TIDMPPS

RNS Number : 0632M

Proton Motor Power Systems PLC

17 September 2021

17 September 2021

Proton Motor Power Systems plc

("Proton Motor" or the "Company")

Unaudited Interim Results for the six months to 30 June 2021

Proton Motor Power Systems plc (AIM: PPS), the designer,

developer and producer of fuel cells and fuel cell electric hybrid

systems with a zero-carbon footprint, announces its unaudited

interim results for the six months ended 30 June 2021.

Highlights

- Order intake of GBP1.8m for a total order book at the period

end of GBP7.3m to be delivered by 2023, including repeat orders

from GKN, the international engineering and aerospace group

- Memorandum of understanding signed with Electra Commercial

Vehicles, which was followed by an initial order after the period

end

- Quotes currently with customers exceeding a value of EUR45m

- Sales of GBP922k in H1 2021 (H1 2020: GBP1.1m)

- Generating a positive gross margin

- Increased existing loan facilities with principal shareholders by approximately EUR12m

For further information:

Proton Motor Power Systems plc

Dr Faiz Nahab, CEO

Helmut Gierse, Chairman

Roman Kotlarzewski, CFO Tel.: +44 (0) 7866 122678

Brendan Bilton, Investor and

Business Relations Tel: +49 (0) 173 189 0923

Antonio Bossi, Non-Executive

Director, Investor Relations www.protonpowersystems.com

investor-relations@proton-motor.de

Shore Capital

Nominated adviser and broker

Tom Griffiths / David Coaten Tel: +44 (0) 20 7408 4050

www.shorecap.co.uk

About Proton Motor Fuel Cell GmbH

Proton Motor has more than 20 years of experience in power

solutions using clean technologies such as hydrogen fuel cells,

fuel cell and hybrid systems with a zero carbon footprint. Based in

Puchheim near Munich, Proton Motor offers complete fuel cell and

hybrid systems from a single source - from the development and

production through the implementation of customized solutions. The

focus of Proton Motor is on back-to-base applications, including

mobile, marine and stationary applications. The product portfolio

consists of base-fuel cell systems, standard complete systems, as

well as customized systems.

Proton Motor serves IT, Telecoms, public infrastructure and

healthcare customers in Germany, Europe and Middle East with power

supply solutions for DC and AC power demand. In addition to power

supply, SPower also offers solutions for Solar Systems as well as a

new product line for Solar Energy Storage.

Proton Motor Fuel Cell GmbH is a wholly owned subsidiary of

Proton Motor Power Systems plc. The Company has been quoted on the

AIM market of the London Stock Exchange since October 2006 (code:

PPS).

Chairman's report

We are pleased to report our unaudited results for the six

months ended 30 June 2021.

Overview:

Proton Motor has made further progress in the first half of this

year in developing its strategic partnerships with some large

customers and building its sales pipeline.

We have strengthened our organisation to continue to deliver

complete zero emission power supply solutions with the addition of

staff in production and product development.

Despite the COVID-19 backdrop, a further strengthening of

industry and consumer demand for alternative sources of energy

continues, supported by various governments' strategies towards the

"hydrogen economy". Proton Motor's technological offering continues

to mature and remains aligned with this growing demand and supports

the continuing commercialisation of the group's products. The

potential sales order and production pipeline is strong and

expected to continue to grow.

Highlights and Financial Results H1 2021:

-- Order intake of GBP1.8m (H1 2020: GBP5.9m, which included a

single large order worth in excess of EUR5m) for a total order book

at the period end of GBP7.3m (H1 2020: GBP6.4m) to be delivered by

2023.

-- Gross profit of GBP97,000.

-- After the period end, we received:

o An initial order from Electra Commercial Vehicles ("Electra")

for a HyRange system

o A follow on order from E-Trucks Europe for seven HyRange 43

systems

o Two further orders from GKN for a total of nine PM Module S8

fuel cell systems.

-- 29% of order intake derived from the stationary segment, 46%

from the mobility segment with most of the remainder relating to an

order for engineering services coupled with the delivery of

specified prototypes.

