TIDMDEMG

RNS Number : 2226M

Deltex Medical Group PLC

20 September 2021

20 September 2021

Deltex Medical Group plc

("Deltex Medical" or the "Group")

Interim results to 30 June 2021

Deltex Medical Group plc (AIM: DEMG), the global leader in

oesophageal Doppler monitoring, today announces its unaudited

interim results to 30 June 2021.

HIGHLIGHTS

Financial

-- revenues of GBP1.1 million (2020: GBP1.2 million)

-- unchanged adjusted EBITDA loss of GBP242,000 (2020: loss of

GBP241,000)

-- 8% improvement in loss before taxation of GBP0.5 million

(2020: loss of GBP0.6 million)

-- cash at hand on 30 June 2021 of GBP0.6 million (2020: GBP0.6

million)

-- standby debt facility of GBP0.5 million put in place;

currently undrawn

Commercial

-- as expected, trading was challenging in H1 as, pre-COVID-19,

80% of Group revenues were generated from elective surgery which

continues to be severely disrupted

-- preliminary encouraging signs of probe sales increasing month

on month, albeit from a low level, correlated with higher elective

surgery rates around the world

-- US probe revenues remain at reduced levels reflecting, among

other things, continuing impact on elective surgery due to

COVID-19-related disruption

-- increased investment by 'payers' to reduce the backlog of

elective surgery should help the Group's trading performance in the

future

-- strong performance by the international division in the first

half is expected to carry on into the second half

Nigel Keen, Chairman of Deltex Medical, said:

"We always expected the first half to be challenging as COVID-19

continues to delay significantly elective surgical procedures

around the world; however, we are encouraged by the increases in

quarterly probe sales since the beginning of the year."

"We expect activity in the second half to be stronger than in

the first half due to increased levels of elective surgery around

the world and continuing stronger performance by our international

division."

"The significant disruption to the global supply chain of

electronic components has been widely reported and is extremely

frustrating. It is in marked contrast to the success of the product

development work carried out by our engineering team on the new

monitor."

For further information, please contact:

Deltex Medical Group plc 01243 774 837

Nigel Keen, Chairman investorinfo@Deltexmedical.com

Andy Mears, Chief Executive

Natalie Wettler, Group Finance Director

Arden Partners plc 020 7614 5900

Paul Shackleton info@arden-partners.com

Joint Broker

Turner Pope Investments (TPI) Ltd 0203 657 0050

Andy Thacker info@turnerpope.com

James Pope

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

Notes for Editors

Deltex Medical manufactures and markets haemodynamic monitoring

technologies which are primarily used in critical care and general

surgical procedures. Deltex Medical's proprietary oesophageal

Doppler monitoring ("ODM") (TrueVue Doppler) measures blood flow

velocity in the central circulation in real time. Minimally

invasive, easy to set-up and quick to focus, the technology

generates a low-frequency ultrasound signal which is highly

sensitive to changes in blood flow and measures such changes in

'real time'. Deltex Medical is the only company in the enhanced

haemodynamic monitoring space to have built a robust and credible

evidence base demonstrating both the clinical and economic benefits

of its core technology: TrueVue Doppler. This technology has been

proven in a wide range of clinical trials to reduce complications

suffered by patients after surgery and consequently can save

hospitals money.

Deltex Medical's TrueVue System on the CardioQ-ODM+ monitor

platform now provides clinicians with two further advanced

haemodynamic monitoring technologies. TrueVue Impedance is an

entirely non-invasive monitoring technology which transmits low

magnitude, high frequency electrical signals through the thorax and

measures the changes to this signal when the heart pumps blood.

TrueVue PressureWave uses the peripheral blood pressure signal

analysis to give doctors information on changes in the circulation

and is particularly suited to monitoring lower risk or

haemodynamically stable patients. The next generation TrueVue

monitor is targeted for release in H1 2022.

Group goal

Haemodynamic management is now becoming widely accepted as a

vital part of the anaesthesia protocols for surgical patients, as

well as treating ventilated intensive care patients, including

ventilated COVID-19 patients. Consequently, the Group's focus is on

maximising value from the opportunities associated with: the CV-19

pandemic; the elective surgery backlog; and the higher profile of

haemodynamic monitoring which has arisen from the recent

consolidation in the sector. The Group aims to provide clinicians

with a modern, next generation, single 'haemodynamic workstation'

platform which offers them a range of technologies from simple to

sophisticated to be deployed according to the patient's clinical

condition as well as the skill and expertise of the user. Doing

this will enable the Group to partner with healthcare providers to

support modern haemodynamic management across the whole

hospital.

