TIDMPOLR

RNS Number : 0076P

Polar Capital Holdings PLC

14 October 2021

14 October 2021 Polar Capital Holdings plc

AuM Update

Polar Capital Holdings plc ("Polar Capital" or the "Group"), the

specialist active asset management group, today provides a

quarterly update of its unaudited statement of Assets under

Management ("AuM").

Group AuM (unaudited)

Polar Capital reports that as at 30 September 2021 its AuM were

GBP23.4bn compared to GBP20.9bn at the end of March 2021, an

increase of 12% over the period. During the period, AuM increased

by net inflows of GBP0.7bn and GBP1.8bn related to market movement

and fund performance.

AuM movement in six months to 30 September 2021

Open ended Investment Segregated Total

funds Trusts mandates

----------- ----------- ----------- -----------

AuM at 1 April 2021 GBP16,579m GBP3,867m GBP417m GBP20,863m

----------- ----------- ----------- -----------

Net subscriptions GBP(42)m GBP136m GBP595m GBP689m

----------- ----------- ----------- -----------

Market movement GBP1,277m GBP454m GBP77m GBP1,808m

and performance

----------- ----------- ----------- -----------

Total AuM at GBP17,814m GBP4,457m GBP1,089m GBP23,360m

30 September 2021

----------- ----------- ----------- -----------

Net performance fees (unaudited)

The table below sets out the position relating to net

performance fee profits due to the Group (after the deduction of

staff interests) as a product of accrued performance fees in funds

managed by the Group three months before the strike point of such

performance fee receipts. The majority of the Group's performance

fees crystallise in the second half of the financial year.

Performance fees Six months Six months Year to Six months

to to to

net of staff allocations 30 Sept 19 30 Sept 20 31 Mar 21 30 Sept 21

(year-end)

Received GBP3.3m GBP0.5m GBP19.5m -

------------ -------------- -------------- ------------

Accrued but not GBP0.9m GBP13.7m n/a GBP2m*

yet earned in funds

with year ends

on or before the

financial year

end

------------ -------------- -------------- ------------

Total net performance GBP4.2m GBP14.2m GBP19.5m GBP2m*

fee profits

------------ -------------- -------------- ------------

*The figures have been reduced by GBP2.8m of net performance fee

distributions that relate to prior accounting periods that IFRS

require to be deducted from this year's receipts.

As is usual at the time of releasing this update, three months

before the crystallisation of performance fees, we disclose the

profits that could be due to Polar Capital as a function of the

amount of accrued performance fees in our funds as at the end of

September. There is no certainty that the fees will be sustained

over the next quarter, as performance fees can be volatile.

Accordingly, the performance fee of GBP4.8m, after adjusting back

prior accounting period accruals required by IFRS, may be lower or

materially higher as at 31 December 2021 when performance fees

crystallise in the funds.

Gavin Rochussen, Chief Executive, commented:

"It is pleasing to report net inflows in the quarter of GBP156m

and GBP689m over the six-month period across our range of fund

strategies including the further funding of segregated

mandates.

"A combination of net inflows, market uplift and outperformance

enabled our AuM to increase by 12% over the six-month period from

GBP20.9bn to GBP23.4bn.

"The Group is also pleased to announce the 30(th) September

launch of two new funds within its UCITS umbrella; the Polar

Capital Smart Energy Fund and the Polar Capital Smart Mobility Fund

which form part of Polar Capital's sustainable investment strategy.

Both funds are Article 9 funds under the Sustainable Finance

Disclosure Regulation ("SFDR") and early investor interest has been

strong.

"The Polar Capital sustainable strategy will invest in companies

at the forefront of the global transition towards a cleaner, more

efficient, and sustainable future.

"Managed by Senior Portfolio Manager Thiemo Lang, based in

London, and the Polar Capital Sustainable Thematic Team, the

strategy is founded on the belief that, with the world facing an

urgent need to decarbonise, demand for smart energy solutions will

rise exponentially. This has the potential to deliver significant

opportunities over the long-term as innovative companies enable

this transition to a decarbonised future.

"Prior to joining Polar Capital in September 2021, Thiemo built

an impressive track record of investing in the smart energy space

since 2007, significantly outperforming the average return within

the sector over this time frame. This team adds a highly

differentiated fund solution for our clients and is the sixteenth

team within the Polar Capital stable of fully integrated highly

active fundamental research and performance-driven teams.

"We remain confident that with our diverse range of

differentiated, active specialist fund strategies we are

well-positioned to perform for our clients and shareholders over

the long term."

Thiemo Lang, Senior Portfolio Manager, Polar Capital Sustainable

Thematic Team, commented:

"Economies must envision and empower an energy future that is

smart, sustainable, and secure to bring CO2 emissions under control

and limit the effects of global warming. We seek to invest in the

innovative companies helping to enable this transition, creating a

long-term investment opportunity against the backdrop of global

efforts to decarbonise."

For further information please contact:

Polar Capital

Gavin Rochussen (Chief Executive) +44 (0)20 7227

Samir Ayub (Finance Director) 2700

Numis Securities Limited - Nomad and Joint

Broker

Charles Farquhar

Stephen Westgate +44 (0)20 7260

Kevin Cruickshank (QE) 1000

Peel Hunt LLP - Joint Broker

Andrew Buchanan +44 (0)20 3597

Rishi Shah 8680

Camarco

Ed Gascoigne-Pees

Jennifer Renwick

Monique Perks +44 (0)20 3757

Phoebe Pugh 4995

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKEDFLKFFFA

(END) Dow Jones Newswires

October 14, 2021 02:00 ET (06:00 GMT)

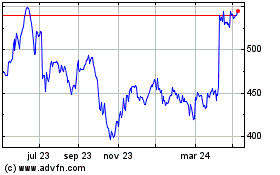

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

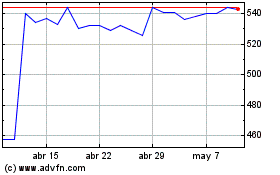

Polar Capital (LSE:POLR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024