TIDMPRES

RNS Number : 7162Q

Pressure Technologies PLC

23 June 2020

23 June 2020

Pressure Technologies plc

("Pressure Technologies" or the "Group")

2020 Interim Results

Pressure Technologies (AIM: PRES), the specialist engineering

group, announces its interim results for the 26 weeks to 28 March

2020.

Financial Highlights*

-- Group revenue of GBP13.9 million (2019: GBP14.5 million)

-- Gross profit of GBP4.0 million (2019: GBP5.0 million)

-- Adjusted operating loss of GBP(0.1) million (2019: profit

GBP1.3 million)

-- Reported loss before tax of GBP(1.5) million (2019:

profit GBP0.1 million)

-- Reported basic loss per share of (5.9)p (2019: earnings

per share 1.6p)

-- Adjusted operating cash inflow** of GBP1.4 million (2019:

outflow GBP1.6 million)

-- Bank facility drawn at GBP9.3 million (2019: GBP10.8

million)

-- Bank facility covenants relaxed to give flexibility

during period of Covid-19 uncertainty

-- Post period end GBP0.6 million cash proceeds from the

sale of 2.5 million shares in Greenlane Renewables Inc.

* All results presented for continuing operations only

** Continuing operations only excluding cash outflow for

exceptional costs

Operational Highlights

-- Overall Group revenue was significantly lower than prior

year period due to phasing of large defence contracts and

the impact of Covid-19 restrictions in March 2020

-- Strong order intake in PMC underpinned a 12% increase in

external revenue, while operational delivery issues and increased

indirect costs adversely impacted margin performance

-- Significant improvement of on-time delivery performance in

PMC, with lower levels of overdue orders, shorter lead times

and higher customer satisfaction levels

-- PMC order book in excess of GBP5.0 million at the half-year

end, but recent intake levels lower than run rate, with uncertainty

in oil and gas markets expected to continue through the second

half

-- Loss-making Quadscot site closed in June 2020, with orderbook

and customers transferred and consolidated into other PMC

sites

-- Growing diversification and sustainability in both divisions,

with further progress made in new customer acquisitions,

long-term supplier agreements and new market development

-- Five-year framework agreement secured by CSC with Shell to

become their approved supplier of ultra-large cylinders for

hydrogen refuelling stations across Europe

-- Continued investment in people and HR practices, helping

to drive cultural change that is delivering stronger colleague

engagement and improvements to customer service

-- Current capital investment programme completed, with GBP1.2

million spent across both divisions on new machining centres

and IT infrastructure

Chris Walters, Chief Executive of Pressure Technologies

commented:

"The operational changes and strategic progress made over the

past year have put the Group in a stronger position to face the

challenges and uncertainty in the current trading environment.

The impact of Covid-19 continues to be felt to varying degrees

across our markets. Strong order books in both divisions at the

half year are encouraging, but it remains difficult to foresee how

the pandemic and an uncertain oil and gas market will impact

performance throughout the remainder of the year, particularly in

the PMC division.

Management actions will seek to preserve cash and core

capability in the business, without undermining the strategic and

operational progress already made in both divisions to establish

resilience and a foundation for future growth. New long-term

strategic supply agreements with key customers demonstrate the

progress being made and we remain focussed on advancing further

with the Group's strategic plans .

I am proud to see the tremendous commitment and hard work of our

teams across the Group as we continue to support business

continuity for our customers during this period."

For further information, please contact:

Pressure Technologies plc Tel: 0114 257 3616 PressureTechnologies@houston.co.uk

Chris Walters, Chief Executive

Joanna Allen, Chief Financial

Officer

N+1 Singer (Nomad and Broker) Tel: 0207 496 3000

Mark Taylor / Carlo Spingardi

Houston (Financial PR and Investor Tel: 0203 701 7660

Relations)

Kate Hoare / Anushka Mathew /

Ben Robinson

COMPANY DESCRIPTION

www.pressuretechnologies.com

With its head office in Sheffield, the Pressure Technologies

Group was founded on its leading market position as a designer and

manufacturer of high-integrity, safety-critical components and

systems serving global supply chains in oil and gas, defence,

industrial gases and hydrogen energy markets.

The Group has two divisions, Chesterfield Special Cylinders and

Precision Machined Components.

Chesterfield Special Cylinders (CSC) -

www.chesterfieldcylinders.com

-- Chesterfield Special Cylinders, Sheffield, includes CSC

Deutschland GmbH and Chesterfield Special Cylinders Inc.

Precision Machined Components (PMC) - www.pt-pmc.com

-- Precision Machined Components includes the Al-Met, Roota

Engineering, Quadscot Precision Engineers and Martract brands.

CHAIRMAN'S STATEMENT

Having joined the Board of Pressure Technologies in January

2020, my first few months as Chairman have given me a good insight

into this business as we continue to navigate through unprecedented

times. Pressure Technologies has a long heritage in the markets

that it serves and under new leadership the Group has outlined a

clear growth strategy to realise its significant potential and good

progress is being made.

Covid-19 has brought challenges to nearly all global industries

and few businesses are immune. I would like to acknowledge the hard

work of our employees and the support from our valued customers and

suppliers. Businesses and their employees are being truly tested

and I have been impressed and reassured by the leadership and the

commitment shown by all colleagues to maintain safety and business

continuity throughout this recent period.

While the crisis has resulted in economic headwinds and

uncertainty for some of our markets and customers, t he operational

changes and strategic progress made over the past year have helped

put the Group in a stronger position to cope with the

uncertainty.

TRADING REVIEW

Overall Group revenue for the period was GBP13.9 million (2019:

GBP14.5 million), gross profit GBP4.0 million (2019: GBP5.0

million) resulting in an overall adjusted operating loss of GBP0.1

million (2019: profit GBP1.3 million).

The Chesterfield Special Cylinders division (CSC) delivered

revenue of GBP6.3 million (2019: GBP7.7 million) and an adjusted

operating profit of GBP0.4 million (2019: GBP1.4 million), both in

line with expectations and reflecting the phasing of large defence

contracts between half-year periods. Gross margin of 33% (2019:

39%) reflected the expected margins for sectors supplied in the

period and at the period end GBP2.8m of contracted revenue remains

to be invoiced on projects which are in progress. Return on sales

was 7% (2019: 18%).