The Group is currently in the implementation phase of achieving

this goal in a number of territories worldwide, operating directly

in the UK and the USA, and via agreements with approximately 40

distributors overseas.

Chairman's statement

Financial results

Revenues for the six months ended 30 June were GBP1.1 million

(2020: GBP1.2 million) reflecting subdued activity in the first

half due to low levels of elective surgical procedures across the

majority of the territories into which the Group sells. Unlike

2020, where activity levels were at pre-pandemic levels in the

months of January and February, the whole of the first half of 2021

was adversely affected by COVID-19 and the associated reduced

volumes of elective surgery.

The reported gross margin was 64% (2020: 65%). In the first half

of 2019 the gross margin was 76%. The comparatively lower gross

margin in 2021 reflects lower activity levels and reduced

manufacturing-related recoveries in the first half.

Adjusted EBITDA, which comprises the operating loss adjusted for

depreciation, amortisation, equity-settled non-executive directors'

fees, share-based payments and certain other items, was unchanged

year-on-year with a loss of GBP(242,000) (2020: GBP(241,000)).

Overheads at GBP1.4 million (2020: GBP1.3 million) were broadly

the same. Prior year overheads were reduced by a one-off credit

relating to receipt of a GBP117,000 payment in relation to the

termination of a third-party distribution agreement.

Other operating income increased to GBP0.2 million (2020:

GBP49,000), principally reflecting increased COVID-19-related

furlough payments.

Loss before taxation was an 8% improvement on prior year at

GBP0.5 million (2020: GBP0.6 million).

Cash at hand on 30 June 2021 was GBP0.6 million (2020: GBP0.6

million).

New standby debt facility

There are preliminary but encouraging signs that based on, among

other things, a quarterly analysis of probe unit sales, the Group

is beginning to see an increase in activity from the low levels

seen at the beginning of the year.

The Board believes that activity levels should continue to rise

in the second half as elective surgery begins to increase around

the world. There are substantial backlogs in elective surgical

procedures in all the territories into which the group, directly or

indirectly, sells into. These backlogs represent a significant and

growing issue for governments and healthcare 'payers'.

The principal risk to the continuing increase in elective

surgical procedures currently appears to be the spread of the delta

variant of COVID-19, particularly among individuals who have not

been fully vaccinated. Some intensive care units in hospitals in

the southern states of the USA are reported to be full with

COVID-19 patients and as a result elective surgery has been

cancelled in these hospitals. There are also reports of COVID-19

patient hospitalisation levels starting to increase in certain

hospitals in the UK. As a result, the Board believes that there is

a significant degree of uncertainty as to the likely trajectory of

increases in elective surgery and hence associated uncertainty with

the likely increases in Group revenues.

Since the start of the pandemic, the Group has been managing its

cash resources extremely carefully. This has included reducing

working capital by reducing its stock levels and trade debtors.

Given the uncertainties relating to COVID-19 hospitalisation rates

it is not possible to predict how quickly or reliably levels of

elective surgery will climb and hence predict with a high degree of

certainty increased TrueVue probe revenues. Accordingly, the Board

has been considering carefully likely demands for cash mindful that

cash at hand was GBP0.6 million at the 30 June, 2021 and has

considered a number of funding options. The Board has entered into

an agreement with Imperialise Limited, a company controlled by

Nigel Keen for a GBP0.5 million standby loan facility (on arm's

length commercial terms) until 31 December, 2022 in the event that

the Group experiences increased demands for cash during this

period. The Company will only draw down on the facility if

necessary.

The interest rate on the facility is 8% per annum, and it is

unsecured. The facility is repayable in full on or before 31

December 2022.

Nigel Keen is a director of both Imperialise Limited and Deltex

Medical, and accordingly, this transaction constitutes a related

party transaction under Rule 13 of the AIM Rules for Companies. The

independent directors, being Andy Mears, Natalie Wettler, Julian

Cazalet, Mark Wippell, Christopher Jones and Tim Irish, having

consulted with the Company's nominated adviser, consider that the

terms of the transaction are fair and reasonable insofar as its

shareholders are concerned.

Commercial activities

Before the pandemic, 80% of the Group's probe sales were

associated with elective surgery. As a result, the Group's

probe-related revenues have been severely adversely affected by

COVID-19.

Deltex Medical sells directly into the UK and US healthcare

markets. In these markets it is seeing widely varying levels of

demand for its probes from existing customers. In most areas where

demand is lower, this appears to reflect the existence of COVID-19

'hot spots' which reduce the number of available critical care beds

and result in a reduction in elective surgical procedures. Even

when the number of COVID-19 patients reduces in a hospital's

critical care unit(s), it can take some time for elective surgery

levels to be increased substantially.

