TIDMEYE

RNS Number : 5205M

Eagle Eye Solutions Group PLC

22 September 2021

22 September 2021

Eagle Eye Solutions Group plc

("Eagle Eye", the "Group", or the "Company")

Final Results for the year ended 30 June 2021

Growing profitability following record win performance, exiting

the year with momentum

Eagle Eye, a leading SaaS technology company that creates

digital connections enabling personalised, real-time marketing

through coupons, loyalty, apps, subscriptions and gift services, is

pleased to announce its results for the financial year ended 30

June 2021 (the "Year").

Financial Highlights

FY21 FY20 Change

--------------------------------- --------- ---------- -------

Group revenue GBP22.8m GBP20.4m +12%

Recurring subscription and

transaction revenue GBP16.9m GBP14.9m +13%

Recurring subscription and

transaction revenue % of Group

revenue 74% 73% +1ppt

Adjusted EBITDA* GBP4.2m GBP3.3m +29%

Adjusted EBITDA* margin 18% 16% +2ppt

Profit / (loss) before tax GBP0.1m GBP(0.3)m

Net cash GBP0.8m GBP1.5m -46%

* EBITDA has been adjusted for the exclusion of share-based

payment charges along with depreciation, amortisation, interest and

tax from the measure of profit.

Operational Highlights

-- Strong close to the Year, delivering 27% growth in Q4

FY21 revenues as compared with Q4 FY20, entering the

new financial year with positive momentum

-- Continued growth of the Group's Tier 1 customer base,

despite COVID-19 headwinds, resulting in an uplift in

"win" related revenue

-- New customers won in the Year included Woolworths Group

in Australia and New Zealand, Staples US Retail in North

America and our first client in the food services sector,

Vermaat in the Netherlands

-- Innovations on behalf of our customers included enabling

Virgin Red, Virgin's new rewards club, a comprehensive

personalised digital marketing programme for Southeastern

Grocers, and a UK first - the Pret A Manger's 'YourPret

Barista' subscription service

-- Chargeable AIR redemption and interaction volumes grew

by 11% to 952m (FY20: 856m)

-- Long term contract customer churn rate by value remained

very low at 0.3% (FY20: 0.9%)

Post Period End Highlights

-- Go live of the Woolworths programme just 10 months since

contract signing

-- Assisting the start of a global rollout of subscriptions

for Pret A Manger, starting in the US

Outlook

-- Following record new client wins during FY21, Eagle Eye

has entered FY22 with a considerably expanded underlying

business and positive trajectory

-- Trading in the current year is in line with Board expectations

and the Board is confident in achieving a positive year

of growth in FY22

Tim Mason, Chief Executive of Eagle Eye , said: " The pandemic

has accelerated the digital engagement strategies of retailers

around the world. We have seen personalised marketing coming to the

fore which plays to our strengths. Our proven capabilities in

enterprise retail, food and beverage and new sectors won in the

year combined with our increased international presence positions

us well to capture a growing proportion of this expanding market.

We will continue to invest in our people and offering, in line with

revenue growth, to ensure that we remain at the forefront of this

growing industry.

"Our people are key to the success of Eagle Eye and with the

challenges presented through this year, their support and

cooperation has been paramount. They have continued to successfully

deliver value for our clients, and I would like to put on record my

thanks and gratitude to each and every one of them.

"Following record new client wins during FY21, Eagle Eye has

entered FY22 with a considerably expanded underlying business and

positive trajectory. In addition to securing new enterprise

customers across multiple geographies, we have increased our

engagement with existing customers and expanded the AIR platform,

while carefully managing our cost base and cash resources,

delivering a maiden full year profit before tax. We have entered

the new financial year with a record pipeline and look to the

future with confidence."

For further information, please contact:

Tim Mason, Chief Executive Officer Tel: 0844 824 3686

Lucy Sharman-Munday, Chief Financial

Officer

Investec (Nominated Advisor and Joint Tel: 020 7597 5970

Broker)

Corporate Finance: David Anderson / Sebastian

Lawrence

Corporate Broking: Sara Hale / Will Brinkley

/ Charlotte Young

Shore Capital (Joint Broker) Tel: 020 7408 4090

Corporate Finance: Hugh Morgan / Daniel

Bush

Corporate Broking: Henry Willcocks

Alma PR Tel: 020 3405 0205

Caroline Forde / Robyn Fisher / Molly

Gretton

About Eagle Eye

Eagle Eye is a leading SaaS technology company transforming

marketing by creating digital connections that enable personalised

performance marketing in real time through coupons, loyalty, apps,

subscriptions and gift services.

Eagle Eye AIR enables the secure issuance and redemption of

digital offers and rewards at scale, across multiple channels,

enabling a single customer view. We create a network between

merchants, brands and audiences to enable customer acquisition,

interaction and retention at lower cost whilst driving marketing

innovation.

The Company's current customer base comprises leading names in

UK Grocery, Retail, Leisure and Food & Beverage sectors,

including Asda, Sainsbury's, Tesco, Waitrose and John Lewis &

Partners, Virgin Red, JD Sports, Pret A Manger, Greggs, Mitchells

& Butlers, Pizza Express; in North America, Loblaws, Shoppers

Drug Mart, Southeastern Grocers and Staples US Retail and in

Australia & New Zealand, Woolworths Group and The Warehouse

Group.

Chairman's Statement

I am pleased to be in a position to update shareholders on a

year of achievement and growth at Eagle Eye, against what has been

a challenging backdrop for all. With the lockdown measures

introduced to tackle the COVID-19 pandemic impacting approximately

10% of Group revenues at the time and elongating sales cycles, it

would be natural to expect the business to hunker down and enter

protection mode to ride out the storm. However, that is not the

Eagle Eye way.

What I have seen in the Eagle Eye team has been an enhanced

sense of passion and purpose to support enterprises through these

difficult times, helping them to connect with their customers in

new and exciting ways. This passion has seen the business continue

to add innovative new functionality to the Eagle Eye AIR platform,

increasing the attractiveness of the platform and as a result,

winning new customers around the world. New customers secured in

the Year included the pioneering Pret A Manger coffee subscription

service, the winning of a five-year contract with Woolworths Group,

the largest retailer in Australia, and securing Staples US Retail,

the Group's second US customer. It is particularly encouraging to

note that the Woolworths programme has gone live in August 2021,

following the end of the year, just ten months since contract

signing, representing a remarkable achievement by the joint

team.

As a result of these wins, our key contracts moving into the

next stage of their lifecycle and the relaxation of COVID-19

restrictions , the Group enjoyed a strong close to the year,

delivering 27% growth in Q4 FY21 revenues as compared with Q4 FY20,

and importantly entered the new financial year with positive

momentum.

Financial Results

Overall, the benefits of the Group's high quality SaaS business

model can be seen in the robust financial performance in the Year.