Strong order intake within the Precision Machined Components

division (PMC) over the past six months across a broadening

customer base underpinned a 12% increase in external revenue to

GBP7.6 million (2019: GBP6.8 million). Despite this progress, a

significant delay to the output of new large complex components,

the onboarding of new customers and the late commissioning of new

machining centres adversely impacted gross margins in the first

quarter. Recovery of output and margin performance in the second

quarter was slower than expected and gross margin reduced to 25%

for the first half (2019: 31%). This, along with higher indirect

costs from the investment in sales and engineering functions,

resulted in a significantly lower adjusted operating profit of

GBP0.3 million (2019: GBP0.8 million) and return on sales was 4%

(2019: 11%).

Over the past six months, we have continued to demonstrate the

strategic potential in both divisions, with increased sales from

existing customers across a broader product range, new customer

acquisitions and major contract wins in target markets.

CHESTERFIELD SPECIAL CYLINDERS

Significant management changes in December 2019 have already

helped drive operational improvements, better customer service and

stronger colleague engagement across the division.

We continue to make good progress with UK and export naval

contracts, which will see us supply bespoke, safety critical

systems for the UK's Dreadnought submarine and Type-26 frigate

programmes as well as the French navy's Barracuda programme. In

June 2020, CSC has secured an order for the supply of cylinders to

the Dreadnought class submarine programme, covering the raw

material milestone for the second boat set which confirms

commitment from UK MOD and BAE Systems to the programme.

Allied to this activity, is our market development of

prospective Asian customers, including a collaboration on a

significant new build submarine programme.

We remain on track to complete the significant contract with EDF

Energy for the supply of high-pressure nitrogen storage solutions

to four UK nuclear power stations. This sector remains a focus area

for further growth, with good prospects in the pipeline.

Despite several opportunities in late 2019, the oil and gas

market has deteriorated sharply, with several ultra-large cylinder

prospects being deferred to 2021 and beyond. Further progress was

made during the period in the hydrogen refuelling market, which

remains an area of strategic focus and significant growth

potential. Recent contract wins for McPhy Energy and Haskel

Hydrogen Systems represent continued market penetration within this

growing market.

In May 2020, CSC was also pleased to be awarded a GBP0.6 million

revenue contract by a new customer, Parker, to provide ultra-large

cylinders for a major wastewater treatment project in Abu Dhabi.

This significant contract represents a new market for CSC's

ultra-large cylinders and through-life support services.

As testament to the progress made in this sector, since the

period end we were pleased to have signed a five-year framework

agreement with Shell, under which CSC becomes the approved supplier

of Type 1 steel cylinders to prospective operators of Shell-branded

hydrogen refuelling stations across Europe. While the number of

potential refuelling stations to be built over the next few years

remains uncertain, the selection of CSC as preferred supplier is a

major strategic step.

Integrity Management services performed well during the period,

with new contract wins for in-situ revalidation projects and

testing of diving support vessels in Azerbaijan and Dubai. These

services are highly valued by existing customers and have

tremendous growth potential in the UK and worldwide. However,

Covid-19 enforced travel restrictions towards the end of March 2020

caused disruption and delays, with the deferral of several

deployments, albeit some UK defence related deployments have been

able to continue in line with supporting national infrastructure

during the Covid-19 outbreak. We anticipate that Covid-19

restrictions will continue to impact performance in the second half

of the year, but periodic inspection regimes will require

revalidation once travel restrictions are safely lifted.

PRECISION MACHINED COMPONENTS

The operating result in the period was disappointing, however we

continue to make strategic progress across this division as changes

made over the past year deliver operational improvements. The

divisional leadership structure and new management appointments are

driving important cultural change that is more focused on

performance and customer service.

A stronger sales team and maturing sales processes have

underpinned increased sales effectiveness and better customer

relationship management. This has been evidenced primarily through

an increase in sales revenue and order intake in the period, but

also through positive customer feedback and new customer

acquisition. At the end of the first half of the year, the PMC

order book value was in excess of GBP5.0 million however intake has

fluctuated in Q3 and there is uncertainty in orderbook development

which is expected to continue through the second half.

Investment in new skills and systems for production planning,

engineering, quality control and purchasing functions are starting

to show returns through operational efficiencies, better

utilisation, cost savings and margin improvements, significantly

improving on-time delivery performance for key customers during the

period.

Oil and gas remains the primary market for this division and

excellent progress has been made to extend and diversify the

customer base within this market. We have made further progress

over the period in strengthening our relationships with our major

OEM customers in these markets and remain focused on achieving key

supplier status to these accounts as they look to rationalise their

supplier base.

Dominance of the top three customers by revenue has also reduced

from 83% to 69% over the last two years. Diversification of product

scope also continues, with a far broader range of components now

being delivered to established and newly acquired customers. With

the current low oil price impacting demand for drilling and

exploration projects, we have increased our focus on

decommissioning opportunities and accelerated our evaluation of new

geographies and adjacent markets, such as renewable energy, nuclear

power and defence, where we have an established customer base with

CSC.

In December 2019, we reported that further changes had been made

to improve operational and financial performance at the Quadscot

Precision Engineers facility in Blantyre, South Lanarkshire, after

more than four years of loss-making performance. These changes

failed to deliver significant improvement and the decision was

taken to consolidate Quadscot's operations, order book and

customers into the Roota Engineering facility in Rotherham, South

Yorkshire. This decision followed a period of collective staff

consultation that concluded on 12 June 2020 and the site is now

closed.

BALANCE SHEET AND LIQUIDITY

As at 28 March 2020 the Group's GBP12.0 million Revolving Credit

Facility (RCF) was drawn at GBP9.3 million, down from GBP10.8

million at 28 September 2019. Cash and cash equivalents increased

in the period to GBP2.6 million (28 September 2019: GBP2.2 million)

taking the net RCF debt down from GBP8.6 million at 28 September

2019 to GBP6.7 million at 28 March 2020. The reduction in net RCF

debt is predominantly due to the receipt in February 2020 of a

GBP2.1 million repayment of the Greenlane Renewables Inc.

Promissory Note and associated interest which was used to repay a

tranche of drawn RCF. Positive operating cash inflow has been

partially utilised in net capital investment of GBP0.7 million,

leaving a GBP0.4 million increase in cash and cash equivalents in

the period.

Finance leases at 28 March 2020 totalled GBP2.9 million, up

slightly from GBP2.8 million at 28 September 2019 with further

leases of GBP0.5 million for key capital equipment in PMC off-set

by lease repayments in the period.