The Group has good data, particularly from the US, which show

that an experienced and successful clinical educator can drive

demand for its probes from existing customers. The converse is also

true: where Deltex Medical is unable to gain access for its

clinical educators to a customer, there is often a concomitant

reduction in probe demand. Accordingly, customer access remains a

key driver for the Group's commercial success. The Group is

continuing to experience differing levels of access for its

clinical educators and trainers, depending on each hospital's

policy in respect of visits by third party vendors.

Due to the public 'payer' status of the National Health Service,

the size of the backlog of elective surgical procedures in the UK

is extremely politically sensitive. Recent reports suggest that

there are some 5.5 to 6 million cases awaiting elective surgery.

The UK Government has recently announced tax increases to finance

substantially higher ongoing levels of funding for the NHS to

address this backlog. The allocation of this funding should be

positive for the Group's financial performance into 2022 and

beyond.

The Board has decided to keep sales and marketing spend in the

USA at a low level until it is clear that US hospitals are opening

up and prepared to accept clinical educators back onto their

premises. The Board believes that, on balance, the risk of higher

levels of US sales and marketing spend not generating a concomitant

increase in revenues represents a more substantial risk than

waiting for the US market to recover before increasing the Group's

investment in US sales and marketing expenditure.

The Group's international division has been the success story of

the first half, particularly in the second quarter. It has seen

significantly higher activity levels, with notably stronger levels

of demand from France. The Board believes that these higher levels

of demand will continue into the second half, and other

international territories should also start to experience increases

in demand as the levels of elective surgery climb around the world.

However, international territories which have seen very high levels

of COVID-19, such as Peru, continue to generate reduced demand for

Deltex Medical probes at the current time.

New product development

Deltex Medical's engineering teams have made good progress in

the first half on the design and development of the new monitor

which will significantly improve the functionality and usability of

the Group's probes and other non-invasive haemodynamic monitoring

technologies.

Unfortunately, the widely reported significant lengthening of

lead times for a number of key components manufactured overseas,

especially electronics, has adversely affected the timetable for

the product launch of the new monitor. Given this significant

uncertainty over component availability, the launch of the new

monitor has now been re-scheduled for the first half of 2022. This

component-related slippage means that it will no longer be possible

for the Group to generate revenues from the new monitor this

year.

Current trading and prospects

As expected, trading has been depressed during the first half

and during the summer months with COVID-19 restrictions in place in

many of our territories, particularly in the USA; however, trading

is beginning to improve, albeit from low levels. For example, for

the past four months we have seen month-on-month increases in probe

revenues. We also expect probe revenues to continue to improve

through to the end of the year.

Our production facility has been on part-time furlough for the

majority of the year; however, the production teams are now back

full time as demand for TrueVue Doppler probes increases. It is

encouraging to see our Chichester facility fully operational once

more.

Deltex Medical's probe sales are strongly correlated with

elective surgery levels around the world, and as the number of

elective surgical procedures continue to increase so there should

be a concomitant increase in probe sales. The two principal risks

relating to this increase in probe sales comprise: (i) any further,

substantial COVID-19 outbreaks which cause reductions in elective

surgery; and (ii) the lack of appropriate access for the Group's

clinical educators to its existing customer base.

Probe sales in the USA remain at reduced levels and there is

significant upside to Group revenues if we can successfully

increase activity levels in our US accounts as the pandemic abates

and elective surgery levels start to climb in US hospitals.

The lack of availability of the new monitor has constrained the

Group's ability to generate significant equipment-related revenues

this year which will have an adverse impact on expected revenues

this year.

Nigel Keen

Chairman

20 September 2021

Condensed Consolidated Statement of Comprehensive Income

For the period ended 30 June 2021

Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

---------------------------------------------- ----- ----------- ----------- -------------

Note GBP'000 GBP'000 GBP'000

Revenue 4 1,072 1,157 2,398

Cost of sales (381) (401) (757)

---------------------------------------------- ----- ----------- ----------- -------------

Gross profit 691 756 1,641

Administrative expenses (777) (578) (1,472)

Sales and distribution expenses (466) (550) (964)

Research and Development, Quality and

Regulatory (117) (186) (246)

Impairment reversal on trade receivables - - 11

Exceptional costs 16 - - (232)

---------------------------------------------- ----- ----------- ----------- -------------

Total costs (1,360) (1,314) (2,903)

---------------------------------------------- ----- ----------- -----------

Other operating income 193 49 469

---------------------------------------------- ----- ----------- -----------

Other gain 25 19 171

---------------------------------------------- ----- ----------- -----------

Operating loss (451) (490) (622)

---------------------------------------------- ----- ----------- ----------- -------------

Finance costs (80) (88) (172)