The Group's high levels of recurring revenue (approx. 74% of

revenues), low customer churn and increased win rate meant Eagle

Eye delivered double digit revenue growth of 12% to GBP22.8m (FY20:

GBP20.4m). Careful management of the cost base, in line with the

Group's revenue profile, alongside continued investment in the

product and sales and marketing, resulted in an increase in

adjusted EBITDA for the Year of 29% to GBP4.2m (FY20: GBP3.3m), and

an increased adjusted EBITDA margin of 18% (FY20: 16%), ahead of

market expectations. The Group is pleased to report a maiden full

year profit before tax for FY21 of GBP0.1m (FY20: loss of

GBP0.3m).

The Group continues to have access to its GBP5m banking facility

which, combined with the Group's net cash, is sufficient to support

its existing growth plans. Following the year end, the Group has

extended the term of the facility to November 2022.

ESG and Our People and Values

Over the past year, we have seen a rapid acceleration in the

importance of Environmental, Social and Governance issues for

businesses, consumers and investors with the pandemic highlighting

to all the importance of these topics. As a Board, we are committed

to high standards of ESG and we are already seeing the early

progress made by our initiatives, building on our existing

foundation of responsible business practice. We are measuring our

progress through KPIs and comparing to the market median to allow

focus on areas of improvement.

Eagle Eye is a business which places the success and happiness

of its people at its heart. The themes of the Company's recent

Annual Company Day, which I was delighted to attend, were value

creation by enriching the lives of everyone with whom we come into

contact and the introduction of a Purple Women inititiative aimed

at supporting women through all aspects of their work/home life.

This is a key initiative which we will build upon in FY22 as our

business strives to become a role model for women in tech by being

an excellent place for women to work.

At this event, and throughout the year, I am continually struck

by the culture that the team have created, where its people are

supported and rewarded and where the management team constantly

strive to make Eagle Eye an exceptional place to work. You can read

more about the culture of Eagle Eye in our People section within

this report and on behalf ot the Board, I once again thank the

Eagle Eye team for their continued commitment during another

challenging year for all. They are exceptional.

As a business, we already have a low Environmental footprint and

we will continue to identify ways to improve on this. Our offering

itself eliminates the use of paper coupons and vouchers. We will

maintain our strong corporate governance framework which we have

already adopted by following the QCA Code.

Opportunity

Eagle Eye has entered FY22 with a considerably expanded

underlying business and positive trajectory. The impact of the

pandemic has been to accelerate the digital engagement strategies

of retailers around the world and the proven enterprise

capabilities of the Eagle Eye AIR platform position the Group well

to capture a growing proportion of this expanding market.

With a growing customer base, including some of the world's

largest retailers, and a record sales pipeline, the Board looks to

the future with increased confidence.

Malcolm Wall, Non-Executive Chairman

CEO's Statement

I am proud of the exceptional performance and high energy our

team has maintained this Year; securing fantastic new retail

clients around the world and delivering innovative solutions that

create value for our customers, while dealing with the challenges

of the pandemic. The business has delivered a good financial

performance, and importantly, we have exited the year with strong

momentum.

The AIR platform sits at the heart of the digital marketing

programmes of a growing number of the world's largest retailers.

Alongside our long-standing Tier 1 customers in the UK, we can now

point to a range of landmark customers internationally, increasing

our profile and demonstrating our credentials in an accelerating

market, where personalised, digital marketing is coming to the

fore.

The success of this Year provides us with a strong position as

we enter the new financial year, focused on creating exceptional

value for our clients and becoming the most flexible and scalable

promotions and loyalty platform in the world.

Market opportunity

In a year in which retailers globally have had to face huge

upheaval and change, the shift to digital has continued at pace,

with retailers of all kinds developing their omnichannel

capabilities to address rapidly changing consumer shopping

behaviours.

McKinsey's latest US Consumer Sentiment research shows that 77%

of consumers tried new shopping behaviours in the past year, and

that they were primarily driven to it by a need for value,

convenience, and availability (Source: US consumer sentiment during

the coronavirus crisis). Ecommerce sales also continue to grow

according to a report by eMarketer which showed worldwide retail

ecommerce sales had grown 28% in 2020. (Source: Global Ecommerce

Update 2021 - January 2021).

This shift has, in turn, driven an acceleration of retailers'

digital engagement strategies. They have been forced to reassess

their marketing spend to ensure they have remained competitive and

attractive in the face of growing and new competition, retaining

the loyalty of existing customers while seeking to win new ones.

They are looking for new ways to harness the increased availability

of customer data, machine learning and AI to power personalised

connections and prosperous long-term relationships.

According to a report by Euromonitor and the National Retail

Federation, 72% of retail professionals say COVID-19 has

accelerated the company's digital transformation by at least a year

(Source: Using Retail Tech Innovation to Enhance the Customer

Experience, June 2021).

However, achieving true personalisation is not easy across

multiple customer touchpoints as it requires data to be aligned

across a retailer's multitude of systems in real time, the

analytics to determine the customer message and the transaction

capability to deliver personalisation at scale; Eagle Eye enables

its clients to address these very issues.

Competitive strength

The proven capabilities of the Eagle Eye AIR platform and the

breadth of solutions we are able to offer across loyalty,

promotional coupons, apps, subscriptions and gifting; position

Eagle Eye well to capture a growing proportion of this expanding

digital loyalty and promotions market.

The competitive advantage we offer can be illustrated by the way

we solve client pain points. There are vendors in the market that

specialise in standalone solutions such as loyalty or gift, but not

at the same scale or range of capabilities that our platform

offers. Typically, the main competition we face is from retailers

who want to try to build a comparable solution to the Eagle Eye AIR

platform in-house. However, by choosing to work with Eagle Eye,

retailers can focus on building the experiences for their end

customers whilst we manage the enabling technology. We help clients

deploy faster, manage their costs, control the risk and ensure

security and data compliance.

The Eagle Eye platform unlocks the power of omnichannel

personalisation, removing any existing channel or technology

limitations on the scale at which retailers can deploy personalised

communications and offers. We are also able to create multiple ways

for retailers to engage with their consumers, from full-scale

loyalty initiatives to cashback programmes, digital stamp cards,

charity donations and more. This allows retailers to develop their

own unique range of promotions and loyalty tactics which work for

their business.

Our platform can automate feeds into finance systems to create a

single source of truth for supplier funds and also consolidate a

retailer's array of legacy systems, centralising all loyalty and

promotions set-up and execution onto one platform which then

creates a single customer view rather than having data in silos

across multiple systems. As a real time platform, Eagle Eye enables

retailers to react faster, providing the capability for them to

view and respond to customer interactions as they happen.

These capabilities have led Eagle Eye to become one of the most

proven and flexible loyalty platforms in the world, powering some

of the largest and most sophisticated marketing and loyalty

programmes globally.