IFRS 16 was adopted in the period and as a result GBP1.2 million

of 'Right-of-use asset' debt has been recognised in respect of the

leases, predominantly in respect of property, that were previously

classed as operating leases.

Total net borrowings, excluding right of use assets, has

therefore reduced to GBP9.6 million at 28 March 2020 from GBP11.4

million at 28 September 2019.

We continue to be in regular and constructive dialogue with

Lloyds Bank regarding ongoing facility requirements and the impact

of Covid-19 disruption on operations and the leverage covenant,

which is tested quarterly. In support of the Group, Lloyds Bank

have agreed a waiver of the June 2020 test and an increase in the

test point for the September and December 2020 quarter ends, to

give additional headroom given the uncertainty in the outlook for

EBITDA and associated cash flow.

The Directors have assessed the risks presented by Covid-19 and

reforecast the original 2020 Budget and the 2021 and 2022

Projections ("the forecasts") to reflect the current and likely

future impact of Covid-19 on the Group's operations and financial

results.

These baseline forecasts reflect:

-- Limited impact of Covid-19 on the CSC division, other than a

significant temporary reduction in the level of Integrity

Management business due to UK and global travel restrictions and

potential supply chain disruption

-- Some reductions in the level of activity across the PMC

division as a result of Covid-19, reflecting the impact of a

reduction in revenue, supply chain disruption and some limited

employee absence

-- The enactment of a number of cash deferral measures

Throughout the forecast period, the Group generates underlying

operating profit and is cash-generative, and along with the

amendments to the RCF, therefore believe there is sufficient

liquidity and covenant headroom for the foreseeable future.

On 15 June 2020, the Group received un-forecast cash proceeds of

GBP0.6 million from the sale of 2,525,610 shares in Greenlane

Renewables Inc. ('Greenlane') which has further reduced the drawn

RCF debt at 22 June 2020 to GBP8.9 million. The Group continues

with its strategy to liquidate its remaining investment in

Greenlane at the earliest opportunity.

COVID-19

As a supplier to customers who support UK Critical National

Infrastructure and Strategic Defence Contracts, we have worked hard

to ensure business continuity whilst maintaining our primary focus

on safeguarding the health and wellbeing of our teams.

We have written and implemented specific policies which have

successfully allowed us to adapt working practices to meet UK

government guidelines on workforce protection, enabling social

distancing across all our facilities, encouraging working from home

wherever roles permit and promoting employee health and wellbeing

across the business. Investments made in our central group

functions including Human Resources and IT infrastructure over the

course of the previous year have underpinned the support we have

been able to offer our teams through this difficult period,

reinforced by regular and open communications with colleagues

working both on site and at home.

Whilst both divisions experienced some early operational

disruption and capacity issues during March as the UK entered

lockdown, we have been able to keep all sites open and operational,

working on the basis of 'business as usual, with caution'.

It remains difficult to predict the duration and severity of the

impact that Covid-19 will have on the business. We have continued

to support our customers, maintaining close dialogue with them

throughout the period and remain focused on safely delivering their

orders. However, our Integrity Management business in the CSC

division continues to be impacted by the domestic and international

travel restrictions which have resulted in the postponement of

several deployments. Whilst some domestic deployments are now

resuming as UK lockdown restrictions begin to lift, these will

continue to be limited due to the necessary ongoing health and

safety constraints.

This uncertainty is compounded by a depressed oil price which

has resulted in some oil and gas customers deferring project spend

and applying pricing pressure throughout the supply chain. We

continue to monitor this closely and remain focused on the

diversification of our customer portfolio, in line with our growth

strategy.

Whilst this uncertainty remains, we are taking a number of

prudent measures to manage cost and conserve cash and core

capability in the business without undermining the progress already

made in both divisions to establish resilience and a foundation for

future growth in strategic focus areas. We continue to review

possible scenarios should there be further changes to trading

conditions and will take actions should the market conditions

require us to do so.

HEALTH AND SAFETY

On 26 November 2019, the Group confirmed that its CSC business

had been found guilty of a charge brought by the Health &

Safety Executive (HSE) pursuant to Section 2 of the Health and

Safety at Work Act 1974 following a fatal accident in June 2015. On

13 January 2020, the Group was sentenced to a fine of GBP0.7

million along with prosecution costs of GBP0.2 million. The Company

has been given by the Court a period of four years over which to

pay the combined fine and costs, which it will do from operational

cash flows. The Group fully respects the verdict of the jury and

deeply regrets the events that resulted in the death of our

colleague and long-standing employee John Townsend, which has left

a terrible gap in the lives of his family, friends and colleagues,

with whom our deepest sympathies remain.

This tragic incident occurred over five years ago in June 2015

and in the period since then we have made significant changes and

improvements to the way we operate at the CSC site and across all

Group sites. The health and safety of our people is of paramount

importance and these enhanced measures, which are being

consistently applied across the business, will help ensure that

this is continually reinforced throughout every area of our

operations. We will continually assess our health and safety

measures and implement changes where necessary.

Following several key Health and Safety personnel appointments

across the PMC business last year, we have been pleased to see

significant improvements in our health and safety maturity and KPIs

for the division. The appointment of a new Health and Safety

Manager at CSC at the end of the period completes the strengthening

of our Quality, Health, Safety and Environmental teams and supports

effective safety leadership that underpin our commitment to the

highest safety standards across the Group.

BOARD

I was delighted to join the Board of Pressure Technologies in

January 2020. The Group has a long heritage in its core markets,

and I look forward to working with the Executive team and my fellow

Non-Executive Directors as the Group continues to make further

progress against its strategy for growth. I would particularly like

to thank Neil MacDonald for his services to the group since his

appointment in June 2013 and wish him well on his retirement from

the Board.

As part of our plans to further strengthen the Board and

reinforce governance, the Group was pleased to announce the

appointment of Tim Cooper as Non-Executive Director in January 2020

and today confirms that Mike Butterworth will join the Board as

Non-Executive Director and Chair of the Audit and Risk Committee

with immediate effect. Both Tim and Mike bring complementary skills

and experience which will be invaluable as we grow the business and

realise its significant potential.

OUTLOOK

The impact of Covid-19 continues to be felt to varying degrees

across our markets and uncertainty remains over the pace of

recovery and possible operational disruption. Both divisions remain

in close contact with customers and suppliers and we will continue

to take all appropriate steps to maintain business continuity and

safely deliver customer orders.

