TIDMTRT

RNS Number : 1422N

Transense Technologies PLC

28 September 2021

The information communicated in this announcement is inside

information for the purposes of Article 7 of EU Regulation 596/2014

as it forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 as amended .

Transense Technologies plc

("Transense", or the "Company")

Final results for the year ended 30 June 2021

& Investor Presentation

Transense Technologies plc (AIM: TRT), the provider of

specialist sensor systems, reports final results for the year ended

30 June 2021 in line with recently upgraded market expectations.

The business model has been substantially de-risked and the Company

reports progress in all three of its current business streams:

Financial highlights:

-- Revenues from continuing operations up threefold to GBP1.77m (2020: GBP0.60m)

-- iTrack Royalty Income annualised run rate up 97% in USD terms from initial annual rate

-- Gross margin increased to 78.3% (2020: 55.1%)

-- Loss before taxation from continuing operations of GBP0.16m (2020: GBP1.27m)

-- Profit for the year of GBP0.16m (2020: loss of GBP2.54m)

-- Earnings per share of 0.96 pence (2020: loss of 15.6 pence)

-- Cash and cash equivalents at year end of GBP1.05m (2020: GBP1.19m)

-- Distributable reserves at year end of GBP0.63m (2020: deficit of GBP5.90m)

-- Corporation tax losses available for future offset of GBP23m (2020: GBP23m)

Executive Chairman of Transense, Nigel Rogers, said:

"We are pleased with the progress made this year in building

firm foundations for future success. With royalty income from

iTrack gathering momentum, and new products in Translogik driving

increased market penetration in tyre probes, the Company has

delivered strong revenue growth.

"The additional management focus on the commercialisation of our

patented SAW technology is now yielding tangible opportunities, as

we better understand the applications in which SAW torque

measurement techniques can offer our customers unique and effective

solutions. As we enter a period of rapid technological change

driven by increased connectivity and the need for sustainable

energy and transportation, there are exciting opportunities

ahead.

"With a strong balance sheet and cash position, the Company is

well placed to embark on a controlled programme of investment to

further develop its engineering and operational capabilities

Furthermore, with a demonstrable track record of success in

building enduring partnerships, the directors believe that the

Company can work collaboratively to bring its technology to new

markets more effectively.

"Trading since the period end is well ahead of prior year, and

the directors continue to be optimistic about the outlook and

prospects for the Company."

Investor Presentation: 4pm, Wednesday 29 September 2021

Nigel Rogers (Executive Chairman) and Melvyn Segal (Chief

Financial Officer) will provide a presentation to review the

Company's results and prospects at 4pm on Wednesday 29 September

2021. The presentation will be hosted through the digital platform

Investor Meet Company.

To attend the presentation, investors can sign up to Investor

Meet Company for free and select to meet Transense Technologies plc

via the following link:

https://www.investormeetcompany.com/transense-technologies-plc/register-investor

. Investors who have already registered and selected to meet the

Company will automatically be invited to the presentation.

Questions can be submitted before the event to

transense@walbrookpr.com or in real time during the presentation

via the "Ask a Question" function.

For further information please visit www.transense.com or

contact:

Transense Technologies plc Tel: Via Walbrook PR

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nominated Adviser and Tel: +44 (0)20 3328

Broker) 5656

Jeremy Porter/George Payne (Corporate Finance)

Tony Quirke (Sales & Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933

Tom Cooper/Nick Rome 8780

Transense@walbrookpr.com

About Transense

Transense is a developer of specialist wireless sensor systems

used to enable real-time data gathering and monitoring. Products

include the patent protected Surface Acoustic Wave (SAW) sensor

technology, used to improve equipment power, performance,

reliability and efficiency; iTrack, Transense 's Tyre Pressure

Monitoring System, licensed to Bridgestone Corporation, the world's

largest tyre producer, under a ten-year deal in June 2020; and a

range of intelligent tyre monitoring equipment under the Translogik

brand. Target sectors include automotive, aerospace, industrial,

green energy, rail and marine.

The Group's strategy is to maximise shareholder value through

the delivery of sustained revenue growth from all three principal

technologies - SAW, iTrack and Translogik probes - through

leveraging excellence in innovation, know-how in commercialising

technologies, industry partnerships and exposure to global growth

markets.

