Vector Capital PLC AGM statement and quarterly trading update (1412Y)

11 Mayo 2021 - 1:00AM

UK Regulatory

TIDMVCAP

RNS Number : 1412Y

Vector Capital PLC

11 May 2021

Vector Capital plc

("Vector Capital", the "Company" or the "Group")

AGM statement and quarterly trading update

Tracking to growth plan

Ahead of the Company's maiden Annual General Meeting ("AGM") as

an AIM company later today, Vector Capital Plc (AIM: VCAP), a

commercial lending group that offers secured loans primarily to

property developers located in England & Wales, is pleased to

provide an update on trading for the Quarter ended 31 March

2021.

As the AGM is being held as a closed meeting due to ongoing

government restrictions on public gatherings, the Company invited

shareholders to submit questions ahead of the AGM and this

statement seeks to answer those questions to the extent

possible.

Loan book summary

As at 31/03/21 As at 31/12/20 As at 31/12/19

Loan book GBP38.6 million GBP36.4 million GBP33.6 million

Number of live

loans 69 63 56

Average loan GBP559,000 GBP577,000 GBP600,485

size

Average loan

to value 46.0% 44.2% 57.46%

Trading update

Vector Capital's shares were admitted to trading on AIM on 29

December 2020 and the Company raised gross proceeds of GBP3.1m (net

GBP2.6m) at that time. The net proceeds have largely been deployed

into new lending and will provide the base for drawing down further

on its debt facilities.

Current trading in 2021 has been in line with expectations and

the Company's pipeline of new loan opportunities remains

strong.

The Company is now concentrating on loan book growth by

enhancing its engagements with its broker network. The Company is

also introducing additional staff training programs so that the

existing team can handle increased activity. It is not anticipated

that the Company will be required to increase its headcount this

year.

Discussions have been held with the Company's two wholesale

lenders, Shawbrook Bank and Aldermore Bank. Both banks are fully

supportive of the Group's operations and have indicated that they

would be ready to increase the facilities should the Company

request them. The Group has also been approached by three other

wholesale banking providers who have offered indicative terms on

additional facilities. The Company will continue discussions with

these providers to maintain flexibility as the business grows,

however, the board considers that the Group's existing facilities

are the best fit for its current requirements.

In these early days as a public company, the Board has been

exploring how best to raise the Group's profile and increase

engagement with individual and institutional investors and with the

market. The Company will report further on this initiative at the

time of the announcement of its interim results to 30 June 2021 and

as the year progresses.

Agam Jain, CEO of Vector Capital will make the following

statement at the AGM:

" We have continued to trade strongly since our year end and our

pipeline of new loan opportunities remain at a historically high

level. We are supported by the improving property and construction

sectors, the latter of which has experienced its strongest growth

phase for circa six and half years, driven by the easing of

COVID-19 restrictions which has led to increased activity in

housing and other commercial developments(1) .

"The Group continues to be well placed to benefit from these

opportunities to further grow revenue, profits and dividends and we

are on track against our strategy to establish ourselves as the go

to lender of choice in our market segment. The Board is confident

of the Group's continued success."

(1) Source: IHS Markit

Enquiries

Vector Capital Plc c/o TB Cardew

Agam Jain

Allenby Capital Limited + 44 (0) 20 3328 5656

James Reeve/George Payne (Corporate www.allenbycapital.com

Finance)

Tony Quirke (Sales and Corporate

Broking)

TB Cardew + 44 (0)7775 848537

Shan Shan Willenbrock + 44 (0)20 7930 0777

Charlotte Anderson vector@tbcardew.com

About Vector Capital:

Vector Capital provides secured, business-to-business loans to

SMEs based in England and Wales. Loans are typically secured by a

first legal charge against real estate. The Company's customers

typically borrow for general working capital purposes, bridging

ahead of refinancing, land development and property acquisition.

The loans provided by the Company are typically for renewable

12-month terms with fixed interest rates.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMAMMFTMTTBBIB

(END) Dow Jones Newswires

May 11, 2021 02:00 ET (06:00 GMT)

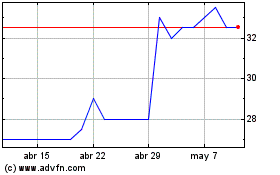

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024