TIDMFRAN

RNS Number : 9051O

Franchise Brands PLC

07 October 2019

7 October 2019

FRANCHISE BRANDS PLC

("Franchise Brands", the "Company" or the "Group")

Acquisition of Willow Pumps - adding highly complementary

services to Metro Rod

Group trading update for Q3

Change to total voting rights

Franchise Brands plc (AIM: FRAN), a multi-brand franchisor, is

pleased to announce that it has acquired a leading water pump

supply, installation and servicing business to complement and

expand Metro Rod's drainage and plumbing businesses. The Company

also provides an update on Group trading for the third quarter of

the year.

Acquisition

Franchise Brands has acquired the entire issued share capital of

WPL Group Holdings Limited and its subsidiaries, Willow Pumps

Limited and Willow Drainage Limited (together, "Willow Pumps") for

an initial consideration of GBP5.0 million (net of non-trading cash

of GBP700,000 in WPL Group Holdings Limited) ("Initial

Consideration") and a performance-based deferred consideration of

up to GBP7.5 million ("Deferred Consideration") payable over the

next five years (the "Acquisition").

The Initial Consideration has been paid as to GBP4.0 million in

cash and GBP1.0 million through the issue of 1,212,121 new ordinary

shares of 0.5p each in the Company ("Ordinary Shares") at 82.5

pence per share (the "Consideration Shares"). The cash element of

the Initial Consideration has been satisfied from the Group's

available cash resources and existing debt facilities. The Deferred

Consideration will be payable in cash, subject to the Company

having the right to settle 20 per cent. of the amount due in new

Ordinary Shares at the then prevailing share price.

Acquisition Highlights

-- Willow Pumps, founded in 1992, is a leading water pump

supply, installation and servicing business, with a below-ground

(foul water) and above-ground (fresh water) capability.

-- Willow Pumps achieved revenue of GBP12.4 million, EBITDA of

GBP1.6m and a profit before tax of GBP1.1 million in the year ended

31 December 2018 and has grown strongly in the first half to 30

June 2019, having achieved revenue of GBP8.4 million, EBITDA of

GBP1.0 million and a profit before tax of GBP0.8 million.

-- The Board believes the Acquisition will be significantly earnings enhancing for the Group.

-- The Acquisition has a strong strategic rationale:

-- It is consistent with Metro Rod's Vision 2023 strategy of

expanding its range of services to the commercial market.

-- The longer-term aim of the Group is to provide a "water in,

waste out" range of drainage, pumps and plumbing-related services

to commercial customers nationally.

-- Pumps are an engineered solution and the acquisition of this

high quality, well-established business represents the optimum way

to enter this specialist market.

-- Willow Pumps will benefit from a significantly expanded

delivery capability through Metro Rod's national network of over

400 engineers working out of 43 depots across the UK.

-- Metro Rod will benefit from potential demand from its

national account customers who are progressively tendering for

combined drainage and pump services and from the opportunity to

supply its wide range of drainage services to Willow Pumps'

customers.

-- The above-ground pump capability of Willow Pumps also

provides a new strategic opportunity to develop the Group's Metro

Plumb and Kemac businesses.

-- The deal structure provides both a significant incentive for

Willow Pumps to help upskill the Metro Rod franchise community and

then subcontract pump work to them, and for Willow Pumps'

management to continue to grow the existing business.

-- The principal vendor, Willow Pumps' founder and Managing

Director Ian Lawrence, will continue to manage the business and

becomes part of Franchise Brands' senior management team.

-- Willow Pumps will continue to operate as a direct labour

organisation ("DLO") within Franchise Brands, working closely with

Metro Rod and its franchisees and benefiting from the Group's

management, resources, and commercial customer relationships.

Commenting on the Acquisition, Stephen Hemsley, Executive

Chairman of Franchise Brands, said: "I am delighted to announce the

acquisition of Willow Pumps, which represents an important step in

expanding Metro Rod's scope of services to the commercial market,

consistent with our Vision 2023 strategy. The longer-term aim of

the Group is to be able to serve our valued commercial customers

with a "water in, waste out" range of drainage, pumps and

plumbing-related services on a national basis. The acquisition of

Willow Pumps, a highly respected business and one of the leaders in

the market, which Metro Rod has already worked alongside, provides

the optimum way for Metro Rod to enter the specialist pump sector

and develop this expertise across our franchise community.

"The deal structure also provides a significant incentive for

Willow Pump's management team to continue to grow its existing

business by developing the many national accounts where Metro Rod

only provides drainage services at present. As such, the Board of

Franchise Brands believes the Acquisition will be significantly

earnings enhancing for the Group.