Transense is headquartered in Oxfordshire, UK, and was admitted

to trading on AIM, a market operated by the London Stock Exchange

(AIM: TRT), in 1999. www.transense.com

For further information please contact transense@walbrookpr.com

.

Chairman's statement for the year ended 30 June 2021

I am pleased to report on considerable progress made at

Transense following the transformational changes brought about by

the licensing of our iTrack technology and the disposal of the

iTrack operational business to Bridgestone Corporation in June

2020. In many respects this represented a fresh start for the

Company, and has given us the opportunity to build firm foundations

for future growth.

Financial overview

Revenue from continuing operations increased almost threefold

over the prior year, which taken together with a net performance

just above breakeven resulted in Transense closing the year in line

with the upgraded expectations set at the time of our interim

results release in February 2021. This favourable outcome, coupled

with improved prospects, has enabled the Company to begin to

recognise deferred tax assets in respect of prior years' losses. In

consequence, earnings per share and distributable reserves at the

end of the year each exceeded expectations.

Cash generation from operations was broadly in line with

profits, and the closing net cash position provides ample headroom

to meet the future needs of the business.

Strategic overview

The overarching strategy of the Company is to develop innovative

solutions for niche applications, using our range of technologies.

These are guided through early stage commercial startup, achieving

realisation by forging relationships with market leading partners

as customers, licensees or acquirers.

This business model led to the successful exit from our iTrack

business with an associated licence to Bridgestone Corporation in

June 2020. The growth in royalties achieved in the first year

confirms our view that this transaction structure optimises our

return on the investment madein iTrack, whilst substantially

de-risking the continuing business model.

The commercialisation of our Translogik range of hand-held tyre

measurement tools has been accelerated by the launch of the modular

TLGX range during the year, generating strong revenue growth and

upgrades in our expectations. This business segment delivers

healthy gross margins and, with a lean overhead structure, it is

both profitable and cash generative. We are committed to continued

development of this business stream, working closely with a number

of major customers to refine the product road map and further

increase market penetration through integration into their fleet

tyre management systems.

Our patented Surface Acoustic Wave (SAW) technology is well

proven in meeting the demanding requirements of low volume high

reliability applications. Renewed commercial focus has been aimed

towards new market sectors, where our technology satisfies unmet

needs that provides customers with technical superiority and in

turn giving them a competitive advantage. In order to broaden our

commercial reach, the Company has sought input from a select group

of experienced industrialists covering a broad range of market

sectors by forming a Commercial Advisory Panel (which we refer to

as the "SAWCAP"). This initiative has proved invaluable allowing us

to gain insights into differentiation and the benefits of our

technology over alternative techniques, targeting our approach to

sales and marketing, and enabling access at a senior level to

commercial networks through the SAWCAP's relationships and

knowledge.

The industrial landscape is entering a period of rapid

technological change, driven by real-time connectivity (Internet of

things, 5G etc) and the recognition that climate change demands

behavioural changes now, rather than in future. Governments in

developed economies are keen to invest in infrastructure as they

plan for the aftermath of the global pandemic, and find sustainable

solutions to the challenges presented in energy, transport and food

production. This opens up exciting opportunities for companies with

enabling technologies. The directors believe that our SAW

technology can provide meaningful data for enhanced control,

efficiency, safety and maintenance routines which offer substantial

benefits to users in such fields.

Business Review

Royalty income from iTrack technology

This is the first full year of royalty income since the

inception of the ten year licence of iTrack technology to ATMS

Limited, a subsidiary of Bridgestone Corporation ("Bridgestone"),

on 24 June 2020. Royalty income is generated by reference to the

number and classification of vehicles upon which iTrack is

deployed. In the year ended 30 June 2021, this royalty income

amounted to GBP0.83m, whilst the Sterling equivalent of the

annualised rate of royalty increased by 76% from GBP0.64m at

inception to a year end rate of GBP1.12m. Royalties are designated

in US dollars, and the rate of growth is based on the volume

increase, which, excluding the effects of foreign exchange

fluctuations was 97%.

iTrack system capabilities continue to be enhanced under

Bridgestone ownership as it becomes further embedded into their

mining solutions business and, as referenced in their mid-term

update in May 2021, a number of global long term contracts have

been committed and are in the roll out stage. This process is

expected to accelerate following completion of Bridgestone's

proposed acquisition of Otraco International PTY Limited, a leader

in tyre management solutions with an extensive service network in

key markets such as Australia, Chile and South Africa and with many

years experience of working with iTrack technology in Latin

America.