We are pleased to be gaining recognition from industry analysts,

with Eagle Eye referenced in two different sector reports in recent

months. In May 2021, we were included in Loyalty360's 2021

Technology Today Report where Eagle Eye was listed as an "all in

one supplier" within the grocery, retail and c-store sectors and in

August 2021 we were delighted to be included in Forrester's Now

Tech: Promotions and Offer Management Providers, Q3 2021 Report

where we were included in both the loyalty standalone and loyalty

embedded functionality segments within the grocery, retail, and

hospitality vendor market focuses. Inclusion in these two reports

reinforces the value and commitment Eagle Eye delivers to

clients.

Strategic Partnerships and Collaborations

Eagle Eye AIR has the ability to sit across the entire marketing

ecosystem, connecting all the elements required to deliver

personalised marketing at scale. As part of our growth strategy, we

will continue to create partnerships and collaborations with other

businesses in the industry, using their expertise to strengthen our

offering and leveraging their marketing reach.

New partnerships in the year include Oracle MICROS Simphony POS

System (to deliver YourPret Barista); Outra, a predictive data

science business, to help retailers, hospitality operators and

branded CPG (Consumer Packaged Goods) to enhance the effectiveness

of their promotional marketing investments; and Artificial

Intelligence provider Peak to help retailers leverage customer data

for loyalty and promotional campaigns. We have continued to build

out our own brand capabilities with CPGs by bringing on partners

such as Gladcloud, Engage Interactive, X Influence and Voxly who

all use our APIs to create consumer facing digital experiences that

help brands to engage with consumers and drive transactions. We

partnered with Chargebee, initially to help retail and hospitality

operators drive customer engagement and recurring revenue through

subscription services; we are now engaged on joint sales and

marketing initiatives.

During the year, the Liberty omnichannel gift programme was

enabled through our integration with Salesforce Commerce Cloud, a

powerful ecommerce solution from the world's largest CRM provider

which enables Eagle Eye to deploy our solutions quickly to the

wider Salesforce customer base. We recently signed our first client

in the food services sector, Vermaat in the Netherlands. Vermaat

has o ver 20 STACH coffee shops that are currently using the Eagle

Eye app and the integration with our partner Qikserve to enable

click and collect for food and beverage orders.

We are continuing to harness relationships to optimise our

expansion into the US. Our partnerships and collaborations with

Neptune Retail Solutions (previously News America Marketing) the

premier marketing services company in the US and Canada, Ecrebo,

the receipt marketing technology provider and dunnhumby, a global

leader in customer data analytics, all continue to progress

well.

We are encouraged by the increasing number of opportunities

entering our sales pipeline via our partners and maintaining these

relationships will be a key focus for us as we continue to scale

internationally.

Delivering against all elements of our growth strategy

I am pleased to report the following progress across all four

elements of our growth strategy:

1."Win, Transact and Deepen"

Our customer strategy is to:

-- 'Win': bring more customers on to the Eagle Eye AIR platform;

-- 'Transact': drive higher redemption and interaction volumes through the platform; and

-- 'Deepen': encourage our customers to adopt more of our

product portfolio as they become more adept at digital

marketing.

Our high level of customer retention means that each new

customer win significantly adds to our growth prospects, with

revenue from our largest revenue-generating customers typically

increasing by a multiple of over three times by the end of their

third year on the AIR platform, through both increased use of the

platform and the addition of new services.

Win

During the Year we saw an increase in win rate both in the UK

and internationally. New customers secured in the Year included a

five-year contract with Woolworths Group in Australia & New

Zealand; a three-year contract with Staples US Retail in North

America; and we signed our first client in the food services

sector, Vermaat, which included the launch of an app to enable

digital loyalty stamp cards for coffee and sandwiches at their

STACH coffee shops in the Netherlands. Wins in the UK included a

three-year contract with Liberty Retail Limited, the luxury

department store, to support their omnichannel gift programme and a

two year contract with Robinsons Brewery, who have approximately

260 pubs, inns and hotels across the North West of England and

North Wales, to run their gift programme.

We were pleased to confirm our role as a key technology provider

for Virgin Red, Virgin's new rewards club during the past year. The

Eagle Eye platform was chosen to support Virgin Red because of its

ability to process and manage the billions of Virgin Points being

earned and spent across multiple organisations globally, bringing

together the Virgin companies and beyond, across multiple sectors.

Our platform has also successfully helped transition Virgin

Atlantic Flying Club miles to Virgin Points and since March 2021,

Virgin Trains Ticketing has been added to the programme, where

members can earn points when booking train tickets within the

UK.

We have been delighted by the success of the Pret Coffee

Subscription. Now a year old, this was the UK's first ever in-shop

coffee subscription, allowing subscribers to enjoy up to five

barista-prepared drinks per day for a fixed monthly fee, including

the first month for free. The service was built on the Eagle Eye

AIR platform as part of Pret A Manger's new digital infrastructure

and was Pret's first major step in delivering against its new

digitally-led, omnichannel strategy.

A first for the UK high street, the new in-shop digital service

capability is providing Pret with new data-led customer insights.

Since launch in September 2020, we are pleased that Pret have been

utilising more of the capabilities of the AIR platform which has

assisted in the start of an international rollout of subscriptions

starting in in the US. We continue to work closely with them as

they seek to drive customer engagement as a digitally-led,

multichannel business.

The increased win rate demonstrates the range of capabilities

being delivered by the Eagle Eye AIR platform, with the ways in

which businesses are using Eagle Eye AIR increasing at pace,

providing us with a strong base for future expected growth.

Transact

Chargeable AIR redemption and interaction volumes, a key measure

of usage of Eagle Eye AIR, grew by 11% to 952m (FY20: 856m),

primarily reflecting an increased number of loyalty transactions

following the successful launch of new customer programmes,

including for Southeastern Grocers ("SEG") and the full Year effect

of Sainsbury's, offset by the impact of COVID-19.

The Year saw an 88% increase in SMS volumes to 85m (FY20: 45m)

driven by the growth of Click & Collect offerings at a

selection of our high-street retail customers during the pandemic

and also from supporting clients following the UK Government's Test

and Trace guidelines. We do not anticipate similar growth rates in

SMS volumes moving forward and overall expect SMS to represent a

decreasing proportion of revenues in coming years.

Brands & Audiences

The Eagle Eye AIR platform is also used by brands to run

campaign activations across our growing Retailer, Operator and

Audience Network. This was one of the key areas of the business

impacted by the COVID-19 lockdown. Overall, t he revenue from

branded drinks campaigns decreased to GBP0.1m (FY20: GBP0.3m),

which was effectively delivered during the still heavily restricted

periods of Q1 FY21 and Q4 FY21. Affiliate revenue held steady at

GBP0.5m (FY20: GBP0.5m), bringing total brand and audience revenue

to GBP0.6m (FY20: GBP0.8m).

We now have over 7,100 hospitality venues connected to the Eagle

Eye AIR platform, creating an attractive platform for Brands to

exploit once lockdown restrictions are lifted, as they seek the

means to recapture lost revenue and strengthen their

businesses.