Despite strong order books in both divisions at the half year,

it remains difficult to predict the length and depth that the

impact of Covid-19 and oil and gas market uncertainty will have on

performance throughout the remainder of the year.

The PMC order book is currently valued in excess of GBP4.0

million. Order intake since the half-year end has been lower than

run rate, but we are encouraged by recent levels of enquiry and

pipeline development alongside new strategic supply agreements with

key OEM customers. With a solid defence order book and recent major

orders from target sectors, the outlook for CSC remains positive,

notwithstanding the delays to Integrity Management projects due to

Covid-19 restrictions.

Whilst the Board continues to review possible scenarios and

determine the actions we may take as the outlook becomes clearer,

market forecasts remain withdrawn. Management actions will seek to

preserve cash and core capability in the business without

undermining the progress already made in both divisions to

establish resilience and a foundation for future growth in

strategic focus areas.

The Group remains focussed on delivering further progress

against its strategic plans as the year progresses.

Sir Roy Gardner

Chairman

Condensed Consolidated Statement of Comprehensive Income

For the 26 weeks ended 28 March 2020

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

Notes GBP'000 GBP'000 GBP'000

Revenue from continuing operations 4 13,901 14,484 28,291

Cost of sales (9,924) (9,440) (19,119)

Gross profit 3,977 5,044 9,172

Administration expenses (4,038) (3,696) (6,938)

Operating (loss)/profit before amortisation

and exceptional charges (61) 1,348 2,234

Separately disclosed items of administrative

expenses:

Amortisation 5 (932) (911) (1,832)

Other exceptional charges 6 (956) (122) (450)

Operating (loss)/profit from continuing

operations (1,949) 315 (48)

Finance costs (102) (226) (467)

Other financial items 7 578 - -

(Loss)/profit before taxation from

continuing operations (1,473) 89 (515)

Taxation 8 372 209 126

(Loss)/profit for the period from

continuing operations (1,101) 298 (389)

Discontinued operations

Loss for the period from discontinued

operations - (2,338) (1,203)

Loss for the period attributable

to owners of the parent (1,101) (2,040) (1,592)

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss:

Currency transaction differences

on translation of foreign operations (10) 117 (140)

Other comprehensive income not to

be reclassified to profit or loss

in subsequent periods:

Exchange differences on translation

of discontinued foreign operations - - 325

Total comprehensive income for the

period attributable to the owners

of the parent (1,111) (1,923) (1,407)

Basic (loss)/earnings per share

From continuing operations 9 (5.9)p 1.6p (2.1)p

From discontinued operations 9 - (12.6)p (6.5)p

From loss for the period (5.9)p (11.0)p (8.6)p

Diluted (loss)/earnings per share

From continuing operations 9 (5.9)p 1.6p (2.1)p

From discontinued operations 9 - (12.6)p (6.5)p

From loss for the period (5.9)p (11.0)p (8.6)p

Condensed Consolidated Statement Of Financial Position

As at 28 March 2020

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 10 9,510 9,510 9,510

Intangible assets 10 5,715 7,298 6,598

Property, plant and equipment and

right of use assets 10 15,711 12,355 14,042

Deferred tax asset 278 402 278

Asset held for sale - 6,801 -

Other long-term financial assets 5,928 - 7,350

37,142 36,366 37,778

Current assets

Inventories 6,665 4,276 5,115

Trade and other receivables 12,284 8,244 9,541

Cash and cash equivalents 11 2,598 4,363 2,208

Current tax 221 28 95

21,768 16,911 16,959

Total assets 58,910 53,277 54,737

Current liabilities

Trade and other payables (12,325) (6,389) (7,360)

Borrowings - asset finance and right

of use asset leases 11 (1,026) (365) (656)

Borrowings - revolving credit facility 11 - - (10,800)

Current tax liabilities - (1) -

(13,351) (6,755) (18,816)

Non-current liabilities

Other payables (698) (178) (158)

Borrowings - asset finance and right

of use asset leases 11 (3,102) (1,571) (2,116)

Borrowings - revolving credit facility 11 (9,319) (11,800) -

Deferred tax liabilities (1,411) (1,449) (1,561)

(14,530) (14,998) (3,835)

Total liabilities (27,881) (21,753) (22,651)

Net assets 31,029 31,524 32,086

Equity

Share capital 930 930 930

Share premium account 26,172 26,172 26,172

Translation reserve (290) (348) (280)

Retained earnings 4,217 4,770 5,264

Total equity 31,029 31,524 32,086

Condensed Consolidated Statement of Changes in Equity

For the 26 weeks ended 28 March 2020

Profit

Share and

Share premium Translation loss Total

capital account reserve account equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 28 September 2019 (audited) 930 26,172 (280) 5,264 32,086

Share based payments - - - 54 54

Transactions with owners - - - 54 54

Loss for the period - continuing

operations - - - (1,101) (1,101)

Exchange differences arising on

retranslation of foreign operations - - (10) - (10)

Total comprehensive income - - (10) (1,101) (1,111)

Balance at 28 March 2020 (unaudited) 930 26,172 (290) 4,217 31,029

For the 26 weeks ended 30 March 2019

Profit

Share and

Share premium Translation loss Total

capital account reserve account equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 29 September 2018 (audited) 930 26,172 (465) 6,756 33,393

Share based payments - - - 54 54

Transactions with owners - - - 54 54

Profit for the period - continuing

operations - - - 298 298

Loss for the period - discontinued

operations - - - (2,338) (2,338)

Exchange differences arising on

retranslation of foreign operations - - 117 - 117

Total comprehensive income - - 117 (2,040) (1,923)

Balance at 30 March 2019 (unaudited) 930 26,172 (348) 4,770 31,524

Condensed Consolidated Statement of Changes in Equity

(continued)

For the 26 weeks ended 28 March 2020

Share Profit

Share premium Translation and loss Total

capital account reserve account equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 29 September 2018 (audited) 930 26,172 (465) 6,756 33,393

Share based payments - - - 100 100

Transactions with owners - - - 100 100

Loss for the period - continuing

operations - - - (389) (389)

Loss for the period - discontinued

operations - - - (1,203) (1,203)

Exchange differences arising on

translating foreign operations - - (140) - (140)

Exchange differences on translation

of discontinued foreign operations - - 325 - 325

Total comprehensive income - - 185 (1,592) (1,407)

Balance at 28 September 2019 (audited) 930 26,172 (280) 5,264 32,086

Condensed Consolidated Cash Flow Statement

For the 26 weeks ended 28 March 2020

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit after tax - continuing

operations (1,101) 298 (389)

