TIDMKDNC

RNS Number : 1070T

Cadence Minerals PLC

22 November 2021

Cadence Minerals Plc

("Cadence Minerals", "Cadence")

Castillo Copper (ASX/LON: CCZ) field trip to the Picasso Lithium

Project identifies circa 10km zone of pegmatites.

Further to the announcement of 27 October 2021, Cadence Minerals

(AIM/AQX: KDNC; OTC: KDNCY) is pleased to announce that Castillo

Copper (ASX/LON: CCZ) ("Castillo") has provided an update on the

Picasso Lithium Project following the visit of its geology team who

mapped and collected samples from the high-density corridor.

For the full Castillo announcement, please click link here .

Highlights

-- A circa 10km zone of pegmatite occurrences was confirmed in

the north-eastern part of the tenure, which significantly exceeds

government mapping; and

-- The observed pegmatites are potentially related to lithium

mineralisation which enhances prospectivity of the tenure's

north-eastern quadrant

-- Due diligence for the Litchfield Lithium Project is

progressing with the laboratory expected to return assays within

2-3 weeks

Field Trip Findings:

Castillo's geology team undertook considerable mapping across

the Picasso Lithium Project, though much of the time was focused on

the tenure's north-east quadrant where the high-density pegmatite

corridor is located. Encouragingly, a circa 10km zone of pegmatite

occurrences was confirmed in the tenure's north-east quadrant which

is the best exposed part of the Picasso Lithium Project. Notably,

the pegmatites potentially host lithium mineralisation though this

is subject to further investigation. There are several areas of

outcropping basement where granite is the dominant rock type.

Interestingly, there is potential to discover further pegmatites

across the tenure as there is significant shallow sand cover.

Simon Paull, Managing Director of Castillo Copper, commented:

"The geology team's visit to the Picasso Lithium Project delivered

encouraging news, confirming that a 10km zone of pegmatites is

apparent in the tenure's north-east quadrant. The Board's

preliminary conclusion, based on due diligence undertaken to date,

is the Picasso Lithium Project is prospective for lithium

mineralisation and delivers significant incremental exploration

potential."

Cadence CEO, Kiran Morzaria, added: "We are pleased to note the

progress and initial conclusions announced today by Castillo

following the field trip work undertaken at the Picasso Project. We

look forward to further progress."

Overview

Lithium Technologies Pty Ltd ("LT") and Lithium Supplies Pty Ltd

("LS"), in which Cadence owns a 29% shareholding, each own 50% of

Synergy Prospecting Pty Ltd ("Synergy") and have granted , as

announced on 29 September 2021, Castillo a 90-day option to acquire

100% of the outstanding shares of LT and LS and by implication 100%

of Synergy.

During this 90-day period, Castillo will be conducting due

diligence on all three entities to ensure the underlying assets are

in good standing and there are no material adverse issues. Under

the terms of the option agreement, Castillo can exercise its right

to acquire LT, LS and Synergy at any time during the 90-day

period.

Castillo Copper Limited is an Australian-based explorer

primarily focused on copper across Australia and Zambia. The group

is embarking on a strategic transformation to morph into a mid-tier

copper group underpinned by its core projects:

-- A large footprint in the in the Mt Isa copper-belt district,

north-west Queensland, which delivers significant exploration

upside through having several high-grade targets and a sizeable

untested anomaly within its boundaries in a copper-rich region.

-- Four high-quality prospective assets across Zambia's

copper-belt which is the second largest copper producer in

Africa.

-- A large tenure footprint proximal to Broken Hill's

world-class deposit that is prospective for

zinc-silver-lead-copper-gold.

-- Cangai Copper Mine in northern New South Wales, which is one

of Australia's highest grading historic copper mines.

The primary assets of Synergy, which are wholly-owned, comprise

the Litchfield Lithium Project (EL31774) in NT and Picasso Lithium

Project (E63/1888) in WA. In addition, Synergy has an application

in NT - EL31828 - known as the Alcoota Lithium Project, which

comprises ground proximal to Alice Springs. Castillo will need to

undertake further geological due diligence on this application.

LT and LS also hold applications for six lithium properties in

San Luis Province, Central Argentina. Again, Castillo will need to

undertake further geological due diligence on these

applications.

Further details on these assets and all the applications and

permits are contained on our website here

Option terms & consideration

The terms of the 90-day option are as follows:

-- A$50,000 non-refundable deposit in cash on formally granting

the option that will go directly to Synergy for working capital

purposes.

Upon exercising the option within the 90-day period, the binding

consideration terms are as follows:

-- A$1m script payment in CCZ shares will become payable to the

Vendor Group based on the 14-day WVAP calculated from the date of

which the option agreement is announced to the ASX. Note, the

Vendor Group will be subject to a 6-month voluntary escrow period

for 50% of the shares and 12-months for the 50% balance from the

date of settlement. In addition, both parties agree to sign off on

a binding term sheet.

Incremental consideration terms are applicable if the following

milestones are achieved:

-- A$1m script payment in CCZ's shares to the Vendor Group based

on the 14-day WVAP if two drill-holes produce assayed intercepts

greater or equal to a true width of at least 10m @ 1.3% Li2O.Note,

the two holes will be at least 100m apart, but not greater than

200m.

-- A$1m script payment in CCZ's shares to the Vendor Group based

on the 14-day WVAP if a JORC compliant total inferred resource of

at least 7Mt @ 1.3% Li2O is modelled by SRK Consulting.

-- In the event of commercial mining operations commencing a 2%

NSR will be payable to the nominees of the facilitator.

- Ends -

For further information: Cadence

Minerals plc +44 (0) 7879 584153

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD & Broker)

James Joyce +44 (0) 207 220 1666

Darshan Patel

Novum Securities Limited (Joint Broker)

Jon Belliss +44 (0) 207 399 9400

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Forward-Looking Statements:

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding Cadence

Minerals Plc's future growth results of operations performance

future capital and other expenditures (including the amount. nature

and sources of funding thereof) competitive advantages business

prospects and opportunities. Such forward-looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. Many factors

could cause actual results to differ materially from the results

discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions competition environmental and other regulatory changes

actions by governmental authorities the availability of capital

markets reliance on key personnel uninsured and underinsured losses

and other factors many of which are beyond the control of Cadence

Minerals Plc. Although any forward-looking statements contained in

this announcement are based upon what the Directors believe to be

reasonable assumptions. Cadence Minerals Plc cannot assure

investors that actual results will be consistent with such

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGIBDBSUDDGBD

(END) Dow Jones Newswires

November 22, 2021 03:57 ET (08:57 GMT)

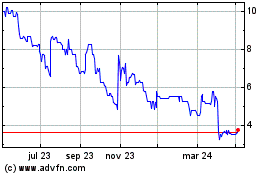

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

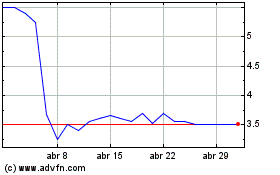

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024