TIDMEST

RNS Number : 6268V

East Star Resources PLC

14 December 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

14 December 2021

East Star Resources plc

("East Star" or the "Company")

Publication of Prospectus

Notice of General Meeting to Approve the Acquisition

Fundraise of GBP3,100,000

Proposed Waiver of Rule 9 of the Takeover Code

Proposed Appointments and Resignations

Capitalised terms used in this announcement shall have the same

meaning as set out in the prospectus dated 14 December 2021

Prospectus Publication

Further to the announcements on 19 July 2021 and 26 October

2021, East Star is pleased to announce that the Financial Conduct

Authority has today approved the publication of its Prospectus

issued in connection with:

-- the terms of the proposed Acquisition of Discovery Ventures

Kazakhstan Limited ("DVK") pursuant to which the consideration for

the acquisition is to be satisfied in full by the issue of

45,000,000 Ordinary Shares in the Company (the "Consideration

Shares"). The Sellers shall have the right to receive an additional

75,000,000 Ordinary Shares (the "Performance Shares") upon the

confirmation of a mineral resource on one of the Licences of at

least one million ounces of gold equivalent at an average grade of

at least two grammes per tonne of gold equivalent;

-- the placing and subscription of a total of 62,000,000

Ordinary Shares at a subscription price of 5 pence each, raising

gross proceeds of GBP3,100,000;

-- the proposed re-admission of the enlarged share capital of

182,250,164 Ordinary Shares to the standard listing segment of the

Official List and to trading on the London Stock Exchange's Main

Market ("Admission"). Application will be made for the Ordinary

Shares to be issued pursuant to the Fundraise to be admitted to

trading on the Main Market of the London Stock Exchange; and

-- the notice convening a General Meeting of the Company which

is to be held at the offices of Hill Dickinson LLP located at The

Broadgate Tower, 20 Primrose Street, London EC2A 2EW at 10:30 a.m.

on 5 January 2022.

Sandy Barblett, Chairman of East Star Resources Plc,

commented:

"We are excited to see this transaction reaching its final

stages following an oversubscribed fundraising. We are delighted

that investors clearly share our belief in the opportunity which

exists in Kazakhstan today to discover and develop tier-1 gold and

base metal deposits by applying modern geophysics and exploration

concepts. We are looking forward to progressing an intensive work

programme over DVK's existing highly prospective tenements while

growing our footprint in-country."

Availability of the Prospectus

The Prospectus will be sent to shareholders and will also be

made available shortly online at www.east-star-resources.com

(subject to applicable securities laws). An electronic copy of the

Prospectus will also be submitted to the National Storage Mechanism

as maintained by the FCA and should be available shortly for

inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

General Meeting

East Star has today published a prospectus in relation to the

matters described above and has convened a general meeting of East

Star's shareholders at 10:30 a.m. on 5 January 2022 at the offices

of Hill Dickinson LLP located at The Broadgate Tower, 20 Primrose

Street, London EC2A 2EW. A notice of the general meeting is

included in the Prospectus and a form of proxy will be provided to

shareholders. East Star will make arrangements for such documents

to be posted. The purpose of the General Meeting is to consider

and, if thought fit, pass the Resolutions, in each case as set out

in full in the notice of General Meeting, including, inter

alia:

-- Resolution 1: will be proposed as an ordinary resolution and

seeks to approve a waiver granted by the Panel on Takeovers and

Mergers of the obligation that would arise under Rule 9 of the City

Code on Takeovers

-- Resolution 2: will be proposed as an ordinary resolution and

seeks to approve the acquisition by East Star of the entire issued

share capital of DVK

-- Resolution 3: will be proposed as an ordinary resolution to

authorize the Directors to issue the New Shares and the Performance

Shares (subject to the Performance Condition), and to grant

warrants to advisers and a total of 11,250,000 options to

directors, employees and management of the enlarged group

-- Resolution 4: will be proposed as an ordinary resolution to

authorize the Directors to issue shares or grant rights over shares

representing 20 per cent of the aggregate value of the ordinary

shares in issue as the close of the first day following

Admission

-- Resolution 5: will be proposed as a special resolution to

dis-apply pre-emption rights in respect of the allotment of shares

authorized pursuant to Resolution 3

-- Resolution 6: will be proposed as a special resolution to

dis-apply pre-emption rights in respect of the allotment of shares

authorized pursuant to Resolution 4

Resolution 1 will need to be approved by Independent

Shareholders voting on a poll. It is expected that Admission will

become effective and that dealings will commence at 8:00 a.m. on 10

January 2022.

