Starwood European Real Estate Finance Ltd (SWEF) SWEF: Portfolio

Update 18-Nov-2021 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information according to

REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

18 November 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, TO U.S. PERSONS OR IN, INTO OR FROM

THE UNITED STATES, AUSTRALIA, CANADA, SOUTH AFRICA, JAPAN, NEW

ZEALAND OR ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH

JURISDICTION

Starwood European Real Estate Finance Limited

Investment and Portfolio Update

GBP76 million UK hotel loan with related party private debt

fund

Starwood European Real Estate Finance Limited and its

subsidiaries ("SEREF" or "the Group"), a leading investor

originating, executing and managing a diverse portfolio of

high-quality real estate debt in the UK and Europe, is pleased to

announce that during November 2021 it closed a GBP76 million

floating rate, acquisition and capital expenditure whole loan

secured on a portfolio of two UK based hotel assets. This loan was

closed in conjunction with Starwood European Real Debt Finance I

and its subsidiaries, a newly launched, Guernsey domiciled, private

debt fund acting as co lender.

SEREF has taken on two thirds of the GBP76 million commitment,

with the private debt fund taking the other third. The loan term is

five years and the Group expects to earn an attractive

risk-adjusted return in line with its stated investment

strategy.

The portfolio consists of two hotels in attractive city centre

locations in Manchester and Edinburgh. The hotels will be

rebranded, targeting domestic and international visitors in two of

Europe's best performing markets in 2021.

Following the initial drawdown of this loan, SEREF will be fully

invested and has a net debt position of GBP4.3m as at 15 November

2021. The Group's pipeline of prospective new investments is

robust, with a strong likelihood of further investments in the

medium term.

The loan benefits from a floating interest rate. This provides

for an inflation hedge as the loan will generate a greater return

in a higher interest rate market that is likely to result from

increased inflation. Following this investment circa 78 per cent of

the portfolio benefits from floating interest rates.

Stephen Smith, Non-executive Chairman, said:

"The UK hospitality leisure market is performing well, with high

levels of domestic demand post-Covid. We are therefore delighted to

have entered into this highly attractive new loan. The assets

themselves are very well located to capitalise on the strength of

the market, and as such will enhance our portfolio and shareholder

value"

Portfolio update: transition from LIBOR to Sonia

Some interest rate benchmarks that have historically been used

for setting real estate loan interest including Sterling LIBOR are

being phased out over the coming years. The Company is well

prepared for LIBOR to SONIA transition and implementation of the

transition plan well progressed.

Borrowing activities where the Group pays floating rate

interest

-- The Group can borrow in Sterling and Euro under two revolving

credit facilities being an unsecuredcorporate RCF of GBP50 million

and a secured RCF of GBP76 million.

-- All borrowings are floating rate.

-- Euro borrowings use Euribor as the reference rate and will

continue to do so as Euribor is not beingretired.

-- For Sterling borrowings on the unsecured corporate RCF,

conversion to a SONIA based reference rate tookeffect on September

30th 2021.

-- For Sterling borrowings on the secured RCF, the reference

rate matches the underlying collateral that isbeing borrowed

against, i.e. as our loan investments are amended to migrate to

SONIA the corresponding borrowingson the secured RCF also

automatically migrate.

Loan investments where the Group received floating rate

income

-- The Group is actively engaging with existing borrowers on

LIBOR referenced loans in order to transitionthem to SONIA in line

with wider market practice given the forthcoming cessation of

LIBOR.

-- Engagement started earlier this year and we are targeting to

have all remaining LIBOR loans legallytransitioned in advance of

year end 2021 or latest by the first interest payment date falling

in Q1 2022.

-- The relevant loan facility agreements are being amended in

line with standard Loan Market AssociationSONIA conversion

provisions which provides for loan interest to be calculated by

reference to SONIA on a 'lookbackwithout observation shift'

basis.

For further information, please contact:

Apex Fund and Corporate Services (Guernsey) Limited as Company

Secretary

+44 (0) 20 3530 3661

Magdala Mullegadoo

Starwood Capital +44 (0) 20 7016 3655

Duncan MacPherson

Jefferies International Limited +44 (0) 20 7029 8000

Stuart Klein

Neil Winward

Gaudi Le Roux

Buchanan +44 (0) 20 7466 5000

Helen Tarbet +44 (0) 07788 528143

Henry Wilson

Hannah Ratcliff

Notes to Editors:

Starwood European Real Estate Finance Limited is an investment

company listed on the main market of the London Stock Exchange with

an investment objective to provide Shareholders with regular

dividends and an attractive total return while limiting downside

risk, through the origination, execution, acquisition and servicing

of a diversified portfolio of real estate debt investments in the

UK and the wider European Union's internal market.

www.starwoodeuropeanfinance.com.

The Group is the largest London-listed vehicle to provide

investors with pure play exposure to real estate lending.

The Group's assets are managed by Starwood European Finance

Partners Limited, an indirect wholly owned subsidiary of the

Starwood Capital Group.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GG00B79WC100

Category Code: PFU

TIDM: SWEF

LEI Code: 5493004YMVUQ9Z7JGZ50

Sequence No.: 127092

EQS News ID: 1249846

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1249846&application_name=news

(END) Dow Jones Newswires

November 18, 2021 02:00 ET (07:00 GMT)

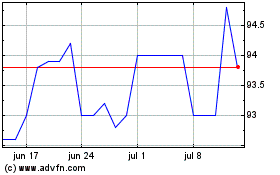

Starwood European Real E... (LSE:SWEF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Starwood European Real E... (LSE:SWEF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024