Deepen

COVID-19 has caused some contract expansion to be delayed and

lower transactional volumes in our Food and Beverage clients which,

together with its effect on brand revenue, has impacted circa 10%

of the Group's pre COVID-19 revenue base. However, throughout the

Year , we have continued to have a wide range of discussions across

our customer base as they consider how to continue on their journey

towards personalised omnichannel loyalty, promotion and gift

offerings. Our 'Deepen' pipeline continues to grow with several new

customers having commenced transacting in the Year, including Pret

A Manger and Virgin Red in the UK and, with our international

customers also continuing with their roll-outs, we anticipate our

recurring, transactional revenues to increase in future

periods.

Pleasingly, our long-term contract customer churn rate by value

remains very low at 0.3% (FY20: 0.9%), with good levels of renewals

taking place, including multi-year contracts with 16 customers.

2. Innovation and the AIR platform

Innovation

Innovation continues to lie at the heart of our proposition,

investing in the capabilities of our flexible Eagle Eye AIR

platform to find new ways to deliver value to our customers, and

their consumers.

POS Connect

Last year, we launched our POS Connect capability, a next

generation approach to enable us to enhance the way we integrate

with our clients' Points of Sale systems. POS Connect was designed

to provide retailers with greater flexibility in their ability to

provide their customers with a diverse range of offer types (e.g.

points and discounts), executed in real time and at huge scale.

During the year, we have continued to invest in this area,

providing our clients with new and innovative ways to engage with

their customers using our cloud-based adjudication service. Using

this service, we are able to execute incredibly complex

calculations in real time at the POS, using Eagle Eye AIR to adjust

customers' basket totals based on any valid discount, points,

multibuy or other promotions that are available them. These

calculations can be complex and involve millions of permutations

which previously would not have been possible to handle by

retailers' existing POS systems. Using POS Connect, retailers are

set free from the limitations they would have faced regarding the

number and/or type of offers they could deliver to their customers,

thus unlocking the power of true omnichannel personalisation.

Message At Till

In the Year we launched our new, personalised Message At Till

capability, enabling the delivery of real-time, relevant and

targeted promotions to customers at the till, through physical

coupons or digital coupons, SMS and in-app push notifications

following a transaction, based on their customers' basket content

and buying behaviour.

This functionality is particularly important in the US, acting

as a digital replacement for the widely prevalent receipt-based

couponing market, adding further capability for our US enterprise

customers while opening-up a new segment of the US retail

market.

Load to Card

Our Load to Card functionality is now live and in use at

Southeastern Grocers. This allows retailers to leverage data

analytics and artificial intelligence ("AI") to recommend and issue

personalised digital rewards via digital channels such as a website

or an app. A consumer is able to select the offers they wish to

redeem and load them to their digital loyalty card.

App

Our app solution is now used in more countries across the world

as IMO rolled out their car wash app in an additional seven

countries and Vermaat launched their STACH coffee app in the

Netherlands.

3. International growth

We have continued to deliver on our international growth

strategy in the Year, winning new customers, and strengthening our

positions in our new territories. Revenue from international

customers grew by 32% to GBP9.3m (FY2020: GBP7.0m).

North America

In December 2020, we were pleased to secure our second US

customer, Staples US Retail.

We are making great progress with Southeastern Grocers (SEG)

since signing them in December 2019, helping them connect with

customers on a personal level, whether that is in stores or through

digital platforms. Eagle Eye and dunnhumby are collaborating to

enable the personalisation of promotions for SEG, and to provide

the retailer with a deeper understanding of its customers'

behaviours and preferences. Once fully integrated, it is expected

to produce more than 200 million digital offers, coupons and

recommendations to customers monthly.

We have now gone live with six media channels, with further

channels to follow. We have also modernised SEG's loyalty offering

and become their points master, enabling SEG to execute more types

of campaigns and support their wider personalised media

objectives.

Through the success of this customer programme we have

demonstrated our ability to manage the digital marketing needs of

US retailers.

In Canada, our relationship with Loblaw Companies Ltd ("Loblaw")

continues to strengthen. During the Year, Eagle Eye supported the

launch of their PC Health app which provides live chat to members

with registered nurses and dietitians, plus the opportunity to earn

PC Optimum(TM) rewards through custom digital health programmes.

More recently, we supported both the Holiday Insiders and Summer

Insiders programmes which are highly anticipated programmes used to

introduce new and exciting products to Canadians and give customers

the opportunity to earn points through the PC Optimum programme. We

also supported the launch of the PC Money Account, a new, no

monthly fee account that lets customers earn PC Optimum points for

their everyday banking.

Australasia

In November 2020, we secured a five-year agreement with

Woolworths Group, Australia's largest retailer; the Group operates

1,400 stores in Australia and New Zealand. Woolworths are using

Eagle Eye AIR to support their personalised real-time digital

marketing programme. Eagle Eye's services allows Woolworths Group

to enable the end-to-end management of real-time personalised

digital promotions and support its transition to a digitally led

rewards programme. Woolworths deploys the proposition across

touchpoints including its app, its eCommerce business and various

other digital media. Eagle Eye AIR is also used to enable a

real-time integration with a network of partners. Implementation

commenced on contract signature and our local team in the region is

supporting Woolworths to deploy our Eagle Eye AIR platform across

Woolworths' network of Australian and New Zealand stores.

Post our financial year end, the programme went live in August

2021, just 10 months after contract signing, to the members of the

Everyday Rewards loyalty scheme, following a successful pilot. This

marked the point at which Eagle Eye's full fees were payable and

the start date of the five-year agreement announced on 10th

November 2020.

We continued our work with The Warehouse Group, one of the

largest retailing groups in New Zealand. The Warehouse Group is

successfully piloting an app-first loyalty programme within its

largest retail banner, The Warehouse.

With two of the largest retailers in the Australasia region now

as customers, we are investing in the team as a platform for Eagle

Eye's entry into the wider Asia Pacific region. The Group believes

there to be a good level of enterprise-level prospects in the

region.

Eagle Eye provides digital loyalty and personalised promotion

services to several of the world's leading grocers, we are uniquely

strong in the UK food and beverage sector and we have added new

clients such as Virgin Red and Pret A Manger opening up the travel

and ('Quick Serve Restaurant') QSR sector alongside the likes of JD

Sports and others. We have established a management structure in

EMEA, North America and APAC where the regional heads and their

teams are using our diverse and loyal existing client base as proof

points to build a strengthened pipeline around the world.

4. "Better, Simpler, Cheaper"

We have developed a proven business model to grow our EBITDA

margin whilst also investing as we 'Win' in sales and marketing to

generate new opportunities for growth, enhancements to the product

to add value to our customers and the 'spine of the business' to

ensure the health of Eagle Eye is maintained. This agility means we

can control our costs through periods of adversity and

prosperity.