-- Quotes currently with customers exceeding a value of EUR45m.

-- Having implemented all recommended protective measures from

the onset of the COVID-19 pandemic at its factory in Puchheim,

there have only been 5 isolated cases of COVID-19 amongst the

Company's staff. Whilst our staff have to maintain social

distancing and other recommended measures to protect themselves

against the virus, our factory in Puchheim remains fully

operational and our production capacity is unaffected.

-- Sales in the first half of 2021 were GBP922k, compared to the

first half 2020 sales of GBP1,101k. Order intake and sales income

are also being derived from service and maintenance agreements for

past and future sales.

Finance

Proton Motor received orders for GBP1.8m in the first half year

including a number of repeat orders from customers. Repeat orders

allow better planning of production material purchases on more

favourable terms, which management expects will lead to an

improvement in margins.

Sales in H1 2021 were GBP922k (H1 2020: GBP1.1m), arising from

the 2020 order intake. GBP1.3m was invested in the development

programme and our workforce increased by 12 to 99 full time

employees. We added staff resources predominantly in the areas of

production and product development.

We generated a Gross Profit of GBP97,000 in the period.

Excluding the impact of the embedded derivative and exchange

losses, the operating loss in the first half of 2021 was GBP3.9m

vs. GBP2.8m in the first half of 2020 which was in line with our

budgeted expectations and resulted from further investments in

product development, production and staff in addition to

manufacturing infrastructure.

GBP197k was invested in equipment and infrastructure during the

period (H1 2020: GBP132k).

The "Fair value gain" in our financial results relating to the

embedded derivative is a non-operating, non-cash item, required by

IFRS financial reporting, which is based on gauging the potential

effects of partial convertible interest on loan financing. The main

value driver of the embedded derivative calculation is the market

price of the Company's ordinary shares. The movement on the

embedded derivative for the first half of 2021 results in a

substantial gain due to the change in the market price of the

shares between 1 January 2021 and 30 June 2021. The non-operating

result in the first half of 2021 was also positively affected by

the movement of exchange rates between Pound Sterling and the

Euro.

Cash burn from operating activities increased during the period

to GBP4.4m vs. GBP4.0m in the first half of 2020 reflecting the

increased level of activity to deliver our sales pipeline and from

further investment. Cash flow is our key financial performance

target and our objective is to achieve a positive cash flow in the

shortest time possible. Current contracts are quoted with up-front

payments reducing reliance on working capital as we continue to

invest in our manufacturing capability. The cash position at 30

June 2021 was GBP2.7m vs. GBP337k at 30 June 2020.

We were very pleased with the continued support of our principal

shareholders with whom we agreed to increase the existing financing

facilities by EUR11.9 million to ensure operational financing for

the Company into 2022. The principal and interest on these

additional facilities is not convertible and interest is charged at

LIBOR+3%.

The fuel cell market

The 2019 global fuel cells market size was valued at

approximately US$10.48 billion, according to a study conducted by

Grand View Research. The upward trend in fuel cell demand was

foreseen to continue throughout 2020 and beyond. Expecting a CAGR

of 15.5% during the years 2020-2027, the market size will exceed

US$33 billion in 2027.

Source:

www.grandviewresearch.com/industry-analysis/fuel-cell-market

The various European Government programmes intended to support

the hydrogen economy which we set out in our trading update of 4

March 2021 remain in place, and we also look forward to any

indication of further support ahead of, or during, the COP26

Climate Change Conference later this year. We were very pleased to

read the recently published UK Government's Hydrogen Strategy which

envisions kick starting a world-leading hydrogen economy set to

support over 9,000 UK jobs and unlock GBP4 billion investment by

2030.

Interestingly, we also note the recent legislative changes in

the UK which will restrict the entitlement to use red diesel and

rebated biodiesel from most sectors from April 2022. As a result,

most users of red diesel in the UK will have to use fuel taxed at

the standard rate for diesel from April 2022. This is likely to

make alternative solutions, such as fuel cells, more competitive in

many settings.