Loss after tax - discontinued operations - (2,338) (1,203)

Adjustments for:

Depreciation of property, plant and

equipment 855 656 1,377

Finance costs - net 102 226 467

Amortisation of intangible assets 932 911 2,390

Profit on disposal of property, plant

and equipment (10) (35) -

Gain on revaluation of equity investment (578) - -

Share option costs 54 54 100

Income tax credit (372) (209) (126)

Changes in working capital:

Increase in inventories (1,550) (472) (1,234)

(Increase)/decrease in trade and other

receivables (2,457) (124) 402

Increase/(decrease) in trade and other

payables 4,532 (697) (1,156)

Increase in other long-term payables 700 - -

Cash flows from operating activities 1,107 (1,730) 628

Finance costs paid net of interest income

received (115) (201) (464)

Income tax refunded 96 35 159

Cash flows from discontinued operations - 301 (2,534)

Net cash inflow/(outflow) from operating

activities 1,088 (1,595) (2,211)

Cash flows from investing activities

Purchase of property, plant and equipment (1,246) (597) (3,693)

Proceeds from disposal of fixed assets 5 35 -

Proceeds from disposal of other long-term

financial assets 2,000 - -

Cash inflow on disposal of subsidiaries

net of cash disposed of - - 1,277

Net cash from/(used) in investing activities 759 (562) (2,416)

Financing activities

Proceeds from new borrowings - 500 -

Proceeds from lease financing 514 - 2,002

Repayment of borrowings (1,971) (120) (1,307)

Net cash (outflow)/inflow from financing

activities (1,457) 380 695

Net increase/(decrease) in cash and

cash equivalents 390 (1,777) (3,932)

Cash and cash equivalents at beginning

of period 2,208 6,140 6,140

Cash and cash equivalents at end of

period 2,598 4,363 2,208

Notes to the Condensed Consolidated Interim Financial

Statements

1. Basis of preparation and statement of compliance with

IFRS

The Group's interim results for the 26 weeks ended 28 March 2020

are prepared in accordance with the Group's accounting policies

which are based on the recognition and measurement principles of

International Financial Reporting Standards ("IFRS") as adopted by

the EU and effective from 29 September 2019. As permitted, this

interim report has been prepared in accordance with the AIM rules

and not in accordance with IAS 34 "Interim financial reporting" and

therefore the interim information is not in full compliance with

IFRS. The principal accounting policies of the Group have remained

unchanged from those set out in the Group's 2019 annual report and

financial statements, with the exception of the adoption of IFRS 16

'Leases' as detailed below. The Principal Risks and Uncertainties

of the Group are also set out in the Group's 2019 annual report and

financial statements and, with the exception of risks arising from

the Covid-19 pandemic, are unchanged in the period.

The Group's 2019 financial statements for the 52 weeks ended 28

September 2019 were prepared under IFRS. The auditor's report on

these financial statements was unmodified and did not contain

statements under Sections 498(2) or (3) of the Companies Act 2006

and they have been filed with the Registrar of Companies.

The Directors have assessed the risks presented by Covid-19 and

reforecast the original 2020 Budget and the 2021 and 2022

Projections ("the forecasts") to reflect the current and likely

future impact of Covid-19 on the Group's operations and financial

results. These baseline forecasts reflect:

-- Limited impact of Covid-19 on the CSC division, other than a

significant temporary reduction in the level of Integrity

Management business due to UK and global travel restrictions and

potential supply chain disruption

-- Some reductions in the level of activity across the PMC

division as a result of Covid-19, reflecting the impact of a

reduction in revenue, supply chain disruption and some limited

employee absence

-- The enactment of a number of cash deferral measures

Throughout the forecast period, the Group generates underlying

operating profit and is cash-generative.

On 10 December 2019, the Group agreed a two-year revolving

credit facility with Lloyds Bank plc for a maximum amount of GBP12

million up to 9 December 2020 and GBP10 million up to 9 December

2021. This facility included, inter alia, three financial covenants

to be tested quarterly, namely (i) Net debt (on a pre-IFRS 16

basis) to Adjusted EBITDA ('Leverage Covenant'), (ii) Net finance

costs (on a pre-IFRS 16 basis) to Adjusted EBITDA, and (iii) CAPEX

covenant. In response to the Covid-19 situation, on 26 May 2020 the

Group agreed with Lloyds Bank plc the following changes to the

financial covenants:

-- the testing of the leverage covenant as at 30 June 2020 to be waived

-- the Leverage Covenant as at 30 September and 31 December 2020

to be relaxed to a maximum of 5.0 times (from a maximum of 3.25

times and 3.0 times respectively). The covenant would revert back

to the previously agreed level of a maximum of 3.0 times

thereafter

-- the Net finance cost to EBITDA and Capex covenants remain unchanged

-- the amount of the facility remains unchanged

Based on the baseline reforecasts prepared on the assumptions

described above and severe but plausible downside scenario

modelling for the PMC division, for the period at least 12 months

from the signing of this interim financial information, the Group's

net debt would remain within the amount of the facility and the

Group would operate within the revised financial covenants.

On 15 June 2020, the Group received un-forecast cash proceeds of

GBP0.6 million from the sale of 2,525,610 shares in Greenlane

Renewables Inc. ("Greenlane"). The Group continues with its

strategy to liquidate its remaining investment in Greenlane at the

earliest opportunity.

On the basis of the above, including consideration as to the

ongoing uncertainty as to the future impact of the Covid-19

pandemic, the Group believes it has sufficient headroom to be able

to continue its operations for the foreseeable future. The

Directors believe that the Group is in a position to manage its

financing and other business risks satisfactorily and have a

reasonable expectation that the Group will have adequate resources

to continue in operation for at least 12 months from the signing

date of this interim financial information. They therefore consider

it appropriate to adopt the going concern basis of accounting in

preparing the financial statements.

The consolidated financial statements are prepared under the

historical cost convention as modified to include the revaluation

of financial instruments.

The financial information for the 26 weeks ended 28 March 2020

and 30 March 2019 has not been audited or reviewed and does not

constitute full financial statements within the meaning of Section

434 of the Companies Act 2006. The unaudited interim financial

statements were approved for issue by the Board of Directors on 22

June 2020.