Our agility extended to our operational approach at the time of

the COVID-19 pandemic, enabling us to swiftly implement home

working and the change of working practices required to ensure its

successful execution. As we now hopefully emerge from the pandemic,

we remain agile and are moving to a hybrid model of working for our

employees, allowing them to work effectively from home some of the

time but ensuring that when they do come to the office that it was

worth the commute. We will ensure that going to the office meets

the three C's: Culture - it helps to grow the Eagle Eye culture and

improve teamwork; Collaboration - it allows our teams to take part

in brainstorming and blue sky thinking sessions to aid innovation

and kick off meetings for new projects to ensure everyone is

aligned; and Coaching - to continue to enhance the skills

capabilities of our employees.

Our new agile methodologies have enabled us to supplement our

local teams by our global resource pool, enabling us to open up

these geographies in a cost-efficient and scalable manner.

The performance of Eagle Eye AIR continues to benefit from our

move to the Google Cloud. We are improving the speed and scale of

the AIR platform as API response times at the POS improved by 30%

and volumes increased by 11%. We were, therefore, able to increase

our scalability and flexibility, being able to grow compute power

as we sign up new customers and as our existing customers require

it. This has seen our direct IT infrastructure costs increase by

only 5% despite an 11% increase in volumes.

We have now introduced site reliability engineering (SRE) with a

major focus on customers in order to be more scalable, automated,

reliable, standardised and secure. We have created a Customer

Reliability Engineering team who follow SRE principles that allow

us to focus on reducing manual or repetitive tasks, automating our

platforms with a focus on keeping our services running, making them

better and faster. It is our intention to introduce the SRE

concepts and principles across the business and to our clients.

During the year we have achieved ISO27001 recertification and

added our Canadian, Australian and US businesses to the

certification. SOC2 Type2 has also been completed and extended to

cover all of our offices in all geographies, providing our

enterprise clients with assurance around the quality of our systems

and the safeguarding of data.

Our People and Beliefs

Creating value for our customers sits at the heart of Eagle Eye

and we believe this is the foundation of our successful business.

We aim to enrich the lives of everyone we come into contact with by

creating exceptional value for them and by being kind, thoughtful,

friendly, generous and considerate. We passionately believe that

the culture we have created sets us apart.

We are committed to delivering value to our clients by

partnering with them to solve their problems in the "Purple way."

By collaborating with clients to deliver solutions that solve their

pain points and to help maximise their return on investment, we

secure customer loyalty. New customer collaboration initiatives

recently commenced include the implementation of Professional

Services Satisfaction Reports and Net Promoter Scores, to monitor

how we are performing.

All the value we create is thanks to our people. Our goal is to

be an exceptional place to work, which will lead us to deliver

exceptional results. We measure our success via our employee NPS

scores, as well as our annual stress survey tool, and annual

Company Day vision and strategy survey. Our June 2021 NPS scores

were +47 (How likely is it that you would recommend Eagle Eye as a

place to work?) and +56 ( How likely is it that you would recommend

Eagle Eye's products and services?), which are above the industry

standard where a score over 30 is considered good. B y training

well and rewarding our employees, we are better able to create and

deliver more value to our customers. To promote our values we have

introduced Company Value Awards, Purple Awards and quarterly

communications on financial and operational company performance.

Having had a successful and popular company day for years we have

now introduced quarterly communications sessions where we promote

our values, give awards for purple performance and update on

financial and operational progress. We also meet for 30 minutes

every Monday at a meeting called 'Tea with Teams' where we keep

everyone up to date on achievements and reasons to celebrate.

Last year we launched Employee Resource Groups (ERGs) where

employee volunteers can update their friends and colleagues on

events that are important to them; through this, we have learnt

from our black colleagues what 'BLM' means to them, we've also

learnt about Diwali, Ramadan and Passover. In conjunction with the

progress of our ERG's launched last year we have also built upon

its success by launching a 'Purple Women's Group' which every woman

in the Company has voluntarily attended. The key areas where we

strive to make a difference for women are by providing a platform

for their voice; supporting them through their career journey;

developing family friendly policies/benefits; creating more

diversity through encouraging more women in tech; and looking to

tackle important health issues that impact people in the

workplace.

We have strengthened our compensation reviews to incorporate

loyalty and to reward our people based on the value they bring, in

addition to our normal annual review process. We believe this will

only further increase engagement and strengthen our retention which

is currently at 91%.

Looking forward to FY22 we have partnered with 52 Lives, a

charity built around the concept of 'kindness' who find people who

need help and then deliver it. We believe that this partnership

will make Eagle Eye a better place and if we are successful not

only will we help 52 Lives to help more people but create a model

for them to expand their charity and help even more people. Working

with our charity committee, this is a whole company effort to team

build, be more kind, and raise important funds for those in need

within our communities.

Outlook

Following record new client wins during the Year, Eagle Eye

enters FY22 with a considerably expanded underlying business and

positive trajectory. In addition to securing new enterprise

customers across multiple geographies, we have increased our

engagement with existing customers and expanded the AIR platform,

while carefully managing our cost base and cash resources,

delivering a maiden full year profit before tax. We have proven the

strength of our business model, growing revenues and profits,

during a challenging year. Our r ecurring revenues, breadth of

customer base, strong customer retention, extent of pipeline and

growing market need have all kept driving the business forward.

Trading in the current year is in line with Board expectations

and the Board is confident in achieving a positive year of growth

in FY22.

The pandemic has accelerated the digital engagement strategies

of retailers around the world. We have seen personalised marketing

coming to the fore which plays to our strengths. Our proven

capabilities in enterprise retail, food and beverage and new

sectors won in the year combined with our increased international

presence positions us well to capture a growing proportion of this

expanding market. We will continue to invest in our people and

offering, in line with revenue growth, to ensure that we remain at

the forefront of this growing industry.

Our people are key to the success of Eagle Eye and with the

challenges presented through the Year their support and cooperation

has been paramount. They have continued to successfully deliver

value for our clients, and I would like to put on record my thanks

and gratitude to each and every one of them.

We have entered the new financial year with a record sales

pipeline and we look to the future with confidence.

Tim Mason, Chief Executive Officer

Financial review

Key Performance Indicators

Financial FY21 FY20

GBP000 GBP000

Revenue 22,800 20,421

Recurring revenue 16,913 14,916

Adjusted EBITDA (1) 4,215 3,278

Profit/(loss) before tax 126 (332)

Net cash (2) 813 1,519

Cash and cash equivalents 1,713 1,519

Short-term borrowings (900) -

--------------------------- -------- ---------

Non-financial FY21 FY20

AIR volumes 951.6m 855.8m

Recurring revenue:

* Licence revenue GBP7.9m 34% GBP7.7m 38%

* AIR transaction revenue GBP2.6m 12% GBP1.2m 6%

* SMS transaction revenue GBP6.4m 28% GBP6.0m 29%

--------- ---- --------- ----

Total recurring revenue GBP16.9m 74% GBP14.9m 73%

Long-term contract customer churn

by value 0.3% 0.9%

------------------------------------- --------------- ---------------

(1) Adjusted EBITDA excludes share-based payment charges along

with depreciation, amortisation, interest and tax from the measure

of profit and is reconciled to the GAAP measure of profit before

taxation in note 5.