Trading in the Company's Ordinary Shares will remain suspended

pending completion of the General Meeting (as set out in the

Timetable below).

Fundraise

Conditional on Admission, the Company has raised gross proceeds

of GBP3,100,000 in an oversubscribed fundraising, via the issue of

62,000,000 Ordinary Shares, which have been conditionally placed at

the Fundraising Price of GBP0.05, by way of a placement of

38,050,000 Ordinary Shares by Peterhouse Capital, Orana Corporate,

Vendors of DVK, and direct subscription with the Company for

23,950,000 Ordinary Shares.

East Star is a company incorporated in England and Wales with

company number 13025608. The Ordinary Shares are registered with

ISIN GB00BN92HZ16, SEDOL code BN92HZ1 and TIDM is EST.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Publication of the Prospectus 14 December 2021

Date for return of forms of 10:30 a.m. on 31 December 2021

proxy

General Meeting of the Company 10.30 a.m. on 5 January 2022

Results of the General Meeting 11:00 a.m. on 5 January 2022

Completion of the Acquisition 10 January 2022

Re-Admission and commencement 8.00 a.m. on 10 January 2022

of dealings in the Enlarged

Ordinary Share Capital

CREST members' accounts credited 8.00 a.m. on 10 January 2022

in (where applicable)

Dispatch of definitive share by no later than 10 days

certificates for Shares (where from Admission

applicable)

ADMISSION STATISTICS

Shares in issue as at today's date 69,540,164

Total Placing Shares 38,050,000

Total Subscription Shares 23,950,000

Total Consideration Shares to be issued on Admission 45,000,000

Total Ilwella Loan Shares to be issued on Admission 5,350,000

Total Fee Shares to be issued on Admission 360,000

Enlarged Ordinary Share Capital 182,250,164

Percentage of Enlarged Ordinary Share Capital represented

by Fundraising Shares 34.0%

Total number of Options 11,250,000

Total number of Founder Warrants 6,000,000

Total number of Broker Warrants 2,767,500

Total number of Orana Warrants 6,046,005

Total Warrants in issue on Admission 14,813,505

Total number of Options and Warrants 26,063,505

Total Performance Shares capable of being issued

following Admission 75,000,000

Fully Diluted Ordinary Share Capital on Admission 283,313,669

Percentage of Fully Diluted Ordinary Share Capital

represented by Warrants 5.2%

Fundraising Price per New Share GBP0.05

Estimated Net Proceeds received by the Company GBP2,604,135

Estimated transaction costs GBP513,865

Expected market capitalisation of the Company on GBP9,112,508

Admission at the Fundraise Price

Directors immediately on and following Re-Admission

On Admission, Charles Wood will stand down as a Director of the

Company. Alexander ("Alex") Walker and David Minchin will be

appointed as Directors of the Company with effect from Admission

and are referred to in this announcement as the Proposed Directors.

Biographies for the Proposed Directors are set out below.

Alex Walker, Age 37 (Chief Executive Officer)

Alex Walker is an investment banker and resources executive with

more than 14 years' experience in natural resources investment with

Norwegian Bank, Pareto Securities, London-based investment bank,

Brandon Hill Capital and Australian broking firm Patersons

Securities. Mr. Walker co-founded and was the General Manager of

ScandiVanadium Ltd. He was also involved in the process of listing

ScandiVanadium Ltd on the Australian Securities Exchange.

Mr. Walker holds a MSc in Mineral and Energy Economics from

Curtin University of Technology, Graduate Diploma of Applied

Finance, BComm, BSocSci, and is a Graduate of the Australian

Institute of Company Directors.