2. New Standards adopted as at 29 September 2019

IFRS 16 'Leases' replaced IAS 17 'Leases' along with three

interpretations (IFRIC 4 'Determining whether an Arrangement

contains a Lease', SIC 15 'Operating Leases-Incentives' and SIC 27

'Evaluating the Substance of Transactions Involving the Legal Form

of a Lease'). The new Standard has been applied using the modified

retrospective approach, with the cumulative effect of adopting IFRS

16 being recognised in equity as an adjustment to the opening

balance of retained earnings for the current period. Prior periods

have not been restated.

For contracts in place at the date of initial application, the

Group has elected to apply the definition of a lease from IAS 17

and IFRIC 4 and has not applied IFRS 16 to the arrangements that

were previously not identified as lease under IAS 17 and IFRIC

4.

The Group has elected not to include initial direct costs in the

measurement of the right-of-use asset for operating leases in

existence at the date of initial application of IFRS 16, being 29

September 2019. At this date, the Group has also elected to measure

the right-of-use assets at an amount equal to the lease liability

adjusted for any prepaid or accrued lease payments that existed at

the date of transition.

Instead of performing an impairment review on the right-of-use

assets at the date of initial application, the Group has relied on

its historic assessment as to whether leases were onerous

immediately before the date of initial application of IFRS 16.

On transition, for leases previously accounted for as operating

leases with a remaining lease term of less than 12 months and for

leases of low-value assets, the Group has applied the optional

exemptions to not recognise right-of-use assets but to account for

the lease expense on a straight-line basis over the remaining lease

term.

For those leases previously classified as finance leases, the

right-of-use asset and lease liability are measured at the date of

initial application at the same amounts under IAS 17 immediately

before the date of initial application.

On transition to IFRS 16 the weighted average incremental

borrowing rate applied to lease liabilities recognised under IFRS

16 was 4.25%.

The Group has benefited from the use of hindsight for

determining a lease term when considering options to extend and

terminate leases.

The following is a reconciliation between total operating lease

commitments as at 28 September 2019 to the leases recognised at 29

September 2019:

GBP'000

Total operating lease commitments disclosed

at 28 September 2019 1,348

Recognition exemptions:

* leases with remaining lease terms of less than 12

months (16)

Total lease liabilities recognised under

IFRS 16 at 29 September 2019 1,332

2.1 Standards and interpretations not yet applied

The following standards and amendments that are effective for

the first time in 2020 and could be applicable to the Group

are:

-- IFR IC 23 - Uncertainty over Income Tax Treatments

-- IFRS 9 - Prepayment Features with Negative compensation (Amendments to IFRS 9)

-- IAS 28 - Long-Term Interests in Associates and Joint-Ventures (Amendments to IAS 28)

These amendments do not have a significant impact on these

interim financial statements and therefore the disclosures have not

been made.

3. Significant accounting policies

The interim financial statements have been prepared in

accordance with the accounting policies adopted in the Group's most

recent annual financial statements for the 52 weeks ended 28

September 2019, except for the effects of applying IFRS 16.

3.1 Leases

As described in Note 2, the Group has applied IFRS 16 using the

modified retrospective approach and therefore comparative

information has not been restated. This means comparative

information is still reported under IAS 17 and IFRIC 4.

3.1 Leases (continued)

Accounting policy applicable from 29 September 2019

The Group as a lessee

For any new contracts entered into on or after 29 September

2019, the Group considers whether a contract is, or contains a

lease. A lease is defined as 'a contract, or part of a contract,

that conveys the right to use an asset (the underlying asset) for a

period of time in exchange for consideration'. To apply this

definition the Group assesses whether the contract meets three key

evaluations which are whether:

-- the contract contains an identified asset, which is either

explicitly identified in the contract or implicitly specified by

being identified at the time the asset is made available to the

Group

-- the Group has the right to obtain substantially all of the

economic benefits from use of the identified asset throughout the

period of use, considering its rights within the defined scope of

the contract

-- the Group has the right to direct the use of the identified

asset throughout the period of use. The Group assesses whether it

has the right to direct 'how and for what purpose' the asset is

used throughout the period of use.

Measurement and recognition of leases as a lessee

At lease commencement date, the Group recognises a right-of-use

asset and a lease liability on the balance sheet. The right-of-use

asset is measured at cost, which is made up of the initial

measurement of the lease liability, any initial direct costs

incurred by the Group, an estimate of any costs to dismantle and

remove the asset at the end of the lease, and any lease payments

made in advance of the lease commencement date (net of any

incentives received).

The Group depreciates the right-of-use assets on a straight-line

basis from the lease commencement date to the earlier of the end of

the useful life of the right-of-use asset or the end of the lease

term. The Group also assesses the right-of-use asset for impairment

when such indicators exist.

At the commencement date, the Group measures the lease liability

at the present value of the lease payments unpaid at that date,

discounted using the interest rate implicit in the lease if that

rate is readily available or the Group's incremental borrowing

rate.

Subsequent to initial measurement, the liability will be reduced

for payments made and increased for interest. It is remeasured to

reflect any reassessment or modification, or if there are changes

in in-substance fixed payments.

When the lease liability is remeasured, the corresponding

adjustment is reflected in the right-of-use asset, or profit and

loss if the right-of-use asset is already reduced to zero.

The Group has elected to account for short-term leases and

leases of low-value assets using the practical expedients. Instead

of recognising a right-of-use asset and lease liability, the

payments in relation to these are recognised as an expense in

profit or loss on a straight-line basis over the lease term.

On the statement of financial position, right-of-use assets have

been included in property, plant and equipment and lease

liabilities have been included in borrowings.

Accounting policy applicable before 29 September 2019

The Group as a lessee

Finance leases

Management applies judgment in considering the substance of a

lease agreement and whether it transfers substantially all the

risks and rewards, incidental to ownership of the leased asset. Key

factors considered include the length of the lease term in relation

to the economic life of the asset, the present value of the minimum

lease payments in relation to the asset's fair value, and whether

the Group obtains ownership of the asset at the end of the lease

term.

For leases of land and buildings, the minimum lease payments are

first allocated to each component based on the relative fair values

of the respective lease interests. Each component is then evaluated

separately for possible treatment as a finance lease, taking into

consideration the fact that land normally has an indefinite

economic life.

See the accounting policy note in the year-end financial

statements for the depreciation methods and useful lives for assets

held under finance leases. The interest element of lease payments

is charged to profit or loss, as finance costs over the period of

the lease.