Group activity

I was particularly pleased that Proton Motor received repeat

orders from some of our key customers including GKN, the

international engineering and aerospace group, and from E-Trucks

Europe, which produces hydrogen-electric hybrid heavy duty

vehicles.

Repeat orders from these important customers are a validation of

both our technology and our commercial proposition.

We are also pleased to see the recent announcement by our

partner, Electra that their first unit comprising a Proton Motor

HyRange 43 system will be on the road in December 2021. Recently,

Electra has also been chosen as a sub-contractor to Sainsbury's and

Element Energy for their trial of hydrogen-powered heavy goods

vehicles in the Tees Valley area.

Following the successful product launch of the fourth generation

stack modules we have been focusing on selling fuel cell systems

with an electrical power output from 30 kW up to 150 kW for mobile,

stationary, maritime and rail applications. In addition, quotes for

complete power supply units are still being offered.

With these fourth-generation fuel cell stacks and systems, the

Company has set up strategic partnerships with electrical drive

train manufacturers and industrial partners. The systems can be

used in combination with a battery to power a hybrid drive train

for electric driven light duty vehicles, inner city buses or

industrial power supply solutions. We are also seeing growing

interest from truck manufacturers for municipality maintenance

vehicles.

Proton Motor has been a member of the EU funded project REVIVE

consortium since 2019. As part of this project, a fuel cell system

for integration into a garbage truck has been designed. A PM400

Stack Module 144 is being integrated into a HyRange(R) fuel cell

system. The integration into the truck is being carried out

together with the vehicle manufacturer E-Trucks Europe

("E-Trucks"), based in Belgium. Several of these HyRange 43 fuel

cell systems were produced and shipped to Belgium at the beginning

of the project. In January 2020 and June 2021, E-Trucks placed

further orders for these systems and for the trucks in which the

systems will be installed as part of the REVIVE project.

As announced on 10 August 2020, Proton Motor is producing a

containerised fuel cell hybrid system intended to power Shell New

Energies' line of portable hydrogen refuelling units for buses and

trucks. The system comprises three PM Frame S43 fuel cell systems

in combination with a battery system installed inside a 20 feet

container. The container is currently being commissioned and will

be delivered in Q4.

We have now delivered and commissioned the 100kW fuel cell

package, integrated into a container, for our partner APEX Energy

Teterow GmbH (APEX). The system has been in operation since May

2021. Proton Motor is now working with APEX under the previously

announced framework agreement which envisages 10 more of these fuel

cell systems to be delivered in the next 3 years.

The system ordered by Linsinger, which was announced on 4

February 2020, has, after the period end, been delivered to the

customer. This system consists of two multistack systems each

including three PM400 Stack module 120. In total, the fuel cell

system package has an installed fuel cell power of 213 kW and will

be used to power a rail milling machine.

As previously announced, Proton Motor has continued the

development of its fifth generation stack modules. These new

generation stacks are ready for volume production through the

automated fuel cell manufacturing line which was installed in May

2019.

I personally thank all our customers who believe in us, our

committed employees and our shareholders who have the vision to

invest in our mission.

Helmut Gierse

Non-Executive Chairman

STATEMENT OF COMPREHENSIVE INCOME

Unaudited Unaudited Audited

At 30 June At 30 June At 31 December

Note 2021 2020 2020

GBP'000 GBP'000 GBP'000

Revenue 922 1,101 1,893

Cost of sales (825) (775) (1,976)

--------------- ---------------- ------------------

Gross profit / (loss) 97 326 (83)

Other operating income 234 28 492

Administrative expenses (4,232) (3,185) (7,537)

--------------- ---------------- ------------------

Operating loss (3,901) (2,831) (7,128)

Finance income 1 2 3

Finance costs incl. exchange

differences 2,735 (7,438) (8,638)

(Loss) for the period before

embedded derivatives (1,165) (10,267) (15,763)

--------------- ---------------- ------------------

Fair value gain/(loss) on embedded

derivatives 212,739 (210,919) (386,870)

