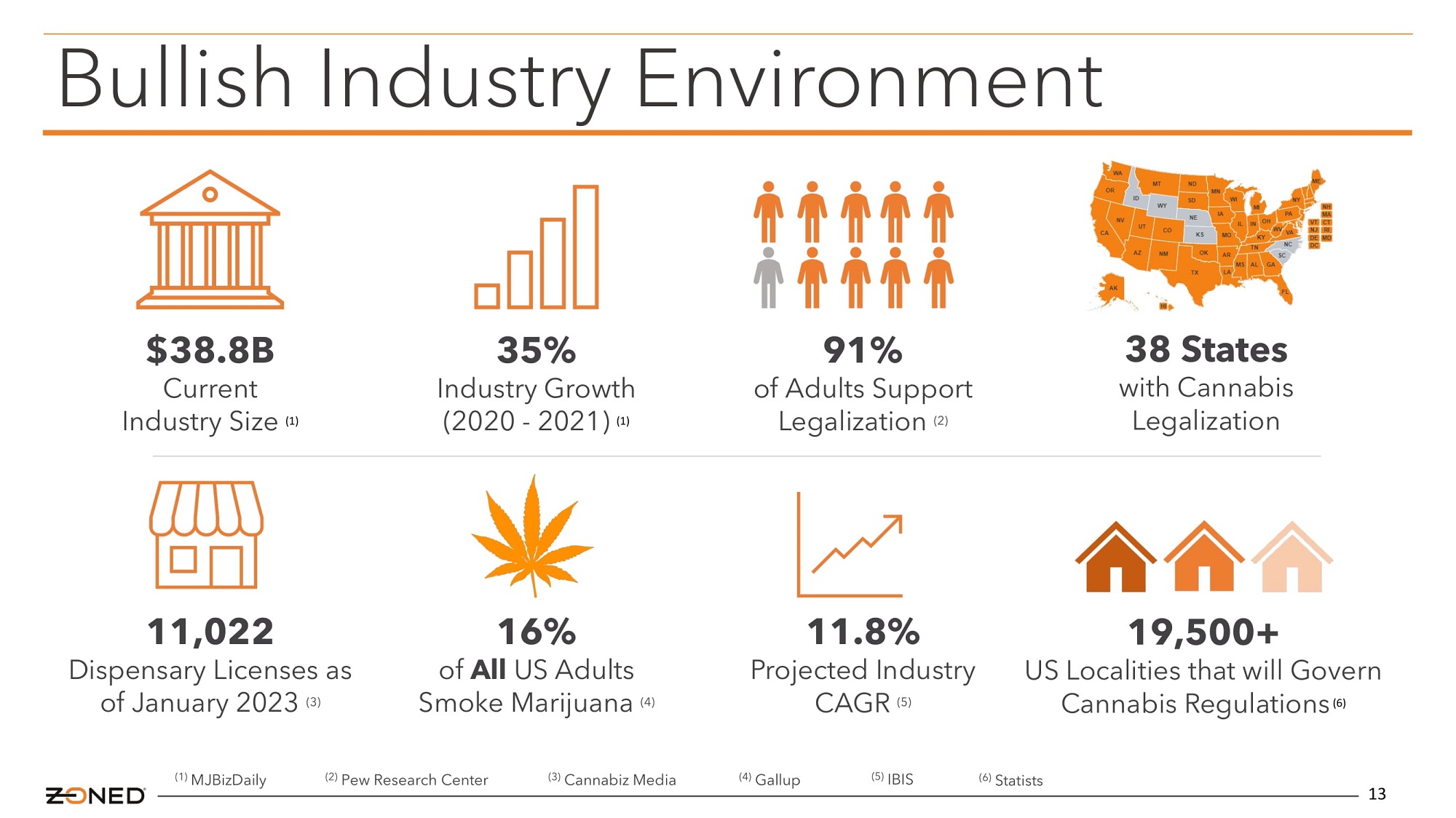

13 $ 38.8 B Current Industry Size (1) 35 % Industry Growth (2020 - 2021) (1) 91% of Adults Support Legalization (2) 38 States with Cannabis Legalization 11,022 Dispensary Licenses as of January 2023 (3) 16% of All US Adults Smoke Marijuana (4) 11.8% Projected Industry CAGR (5) 19,500+ US Localities that will Govern Cannabis Regulations (6) Bullish Industry Environment (1) MJBizDaily (2) Pew Research Center (3) Cannabiz Media (4) Gallup (5) IBIS (6) Statists