(2) Net cash is cash and cash equivalents less borrowings.

Group results

Revenue

Revenue growth for the Group was 12% for the Year (FY20: 21%),

reflecting an increased win rate in the Year, offset by the

continuing impact of the COVID-19 pandemic. However, with

successful client implementations in Q4 2021 the revenue growth

rate on exiting the year was 27% compared to Q4 2020.

COVID-19 saw many of the Group's clients in the UK shut or only

partially open throughout the Year, impacting circa 10% of the

Group's pre COVID-19 revenue base. The impact of this was on brand

and F&B transactional revenue but there was also an impact on

the continued deepening of client accounts that we would

traditionally see.

Chargeable AIR redemption and interaction volumes, a key measure

of usage of the Eagle Eye AIR platform, grew by 11% year-on-year to

951.6m for the year (FY20: 855.9m) with AIR revenue increasing to

GBP20.2m (FY20: GBP19.2m). As expected, UK non-grocery volumes were

significantly impacted by COVID-19, but the gradual relaxation of

restrictions from late March 2021 onwards and increased

international transactions as those clients ramped up their

services helped drive 20% quarter-on-quarter volume growth in Q4

2021.

SMS messaging revenue grew by 110% to GBP2.6m (FY20: GBP1.3m),

reflecting changing consumer shopping habits during the pandemic

from clients where the Group is integrated for both their High

Street stores and their eCommerce offering, as well as use of the

Group's SMS messaging platform to support clients in following the

UK Government's Test & Trace guidelines. As pandemic

restrictions ease, SMS is expected to represent a decreasing

proportion of the business in future years.

Overall, GBP16.9m of revenue was generated from subscription

fees and transactions over the network, representing 74% of total

revenue (FY20: 73%, GBP14.9m). The balance, GBP5.9m, relates to

implementation fees for new customers or new services for existing

customers and represents 26% of total revenue (FY20: 27%, GBP5.5m).

The increase in implementation fees primarily reflects contract

wins in North America, including the full year effect of SEG, and

Australia.

In addition to winning new business and deepening existing

accounts, the Group successfully maintained an extremely low rate

of long-term contract customer churn by value at 0.3% (FY20: 0.9%).

This reflects the scale and breadth of the AIR platform in meeting

our customers' needs.

Gross profit

Gross profit grew 8% to GBP20.7m (FY20: GBP19.1m), although

gross margin fell to 91% (FY20: 94%). The underlying gross margin

from AIR platform revenues increased to 98% (FY20: 97%) but this

was offset by the impact of the increased share of revenue from the

lower margin SMS messaging business which accounted for 4% of gross

profit (FY20: 2%).

Costs of sales include the cost of sending SMS messages, revenue

share agreements and outsourced, bespoke development work. All

internal resource costs are recognised within operating costs, net

of capitalised development and contract costs.

Adjusted operating expenses

The global uncertainties caused by the COVID-19 pandemic have

meant that the Group has chosen to carefully manage its cost base,

in line with our revenue profile in particular internationally,

whilst continuing to invest in the product and sales &

marketing. This has seen growth in adjusted operating expenses

limited to just 4% at GBP16.5m (FY20: GBP15.8m). This cost

represents sales and marketing, product development (net of

capitalised costs), operational IT, general and administration

costs.

The 7% increase in staff costs to GBP13.0m (FY20: GBP12.1m)

reflected standard annual pay awards and increased commission/bonus

reflecting the increased new customer win rate and the Group's

strong EBITDA performance. Average headcount for the year was 141

(FY20: 139). We continue to invest in the product and sales and

marketing; within staff costs, gross expenditure on product

development increased to GBP4.3m (FY20: GBP4.0m) and sales and

marketing spend was GBP2.8m (FY20: GBP2.9m).

The benefits of the migration of our environments to the Google

Cloud continue to be felt. Although transaction volumes grew by 11%

and further infrastructure investment was required to support new

international clients, infrastructure costs increased by just 2% to

GBP4.5m (FY20: GBP4.4m). Reflecting the Group's agile investment

strategy and cost control measures during COVID-19, marketing,

travel and administration costs were 13% lower than in FY20 at

GBP1.8m (FY20: GBP2.1m).

Capitalised product development costs were GBP2.2m (FY20:

GBP2.4m), whilst amortisation of capitalised development costs was

GBP2.2m (FY20: GBP2.0m). Contract costs (including costs to obtain

contracts and contract fulfilment costs), recognised as assets

under IFRS 15, were GBP0.7m (FY20: GBP0.5m) and amortisation of

contract costs was GBP0.6m (FY20: GBP0.5m).

Adjusted EBITDA and Profit before tax

The growth in revenue, continued tight control of costs and net

furlough receipts of GBP0.1m have resulted in a significant

increase in adjusted EBITDA which was up 29% at GBP4.2m (FY20:

GBP3.3m) for the year, with EBITDA margin improving to 18% (FY20:

16%). To provide a better guide to the underlying business

performance, adjusted EBITDA excludes share-based payment charges

along with depreciation, amortisation, interest and tax from the

measure of profit. The GAAP measure of operating profit before

interest and tax was GBP0.2m (FY20: GBP0.04m loss) reflecting the

EBITDA profit achieved in the year, offset by increased

amortisation and the non-cash share-based payment charge of GBP0.9m

(FY20: GBP0.5m), reflecting the successful EBITDA performance this

year and the strong position the Group is now in to deliver

increased revenue and profits which are reflected in future

performance related vesting assumptions.

The Group is pleased to report a maiden full year profit before

tax for FY21 of GBP0.1m (FY20: loss of GBP0.3m) reflecting the

improved profit before interest and tax and a reduction in finance

expense to GBP0.1m (FY20: GBP0.3m) due to lower utilisation of the

Group's revolving loan facility during the year as expected

following careful working capital management and improved operating

performance.

EPS and dividend

The Group's international businesses have continued to grow

successfully and as a result, overseas tax charges increased to

GBP0.4m (FY20: GBP0.3m). The impact of this is partially mitigated

in the UK by the continued successful R&D tax claims and the

deferred tax asset recognised in relation to a proportion of the

historic losses brought forward.

As a result, loss after taxation was GBP0.1m (FY20: GBP0.5m) and

reported basic and diluted loss per share improved by 88% to 0.22p

(FY20: loss per share 1.77p).

Group Statement of Financial Position

The Group had net assets of GBP5.4m at 30 June 2021 (30 June

2020: GBP4.4m), including capitalised intellectual property of

GBP3.6m (30 June 2020: GBP3.7m). The movement in net assets

reflects the improved EBITDA performance in the year and the

exercise of share options during the year.

Current assets increased by GBP1.8m primarily due to higher

revenue in the year and the timing of significant receipts,

including the research and development tax credit of GBP0.2m

received in July 2021. Liabilities increased by GBP0.7m due to the

value of the drawdown of the Group's revolving credit facility,

offset by a lower overseas corporate tax creditor due to payments

made on account during the year.