This business segment now bears no cash costs, with the only

overhead being the amortisation of intangible development costs

relating to iTrack in prior years. Accordingly, the segmental

operating result was a profit of GBP0.79m compared with a loss from

the discontinued operational business of GBP1.38m in the prior

year.

Translogik tyre inspection probes

Revenues from Translogik probes increased by 50% to GBP0.76m

(2020: GBP0.51m), and this segment generated a trading profit of

GBP0.27m (2020: GBP0.12m), which was comfortably above the annual

budget.

Last year we reported that our product range was expanded in May

2020 to include the TLGX Series, being a modular range of four new

probes offering a broad variety of features at competitive prices.

These have been developed primarily for system integrators and OEM

fleet management systems, and offer longer life using a lithium

battery, a USB charging facility and a greater range of usage,

including the reading of RFID tags and tyre pressure sensors. These

new products generated more than 27% of the total sales value

during the year.

In the second half of the financial year, a number of major tyre

OEMs and fleet management software providers undertook trials of

the new range. This process temporarily diminished demand for the

first generation probe, as the customers evaluated the benefits of

switching to the new TLGX range. By the end of the year, and into

the current trading year, it has become evident that these trials

were successful with the switch to the new range being well

underway. This has also prompted commercial discussions to secure

mutual longer term commitment and the prospect of further

customisation of our products to customers' fleet management

solutions.

Surface Acoustic Wave technology (SAW)

Revenues generated by SAW almost doubled to GBP0.18m (2020:

GBP0.09m) supplemented by grant income of GBP0.05m (2020:

GBP0.12m). The net loss attributable to this segment was virtually

unchanged at GBP0.53m (2020: GBP0.58m). As the only part of the

business that requires some bespoke business premises, the

allocation of the cost of running these premises is allocated to

the SAW segment along with other associated costs. The R & D

tax credit relating to FY20 is evenly split between work on SAW

projects and the development of iTrack prior to the licence being

granted. The introduction of the R & D tax credit for the

current year is solely relating to SAW.

Although our technology is well advanced from an engineering

standpoint, commercialisation for higher volume applications

remains at a relatively early stage. More than half of revenue was

derived from providing components and engineering support for

projects expected to mature in future years, with the remainder

from ongoing activities, primarily motorsport. Revenue during the

year also included chargeable engineering support on behalf of

first tier suppliers to GE's Improved Turbine Engine Program

("ITEP"), which is scheduled to execute the First Engine To Test

(FETT) by the end of this calendar year. FETT will be the next

critical milestone for the programme which is planned to provide

the next-generation turbine engine power to the chosen Future

Attack Reconnaissance Aircraft (FARA) aircraft and the enduring

Apache and Black Hawk fleets.

With new management in place in our SAW business, buttressed by

the resources and expertise of SAWCAP, the commercial activities

and profile of the Company have been re-invigorated. There has been

meaningful engagement with multiple well known international

companies across a broad range of target sectors, providing

opportunities to showcase our capabilities and gain valuable

feedback on potential applications. These have deepened our

understanding, not only of the unique benefits of SAW technology,

but also of some technical and commercial barriers in certain

markets, especially in relatively heavy engineering such as wind

turbines.

This additional applications experience is now assisting greatly

in better targeting our sales and marketing efforts. On 14

September we announced that the Company has entered a Joint

Collaboration Agreement ("JCA")with McLaren Applied Limited which

builds on from the previous agreement that has been in force since

2011. The JCA sets out a shared objective of developing non-contact

torque products for specific motorsport applications and target

customers in other sectors using our SAW technology. The new

agreement is initially for five years and will continue development

of the Transense Torque Measurement System using SAW technology,

extending McLaren Applied exclusivity in elite motorsport

drivetrain applications in exchange for minimum target revenues on

an annual basis over a five year period.

Although elite motorsport is a market with limited potential in

absolute terms, McLaren anticipate significant growth in the

adoption of SAW technology for torque sensing. This will apply at

theregulatory body level as a control sensor both for rules

compliance and for performance optimisation in accredited race

series, which is how it has been used for many years in a

regulatory role for the IndyCar series. SAW technology lends itself

to motorsport applications in particular because of the low mass of

the applications components, coupled with the frequency, accuracy

and reliability of measurement. This is a valuable proving ground

for our technology and showcases our capabilities in a premium and

highly regulated environment.