David Minchin, Age 40 (Non-executive Director)

David Minchin is a geologist with over 15 years' experience in

production, exploration, and resource investment. Mr. Minchin has

worked for Rio Tinto and the British Geological Survey, as well

working as Senior Exploration Geologist for ICL-Boulby where he was

closely involved in the discovery of the 3.2 billion tonne

polyhalite deposit that was subsequently put into production and

extended operating mine life by over 30 years.

Mr. Minchin has worked as Director of Geology for AMED Funds, a

London based private equity group that focuses on exploration

projects in Africa. In this role, Mr. Minchin was part of the team

responsible for investing and monitoring approximately USD 450

million in projects from exploration through to feasibility and

across a range of commodities.

Mr. Minchin is currently CEO of Helium One Global Limited, an

AIM quoted company developing a significant primary helium project

in Tanzania and was formerly Managing Director of ASX-listed

ScandiVanadium.

Director/Key Current directorships/partnerships Previous directorships/partnerships

Management

Name

Anthony Eastman Windyhollows Limited Kore Genetics Limited

Extrax Limited Critical Anubis Pharma Limited

Metals Plc Orana Corporate Mute International

LLP Limited

Graft Polymer (UK) Caracal Gold Plc

Limited Graft Polymer (previously named,

IP Limited Vaxeal Papillon Holdings

Immunotherapy Ltd Plc)

MGC Pharma (UK) Ltd Thrivanta Investments

Tournesol Consulting Plc Beyond Diamonds

Ltd NTSU Gems UK Limited Limited

(previously named

Kore Genetics Limited)

Sandy Barblett Ironbridge Capital Brandshield Systems

Partners LLP Plc Scirocco Energy

Envirostream (UK) Plc

Limited Arwon Capital Blenheim Natural

(UK) Limited TECC Resources Limited

Capital plc Sandonjo Rogue Baron Plc

Capital Plc IAMFIRE Opus Media Services

Plc Ltd Bioworks Plc

Rottnest Foundation

London Chapter Limited

Alex Walker ScandiVanadium Sweden ScandiVanadium Ltd

AB (UK) Walk On Fitness

Heavy Minerals Ltd Ltd

Discovery Ventures

Kazakhstan Ltd

ASK Green Energy Ltd

David Minchin Helium One Global ScandiVanadium Ltd

Ltd Scandivanadium Pty (Australia)

Australia Pty

Ltd

ScandiVanadium Ltd

(UK)

ScandiVanadium Ltd

Pty (Australia)

For further information, please visit

http://www.east-star-resources.com/ or contact the following:

East Star Resources PLC

Sandy Barblett

Tel: +44 (0)20 3918 8792

Peterhouse Capital Limited (Corporate Broker and Placing

Agent)

Duncan Vasey / Lucy Williams

Tel: +44 (0) 20 7469 0930

Vigo Consulting (Investor Relations)

Ben Simons / Oliver Clark

Tel: +44 (0)20 7390 0234

Notes

No offer of securities

This Document does not constitute, and may not be used for the

purposes of, an offer to sell or an invitation or the solicitation

of an offer or invitation to subscribe for or buy, any Shares by

any person in any jurisdiction: (i) in which such offer or

invitation is not authorised; (ii) in which the person making such

offer or invitation is not qualified to do so; or (iii) in which,

or to any person to whom, it is unlawful to make such offer,

solicitation or invitation. The distribution of this Document and

the offering of the Ordinary Shares in certain jurisdictions may be

restricted. Accordingly, persons outside the United Kingdom who

obtain possession of this Document are required by the Company, and

the Directors to inform themselves about, and to observe any

restrictions as to the offer or sale of Shares and the distribution

of, this Document under the laws and regulations of any territory

in connection with any applications for Shares, including obtaining

any requisite governmental or other consent and observing any other

formality prescribed in such territory. No action has been taken or

will be taken in any jurisdiction by the Company or the Directors,

that would permit a public offering of the Ordinary Shares in any

jurisdiction where action for that purpose is required, nor has any

such action been taken with respect to the possession or

distribution of this Document other than in any jurisdiction where

action for that purpose is required. Neither the Company, nor the

Directors accepts any responsibility for any violation of any of

these restrictions by any other person.

