Euro Rises Amid Risk Appetite

01 Marzo 2019 - 12:17AM

RTTF2

The euro strengthened against its major opponents in the

European session on Friday amid risk appetite, as

stronger-than-expected U.S GDP data released overnight coupled with

positive manufacturing data from China helped ease growth worries.

Sentiment was also bolstered after White House economic advisor

Larry Kudlow said the U.S. and China are making "fantastic"

progress in their trade negotiations.

Data from Eurostat showed that Eurozone inflation accelerated in

February, while core price growth eased, and the unemployment rate

held steady in January.

The flash harmonized inflation for February was 1.5 percent,

which was higher than January's 1.4 percent. The latest rate was in

line with economists' expectations.

Meanwhile, the core inflation rate that excludes energy, food,

alcohol and tobacco, slowed to 1 percent in February from 1.1

percent in January. Economists had expected the rate to remain

unchanged.

Separate data showed that the euro area unemployment data was

steady at 7.8 percent in January after December's figure was

revised down from 7.9 percent.

Economists had expected the rate to remain unchanged at

December's original 7.9 percent.

The latest jobless rate was the lowest rate recorded in the euro

area since October 2008, Eurostat said.

The currency traded mixed against its major counterparts in the

Asian session. While it rose against the franc and the yen, it held

steady against the greenback and the pound.

The euro advanced to 1.1371 against the franc, from a low of

1.1337 hit at 5:45 pm ET. The euro is seen finding resistance

around the 1.15 level.

The single currency appreciated to a 2-day high of 0.8589

against the pound, following a decline to 0.8571 at 3:45 am ET. If

the euro rises further, 0.87 is possibly seen as its next

resistance level.

Survey data from IHS Markit showed that British manufacturing

growth slowed to its weakest level in four months in February with

manufacturers hastening to implement measures to cushion the

adverse effects of Brexit.

The IHS Markit/CIPS Purchasing Managers' Index for manufacturing

fell to a four-month low of 52 from 52.6 in January, which was

revised down from 52.8. The reading was in line with economists'

expectations.

The euro strengthened to 127.26 against the yen, a level unseen

since December 21, 2018. Next key resistance for the euro is seen

around the 129.00 level.

The euro recovered to 1.1377 against the greenback, from a 3-day

low of 1.1353 touched at 3:30 am ET. The euro is poised to

challenge resistance around the 1.16 level.

Looking ahead, Canada GDP data for December, U.S. personal

income and spending data for the same month, ISM manufacturing

index for February and University of Michigan's final consumer

sentiment index for February are due in the New York session.

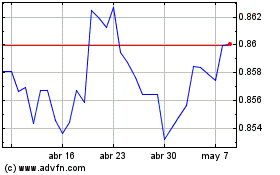

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2024 a May 2024

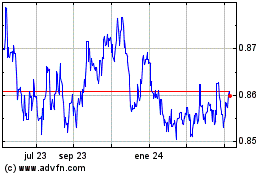

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De May 2023 a May 2024