--------------- ---------------- ------------------

Gain/(Loss) for the period

attributable to shareholders 211,574 (221,186) (402,633)

--------------- ---------------- ------------------

Gain/(Loss) / Profit per share

(expressed as pence per share)

Basic 7 27.3 (32.9) (57.0)

Diluted 7 13.2 (14.8) (26.4)

(Loss) / Profit per share (expressed

as pence per share) excluding

embedded derivative

Basic 7 (0.2) (1.5) (2.2)

Diluted 7 (0.1) (0.7) (1.0)

OTHER COMPREHENSIVE INCOME

Unaudited Unaudited Audited

At 30 June At 30 June At 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------ ------------ ----------------

Gain/(Loss) / Profit for the

period 211,574 (221,186) (402,633)

------------ ------------ ----------------

Other comprehensive (expense)

/ income

------------ ------------ ----------------

Items that may not be reclassified

to profit and loss

Exchange differences on translating

foreign operations 185 (113) (761)

------------ ------------ ----------------

Total other comprehensive income

/ (expense) 185 (113) (761)

------------ ------------ ----------------

Total comprehensive (expense)

for the year 211,759 (221,299) (403,394)

============ ============ ================

STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

At 30 June At 30 June At 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 97 29 64

Property, plant and equipment 1,434 1,451 1,484

Right-of-use assets 210 388 285

Fixed asset investments 11 11 11

------------ ------------ ----------------

Total non-current assets 1,752 1,879 1,844

Current assets

Inventories 2,842 2,580 1,790

Trade and other receivables 699 284 348

Cash and cash equivalents 2,702 337 2,739

------------ ------------ ----------------

Total current assets 6,243 3,201 4,877

------------ ------------ ----------------

Total Assets 7,995 5,080 6,721

============ ============ ================

Current Liabilities

Trade and other payables (5,019) (1,859) (4,389)

Lease debt (206) (106) (196)

Borrowings (615) (865) (814)

------------ ------------ ----------------

Total current liabilities (5,840) (2,830) (5,399)

Non-current liabilities

Borrowings (80,023) (75,852) (79,238)

Lease debt (15) (289) (104)

Embedded derivatives on convertible

interest (396,462) (433,250) (609,201)

------------ ------------ ----------------

Total non-current liabilities (476,500) (509,391) (688,543)

------------ ------------ ----------------

Total Liabilities (482,340) (512,221) (693,942)

------------ ------------ ----------------

Net liabilities (474,345) (507,141) (687,221)

============ ============ ================

Equity

Capital and reserves attributable

to equity shareholders

Share capital 11,022 9,996 10,598

Share premium account 20,254 18,825 19,574

Merger reserve 15,656 15,656 15,656

Reverse acquisition reserve (13,861) (13,861) (13,861)

Share option reserve 961 948 949

Foreign translation reserve 9,448 12,887 11,038

Capital contributions 1,215 1,233 1,215

Accumulated losses (519,040) (552,825) (732,390)

------------ ------------ ----------------

Total equity (474,345) (507,141) (687,221)

============ ============ ================

STATEMENT OF CHANGES IN EQUITY

Reverse Share Foreign Capital

Share Share Merger Acquisition Option Translation Contribution Accumulated Total

Capital Premium Reserve Reserve Reserve Reserve Reserves Losses Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2020 9,970 18,704 15,656 (13,861) 968 10,437 1,151 (328,996) (285,971)

Share based

payments - - - - (20) - - - (20)

Proceeds from

share issues 26 121 - - - - - - 147

Currency

translation

differences - - - - - - - -

Transactions

with owners 26 121 - - (20) - - - 127

Loss for the

year - - - - - - - (221,185) (221,185)

Other

comprehensive

income:

Currency

translation

differences - - - - - 2,450 82 (2,644) (112)

Total

comprehensive

income for

the

year - - - - - 2,450 82 (223,829) (221,297)

Balance at 30

June 2020 9,996 18,825 15,656 (13,861) 948 12,887 1,233 (552,825) (507,141)

