TIDMBT.A

RNS Number : 7069R

BT Group PLC

31 October 2019

Financial results

Results for the half year to 30 September 2019

BT Group plc

31 October 2019

BT Group plc (BT.L) today announced its results for the half

year to 30 September 2019.

Key strategic developments:

-- Launched a host of new products for consumer and business

segments, including the new Halo converged product plans and BT

Mobile 5G

-- Introduced a range of new service initiatives including

bringing the BT brand to the high street in over 600 EE/BT

dual-branded stores, and to answer 100% of customer calls in the UK

& Ireland from January 2020

-- Continued to make progress on the BT modernisation agenda,

including delivering over GBP1.1bn transformation benefits,

announcing the first locations in our Better Workplace Programme,

and disposal of BT Fleet Solutions

-- Outlined our Skills for Tomorrow programme to provide digital

skills training for 10m UK children, families and businesses

Operational:

-- 5G network live in over 20 cities and large towns; 5G

smartphone plans now available on both EE and BT brands

-- Openreach announced the launch of new FTTP 1Gbps and 550Mbps

products. FTTP rollout at c.23k premises passed per week; 4.2m

ultrafast (FTTP and Gfast) premises passed to date; currently

announced plans to build FTTP in 103 locations

-- Consumer fixed ARPC GBP38.5, broadly flat year on year;

postpaid mobile ARPC GBP20.8, down 5.5% year on year due to impact

of regulation and continued trend towards SIM-only; RGUs per

address up to 2.38

-- Postpaid mobile churn remains low at 1.2% in Q2 despite

impact of auto switching; fixed churn at 1.3% in Q2 down from 1.6%

in prior year

Financial:

-- Reported revenue GBP11,467m, down 1%(1) mainly reflecting the

impact of regulation, declines in legacy products, and

strategically reducing low margin business

-- Reported profit before tax GBP1,333m, broadly flat year on

year; adjusted(2) EBITDA GBP3,923m, down 3%(1) due to lower

revenues, increased spectrum fees, content costs and investment to

improve competitive positioning partly offset by cost savings from

transformation programmes

-- Net cash inflow from operating activities of GBP2,173m;

normalised free cash flow(2) of GBP604m, down 38% due to increased

capital expenditure, higher interest and tax payments, partially

offset by one-off cash flows

-- Capital expenditure GBP1,882m. Up GBP225m excluding BDUK

grant funding deferral, driven by increased network investment

-- Net debt(2) increased primarily due to implementation of IFRS

16, GBP6.1bn, and net business cash outflows, GBP1.2bn

-- Interim dividend of 4.62p per share; 30% of last year's

full-year dividend of 15.4p per share

-- Overall financial outlook maintained

Philip Jansen, Chief Executive, commenting on the results, said

"BT delivered results in line with our expectations for the second

quarter and first half of the year, and we remain on track to

meet our outlook for the full year.

"We've invested to strengthen our competitive position. We've

accelerated our 5G and FTTP rollouts, introduced an enhanced range

of product and service initiatives for both consumer and business

segments, and announced price and technology commitments to deliver

fair, predictable and competitive pricing for customers.

"Openreach is significantly accelerating its pace of FTTP build

and is now passing a home or business every 26 seconds. Openreach

announced a further 29 locations in its build plan to reach 4m

premises by March 2021, and we continue to make positive progress

with Government and Ofcom on the enablers to stimulate further

investment in full fibre.

"We continue to make progress on the BT modernisation agenda,

delivering over GBP1.1bn in annualised cost savings, and announcing

locations in our Better Workplace Programme."

==========

Half year to 30 September 2019 2018 2018 Change(1)

(IFRS 16) (IAS 17) (IFRS 16

pro forma(2)

)

============================== ===== =========== ========== =============== ==========

GBPm GBPm GBPm %

============================== ===== =========== ========== =============== ==========

Reported measures

Revenue 11,467 11,588 (1)

Profit before tax 1,333 1,340 n/m

Profit after tax 1,068 1,052 n/m

Basic earnings per share 10.8p 10.6p 2

Net cash inflow from operating

activities 2,173 754 188

Interim dividend 4.62p 4.62p -

Capital expenditure 1,882 1,833 3

Adjusted measures

Adjusted(2) revenue 11,413 11,624 11,624 (2)

Adjusted(2) EBITDA 3,923 3,675 4,038 (3)

Normalised free cash

flow(2) 604 974 974 (38)

Net debt(2) 18,347 11,895 n/m

===================================== =========== ========== =============== ==========

Customer-facing unit results for the half year to 30 September

2019

Adjusted(1) revenue Adjusted(1) EBITDA Normalised free cash

flow(1)

================================= ================================

Half year 2019 2018(2) Change 2019 2018(2) Change 2019 2018(2) Change

to

30 September (IFRS (IFRS (IFRS (IFRS (IFRS (IFRS

16) 16 16) 16 16) 16

pro forma(1) pro forma(1) pro forma(1)