A significant target sector where SAW technology offers true

competitive advantages is in the growing aerospace sector. The fast

responses, small size and mass of the SAW sensor together with

digital outputs from our electronics is aptly suited to build upon

the rigorous testing and implementation from the GE ITEP into other

programmes and other types of power units. Such areas of growth in

the aerospace sector are with the revolutionary hybrid electrical

engines for regional commercial aircraft. During the year, we

engaged on a confidential technology transfer program with a major

participant in this field to explore the use of SAW torque

measurement technology. There is also initial interest in our

capabilities from companies in the fast-growing Advanced Air

Mobility sector which uses multiple electric power units for

vertical lift rotors.

In addition, we have gained interest from the agricultural

sector where again the suitability of SAW technology for medium

volume, high value units has a value in improving agricultural

machines with many rotating parts to gain competitive advantages

over rivals in providing easier to use plant that has greater up

time use.

In view of these opportunities, there is sufficient confidence

in the outlook to justify further modest investment in people and

equipment to continuing building our engineering and operational

capabilities. In recent weeks we have expanded the engineering team

with three key additional members. In addition, evaluation of

potential capital expenditure in the region of GBP0.15m is ongoing

to facilitate increased test and production volumes to meet

potential demand.

Overall, we are satisfied both with progress during the year and

the pipeline of potential opportunities. We continue to pursue a

short term objective of SAW being financially self-sufficient as a

contributor to the Company's financial results, whilst seeking

applications that can deliver further substantial streams of

licensing income over the long term.

Board, governance and investor relations

The directors are committed to the framework and principles of

the QCA Corporate Governance Code ("the Code"), and seek to apply

these wherever this is practicable. Full application of the Code,

with the implications that this may have on board and compliance

costs, is counterbalanced by scale of the Company and the

relatively low risk profile of its operations.

Accordingly, the Board is satisfied that the overall board

structure and balance of independent input into board decision

making is appropriate to the circumstances. In particular, the

directors are all shareholders whose interests are well aligned

with shareholders as a whole. Furthermore, the involvement of

highly qualified and experienced independent advisers via SAWCAP

provides an additional layer of scrutiny and oversight over the

commercial activities of the Company.

There have also been significant efforts to improve our investor

relations programme for private and retail shareholders, including

frequent engagement via online investor presentations. This has

been supplemented by a major redesign of the Company's website (

www.transense.com ) and associated social media platforms. The

directors actively encourage regular engagement with all

shareholders, and details of how investors can engage are set out

on the website.

The Board fully recognise the importance of Enviromental, Social

& Governance (ESG) issues and have introduced a new statement

in this report to emphasise how our technology is supporting the

environment, and how we operate in a collaborative and ethical

manner seeking to apply high moral standards in accordance with the

QCA code referred to above.

Distribution policy

In December 2020 the shareholders approved a resolution to

reduce the capital of the Company, which was subsequently approved

by the Court resulting in the availability of distributable

reserves. At 30 June 2021, the total reserves available for

distribution amounted to GBP0.63m.

The directors are committed to delivering sustainable

improvement in investment returns to shareholders in the form of

both income and capital growth. As the net income and prospects of

the Company continue to build momentum, the Board will maintain

dialogue with shareholders, and seek to optimise the balance

between dividends, share buybacks and reinvestment in the business.

As a component of overall policy, it is anticipated that

commencement of progressive dividend payments will be considered in

respect of the financial year ending 30 June 2023.

Current trading and prospects

There has been a further increase in royalty income in the

period since the year end to 31 August 2021 such that the

annualised rate at constant currency had increased by 8% to

US$1.67m since inception, with the Sterling equivalent up by 9% to

GBP1.21m. Revenues from Translogik tyre inspection probes and SAW

were also substantially higher. Overall, the total revenues for the

first two months of the current year were 98% ahead of the

corresponding period last year.

There is a groundswell of momentum behind the potential for

growth in royalty income, and the positive market response to new

products for Translogik indicating the likelihood of further

success.

The recent agreement relating to the use of our technology in

motorsport applications underpins an element of short term revenue

for SAW, with further potential in off-road vehicles, agriculture

and aerospace in the development pipeline, and GE ITEP production

on the horizon.

Accordingly, the directors continue to be optimistic about the

outlook and future prospects for the Company.