Balance at 1

July 2020 9,996 18,825 15,656 (13,861) 948 12,887 1,233 (552,825) (507,141)

Share based

payments - - - - 1 - - - 1

Proceeds from

share issues 602 749 - - - - - - 1,351

Currency

translation

differences - - - - - - - -

Transactions

with owners 602 749 - - 1 - - - 1,352

Loss for the

year - - - - - - - (181,448) (181,448)

Other

comprehensive

income:

Currency

translation

differences - - - - - (1,849) (18) 1,883 16

Total

comprehensive

income for

the

year - - - - - (1,849) (18) (179,565) (181,432)

Balance at 31

December 2020 10,598 19,574 15,656 (13,861) 949 11,038 1,215 (732,390) (687,221)

Balance at 1

January 2021 10,598 19,574 15,656 (13,861) 949 11,038 1,215 (732,390) (687,221)

Share based payments - - - - 12 - - - 12

Proceeds from

share issues 424 680 - - - - - - 1,104

Currency translation

differences - - - - - - - -

Transactions

with owners 424 680 - - 12 - - - 1,116

Loss for the

year - - - - - - - 211,574 211,574

Other comprehensive

income:

Currency translation

differences - - - - - (1,590) - 1,776 186

Total comprehensive

income for the

year - - - - - (1.590) - 213,350 211,760

------ ------ ------ -------- --- ------- ----- --------- ---------

Balance at 30

June 2021 11,022 20,254 15,656 (13,861) 961 9,448 1,215 (519,040) (474,345)

====== ====== ====== ======== === ======= ===== ========= =========

Share premium account

Costs directly associated with the issue of the new shares have

been set off against the premium generated on issue of new

shares.

Merger reserve

The merger reserve of GBP15,656,000 arose as a result of the

acquisition of Proton Motor Fuel Cell GmbH during 2006. The merger

reserve represents the difference between the nominal value of the

share capital issued by the Company and their fair value at 31

October 2006, the date of the acquisition.

Reverse acquisition reserve

The reverse acquisition reserve arose as a result of the method

of accounting for the acquisition of Proton Motor Fuel Cell GmbH by

the Company. In accordance with IFRS 3 the acquisition has been

accounted for as a reverse acquisition.

Share option reserve

The Group operates an equity settled share-based compensation

scheme. The fair value of the employee services received for the

grant of the options is recognised as an expense. The total amount

to be expensed over the vesting period is determined by reference

fair value of the options granted. At each balance sheet date the

Company revises its estimate of the number of options that are

expected to vest. The original expense and revisions of the

original estimates are reflected in the income statement with a

corresponding adjustment to equity. The share option reserve

represents the balance of that equity.

CASH FLOW STATEMENT

Unaudited Unaudited Audited

At 30 June At 30 June At 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit / (Loss) for the period 211,574 (221,186) (402,633)

------------ ------------ -------------------------

Adjustments for:

Depreciation and amortisation 201 275 574

Loss on disposal of property, - - -

plant and equipment

Impairment of investment - - -

Interest income (1) (2) (3)

Interest expense 721 2,509 5,192

Share based payments (12) (20) (19)

Movement in inventories (1,052) (172) 618

Movement in trade and other

receivables (351) (44) (108)

Movement in trade and other

payables 630 (1,190) 1,340

Movement in fair value of embedded

derivatives (212,739) 210,919 386,870

Exchange rate movements (3,456) 4,929 3,446

------------ ------------ -------------------------

Net cash used in operations (4,485) (3,982) (4,723)

------------ ------------ -------------------------

Cash flows from investing activities

Purchase of intangible assets (45) (8) (56)

Purchase of property, plant

and equipment (152) (120) (373)

Purchase value of leased assets (21) - -

Investment in associate company - - -

Interest received 2 2 3

------------ ------------ -------------------------

Net cash used in investing

activities (216) (127) (426)

------------ ------------ -------------------------

Cash flows from financing activities

Proceeds from issue of loan

instruments 4,423 3,617 5,776

Proceeds from issue of new

shares 30 147 1,498

New obligations of lease debt 21 - -

Repayment of obligations under

lease debt (106) (93) (187)