) ) )

GBPm GBPm % GBPm GBPm % GBPm GBPm %

================ ======== ============== ======= ======= ============== ======= ======= ============== =======

Consumer 5,194 5,224 (1) 1,180 1,237 (5) 534 617 (13)

Enterprise 3,055 3,221 (5) 968 1,003 (3) 630 564 12

Global 2,196 2,332 (6) 304 255 19 40 (74) 154

Openreach 2,536 2,548 - 1,417 1,478 (4) 197 448 (56)

Other - 2 n/m 54 65 (17) (797) (581) (37)

Intra-group

items (1,568) (1,703) 8 - - - - - -

================ ======== ============== ======= ======= ============== ======= ======= ============== =======

Total 11,413 11,624 (2) 3,923 4,038 (3) 604 974 (38)

================ ======== ============== ======= ======= ============== ======= ======= ============== =======

Second quarter

to 30 September

================ ======== ============== ======= ======= ============== ======= ======= ============== =======

Consumer 2,644 2,654 - 592 617 (4)

Enterprise 1,539 1,633 (6) 497 517 (4)

Global 1,111 1,185 (6) 164 136 21

Openreach 1,268 1,293 (2) 700 761 (8)

Other (1) 1 n/m 12 27 (56)

Intra-group

items (781) (858) 9 - - -

================ ======== ============== ======= ======= ============== ======= ======= ============== =======

Total 5,780 5,908 (2) 1,965 2,058 (5) 281 467 (40)

================ ======== ============== ======= ======= ============== ======= ======= ============== =======

(1) See Glossary below

(2) Segmental results as reported in the Q2 2018/19 results

release have been restated to reflect i) the bringing together of

our Business and Public Sector and Wholesale and Ventures

customer-facing units into a single customer-facing unit,

Enterprise, on 1 October 2018; the transfer of our Northern Ireland

Networks business from Enterprise to Openreach and reclassification

of certain internal revenues generated by our Ventures businesses

as segmental revenue rather than internal recovery of cost; (see

press release on 17 January 2019) and ii) the change in the

allocation of group overhead costs and the transfer of the

Emergency Services Network contract from Consumer to Enterprise

(see press release on 3 July 2019)

n/m = not meaningful

Glossary of alternative performance measures

Adjusted Before specific items

EBITDA Earnings before interest, tax, depreciation and amortisation

Adjusted EBITDA EBITDA before specific items, share of post tax profits/losses

of associates and joint ventures and net non-interest

related finance expense

Free cash flow Net cash inflow from operating activities after net

capital expenditure

Capital expenditure Additions to property, plant and equipment and intangible

assets in the period

Normalised free Free cash flow after net interest paid and payment

cash flow of lease liabilities, before pension deficit payments

(including the cash tax benefit of pension deficit

payments) and specific items

Net debt Loans and other borrowings and lease liabilities

(both current and non-current), less current asset

investments and cash and cash equivalents. Currency

denominated balances within net debt are translated

into sterling at swapped rates where hedged. Fair

value adjustments and accrued interest applied to

reflect the effective interest method are removed

IFRS 16 pro forma On 1 April 2019, BT adopted IFRS 16 Leases, which

replaced IAS 17 Leases. To aid comparability, pro

forma financial information for 2018/19 has been

presented to reflect how the results would have looked

like if the accounting standard had been adopted

last year. See page 9 for more details.

Specific items Items that in management's judgement need to be disclosed

separately by virtue of their size, nature or incidence.

Further information is provided in note 6 on page

25

==================== ===============================================================

We assess the performance of the group using a variety of

alternative performance measures. The rationale for using adjusted

measures is explained in note 1 on page 32. Results on an adjusted

basis are presented before specific items. Reconciliations from the

most directly comparable IFRS measures are in Additional

Information on pages 32 to 34.

Enquiries

Press office:

Tom Engel Tel: 020 7356 5369

Investor relations:

Mark Lidiard Tel: 020 7356 4909

We will hold a conference call for analysts and investors in

London at 9am today and a simultaneous webcast will be available at

www.bt.com/results

We are scheduled to announce the third quarter results for

2019/20 on 30 January 2020.

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/7069R_1-2019-10-30.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR WGGMCUUPBGBU

(END) Dow Jones Newswires

October 31, 2019 03:00 ET (07:00 GMT)

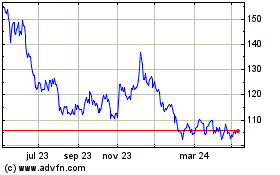

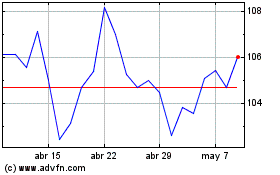

Bt (LSE:BT.A)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bt (LSE:BT.A)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024