Operating leases

All other leases are treated as operating leases. Where the

Group is a lessee, payments on operating lease agreements are

recognised as an expense on a straight-line basis over the lease

term. Associated costs, such as maintenance and insurance, are

expensed as incurred.

4. Segmental analysis and Earnings before Interest, Taxation,

Depreciation and Amortisation (EBITDA)

Revenue by destination - continuing operations

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

United Kingdom 9,230 7,696 15,799

European Union 3,492 3,294 7,168

Rest of World 1,179 3,494 5,324

13,901 14,484 28,291

Revenue by sector - continuing operations

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Oil and gas 8,137 7,704 16,272

Defence 2,021 5,384 9,118

Industrial gases 3,743 955 2,175

Hydrogen energy - 441 726

13,901 14,484 28,291

Revenue by activity - continuing operations

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Cylinders 6,272 7,651 13,860

Precision Machined Components 7,872 7,148 14,449

Intra divisional (243) (315) (18)

13,901 14,484 28,291

4. Segmental analysis and Earnings before Interest, Taxation,

Depreciation and Amortisation (EBITDA) (continued)

The Group's revenue disaggregated by pattern of revenue

recognition and category is as follows:

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Sale of goods transferred at a point

in time 8,582 13,267 23,427

Sale of goods transferred over time 3,863 406 1,739

Rendering of services 1,456 811 3,125

13,901 14,484 28,291

The following aggregated amounts of transaction values relate to

the performance obligations from existing contracts that are

unsatisfied or partially unsatisfied as at 28 March 2020:

Deliverable

within next

12 months

GBP'000

Contracted revenue yet to be invoiced - Cylinders 2,819

(Loss)/profit before taxation by activity - continuing

operations

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Cylinders 441 1,372 2,089

Precision Machined Components 330 772 1,879

Manufacturing subtotal 771 2,144 3,968

Unallocated central costs (832) (796) (1,734)

Operating (loss)/profit pre amortisation

and other exceptional charges (61) 1,348 2,234

Amortisation (note 5) (932) (911) (1,832)

Other exceptional charges (note 6) (956) (122) (450)

Operating (loss)/profit (1,949) 315 (48)

Finance costs (102) (226) (467)

Other financial items (note 7) 578 - -

(Loss)/profit before tax (1,473) 89 (515)

The Operating (loss)/profit by activity is stated before the

allocation of Group management charges which are included within

'Unallocated central costs'.

4. Segmental analysis and Earnings before Interest, Taxation,

Depreciation and Amortisation (EBITDA) (continued)

Earnings before interest, taxation, depreciation, and

amortisation (EBITDA) - continuing operations

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Adjusted EBITDA 794 2,004 3,591

Other exceptional charges (note 6) (956) (122) (450)

EBITDA (162) 1,882 3,141

Depreciation (855) (656) (1,357)

Amortisation (note 5) (932) (911) (1,832)

Interest (102) (226) (467)

Other financial items (note 7) 578 - -

(Loss)/profit before tax (1,473) 89 (515)

Amortisation on acquired businesses as set out above consists of

the amortisation charged on intangible assets acquired as a result

of business combinations in previous periods.

5. Amortisation

Amortisation of intangible assets is shown separately in the

Condensed Consolidated Statement of Comprehensive Income. A

breakdown of those costs can be seen below.

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Amortisation of intangible assets arising

on a business combination (932) (911) (1,832)

6. Other exceptional charges

Items that are material either because of their size or their

nature, or that are non-recurring are considered as exceptional

items and are disclosed separately on the face of the Condensed

Consolidated Statement of Comprehensive Income.

An analysis of the amounts presented as exceptional items in

these financial statements is given below:

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Reorganisation and redundancy (256) (122) (450)

Exceptional insurance credit 169 - -

HSE Fine (869) - -

(956) (122) (450)

The reorganisation costs relate to various costs of

restructuring across the Group. They are recognised in accordance

with IAS 19.

Given that these costs do not relate to underlying trading, the

Directors consider it appropriate to disclose these as exceptional

items.

HSE Fine

On 26 November 2019, the Group, announced that its subsidiary

Chesterfield Special Cylinders ("CSC") had been found guilty of a

charge brought by the Health & Safety Executive ("HSE")

pursuant to Section 2 of the Health and Safety at Work Act 1974

following a fatal accident in June 2015. The sentencing hearing was

held on 13 January 2020 at Sheffield Crown Court, at which a fine

of GBP700,000 was determined and prosecution costs of GBP169,499

were set. The fine is due to be paid over five six-monthly

instalments of GBP140,000 commencing 31 January 2021.

7. Other financial items

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Gain on revaluation of equity investment 578 - -

Following the application of IFRS 9, the investment in Greenlane

Renewables Inc. is categorised at Fair Value through Profit and

Loss (FVTPL). Therefore the investment has been measured at fair

value at the period end with any subsequent gain or loss being

recognised in profit or loss.

The fair value of the shareholding in Greenlane Renewables Inc.

was determined by reference to published price quotations in an

active market on the Toronto Stock Exchange (TSX-V) and using a

valuation technique to discount relevant future flows of value

beyond the period end date.

8. Taxation

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Current tax credit 221 65 (299)

Deferred taxation credit 151 144 94

Taxation credit to the income statement 372 209 (205)

9. (Loss)/earnings per ordinary share

The calculation of basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period.

The calculation of diluted earnings per share is based on basic

earnings per share, adjusted to allow for the issue of shares on

the assumed conversion of all dilutive options.

Adjusted earnings per share shows earnings per share, adjusting

for the impact of the amortisation charged on intangible assets

acquired as a result of business combinations and any exceptional

items, and for the estimated tax impact, if any, of those costs.

Adjusted earnings per share is based on the profits as adjusted

divided by the weighted average number of shares in issue.

For the 26 week period ended 28 March 2020

Continuing Discontinued Total

GBP'000 GBP'000 GBP'000

Loss after tax (1,101) - (1,101)

No.

Weighted average number of shares -

basic 18,595,165

Dilutive effect of share options 44,974

Weighted average number of shares -

diluted 18,640,139

Basic loss per share (5.9)p - (5.9)p

Diluted loss per share (5.9)p - (5.9)p

The Group adjusted earnings per share is calculated as

follows:

Loss after tax (1,101) -(1,101)

Amortisation (note 5) 932 - 932

Other exceptional charges and credits

(note 6) 956 - 956

Gain on revaluation of equity investment

(note 7) (578) - (578)

Theoretical tax effect of above adjustments (207) - (207)

Adjusted earnings 2 - 2

Adjusted earnings per share - basic

and diluted 0.0p - 0.0p

9. (Loss)/earnings per ordinary share (continued)

For the 26 week period ended 30 March 2019

Continuing Discontinued Total

GBP'000 GBP'000 GBP'000

Profit/(loss) after tax 298 (2,338) (2,040)

No.

