Euro Climbs After ECB Maintains Rates, PEPP Program

16 Julio 2020 - 3:49AM

RTTF2

The euro advanced against its most major rivals in the European

session on Thursday, after the European Central Bank kept its key

interest rates and the size of the pandemic emergency purchase

programme unchanged to support Eurozone economy.

The Governing Council left the main refi rate at a record low of

zero percent and the deposit rate at -0.50 percent. The marginal

lending facility rate is at 0.25 percent. The decision was in line

with expectations.

"The Governing Council expects the key ECB interest rates to

remain at their present or lower levels until it has seen the

inflation outlook robustly converge to a level sufficiently close

to, but below, 2% within its projection horizon, and such

convergence has been consistently reflected in underlying inflation

dynamics," the bank said.

The Governing Council decided to retain the pandemic emergency

purchase programme at EUR 1.35 billion.

Net asset purchases under the PEPP will be conducted until at

least the end of June 2021. The bank said it will reinvest proceeds

from maturing bonds in the scheme at least until the end of

2022.

Data from Eurostat showed that the euro area trade surplus

increased sharply in May as the relaxation of coronavirus

containment measures boosted both exports and imports.

The trade surplus rose to a seasonally adjusted EUR 8 billion

from EUR 1.6 billion in April.

The euro showed mixed performance against its major peers in the

Asian session. While it fell against the greenback and the yen, it

climbed against the pound and the franc.

The euro gained to 0.9095 versus the pound, up from yesterday's

closing value of 0.9065. The euro is seen finding resistance around

the 0.92 mark.

Data from the Office for National Statistics showed that the UK

unemployment remained unchanged in three months to May.

In three months to May, the jobless rate was largely unchanged

at 3.9 percent, well below economists' forecast of 4.2 percent.

The euro recovered to 1.1418 against the greenback, from a 2-day

low of 1.1378 seen at 6:00 am ET. The pair had closed Wednesday's

deals at 1.1412. Next key resistance for the euro is likely seen

around the 1.17 level.

The euro rallied to 122.35 against the yen, after falling to

121.82 at 2:15 am ET. The pair was worth 122.02 when it ended deals

on Wednesday. The euro is likely to face resistance around the

124.00 region, if it gains again.

The euro spiked up to 1.0796 against the franc, its biggest

level since June 9. At Wednesday's close, the pair was valued at

1.0776. Should the euro strengthens further, it is likely to test

resistance around the 1.09 region.

Looking ahead, U.S. NAHB housing market index for July and

business inventories for May will be featured in the New York

session.

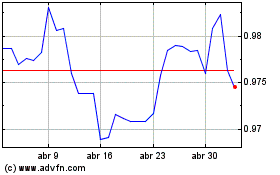

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

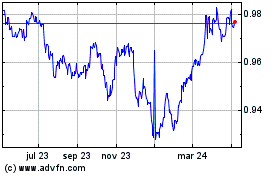

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024