Nigel Rogers

Executive Chairman

Financial Review

Results for the year

Revenues for the year from continuing operations increased

nearly threefold to GBP1.77m (2020: GBP0.60m). Royalty income from

iTrack was GBP0.83m for the first year of the new licence agreement

and will increase in line with the growth in the installed base.In

the previous year revenues of GBP1.47m were generated from users of

the iTracksystem and accounted for as part of discontinued

activities in 2020 following the sale of the iTrack operating

business in June 2020.

Gross margin was78.3% of revenues from continuing operations

(2020: 55.1%).

Administrative expenses wereGBP1.59m (2020: GBP1.70m). In 2020

there were increased amortisation costs and a one-off impairment

charge relating to intangible SAW patent assets. The net loss

before taxation from continuing operations was GBP0.16m (2020:

GBP1.27m).

The total comprehensive profit for the yearwas GBP0.16m (2020:

loss of GBP2.45m), reflecting the restructured business and licence

income in FY21 (2020: loss on discontinued activities of GBP1.45m)

and an R&D tax credit of GBP0.27m for the first time including

the current years credit GBP0.06m and a deferred tax credit of

GBP0.05m (2020: R & D Tax Credit GBP0.18m).

The Earnings per share (EPS) are set out below (in Pence):

2021 2020

EPS (profit/(loss) from continuing operations) 0.96 (6.7)

EPS (total profit/(loss)) 0.96 (15.6)

Taxation

The Company has UK tax losses available to carry forward at 30

June 2021 of approximately GBP23m, subject to HMRC agreement.

Certain elements of development expenditure undertaken by the

Company are eligible for enhanced research and development tax

relief which generally relates to salary costs of technical staff.

In the year R&D tax credits are recognised on an accruals basis

and not as in previous years on a cash basis, as the track record

on claims has now removed some of the uncertainty.

Cash flow and financial position

Net cash used in operations decreased to GBP0.25m following the

sale of the iTrack operational business (2020: GBP1.86m, which

includes the cash resources absorbed by iTrack operating activities

during the year of GBP1.33m up to the date of the transfer of the

business to AMTS on 24 June 2020). During the prior year, the

Company received the benefit of interest-free working capital loans

from Bridgestone of GBP1.59m, GBP0.61m of which was repaid in June

on completion of the transfer, and the remaining balance was

settled in September 2020 out of the consideration monies. Included

in the opening creditors were GBP0.32m relating to the discontinued

operations that were settled by Transense in the year.

The Company closed the year with net cash and cash equivalents

of GBP1.05m (2020: GBP1.19m). The completion Balance Sheet relating

to the iTrack business was agreed between the Company and ATMS on

10 September 2020, at which time the balance of the consideration

monies was settled, together with the settlement of the Bridgestone

loan and the payment of related fees.

The forward looking cash flow forecasts based on the anticipated

level of activity indicates that the Group should have sufficient

funds available for the foreseeable future.

Going Concern

The financial statements have been prepared on the going concern

basis.

The Group meets its day to day working capital requirements

through existing cash reserves and does not currently have an

overdraft facility. The Directors have prepared cash flow forecasts

for the period to 30 June 2023. These forecasts indicate that the

Group should continue to be able to operate within its current cash

resources for this period.

Melvyn Segal

Finance Director

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2021

Year ended Year ended

30 June 30 June

2021 2020

GBP'000 GBP'000

Continuing

operations

Revenue 1,773 603

Cost of sales (385) (271)

---------------------------------------------- ----------------------------------------------

Gross profit 1,388 332

Administrative

expenses (1,581) (1,703)

---------------------------------------------- ----------------------------------------------

Operating loss (193) (1,371)

Financial income - 5

Financial expense (12) (17)

Other income 48 118

---------------------------------------------- ----------------------------------------------

Loss before

taxation (157) (1,265)

Taxation 313 175

---------------------------------------------- ----------------------------------------------

Profit/(loss)for

the year from

continuing

operations 156 (1,090)

---------------------------------------------- ----------------------------------------------

Discontinued

operations

Loss for the year

from discontinued

operations - (1,452)

---------------------------------------------- ----------------------------------------------

Profit/(loss)and

total

comprehensive

income/(loss) for

the

yearattributable

to the equity

holders of the

parent 156 (2,542)

============================================== ==============================================

Basic and fully

diluted

profit/(loss) per

share (pence)