"I am really looking forward to working with Ian Lawrence and

his high quality management team to create a national leader for

drainage, pumps and plumbing services."

Ian Lawrence, the founder and Managing Director of Willow Pumps,

commented: "I am very excited about building on our success to date

as part of a larger, publicly quoted group with significant

ambitions in the drainage, pumps and plumbing markets. The Group's

management and wider resources will be of particular value as we

continue to grow Willow Pumps under Franchise Brands'

ownership.

"My team and I welcome the opportunity to work with Metro Rod

franchisees all across the country and we look forward to working

with Metro Rod to deliver first-class pump services and support to

their national accounts."

Background to and rationale for the Acquisition

Willow Pumps is one of the UK's leading providers of water pumps

and pump solutions, including supply, installation and servicing.

It has a below-ground (foul water) capability as well as an

above-ground (fresh water) capability. Since 2017, Willow Pumps has

also developed a complementary drainage business which is engaged

predominantly in tanker work to support the pump maintenance and

emergency clearance side of the business.

The business is highly complementary to the Group's Metro Rod

and Metro Plumb businesses and provides a strategic opportunity to

expand the range of services that Metro Rod and Metro Plumb can

offer, consistent with our Vision 2023 strategy. The longer-term

objective is to be able to offer an end-to-end range of drainage,

pumps and plumbing-related services to commercial customers that

will extend from "water in" to "waste out" on a national basis.

Pumps are engineered solutions and incorporate an electrical, as

well as a mechanical, component. As such, they have certain

specialisations over and above drainage services. The Metro Rod

franchisees currently have little or no pump capability because of

the specialist nature of this work. However, given the linkage

between pumps and drainage, such work is frequently encountered.

Currently, Metro Rod franchisees subcontract the pump work which

stems from their drainage jobs, and, since 2013, a proportion of

this has been subcontracted to Willow Pumps. In addition, there is

increasing demand for a pump servicing capability from Metro Rod's

national account customers who are progressively tendering combined

drainage and pump services. As Metro Rod has historically been

unable to self-deliver this service, it has not competed in this

area of the market.

The organic development of a complete range of market-leading

pump services within a franchise business would take a considerable

amount of time to achieve and national coverage would be patchy, as

the pace at which franchisees would embrace the opportunity would

vary across the network. The Board therefore concluded that the

acquisition of Willow Pumps, one of the leading pump companies in

the UK, and one which had a below-ground and above-ground

capability, would be the optimum way to enter this specialist

market.

The above-ground capability of Willow Pumps, which includes cold

water booster sets, storage tanks, and pressurisation units within

its offering, also provides a new strategic opportunity to develop

the Metro Plumb business. Currently, Metro Plumb is focused on

lower-value insurance stabilisation work, but the expertise of

Willow Pumps will provide the opportunity to enhance Metro Plumb's

skill base and to undertake higher value work. Furthermore, an

opportunity has been identified for Kemac, which carries out some

high-end specialist plumbing work for water utilities, to work more

closely with the above-ground team at Willow Pumps.

The Board of Franchise Brands believes that the Acquisition will

be significantly earnings enhancing given the considerable growth

opportunities that have been identified for the Group and Willow

Pumps. The additional pump work undertaken by Metro Rod franchisees

is expected to enhance their profitability and generate additional

Management Service Fee income for the Group. Willow Pumps is also

expected to continue to grow organically as a result of access to a

wider customer base and the opportunity to service customers on a

truly nationwide basis.

Structure of the Acquisition and integration with the Group

The structure of the Acquisition provides a significant

incentive for Willow Pumps to provide the necessary specialist

training and support to the Metro Rod franchise community to enable

them to undertake pump work to the required standard. All Metro Rod

franchisees will be given the opportunity to upskill, identify and

self-deliver pump work utilising Willow Pumps' expertise. Growth

incentives, similar to the incentive scheme that has successfully

encouraged significant investment by franchisees in a tankering

capability, will also be offered to the Metro Rod franchise

community to encourage them to invest in a pump servicing

capability. Over time, Willow Pumps will benefit from a

significantly expanded delivery capability through Metro Rod's

national network of over 400 engineers working out of 43 depots

across the UK. Metro Rod will also benefit from the opportunity to

supply its wide range of drainage services to Willow Pumps'

customers.

The deal structure also provides a significant incentive for

Willow Pumps' management team to continue to grow its existing

business. Willow Pumps will continue to operate as a DLO within

Franchise Brands and will benefit from the Group's management,

resources, and national account customer relationships. In

particular, the business will benefit from Metro Rod's

relationships with facilities management companies to win new

contracts to deliver pump services.