---------------------------------------------- ----- ----------- ----------- -------------

Loss before taxation (531) (578) (794)

Tax credit on loss 7 7 4 9

---------------------------------------------- ----- ----------- ----------- -------------

Loss for the period/year (524) (574) (785)

---------------------------------------------- ----- ----------- ----------- -------------

Other comprehensive income/(expense)

Items that may be reclassified to profit

or loss:

Net translation differences on overseas

subsidiaries 1 24 (6)

---------------------------------------------- ----- ----------- ----------- -------------

Other comprehensive income/(expense)

for the period/year, net of tax 1 24 (6)

---------------------------------------------- ----- ----------- ----------- -------------

Total comprehensive loss for the period/year (523) (550) (791)

---------------------------------------------- ----- ----------- ----------- -------------

Total comprehensive loss for the period/year

attributable to:

Owners of the Parent (524) (560) (804)

Non-controlling interests 1 10 13

---------------------------------------------- ----- ----------- ----------- -------------

(523) (550) (791)

---------------------------------------------- ----- ----------- ----------- -------------

Loss per share - basic and diluted 8 (0.09)p (0.11)p (0.15p)

---------------------------------------------- ----- ----------- ----------- -------------

Condensed Consolidated Balance Sheet

As at 30 June 2021

Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

Note

GBP'000 GBP'000 GBP'000

-------------------------------------- ------ --------- --------- ------------

Assets

Non-current assets

Property, plant and equipment 271 344 305

Intangible assets 2,756 2,696 2,554

Financial assets at amortised cost 157 159 153

-------------------------------------- ------ --------- --------- ------------

Total non-current assets 3,184 3,199 3,012

Current assets

Inventories 9 812 1,000 895

Trade and other receivables 392 655 576

Financial assets at amortised cost 15 214 15

Other current assets 103 114 122

Current income tax recoverable 94 103 61

Cash and cash equivalents 10 553 568 853

-------------------------------------- ------ --------- --------- ------------

Total current assets 1,969 2,654 2,522

-------------------------------------- ------ --------- --------- ------------

Total assets 5,153 5,853 5,534

Liabilities

Current liabilities

Borrowings 12 (163) (77) (159)

Trade and other payables 13 (1,527) (2,185) (1,416)

Total current liabilities (1,690) (2,262) (1,575)

-------------------------------------- ------ --------- --------- ------------

Non-current liabilities

Borrowings 12,14 (1,010) (1,092) (993)

Trade and other payables (252) (300) (274)

Provisions (51) (65) (51)

-------------------------------------- ------ --------- --------- ------------

Total non-current liabilities (1,313) (1,457) (1,318)

-------------------------------------- ------ --------- --------- ------------

Total liabilities (3,003) (3,719) (2,893)

-------------------------------------- ------ --------- --------- ------------

Net assets 2,150 2,134 2,641

-------------------------------------- ------ --------- --------- ------------

Equity

Share capital 15 5,773 5,249 5,773

Share premium 33,444 33,230 33,444

Capital redemption reserve 17,476 17,476 17,476

Other reserve 537 468 505

Translation reserve 136 165 135

Convertible loan note reserve 82 82 82

Accumulated losses (55,173) (54,407) (54,648)

-------------------------------------- ------ --------- --------- ------------

Equity attributable to owners of the

Parent 2,275 2,263 2,767

Non-controlling interests (125) (129) (126)

-------------------------------------- ------ --------- --------- ------------

Total equity 2,150 2,134 2,641

-------------------------------------- ------ --------- --------- ------------

Condensed Consolidated Statement of Changes in Equity for the

period ended 30 June 2021 (unaudited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest Total

capital premium reserve reserve reserve reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

1 January 2021 5,773 33,444 17,476 505 82 135 (54,648) 2,767 (126) 2,641

Comprehensive

income

Loss for the

period - - - - - - (525) (525) 1 (524)

Other

comprehensive

income for the

period - - - - - 1 - 1 - 1

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for the

six-month

period - - - - - 1 (525) (524) 1 (523)

Transactions

with owners

of the Group

Equity-settled

share-based

payment - - - 32 - - - 32 - 32

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

30 June 2021 5,773 33,444 17,476 537 82 136 (55,173) 2,275 (125) 2,150

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity for the

period ended 30 June 2020 (unaudited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest Total

capital premium reserve reserve reserve reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

1 January 2020 5,249 33,230 17,476 439 82 141 (53,823) 2,794 (139) 2,655

Comprehensive

income

Loss for the

period - - - - - - (584) (584) 10 (574)

Other

comprehensive

income for the

period - - - - - 24 - 24 - 24

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for the

six-month

period - - - - - 24 (584) (560) 10 (550)