Repayment of short term borrowings (175) - (69)

------------ ------------ -------------------------

Net cash generated from financing

activities 4,193 3,671 7,018

------------ ------------ -------------------------

Net increase in cash and cash

equivalents (508) (438) 1,869

Effect of foreign exchange

rates 471 (253) (158)

Opening cash and cash equivalents 2,739 1,028 1,028

------------ ------------ -------------------------

Closing cash and cash equivalents 2,702 337 2,739

============ ============ =========================

Notes to the interim report

1. Basis of preparation

These interim consolidated financial statements of Proton Power

Systems plc were prepared in accordance with International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB) as adopted by the European Union

and with those parts of the Companies Act 2006 applicable to those

companies under IFRS. They were also prepared under the historical

cost convention and in accordance with IFRS interpretations

(IFRICS) except for embedded derivatives which are carried at fair

value through the income statement and on the basis that the Group

continues to be a going concern. The condensed consolidated interim

financial statements have been prepared in accordance with the

accounting policies adopted in the 31 December 2020 statutory

audited financial statements. No new accounting standards have been

adopted by the group since preparing its last annual report.

The Group has chosen not to adopt IAS 34 (Interim Financial

Statements) in preparing these financial statements therefore the

interim financial information is not in full compliance with

IFRS.

The financial information for the half year ended 30 June 2021

set out in this interim report is unaudited and does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The Group's audited statutory financial statements for the

year ended 31 December 2020 have been filed with the Registrar of

Companies. The independent auditor's report on those financial

statements was unqualified and did not contain statements under

Section 498(2) or (3) of the Companies Act 2006.

Until such time as the Group achieves operational cash inflows

through becoming a volume producer of its products to a receptive

market it will remain dependent on its ability to raise cash to

fund its operations from existing and potential shareholders and

the debt market.

In preparing the consolidated financial information, Proton

Motor Fuel Cell GmbH has been deemed to be the acquirer and the

Company, the legal parent, has been deemed to be the acquiree.

Under IFRS 3 "Business Combinations", the acquisition of Proton

Motor Fuel Cell GmbH by the Company has been accounted for as a

reverse acquisition and the consolidated IFRS financial information

of the Company is therefore a continuation of the financial

information of Proton Motor Fuel Cell GmbH.

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of a subsidiary, associate

or jointly controlled entity at the date of acquisition. The cost

of an acquisition is measured as the fair value of the assets

given, equity instruments issued and liabilities incurred or

assumed at the date of exchange. Goodwill is initially recognised

as an asset at cost and is subsequently measured at cost less any

accumulated impairment losses. Goodwill is reviewed for impairment

at least annually, or more frequently where circumstances suggest

an impairment may have occurred. Any impairment is recognised

immediately in income statement and is not subsequently

reversed.

On disposal of a subsidiary, the attributable amount of goodwill

is included in the determination of the profit or loss on

disposal.

2. Critical accounting estimates and judgements

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results. Estimates and judgements are

continually evaluated and are based on historical experience and

other factors, including expectations of future events that are

believed to be reasonable under the circumstances. The estimates

and assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial period are discussed below.

Recognition of development costs

Self developed intangible assets are recognised where the Group

can estimate that it is probable that future economic benefits will

flow to the entity.

Impairment of goodwill

The carrying value of goodwill must be assessed for impairment

annually, or more frequently if there are indications that goodwill

might be impaired. This requires an estimation of the value in use

of the cash generating units to which goodwill is allocated. Value

in use is dependent on estimations of future cash flows from the

cash generating unit and the use of an appropriate discount rate to

discount those cash flows to their present value.

Classification and fair value of financial instruments

The Group uses judgement to determine the classification of

certain financial instruments, in particular convertible loans

advanced during the year. Judgement is applied to determine whether

the instrument is a debt, equity or compound instrument and whether

any embedded derivatives exist within the contracts.