Willow Pumps has a strong management team led by the founder,

Ian Lawrence. Ian will continue to manage the business as Managing

Director of Willow Pumps and has joined Franchise Brands' senior

management team reporting to the Executive Chairman. Each area of

the business is headed by an experienced manager who will be

directly incentivised to assist the achievement of the Acquisition

earn-out targets. This senior team of five individuals will be

incentivised through the grant of EMI options over new Ordinary

Shares to an aggregate value of GBP1.0 million and up to GBP500,000

of cash bonuses payable over five years on the same basis as the

Deferred Consideration.

Details of Willow Pumps' business

Willow Pumps was founded by Ian Lawrence in 1992 and has been

family owned until the acquisition by Franchise Brands. The scope

of work involves the supply and installation of pumps, routine

servicing work, the repair and maintenance of pumps and related

drainage services that may be required. Pumps are supplied and

installed for both below-ground and above-ground applications.

Supply and installation work involves the design and

installation of below ground pumping stations, typically in

new-build developments. These range from central pump stations on

new housing estates to new-build commercial premises. These

installations take place over a number of months, in discrete

phases. At the end of the project a customer may sign up to a

maintenance contract prior to the installation being adopted by a

water authority. The design aspect of directly won work is either

undertaken in house or subcontracted to a specialist consultancy

firm. This firm also wins contracts directly, particularly from

housebuilders, and then refers the installation work to Willow

Pumps, which invoices the customer directly.

Servicing and maintenance work comprises the routine servicing

of pump systems and equipment and reactive call outs for pump

failures or blockages. The routine servicing work can be scheduled

in advance, resulting in high levels of labour efficiency. The

reactive work often involves a significant drainage or tanker

element which is expected to give rise to additional subcontract

work for Metro Rod. Willow Pumps has built up a high-quality

service and maintenance client base, with customers in the

hospitality, retail and housebuilding sectors.

Above-ground pump applications, which handle fresh water,

require a separate means of service delivery in order to mitigate

against the potential risk of cross-contamination with foul water.

Willow Pumps, therefore, has a specialist team operating from

dedicated vehicles and premises engaged in this activity. The Board

believes that there is significant potential in the above-ground

market, in particular to develop a national capability, and this

potential will be further enhanced by the development of

opportunities in association with Kemac and Metro Plumb.

Willow Pumps employs 74 people, including 35 engineers, and has

support centre teams in sales, contracts, national account

management, finance, servicing, operations and health and safety.

The majority of these employees work out of the main premises in

Aylesford, near Maidstone, Kent. In 2018, Willow Pumps established

a depot in Wetherby, Yorkshire, to better service the below-ground

pump market in the north of the country. In addition, the company

has various satellite sales offices and workshops from which a

number of engineers operate.

Financial information on Willow Pumps

Franchise Brands has acquired the entire issued share capital of

WPL Group Holdings Limited and its subsidiaries, Willow Pumps

Limited and Willow Drainage Limited. Consolidated accounts have not

historically been prepared for the group as WPL Group Holdings

Limited was, and remains, a non-trading holding company and Willow

Drainage Limited, which was controlled by the Lawrence family, was

acquired by WPL Group Holdings Limited shortly before completion of

the Acquisition.

On a group pro-forma unaudited basis, for the financial year

ended 31 December 2018, Willow Pumps achieved revenue of GBP12.4

million, EBITDA of GBP1.6 million and a profit before tax of GBP1.1

million. In the six months to 30 June 2019, pro-forma unaudited

management accounts of Willow Pumps show revenue of GBP8.4 million,

EBITDA of GBP1.0 million and a profit before tax of GBP0.8

million.

The net assets of Willow Pumps on a group pro-forma unaudited

basis as at 30 June 2019 were GBP2.7million, including borrowing

(substantially comprising leasing and hire purchase commitments) of

GBP1.6 million and cash of GBP0.9 million, of which the GBP0.7

million of cash not required for trading has been netted off

against the Initial Consideration.

Terms of the Acquisition

Franchise Brands has acquired the entire issued share capital of

Willow Pumps for an initial consideration of GBP5.0 million (net of

non-trading cash of GBP700,000) and a potential deferred

consideration of up to GBP7.5 million. Of the Initial

Consideration, GBP4.0 million has been paid in cash and GBP1.0

million was satisfied by the issue of 1,212,121 new Ordinary Shares

of 0.5p each in the Company at 82.5 pence per share (being the

latest closing middle market price of an Ordinary Share on the last

day of trading prior to this announcement). The Consideration

Shares rank pari passu in all respects with the existing Ordinary

Shares.

As a result of the issue of the Consideration Shares, the

vendors of Willow Pumps (Ian Lawrence and his wife) now have an

aggregate beneficial interest in 1.55 per cent. of the issued share

capital and voting rights of the Company. It has been agreed that

the vendors will hold the Consideration Shares for three years and

then be subject to an orderly market arrangement for a further two

years thereafter.