Transactions

with owners

of the Group

Equity-settled

share-based

payment - - - 29 - - - 29 - 29

Balance at

30 June 2020 5,249 33,230 17,476 468 82 165 (54,407) 2,263 (129) 2,134

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity for the

year ended 31 December 2020 (audited)

Capital Convertible Non-controlling

Share Share redemption Other loan note Translation Accumulated interest

capital premium reserve reserve reserve reserve losses Total Total

equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at 1

January 2020 5,249 33,230 17,476 439 82 141 (53,823) 2,794 (139) 2,655

Comprehensive

income

Loss for the

period - - - - - - (798) (798) 13 (785)

Other

comprehensive

income for the

period - - - - - (6) - (6) - (6)

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Total

comprehensive

income for

year - - - - - (6) (798) (804) 13 (791)

Transactions

with owners

of the Group

Shares issued

during the

year 524 217 - - - - - 741 - 741

Issue expenses - (3) - - - - - (3) - (3)

Equity-settled

share-based

payment - - - 39 - - - 39 - 39

Transfers - - - 27 - - 27 - - -

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Balance at

31 December

2020 5,773 33,444 17,476 505 82 135 (54,648) 2,767 (126) 2,641

---------------- -------- -------- ----------- -------- ------------ ------------ ------------ -------- ---------------- --------

Condensed Consolidated Statement of Cash Flows

For the period ended 30 June 2021

Unaudited Audited

Six months Six months Year

ended ended ended 31

30 June 30 June December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------------- ----------- ----------- ----------

Cash flows from operating activities

Loss before taxation (531) (578) (794)

Adjustments for:

Net finance costs 80 88 172

Depreciation of property, plant and

equipment 35 97 103

Profit on disposal of loan monitors - (35) -

Amortisation of intangible assets 26 40 40

Write off of research and development

projects not taken forwards - - 222

Modification gain on convertible loan

note - - (119)

Share-based payment expense 32 29 39

Other tax income (25) - (52)

Effect of exchange rate fluctuations 1 (1) (6)

-------------------------------------------- ----------- ----------- ----------

(382) (360) (395)

(Increase)/decrease in inventories 83 (85) 13

Decrease in trade and other receivables 199 383 680

Increase/(decrease) in trade and other

payables 109 (16) (303)

Increase in provisions - 3 (11)

Net cash from/(used in) operations 9 (75) (16)

Interest paid (63) (67) (132)

Income taxes received - - 80

-------------------------------------------- ----------- ----------- ----------

Net cash generated from/(used in)

operating activities (54) (142) (68)

Cash flows from investing activities

Purchase of property, plant and equipment (1) (10) (6)

Capitalised development expenditure (228) (85) (165)

Net cash used in investing activities (229) (95) (171)

Cash flows from financing activities

Issue of ordinary share capital - - 253

Expenses in connection with share

issue - - (3)

Net movement in invoice discounting

facility 4 (111) (23)

Principal lease payments (20) (17) (37)

-------------------------------------------- ----------- ----------- ----------

Net cash (used in)/generated from

financing activities (16) (128) 190

-------------------------------------------- ----------- ----------- ----------

Net increase in cash and cash equivalents (299) (365) (49)

Cash and cash equivalents at beginning

of the period 853 908 908

Exchange (loss)/gain on cash and cash

equivalents (1) 25 (6)

-------------------------------------------- ----------- ----------- ----------

Cash and cash equivalents at the end

of the period/year 553 568 853

-------------------------------------------- ----------- ----------- ----------

Notes to the condensed consolidated interim financial

statements

1. Reporting Entity

Deltex Medical Group plc is a company that is domiciled in the

United Kingdom. It is incorporated in England and Wales (Company

Number 03902895) and its registered office is at Terminus Road,

Chichester, PO19 8TX, United Kingdom. These condensed consolidated

interim financial statements (Interim Financial Statements) as at

and for the period ended 30 June 2021 comprise the Company and its

subsidiaries (together referred to as 'the Group'). The Group is

principally involved with the manufacture and sale of advanced

haemodynamic monitoring technologies.

2. Basis of accounting

These interim financial statements have been prepared in

accordance with IAS 34, 'Interim Financial Reporting', and should

be read in conjunction with the Group's last annual consolidated

financial statements as at and for the year ended 31 December 2020

(Annual Report & Accounts 2020). They do not include all the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position.