Important notices relating to advisers

Peterhouse Capital Limited ("Peterhouse"), has been appointed by

the Company as a broker and placing agent in connection with the

Placing. Peterhouse is also providing independent financial advice

to the Directors for the purposes of Rule 3 of the City Code.

Peterhouse is authorised and regulated in the United Kingdom by the

FCA, is acting exclusively for the Company and for no one else in

relation to Admission and the arrangements referred to in this

Document. Peterhouse will not regard any other person (whether or

not a recipient of this Document) as its client in relation to

Admission and will not be responsible to anyone other than the

Company for providing the protections afforded to clients of

Peterhouse or for providing any advice in relation to Admission,

the contents of this Document or any transaction or arrangement

referred to herein. No liability whatsoever is accepted by

Peterhouse for the accuracy of any information or opinions

contained in this Document or for the omission of any material

information, for which it is not responsible.

Forward-looking statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". In some cases, these

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms "targets",

"believes", "estimates", "anticipates", "expects", "intends",

"may", "will", "should" or, in each case, their negative or other

variations or comparable terminology. They appear in a number of

places throughout the [announcement] and include statements

regarding the intentions, beliefs or current expectations of the

Company and the Board of Directors concerning, among other things:

(i) the Company's objective, acquisition and financing strategies,

results of operations, financial condition, capital resources,

prospects, capital appreciation of the Ordinary Shares and

dividends; and (ii) future deal flow and implementation of active

management strategies, including with regard to any acquisitions.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not a guarantee of future

performance. The Company's actual performance, results of

operations, financial condition, distributions to shareholders and

the development of its financing strategies may differ materially

from the forward-looking statements contained in this

[announcement]. In addition, even if the Company's actual

performance, results of operations, financial condition,

distributions to shareholders and the development of its financing

strategies are consistent with the forward-looking statements

contained in this [announcement], those results or developments may

not be indicative of results or developments in subsequent

periods.

Prospective Investors should carefully review the "Risk Factors"

section of [the Prospectus] for a discussion of additional factors

that could cause the Company's actual results to differ materially,

before making an investment decision. For the avoidance of doubt,

nothing in this paragraph constitutes a qualification of the

working capital statement contained in paragraph [15] of "Part XI -

Additional Information".

Forward looking statements speak only as at the date of this

[announcement]. Subject to its legal and regulatory obligations

(including under the Prospectus Regulation Rules), the Company

expressly disclaims any obligation to update or revise any forward

looking statement contained herein to reflect any change in

expectations with regard thereto or any changes in events,

conditions or circumstances on which any statement is based unless

required to do so by law or any appropriate regulatory authority,

including, FSMA, the Listing Rules, the Prospectus Regulation

Rules, the Disclosure Guidance and Transparency Rules, the

Prospectus Regulation and UK MAR.

Transaction conditions

Completion of the Transaction is subject to the satisfaction of

certain conditions as more fully described in the Prospectus.

Consequently, there can be no certainty that completion of the

Transaction will be forthcoming.

Transmission of this announcement and the Prospectus

Neither this announcement, the Prospectus, nor any copy of

either of them may be taken or transmitted directly or indirectly

into or from any jurisdiction where to do so would constitute a

violation of the relevant laws or regulations of such jurisdiction.

Any failure to comply with this restriction may constitute a

violation of such laws or regulations. Persons into whose

possession this announcement, the Prospectus or other information

referred to therein comes, should inform themselves about, and

observe, any restrictions in such laws or regulations.

Compliance with laws

This announcement and the Prospectus have been prepared for the

purpose of complying with the applicable laws and regulations of

the United Kingdom and information disclosed may not be the same as

that which would have been disclosed if this announcement or the

Prospectus had been prepared in accordance with the laws and

regulations of jurisdictions outside the United Kingdom.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PDIMZMMZFDGGMZM

(END) Dow Jones Newswires

December 14, 2021 08:13 ET (13:13 GMT)

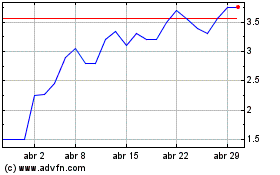

East Star Resources (LSE:EST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

East Star Resources (LSE:EST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024