TIDMRCOI

RNS Number : 4936Q

Riverstone Credit Opps. Inc PLC

28 October 2021

Riverstone Credit Opportunities Income

Interim Management Statement

London, UK 28 October 2021: Riverstone Credit Opportunities

Income Plc ("RCOI" or the "Company") is issuing this Interim

Management Statement ("IMS") for the period from 01 January 2021 to

30 September 2021 (the "Period").

Summary Performance

30 September 2021

Key Financials

NAV $93.32 million

NAV per share $1.02

Market capitalization $78.73 million

Share Price $0.86

Total comprehensive income for the period $2.82 million

-- As of 30 September 2021, RCOI had a NAV per share of

$1.02.

Quarterly Distribution

-- Riverstone Credit Opportunities Income Plc ("RCOI" or the

"Company") is pleased to announce that the distribution for the

period ending 30 September 2021 of 1.8 cents per share, has been

declared by the Directors, payable on 26 November 2021 to holders

of ordinary shares on the register at the close of business on 5

November 2021 (ex-distribution date is 4 November 2021).

-- The Company's quarterly factsheet will be located on the

Company's website, www.RiverstoneCOI.com .

-- RCOI's Prospectus is available to view at:

www.RiverstoneCOI.com .

Riverstone Credit Opportunities Income ("RCOI") announces its

quarterly portfolio summary as of 30 September 2021, inclusive of

updated quarterly unaudited fair market valuations:

Cumulative Portfolio Summary

Unrealised Portfolio

Investment Subsector Commitment Cumulative Cumulative Gross Gross Gross % of Gross

Name Date Committed Invested Realised Unrealised Realised Par as MOIC

Capital Capital Capital Value Capital & of 30

($mm) ($mm) ($mm)(1) ($mm) Unrealised Sep

Value 2021(2)

($mm)

Project Infrastructure

Mariners Services Jul-19 13.2 13.2 6.7 11.0 17.6 108.21% 1.27 x

Caliber

Midstream Midstream Aug-19 3.4 3.4 0.4 0.2 0.6 5.96% 0.18 x

Epic Propane

Pipeline Midstream Dec-19 14.8 14.8 2.3 15.5 17.8 101.94% 1.20 x

FS Crude Midstream Mar-20 13.7 13.7 9.3 6.8 16.0 99.96% 1.17 x

Hoover

Circular Infrastructure

Solutions Services Oct-20 7.4 7.4 4.1 4.0 8.1 100.84% 1.10 x

Aspen Power Energy

Partners Transition Dec-20 6.9 3.4 0.4 3.8 4.2 108.61% 1.24 x

Roaring Fork

Midstream Midstream Mar-21 5.9 3.5 0.3 3.6 3.9 99.74% 1.12 x

Imperium3NY Energy

LLC Transition Apr-21 6.8 5.4 1.4 5.2 6.6 116.91% 1.23 x

Caliber

Midstream

Revolver Midstream Apr-21 0.6 0.6 0.0 0.3 0.3 50.00% 0.57 x

Blackbuck

Resources Infrastructure

LLC Services Jun-21 9.9 8.9 0.4 8.9 9.3 99.18% 1.05 x

Project Infrastructure

Sphere Services Aug-21 12.3 12.3 0.2 12.3 12.5 98.32% 1.02 x

-------

$94.8 $86.3 $25.3 $71.6 $96.9 1.11 x

Realised Portfolio

Investment Subsector Commitment Realisation Cumulative Cumulative Gross Gross MOIC

Name Date Date Committed Invested Realised

Capital Capital Capital

($mm) ($mm) ($mm)(1)

Rocky Creek Exploration &

Resources Production Jun-19 Dec-19 6.0 4.3 4.9 1.15 x

CIG Infrastructure

Logistics Services Jan-20 Jan-20 8.7 8.7 8.9 1.02 x

Mallard Exploration &

Exploration Production Nov-19 Apr-20 13.8 6.8 7.7 1.13 x

Market Based Multiple Aug-20 Nov-20 13.4 13.4 13.6 1.01 x

Project

Yellowstone Midstream Jun-19 Mar-21 5.8 5.8 7.2 1.23 x

Ascent Exploration &

Energy Production Jun-19 Jun-21 13.3 13.3 16.1 1.21 x

Pursuit Oil Exploration &

& Gas Production Jul-19 Jun-21 12.3 12.3 15.0 1.22 x

U.S.

Shipping Midstream Feb-21 Aug-21 6.5 6.5 7.3 1.13 x

------------ ------------ ------------ -----------

$79.9 $71.1 $80.7 1.13 x

The Gross Realised Capital column includes interest, fee income,

and principal received. The Gross Unrealised Value column includes

the amortization of OID, accrued interest, fees and any unrealised

change in the value of the investment.