These condensed consolidated interim financial statements do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The summary of results for the year ended

31 December 2020 is an extract from the published consolidated

financial statements of the Group for that year which have been

reported on by the Group's auditors and delivered to the Registrar

of Companies. The Independent Auditors' Report on the Annual Report

& Accounts for 2020 was unqualified, however, it did draw

attention to the impact of COVID-19 on the Group by way of

emphasis, but the opinion was not modified, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

These condensed consolidated interim financial statements have

been prepared applying the accounting policies and presentation

that were applied in the preparation of the Group's published

consolidated financial statements for the year ended 31 December

2020 and are expected to be applied in the preparation of the

financial statements for the year ending 31 December 2021. The

Group has not early adopted any other standard, interpretation or

amendment that has been issued but is not yet effective.

These condensed consolidated interim financial statements were

approved by the Board of Directors and approved for issue on 20

September 2021.

3. Use of judgements and estimates

In preparing these interim financial statements, management has

made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets and

liabilities, income and expense. Although these estimates are based

on the directors' best knowledge of the amount, event or actions,

it should be noted that actual results may differ from those

estimates.

The significant judgements and estimates made by the directors

in applying the Group's accounting policies and key sources of

estimation uncertainty were the same as those disclosed in Annual

Report & Accounts 2020.

4. Revenue

The Group's revenue disaggregated by primary geographical

markets is as follows:

For the six months ended 30 June 2021 (Unaudited)

Direct markets Indirect markets

Probes Monitors Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- -------- -------- --------- --------- --------

UK 268 15 28 - - - 311

USA 302 36 24 - - - 362

France - - - 181 20 4 205

Scandinavia - - - 63 - 1 64

South Korea - - - 67 - - 67

Other countries 7 - - 35 21 - 63

----------------- -------- --------- -------- -------- --------- --------- --------

577 51 52 346 41 5 1,072

----------------- -------- --------- -------- -------- --------- --------- --------

For the six months ended 30 June 2020 (Unaudited)

Direct markets Indirect markets

Probes Monitors Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- -------- -------- --------- --------- --------

UK 377 16 31 - - - 424

USA 477 16 12 - - - 505

France - - - - - 7 7

Scandinavia - - - 41 - - 41

South Korea - - - 53 - 1 54

Other countries - - - 96 28 2 126

----------------- -------- --------- -------- -------- --------- --------- --------

854 32 43 190 28 10 1,157

----------------- -------- --------- -------- -------- --------- --------- --------

For the year ended 31 December 2020 (Audited)

Direct markets Indirect markets

Probes Monitors Other Probes Monitors Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- --------- -------- -------- --------- --------- --------

UK 652 102 83 - - - 837

USA 858 16 26 - - - 900

France - - - 170 - 10 180

Scandinavia - - - 95 - 2 97

South Korea - - - 159 - 1 160

Portugal - - - 86 - - 86

Other countries 15 32 - 78 11 2 138

----------------- -------- --------- -------- -------- --------- --------- --------

1,525 150 109 588 11 15 2,398

----------------- -------- --------- -------- -------- --------- --------- --------

The Group's revenue disaggregated between the sale of goods and

the provision of services is set out below. All revenues are

recognised at a point in time.

Period ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------- ------------------- ------------------- -----------------------

Sale of goods 1,056 1,138 2,338

Maintenance income 16 19 60

1,072 1,157 2,398

------------------------------- ------------------- ------------------- -----------------------

The following table provides information about trade receivables

and contract liabilities from contracts with customers. There were

no contract assets at either 30 June 2021 or 1 January 2021.

30 June 1 January

2021 2021

GBP'000 GBP'000

------------------------------------------------------------ ------------------- ---------------------

Trade receivables which are in 'Trade and other

receivables' 355 576

Contract liabilities (77) (58)

------------------------------------------------------------ ------------------- ---------------------

The following aggregated amounts of transaction prices relate to

the performance obligations from existing contracts that are

unsatisfied or partially unsatisfied as at 30 June 2021:

2021 2022 2023 2024 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Revenue

expected

to be

recognised 45 25 4 3 77

----------------------- ------------------- ------------------- ------------------- ------------------- -------------------

5. Segment results

Performance and the allocation of resources are made on the

basis of results derived from the sale of probes and monitors for

which revenues and gross margins are regularly reported to the

Group's Chief Executive Officer who has been identified as the

Chief Operating Decision Maker (CODM). The CODM also monitors a

profit measure described internally as 'adjusted earnings before

interest, tax, depreciation and amortisation, share-based payments,

non-executive directors' fees, as well as any exceptional items'

(Adjusted EBITDA). However, this measure is reported at a Group

level rather than an operating segment which is based on the nature

of the goods provided rather than the geographical market in which

they are sold.