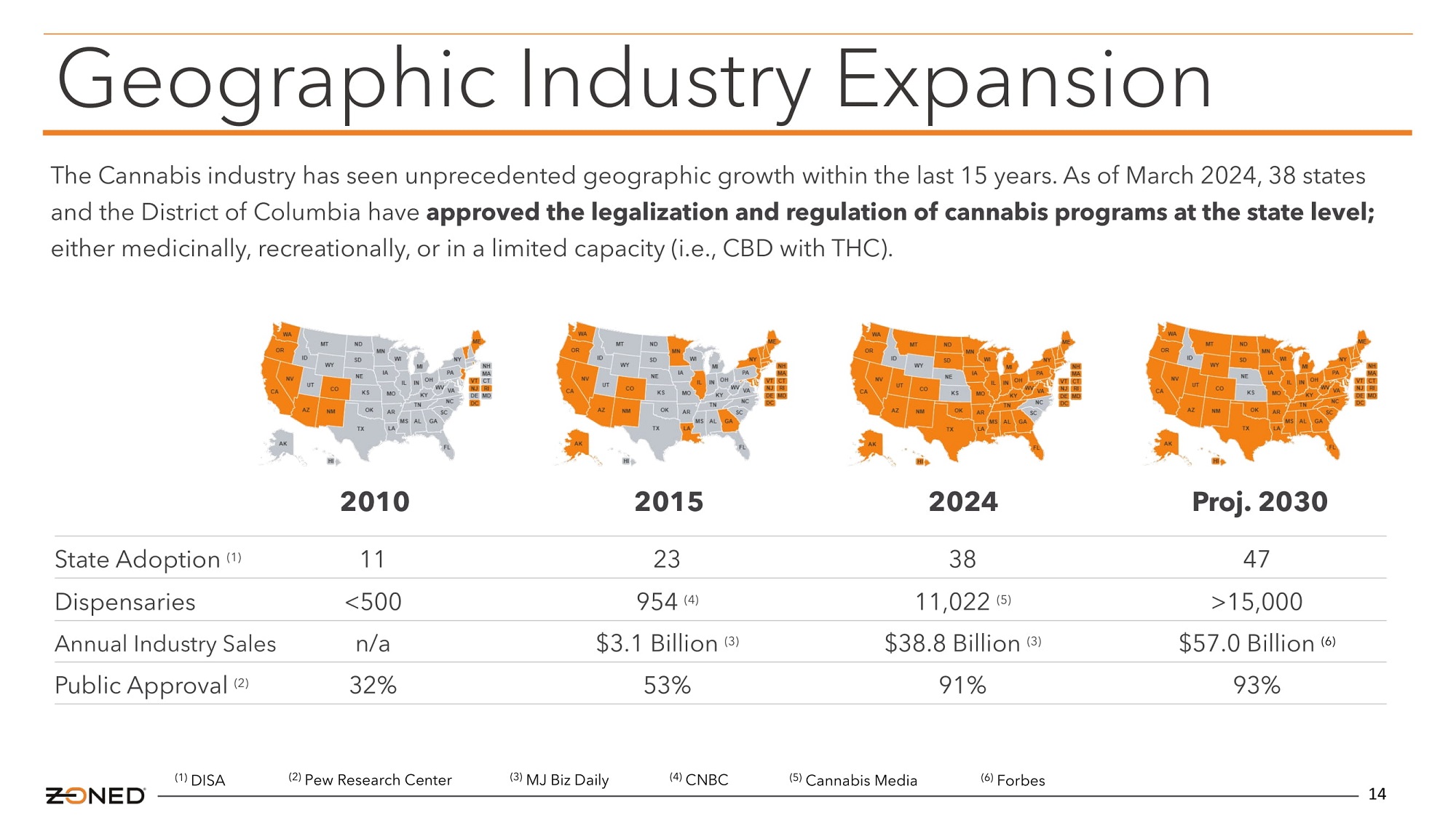

14 The Cannabis industry has seen unprecedented geographic growth within the last 15 years. As of March 2024, 38 states and the District of Columbia have approved the legalization and regulation of cannabis programs at the state level; either medicinally, recreationally, or in a limited capacity (i.e., CBD with THC). Geographic Industry Expansion State Adoption (1) Dispensaries Annual Industry Sales Public Approval (2) 11 <500 n/a 32% 23 954 (4) $3.1 Billion (3) 53% 38 11,022 (5) $38.8 Billion (3) 91% 47 >15,000 $57.0 Billion (6) 93% 2010 2015 2024 Proj. 2030 (1) DISA (2) Pew Research Center (3) MJ Biz Daily (4) CNBC (5) Cannabis Media (6) Forbes

