Chevron CIO Says Technology Triggers Faster Human Decisions

29 Enero 2019 - 6:57PM

Noticias Dow Jones

By Sara Castellanos

Energy giant Chevron Corp. is among the many companies across

industries that are feeling pressure to innovate rapidly.

Chief Innovation Officer Bill Braun says that's causing the

nature of his job to change.

In addition to overseeing information technology for the

company's nearly 52,000 employees, he's working to assess and

validate cutting-edge technology through partnerships with

Chevron's venture-capital fund and other large technology

companies. He also works with a technology advisory board that

governs Chevron's total technology spending.

"The nimbleness and speed at which we need to be able to move is

much more compressed," said Mr. Braun, who joined the San Ramon,

Calif., company as a programmer in 1991 and has served as CIO since

2015. "It's really critical that we're able to react faster."

New technologies such as advanced sensors, artificial

intelligence, quantum computing and virtual and augmented reality

are flooding into the market at a rapid pace, and at the same time,

large companies are realizing they can't innovate alone.

Chevron joins other enterprises such as JetBlue Airways Corp.,

Walmart Inc. and SAP SE that are establishing formal processes for

working with startups. Their respective technology executives are

becoming deeply involved in evaluating new ideas.

As CIO, Mr. Braun said he never expected to be so closely

involved with certain cutting-edge technology deployments, such as

facial recognition technology that Chevron is beginning to use in

trucks to help detect fatigue in drivers. He's also working much

closer with other technology vendors on initiatives that could have

significant financial payoffs within the next few years.

For example, with Mr. Braun's involvement, Chevron launched an

effort to predict maintenance problems in its oil fields and

refineries using Internet of Things services from Microsoft Corp.

He's involved in helping set priorities for the deal and making

sure the companies are jointly "pushing the envelope in how we're

trying to apply technology," he said.

Mr. Braun is excited about advancements in technologies that

could, for example, help make predictive maintenance more

effective. Chevron is doing 700 less inspections on pressure valves

annually, in part because emerging technologies such as data

analytics, sensors and machine learning have become so advanced and

accurate at predicting equipment failures, he said. That technology

also helps prevent the need for dangerous manual inspections, he

said.

Fiber optic cables also have gotten on his radar, but not for

purposes of telecommunication. Chevron is experimenting with the

use of the cables, which are sensitive to sound waves, pressure and

temperature, and could be used in oil wells to detect leaks. They

also could be placed along an oil pipeline to help better detect

incoming trucks or footsteps for security reasons.

Mr. Braun said he also must work closely with small startups

that could eventually have scalable technology deployments under

his purview.

That is where Chevron Technology Ventures comes into play -- a

corporate venture fund that has invested $325 million in about 80

startups over two decades. "We have to be much closer to some of

these smaller, faster companies," Mr. Braun said.

Chevron's use of biofuels, which are produced through processes

involving biology rather than geology, originated from the venture

group.

Although the venture fund isn't new, the rapidly changing pace

of technology and the competitive technology landscape is resulting

in faster timelines for evaluating and testing new ideas, said

Barbara Burger, who has been president of Chevron's venture unit

since 2013.

It takes days for the division to become aware of a startup and

to begin evaluating their technology, as opposed to weeks and

months in years past, Ms. Burger said.

"The pace and amount of innovation, and the abundance of

information about innovation has increased dramatically," she

said.

The venture arm is interested in pursuing startups that offer

technology to help increase oil-and-gas production, and materials

that could result in stronger, lightweight equipment. Last year, it

also announced a new venture fund with an initial $100 million to

invest in technologies that could lower emissions from oil-and-gas

operations and technologies that help produce lower carbon energy

sources.

Emerging technologies that might take several years to come to

fruition, such as quantum computing, are also on Chevron's

radar.

"It holds a lot of promise, but you measure it on a different

time scale than you would some of the others," Mr. Braun said.

Write to Sara Castellanos at sara.castellanos@wsj.com

(END) Dow Jones Newswires

January 29, 2019 19:42 ET (00:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

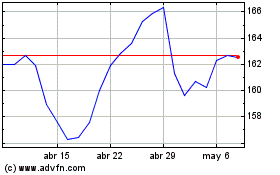

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

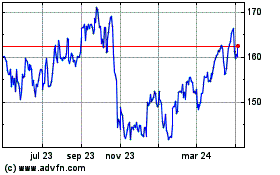

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De May 2023 a May 2024