The unaudited segment results for the six months ended 30 June

2021 were:

Probes(1) Monitors Other Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ----------- ---------- -------- ------------- --------

Revenues 923 92 57 - 1,072

------------------------- ----------- ---------- -------- ------------- --------

Adjusted gross profit(2

3) 701 74 26 - 801

------------------------- ----------- ---------- -------- ------------- --------

Sales and marketing

costs(3) - - - - (399)

Administration costs(3) - - - - (572)

R&D costs(3) - - - - (3)

Quality and regulation

costs(3) - - - - (69)

------------------------- ----------- ---------- -------- ------------- --------

Adjusted EBITDA - - - - (242)

------------------------- ----------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

3. Other operating income is allocated within the corresponding expense categories

The unaudited segment results for the six months ended 30 June

2020 were:

Probes(1) Monitors Other Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ----------- ---------- -------- ------------- --------

Revenues 1,044 60 53 - 1,157

------------------------- ----------- ---------- -------- ------------- --------

Adjusted gross profit(2

3) 726 68 41 - 835

------------------------- ----------- ---------- -------- ------------- --------

Sales and marketing

costs(3) - - - - (519)

Administration costs(3) - - - - (423)

R&D costs(3) - - - - (53)

Quality and regulation

costs(3) - - - - (81)

------------------------- ----------- ---------- -------- ------------- --------

Adjusted EBITDA - - - - (241)

------------------------- ----------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

3. Other operating income is allocated within the corresponding expense categories

The audited segment results for the year ended 31 December 2020

were:

Probes(1) Monitors Other Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ----------- ---------- -------- ------------- --------

Revenues 2,113 161 124 - 2,398

------------------------- ----------- ---------- -------- ------------- --------

Adjusted gross profit(2

3) 1,585 136 106 - 1,827

------------------------- ----------- ---------- -------- ------------- --------

Sales and marketing

costs(3) - - - (942) (942)

Administration costs(3) - - - (903) (903)

R&D costs(3) - - - (23) (23)

Quality and regulation

costs(3) - - - (167) (167)

------------------------- ----------- ---------- -------- ------------- --------

Adjusted EBITDA - - - - (208)

------------------------- ----------- ---------- -------- ------------- --------

1. Managed care service revenue is categorised as probe revenue

2. Gross profit excluding the depreciation charge relating to

monitors loaned to customers and production equipment

3. Other operating income is allocated within the corresponding expense categories

The reconciliation of the profit measure used by the Group's

CODM to the result reported in the Group's consolidated SOCI is set

out below:

Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

----------------------------------------------- --------- --------- ------------

Adjusted EBITDA (242) (241) (208)

Non-cash items:

Depreciation of property, plant and equipment (35) (61) (103)

Amortisation of development costs (26) (40) (40)

Write off of research and development

projects not taken forwards - - (222)

Non-executive directors' fees and employer's

social security costs (68) (72) (172)

Share-based payment expense (32) (29) (39)

Change in accumulated absence cost liability (73) (66) 1

Bonus accrual releases - - (10)

Gain on convertible loan note - - 119

Cash item: Other tax income 25 19 52

----------------------------------------------- --------- --------- ------------

(209) (249) (414)

----------------------------------------------- --------- --------- ------------

Operating loss (451) (490) (622)

Finance costs (80) (88) (172)

----------------------------------------------- --------- --------- ------------

Loss before tax (531) (578) (794)

Tax credit on loss 7 4 9

----------------------------------------------- --------- --------- ------------

Loss for the period/year (524) (574) (785)

----------------------------------------------- --------- --------- ------------

6. Dividends

The Directors cannot recommend the payment of a dividend (2020:

nil) for 2021.

7. Tax credit on loss

Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------------------------- ------------------- ------------------- -----------------------

Research and development tax credit (7) (4) (9)

Adjustment in respect of prior periods - - -

--------------------------------------------------- ------------------- ------------------- -----------------------

Total tax credit on loss (7) (4) (9)

--------------------------------------------------- ------------------- ------------------- -----------------------

The other gain amount for six months to 30 June 2021 of

GBP25,000 (six months to 30 June 2020: GBP19,000) comprises tax

income arising from the Research and Development Expenditure Credit

scheme which is accounted for as a government grant.

8. Loss per share

Basic loss per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares issued during the year.

The loss per share calculation for six months to 30 June 2021 is

based on the loss after tax attributable to owners of the parent of

GBP525,000 and the weighted average number of shares in issue of

577,290,545.

The loss per share calculation for six months to 30 June 2020 is

based on the loss after tax attributable to owners of the parent of

GBP584,000 and the weighted average number of shares in issue of

524,868,826.

The loss per share calculation for the year ended 31 December

2020 is based on the loss after tax attributable to owners of the

parent of GBP798,000 and the weighted average number of shares in

issue of 526,448,659. While the Company is loss-making, the diluted

loss per share and the loss per share are the same.