Cashflow and net cash

The Group ended the year with net cash of GBP0.8m (30 June 2020:

net cash of GBP1.5m) being better than the Board's expectations.

During FY20, the Group made use of a number of COVID-19 linked

schemes in order to manage its working capital, including the

deferral of VAT and PAYE in the UK. As a result, GBP1.7m of cash

outflow was deferred from FY20 to FY21 with a further GBP0.4m

deferred to FY22 in line with agreed payment plans. Stripping out

the impact of these schemes, the underlying net cash inflow for the

year was GBP0.9m (FY20: GBP0.8m inflow). Overall net cash outflow

for the year was GBP0.7m (FY20: inflow of GBP2.8m).

The main components to the net cash inflow (unadjusted for the

impact of COVID-19 deferral schemes) were the operating cash inflow

of GBP2.4m (FY20: inflow of GBP6.1m), reflecting the EBITDA profit

of GBP4.2m (FY20: GBP3.3m), a working capital outflow of GBP1.2m

(FY20: GBP2.6m inflow), including COVID-19 deferral repayments, and

net tax payments of GBP0.6m (FY20: GBP0.2m net receipt), offset by

capital investment in the AIR platform and other infrastructure of

GBP2.4m (FY20: GBP2.4m), contract costs capitalised under IFRS 15

of GBP0.6m (FY20: GBP0.5m), payments in respect of leases GBP0.1m

(FY20: GBP0.3m) and interest due on the Group's revolving credit

facility with Barclays GBP0.1m (FY20: GBP0.2m).

The Board does not feel it appropriate at this time to commence

paying dividends and continues to invest in its growth

strategy.

Banking facility

The Group has remained comfortably within its banking covenants

which relate to available headroom and adjusted EBITDA performance.

Following the year end, the Group has extended the term of its

GBP5.0m revolving loan facility with Barclays Bank PLC to November

2022. The Group's gross cash of GBP1.7m (FY20: GBP1.5m) and the

undrawn GBP4.1m of the GBP5.0m facility (FY20: GBP5.0m undrawn)

gives the Group GBP5.8m of headroom, which the Directors believe is

sufficient to support the Group's existing growth plans.

Consolidated statement of profit or loss and total comprehensive

income

for the year ended 30 June 2021

2021 2020

Note GBP000 GBP000

Continuing operations

Revenue 3 22,800 20,421

Cost of sales (2,134) (1,318)

--------------------------------------- ----- --------------------- ------------------

Gross profit 20,666 19,103

Operating expenses (20,432) (19,145)

Adjusted EBITDA (1) 5 4,215 3,278

Share-based payment charge (877) (464)

Depreciation and amortisation (3,104) (2,856)

--------------------------------------- ----- --------------------- ------------------

Operating profit/(loss) 234 (42)

Finance income - 1

Finance expense (108) (291)

Profit/(loss) before taxation 126 (332)

Taxation (183) (122)

--------------------------------------- ----- --------------------- ------------------

Loss after taxation for the

financial year (57) (454)

Foreign exchange adjustments (100) (98)

--------------------------------------- ----- --------------------- ------------------

Total comprehensive loss attributable

to the owners of the parent

for the financial year (157) (552)

--------------------------------------- ----- --------------------- ------------------

(1) Adjusted EBITDA excludes share-based payment charge,

depreciation and amortisation from the measure of profit

Loss per share

From continuing operations

Basic and diluted 4 (0.22)p (1.77)p

--------------------------------------- ----- --------------------- ------------------

Consolidated statement of financial position

as at 30 June 2021

2021 2020

GBP000 GBP000

Non-current assets

Intangible assets 6,527 6,494

Contract fulfilment

costs 196 209

Property, plant and

equipment 826 903

Deferred taxation 121 121

7,670 7,727

----------------------------- ---------- ---------

Current assets

Trade and other receivables 6,194 4,840

Current tax receivable 221 -

Cash and cash equivalents 1,713 1,519

------------------------------- ---------- ---------

8,128 6,359

----------------------------- ---------- ---------

Total assets 15,798 14,086

------------------------------- ---------- ---------

Current liabilities

Trade and other payables (8,575) (7,879)

Financial liabilities (900) -

(9,475) (7,879)

Non-current liabilities

Other payables (928) (1,783)

Total liabilities (10,403) (9,662)

------------------------------- ---------- ---------

Net assets 5,395 4,424

------------------------------- ---------- ---------

Equity attributable

to owners of the parent

Share capital 261 257

Share premium 17,503 17,256

Merger reserve 3,278 3,278

Share option reserve 3,997 3,525

Retained losses (19,644) (19,892)

------------------------------- ---------- ---------

Total equity 5,395 4,424

------------------------------- ---------- ---------

Consolidated statement of changes in equity

for the year ended 30 June 2021

Share

Share Share Merger option Retained

capital premium reserve reserve losses Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

July 2019 255 17,066 3,278 3,236 (19,515) 4,320

----------------------- --------- --------- --------- --------- --------- ----------

Loss for the

financial year - - - - (454) (454)

Other comprehensive

income

Foreign exchange

adjustments - - - - (98) (98)

----------------------- --------- --------- --------- --------- --------- ----------

- - - - (552) (552)

----------------------- --------- --------- --------- --------- --------- ----------

Transactions

with owners

recognised in

equity

Exercise of

share options 2 190 - - - 192

Fair value of

share options

exercised in

the year - - - (175) 175 -

Share-based

payment charge - - - 464 - 464

2 190 - 289 175 656

----------------------- --------- --------- --------- --------- --------- ----------

Balance at 30

June 2020 257 17,256 3,278 3,525 (19,892) 4,424

----------------------- --------- --------- --------- --------- --------- ----------

Loss for the

financial year - - - - (57) (57)

Other comprehensive

income

Foreign exchange

adjustments - - - - (100) (100)

----------------------- --------- --------- --------- --------- --------- ----------

- - - - (157) (157)

----------------------- --------- --------- --------- --------- --------- ----------

Transactions

with owners

recognised in

equity

Exercise of

share options 4 247 - - - 251

Fair value of

share options

exercised in

the year - - - (405) 405 -

Share-based

payment charge - - - 877 - 877

4 247 - 472 405 1,128

----------------------- --------- --------- --------- --------- --------- ----------

Balance at 30

June 2021 261 17,503 3,278 3,997 (19,644) 5,395

----------------------- --------- --------- --------- --------- --------- ----------

Included in Retained losses is a cumulative foreign exchange

loss balance of GBP(69,000) (2020: profit GBP31,000).