Financial Performance

Quarterly Performance (Q2 2024) 16 Total Revenue & Cash Flow from Operations 11% Increase in Q2 Total Rental Revenue (YoY) 17% Decrease in Q2 Operating Expenses (YoY) 59% Increase in Q2 Operating Income (YoY) 71% Increase in YTD Operating Cash Flow (YoY) 460% Increase in YTD Operating Income (YoY) Financial Highlights Recent Highlights Zoned Properties has announced a stock repurchase program, up to $1 Million of its common stock over an unlimited time period Zoned Properties has listed its cultivation property in Chino Valley, Arizona for sale at a purchase price of $16 million. This potential transaction marks a significant development in the Company's strategic real estate portfolio optimization $550,064 $498,652 $772,617 $692,326 $119,373 $151,226 $140,195 $38,295 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 Q2 2021 Q2 2022 Q2 2023 Q2 2024 Total Revenue Cash Flow from Operations

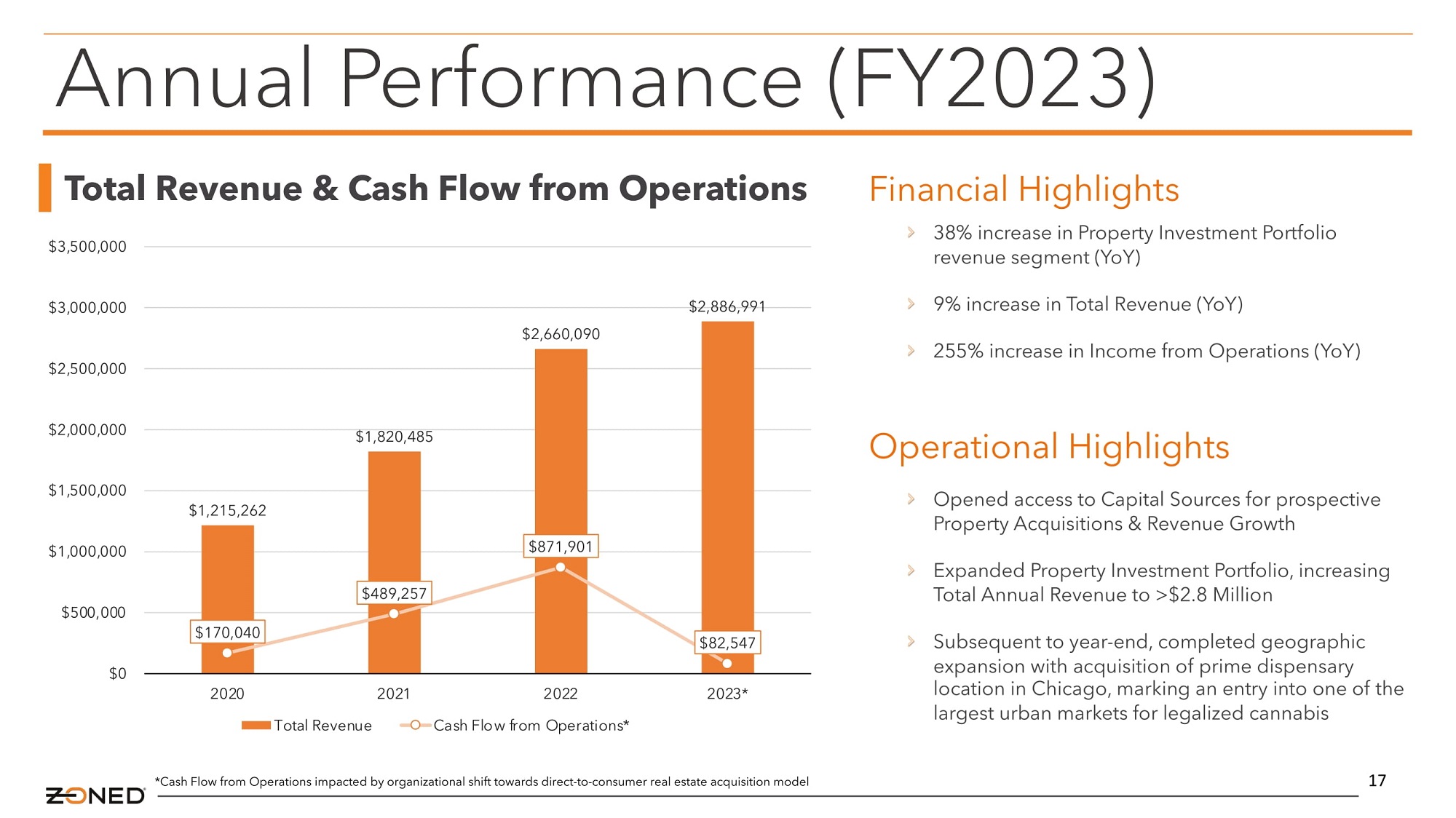

$1,215,262 $1,820,485 $2,660,090 $2,886,991 $170,040 $489,257 $871,901 $82,547 $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 2020 2021 2022 2023* Total Revenue Cash Flow from Operations* 17 Annual Performance (FY2023) Total Revenue & Cash Flow from Operations 38% increase in Property Investment Portfolio revenue segment (YoY) 9% increase in Total Revenue (YoY) 255% increase in Income from Operations (YoY) Financial Highlights Opened access to Capital Sources for prospective Property Acquisitions & Revenue Growth Expanded Property Investment Portfolio, increasing Total Annual Revenue to >$2.8 Million Subsequent to year - end, completed geographic expansion with acquisition of prime dispensary location in Chicago, marking an entry into one of the largest urban markets for legalized cannabis Operational Highlights *Cash Flow from Operations impacted by organizational shift towards direct - to - consumer real estate acquisition model