From continuing

operations 0.96 (6.68)

============================================== ==============================================

From total

profit/(loss) for

the year 0.96 (15.59)

============================================== ==============================================

Consolidated Balance Sheet

At 30 June 2021

30 June 30 June

2021 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000

Non current assets

Property, plant and

equipment 211 290

Intangible assets 770 844

Deferred tax 47 -

---------------------------------------------- ----------------------------------------------

1,028 1,134

Current assets

Inventories 73 63

Corporation tax 60 175

Trade and other

receivables 564 1,677

Cash and cash

equivalents 1,046 1,193

---------------------------------------------- ----------------------------------------------

1,743 3,108

---------------------------------------------- ----------------------------------------------

Total assets 2,771 4,242

Current liabilities

Trade and other

payables (260) (854)

Borrowings - (976)

Lease liabilities (65) (61)

---------------------------------------------- ----------------------------------------------

(325) (1,891)

Non current liabilities

Lease liabilities (104) (168)

---------------------------------------------- ----------------------------------------------

Total liabilities (429) (2,059)

---------------------------------------------- ----------------------------------------------

Net assets 2,342 2,183

============================================== ==============================================

Equity

Issued share capital 1,631 5,451

Share premium - 2,591

Share based payments 82 41

Retained

earnings/(accumulated

loss) 629 (5,900)

---------------------------------------------- ----------------------------------------------

Total equity 2,342 2,183

============================================== ==============================================

Consolidated Statement of Changes in Equity

Share Share Translation reserve Share based payments Retained earnings Total

capital premium equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

July 2019 5,451 2,591 23 41 (3,358) 4,748

Comprehensive

income for the

year:

Loss for the

year - - - - (2,542) (2,542)

- - - -

Translation

reserve

recycled on

disposal - - (23) - - (23)

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2020 5,451 2,591 - 41 (5,900) 2,183

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Comprehensive

income for the

year:

Profit for the

year - - - - 156 156

Share based

payment - - - 41 - 41

Share capital

reduction (3,820) (2,591) - - 6,411 -

Expenses of

capital

reduction - - - - (38) (38)

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2021 1,631 - - 82 629 2,342

========================================= ============================================== ============================================== ============================================== ============================================== ==============================================

Consolidated Cash Flow Statement

For the year ended 30 June 2021

Year ended Year ended

30 June 30

2021 June

2020

GBP'000 GBP'000

Profit/(loss) from

operations 156 (2,542)

Adjustments for:

Taxation (313) (171)

Loss on disposal of

trade and assets - 72

Net financial expense 12 9

Share based payment 41 -

Depreciation 85 538

Loss on disposal of

fixed assets - 18

Impairment of - -

investments

Amortisation and

impairment of

intangible

assets 121 504

---------------------------------------------- ----------------------------------------------

Operating cash flows

before movements

in working capital 102 (1,572)

(Iincrease) in

receivables (124) (177)

(Decrease)/increase in

payables (594) 477

(Increase) in

inventories (10) (582)

---------------------------------------------- ----------------------------------------------

Cash used in operations (626) (1,854)

Taxation

received/(paid) 381 (4)

---------------------------------------------- ----------------------------------------------

Net cash used in

operations (245) (1,858)

---------------------------------------------- ----------------------------------------------

Investing activities

Interest received - 8

Acquisitions of

property, plant and

equipment (6) (764)

Acquisitions of

intangible assets (47) (513)

Investment in - -

subsidiary

Proceeds from disposal

of trade and

assets (net of cash

disposed of) 1,237 772

---------------------------------------------- ----------------------------------------------

Net cash generated

from/(used in)

investing

activities 1,184 (497)

---------------------------------------------- ----------------------------------------------

Financing activities

Capital reduction

expenses (38) -

Loans advanced - 1,585

Loans repaid (976) (609)

Interest paid (12) (17)

Payment of lease

liabilities (60) (58)

---------------------------------------------- ----------------------------------------------

Net cash (used in)/from

financing activities (1,086) 901

---------------------------------------------- ----------------------------------------------

Net (decrease)in cash

and cash equivalents (147) (1,454)

Cash and equivalents at

the beginning

of year 1,193 2,647

---------------------------------------------- ----------------------------------------------

Cash and equivalents at

the end of year 1,046 1,193

============================================== ==============================================

NOTES RELATING TO THE GROUP FINANCIAL STATEMENTS

BASIS OF PREPARATION

The group financial statements have been prepared and approved

by the Directors in accordance with the International Financial

Reporting Standards (IFRS) as adopted by the United Kingdom and

with those parts of the Companies Act 2006 applicable to companies

reporting under adopted IFRS.

