UniCredit to Sell About 12% in Turkish Bank Yapi Kredi

05 Febrero 2020 - 11:59AM

Noticias Dow Jones

By Cristina Roca

UniCredit SpA (UCG.MI) said Wednesday that it will place a part

of its stake in Turkey's Yapi ve Kredi Bankasi AS (YKBNK.IS) after

becoming a direct shareholder in the bank following the completion

of a deal aimed at simplifying its structure.

The Italian bank said it has launched a placement for shares

representing around 12% of Yapi Kredi's capital via accelerated

bookbuilding.

The move follows Wednesday's closing of a deal through which

Italy's largest bank simultaneously became a direct shareholder in

Yapi Kredi, in which it previously held shares via a joint venture,

and cut its stake in it down to 31.9%.

The Istanbul-listed lender has a market value of 25.6 billion

Turkish lira ($4.28 billion).

Unicredit's move to further reduce its shareholding in Yapi

Kredi is part of the bank's continued strategy to optimize its

capital allocation, the company said.

Analysts believe UniCredit is preparing to potentially exit

Turkey altogether.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

February 05, 2020 12:44 ET (17:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

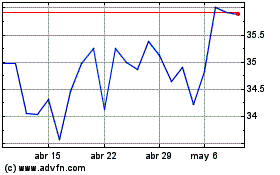

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De May 2023 a May 2024