Weighted average number of shares -

basic 18,595,165

Dilutive effect of share options -

Weighted average number of shares -

diluted 18,595,165

Basic earnings/(loss) per share 1.6p (12.6)p (11.0)p

Diluted earnings/(loss) per share 1.6p (12.6)p (11.0)p

The Group adjusted earnings/(loss) per share is calculated as

follows:

Profit/(loss) after tax 298 (2,338) (2,040)

Amortisation (note 5) 911 418 1,329

Other exceptional charges and credits

(note 6) 122 6 128

Theoretical tax effect of above adjustments (178) (72) (250)

Adjusted earnings/(loss) 1,153 (1,986) (833)

Adjusted earnings/(loss) per share -

basic and diluted 6.2p (10.7)p (4.5)p

For the 52 week period ended 28 September 2019

Continuing Discontinued Total

GBP'000 GBP'000 GBP'000

Loss after tax (389) (1,203) (1,592)

No.

Weighted average number of shares -

basic 18,595,165

Dilutive effect of share options 9,234

Weighted average number of shares -

diluted 18,604,399

Basic loss per share (2.1)p (6.5)p (8.6)p

Diluted loss per share (2.1)p (6.5)p (8.6)p

9. (Loss)/earnings per ordinary share (continued)

The Group adjusted earnings/(loss) per share is calculated as

follows:

For the 52 week period ended 28 September 2019

Continuing Discontinued Total

GBP'000 GBP'000 GBP'000

Loss after tax (389) (1,203) (1,592)

Amortisation (note 5) 1,832 558 2,390

Other exceptional charges and credits

(note 6) 450 (1,401) (951)

Theoretical tax effect of above adjustments (434) (428) (862)

Adjusted earnings/(loss) 1,459 (2,474) (1,015)

Adjusted earnings/(loss) per share -

basic and diluted 7.8p (13.3)p (5.5)p

10. Asset Impairment Review

The Group tests annually for impairment, or more frequently if

there are indicators that goodwill, other intangibles and tangible

fixed assets might be impaired. The occurrence of the Coronavirus

is a global issue affecting every single business sector and every

country to some degree. It has already had a significant impact on

the global economy, and its impacts are expected to continue for

the foreseeable future. Consequently, the impact of the pandemic is

considered to be an indicator that the carrying value of our

intangible and tangible assets in the Group's only cash generating

unit (CGU) - the Precision Machined Components (PMC) division - may

be impaired.

In light of the pandemic, the Group has considered a range of

economic conditions for the sectors in which the Group operates

that may exist over the next three years. These economic

conditions, together with reasonable and supportable assumptions,

have been used to estimate the future cash inflows and outflows for

the PMC CGU over the next three years. The assumptions underlying

these forecasts are detailed in note 1 to these interim financial

statements.

These forecasts have been approved by management and the Board

of Directors, and are based on a bottom up assessment of costs and

uses the current and estimated future sales pipeline. The forecasts

used for years two to three assume revenue growth, but no long-term

rate of growth or inflation is incorporated into the perpetuity

calculation at the end of year three. A value in use calculation

has been calculated by applying a discount rate of 12.0% (Sep 2019:

14.7%) to the cash flows in these forecasts. The discount rate has

reduced from the prior year due to the change in the mix of the

Group's businesses following the disposal of the Alternative Energy

division in June 2019.

Management's key assumptions are based on their past experience

and future expectations of the market over the longer term. The key

assumptions for the value in use calculations are those regarding

the discount rates, growth rates and expected changes to selling

prices and direct costs. A baseline reforecast was produced

reflecting management's best estimate of the likely impact of the

pandemic on the Group's businesses, along with a more pessimistic

but plausible downside scenario in respect of the PMC division.

Carrying amount of assets allocated to the PMC CGU

28 March

2020

GBP'000

Carrying value of allocated goodwill 9,510

Carrying value of customer relationships and intellectual

property 5,097

Carrying value of tangible fixed assets 6,546

Carrying value of other intangibles 106

21,259

10. Asset Impairment Review (continued)

The value in use calculation for the PMC CGU based on the

baseline reforecast resulted in headroom of GBP0.3 million over the

total carrying value of GBP21.3 million, such that no impairment is

required for the PMC division in these interim results. The

recoverable amount is most sensitive to the assumptions regarding

expected future cash inflows and the discount rate. Given the

limited headroom, a relatively small change in the assumptions used

in the baseline forecasts for the division's profitability and/or

the discount rate applied to the cash flows could cause the

carrying value to exceed the recoverable amount, thus indicating

that an impairment may be required. This will be next reviewed at

the annual impairment test in September 2020.

11. Reconciliation of net borrowings

Unaudited Audited

Unaudited 26 weeks 52 weeks

26 weeks ended ended ended

28 March 30 March 28 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 2,598 4,363 2,208

Bank borrowings (9,319) (12,300) (10,800)

Net debt excluding finance leases (6,721) (7,937) (8,592)

Finance leases (2,916) (1,436) (2,772)

Right of use asset leases (1,212) - -

Net borrowings (10,849) (9,373) (11,364)

During the period the bank committed to extend the revolving

credit facility termination date to 9 December 2021. Accordingly,

the directors have concluded that it is appropriate to present the

loan as due for repayment after one year.

12. Dividends

No final or interim dividend was paid for either of the 52 week

periods ended 29 September 2018 or 28 September 2019. No interim

dividend for the 53 week period ending 3 October 2020 is

proposed.

A copy of the Interim Report will be sent to shareholders

shortly and will be available on the Company's website:

www.pressuretechnologies.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FTMPTMTJTBFM

(END) Dow Jones Newswires

June 23, 2020 02:01 ET (06:01 GMT)

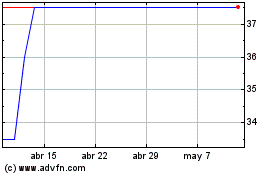

Pressure Technologies (LSE:PRES)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pressure Technologies (LSE:PRES)

Gráfica de Acción Histórica

De May 2023 a May 2024