Executive Management

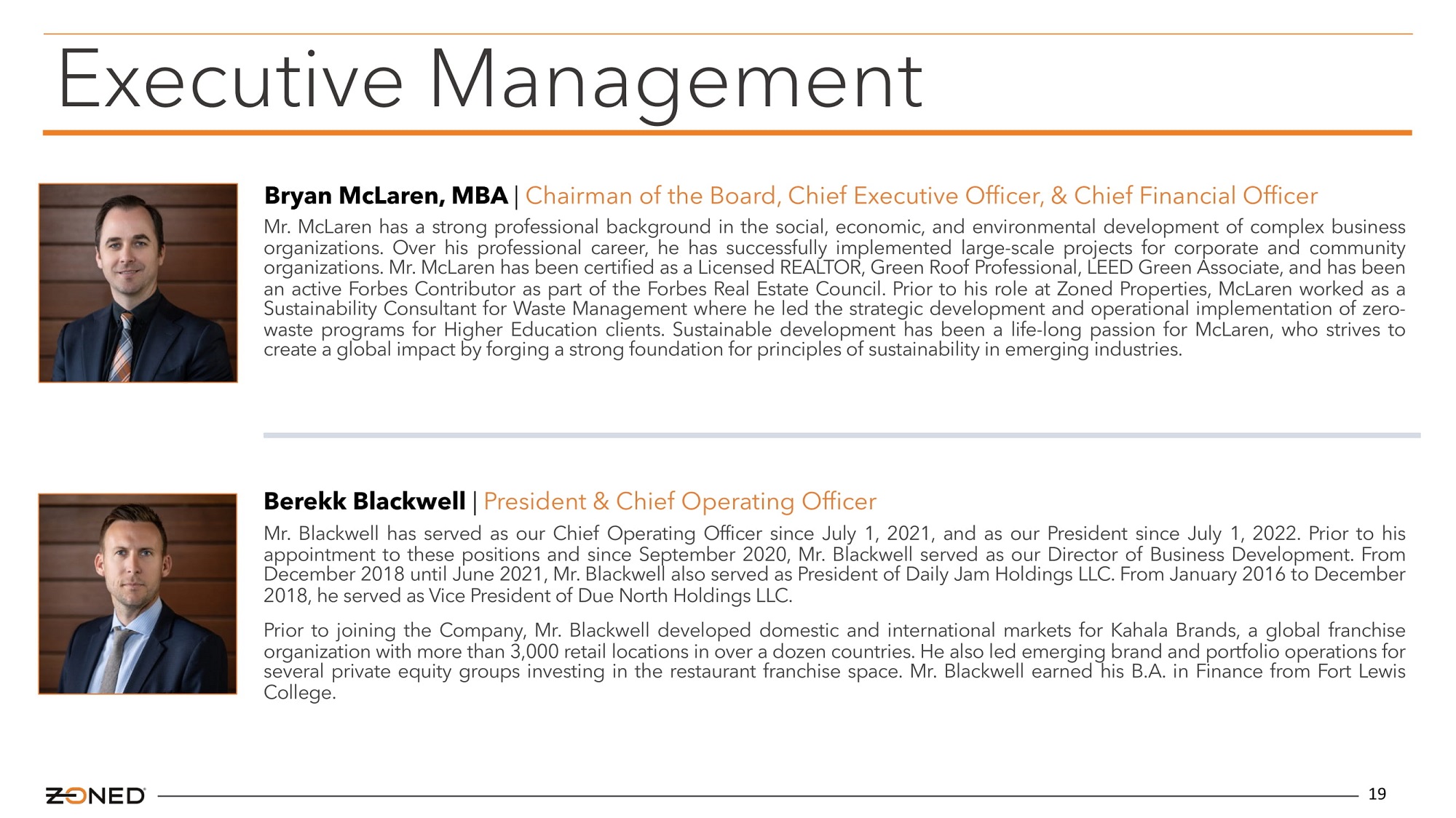

Executive Management 19 Mr . McLaren has a strong professional background in the social, economic, and environmental development of complex business organizations . Over his professional career, he has successfully implemented large - scale projects for corporate and community organizations . Mr . McLaren has been certified as a Licensed REALTOR, Green Roof Professional, LEED Green Associate, and has been an active Forbes Contributor as part of the Forbes Real Estate Council . Prior to his role at Zoned Properties, McLaren worked as a Sustainability Consultant for Waste Management where he led the strategic development and operational implementation of zero - waste programs for Higher Education clients . Sustainable development has been a life - long passion for McLaren, who strives to create a global impact by forging a strong foundation for principles of sustainability in emerging industries . Mr . Blackwell has served as our Chief Operating Officer since July 1 , 2021 , and as our President since July 1 , 2022 . Prior to his appointment to these positions and since September 2020 , Mr . Blackwell served as our Director of Business Development . From December 2018 until June 2021 , Mr . Blackwell also served as President of Daily Jam Holdings LLC . From January 2016 to December 2018 , he served as Vice President of Due North Holdings LLC . Prior to joining the Company, Mr . Blackwell developed domestic and international markets for Kahala Brands, a global franchise organization with more than 3 , 000 retail locations in over a dozen countries . He also led emerging brand and portfolio operations for several private equity groups investing in the restaurant franchise space . Mr . Blackwell earned his B . A . in Finance from Fort Lewis College . Berekk Blackwell | President & Chief Operating Officer Bryan McLaren, MBA | Chairman of the Board, Chief Executive Officer, & Chief Financial Officer

