TIDMINPP

RNS Number : 6461A

International Public Partnerships

03 June 2021

INTERNATIONAL PUBLIC PARTNERSHIPS LIMITED

PORTFOLIO UPDATE

FOR THE PERIOD 1 JANUARY 2021 TO 31 MAY 2021

3 June 2021

International Public Partnerships Limited ('INPP', the

'Company'), the FTSE 250 listed investment company which invests in

global public infrastructure projects and businesses, has today

issued the following portfolio update for the period 1 January 2021

to 31 May 2021.

OPERATIONAL HIGHLIGHTS

-- The Company is performing successfully and its portfolio of

130 investments in public and social infrastructure projects and

businesses continues to deliver essential services to all its

stakeholders, maintaining high levels of asset availability

-- There have been no material changes to the Company's

operational or financial performance since it announced its results

for the year ended 31 December 2020 on 25 March 2021

-- The Company continues to have the benefit of a high-quality

pipeline of near-term investment commitments equating to c.GBP200

million, including Beatrice, Rampion and East Anglia One Offshore

Transmission Projects

-- The Company has now delivered a Total Shareholder Return(1)

since IPO in November 2006 to 28 May 2021 of 243.3% or 8.8% on an

annualised basis

-- In line with previous forecasts a second half-year 2020

dividend of 3.68 pence per share was declared on 25 March 2021

supported by a strong 2020 cash dividend cover of 1.2x(2)

-- Whilst in overall terms the Company's portfolio has

experienced limited impact as a result of Covid-19, it continues to

monitor certain specific risk areas, particularly relating to

Tideway and the Diabolo Rail Link ('Diabolo'), as previously

highlighted

-- The Company retains a specific focus on highlighting its ESG

performance and continues to evolve its sustainability reporting

and align its disclosures with the recommendations of the Task

Force on Climate-related Financial Disclosures ('TCFD'). The

Company's ESG Committee meets at least twice a year

PORTFOLIO UPDATE

The Company's portfolio of assets continue to deliver

successfully on the Company's objectives for its shareholders and

wider stakeholders.

-- The portfolio currently has 9.1%(3) of assets still in

physical construction. The weighted average investment life of the

portfolio is currently 32 years(4) with a weighted average

(non-recourse) debt tenor of 30 years(4) .

-- As at 31 December 2020, the portfolio comprised economic

interests in 130 projects and businesses with a composition as

detailed below. This has remained substantially unchanged to 31 May

2021:

Energy Transmission 22%

----------------------- ------

Transport 19%

----------------------- ------

Education 19%

----------------------- ------

Gas Distribution 17%

----------------------- ------

Waste Water 9%

----------------------- ------

Health 4%

----------------------- ------

Courts 3%

----------------------- ------

Military Housing 3%

----------------------- ------

Other 4%

PORTFOLIO REVIEW

The overall portfolio has continued to perform well. This

section provides a brief update on key assets where there have been

noteworthy developments since the Company's results for the year

ended 31 December 2020 were published on 25 March 2021.

Tideway, UK | SDGs 6, 9 & 11: clean water and sanitation,

industry, innovation and infrastructure and making sustainable

cities and communities

Tideway is building a 25km 'super sewer' under the River Thames

to create a healthier environment for London by cleaning up the

city's greatest natural asset. The impact of Covid-19 on both the

cost and schedule of the project was reported previously and it was

noted that, in addition to existing contractual and regulatory

safeguards, Tideway has been in discussions with Ofwat on a package

of measures that would further mitigate the financial impact of

Covid-19 on Tideway's shareholders (the Company is a 16%

shareholder in Tideway). Since the release of the Company's annual

results, progress has been made in these discussions and the

proposed measures were the subject of a recent public

consultation(5) run by Ofwat. The consultation has now closed and

Tideway expects the measures to be formally implemented via

modifications to its licence before the end of 2021. The Company is

pleased that these modifications seem likely to ensure a more

appropriate allocation between stakeholders of the impact that

Covid-19 is expected to have on the project's cost and schedule. At

the time of writing, the project is approaching being 65%

complete.

Diabolo, Belgium | SDG 11: Making sustainable cities and

communities

Diabolo is a rail infrastructure investment which integrates

Brussels Airport with Belgium's national rail network. The majority

of revenues generated by Diabolo are linked to passenger use of

either the rail link itself or the wider Belgian rail network.

Accordingly, Diabolo has been impacted by the restrictions on

international travel and national lockdowns implemented in Belgium

as a result of the Covid-19 pandemic. As previously disclosed, the

Company invested GBP9.1 million in December 2020, and made a

further contingent commitment of GBP12.6 million, to protect

Diabolo's liquidity position and ensure its debt covenants continue

to be met. Since the release of the Company's annual results the

asset has continued to operate fully in compliance with its

contractual obligations and the Company is continuing to closely

monitor passenger numbers. Whilst the full GBP12.6 million

commitment referred to above remains available to support Diabolo's

liquidity position, ensure debt covenants will continue to be met

and protect the value of the Company's investment, the extent and

timing of any further cash injections will depend upon the

trajectory of the recovery in passenger numbers over the coming

months.

Gas distribution, UK | SDG 7 & 9: affordable and clean

energy, and industry, innovation and infrastructure

The Company's investment in the UK's largest gas distribution

network which serves 11 million customers is the Company's largest

asset by investment fair value. As previously announced, following

Ofgem's final determination for Cadent in respect of RIIO-2 in

December 2020, Cadent has sought an independent review by the

Competition and Markets Authority as it believes this approach will

best serve Cadent's customers' interests. The outcome of the appeal

is due later in the year.