1 SEGMENT INFORMATION

The Group had three reportable segments being the unique trading

divisions, SAW and Translogik, which make use of technology

developed by the Group to measure and record temperature, pressure

and torque, and the iTrack royalty activity in respect of income

from licensed technology. In prior year financial statement

disclosures, the Translogik segment included the material iTrack

results. A decision was made to sell the iTrack trade to

Bridgestone and enter into a licence agreement to receive future

royalties. As a consequence of the focus on the impact of this,

Translogik now includes only continuing activity and the continuing

royalty income and discontinued iTrack activity have been shown as

separate segments. The revenues include royalties, engineering

support and sale of product in relation to this technology.

Revenue and EBITDA are the Group's key focus and in turn is the

main performance measure adopted by management.

The tables below set out the Group's revenue split and operating

segments. These disclose information for continuing operations and

in view of their relative size, information for discontinued

operations. The disposal of iTrack operations will result in future

royalty income replacing direct sales income and costs.

Revenue

Year ended Year ended Year ended Year ended

30 June 2021 30 June 2021 30 June 2020 30 June 2020

Continuing Discontinued Continuing Discontinued

GBP'000 GBP'000 GBP'000 GBP'000

North

America 1,150 - 282 235

South

America 244 - 83 793

Australia 28 - 5 479

UK and

Europe 83 - 148 -

Rest of

the World 268 - 85 201

---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

1,773 - 603 1,708

============================================= ============================================= ============================================= =============================================

Segments

Translogik SAW iTrack royalties Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30

June 2021

Sales 764 177 832 - 1,773

===================== ===================== ===================== ===================== ====================

Gross profit 385 171 832 - 1,388

Overheads (114) (917) (47) (503) (1,581)

------------------------------ ------------------------------ ----------------------------- ------------------------------ -----------------------------

Operating

profit/(loss) 271 (746) 785 (503) (193)

Other income - 48 - - 48

Net financial

expense - - - (12) (12)

Taxation - 164 102 - 266

Deferred Tax - - - 47 47

------------------------------- ------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for the year 271 (534) 887 (468) 156

====================== ====================== ====================== ====================== ======================

EBITDA

reconciliation GBP'000

Operating loss (193)

Other income 48

Depreciation

and

amortisation 206

-------------------------------

EBITDA 61

======================

Translogik SAW Discontinued Unallocated Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30

June 2020

Sales 510 93 1,708 - 2,311

===================== ===================== ===================== ===================== ====================

Gross profit 249 83 1,380 - 1,712

Overheads (121) (783) (2,759) (799) (4,462)

----------------------------- ------------------------------ ------------------------------ ------------------------------ -----------------------------

Operating

profit/(loss) 128 (700) (1,379) (799) (2,750)

Other income - 118 - - 118

Net financial

expense - - 3 (12) (9)

Loss on

disposal - - (72) - (72)

Taxation - - (4) 175 171

------------------------------- ------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for the year 128 (582) (1,452) (636) (2,542)

====================== ====================== ====================== ====================== ======================

EBITDA Discontinued Continuing Total

reconciliation GBP'000 GBP'000 GBP'000

Operating loss (1,379) (1,371) (2,750)

Other income 118 118

Depreciation,

amortisation

and impairment 470 572 1,042

------------------------------- ------------------------------- -------------------------------

EBITDA (909) (681) (1,590)

====================== ====================== ======================

During the year ended 30 June 2021 there was 1 customer ( 2020 :

2) whose turnover accounted for more than 10% of the Group's total

continuing revenue as follows:

Year ended 30 June 2021 Revenue Percentage

GBP'000 of total

Customer A 915 52

Customer B 200 11

Year ended 30 June 2020 Revenue Percentage

GBP000 of total

Customer B 93 15

Customer C 66 11

Discontinued revenue in FY20 included Bridgestone as a customer,

who have now acquired the iTrack business and from which all the

royalty income now arises within continuing revenue.

