Euro Strengthens On Progress In EU Recovery Fund Talks

20 Julio 2020 - 12:55AM

RTTF2

The euro appreciated against its major rivals in the early

European session on Monday, as investors focused on the ongoing

talks over European Recovery Fund amid hopes for a breakthrough in

the EU Summit in Brussels.

After three days of argument over the rescue package, European

leaders are reportedly considering a compromise proposal of €390

billion of grants for Covid-19 relief instead of the $500 billion

initially planned.

The meeting is scheduled to resume at 1400 GMT.

Dutch prime Minister Mark Rutte said that talks were making

progress but warned discussions could still fall apart.

There are several issues to be finalized, including the

conditionality of funds, terms of loans and the veto of aid

disbursements.

Data from the European Central Bank showed that the euro area

current account surplus declined in May largely reflecting the

widening deficit on the secondary income.

The current account surplus fell to EUR 8 billion in May from

EUR 14 billion in April. In the same period last year, the surplus

was EUR 23 billion.

The euro firmed to 1.1468 against the greenback, its highest

level since March 9. The currency is likely to locate resistance

around the 1.16 level.

The euro strengthened to a 1-1/2-month high of 122.98 against

the yen, while approaching 0.9138 against the pound for the first

time since June 30. Next immediate resistance for the euro is seen

around 125 against the yen and 0.92 against the pound.

The single currency climbed to a 4-day high of 1.0776 against

the franc, up from Friday's closing value of 1.0717. On the upside,

1.09 is likely seen as its next resistance level.

The euro that finished Friday's trading at 1.6335 against the

aussie and 1.5516 against the loonie moved up to a 3-week high of

1.6407 and a 3-1/2-month high of 1.5575, respectively. The next

possible resistance for the euro is seen near 1.66 against the

aussie and 1.59 against the loonie.

The euro edged higher to 1.7489 against the kiwi from last

week's closing value of 1.7427. The euro is likely to face

resistance around the 1.78 region, if it gains again.

The latest survey from BusinessNZ showed that the services

sector in New Zealand swung back into expansion territory in June,

with a Performance of Services Index score of 54.1.

That's up sharply from the upwardly revised 37.5 in May

(originally 37.2) and it moves back above the boom-or-bust line of

50 that separates expansion from contraction.

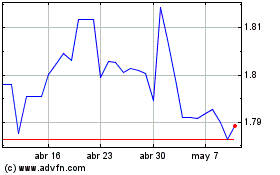

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2024 a May 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De May 2023 a May 2024