Judgements have been made regarding whether the conversion

feature meets the "fixed for fixed" test in each instrument. In the

case of each instrument it is deemed it is not met on the basis

that the loan is in Euros and shares are in Sterling.

The Group uses valuation techniques to measure the fair value of

these financial instruments. In applying these valuation

techniques, management use estimates and assumptions that are, as

far as possible, consistent with observable market data. Where

applicable market data is not observable, management uses its best

estimate about the assumptions that market participants would make.

These estimates may vary from the actual prices that would be

achieved in an arm's length transaction at the reporting date.

3. Segmental information

An operating segment is a group of assets and operations engaged

in providing products or services that are subject to risks and

returns that are different from those of other operating segments

for which discreet financial information is available and is

regularly reviewed by the Chief Operating Decision Maker

("CODM").

Based on an analysis of risks and returns, the Directors

consider that the Group has only one identifiable operating

segment, green energy.

All non-current assets are located in Germany.

4. Share based payments

The Group has incurred an expense in respect of share options

and shares issued to directors as follows:

Unaudited Unaudited Audited

At 30 June At 30 June At 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Share options 10 20 (19)

Shares 65 26 188

------------ ------------ ----------------

75 46 169

============ ============ ================

5. Finance costs including exchange differences

Unaudited Unaudited Audited

At 30 June At 30 June At 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Interest 721 2,509 5,192

Exchange (gain) on shareholder loans (3,456) - -

Exchange loss on shareholder loans - 4,929 3,446

----------- ----------- ---------------

Net finance cost (gain)/loss (2,735) 7,438 8,638

=========== =========== ===============

6. Taxation

Due to losses within the Group, no expenses for tax on income

were required in either the current or prior periods.

7. Profit / (Loss) per share

Unaudited Unaudited Audited

At 30 At 30 At 31

June June December

2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Basic Diluted Basic Diluted Basic Diluted

(Loss) before

embedded derivative (1,165) (1,165) (10,267) (10,267) (15,763) (15,763)

Fair value gain/(loss)

Embedded derivative 212,739 212,739 (210,919) (210,919) (386,870) (386,870)

------------ ------------ ------------ ------------ ------------ ------------

Profit / (Loss)

attributable

to equity holders

of the company 211,574 211,574 (221,186) (221,186) (402,633) (402,633)

------------ ------------ ------------ ------------ ------------ ------------

Weighted average

number of ordinary

shares (thousands) 774,285 1,597,816 671,451 1,495,601 706,344 1,523,093

------------ ------------ ------------ ------------ ------------ ------------

Pence Pence Pence Pence

per share per share Pence Pence per share per share

per share per share

Profit / (Loss)

per share (pence

per share) 27.3 13.2 (32.9) (14.8) (57.0) (26.4)

Profit / (Loss)

per share (pence

per share) excluding

embedded derivative (0.2) (0.1) (1.5) (0.7) (2.2) (1.0)

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

Diluted loss per share is calculated by adjusting the weighted

average number of ordinary shares outstanding to assume conversion

of all dilutive potential ordinary shares. The Company has two

categories of dilutive potential ordinary shares, these being share

options and shares on eligible interest conversion; of which the

share options have not been included in the calculation of loss per

share because they are anti-dilutive for these periods. No interim

dividend has been proposed or paid in relation to the current or

prior interim period.

Further to expirations of share options granted to three

executive directors, the Remuneration Committee is considering

alternatives in order to continue to incentivise the management

team including a possible extension of the terms of these existing

options for a further three years. A further announcement will be

made once the Remuneration Committee has finalised the new

incentive plan.

A copy of the interim report and the information required by AIM

Rule 26 is available from the Company's website at

www.protonmotor-powersystems.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EQLFFFKLZBBV

(END) Dow Jones Newswires

September 17, 2021 01:59 ET (05:59 GMT)

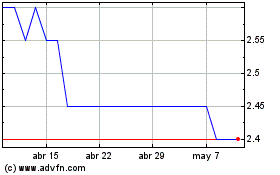

Proton Motor Power Systems (LSE:PPS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Proton Motor Power Systems (LSE:PPS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024