U.S. Dollar Advances Amid Risk Aversion

09 Agosto 2018 - 2:10AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

European session on Thursday, as fears over a trade war escalated

after China announced additional import tariffs on U.S. goods,

raising the appeal of safe-haven assets.

China said on Wednesday that it would impose a 25 percent tariff

on $16 billion of U.S. goods, in tit-for-tat move against the Trump

administration's latest import levies on Chinese goods.

Sentiment further eroded after the U.S. said it would impose new

sanctions on Russia over the poisoning of former Russian spy Sergei

Skripal. The sanctions are expected to take effect on or around

August 22.

Meanwhile, Richmond Fed President Thomas Barkin suggested to

raise U.S. interest rates back to normal levels given strong

economic fundamentals.

"It is difficult to argue that lower-than-normal rates are

appropriate when unemployment is low and inflation is effectively

at the Fed's target," he said on Wednesday.

The U.S. weekly jobless claims, wholesale trade and producer

prices are due later in the day, while Chicago Fed President

Charles Evans will participate in a group media interview in

Chicago.

The currency was trading mixed against its major counterparts in

the Asian session. While it fell against the yen and the franc, it

rose against the pound. Against the euro, it held steady.

The greenback advanced to 111.19 against the yen, from a 2-week

low of 110.71 hit at 10:45 pm ET. The greenback is poised to find

resistance around the 113.00 level.

Data from the Bank of Japan showed that Japan's M2 money stock

rose 3.0 percent on year in July, coming in at 1,007.5 trillion

yen.

That was shy of expectations for an increase of 3.1 percent,

which would have been unchanged from the June reading.

The greenback edged up to 0.9951 against the franc, after

declining to a 6-day low of 0.9921 at 5:00 pm ET. Continuation of

the greenback's uptrend is likely to see it challenging resistance

around the 1.01 region.

The greenback reversed from an early low of 1.1619 against the

euro, rising to 1.1576. The next likely resistance for the

greenback is seen around the 1.13 level.

Extending early rally, the greenback hit 0.6641 against the

kiwi, its highest since March 2016. The greenback is seen finding

resistance around the 0.65 area.

The greenback bounced off to 0.7414 against the aussie and

1.3031 against the loonie, from its early 2-week low of 0.7453 and

a 2-day low 1.3000, respectively. On the upside, 0.72 and 1.32 are

possibly seen as the next resistance levels for the greenback

against the aussie and the loonie, respectively.

On the flip side, the greenback dropped to 1.2912 against the

pound, from an early near a 1-year high of 1.2842. Next key support

for the greenback is seen around the 1.30 region.

Looking ahead, at 8:15 am ET, Canada housing starts for July are

set for release.

In the New York session, Canada new housing price index for

June, U.S. weekly jobless claims for the week ended August 4,

producer price index for July and wholesale inventories for June

are due.

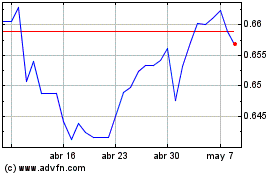

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

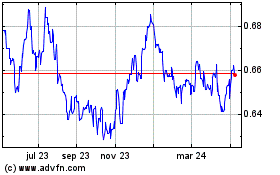

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024