9. Inventories

Inventories at 30 June 2021 include the following finished

Goods: 12,887 probes and 217 monitors.

10. Cash at bank

Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------- ------------------- ------------------- -----------------------

Cash at bank 553 568 853

------------------------- ------------------- ------------------- -----------------------

11. Net cash

Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------------- ------------------- -------------------------

Cash at bank 553 568 853

Less Invoice discount facility (163) (77) (159)

------------------------------------------- ------------------- ------------------- -------------------------

390 491 694

------------------------------------------- ------------------- ------------------- -------------------------

12. Borrowings

Unaudited Audited

30 June 2021 30 June 2020 31 December 2020

Current Non-current Current Non-current Current Non-current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

Invoice

discount

facility 163 - 77 - 159 -

Convertible

loan

notes - 1,010 - 1,092 - 993

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

163 1,010 77 1,092 159 993

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

13. Trade and other payables

Unaudited Audited

30 June 2021 30 June 2020 31 December 2020

Current Non-current Current Non-current Current Non-current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

Trade

payables 223 - 445 - 201 -

Other

payables 315 - 348 - 249 -

Social

security

and other

taxes 139 - 175 - 141 -

Lease

obligations 43 252 35 300 41 274

Contract

liabilities 77 - 72 - 58 -

Employee

short-term

liabilities 103 - 98 - 30 -

Accrued

expenses 627 - 1,012 - 696 -

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

1,527 252 2,185 300 1,416 274

------------------------ ------------------- ----------------------- ------------------- ----------------------- ------------------- -----------------------

14. Convertible loan note

The convertible loan note recognised in the Condensed

Consolidated Balance Sheet is calculated as:

Financial Equity

liability component Total

GBP'000 GBP'000 GBP'000

---------------------------------------------- ---------------------- ---------------------- -------------------

Carrying amount at 1 January 2021 993 82 1,075

Interest expense 61 - 61

Interest paid (44) - (44)

---------------------------------------------- ---------------------- ---------------------- -------------------

Carrying amount at 30 June 2021 1,010 82 1,092

---------------------------------------------- ---------------------- ---------------------- -------------------

The convertible loan note falls due for repayment in February

2024. The convertible loan note is, at the option of the loan note

holder, convertible at anytime into new ordinary shares of 1 penny

each at a conversion price of 4 pence per share.

15. Share capital

During the six months ended 30 June 2021, there were no share

issues or exercises of shares.

16. Exceptional items

Exceptional items comprised:

Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------------- --------------------- --------------------- -----------------------

Net bonus accrual and staff advances

movement - - 10

Write off of research and development

obsolete projects - - 222

---------------------------------------- --------------------- -------------------- -------------------------

- - 232

---------------------------------------- --------------------- -------------------- -------------------------

17. Seasonal fluctuations

Revenues in our Distributor markets are traditionally higher in

the second half of the financial year due to the purchasing

patterns of customers.

18. Foreign exchange rates

The following are the principal foreign exchange rates used in

the preparation of the condensed consolidated interim financial

statements:

Unaudited Audited

30 June 2021 30 June 2020 31 December 2020

Average Closing Average Closing Average Closing

rate rate rate rate rate rate

------------------------------ ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Sterling/US dollar 1.39 1.38 1.27 1.24 1.29 1.37

Sterling/Euro 1.15 1.17 1.15 1.10 1.13 1.12

Sterling/Canadian

dollar 1.73 1.71 1.72 1.68 1.73 1.74

------------------------------ ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

19. Distribution of the announcement

Copies of this announcement are sent to shareholders on request

and will be available for collection free of charge from the

Company's registered office at Terminus Road, Chichester, PO19 8TX,

United Kingdom. This announcement is available, free of charge,

from the Company's website at www.deltexmedical.com

20. Cautionary statement

This announcement contains forward-looking statements which are

made in good faith based on the information available at the time

of its approval. It is believed that the expectations reflected in

these statements are reasonable, but they may be affected by

several risks and uncertainties that are inherent in any

forward-looking statement which could cause actual results to

differ materially from those currently anticipated. Nothing in this

document should be considered to be a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAANNFSFFEFA

(END) Dow Jones Newswires

September 20, 2021 02:00 ET (06:00 GMT)

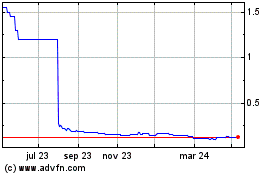

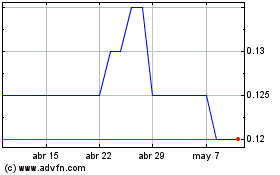

Deltex Medical (LSE:DEMG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Deltex Medical (LSE:DEMG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024