XP Power Ltd Q3 Trading Update

11 Octubre 2021 - 1:00AM

UK Regulatory

TIDMXPP

11 October 2021

XP Power Limited

("XP Power" or "the Group" or the "Company")

Q3 Trading Update

XP Power, one of the world's leading developers and manufacturers of critical

power control components to the electronics industry, is today issuing a

trading update for the third quarter ended 30 September 2021.

Trading

The strong momentum in order intake seen in the first half of the year

accelerated in Q3, with orders up 87% at constant currency, and 73% as

reported, to £97.2 million. Order growth was driven by continued strength in

the Semiconductor Manufacturing Equipment sector, the ongoing recovery in

Industrial Technology, and a pick-up in Healthcare, where third quarter orders

were 70% above 2019 levels. The extension of lead times to customers has

brought orders forward as customers seek to secure supply. Year to date order

intake was up 37% at constant currency. The Group enters the final quarter of

the year with a very strong order backlog position partially as a result of

lead times that have continued to extend.

As expected, revenue of £61.6 million in Q3 2021 was down year-on-year, 5% on a

constant currency basis and 11% as reported, as the exceptional COVID-19

related Healthcare revenue in the prior year was not repeated. Year to date,

revenue has grown 12% on a constant currency basis (4% as reported) mostly

driven by the Semiconductor Manufacturing Equipment sector.

The book to bill ratio, which tracks the relationship between orders received

and completed sales, was 1.58 for the third quarter of 2021 (Q3 2020: 0.82).

£ Millions Q3 2021 Q3 2020 Change Change in

constant

currency

Orders 97.2 56.3 +73% +87%

Year to date 254.7 202.1 +26% +37%

Revenue 61.6 69.0 -11% -5%

Year to date 181.4 174.1 +4% +12%

Book to Bill

Third quarter 1.58 0.82 +0.76

Year to date 1.40 1.16 +0.24

Financial Position and dividend

Net debt at 30 September 2021 was £25.2 million, compared with £17.9 million at

31 December 2020. The Group will continue its disciplined approach to capital

allocation, prioritising a strong balance sheet and the flexibility that this

provides.

The Board has declared a dividend for the third quarter of 21.0 pence per share

(2020: 20.0 pence per share). The ex-dividend date will be 9 December 2021 and

the dividend will be paid on 17 January 2022 to shareholders on the register at

the record date of 10 December 2021. The last date for election for the share

alternative to the dividend under the Company's Dividend Reinvestment Plan is

24 December 2021.

Outlook

The Board's expectations for the full year remain in line with current market

expectations. While our order book provides us with excellent visibility well

into 2022, we continue to monitor closely the impact of the current

uncertainties in global supply chains, including shortages of key components,

ongoing COVID-19 challenges and freight capacity constraints, with associated

increased costs.

Longer term, the Board believes XP Power remains very well positioned to grow

ahead of its end markets, supported by its strong cash generation and robust

balance sheet.

Enquiries:

XP

Power

Gavin Griggs, Chief Executive

Officer +44 (0)118 984

5515

Oskar Zahn, Chief Financial Officer

+44 (0)118 984 5515

Citigate Dewe

Rogerson

Kevin Smith/Jos

Bieneman

+44 (0)207 638 9571

Note to editors

XP Power designs and manufactures power controllers, the essential hardware

component in every piece of electrical equipment that converts power from the

electricity grid into the right form for equipment to function.

XP Power has invested in research and development and its own manufacturing

facilities in China and Vietnam, to develop a range of tailored products based

on its own intellectual property that provide its customers with significantly

improved functionality and efficiency.

Headquartered in Singapore and listed on the Main Market of the London Stock

Exchange since 2000, XP Power is a constituent of the FTSE 250 Index. XP Power

serves a global blue-chip customer base from 29 locations in Europe, North

America, and Asia.

For further information, please visit xppower.com

END

(END) Dow Jones Newswires

October 11, 2021 02:00 ET (06:00 GMT)

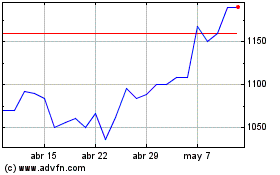

Xp Power (LSE:XPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Xp Power (LSE:XPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024