2 TAXATION

Recognised in the statement of comprehensive income in respect

of continuing operations

Year ended Year ended

30 June 30 June 2020

2021

GBP'000 GBP'000

Current tax credit

Current year (60) -

Adjustment for

previous year (206) (175)

Deferred tax credit

Current year (47) -

---------------------------------------------- ----------------------------------------------

Tax credit in

Statement of

Comprehensive Income (313) (175)

============================================= =============================================

Reconciliation of effective tax rate

Year ended Year ended

30 June 30 June

2021 2020

GBP'000 GBP'000

Loss before tax

from continuing

operations (157) (1,265)

============================================= =============================================

Tax calculated at

the average

standard UK

corporation tax

rate of 19.00%

(2020: 19:00%) (30) (240)

Expenses not

deductible for tax

purposes 8 2

Additional

deduction for R&D

expenditure (38) (145)

Current year losses

for which no

deferred

tax asset was

recognised - 383

Recognition of

deferred tax in

respect of

prior year losses (47) -

Prior year

adjustment (206) (175)

---------------------------------------------- ----------------------------------------------

Total tax credit (313) (175)

============================================= =============================================

Deferred tax assets

are

Recognised - in

respect of tax

losses 47 -

Unrecognised - in

respect of tax

losses and

other timing

differences 5,670 4,416

============================================= =============================================

The applicable UK corporation tax rate is 19% throughout the

reporting period.

The Group has tax losses, subject to agreement by HM Revenue and

Customs, in the sum of GBP23.1m (2020: GBP23.2m), which are

available for offset against future profits of the same trade.

There is no expiry date for tax losses. An appropriate asset will

be recognised when the Group can demonstrate a reasonable

expectation of sufficient taxable profits to utilise the temporary

differences.

The Finance Act 2020 maintained the rate of UK Corporation Tax

at 19% and in May 2021 the Finance Act 2021 was substantively

enacted with a rate of 25% to apply from April 2023. The effective

tax rate used to calculate the current tax for the year ended 30

June 2021 was 19.00% (2020: 19.00%).Unrecognised deferred tax

balances at 30 June 2021 have been calculated using a rate of 25%

(2020: 19%) as this was the substantively enacted rate at the year

end dates.

3 EARNINGS PER SHARE

Year ended Year ended

30 June 30 June

2021 2020

Number Number

Weighted average number of shares - basic 16,307,282 16,307,282

Share option adjustment 30,206 -

------------------------------ ------------------------------

Weighted average number of shares - diluted 16,337,488 16,307,282

====================== ======================

Basic loss per share is calculated by dividing the lossby the

weighted average number of ordinary shares in issue during the year

of 16,307,282 ( 2020 : 16,307,282). Unexercised options and

warrants over the ordinary shares results in a highly immaterial

number of dilutive shares included in the calculation of diluted

loss per share as the exercise price of most options exceeds the

average share price during the year.

Year ended Year ended

30 June 30 June

2021 2020

GBP'000 GBP'000

Proft/(loss) from continuing operations 156 (1,090)

Loss from discontinued operations - (1,452)

------------------------------ ------------------------------

156 (2,542)

------------------------------ ------------------------------

Basic profit/(loss) per share from continuing

operations 0.96 (6.68)

Basic loss per share from discontinued operations - (8.91)

------------------------------ ------------------------------

Basic profit/(loss) per share 0.96 (15.59)

====================== ======================

There are 1,435,085 share options and 130,458 warrantsin place

at 30 June 2021 (1,544,085 share options and 226,850 warrants at 30

June 2020).

4 STATUTORY ACCOUNTS

The Financial information set out in this announcement does not

constitute the Company's Consolidated Financial Statements for the

financial years ended 30 June 2021 or 30 June 2020 but are derived

from those Financial Statements. Statutory Financial Statements for

2020 have been delivered to the Registrar of Companies and those

for 2021 will be delivered following the Company's AGM. The

auditors Cooper Parry Group Limited have reported on the 2020and

2021 financial statements. Their reports were unqualified, did not

draw attention to any matters by way of emphasis without qualifying

their report and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006 in respect of the Financial

Statements for 2020or 2019.

The Statutory accounts are available on the Company's website

and will be posted to shareholders who have requested a copy and

thereafter by request to the Company's registered office.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR LDLLLFKLXBBD

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

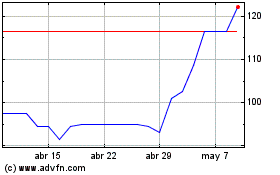

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024