The Deferred Consideration of up to GBP7.5 million will be paid

based on business generated for the Group and profits of Willow

Pumps over the next five years as follows:

I. Up to GBP3.75 million will be paid at the rate of up to

GBP750,000 per annum on a pro-rata basis for every GBP3.0 million

per annum of additional pump and related drainage business that

Willow Pumps generates for Metro Rod for each of the five financial

years ending 31 December 2020 to 2024 (inclusive) ("Further

Consideration"). Therefore, to achieve payment in full,

subcontracted work to Metro Rod would need to have grown by GBP3.0

million per annum and be GBP15.0 million or more in the year ending

31 December 2024. The Further Consideration will be calculated and

will be payable annually. The Further Consideration is capped at

GBP750,000 per annum and GBP3.75 million in total.

II. Up to GBP3.75 million will be paid at the rate of up to

GBP750,000 per annum on a pro-rata basis for every GBP250,000 by

which additional maintainable profits after tax ("PAT") of Willow

Pumps exceed GBP1.0 million in each of the five financial years

ending 31 December 2020 to 2024 (inclusive) ("Additional

Consideration"). Therefore, to achieve payment in full, PAT will

have to grow to GBP2.25 million by the year ending 31 December

2024. For this purpose, maintainable PAT is the PAT excluding items

of income or expenditure of a non-recurring, unusual, exceptional

or one-off nature. The Additional Consideration will be calculated

and agreed annually based on the actual growth in maintainable PAT

in each year and will be payable on finalisation of the

consolidated accounts of Willow Pumps for the year ending 31

December 2022 in respect of the first three years (capped at

GBP2.25 million) and on the finalisation of those accounts for the

year ending 31 December 2024 in respect of the fourth and fifth

years (capped at GBP1.5 million).

III. The Further Consideration and Additional Consideration will

be payable in cash, subject to the Company having the right to

settle 20 per cent. of the amount due in new Ordinary Shares at the

then prevailing share price.

Group trading update

The second half of the financial year ending 31 December 2019

has started encouragingly, with momentum being maintained in Metro

Rod's Systems Sales growth with an increase year-to-date of 15 per

cent. (2018: 6 per cent.). Metro Rod franchisees continue to invest

in their businesses, including the continued expansion of the

tanker fleet. The first of our new Vision 2023 depots is also due

to open shortly in Lincoln. As a result of the growing pipeline of

candidates we have developed, the number of Metro Rod franchise

businesses (or territories) being purchased by ambitious new owners

is accelerating. We are particularly pleased to welcome the first

ever Metro Rod franchisee in Northern Ireland, who began trading on

1 October 2019.

Across our B2C brands, we continue to see an improvement in

franchise recruitment. Year-to-date we have recruited 54 new

franchisees (2018: 49) at ChipsAway, Ovenclean and Barking Mad.

Barking Mad experienced a particularly strong third quarter

following the management change in June.

This good trading performance together with strong momentum

across the Group means that the Board looks forward to the

remainder of the year with confidence.

Issue of equity and change to Total Voting Rights

Application will be made to the London Stock Exchange for the

Consideration Shares to be admitted to trading on AIM

("Admission"). It is expected that Admission will take place on or

around 10 October 2019.

With the issue of the Consideration Shares, the total number of

Ordinary Shares of 0.5p each in the Company in issue is now

79,339,544. There are 25,000 Ordinary Shares held in treasury and

so the total number of voting rights in the Company is 79,314,544.

This figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Enquiries:

+ 44 (0) 1562

Franchise Brands plc 826705

Stephen Hemsley, Executive Chairman

Chris Dent, Chief Financial Officer

Julia Choudhury, Corporate Development

Director

Allenby Capital Limited (Nominated Adviser +44 (0) 20 3328

and Joint Broker) 5656

Jeremy Porter / Liz Kirchner / Nicholas

Chambers

+44 (0) 20 3903

Dowgate Capital Limited (Joint Broker) 7715

James Serjeant / Colin Climie

+44 (0) 20 3128

MHP Communications (Financial PR) 8100

Katie Hunt / Patrick Hanrahan

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQMFBMTMBJMTJL

(END) Dow Jones Newswires

October 07, 2019 02:00 ET (06:00 GMT)

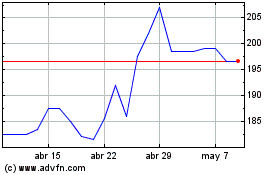

Franchise Brands (LSE:FRAN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Franchise Brands (LSE:FRAN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024