Sonae SGPS to List Food-Retail Business on Lisbon Euronext

19 Septiembre 2018 - 2:55AM

Noticias Dow Jones

By Nathan Allen

Sonae SGPS S/A (SON.LB) said Wednesday that it plans to list its

food-retail business, Sonae MC, on the Portuguese stock exchange

during the fourth quarter.

The aim of the initial public offering is to provide greater

visibility of the food unit's standalone valuation and to reduce

the group's conglomerate discount, Sonae said.

Sonae SGPS will remain the majority shareholder and is planning

to list at least 25% of the company's shares, it said.

The offer will take the form of a secondary sale of existing

shares in Sonae MC and will comprise a public offering to

Portuguese institutional and retail investors, and a private

placement to international institutional investors.

Barclays PLC (BARC.LN), BNP Paribas SA (BNP.FR) and Deutsche

Bank AG (DBK.XE) are coordinating the IPO and will act as joint

bookrunners for the institutional placement.

Sonae MC is Portugal's biggest food retailer with a market share

of 21.9%, according to its parent. It posted net profit of 115

million euros ($134.3 million) on sales of EUR3.94 billion in

2017.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

September 19, 2018 03:40 ET (07:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

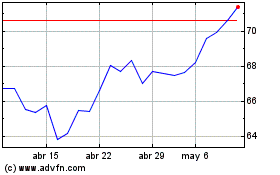

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

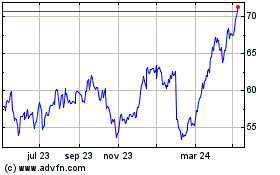

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024