Direct Lending Consolidated Portfolio Key Stats at Entry As of 30 September

2021

Weighted Avg. Entry Basis 97.4%

-------------------------

Weighted Avg. All-in Coupon at Entry 9.37 p.a.

-------------------------

Weighted Avg. Undrawn Spread at Entry 5.1% p.a.

-------------------------

Weighted Avg. Tenor at Entry 3.0 years

-------------------------

Weighted Avg. Call Premium at Entry 107.8

-------------------------

Security 100% Secured

-------------------------

Coupon Type 100% Floating Rate

-------------------------

Manager Outlook

-- Investor sentiment for the energy sector in the third quarter

reached its highest level since the IPO. Supply and demand

fundamentals continue to improve, with many expecting these trends

to continue throughout the rest of 2021. RCOI remains well

positioned to capitalise on the increasing market fundamentals

through an opportunistic investment approach, made up of a

diversified portfolio of short duration loans.

-- Throughout the quarter, RCOI successfully realised its U.S.

Shipping Loan which resulted in a 27.7% IRR and 1.13x MOIC. In

addition, RCOI capitalized on the market momentum to put in place

two new loans for Project Sphere and Blackbuck resources.

-- Despite the strong market environment, the Investment Manager

has taken a meaningful write-down with respect to its investment in

Caliber Midstream ("Caliber"). The bankruptcy of one of Caliber's

key customers has led to a significant reduction in revenue which

has resulted in the conversion of the investment from debt to

equity. While Caliber represents the smallest position of RCOI's

holdings at 4%, the investment remains significant across all the

pools of capital managed by the Investment Manager, who remains

focused on maximizing recovery for investors.

-- The Investment Manager continues to target infrastructure,

infrastructure services and energy transition investment

opportunities which will allow for steady income and positive

returns for shareholders.

Reuben Jeffery III, Chairman of RCOI, commented:

"With the trend of improving market fundamentals continuing

throughout Q3 2021, we are pleased with the performance of the RCOI

vehicle. The Company currently has a net asset value per share of

$1.02 and has returned approximately 19 cents per share to

investors since the IPO. While the situation at Caliber is

disappointing, given the small size of the investment, the overall

impact to the portfolio is minimal."

Christopher Abbate and Jamie Brodsky, Co-Founders of Riverstone

Credit, added:

"Even with the ongoing challenging circumstances at Caliber,

RCOI had another strong quarter. The portfolio saw another realised

investment with a strong return within the targeted market sector,

with U.S. Shipping being refinanced in August 2021. In addition,

the two new investments for Q3 represented a green loan and a

sustainability-linked loan through Project Sphere and Blackbuck

Resources, respectively. A green loan has the use of proceeds tied

to specific green initiatives while a sustainability-linked loan

encourages sustainable behavior by having loan pricing step up if

certain targets are not achieved. Our pipeline continues to offer a

wide range of similar investments, across infrastructure and

infrastructure service-focused companies across conventional and

low-carbon/renewable energy sources. We remain focused on

continuing to deploy capital across this pipeline as realisations

occur."

About Riverstone Credit Opportunities Income Plc :

RCOI seeks to generate consistent Shareholder returns

predominantly in the form of income distributions, principally by

making senior secured loans to small and middle-market energy

companies, which span conventional energy as well as low carbon and

renewable sources. The investment strategy is predicated on

asset-based lending, with conservative loan-to-value ratios and

structural protective features to mitigate risk. The Company will

invest broadly across energy subsectors globally, with a primary

focus on infrastructure businesses and going forward those with

de-carbonization strategies in North America. RCOI intends to

create a diversified portfolio across basins, commodities,

technologies and end-markets to provide natural synergies and

hedges that could enhance the overall stability of the

portfolio.

For further details, see https://www.riverstonecoi.com/ .

Neither the contents of RCOI's website nor the contents of any

website accessible from hyperlinks on the

websites (or any other website) is incorporated into, or forms part of, this announcement.

Media Contacts

For Riverstone Credit Opportunities Income Plc:

Adam Weiss

+1 212 271 2953

1 Gross realised capital is total gross income realised on invested capital.

(2) Includes fair market value of equity and rights where

applicable as a percentage of par.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVDDLFLFBLBFBX

(END) Dow Jones Newswires

October 28, 2021 02:00 ET (06:00 GMT)

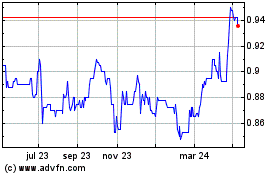

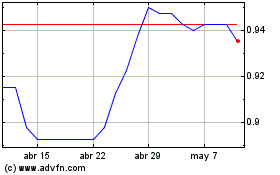

Riverstone Credit Opport... (LSE:RCOI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Riverstone Credit Opport... (LSE:RCOI)

Gráfica de Acción Histórica

De May 2023 a May 2024