Capital Structure

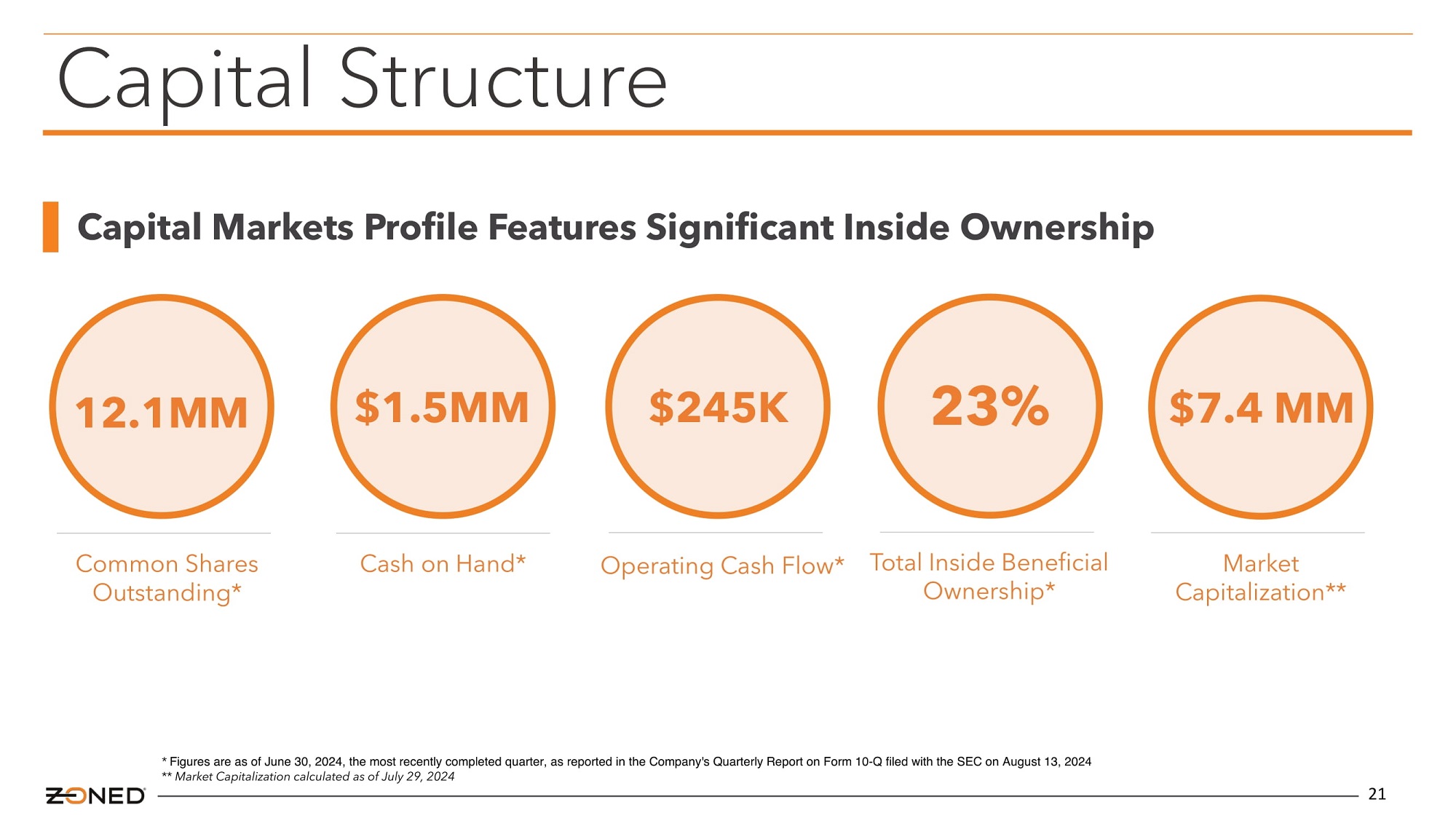

21 Capital Structure Common Shares Outstanding* Cash on Hand* 12.1MM $1.5MM Market Capitalization** $7.4 MM Operating Cash Flow* $245K Total Inside Beneficial Ownership* 23% Capital Markets Profile Features Significant Inside Ownership * Figures are as of June 30, 2024, the most recently completed quarter, as reported in the Company's Quarterly Report on Form 10 - Q filed with the SEC on August 13, 2024 ** Market Capitalization calculated as of July 29, 2024

Investment Thesis

23 Property Investment Portfolio Generating $3 Million Passive Rental Revenue (Annually) Focused on Direct - to - Consumer commercial real estate investments within the regulated cannabis industry Competitive Positioning with Access to Unique Pipeline of New Property Acquisitions Technology - driven business model that fuels its property investments, which can produce 12% - 20% Cap Rate properties. Non - Plant Touching Company in the High Growth Emerging Cannabis Industry The commercial cannabis industry topped $38 billion in 2022, with analysts expecting the industry to reach $57 billion by 203 0 Innovative Technology Driven Property Acquisition Model Catalyzes Robust Cap Rates Standardized process in conjunction with REZONE platform results in property acquisition closings with attractive cap rates Initiated Share Repurchase Program for up to $1 Million Over Unlimited Time Period Enhancing shareholder value through a flexible capital allocation Investment Thesis

Company Contact Information 24 Bryan McLaren Chairman, CEO, & CFO Zoned Properties, Inc. | Scottsdale, AZ www.ZonedProperties.com Tel 480.351.8193 | Investors@ZonedProperties.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Zoned Properties (QB) (USOTC:ZDPY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Zoned Properties (QB) (USOTC:ZDPY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024