FINANCIAL HIGHLIGHTS

The Company's investment portfolio valuation is determined

semi-annually by the Directors after advice from the Investment

Adviser and is reviewed by the Company's auditors. This semi-annual

valuation is published within the Company's interim and annual

accounts, the last of which was published with the Company's annual

results for the year ended 31 December 2020 on 25 March 2021

reporting:

-- A net asset value ('NAV') per share of 147.1 pence (31 Dec 2019: 150.6 pence)

-- The Company's underlying revenues continue to be underpinned

by strong inflation-linkage with a projected increase in return of

0.78% p.a. for a 1.00% p.a. increase in inflation (31 December

2019: 0.82% p.a.)(6)

-- A second half-year 2020 dividend of 3.68 pence per share was

declared on 25 March 2021 and is expected to be paid on 4 June

2021. This dividend is in respect of the period 1 July 2020 to 31

December 2020 and represents a c.2.5% increase on the dividend paid

in the corresponding period in the prior year

-- The Scrip Dividend Alternative Circular applicable to that

dividend was available to investors and the associated scrip

allotment or dividend payment is due to be paid on 4 June 2021

-- The Company will target full-year dividends in respect of

2021 and 2022 of 7.55 and 7.74 pence per share, respectively, in

line with the current targeted annual increase of c.2.5%(7) .

Whilst the Company currently has good forward-visibility of the

cash flows projected to be generated by its investments, the

Company continues to monitor the portfolio for any impact from

Covid-19 related risks, including those noted above

-- In March 2021, the UK Government announced that the headline

rate of corporation tax will be increased from 19% to 25% with

effect from April 2023. This future tax rate increase was not

reflected within the 31 December 2020 valuations owing to the

timing of the announcement (which occurred following the period

end) but was estimated to have a c.GBP30 million negative impact on

the Company's NAV once the increase is reflected in the forecast

investment cash flows. This is likely to be reflected within the 30

June 2021 valuations

As at 31 May 2021, the Company had utilised GBP60 million of the

credit available to it under the debt facility, leaving GBP190

million of the new GBP250 million committed facility available for

the Company's exiting investment commitments.

As previously announced, the Company is transitioning auditors

from EY to PwC following a comprehensive assessment process. PwC

will assume the role of the Company's auditor for the 2021

financial year. The transition process is progressing well.

INVESTMENT ENVIRONMENT AND OUTLOOK

-- The Company's portfolio of investments provides essential

infrastructure to over 13 million people, households and businesses

daily across the countries in which it invests.

-- Since the outbreak of Covid-19 in Q1 2020, there has been an

increased focus on ensuring resilience against future threats and

there is a broad recognition from governments of the pivotal role

that infrastructure will play in supporting a sustainable economic

recovery

-- While the full consequences of the pandemic and its long-term

effects, both economic and social, remain unclear, the Company

believes its business model and investment objectives continue to

offer a significant degree of protection for investors and there is

sustained appetite for long-term responsible investment into public

and social infrastructure across the geographies that the Company

invests in

-- The Company is monitoring the emerging requirements of The EU

Sustainable Finance Disclosure Regulation, and will support its

investors with relevant disclosures when required

-- The pipeline for the types of assets the Company invests in

remains strong and the Company continues to be confident in its

ability to continue to source and develop quality, high-performing

opportunities, across the Company's target geographies, that

deliver long-term, predictable cash flows with strong

inflation-linkage that meet the Company's risk-return profile

Notes to Editors:

While it is no longer a requirement under the Disclosure and

Transparency Rules for the Company to issue Interim Management

Statements, the Board believes it is in the interest of

shareholders for the Company to provide quarterly updates in

addition to its half year reports.

1. Source: Bloomberg. Share price appreciation plus dividends assumed to be reinvested.

2. Cash dividend payments to investors are paid from net

operating cash flow before non-recurring operating costs.

3. This is based on the fair valuation of the Company's

investments as at 31 December 2020 calculated utilising a

discounted cash flow methodology.

4. This includes non-concession entities which have potentially

a perpetual life but are assumed to have finite lives.

5.

https://www.ofwat.gov.uk/wp-content/uploads/2021/04/Consultation-on-amending-Tideways-project-licence.pdf

6. In aggregate, the weighted average return of the portfolio

would be expected to increase by 0.78% per annum in response to a

1.00% per annum inflation increase over the currently assumed

inflation rates across the whole portfolio. Based on analysis as at

31 December 2020.

7. Dividend targets are targets and not profit forecasts and

there can be no guarantee they will be achieved. Projections are

based on the current individual asset financial models and may vary

in the future.

ENDS.

For further information:

Erica Sibree/Amy Edwards +44 (0)20 7939 0558/0587

Amber Fund Management Limited

Hugh Jonathan +44 (0)20 7260 1263

Numis Securities

Ed Berry/Mitch Barltrop +44 (0) 20 3727 1046/1039

FTI Consulting

About International Public Partnerships (INPP):

INPP is a listed infrastructure investment company that invests

in global public infrastructure projects and businesses, which

meets societal and environmental needs, both now, and into the

future.

INPP is a responsible, long-term investor in 130 infrastructure

projects and businesses. The portfolio consists of utility and

transmission, transport, education, health, justice and digital

infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both a long-term yield and capital growth.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of over 150 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

Visit the INPP website at

www.internationalpublicpartnerships.com for more information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUFLFEDRRIFIIL

(END) Dow Jones Newswires

June 03, 2021 02:00 ET (06:00 GMT)

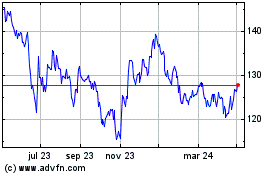

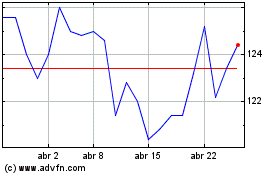

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024