Consolidated statement of cash flows

for the year ended 30 June 2021

2021 2020

GBP000 GBP000

Cash flows from operating

activities

Profit/(loss) before taxation 126 (332)

Adjustments for:

Depreciation 297 370

Amortisation 2,806 2,487

Share-based payment charge 877 464

Finance income - (1)

Finance expense 108 291

Increase in trade and other receivables (1,233) (1,222)

(Decrease)/increase in trade and other

payables (15) 3,793

Income tax paid (563) (180)

Income tax received - 389

Net cash flows from operating activities 2,403 6,059

------------------------------------------------ -------- --------

Cash flows from investing

activities

Payments to acquire property, plant and

equipment (221) (68)

Payments to acquire intangible

assets and contract fulfilment

costs (2,826) (2,815)

Net cash flows used in investing activities (3,047) (2,883)

------------------------------------------------ -------- --------

Cash flows from financing

activities

Net proceeds from issue of

equity 251 192

Proceeds from borrowings 2,200 2,000

Repayment of borrowings (1,300) (4,600)

Capital payments in respect

of leases (104) (224)

Interest paid in respect

of leases (38) (44)

Interest received - 2

Interest paid (71) (248)

Net cash flows from financing

activities 938 (2,922)

-------- --------

Net increase/(decrease) in cash and cash

equivalents in the year 294 254

Foreign exchange adjustments (100) (98)

Cash and cash equivalents

at beginning of year 1,519 1,363

------------------------------------------------ -------- --------

Cash and cash equivalents

at end of year 1,713 1,519

------------------------------------------------ -------- --------

Notes to the consolidated preliminary financial information

1 Basis of preparation

The financial information set out herein does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The financial information for the Year ended 30 June 2021 has

been extracted from the Group's audited financial statements which

were approved by the Board of Directors on 21 September 2021 and

which, if adopted by the members at the Annual General Meeting,

will be delivered to the Registrar of Companies for England and

Wales.

The financial information for the Year ended 30 June 2020 has

been extracted from the Group's audited financial statements which

were approved by the Board of Directors on 15 September 2020 and

which have been delivered to the Registrar of Companies for England

and Wales.

The reports of the auditor on both these financial statements

were unqualified, did not include any references to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report and did not contain a statement under

Section 498(2) or Section 498(3) of the Companies Act 2006.

The information included in this preliminary announcement has

been prepared on a going concern basis under the historical cost

convention, and in accordance with International Accounting

Standards in conformity with the requirements of the Companies Act

2006 and the International Financial Reporting Interpretations

Committee (IFRIC) interpretations issued by the International

Accounting Standards Board ("IASB") that are effective as at the

date of these financial statements.

The Company is a public limited Company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange.

2 Going concern

As part of their going concern review the Directors have

followed the guidelines published by the Financial Reporting

Council entitled "Guidance on the Going Concern Basis of Accounting

and Reporting on Solvency and Liquidity Risks- Guidance for

directors of companies that do not apply the UK Corporate

Governance Code".

The Directors have prepared detailed financial forecasts and

cash flows looking beyond 12 months from the date of approval of

these consolidated financial statements. In developing these

forecasts, the Directors have made assumptions based upon their

view of the current and future economic conditions that will

prevail over the forecast period. A number of forecasts have been

produced which take into consideration different assumptions on the

timing and extent of recovery from Covid-19, including the risk of

debtor default and the likely different recovery profiles of the

different sectors in which the Group's services are offered.

On the basis of the above projections, and although the Group

has net current liabilities at 30 June 2021, the Directors are

confident that the Group has sufficient working capital and

available funds to honour all of its obligations to creditors as

and when they fall due. In reaching this conclusion, the Directors

have considered the forecast cash headroom, including the impact of

the extension of the revolving credit facility with Barclays Bank

plc and the covenants associated with it, the resources available

to the Group and the potential impact of changes in forecast growth

and other assumptions, including the potential to avoid or defer

certain costs and to reduce discretionary spend as mitigating

actions in the event of such changes. Accordingly, the Directors

continue to adopt the going concern basis in preparing these

consolidated financial statements.

3 Segmental analysis

The Group is organised into one principal operating division for

management purposes. Therefore, the Group has only one operating

segment and segmental information is not required to be disclosed.

Revenue is analysed as follows:

2021 2020

GBP000 GBP000

Development and set up fees 5,887 5,505

Subscription and transaction

fees 16,913 14,916

22,800 20,421

------------------------------ ------- -------

2021 2020

GBP000 GBP000

AIR revenue 20,164 19,165

Messaging revenue 2,636 1,256

22,800 20,421

------------------- ------- -------

Continuing revenues can be attributed to the following

countries, based on the customers' location:

2021 2020

GBP000 GBP000

United Kingdom 13,494 13,398

North America 7,857 6,706

Rest of Europe 116 159

Asia Pacific 1,332 158

22,800 20,421

---------------- ------- -------

4 Loss per share

The calculation of basic and diluted loss per share is based on

the result attributable to ordinary shareholders divided by the

weighted average number of ordinary shares in issue during the

Year. The weighted average number of shares for the purpose of

calculating the basic and diluted measures is the same. This is

because the outstanding share options would have the effect of

reducing the loss per ordinary share and therefore would be

anti-dilutive. Basic and diluted loss per share from continuing

operations is calculated as follows:

2020

Loss 2021 Loss Weighted

per Weighted average per average number

share Loss number of share Loss of ordinary

pence GBP000 ordinary shares pence GBP000 shares

Basic and diluted

loss per share (0.22) (57) 25,850,194 (1.77) (454) 25,659,034

------------------- ------- -------- ------------------ ------- -------- ----------------

5 Alternative performance measure

EBITDA is a key performance measure for the Group and is derived

as follows:

2021 2020

GBP000 GBP000

Profit/(loss) before taxation 126 (332)

Add back:

Finance income and expense 108 290

Share-based payments 877 464

Depreciation and amortisation 3,104 2,856

------------------------------------------- -------- --------

EBITDA 4,215 3,278

------------------------------------------- -------- --------

6 Net cash/(debt)

Foreign

30 June exchange 30 June

2020 Cash flow adjustments 2021

GBP000 GBP000 GBP000 GBP000

Cash and cash equivalents 1,519 294 (100) 1,713

Financial liabilities - (900) - (900)

Net cash/(debt) 1,519 (606) (100) 813

--------------------------- -------- ---------- ------------- --------

The cash flow above includes GBP1.6m of Covid-19 repayments

relating to government schemes allowing deferral of certain taxes

due to the economic impact of the COVID-19 pandemic.

7 Report and Accounts

A copy of the Annual Report and Accounts for the Year ended 30

June 2021 will be sent to all shareholders in due course together

with notice of the Annual General Meeting

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DFLFLFKLBBBV

(END) Dow Jones Newswires

September 22, 2021 01:59 ET (05:59 GMT)

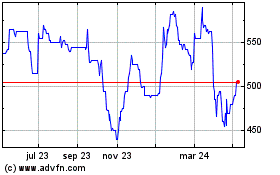

Eagle Eye Solutions (LSE:EYE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

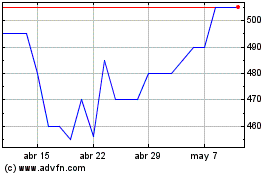

Eagle Eye Solutions (LSE:EYE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024